ICE Clear U.S. Membership Information

ICE Clear U.S. Membership Information

ICE Clear U.S. Membership Information

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Clear</strong>ing <strong>Membership</strong><br />

<strong>Information</strong> Pack<br />

A LETTER FROM THE PRESIDENT OF <strong>ICE</strong> CLEAR U.S.<br />

To prospective clearing members of <strong>ICE</strong> <strong>Clear</strong> U.S.:<br />

Thank you for your interest in becoming a clearing member of <strong>ICE</strong> <strong>Clear</strong> U.S. As clearing house president, I welcome this opportunity to<br />

provide information about <strong>ICE</strong> <strong>Clear</strong> U.S. and information on the process to become a member of our organization.<br />

<strong>ICE</strong> <strong>Clear</strong> U.S. is a subsidiary of <strong>ICE</strong> Futures U.S. and serves as the clearing house for products traded on the Exchange. <strong>ICE</strong> Futures U.S. is the<br />

successor organization to the New York Board of Trade and its affiliated clearing house, the New York <strong>Clear</strong>ing Corporation. <strong>ICE</strong> Futures U.S.<br />

and <strong>ICE</strong> <strong>Clear</strong> U.S., which are relatively new participants in the U.S. derivatives markets, benefit from the long and rich history of some the first<br />

established futures markets in the U.S. The New York Board of Trade, prior to the acquisition by the IntercontinentalExchange, grew from the<br />

merger of several of the original futures exchanges in New York. The oldest of these exchanges was the New York Cotton Exchange that was<br />

established in 1870. Individual futures markets for coffee, sugar, cocoa and orange juice followed and eventually merged into the New York<br />

Board of Trade. The New York futures markets for these “soft” commodities have had a long and storied role in the economic history of New<br />

York and U.S. popular culture. In 2007, the New York Board of Trade was acquired by IntercontinentalExchange, Inc. As part of that acquisition,<br />

the futures exchange was re-named <strong>ICE</strong> Futures U.S. and its clearing subsidiary became <strong>ICE</strong> <strong>Clear</strong> U.S.<br />

The clearing services offered by <strong>ICE</strong> <strong>Clear</strong> U.S. provide a key role in the success of the markets of <strong>ICE</strong> Futures U.S. By serving as the central<br />

counterparty to each matched trade, trading participants do not need to evaluate the credit potential of counterparties on each executed<br />

transaction or limit their execution to a select group of counterparties. In addition, the risk management procedures and policies of <strong>ICE</strong><br />

<strong>Clear</strong> U.S. which include; intraday mark-to-market, the continuous margining of trading activity and positions, and a rigorous membership<br />

process are designed to mitigate risk exposure to the clearing house and ensure the continued integrity of the marketplace. This discipline<br />

and counterparty risk intermediation is the critical feature of <strong>ICE</strong> <strong>Clear</strong> U.S. that supports the availability of efficient and liquid markets of <strong>ICE</strong><br />

Futures U.S 1 .<br />

The document that follows is designed to help you better understand the role of a new clearing member and the application process required<br />

to become a clearing member of <strong>ICE</strong> <strong>Clear</strong> U.S. In this document you will learn more about clearing member responsibilities and operations of<br />

<strong>ICE</strong> <strong>Clear</strong> U.S. The clearing membership application and supporting information has been assembled in both English and equivalent Mandarin<br />

translations so you can better understand how the financial safeguards and operations of the clearing house work and to make it easier for<br />

you to navigate through the application process to become a clearing member.<br />

Both staff from the Exchange and from the clearing house stand ready to answer your questions and guide you through the requirements.<br />

We look forward to your organization becoming a part of <strong>ICE</strong> <strong>Clear</strong> U.S. and taking its place on a membership roster that includes many of<br />

the most distinguished participants in the financial industry.<br />

Sincerely,<br />

Thomas Hammond<br />

1<br />

IntercontinentalExchange (<strong>ICE</strong>) is a leading operator of regulated futures exchanges and over-the-counter markets. <strong>ICE</strong> is also a leading operator of central clearing services for the futures and over-the-counter markets, with<br />

five regulated clearing houses across North America and Europe. <strong>ICE</strong> serves customers in more than 70 countries.

<strong>ICE</strong> <strong>Clear</strong> U.S. <strong>Clear</strong>ing <strong>Membership</strong> <strong>Information</strong> Pack 2<br />

TABLE OF CONTENTS<br />

PAGE<br />

BRIEF OVERVIEW OF <strong>ICE</strong> FUTURES U.S.<br />

Products, Regulation, Market Participants, Trading Technology, Connectivity, Key Senior Contacts<br />

3<br />

ABOUT <strong>ICE</strong> CLEAR U.S.<br />

Background, Role of the <strong>Clear</strong>ing House, <strong>Clear</strong>ing Member Financial Requirements, Customer Protection, Controlling<br />

5<br />

Risk Through Collection of Margin, Monitoring Risk Intra-day, Position Limits, The Guarantee Fund, Financial Stress,<br />

General Contact <strong>Information</strong>, Website Links, Key Senior Contacts<br />

MEMBERS OF <strong>ICE</strong> CLEAR U.S.<br />

8<br />

<strong>ICE</strong> CLEAR U.S. COMMUNICATIONS<br />

Website Navigation and Subscriptions, <strong>Clear</strong>ing Notices, <strong>ICE</strong> Community<br />

9<br />

APPLYING FOR <strong>ICE</strong> CLEAR U.S. MEMBERSHIP<br />

Five Steps, Quick References, Summary of Financial Requirements (sidebar)<br />

11<br />

Submitting an Application for <strong>ICE</strong> Futures U.S. <strong>Membership</strong><br />

Submitting an Application for Member Firm Privileges<br />

Securing IntercontinentalExchange Shares<br />

Acquiring an <strong>ICE</strong> Futures U.S. Trading <strong>Membership</strong><br />

Submitting an Application for <strong>ICE</strong> <strong>Clear</strong> U.S. <strong>Membership</strong><br />

NFA Registration, Link to Online Application, Filing Financial Reports, Guaranty Fund, Capital Requirements<br />

SETTING UP OPERATIONS AT <strong>ICE</strong> CLEAR U.S.<br />

Banking and Treasury<br />

16<br />

Products <strong>Clear</strong>ed by <strong>ICE</strong> <strong>Clear</strong> U.S., Acceptable Collateral, SPAN Margining, Link to <strong>ICE</strong> Futures U.S. Margins, Approved<br />

Depository Banks<br />

Delivery of Physical Commodities<br />

Position Reporting<br />

Position Change Sheet, Evening PCS, A.M. Position Adjustments<br />

<strong>Clear</strong>ing Technology<br />

Extensible <strong>Clear</strong>ing System (ECS) and Post Trade<br />

Management System (PTMS)<br />

<strong>Clear</strong>ing Technology Special Purpose Applications<br />

Trade Messages/MQ/FixML Messaging<br />

Connectivity/MFT (Managed File Transfer)<br />

Physical Commodity Deliveries/eCOPS (Electronic Commodity Operations System)<br />

Automated Payment of Brokerage/ATOM (Automated Transfer of Money)

<strong>ICE</strong> <strong>Clear</strong> U.S. <strong>Clear</strong>ing <strong>Membership</strong> <strong>Information</strong> Pack 3<br />

A BRIEF OVERVIEW OF <strong>ICE</strong> FUTURES U.S.<br />

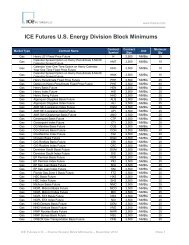

<strong>ICE</strong> Futures U.S. (IFUS) is a leading regulated commodity futures exchange for the trading of agricultural commodities. IFUS and its predecessor<br />

companies have offered trading in contracts based on agricultural commodities for over 130 years and IFUS maintains a strong franchise in<br />

these products. The contracts are designed to provide effective pricing and hedging tools to industry users worldwide, as well as strategic<br />

trading opportunities for investors. The prices for IFUS agricultural contracts serve as global benchmarks for the physical commodity markets,<br />

including Sugar No. 11 (world raw sugar), Coffee “C” (Arabica coffee), Cotton No. 2 (cotton), Frozen Concentrated Orange Juice and Cocoa.<br />

In 2012, IFUS broadened its commodity product suite to include financially-settled futures on US grains and oilseeds and options on those<br />

futures.<br />

IFUS offers financial products in equity index, currency and commodity index markets. The exchange lists futures and options contracts on<br />

Russell indexes, including the US small cap equity benchmark Russell 2000® index, as well as the Russell 1000® and related style indexes. <strong>ICE</strong><br />

entered into a licensing agreement with Russell for the use of its indexes as the basis for equity index futures and options and <strong>ICE</strong> has exclusive<br />

rights through the remainder of the licensing agreement, which extends through June 2017 1 .<br />

