Foreign Tax Redeterminations under § 905(c) - Fenwick & West LLP

Foreign Tax Redeterminations under § 905(c) - Fenwick & West LLP

Foreign Tax Redeterminations under § 905(c) - Fenwick & West LLP

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

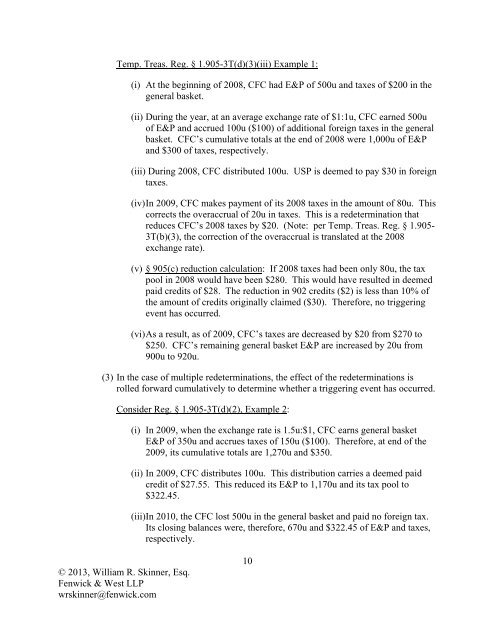

Temp. Treas. Reg. § 1.<strong>905</strong>-3T(d)(3)(iii) Example 1:<br />

(i) At the beginning of 2008, CFC had E&P of 500u and taxes of $200 in the<br />

general basket.<br />

(ii) During the year, at an average exchange rate of $1:1u, CFC earned 500u<br />

of E&P and accrued 100u ($100) of additional foreign taxes in the general<br />

basket. CFC’s cumulative totals at the end of 2008 were 1,000u of E&P<br />

and $300 of taxes, respectively.<br />

(iii) During 2008, CFC distributed 100u. USP is deemed to pay $30 in foreign<br />

taxes.<br />

(iv) In 2009, CFC makes payment of its 2008 taxes in the amount of 80u. This<br />

corrects the overaccrual of 20u in taxes. This is a redetermination that<br />

reduces CFC’s 2008 taxes by $20. (Note: per Temp. Treas. Reg. § 1.<strong>905</strong>-<br />

3T(b)(3), the correction of the overaccrual is translated at the 2008<br />

exchange rate).<br />

(v) § <strong>905</strong>(c) reduction calculation: If 2008 taxes had been only 80u, the tax<br />

pool in 2008 would have been $280. This would have resulted in deemed<br />

paid credits of $28. The reduction in 902 credits ($2) is less than 10% of<br />

the amount of credits originally claimed ($30). Therefore, no triggering<br />

event has occurred.<br />

(vi) As a result, as of 2009, CFC’s taxes are decreased by $20 from $270 to<br />

$250. CFC’s remaining general basket E&P are increased by 20u from<br />

900u to 920u.<br />

(3) In the case of multiple redeterminations, the effect of the redeterminations is<br />

rolled forward cumulatively to determine whether a triggering event has occurred.<br />

Consider Reg. § 1.<strong>905</strong>-3T(d)(2), Example 2:<br />

(i) In 2009, when the exchange rate is 1.5u:$1, CFC earns general basket<br />

E&P of 350u and accrues taxes of 150u ($100). Therefore, at end of the<br />

2009, its cumulative totals are 1,270u and $350.<br />

(ii) In 2009, CFC distributes 100u. This distribution carries a deemed paid<br />

credit of $27.55. This reduced its E&P to 1,170u and its tax pool to<br />

$322.45.<br />

(iii)In 2010, the CFC lost 500u in the general basket and paid no foreign tax.<br />

Its closing balances were, therefore, 670u and $322.45 of E&P and taxes,<br />

respectively.<br />

© 2013, William R. Skinner, Esq.<br />

<strong>Fenwick</strong> & <strong>West</strong> <strong>LLP</strong><br />

wrskinner@fenwick.com<br />

10