- Page 1 and 2:

NI 43-101 REVISED TECHNICAL REPORT

- Page 4:

Date and Signature This report is e

- Page 22 and 23:

EBITDA ERO Er Eu FeCl 3 Fe 2 O 3 FO

- Page 24 and 25:

RM RM-Cl RMO RoM RQD SG&A Sm Sc s S

- Page 26 and 27:

2 INTRODUCTION ....................

- Page 28 and 29:

11.10.2 Results of 2011 REE Samplin

- Page 30 and 31:

17.2.3 Leaching (Acid Leaching Plan

- Page 32 and 33:

20.2.4 Waste Rock Piles ...........

- Page 34 and 35:

FIGURES Figure 1-1 Operating Costs

- Page 36 and 37:

Figure 20-1 Biological and Physical

- Page 38 and 39:

Table 11-7 Homogeneity of Results t

- Page 40 and 41:

1 SUMMARY Originally, Orbite Alumin

- Page 42 and 43:

except rare earths and rare metals

- Page 44 and 45:

plant varies from $1.7 B to $4.8 B,

- Page 46 and 47:

No mineralogical or speciation stud

- Page 48 and 49:

the claystone and the mudstone as w

- Page 50 and 51:

and sections, within the accuracy o

- Page 52 and 53:

Project. In accordance with the gui

- Page 54 and 55:

1.10.2 Mining Operation for Project

- Page 56 and 57:

The second main portion of the hydr

- Page 58 and 59:

submitted to the MNRF for discussio

- Page 60 and 61:

first year of production and Year -

- Page 62 and 63:

1.16 Financial Analysis 1.16.1 Fina

- Page 64 and 65:

1.16.2 Internal Rate of Return (IRR

- Page 66 and 67:

The sensitivity analysis of the pre

- Page 68 and 69:

As an example, when discounting onl

- Page 70 and 71:

Environmental impact assessment and

- Page 72 and 73:

identified as a result of all sub s

- Page 74:

- Orbite should have a marketabilit

- Page 77 and 78:

The Corporation’s head and regist

- Page 79 and 80:

- Genivar and Al., January 2012, Pr

- Page 81 and 82:

The level of confidence in the esti

- Page 84 and 85:

4 PROPERTY DESCRIPTION AND LOCATION

- Page 86 and 87:

Figure 4-2 Location of the Three Se

- Page 88 and 89:

Claim Number State Owner % owned Re

- Page 90 and 91:

Claim Number State Owner % owned Re

- Page 92 and 93:

Marin Sector to be exploited, it is

- Page 94 and 95:

5 ACCESSIBILITY, CLIMATE, LOCAL RES

- Page 96:

The topography of the Marin Sector

- Page 99 and 100:

Core analysis, performed at the COR

- Page 101 and 102:

Figure 7-1 Main Tectonostratigraphi

- Page 103 and 104:

The structural geometry of the area

- Page 105 and 106:

All these Cambro-Ordovician units w

- Page 107 and 108:

7.2 Grande-Vallée Property Geology

- Page 109 and 110:

The L’Orignal Formation is known

- Page 111 and 112:

7.2.2 Marin Sector Geology 7.2.2.1

- Page 113 and 114:

7.2.2.2 Stratigraphy and Lithology

- Page 115 and 116:

The Nappe is bounded to the north b

- Page 117 and 118:

7.3 Mineralization The mineral depo

- Page 119 and 120:

Figure 7-10 Argilite Composition Mu

- Page 121 and 122:

weathering after the deposition of

- Page 124 and 125:

9 EXPLORATION 9.1 2005 Exploration

- Page 126 and 127:

Mineralogical analyses also indicat

- Page 128:

The A, B and C regrouping resulted

- Page 131 and 132:

is included in each geological log

- Page 133 and 134:

Table 10-2 2007 Drill Holes Execute

- Page 135 and 136:

10.5 2010 Drilling Program Orbite

- Page 137 and 138:

Figure 10-1 Drill Plan 2007 to 2011

- Page 139 and 140:

In addition, random sampling of 10

- Page 142 and 143:

11 SAMPLE PREPARATION, ANALYSES AND

- Page 144 and 145:

1050 - 1100°C. A fused bead is pou

- Page 146 and 147:

Table 11-3 Analytical Analysis Limi

- Page 148 and 149:

Table 11-5 Duplicate Analysis Suppl

- Page 150 and 151:

Table 11-8 Comparison of the Clayst

- Page 152 and 153:

Figure 11-1 Alumina Histogram for A

- Page 154 and 155:

Figure 11-3 Iron Histogram for All

- Page 156 and 157:

The scattergrams, shown in Figures

- Page 158 and 159:

Figure 11-8 Samples Length Distribu

- Page 160 and 161:

Figure 11-9 Linear Semi-Variogram o

- Page 162 and 163:

11.10.1 History of REE Study The pr

- Page 164 and 165:

Claystone Unit (none from the 2011

- Page 166 and 167:

Figure 11-13 Al 2 O 3 vs TREE - Ran

- Page 168 and 169:

Figure 11-17 Al 2 O 3 vs Galium Fig

- Page 170:

Figure 11-19 Chondrite -Normalized

- Page 173 and 174:

To perform the Audit the following

- Page 175 and 176:

Sample Position Sample # Descriptio

- Page 177 and 178:

Table 13-1 Patents and Patent Appli

- Page 179 and 180:

Figure 13-1 represents the basic pr

- Page 181 and 182:

The company concluded a cooperation

- Page 183 and 184:

Figure 13-2 Orbite Alumina from Cla

- Page 185 and 186:

13.6.4 Aluminum Hydroxide Synthesis

- Page 187 and 188:

conducted using the 4 clay families

- Page 189 and 190:

Table 13-2 Head Assay of Four Famil

- Page 191 and 192:

The reaction is done using reactant

- Page 193 and 194:

the low temperature hydrolysis, dec

- Page 196 and 197:

14 MINERAL RESOURCE ESTIMATES 14.1

- Page 198 and 199:

Table 14-2 Average Concentrations o

- Page 200 and 201:

limited to projection at 100m A.S.L

- Page 202 and 203:

Figure 14-3 Center Sections of the

- Page 204 and 205:

The drill spacing according to geol

- Page 206:

property. The authors believe that

- Page 210 and 211:

16 MINING METHOD The mining of Orbi

- Page 212 and 213:

16.3 Detailed Mine Design The conse

- Page 214 and 215:

compared to waste rock and overburd

- Page 216 and 217:

The tonnage summary of this mining

- Page 218 and 219:

Figure 16-2 Open Pit Mining below t

- Page 220 and 221:

Table 16-5 Mine Plan (2.45 M tonnes

- Page 222 and 223:

Cat 980 loaders will be used to per

- Page 224 and 225:

Table 16-6 Annual Major Mine Equipm

- Page 226:

Table 16-7 Annual Hourly Personnel

- Page 229 and 230:

The main process sections are: - CP

- Page 231 and 232:

The slurry leachate is first filter

- Page 233 and 234:

17.2 Process Design The overall pro

- Page 235 and 236: arrangement, the crushed clay is tr

- Page 237 and 238: The ground feed material is reacted

- Page 239 and 240: crystallization/precipitation step,

- Page 241 and 242: ecovery process route where all the

- Page 243 and 244: Results from 2011 RM and RE explora

- Page 245 and 246: Figure 17-5 Proposed Metallurgical

- Page 247 and 248: 17.2.12 Reagents Hydrochloric Acid

- Page 250 and 251: 18 PROJECT INFRASTRUCTURE 18.1 Proj

- Page 252 and 253: 18.2 Grande-Vallée-Infrastructure

- Page 254 and 255: From the Plant site, Orbite has acc

- Page 256 and 257: Table 18-1 Murdochville Rail Transp

- Page 258 and 259: Hydro-Québec in order to determine

- Page 260 and 261: 18.4.6 Steam performed for the Opex

- Page 262: side will be implemented and basic

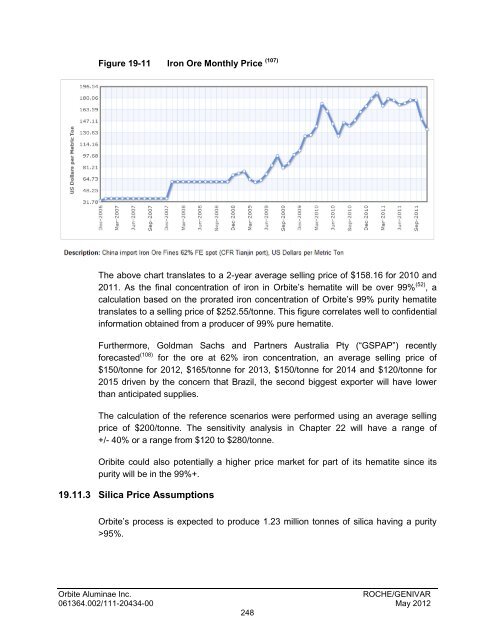

- Page 265 and 266: The economy in the second half of 2

- Page 267 and 268: lightness and strength. In aircraft

- Page 269 and 270: process. Therefore the majority of

- Page 271 and 272: 19.2.5 Orbite’s Opportunity for i

- Page 273 and 274: 19.3.1 Global Carbon Steel Market S

- Page 275 and 276: agent, also known as a denaturating

- Page 277 and 278: Table 19-2 Uses of High Purity Quar

- Page 279 and 280: The United States Department of Ene

- Page 281 and 282: 19.9.1 Gallium Market Production an

- Page 283 and 284: Table 19-6 GENIVAR PEA Annual Produ

- Page 285: Figure 19-9 2011 Alumina Cash Cost

- Page 289 and 290: average composition of the rare ear

- Page 291 and 292: Table 19-10 Rare Earth and Rare Met

- Page 293 and 294: Figure 19-12 Rare Earth Element His

- Page 295 and 296: The preliminary findings are summar

- Page 297 and 298: There were also exceedences of thes

- Page 299 and 300: Figure 20-2 Marin Sector Vegetation

- Page 301 and 302: Finally, Figure 20-3 indicates othe

- Page 303 and 304: 20.1.7 Global Environmental Impact

- Page 305 and 306: It is worth to be noted that no pri

- Page 307 and 308: 20.1.10.4 Water Management - Efflue

- Page 309 and 310: and the treatment wastes. The Grand

- Page 311 and 312: process buildings, storage area, as

- Page 313 and 314: slopes of the borrow pit and quarri

- Page 315 and 316: that no fish habitat is present on

- Page 317 and 318: In addition, the following provinci

- Page 319 and 320: Figure 21-1 Chemical Processing Pla

- Page 321 and 322: 21.1.2 Process Plant Capital Costs

- Page 323 and 324: TOTAL PLANT CAPITAL COSTS $466,554,

- Page 325 and 326: Figure 21-2 Operating Costs Summary

- Page 327 and 328: Table 21-4 Plant OPEX (Scenario 1)

- Page 329 and 330: 21.2.5 Assumptions OPEX Mine and Ch

- Page 331 and 332: pricing range within the vicinity a

- Page 333 and 334: 22 ECONOMIC ANALYSIS This section o

- Page 335 and 336: 22.2 Annual Projected EBITDA Table

- Page 337 and 338:

22.3 Internal Rate of Return and Pr

- Page 339 and 340:

Table 22-3 Sensitivity Analysis (Sc

- Page 341 and 342:

Figure 22-3 Sensitivity Analysis fo

- Page 343 and 344:

Table 22-5 Sensitivity Analysis - S

- Page 345 and 346:

As an example, when discounting onl

- Page 348 and 349:

23 ADJACENT PROPERTIES The Company

- Page 350 and 351:

24 OTHER RELEVANT DATA AND INFORMAT

- Page 352:

Figure 24-1 Project Preliminary Tim

- Page 355 and 356:

are earths and rare metals behavior

- Page 357 and 358:

25.3 Other Risks, Uncertainties and

- Page 359 and 360:

impact of this bill were described

- Page 361 and 362:

determine the angle of repose, flow

- Page 363 and 364:

of such with European’s group act

- Page 365 and 366:

(13) SLIVITZKY, A., 1994- Géologie

- Page 367 and 368:

(48) ORBITE, November 2011. 2011 an

- Page 369 and 370:

(81) RIO TINTO ALCAN website, http:

- Page 371:

(117) MARKETWIRE news release, Octo