IFUS also provides futures and options markets for over 60 currency pair contracts including euro-based, US dollar-based, yen-based, sterlingbased<br />

and other cross-rates, as well as the benchmark US Dollar Index® futures contract. The US Dollar Index futures contract is based on the<br />

<strong>ICE</strong> US Dollar Index, the most well-known and widely quoted measure of the performance of the US dollar. The exchange also offers futures<br />

contracts based on the Continuous Commodity Index, or CCI, and the Reuters Jefferies CRB Futures Price Index.<br />

The US Commodity Exchange Act generally requires that futures trading in the US be conducted on a commodity exchange registered as<br />

a designated contract market by the Commodity Futures Trading Commission, or CFTC. <strong>ICE</strong> Futures U.S. operates as a designated contract<br />

market and is regulated by the CFTC. <strong>ICE</strong> Futures U.S. is responsible for carrying out self-regulatory functions and has its own governance,<br />

compliance, surveillance functions, as well as a framework for disciplining members and other market participants that do not comply with<br />

exchange rules and policies. IFUS is periodically reviewed by the CFTC to insure that it is complying with its self-regulatory obligations.<br />

The Rulebook for <strong>ICE</strong> Futures U.S. is available on the <strong>ICE</strong> website at: https://www.theice.com/Rulebook.shtmlfuturesUSRulebook=<br />

MARKET PARTICIPANTS<br />

<strong>ICE</strong> Futures U.S.’s participants include representatives from segments of the underlying industries served by its agricultural and financial<br />

markets, including the sugar, coffee,cotton and cocoa industries. Traders in these futures markets include hedgers, speculators and investors.<br />

Investors and speculators typically place orders through futures commission merchants (FCMs) or through introducing brokers (IBs) who<br />

have clearing relationships with FCMs. Investors may also pool their funds with other investors in collective investment vehicles known as<br />

commodity pools, which are managed by commodity pool operators and commodity trading advisors (CTAs).<br />

TRADING TECHNOLOGY<br />

Trading of all <strong>ICE</strong> Futures U.S. listed products takes place electronically 2 . IFUS offers its screens for electronic trading in 30 jurisdictions.<br />

IFUS uses the <strong>ICE</strong> electronic trading platform for it futures and options contracts. For futures-related products, the platform supports several<br />

order types, matching algorithms, price reasonability checks, inter-commodity spread pricing and real-time risk management. <strong>ICE</strong> has also<br />

developed an implied matching engine that automatically discovers best bid and offer prices throughout the forward curve.<br />

The <strong>ICE</strong> platform delivers average round trip transaction times of approximately 700 microseconds in its futures markets (transaction time is<br />

1<br />

Subject to achieving specified volumes for the various indexes<br />

2<br />

In 2008, futures contracts at <strong>ICE</strong> Futures U.S. transitioned to exclusive electronic trading. In October 2012, open outcry trading of options came to an end. Some transactions, such as EFPs and blocks, are transacted privately<br />

rather than on the electronic trading platform and submitted electronically for clearing using <strong>ICE</strong>Block.<br />

RETURN TO CONTENTS

<strong>ICE</strong> <strong>Clear</strong> U.S. <strong>Clear</strong>ing <strong>Membership</strong> <strong>Information</strong> Pack 4<br />

measured round trip performance end-to-end within the <strong>ICE</strong> data center and through the <strong>ICE</strong> matching engine). <strong>ICE</strong>’s platform has proven to<br />

be extremely consistent, with more than 99.5% of transactions being completed in less than twenty milliseconds during peak trading periods.<br />

Along with speed and consistency, the <strong>ICE</strong> trading platform is reliable, typically offering greater than 99.99% availability.<br />

CONNECTIVITY<br />

<strong>ICE</strong> offers access to its electronic markets through a broad range of interfaces, including dedicated lines, server co-location data centers,<br />

telecommunications hubs in the US, Europe and Asia, and directly via the Internet. The <strong>ICE</strong> global network consists of high speed dedicated<br />

data lines connecting data hubs in New York, Atlanta, Chicago, London and Singapore with the exchange’s and clearing house’s primary<br />

and disaster recovery data centers. <strong>ICE</strong>’s state-of-the-art hosting center is in Illinois, outside Chicago, and its disaster recovery site for its<br />

technology systems is in Georgia.<br />

<strong>ICE</strong> offers server co-location space at its data centers to all its customers. This service allows customers to deploy their trading servers and<br />

applications onsite, virtually eliminating data transmission latency between the customer and the exchange.<br />

<strong>ICE</strong>’s web-based front-end is called Web<strong>ICE</strong>, and connectivity to the <strong>ICE</strong> trading platform is available through Web<strong>ICE</strong> as well as multiple<br />

independent software vendors (ISVs) 3 and application program interfaces (APIs) for order routing, market data and trade capture. Generally,<br />

<strong>ICE</strong> has over 10,000 connections to its platform daily via Web<strong>ICE</strong> and over 4,000 connections to its platform through multiple ISVs, colocation<br />

centers, dedicated lines and global telecommunications hubs. <strong>ICE</strong> also has introduced <strong>ICE</strong> mobile for iPhone®, iPod Touch® and<br />

iPad®, and Android® and Blackberry enabled devices. <strong>ICE</strong> mobile allows Web<strong>ICE</strong> users the ability to view and manage their Web<strong>ICE</strong> orders<br />

from mobile devices as well as the option to enter orders and trade from certain mobile devices 4 .<br />

KEY SENIOR EXCHANGE CONTACTS AT <strong>ICE</strong> FUTURES U.S.<br />

President<br />

Benjamin Jackson<br />

T: +1 212 748 4150 E: Benjamin.Jackson@theice.com<br />

General Counsel<br />

Audrey Hirschfeld<br />

T: +1 212 748 4083 E: Audrey.Hirschfeld@theice.com<br />

Market Regulation, Compliance<br />

and Market Supervision<br />

Mark Fabian<br />

T: +1 212 748 4010 E: Mark.Fabian@theice.com<br />

Product Development<br />

Tim Barry<br />

T: +1 212 748 4096 E: Tim.Barry@theice.com<br />

Market Development<br />

and Customer Relations<br />

Ray McKenzie<br />

T: +1 212 748 4053 E: Ray.McKenzie@theice.com<br />

3<br />

<strong>ICE</strong> has approved a number of ISVs based on their technology offering and commitment to customer service. A list of the approved ISVs is available on the <strong>ICE</strong> website: theice.com/isv<br />

4<br />

These devices include the iPhone, IPad and Android devices.<br />

RETURN TO CONTENTS

<strong>ICE</strong> <strong>Clear</strong> U.S. <strong>Clear</strong>ing <strong>Membership</strong> <strong>Information</strong> Pack 5<br />

ABOUT <strong>ICE</strong> CLEAR U.S.<br />

BACKGROUND<br />

<strong>ICE</strong> <strong>Clear</strong> U.S. is the derivatives clearing organization for <strong>ICE</strong> Futures U.S., a commodity exchange regulated by the Commodity Futures<br />

Trading Commission (CFTC). Although <strong>ICE</strong> <strong>Clear</strong> U.S. is a wholly-owned subsidiary of <strong>ICE</strong> Futures U.S., it maintains its own membership, Board<br />

of Directors, officers and operating staff.<br />

<strong>ICE</strong> <strong>Clear</strong> U.S. provides an integral service that enhances the stability and integrity of <strong>ICE</strong> Futures U.S. through a comprehensive set of<br />

procedures that includes enforcement of stringent membership standards; management of risk through real-time oversight of clearing<br />

member positions; twice daily margin settlements with its clearing members; limits on the size of positions that may be carried in relation to<br />

a clearing member’s capital; and substantial default resources, including a Guaranty Fund. <strong>ICE</strong> <strong>Clear</strong> U.S. provides the financial backing for all<br />

<strong>ICE</strong> Futures U.S. market participants and <strong>ICE</strong> <strong>Clear</strong> U.S. clearing members.<br />

The <strong>ICE</strong> <strong>Clear</strong>ing Systems encompass a number of integrated systems, most importantly the Post-Trade Management System, or PTMS,<br />

Allocation and Claim Transaction System, or ACT, and the Extensible <strong>Clear</strong>ing System, or ECS. PTMS provides real-time trade processing<br />

services enabling clearing members to offer real-time risk management services. ACT provides for straight through processing of trade<br />

executions given up to other clearing members. ECS supports open and delivery position management, real-time trade and post-trade<br />

accounting, risk management (daily and intra-day cash, marked-to-market/option premium and original margin using the CME SPAN®<br />

algorithm), collateral management, daily settlement and banking. Each of the parts of <strong>ICE</strong> <strong>Clear</strong> U.S. risk management process is explained<br />

more fully below.<br />

THE ROLE OF THE CLEARING HOUSE<br />

Through its system of financial safeguards, <strong>ICE</strong> <strong>Clear</strong> U.S. Inc. (<strong>Clear</strong>ing House) performs two major functions: (1) reconciling and clearing all<br />

futures and options transactions executed on <strong>ICE</strong> Futures U.S. and (2) assuring the financial integrity of each transaction and resulting position.<br />

