CIRCULAR 11/142 - ICE

CIRCULAR 11/142 - ICE

CIRCULAR 11/142 - ICE

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>CIRCULAR</strong><br />

<strong>11</strong>/<strong>142</strong><br />

18 November 20<strong>11</strong><br />

Category:<br />

Trading<br />

Attachments:<br />

None<br />

Summary of content:<br />

Additional Details:<br />

Launch of <strong>ICE</strong> Brent<br />

NX (New Expiry) Crude<br />

Futures and Options<br />

Contracts<br />

For more information<br />

please contact:<br />

Mike Davis<br />

Director,<br />

Market Development<br />

+44 (0)20 7065 7753<br />

mike.davis@theice.com<br />

Jean-Luc Amos<br />

Oil Products Manager,<br />

Market Development<br />

+44 (0)20 7065 7744<br />

jean-luc.amos@theice.com<br />

Deborah Pratt<br />

Director,<br />

Oil Marketing<br />

+44 (0)20 7065 7734<br />

deborah.Pratt@theice.com<br />

Jeff Barbuto<br />

Vice President,<br />

US Oil Marketing<br />

+1 646 733 5014<br />

jeff.Barbuto@theice.com<br />

Julius Foo<br />

Marketing Manager,<br />

Asia Pacific<br />

+65 6594 0162<br />

julius.Foo@theice.com<br />

Additional Details: Launch of <strong>ICE</strong> Brent NX (New Expiry)<br />

Crude Futures and Options Contracts<br />

Circular <strong>11</strong>/132, dated 7 November 20<strong>11</strong> notified Members of the<br />

launch of <strong>ICE</strong> Brent NX (New Expiry) Crude Futures and Options (“<strong>ICE</strong><br />

Brent NX Futures and Options”). The purpose of this Circular is to<br />

provide additional details in respect of these Contracts. <strong>ICE</strong> Brent NX<br />

Futures and Options and related spreads will be made available for a<br />

first trade date of Monday 5 December 20<strong>11</strong>:<br />

• <strong>ICE</strong> Brent NX Futures and Options for a first Contract Month of<br />

December 2012; and<br />

• related on-screen futures spreads, including:<br />

o<br />

o<br />

o<br />

o<br />

o<br />

o<br />

Brent NX / Brent (BNX-BRN)<br />

Gasoil / Brent NX (The Gasoil NX Crack, GAS-BNX)<br />

Low Sulphur Gasoil / Brent NX (The Low Sulphur<br />

Gasoil NX Crack, ULS-BNX)<br />

Brent NX / WTI (BNX-WBS)<br />

RBOB / Brent NX (UHU-BNX)<br />

Heating Oil / Brent NX (UHO-BNX)<br />

Transition mechanisms: EFM facility<br />

The Exchange is committed to encouraging an orderly transition of open<br />

interest in the existing <strong>ICE</strong> Brent Crude Futures and Options Contracts<br />

to <strong>ICE</strong> Brent NX Futures and Options during 2012. The Exchange will<br />

provide two principal mechanisms to facilitate such transfers:<br />

• the Brent NX / Brent (BNX-BRN) on screen futures spread<br />

(noted above); and<br />

• an Exchange of Futures for (related) Market facility (“EFM”).<br />

The EFM facility will allow Members and their customers to exchange a<br />

position in an existing <strong>ICE</strong> Brent Contract for an equivalent position in<br />

<strong>ICE</strong> Brent NX Futures or Options. EFM transactions may be used only<br />

to reduce positions in an existing <strong>ICE</strong> Brent contract and create or<br />

increase a corresponding position in <strong>ICE</strong> Brent NX. The EFM facility will<br />

be made available shortly after the launch of the Brent NX Contracts.<br />

Further information, including confirmation of the launch date of the<br />

facility will be provided in due course.<br />

Contract outline<br />

The Brent NX Crude Futures and Options Contracts will be quoted in<br />

US dollars and cents per barrel. Like the <strong>ICE</strong> Brent Crude Futures<br />

