- Page 2: Commodity Investing Maximizing Retu

- Page 5 and 6: Founded in 1807, John Wiley & Sons

- Page 7 and 8: Copyright C○ 2008 by Adam Dunsby,

- Page 9 and 10: vi CONTENTS PART THREE Understandin

- Page 12: Acknowledgments We thank Kumar Dand

- Page 16 and 17: CHAPTER 1 Introduction In 1980 Juli

- Page 18 and 19: Introduction 5 to the theme of inve

- Page 20 and 21: Introduction 7 Are we sliding down

- Page 22 and 23: CHAPTER 2 Commodity Futures as Inve

- Page 24 and 25: Commodity Futures as Investments 11

- Page 26 and 27: Commodity Futures as Investments 13

- Page 28 and 29: Commodity Futures as Investments 15

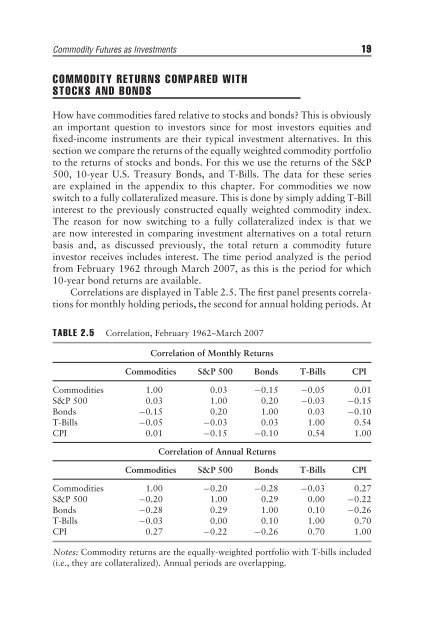

- Page 30 and 31: Commodity Futures as Investments 17

- Page 34 and 35: Commodity Futures as Investments 21

- Page 36 and 37: Commodity Futures as Investments 23

- Page 38 and 39: Commodity Futures as Investments 25

- Page 40 and 41: Commodity Futures as Investments 27

- Page 42 and 43: CHAPTER 3 Commodities for the Long

- Page 44 and 45: Commodities for the Long Run 31 the

- Page 46 and 47: Commodities for the Long Run 33 com

- Page 48: Commodities for the Long Run 35 of

- Page 52 and 53: CHAPTER 4 Crude Oil Crude oil, also

- Page 54 and 55: Crude Oil 41 called in-situ process

- Page 56 and 57: Crude Oil 43 HUBBERT’S PEAK Durin

- Page 58 and 59: Crude Oil 45 TABLE 4.1 Oil Producti

- Page 60 and 61: Crude Oil 47 consumption levels, cu

- Page 62 and 63: Crude Oil 49 characteristics of cru

- Page 64 and 65: Crude Oil 51 accessible to the spot

- Page 66 and 67: Crude Oil 53 oil crisis was fresh i

- Page 68: Crude Oil 55 hay, and switchgrass,

- Page 71 and 72: 58 UNDERSTANDING ENERGY PRODUCTION

- Page 73 and 74: 60 UNDERSTANDING ENERGY vehicles, f

- Page 75 and 76: 62 UNDERSTANDING ENERGY $100 $90 $

- Page 77 and 78: 64 UNDERSTANDING ENERGY $10.00 Natu

- Page 80 and 81: CHAPTER 6 Gasoline Gasoline is one

- Page 82 and 83:

Gasoline 69 oxygenated gasoline, wi

- Page 84 and 85:

Gasoline 71 a total of 230 million

- Page 86 and 87:

Gasoline 73 other nations for these

- Page 88 and 89:

Gasoline 75 The RBOB is made so tha

- Page 90 and 91:

Gasoline 77 The Weekly Petroleum St

- Page 92 and 93:

CHAPTER 7 Natural Gas When people t

- Page 94 and 95:

Natural Gas 81 price received for n

- Page 96 and 97:

Natural Gas 83 natural gas liquids

- Page 98 and 99:

Natural Gas 85 it is onshore or off

- Page 100 and 101:

Natural Gas 87 CONSUMPTION Natural

- Page 102 and 103:

Natural Gas 89 $6 $4 Heating Oil Ch

- Page 104 and 105:

Natural Gas 91 $18 $16 Hurricanes K

- Page 106:

PART Three Understanding Grains and

- Page 109 and 110:

96 UNDERSTANDING GRAINS AND OILSEED

- Page 111 and 112:

98 UNDERSTANDING GRAINS AND OILSEED

- Page 113 and 114:

100 UNDERSTANDING GRAINS AND OILSEE

- Page 115 and 116:

102 UNDERSTANDING GRAINS AND OILSEE

- Page 117 and 118:

104 UNDERSTANDING GRAINS AND OILSEE

- Page 119 and 120:

106 UNDERSTANDING GRAINS AND OILSEE

- Page 121 and 122:

108 UNDERSTANDING GRAINS AND OILSEE

- Page 123 and 124:

110 UNDERSTANDING GRAINS AND OILSEE

- Page 125 and 126:

112 UNDERSTANDING GRAINS AND OILSEE

- Page 127 and 128:

114 UNDERSTANDING GRAINS AND OILSEE

- Page 130 and 131:

CHAPTER 10 Soybeans Soybeans date b

- Page 132 and 133:

Soybeans 119 the past 20 years. It

- Page 134 and 135:

Soybeans 121 20% 18% GPM as % of So

- Page 136 and 137:

Soybeans 123 More recently, soymeal

- Page 138 and 139:

Soybeans 125 gallons) of biodiesel

- Page 140 and 141:

Soybeans 127 $350 $300 $ per Short

- Page 142:

Soybeans 129 ADDITIONAL SOURCES OF

- Page 146 and 147:

CHAPTER 11 Hogs Hogs, along with go

- Page 148 and 149:

Hogs 135 We next turn to an interes

- Page 150 and 151:

Hogs 137 more than 50 plants closin

- Page 152 and 153:

Hogs 139 two commodities may be exp

- Page 154 and 155:

CHAPTER 12 Cattle Perhaps the cow o

- Page 156 and 157:

Cattle 143 Choice or Select, with t

- Page 158 and 159:

Cattle 145 Thousands of Metric Tons

- Page 160 and 161:

Cattle 147 100 90 80 Beef + Veal Po

- Page 162 and 163:

Cattle 149 demand for beef. Further

- Page 164:

PART Five Understanding Industrial

- Page 167 and 168:

154 UNDERSTANDING INDUSTRIAL METALS

- Page 169 and 170:

156 UNDERSTANDING INDUSTRIAL METALS

- Page 171 and 172:

158 UNDERSTANDING INDUSTRIAL METALS

- Page 173 and 174:

160 UNDERSTANDING INDUSTRIAL METALS

- Page 175 and 176:

162 UNDERSTANDING INDUSTRIAL METALS

- Page 178 and 179:

CHAPTER 14 Aluminum Aluminum is the

- Page 180 and 181:

Aluminum 167 35 33 31 Millions of m

- Page 182 and 183:

Aluminum 169 CONSUMPTION Primary an

- Page 184 and 185:

Aluminum 171 metallurgically unwork

- Page 186 and 187:

Aluminum 173 3.5 3 Copper Aluminum

- Page 188:

Aluminum 175 1:00 PM. The second se

- Page 191 and 192:

178 UNDERSTANDING INDUSTRIAL METALS

- Page 193 and 194:

180 UNDERSTANDING INDUSTRIAL METALS

- Page 195 and 196:

182 UNDERSTANDING INDUSTRIAL METALS

- Page 197 and 198:

184 UNDERSTANDING INDUSTRIAL METALS

- Page 200:

PART Six Understanding the Softs

- Page 203 and 204:

190 UNDERSTANDING THE SOFTS eating

- Page 205 and 206:

192 UNDERSTANDING THE SOFTS Other 2

- Page 207 and 208:

194 UNDERSTANDING THE SOFTS 70,000

- Page 209 and 210:

196 UNDERSTANDING THE SOFTS ADDITIO

- Page 211 and 212:

198 UNDERSTANDING THE SOFTS sugarca

- Page 213 and 214:

200 UNDERSTANDING THE SOFTS 30% 25%

- Page 215 and 216:

202 UNDERSTANDING THE SOFTS market

- Page 217 and 218:

204 UNDERSTANDING THE SOFTS curb de

- Page 220 and 221:

CHAPTER 18 Cocoa Cocoa is the funda

- Page 222 and 223:

Cocoa 209 4,000 3,500 Gross Crop Gr

- Page 224:

Cocoa 211 6,000 5,000 Disease damag

- Page 227 and 228:

214 UNDERSTANDING THE SOFTS PRODUCT

- Page 229 and 230:

216 UNDERSTANDING THE SOFTS 50,000

- Page 231 and 232:

218 UNDERSTANDING THE SOFTS tick (.

- Page 233 and 234:

220 UNDERSTANDING THE SOFTS ADDITIO

- Page 236 and 237:

CHAPTER 20 Some Building Blocks of

- Page 238 and 239:

Some Building Blocks of a Commodity

- Page 240 and 241:

Some Building Blocks of a Commodity

- Page 242 and 243:

Some Building Blocks of a Commodity

- Page 244 and 245:

Some Building Blocks of a Commodity

- Page 246 and 247:

Some Building Blocks of a Commodity

- Page 248 and 249:

Some Building Blocks of a Commodity

- Page 250 and 251:

Some Building Blocks of a Commodity

- Page 252 and 253:

Some Building Blocks of a Commodity

- Page 254 and 255:

Some Building Blocks of a Commodity

- Page 256 and 257:

Some Building Blocks of a Commodity

- Page 258 and 259:

CHAPTER 21 The Rise of the Indexes

- Page 260 and 261:

The Rise of the Indexes 247 markets

- Page 262 and 263:

Correlation of Monthly Returns CRB

- Page 264 and 265:

The Rise of the Indexes 251 100% Me

- Page 266 and 267:

The Rise of the Indexes 253 Table 2

- Page 268 and 269:

TABLE 21.3 Decomposing S&P GSCI Ret

- Page 270 and 271:

The Rise of the Indexes 257 ending

- Page 272 and 273:

The Rise of the Indexes 259 EQUITY

- Page 274 and 275:

Aluminum Alcoa, Inc. AA US 0.39 0.5

- Page 276 and 277:

The Rise of the Indexes 263 TABLE 2

- Page 278 and 279:

CHAPTER 22 Conclusion Without doubt

- Page 280:

Conclusion 267 Building Blocks of a

- Page 283 and 284:

270 HOW TO INVEST or contango relat

- Page 285 and 286:

272 HOW TO INVEST 45 minutes. Kerbs

- Page 287 and 288:

274 NOTES 14. Energy Information Ad

- Page 289 and 290:

276 NOTES 11. BP. BP Annual Statist

- Page 291 and 292:

278 NOTES 14. European Biodiesel Bo

- Page 293 and 294:

280 NOTES CHAPTER 14 1. Internation

- Page 296 and 297:

References Andersen, T.G., T. Bolle

- Page 298:

References 285 Plain, Ronald. “St

- Page 302 and 303:

Index Alternative Energy, 54-55. Se