When a trade has been matched and cleared, <strong>ICE</strong> <strong>Clear</strong> U.S. is substituted as the central counterparty to the trade, thereby guaranteeing<br />

financial performance of the contract to the clearing member on the opposite side. In its role as counterparty for all cleared contracts, <strong>ICE</strong><br />

<strong>Clear</strong> U.S. deals exclusively with <strong>Clear</strong>ing Members.<br />

Each <strong>Clear</strong>ing Member is financially responsible for the contracts it has submitted to <strong>ICE</strong> <strong>Clear</strong> U.S., and the <strong>Clear</strong>inghouse is responsible<br />

to each <strong>Clear</strong>ing Member for the net settlement from all contracts it clears. In support of its role as the central counterparty for all cleared<br />

contracts, <strong>ICE</strong> <strong>Clear</strong> U.S. has instituted a series of financial safeguards and procedures designed to manage the risks it assumes and protect<br />

the integrity of the <strong>Clear</strong>inghouse, as described below.<br />

CLEARING MEMBERSHIP FINANCIAL REQUIREMENTS<br />

Only firms that have adequate capital are eligible to become members of <strong>ICE</strong> <strong>Clear</strong> U.S. Once admitted, <strong>Clear</strong>ing Members must adhere to<br />

stringent financial and operational requirements. <strong>Clear</strong>ing Members must have at least $5,000,000 in adjusted net capital, and any <strong>Clear</strong>ing<br />

Member regulated by the CFTC must also satisfy applicable CFTC capital requirements and segregate and account for all customer funds<br />

and property separate and apart from the <strong>Clear</strong>ing Member’s own property. All clearing members must also be member firms of <strong>ICE</strong> Futures<br />

U.S. (See section entitled Applying for <strong>ICE</strong> <strong>Clear</strong> U.S. <strong>Membership</strong> for a guide to becoming a member firm of <strong>ICE</strong> Futures U.S.) Additionally,<br />

<strong>Clear</strong>ing Members must institute risk management controls and demonstrate the operational capability to handle customer business. All<br />

clearing members must establish banking arrangements with approved banks to facilitate payments to and from <strong>ICE</strong> <strong>Clear</strong> U.S.<br />

CUSTOMER PROTECTION<br />

The contracts cleared by <strong>ICE</strong> <strong>Clear</strong> U.S. are maintained in its records within two accounts or “origins.” These accounts isolate the clearing<br />

RETURN TO CONTENTS

<strong>ICE</strong> <strong>Clear</strong> U.S. <strong>Clear</strong>ing <strong>Membership</strong> <strong>Information</strong> Pack 6<br />

activity related to a <strong>Clear</strong>ing Member’s proprietary business in the “house” origin account and the clearing activity of clients into the “customer<br />

segregated” origin account for each <strong>Clear</strong>ing Member. The <strong>ICE</strong> <strong>Clear</strong> U.S. rules and <strong>Clear</strong>ing Member Agreement clearly define the exclusive<br />

relationship between <strong>ICE</strong> <strong>Clear</strong> U.S. and its members: https://www.theice.com/Rulebook.shtmlclearUSRulebook=<br />

CONTROLLING RISK THROUGH THE COLLECTION OF MARGIN<br />

Unique to the clearing of commodity futures contracts, two margin methods are used by <strong>ICE</strong> <strong>Clear</strong> U.S. to secure performance by its clearing<br />

members. One method is the collection of variation margin based on the twice-daily mark-to-market of open contracts. Following this<br />

procedure, <strong>ICE</strong> <strong>Clear</strong> U.S. typically collects from member firms the vast majority of its financial exposure from open positions before the end<br />

of the trading day. The second margin method is the collection of original margin, which is a good-faith deposit designed to serve as security<br />

for the payment of the <strong>Clear</strong>ing Member’s variation margin obligations to the <strong>Clear</strong>ing House. These two kinds of margin are described below.<br />

Variation Margin<br />

Variation margin covers the previous day’s open positions and the new positions resulting from the current day’s trading activity of the<br />

clearing member. Variation margin for futures contracts can be paid to, and must be collected from, clearing members twice each day. The<br />

intra-day variation calculation uses a prevailing market price whereas the end of day calculation uses the daily settlement price for each<br />

futures contract.<br />

In addition to the scheduled intra-day variation calculation, the <strong>Clear</strong>inghouse may initiate additional intra-day variation calls, for example, in<br />

times of great volatility. These intra-day variation payments constitute advance payments against the end-of- day variation calculation. Calls<br />

for intra-day variation payments by clearing members are required to be satisfied within 60 minutes of request by <strong>ICE</strong> <strong>Clear</strong> U.S.<br />

<strong>Clear</strong>ing members must pay the variation margin calculated at the end of each day by the morning of the following business day. The end-ofday<br />

variation margin includes any remaining variation margin not paid or received from the prior day’s intra-day variation margin calls resulting<br />

from price changes, new trading activity and option premiums.<br />

Original Margin<br />

Original margin is sometimes referred to as a performance bond and is calculated using the historical price volatility of the contract being<br />

margined. It is collected to ensure <strong>Clear</strong>ing Members can meet their variation margin obligations for the next day, should the market move<br />

significantly against the positions they are carrying. <strong>ICE</strong> <strong>Clear</strong> U.S. calculates original margin requirements using a system that determines the<br />

largest theoretical loss a <strong>Clear</strong>ing Member could incur in one day based on historical market prices and volatility.<br />

The Risk Department at <strong>ICE</strong> <strong>Clear</strong> U.S. uses a variety of analytical tools and procedures to establish and validate the margin requirement.<br />

The Risk Department’s targeted minimum confidence interval covers the greater of 97th percentile or 99th confidence interval of one day<br />

price moves during the preceding 10, 30, and 60 days. The <strong>Clear</strong>inghouse adjusts the margin requirement for each commodity up or down<br />

as market volatility changes.<br />

If a clearing member’s original margin requirement increases and <strong>ICE</strong> <strong>Clear</strong> U.S. is not holding sufficient excess cash or collateral from the firm<br />

to cover the increase, <strong>ICE</strong> <strong>Clear</strong> U.S. will call that <strong>Clear</strong>ing Member for additional original margin to meet the deficiency. This calculation is<br />

made daily on the basis of each firm’s end-of-day positions. The clearing house is required to collect gross margins for customer segregated<br />

positions from its clearing members. As such, clearing members are required to submit customer positions by account to the clearing house<br />

on a daily basis. The positions reported by the clearing member are reconciled against the customer segregated positions in clearing. Those<br />

positions that cannot be reconciled comprise a balancing account which is margined on an outright basis.<br />

Monitoring Risk Intra-Day<br />

Throughout the trading day, <strong>ICE</strong> <strong>Clear</strong> U.S. monitors the position and market exposure of each clearing member to ensure that there are<br />

RETURN TO CONTENTS

<strong>ICE</strong> <strong>Clear</strong> U.S. <strong>Clear</strong>ing <strong>Membership</strong> <strong>Information</strong> Pack 7<br />

enough funds on deposit as original margin to cover their risk. This is done by calculating real time profit and loss using up-to-date position<br />

and pricing information and by calculating potential losses using pricing information based on simulated adverse market conditions. <strong>ICE</strong> <strong>Clear</strong><br />

U.S. risk management staff is automatically notified when clearing members have breached pre-defined thresholds allowing them to take<br />

immediate action to resolve any risk issues.<br />

Position Limits<br />

<strong>ICE</strong> <strong>Clear</strong> U.S. establishes for each clearing member a limit that restricts the size of the total positions it may carry with the <strong>Clear</strong>inghouse.<br />

These limits are based on the adjusted net capital of the firm. If a <strong>Clear</strong>ing Member exceeds its position limits, a margin surcharge is added<br />

to its original margin requirement. <strong>ICE</strong> <strong>Clear</strong> U.S. may also reduce the position limits of a clearing member when circumstances warrant. (See<br />

section 5.6, Position Risk, of <strong>ICE</strong> <strong>Clear</strong> U.S. Bylaws: https://www.theice.com/publicdocs/rulebooks/clear/<strong>ICE</strong>_<strong>Clear</strong>_Bylaws.pdf)<br />