Contract, the <strong>ICE</strong> Brent NX Futures Contract is a deliverable contract<br />

based on EFP delivery with an option to cash settle.<br />

The Contract will be cleared by <strong>ICE</strong> Clear Europe.<br />

A comprehensive set of Contract Specifications are available at:<br />

<strong>ICE</strong> Futures Europe, a Recognised Investment Exchange <strong>ICE</strong> Futures Europe Circular <strong>11</strong>/<strong>142</strong><br />

under the Financial Services & Markets Act 2000<br />

Registered in England & Wales with Registered Office at<br />

Milton Gate, 60 Chiswell Street, London, EC1Y 4SA<br />

Company Registration No. 1528617 1

<strong>ICE</strong> Brent NX Crude Futures:<br />

https://www.theice.com/productguide/ProductDetails.shtmlspecId=3775846<br />

<strong>ICE</strong> Brent NX Crude Options:<br />

https://www.theice.com/productguide/ProductDetails.shtmlspecId=3775848<br />

<strong>ICE</strong> Brent NX Crude TAS, Singapore and Afternoon Minute Marker:<br />

https://www.theice.com/publicdocs/futures/<strong>ICE</strong>_Settlement_Markers_Fact_Sheet.pdf<br />

Contract Rules and Administrative Procedures<br />

The Contract Rules and Administrative Procedures governing the<br />

trading and delivery of the Contract are available at:<br />

https://www.theice.com/FuturesEuropeRegulations.shtml<br />

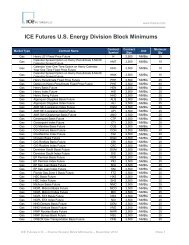

Listed contracts/periods<br />

The table below sets out the contract periods which will be listed at<br />

launch.<br />

<strong>ICE</strong> Brent NX Crude<br />

Period Futures Options<br />

Months Up to 72 consecutive<br />

months<br />

(Initially 61 months<br />

from December 2012<br />

to December 2017)<br />

Up to 24 consecutive<br />

months (Initially Dec<br />

2012 to Nov 2013)<br />

Half yearly months<br />

4 subsequent June<br />

and December<br />

contract months out<br />

to 96 months<br />

maximum (Dec 2019<br />

initially)<br />

The remaining<br />

Jun/Dec contract<br />

months (Dec 2013,<br />

June and Dec 2014<br />

to 2019 inclusive)<br />

Expiry time and dates:<br />

<strong>ICE</strong> Brent NX Crude Futures: Trading shall cease at the end of the<br />

designated settlement period on the Business Day (a trading day which<br />

is not a public holiday in England and Wales) immediately preceding the<br />

25th calendar day preceding the first day of the contract month, or the<br />

day prior to that if the 25 th calendar day is not a Business day. From the<br />

March 2015 contract month trading shall cease on the last Business<br />

Day (a trading day which is not a public holiday in England and Wales)<br />

of the second month preceding the contract month.<br />

<strong>ICE</strong> Brent NX Crude Options: Trading shall cease 3 Business Days (a<br />

trading day which is not a public holiday in England and Wales) prior to<br />

the expiration of the relevant future.<br />

In the event that the applicable day for expiry purposes would be either:<br />

(i) the Business day preceding Christmas Day, or (ii) the Business day<br />

preceding New Year’s Day, then the Expiration Date/Last Trading Day<br />

will move to the next preceding Business Day.<br />

The full expiry calendar for the <strong>ICE</strong> Brent NX Futures and Options<br />

contracts is available at:<br />

https://www.theice.com/publicdocs/futures/<strong>ICE</strong>_Brent_NX_Expiry_Dates.pdf<br />

