Foreign Tax Redeterminations under § 905(c) - Fenwick & West LLP

Foreign Tax Redeterminations under § 905(c) - Fenwick & West LLP

Foreign Tax Redeterminations under § 905(c) - Fenwick & West LLP

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

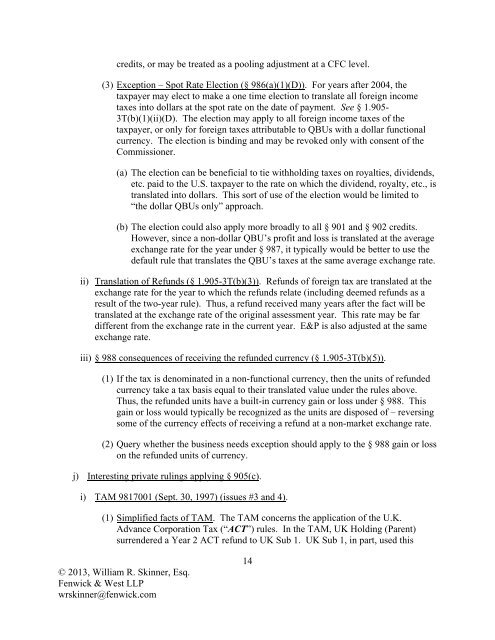

credits, or may be treated as a pooling adjustment at a CFC level.<br />

(3) Exception – Spot Rate Election (§ 986(a)(1)(D)). For years after 2004, the<br />

taxpayer may elect to make a one time election to translate all foreign income<br />

taxes into dollars at the spot rate on the date of payment. See § 1.<strong>905</strong>-<br />

3T(b)(1)(ii)(D). The election may apply to all foreign income taxes of the<br />

taxpayer, or only for foreign taxes attributable to QBUs with a dollar functional<br />

currency. The election is binding and may be revoked only with consent of the<br />

Commissioner.<br />

(a) The election can be beneficial to tie withholding taxes on royalties, dividends,<br />

etc. paid to the U.S. taxpayer to the rate on which the dividend, royalty, etc., is<br />

translated into dollars. This sort of use of the election would be limited to<br />

“the dollar QBUs only” approach.<br />

(b) The election could also apply more broadly to all § 901 and § 902 credits.<br />

However, since a non-dollar QBU’s profit and loss is translated at the average<br />

exchange rate for the year <strong>under</strong> § 987, it typically would be better to use the<br />

default rule that translates the QBU’s taxes at the same average exchange rate.<br />

ii) Translation of Refunds (§ 1.<strong>905</strong>-3T(b)(3)). Refunds of foreign tax are translated at the<br />

exchange rate for the year to which the refunds relate (including deemed refunds as a<br />

result of the two-year rule). Thus, a refund received many years after the fact will be<br />

translated at the exchange rate of the original assessment year. This rate may be far<br />

different from the exchange rate in the current year. E&P is also adjusted at the same<br />

exchange rate.<br />

iii) § 988 consequences of receiving the refunded currency (§ 1.<strong>905</strong>-3T(b)(5)).<br />

(1) If the tax is denominated in a non-functional currency, then the units of refunded<br />

currency take a tax basis equal to their translated value <strong>under</strong> the rules above.<br />

Thus, the refunded units have a built-in currency gain or loss <strong>under</strong> § 988. This<br />

gain or loss would typically be recognized as the units are disposed of – reversing<br />

some of the currency effects of receiving a refund at a non-market exchange rate.<br />

(2) Query whether the business needs exception should apply to the § 988 gain or loss<br />

on the refunded units of currency.<br />

j) Interesting private rulings applying § <strong>905</strong>(c).<br />

i) TAM 9817001 (Sept. 30, 1997) (issues #3 and 4).<br />

(1) Simplified facts of TAM. The TAM concerns the application of the U.K.<br />

Advance Corporation <strong>Tax</strong> (“ACT”) rules. In the TAM, UK Holding (Parent)<br />

surrendered a Year 2 ACT refund to UK Sub 1. UK Sub 1, in part, used this<br />

© 2013, William R. Skinner, Esq.<br />

<strong>Fenwick</strong> & <strong>West</strong> <strong>LLP</strong><br />

wrskinner@fenwick.com<br />

14