The Guaranty Fund: Covering Unmargined Risk<br />

The margin procedures and establishment of position limits by the <strong>Clear</strong>inghouse have proven, over time, to be a sound risk management<br />

technique. It is possible, however, that extreme market conditions or special circumstances relating to a particular clearing member may<br />

result in a default by a clearing member. <strong>ICE</strong> <strong>Clear</strong> U.S. further protects itself from such an event by maintaining a Guaranty Fund into which<br />

each clearing member must make a specified contribution based on the percentage of the overall margins held by the <strong>Clear</strong>ing House and of<br />

the trading volume cleared by the <strong>Clear</strong>ing House it represents. The minimum contribution by each clearing member to the Guaranty Fund<br />

currently is $2,000,000. The Guaranty Fund provides <strong>ICE</strong> <strong>Clear</strong> U.S. with additional resources to cover a default where the losses of a clearing<br />

member are greater than the amount of the original margin held by the <strong>Clear</strong>inghouse from that firm. In such a case, <strong>ICE</strong> <strong>Clear</strong> U.S. can<br />

apply the clearing member’s Guaranty Fund contribution and, if any deficiency still remains, may apply all or any part of the Guaranty Fund<br />

contributions of all other clearing members, in addition to utilizing other sources of funds described below. The size of the guaranty fund is<br />

designed to cover the greatest potential loss at any one clearing member given the largest historical price move in any one commodity. (See<br />

Section 5.4 Guaranty Fund of <strong>ICE</strong> <strong>Clear</strong> U.S. Bylaws: https://www.theice.com/publicdocs/rulebooks/clear/<strong>ICE</strong>_<strong>Clear</strong>_Bylaws.pdf)<br />

It is important to note that while <strong>ICE</strong> <strong>Clear</strong> U.S. has established the Guaranty Fund as a resource, the need to draw upon it has never arisen.<br />

Financial Stress<br />

The U.S. Bankruptcy Code contains provisions that allow the <strong>Clear</strong>inghouse to take actions to minimize its exposure to loss from an insolvent<br />

clearing member. In addition, CFTC Regulations establish a regime governing the distribution of the assets of a bankrupt commodity broker. In<br />

the event of a clearing member’s financial default, <strong>ICE</strong> <strong>Clear</strong> U.S. will suspend the clearing member and attempt to transfer all open positions<br />

of its non-defaulting customers to one or more other clearing members who are in good standing. Any positions not transferred can be<br />

liquidated by the <strong>Clear</strong>inghouse in the market or by book entry in certain cases. The Bylaws authorize <strong>ICE</strong> <strong>Clear</strong> U.S. to use the following<br />

additional sources of funds in the event that the original margin deposits held by the <strong>Clear</strong>inghouse from a defaulting firm, along with that<br />

firm’s Guaranty Fund deposit, is not sufficient to cover its obligation to <strong>ICE</strong> <strong>Clear</strong> U.S.:<br />

• the portion of the surplus capital of <strong>ICE</strong> <strong>Clear</strong> U.S. that the <strong>Clear</strong>inghouse’s Board of Directors determines is available to cover the default;<br />

• a loan, which may be secured by the Guaranty Fund;<br />

• the Guaranty Fund (. For the most recent information regarding the size of Guaranty Fund, please see IntercontinentalExchange, Inc.’s most<br />

recent 10-K or 10-Q SEC filing: http://ir.theice.com/sec.cfmDocType=Annual&Year=&FormatFilter=;<br />

• insurance proceeds, if any, received by the Corporation in connection with the default; and<br />

• assessments levied by the <strong>Clear</strong>inghouse upon all of the non-defaulting clearing members.<br />

In addition, IntercontinentalExchange, Inc. has reserved $50,000,000 of a committed line of credit for the use of <strong>ICE</strong> <strong>Clear</strong> U.S. should it be<br />

needed to provide short-term liquidity in the event of a clearing member default.<br />

RETURN TO CONTENTS

<strong>ICE</strong> <strong>Clear</strong> U.S. <strong>Clear</strong>ing <strong>Membership</strong> <strong>Information</strong> Pack 8<br />

<strong>ICE</strong> CLEAR U.S. MEMBER ORGANIZATIONS 5<br />

ABN AMRO <strong>Clear</strong>ing Chicago, LLC<br />

ADM Investor Services, Inc.<br />

Advantage Futures LLC<br />

Barclays Capital Inc.<br />

BNP Paribas Prime Brokerage, Inc<br />

Citigroup Global Markets, Inc.<br />

Credit Suisse Securities (USA) LLC<br />

Deutsche Bank Securities, Inc.<br />

Dorman Trading, LLC<br />

ED & F Man Capital Markets Inc.<br />

F.C. Stone, L.L.C.<br />

Getco LLC<br />

G.H. Financials, LLC<br />

Goldman Sachs & Company<br />

Goldman Sachs Execution and <strong>Clear</strong>ing<br />

HSBC Securities (USA) Inc.<br />

Interactive Brokers LLC.<br />

J.P. Morgan Securities, LLC<br />

Jefferies Bache, LLC<br />

Jump Trading Futures LLC<br />

Knight Execution & <strong>Clear</strong>ing Services LLC<br />

Macquarie Futures USA, Inc<br />

Marex North America LLC.<br />

Merrill Lynch, Pierce, Fenner & Smith, Inc<br />

Mizuho Securities USA, Inc<br />

Morgan Stanley & Co. LLC<br />

Newedge USA, LLC<br />

Rand Financial Services, Inc.<br />

RBC Capital Markets, LLC.<br />

RBS Securities Inc.<br />

R.J. O’Brien & Associates, LLC.<br />

Rosenthal Collins Group, L.L.C.<br />

Santander Investment Securities, Inc<br />

Term Commodities, Incorporated<br />

UBS Securities, L.L.C.<br />

Vision Financial Markets LLC<br />

5<br />

This list is current as January, 2013. The most current list of <strong>ICE</strong> <strong>Clear</strong> U.S. member organizations can be found online at: https://www.theice.com/clear_us_members.jhtml<br />

RETURN TO CONTENTS

<strong>ICE</strong> <strong>Clear</strong> U.S. <strong>Clear</strong>ing <strong>Membership</strong> <strong>Information</strong> Pack 9<br />

<strong>ICE</strong> CLEAR U.S. COMMUNICATIONS<br />

<strong>ICE</strong> CLEAR U.S. GENERAL PHONE NUMBER<br />

<strong>ICE</strong> CLEAR U.S. MAILING ADDRESS<br />

T: +1 212 748 4001 55 East 52 nd Street, New York, NY 10055<br />

<strong>ICE</strong> CLEAR U.S. WEBSITE<br />

https://www.theice.com/clear_us.jhtml<br />

<strong>ICE</strong> FUTURES U.S. EXCHANGE AND CLEARING FEES (BUNDLED)<br />

https://www.theice.com/publicdocs/futures_us/Exchange_and_<strong>Clear</strong>ing_Fees.pdf<br />

KEY SENIOR CONTACTS AT <strong>ICE</strong> CLEAR U.S.<br />

President<br />

Thomas Hammond<br />

T: +1 212 748 4115/+1 312 836 6714 E: Thomas.Hammond@theice.com<br />

Chief Compliance Officer<br />

Eric Nield<br />

T: +1 312 836 6743 E: Eric.Nield@theice.com<br />

VP, <strong>Clear</strong>ing Operations<br />

Brian Sayler<br />

T: +1 212 748 4118 E: Brian.Sayler@theice.com<br />

Director, Chicago Operations<br />

Diane McFadden<br />

T: +1 312 836 6719 E: Diane.McFadden@theice.com<br />

Director of Risk<br />

Bruce Domash<br />

T: +1 312 836 6709 E: Bruce.Domash@theice.com<br />

CLEARING NOT<strong>ICE</strong>S<br />

One of the primary ways <strong>ICE</strong> <strong>Clear</strong> U.S. communicates with its clearing member community is by way of <strong>Clear</strong>ing Notices. The <strong>Clear</strong>ing<br />

Notices regularly report margin changes, changes of rules and by-laws, system notices and calendars. One of the <strong>Clear</strong>ing Notices published<br />

each month is a calendar of events that includes holidays, new contracts and relevant delivery and expiration dates for that month. The<br />

calendar is published at the end of each month for the next month’s events.<br />

Every clearing member should subscribe to the <strong>Clear</strong>ing Notices distribution. Any number of your company’s staff members may subscribe to<br />

<strong>Clear</strong>ing Notices by visiting: https://www.theice.com/Subscription.shtml, submitting an e-mail address, and choosing the <strong>ICE</strong> <strong>Clear</strong> US Feed.<br />