<strong>ICE</strong> Futures Europe, a Recognised Investment Exchange <strong>ICE</strong> Futures Europe Circular <strong>11</strong>/<strong>142</strong><br />

under the Financial Services & Markets Act 2000<br />

Registered in England & Wales with Registered Office at<br />

Milton Gate, 60 Chiswell Street, London, EC1Y 4SA<br />

Company Registration No. 1528617 2

Trading hours (as at contract launch):<br />

Monday - Friday<br />

London Singapore Geneva New<br />

York<br />

Open 01:00<br />

(23:00 on<br />

Sunday)<br />

09:00<br />

(07:00 on<br />

Sunday)<br />

02:00<br />

(00:00 on<br />

Sunday)<br />

20:00<br />

(18:00 on<br />

Sunday)<br />

Chicago<br />

19:00<br />

(17:00 on<br />

Sunday)<br />

Close 23:00 07:00<br />

(the next<br />

day)<br />

00:00<br />

(the next<br />

day)<br />

18:00<br />

(the next<br />

day)<br />

17:00<br />

(the next<br />

day)<br />

* A circular will be issued when the UK switches from GMT to BST<br />

and also when the US switches from DST which will affect the<br />

opening and closing times.<br />

EFP and EFS trades<br />

Members may report EFP and EFS trades up to the close of business<br />

each day. The reporting method is set out in the <strong>ICE</strong> Futures Europe<br />

EFP/EFS Policy document available at:<br />

https://www.theice.com/futures_europe.jhtml<br />

This document will be updated to reflect the implementation of this<br />

Contract.<br />

PTMS-ECS contract codes and trade types:<br />

PTMS-ECS<br />

contract codes<br />

Physical Contract<br />

Logical Commodity<br />

Generic Contract<br />

<strong>ICE</strong> Brent NX Crude<br />

Futures Options<br />

BNX<br />

BNX<br />

F<br />

BNX<br />

BNX<br />

F<br />

EFP<br />

EFS<br />

Block Trade<br />

Screen<br />

TAS/TIC<br />

Block TAS/TIC<br />

PTMS-ECS<br />

Trade Type<br />

EFP<br />

EFS<br />

BLK<br />

REG<br />

TAS<br />

TASB<br />

Transaction charges<br />

The per contract Exchange and Clearing fees will be consistent with<br />

those for the existing Brent contracts: $0.82 per contract per side<br />

(including clearing) for screen-executed transactions and $1.32 per<br />

contract per side (including clearing) for Block Trades, EFPs and EFSs.<br />

<strong>ICE</strong> Futures Europe, a Recognised Investment Exchange <strong>ICE</strong> Futures Europe Circular <strong>11</strong>/<strong>142</strong><br />

under the Financial Services & Markets Act 2000<br />

Registered in England & Wales with Registered Office at<br />

Milton Gate, 60 Chiswell Street, London, EC1Y 4SA<br />

Company Registration No. 1528617 3

Settlement price procedures and designated settlement period<br />

Daily settlement prices will be determined in accordance with Trading<br />

Procedure 2.4 which can be found at:<br />

https://www.theice.com/publicdocs/contractregs/XX%20TRADING%20PROCEDURES.pdf<br />

Margin rates<br />

Initial margin rates for the contract will at the outset be the same as<br />

those for the existing <strong>ICE</strong> Brent Futures and Options Contracts.<br />

Margin rates for <strong>ICE</strong> Clear Europe Exchange-listed futures and<br />

options, and for OTC contracts are available at:<br />

https://www.theice.com/productguide/MarginRates.shtmlindex=&specId=3449058<br />

https://www.theice.com/ClearEuropeSpanParameterFiles.shtml<br />

Screen access<br />

Participants permissioned for the <strong>ICE</strong> Brent Futures and Options will<br />

automatically be permissioned for <strong>ICE</strong> Brent NX Futures and Options.<br />

The new <strong>ICE</strong> Brent NX Futures, Options and related spreads will be<br />

grouped into a new Web<strong>ICE</strong> portfolio titled 'Brent NX’ where traders will<br />

be able to access and incorporate the products selectively into their<br />

existing screen portfolios as they wish. The <strong>ICE</strong> Brent NX portfolio will<br />

automatically be created for any Web<strong>ICE</strong> user who already has any <strong>ICE</strong><br />

