Money Multiplier

Money Multiplier

Money Multiplier

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Money</strong> <strong>Multiplier</strong><br />

What is <strong>Money</strong> <strong>Multiplier</strong><br />

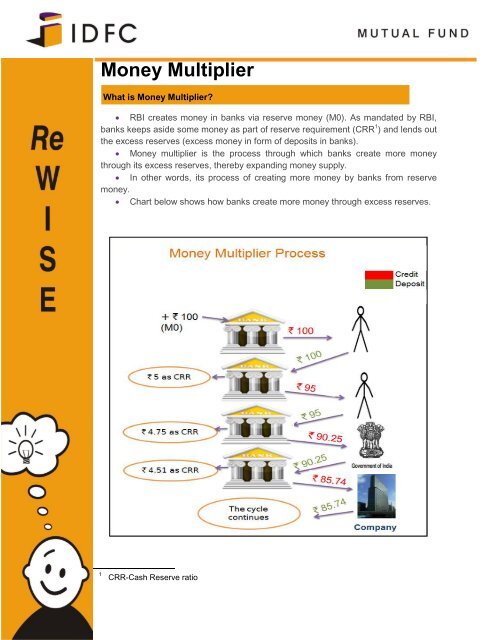

RBI creates money in banks via reserve money (M0). As mandated by RBI,<br />

banks keeps aside some money as part of reserve requirement (CRR 1 ) and lends out<br />

the excess reserves (excess money in form of deposits in banks).<br />

<strong>Money</strong> multiplier is the process through which banks create more money<br />

through its excess reserves, thereby expanding money supply.<br />

In other words, its process of creating more money by banks from reserve<br />

money.<br />

Chart below shows how banks create more money through excess reserves.<br />

1<br />

CRR-Cash Reserve ratio

How <strong>Money</strong> <strong>Multiplier</strong> impacts <strong>Money</strong> Supply<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<strong>Money</strong> supply 2 is a function of money multiplier and reserve money.<br />

Changes in money multiplier will have impact on the money supply.<br />

Factors determining money multiplier are reserve ratio, currency to deposit ratio, creditdeposit<br />

ratio.<br />

Low reserve ratio, would require banks to keep aside less reserves as CRR, thereby<br />

increasing its excess reserves to lend out which increases money supply. Higher reserve<br />

ratio will have reverse effect on money supply.<br />

Currency to deposit ratio (currency leakage) tells how much public is holding as cash<br />

and not re depositing in banks. More cash held by public means lesser deposits thereby<br />

reducing the amount bank can lend out resulting in lower money supply. Reverse holds<br />

true when less cash is held by public.<br />

Credit-deposit ratio indicates how much banks are lending out rather than keeping with<br />

themselves. High ratio means banks are lending out more money which in turn would<br />

increase money supply.<br />

Chart below gives a snap shot of the money supply.<br />

2<br />

<strong>Money</strong> supply refers to broad money(M3) which is currency with public + Deposits with bank (time+<br />

demand deposits )

Statistics<br />

<br />

Chart below shows <strong>Money</strong> supply growth as a function of Reserve money growth and<br />

<strong>Money</strong> <strong>Multiplier</strong><br />

<br />

<br />

<br />

<br />

In ` billion<br />

From the above chart, we can see <strong>Money</strong> supply growth has been supported by<br />

increase in money multiplier.<br />

Post 2008, creation of reserve money has reduced and increase in money supply has<br />

predominantly let to growth in money supply.<br />

Since 2011, RBI has reduced CRR, which has led to money multiplier increase thereby<br />

increasing money supply.<br />

Table below shows data on money supply, reserve money and money multiplier.<br />

M3 M0 <strong>Money</strong> <strong>Multiplier</strong><br />

FY 2013 3 80319.2 14582.1 5.51<br />

FY 2012 73592.0 14271.7 5.16<br />

FY 2011 65041.2 13768.2 4.72<br />

FY 2010 56027.0 11556.5 4.85<br />

FY 2009 47947.8 9879.6 4.85<br />

FY 2008 40178.6 9282.7 4.33<br />

FY 2007 33100.4 7088.6 4.67<br />

3 Data for FY2013 is till 28 th December 2012