Within the <strong>ICE</strong> <strong>Clear</strong> U.S. Feed, you may subscribe to Expiration Notices, General <strong>Information</strong>, and Margin notices; you may assign different<br />

e-mail addresses to receive these notices, but someone at your firm should be receiving each kind of notice. The <strong>ICE</strong> <strong>Clear</strong> U.S. monthly<br />

calendar is included in the General <strong>Information</strong> notices.<br />

In addition to the items in the <strong>ICE</strong> <strong>Clear</strong> U.S. Feed, for clearing and delivery considerations you should consider subscribing to these items:<br />

• from the <strong>ICE</strong> System Alert Feed, to the <strong>ICE</strong> <strong>Clear</strong> U.S. Alerts, which are time sensitive alerts sent by e-mail;<br />

• from the Market Notices Feed, to the notices labeled “<strong>ICE</strong> Futures U.S.” — in particular to the <strong>ICE</strong> Futures U.S. Exchange Notices;<br />

• from the General <strong>Information</strong> Feed, the <strong>ICE</strong> News Releases.<br />

RETURN TO CONTENTS

<strong>ICE</strong> <strong>Clear</strong> U.S. <strong>Clear</strong>ing <strong>Membership</strong> <strong>Information</strong> Pack 10<br />

<strong>ICE</strong> COMMUNITY<br />

All clearing members are encouraged to sign up for access to <strong>ICE</strong> Community, an online network for clearing member firms that serves as a<br />

resource for information on technical system specifications, commonly used forms required by <strong>ICE</strong> <strong>Clear</strong> U.S., clearing member contact lists<br />

and recaps of the clearing member working group meetings. Users are also able to post documents and start discussions about ongoing <strong>ICE</strong><br />

projects or generic industry topics with others in the community. When <strong>ICE</strong> <strong>Clear</strong> U.S. is planning a major system initiative, a separate space is<br />

be dedicated in <strong>ICE</strong> Community for system specifications, FAQs and manuals. Some documents are only available online at <strong>ICE</strong> Community.<br />

To ensure that information is shared only with the community of <strong>ICE</strong> <strong>Clear</strong> U.S. members and service vendors, the application for admission to<br />

<strong>ICE</strong> Community is password protected. Access to <strong>ICE</strong> Community can by requested at: https://community.theice.com<br />

Once access is approved and users are logged in, users will note that there are several Communities (column on the left) from which to select,<br />

<strong>ICE</strong> <strong>Clear</strong> being one among several. The space is also shared with other <strong>ICE</strong> clearing houses. Users should also take note of the Notifications<br />

Heading on the lower right side of the page. <strong>ICE</strong> Community users receive email notifications when new or updated information is posted to<br />

the Community.<br />

RETURN TO CONTENTS

<strong>ICE</strong> <strong>Clear</strong> U.S. <strong>Clear</strong>ing <strong>Membership</strong> <strong>Information</strong> Pack 11<br />

APPLYING FOR <strong>ICE</strong> CLEAR U.S. MEMBERSHIP<br />

QUICK REFERENCES<br />

To become a member of <strong>ICE</strong> <strong>Clear</strong> U.S., with clearing privileges for all contracts listed by the<br />

Exchange, your firm must complete the following application process.<br />

Contacts<br />

The primary contact for Steps One<br />

through Four is the <strong>ICE</strong> Futures U.S.<br />

membership department, Linda Chin,<br />

Senior <strong>Membership</strong> Services Coordinator.<br />

Linda can be reached at 212-748-4166,<br />

linda.chin@theice.com<br />

The primary contact for Step Five is Brian<br />

Sayler, Vice-President, <strong>ICE</strong> <strong>Clear</strong> U.S., 212-<br />

748-4118, brian.sayler@theice.com<br />

$ FINANCIAL REQUIREMENTS<br />

• $750 <strong>Membership</strong> Application Fee (for<br />

Step One)<br />

• $1,000 <strong>Membership</strong> Initiation Fee (for<br />

Step One)<br />

• $750 Member Firm Application Fee<br />

(for Step Two)<br />

• Market price for one <strong>ICE</strong> Futures U.S.<br />

Trading <strong>Membership</strong><br />

• 3,162 shares of<br />

IntercontinentalExchange stock<br />

(NYSE:<strong>ICE</strong>)<br />

• $1,500 <strong>Clear</strong>ing Member Application<br />

Fee (Step Five)<br />

• Once the application for membership<br />

in <strong>ICE</strong> <strong>Clear</strong> U.S. is approved, a<br />

contribution to the Guaranty Fund; the<br />

minimum Guaranty Fund deposit is<br />

$2,000,000 (See Step Five).<br />

• The minimum net capital requirement<br />

for clearing members is $5,000,000.<br />

1. A qualified representative of your firm must apply to become and be approved as an<br />

individual Exchange member by the Exchange and the Exchange’s membership committee.<br />

2. Your firm must apply and be approved as a member firm of the Exchange (this application<br />

may be submitted at the same time as the application for individual membership).<br />

3. Your firm must secure 3,162 shares of IntercontinentalExchange common stock (NYSE:<strong>ICE</strong>),<br />

pledge the shares to the Exchange, and place the shares in a restricted account held in the<br />

name of your organization at Computershare Investor Services.<br />

4. Your firm must acquire one Trading <strong>Membership</strong> in <strong>ICE</strong> Futures U.S.<br />

5. Your firm must apply for clearing membership in <strong>ICE</strong> <strong>Clear</strong> U.S. and be approved as a<br />

clearing member by the Board of <strong>ICE</strong> <strong>Clear</strong> U.S.<br />

Each of these steps is discussed in more detail on the following pages.<br />

MAILING ADDRESS<br />

<strong>ICE</strong> Futures U.S.<br />

55 East 52 nd Street, New York, NY 10055<br />

ONLINE INFORMATION<br />

Member Services<br />

theice.com/futures_us_membership.jhtml<br />

<strong>ICE</strong> <strong>Clear</strong> U.S<br />

theice.com/clear_us.jhtml<br />

RETURN TO CONTENTS

<strong>ICE</strong> <strong>Clear</strong> U.S. <strong>Clear</strong>ing <strong>Membership</strong> <strong>Information</strong> Pack 12<br />

1. SUBMIT AN APPLICATION FOR MEMBERSHIP AT <strong>ICE</strong> FUTURES U.S.<br />

One of the officers, directors or executive employees or managers of your firm must complete an application for a trading membership at the<br />

Exchange and be approved by the Exchange and the Exchange’s membership committee. The person who applies for membership must be a<br />

full-time employee of your firm and exercise authority over the firm’s activities on the Exchange. (A qualified person at your firm must become<br />

an Exchange member because only members of the Exchange may purchase the trading membership your firm must have to become an<br />

Exchange member firm, and <strong>ICE</strong> <strong>Clear</strong> rules require that your firm must be an Exchange member firm to become an <strong>ICE</strong> <strong>Clear</strong> U.S. clearing<br />

member.)<br />

The application for membership is available at: https://www.theice.com/publicdocs/futures_us/Form_M01_Application_for_<strong>Membership</strong>.pdf<br />

The application may be completed online, downloaded, printed and signed.<br />

A non-refundable $750 application fee must accompany the application. All fees should be in the form of a check or money order payable to<br />

<strong>ICE</strong> Futures U.S.<br />

The completed application, along with attachments and fees, should be returned to:<br />

Linda Chin<br />

Senior <strong>Membership</strong> Services Coordinator, Member Services Department,<br />

<strong>ICE</strong> Futures U.S., 55 East 52 nd Street, New York, NY 10055<br />

At least ten days prior to any consideration of an application by the Exchange, the name and address of an applicant is sent to all members of<br />

<strong>ICE</strong> Futures U.S; this ten day period should be added to the your projected time line for the length of the application procedure.<br />

Completed applications are submitted to investigation, a process that normally takes two weeks. The report from the investigators, along with<br />

the application, is sent to the <strong>ICE</strong> Futures U.S. <strong>Membership</strong> Committee for review and approval. The <strong>Membership</strong> Committee review should<br />

also be completed within a two week period after it receives the investigation report. You will be notified of committee approval by phone at<br />

the preferred contact number indicated on your application. The phone notification will be followed up by a mailed notice of approval.<br />

Once your application is approved by the Exchange and the Exchange <strong>Membership</strong> Committee, you have thirty days to purchase and pay<br />

for one <strong>ICE</strong> Futures U.S. trading membership and pay a $1,000 initiation fee. Again, the fee should be in the form of a check or money order<br />

payable to <strong>ICE</strong> Futures U.S. Incomplete applications are kept on file for two months. After that time, the application is considered withdrawn<br />

and a new application must be submitted.<br />

2. SUBMIT AN APPLICATION TO RECEIVE MEMBER FIRM PRIVILEGES.<br />

By submitting this application, the individual at your firm who has been approved as an <strong>ICE</strong> Futures U.S. member requests that the Exchange<br />

confer member firm privileges on your firm. This application can be submitted along with the application for individual membership described<br />

in Step One.<br />

There is a $750 application fee associated with the member firm application, again payable by check or money order to <strong>ICE</strong> Futures U.S.<br />