Brent Future contract elements in their existing portfolio.<br />

Traders accessing <strong>ICE</strong> Brent NX Futures contracts via a third-party<br />

vendor should contact that vendor directly to ensure that the <strong>ICE</strong> Brent<br />

NX product range (BNX) is coded and available on their screen from 5<br />

December 20<strong>11</strong>.<br />

API testing<br />

The <strong>ICE</strong> Brent NX Contracts will shortly be available in the API test<br />

environment.<br />

Risk Limits and Clearing Access<br />

The new <strong>ICE</strong> Brent NX contract and related spreads will be covered by<br />

existing <strong>ICE</strong> Brent risk limits. If a trader has an existing clearing limit for<br />

the existing <strong>ICE</strong> Brent Futures Contracts, that limit will apply in<br />

aggregate also for trade in <strong>ICE</strong> Brent NX Futures. Those with a clearing<br />

limit for an existing inter-contract spread between <strong>ICE</strong> Brent Crude<br />

Futures and another contract will have the same limit in addition applied<br />

to the new related spread. So, for example, a market participant with a<br />

limit in the existing <strong>ICE</strong> Gasoil Crack (GAS-BRN) will have the same<br />

limit in addition applied to the new <strong>ICE</strong> Gasoil NX Crack (GAS-BNX).<br />

Traders wishing to execute volumes in the new contract that would<br />

otherwise raise the total beyond their existing limits for <strong>ICE</strong> Brent<br />

Futures should arrange to increase their limits via their Risk Manager<br />

and/or Clearer as appropriate.<br />

Members and their customers need to ensure they have the necessary<br />

clearing limits in place to trade the <strong>ICE</strong> Brent NX Futures and Options<br />

(see above). The contracts will be available in Credit Management and<br />

Clearing Admin from 2 December 20<strong>11</strong> and can be identified under the<br />

following product names:<br />

<strong>ICE</strong> Futures Europe, a Recognised Investment Exchange <strong>ICE</strong> Futures Europe Circular <strong>11</strong>/<strong>142</strong><br />

under the Financial Services & Markets Act 2000<br />

Registered in England & Wales with Registered Office at<br />

Milton Gate, 60 Chiswell Street, London, EC1Y 4SA<br />

Company Registration No. 1528617 4

Contract<br />

<strong>ICE</strong> Brent NX Futures<br />

<strong>ICE</strong> Brent NX Options<br />

<strong>ICE</strong> Brent NX / Brent<br />

(BNX-BRN)<br />

Gasoil / Brent NX<br />

(The Gasoil NX Crack)<br />

Low Sulphur Gasoil / Brent NX<br />

(The Low Sulphur Gasoil NX Crack)<br />

Brent NX / WTI<br />

RBOB / Brent NX<br />

Heating Oil / Brent NX<br />

Credit Management and<br />

Clearing Admin Name<br />

IPE e-Brent<br />

Options-IPE e-Brent<br />

BNX, BRN<br />

GAS, BNX<br />

ULS, BNX<br />

BNX, WBS<br />

UHU, BNX<br />

UHO, BNX<br />

Third party notification<br />

Back office systems providers and Independent Software Vendors will<br />

be notified simultaneously with the release of this Circular.<br />

Please ensure that the appropriate staff within your organisation are<br />

advised of the content of this Circular.<br />

Signed:<br />

Dee Blake<br />

Director of Regulation<br />

<strong>ICE</strong> Futures Europe, a Recognised Investment Exchange <strong>ICE</strong> Futures Europe Circular <strong>11</strong>/<strong>142</strong><br />

under the Financial Services & Markets Act 2000<br />

Registered in England & Wales with Registered Office at<br />

Milton Gate, 60 Chiswell Street, London, EC1Y 4SA<br />

Company Registration No. 1528617 5