The member firm application form is available at:<br />

https://www.theice.com/publicdocs/futures_us/Form_C01_Application_to_Receive_Member_Firm_Privileges.pdf<br />

It can be filled out online, printed and returned to the <strong>ICE</strong> Futures U.S. membership department at the address shown above.<br />

RETURN TO CONTENTS

<strong>ICE</strong> <strong>Clear</strong> U.S. <strong>Clear</strong>ing <strong>Membership</strong> <strong>Information</strong> Pack 13<br />

In the case of a corporation, the application must be signed by an officer. Corporations applying for member firm privileges must provide<br />

a copy of the certificate of incorporation, including all amendments, by-laws, and a resolution of the board of directors authorizing the<br />

application for member firm privileges certified by the secretary of the corporation. The application also asks for a designated exchange<br />

liaison.<br />

In order to recognize the membership as an asset of the firm, an A-B-C agreement must be completed and signed by an officer of the firm<br />

and the applicant. The completed agreement should accompany your application.<br />

The Exchange’s A-B-C agreement may be found at: https://www.theice.com/publicdocs/futures_us/Form_S06_ABCAgreement.pdf<br />

This application, application fee and attachments should be submitted to the <strong>ICE</strong> Futures U.S. membership department at the address shown<br />

in Step One. The notice that your firm has been approved as a member firm of the Exchange should be received within approximately two<br />

weeks of submission.<br />

3. SECURE 3,162 SHARES OF INTERCONTINENTALEXCHANGE, PLEDGE THE SHARES TO <strong>ICE</strong> FUTURES U.S., AND PLACE THE STOCK IN<br />

A RESTRICTED ACCOUNT AT COMPUTERSHARE INVESTOR SERV<strong>ICE</strong>S<br />

Please call Linda Chin at the <strong>ICE</strong> Futures membership department (212-748-4166) to request that a restricted account be set up in your<br />

company’s name at Computershare Investor Services, the Exchange’s transfer agent. Your firm should then instruct its broker to transfer the<br />

required number of <strong>ICE</strong> shares to the Computershare account. (The shares may either have been held by your firm previously or acquired<br />

in open market transactions.) This account is monitored by the Exchange to assure that the required number of shares for clearing member<br />

status is maintained.<br />

After your account is set up, you can visit: computershare.com to monitor and value your stock position.<br />

4. ACQUIRE ONE <strong>ICE</strong> FUTURES U.S. TRADING MEMBERSHIP<br />

Once the qualifying person at your firm has applied for and been approved as an individual member of the Exchange and the <strong>ICE</strong> stock is in<br />

the restricted account at Computershare Investor Services, your firm must acquire one <strong>ICE</strong> Futures U.S. Trading <strong>Membership</strong>.<br />

The current bid/offer prices for the membership can be viewed at:<br />

https://www.theice.com/publicdocs/futures_us/<strong>Membership</strong>_Seat_Market.pdf<br />

To purchase a Trading <strong>Membership</strong>, the person at your firm who has been approved as a member must submit a bid form in writing to the<br />

Exchange. Typically, a bid form is provided to you by the <strong>ICE</strong> Futures U.S. membership department at the point in the application process<br />

at which a trading membership needs to be acquired; if you have not received the bid form, the form is available from the membership<br />

department (the bid form is not online). The completed bid form maybe submitted in person at the <strong>ICE</strong> Futures U.S. membership department<br />

in New York, by fax to +1 212 748 4808, attn. Linda Chin, or by e-mail to: Linda.Chin@theice.com<br />

Notification of the acceptance of your bid and the name of the seller will be delivered by phone to the preferred contact phone number on<br />

your bid form and by e-mail. Within ten days of the acceptance notice, an Official Teller’s Check or Certified Check payable to the seller must<br />

be submitted to the membership department. The check may be delivered to the Exchange membership department or sent to Linda Chin<br />

at the address given above.<br />

Special Note: Large Trader Reporting Requirements<br />

CFTC regulations require all clearing members to report the positions of large traders daily. Large traders are customers of clearing members<br />

RETURN TO CONTENTS

<strong>ICE</strong> <strong>Clear</strong> U.S. <strong>Clear</strong>ing <strong>Membership</strong> <strong>Information</strong> Pack 14<br />

who have open positions at the end of the day exceeding reportable position levels. The reportable position levels are established by <strong>ICE</strong><br />

Futures U.S. Although the large trader reporting requirements are not clearing house regulations, clearing members fulfill their large trading<br />

reporting requirements with respect to <strong>ICE</strong> Futures U.S. products by transmitting a file containing the applicable information to <strong>ICE</strong> <strong>Clear</strong> U.S.,<br />

which then passes the information to the CFTC. The large trader report is submitted via the clearing house’s Managed File Transfer (MFT)<br />

protocol that is discussed in the <strong>Clear</strong>ing Technology, Special Purpose Applications section of this document.<br />

A table with the reportable levels of all <strong>ICE</strong> Futures US listed products can be found at:<br />

https://www.theice.com/publicdocs/futures_us_reports/all/Futures_US_Reportable_Levels.pdf<br />

The file format for the larger trader report can be found at: https://www.cftc.gov/industryoversight/marketsurveillance/ltrformat<br />

Special Note: Automated Payment of Brokerage Commissions (ATOM)<br />

<strong>ICE</strong> clearing members may use the Exchange’s automated payment system (ATOM) for paying brokerage commissions to <strong>ICE</strong> Futures<br />

U.S. members. Use of this system is not mandatory. Applications for clearing member participation in ATOM are handled through the <strong>ICE</strong><br />

Futures U.S. membership department. The ATOM system is discussed in the <strong>Clear</strong>ing Technology, Special Purpose Applications section of this<br />

document.<br />

5. COMPLETE AN APPLICATION FOR MEMBERSHIP IN <strong>ICE</strong> CLEAR U.S.<br />

NFA REGISTRATION<br />

An applicant firm may need to be registered with the U.S. futures industry’s self regulatory organization, the National Futures Association<br />

(NFA), to conduct its U.S. business. An applicant organization that intends to clear business for U.S. customers must be registered with<br />

the NFA as a Futures Commission Merchant (FCM) or a Broker Dealer (BD). An applicant firm intending to clear proprietary business only<br />

is not required to register with the NFA. Please visit: nfa.org for more complete information.<br />

Your organization is required to complete an application to become a member of <strong>ICE</strong> <strong>Clear</strong> U.S. Contacts for help with the <strong>ICE</strong> <strong>Clear</strong> U.S.<br />

application can be found on the first page of this section. Payment of a $1,500 application fee must accompany the application.<br />

The application for clearing membership is available at: https://www.theice.com/publicdocs/clear_us/<strong>Clear</strong>_US_Member_Application.pdf<br />

An applicant is required to file financial reports at the time of application and on an on-going basis as a condition of clearing membership.<br />

Reports are to be filed through the Winjammer service. Within Winjammer, the applicant firm enables reports to be distributed to <strong>ICE</strong> <strong>Clear</strong><br />

U.S.<br />

The rules regarding the financial reporting requirements of clearing members are in <strong>ICE</strong> <strong>Clear</strong> U.S. Rules, section 3:<br />

https://www.theice.com/publicdocs/rulebooks/clear/3_Financial_Requirements.pdf<br />

The WinJammer Online Filing System is a web application developed jointly by the CME Group, Inc. and the National Futures Association.<br />

WinJammer is the futures industry standard for futures firms to enter and transmit FOCUS, 1FR-FCM, Segregated Investment Detail Reports<br />

(SIDR) and other financial statements. Steps for getting your firm ready to file WinJammer reports can be found at:<br />

https://www.nfa.futures.org/NFA-electronic-filings/winJammer.html<br />

Once your organization’s completed clearing member application is submitted, the risk department of <strong>ICE</strong> <strong>Clear</strong> U.S. performs a due diligence<br />

review, including a risk review. Elements of this review include a discussion of the applicant firm’s financial statements and capital position and<br />

an examination of its risk monitoring procedures. Following the review, the risk department makes a recommendation to <strong>ICE</strong> <strong>Clear</strong> U.S.’s Risk<br />

RETURN TO CONTENTS

<strong>ICE</strong> <strong>Clear</strong> U.S. <strong>Clear</strong>ing <strong>Membership</strong> <strong>Information</strong> Pack 15<br />

Committee. The Risk Committee considers the staff recommendation and makes a recommendation to the <strong>ICE</strong> Futures U.S. Board of Directors<br />

for final approval. The Risk Committee and the Board normally meet monthly and quarterly, respectively. The process from the submission of<br />

your firm’s application to approval by the Board can be expected to take approximately four to six weeks under normal circumstances.<br />

When your organization’s application for clearing membership is approved, your firm is required to make a minimum Guaranty Fund deposit<br />

of $2,000,000. (Once your firm has been a clearing member for at least one month, its contribution to the Guaranty Fund Is based on the<br />

normal calculation for Guaranty Fund contributions described in Section 5.4 of the <strong>ICE</strong> <strong>Clear</strong> U.S. by-laws.) Guaranty Fund requirements must<br />

be met with US dollar-denominated collateral.<br />

The <strong>ICE</strong> <strong>Clear</strong> By-Law 5.4 that describes the calculation of Guaranty Fund contributions can be found at:<br />

https://www.theice.com/publicdocs/rulebooks/clear/<strong>ICE</strong>_<strong>Clear</strong>_Bylaws.pdf<br />

The minimum net capital required of <strong>ICE</strong> <strong>Clear</strong> U.S. clearing members is $5,000,000.<br />

RETURN TO CONTENTS

<strong>ICE</strong> <strong>Clear</strong> U.S. <strong>Clear</strong>ing <strong>Membership</strong> <strong>Information</strong> Pack 16<br />

SETTING UP OPERATIONS AT <strong>ICE</strong> CLEAR U.S.<br />

JOIN THE <strong>ICE</strong> COMMUNITY INFORMATION NETWORK!<br />

<strong>ICE</strong> Community is an information network website for clearing member firms. It serves as a valuable resource for clearing system<br />

specifications information, required forms, clearing member contact lists and recaps of clearing member working group meetings and<br />

certain documents are not accessible except on this site. A user name and password are required. If staff members from your organization<br />

are not using <strong>ICE</strong> Community, registration is available at: https://community.theice.com<br />

BANKING AND TREASURY<br />

<strong>ICE</strong> <strong>Clear</strong> U.S. clears contracts that settle (require the payment of daily variation margin) in U.S. dollars, so each clearing member must have<br />

a U.S. dollar settlement account.<br />

<strong>ICE</strong> <strong>Clear</strong> U.S. also clears a number of currency contracts that settle in twelve foreign currencies. In order to clear the Exchange’s currency<br />

contracts, a clearing member also must have a settlement account in the settlement currency specified for the contract.<br />

A list of the <strong>ICE</strong> Futures U.S. currency contracts cleared by <strong>ICE</strong> <strong>Clear</strong> U.S. can be viewed at:<br />

https://www.theice.com/publicdocs/futures_us/<strong>ICE</strong>_Futures_US_Currency_Pair_Contracts.pdf<br />

The settlement currency is the currency of the price quotation.<br />

<strong>ICE</strong> <strong>Clear</strong> U.S. calculates original margin requirements for each clearing member position account as part of end-of-day processing using the<br />

SPAN margining system. Margins are calculated on a gross basis for customer segregated positions based on position information by account<br />

that is submitted by the clearing members. Margins are calculated on a net basis for proprietary position accounts.<br />

Margins on deposit are compared to the new original margin requirement to determine whether a clearing member has an original margin<br />

deficiency or surplus. Original margin requirements may be met with cash or with acceptable collateral.<br />

View a table with information about acceptable collateral at <strong>ICE</strong> <strong>Clear</strong> U.S. and haircuts on each type of collateral at:<br />

https://www.theice.com/publicdocs/clear_us/ICUS_Collateral_<strong>Information</strong>.pdf<br />

An explanation of the SPAN margining system can be found at: https://www.theice.com/publicdocs/clear_us/SPAN_Explanation.pdf<br />

Current <strong>ICE</strong> Futures U.S. margin requirements for contracts cleared by <strong>ICE</strong> <strong>Clear</strong> U.S. are available at:<br />

https://www.theice.com/publicdocs/futures_us_reports/all/Futures_US_Margin_Requirements.pdf<br />

<strong>Clear</strong>ing members are required to establish and maintain banking relationships with one or more of the clearing house’s approved depositories<br />

listed below for the purpose of meeting daily cash and collateral margin requirements.<br />

The list of approved depository banks is online at: https://www.theice.com/publicdocs/clear_us/Approved_Depositories.pdf<br />

US Dollar Margin Settlement<br />

• Bank of New York Mellon<br />

• Brown Brothers Harriman & Company<br />

• Deutsche Bank Trust Company Americas<br />

RETURN TO CONTENTS

<strong>ICE</strong> <strong>Clear</strong> U.S. <strong>Clear</strong>ing <strong>Membership</strong> <strong>Information</strong> Pack 17<br />

• JPMorgan Chase Bank, N.A.<br />

• BMO Harris Bank N.A.<br />

Foreign Currency Margin Settlements<br />

• Brown Brothers Harriman & Company<br />

• JPMorgan Chase Bank, N.A.<br />

• BMO Harris Bank N.A.<br />

Custody<br />

• Brown Brothers Harriman & Company<br />

• JP Morgan Chase Bank, N.A.<br />

• BMO Harris Bank N.A.<br />

A clearing member must designate to <strong>ICE</strong> <strong>Clear</strong> U.S. which of these three custodian banks will hold its margin securities.<br />

PHYSICALLY-DELIVERED CONTRACTS<br />

<strong>Clear</strong>ing members are required to have expertise about the delivery provisions of <strong>ICE</strong> Futures U.S. physically-delivered contracts if they plan<br />

to engage in activity in those markets.<br />

Agricultural Contracts<br />

Currently, the <strong>ICE</strong> Futures U.S. agricultural contracts that include a delivery of physical commodity for final settlement are coffee, sugar, cocoa,<br />

cotton and orange juice. Rules governing physical delivery for each deliverable agricultural commodity can be found in the <strong>ICE</strong> Futures U.S.<br />

Rulebook at these locations.<br />

Cocoa:<br />

Coffee:<br />

Cotton:<br />

Orange Juice:<br />

Sugar:<br />

https://www.theice.com/publicdocs/rulebooks/futures_us/9_Cocoa.pdf<br />

https://www.theice.com/publicdocs/rulebooks/futures_us/8_Coffee.pdf<br />

https://www.theice.com/publicdocs/rulebooks/futures_us/10_Cotton.pdf<br />

https://www.theice.com/publicdocs/rulebooks/futures_us/13_FCOJ.pdf<br />

https://www.theice.com/publicdocs/rulebooks/futures_us/11_Sugar_11.pdf<br />

For contracts that settle through physical delivery of an agricultural commodity, a clearing member uses the Exchange’s eCOPS application<br />

to enter positions for allocation of delivery notices, to issue notices of delivery and to manage receipts for physical product when applicable.<br />

More details about using the eCOPS system can be found in the <strong>Clear</strong>ing Technology, Special Purpose Applications section of this document.<br />

Financial Contracts<br />

Financial contracts requiring physical delivery are the <strong>ICE</strong> Futures U.S. Dollar Index and currency futures contracts.<br />

Delivery procedures for <strong>ICE</strong> Futures U.S. currency contracts are found in the Exchange rulebook:<br />

https://www.theice.com/publicdocs/rulebooks/futures_us/16_Currencies.pdf, Rule 16.04<br />

Physical delivery of eligible foreign currencies at the final settlement of an <strong>ICE</strong> Futures U.S. currency futures contract, including final settlement<br />

for the <strong>ICE</strong> U.S. Dollar Index contract, is completed through CLS, the multi-currency cash settlement system owned by the major FX banks. A<br />

clearing member must have access to CLS either as a direct member or third-party client. Participation in CLS should be arranged through a<br />

clearing firm’s bank. More information about CLS can be found at: http://www.cls-group.com/Pages/default.aspx<br />

RETURN TO CONTENTS

<strong>ICE</strong> <strong>Clear</strong> U.S. <strong>Clear</strong>ing <strong>Membership</strong> <strong>Information</strong> Pack 18<br />

Examples of the Dollar Index contract’s USDX final settlement procedures are available in the US Dollar Index FAQ:<br />

https://www.theice.com/publicdocs/futures_us/<strong>ICE</strong>_Dollar_Index_FAQ.pdf<br />

POSITION REPORTING<br />

Positions are maintained within the clearing house system on a gross basis. In order to maintain updated positions (prior day’s positions<br />

adjusted for current day—also called top day—trading), clearing members are required to make evening and morning submissions to the<br />

clearing house.<br />

PCS (Position Change Submission)<br />

PCS instructions are used by members as the means through which clearing members notify the clearing house of adjustments to the open<br />

positions on gross maintained position accounts. Broadly, these are used to notify the clearing house of a close-out or establishment of a<br />

position and are required by the clearing house and the Exchange in order to maintain an accurate view of open interest and ensure that<br />

positions that are subject to option exercise and delivery activity are correct at the time of options exercise or delivery allocation.<br />

PCS files are submitted to the clearing house through <strong>ICE</strong> <strong>Clear</strong> U.S.’s Managed File Transfer (MFT) service. More information about MFT is<br />

available in the <strong>Clear</strong>ing Technology, Special Purpose Applications section of this document. FixML file specifications for PCS can be found in<br />

<strong>ICE</strong> Community: https://community.theice.com<br />

Evening PCS<br />

A position change submission (PCS) file should be delivered to the clearing house each evening. The evening submission details the clearing<br />

member’s updated gross position in each <strong>ICE</strong> Futures U.S. contract. The submission deadline for the evening PCS is 7:00PM ET.<br />

AM Position Adjustments<br />

A clearing member may make adjustments to its prior-day gross positions through the clearing system user interface (see ECS, below) the<br />

day after trade day. The submission deadline for the morning position adjustment is 9:00AM ET.<br />

GCM (GROSS CUSTOMER MARGIN) REPORTING<br />

GCM files are used to determine a clearing member’s positions for the purpose of calculating original margin. In addition to PCS submission,<br />

clearing members must also submit a GCM file of customer positions by account. The positions reported in the GCM file are reconciled against<br />

the positions in clearing after the processing of PCS. Unreconciled positions are included in a balancing account which is margined on an<br />

outright basis and added to the clearing member’s margin calculation.<br />

CLEARING TECHNOLOGY<br />

<strong>ICE</strong> clearing systems encompass a number of integrated systems, most importantly, the Extensible <strong>Clear</strong>ing System, or ECS, and the Post-<br />

Trade Management System, or PTMS, and ACT (Allocation and Claim Transaction) system. <strong>Clear</strong>ing members are given access to all clearing<br />

system applications necessary to meet clearing member requirements.<br />

Extensible <strong>Clear</strong>ing System (ECS)<br />

Internet-based ECS is the core clearing system. ECS supports open and delivery position management, real-time trade and post-trade<br />

accounting, risk management (daily and intra-day cash, mark-to-market option premium, and original margin using the CME SPAN algorithm),<br />

collateral management, daily settlement and banking. ECS is a state-of-the-art system offering open, Internet-based connectivity and<br />

integration options for clearing member access to user and account management, position reporting and collateral management. ECS also<br />

has a reporting system that delivers on-line access to daily and historical reports in multiple formats, as well as a currency delivery system to<br />

manage the delivery and payment of currency settlements.<br />

RETURN TO CONTENTS

<strong>ICE</strong> <strong>Clear</strong> U.S. <strong>Clear</strong>ing <strong>Membership</strong> <strong>Information</strong> Pack 19<br />

ECS is password protected. Visit: https://ecs.usclearing.theice.com for login access to ECS. The ECS manual can be found at:<br />

https://www.theice.com/publicdocs/futures_us/ICUS_ECS_Procedures.pdf<br />

Post Trade Management System (PTMS)<br />

PTMS is the primary application for post-trade management. The system provides real-time trade processing services enabling clearing<br />

members to offer real-time risk management services. <strong>ICE</strong> <strong>Clear</strong> U.S. offers real-time confirmation of trades booked for clearing over standard<br />

FIXML API and supports post-trade management functions including trade corrections, trade adjustments, position transfers, average pricing<br />

and give-up processing.<br />

PTMS is password protected. Login access to PTMS training guides and both test and production systems is at:<br />

https://ptms.usclearing.theice.com/client/ptms.jnlp<br />

A PTMS User Manual can be accessed at: https://www.theice.com/publicdocs/clear_us/<strong>ICE</strong>_<strong>Clear</strong>_US_PTMS2_User_Guide.pdf<br />

Allocation and Claim Transaction (ACT) System<br />

Trades marked for give-up in PTMS are sent to ACT. Using ACT, a clearing member can initiate allocations (give-outs) to multiple clearing<br />

members and monitor the status of those allocations as well as the status of give-ins from other firms. ACT also allows a clearing member to<br />

define profiles to automate the allocation and claiming of trade activity. Give-up transactions (from and to) are recorded in the clearing system<br />

and reflected on the clearing member’s clearing records. <strong>Information</strong> about the give-up transactions is also sent for billing to the eGains<br />

system, an automated billing system supported by the Futures Industry Association (FIA) and Markit.<br />

Exchange fee billing for give-up transactions passes charges to the ultimate carrying (claiming) firm. A clearing member is not assessed<br />

exchange fees for trades it executes and allocates to other clearing members. A fee of $ .10 per contract side ($ .05 for Russell stock index<br />

mini contracts) is assessed to the claiming firm for allocation records processed in clearing.<br />

Login is required for the ACT system. Login access to both test and production systems and trading guides is at:<br />

https://www.theice.com/clear_us_technology.jhtml<br />

Technical specifications for ACT are available in <strong>ICE</strong> Community — https://community.theice.com — registration required:<br />

https://community.theice.com/community/ice_clear/technical_specifications<br />

An ACT Training Guide can be found at: https://www.theice.com/publicdocs/clear_us/ACT_TrainingGuide.pdf<br />

An updated list of ACT contacts for each clearing member: https://community.theice.com/docs/DOC-1792 is available through <strong>ICE</strong><br />

Community (registration required).<br />

CLEARING TECHNOLOGY: SPECIAL PURPOSE APPLICATIONS<br />

<strong>ICE</strong> <strong>Clear</strong> U.S offers a number of special purpose applications to handle specific clearing tasks and services. These applications are described<br />

below, along with information about setting up to use the application.<br />

FOR RECEIVING TRADE MESSAGES<br />

MQ/FixML Messaging<br />

A clearing member typically receives trade messages during the trading day to load to internal bookkeeping and risk systems. <strong>ICE</strong> <strong>Clear</strong> U.S<br />

uses the industry standard FixML trade confirmation messages sent over MQ channels set up with the clearing member.<br />

RETURN TO CONTENTS

<strong>ICE</strong> <strong>Clear</strong> U.S. <strong>Clear</strong>ing <strong>Membership</strong> <strong>Information</strong> Pack 20<br />

Messaging specifications and a set-up questionnaire are available in <strong>ICE</strong> Community, the information network for clearing member firms. (A<br />

clearing member can register for <strong>ICE</strong> Community at: https://community.theice.com).<br />

FixML specifications are available in <strong>ICE</strong> Community at: https://community.theice.com/community/ice_clear/technical_specificationsFixML<br />

real-time trade feeds specifications, along with a set-up questionnaire, are available in <strong>ICE</strong> Community at:<br />

https://community.theice.com/community/ice_clear/technical_specifications<br />

FOR CONNECTIVITY<br />

MFT (Managed File Transfer)<br />

The <strong>ICE</strong> <strong>Clear</strong> U.S. MFT service is a member interface that provides access to key reports and data published by the clearing house. It is also<br />

the service that a clearing firm uses to send important data, including regulatory reports and position change and gross customer margin<br />

submissions, to the clearing house. MFT is not a browser based application. Connectivity to MFT is provided through SFTP client software.<br />

The system URL for the MFT system is: mft.usclearing.theice.com<br />

The MFT User Access Form is available at: https://community.theice.com/docs/DOC-10017<br />

A MFT User Guide is available at: https://community.theice.com/docs/DOC-10016<br />

Please note that the documents are only available to users registered on the <strong>ICE</strong> Community site.<br />

The following reports and files are sent/received via MFT.<br />

FROM <strong>ICE</strong> CLEAR U.S. TO CLEARING MEMBERS (CLEARING MEMBER DOWNLOADS)<br />

Billing<br />

<strong>ICE</strong> <strong>Clear</strong> U.S. provides clearing members with a report of monthly exchange and clearing fee details on a preliminary daily and final monthly<br />

basis. A summary of fees is processed through the clearing member’s proprietary settlement account on a date determined by the clearing<br />

house. The most current <strong>ICE</strong> Futures U.S. Exchange and <strong>Clear</strong>ing Fees can always be found at:<br />

https://www.theice.com/publicdocs/futures_us/Exchange_and_<strong>Clear</strong>ing_Fees.pdf<br />

Scroll to the bottom of the document for miscellaneous clearing fees and charges.<br />

Reconciliation<br />

Matchoff file: <strong>ICE</strong> <strong>Clear</strong> U.S. provides a data file version of the Trade and Position Register that clearing members can use in their point balance<br />

systems.<br />

Exercise/Assignments: <strong>ICE</strong> <strong>Clear</strong> U.S. provides a data file version of the Exercise/Assignment report that clearing members can use to automate<br />

the assignment of options in their bookkeeping systems.<br />

The FixML Matchoff file and Exercise/Assignment file layouts can be found at:<br />

https://community.theice.com/community/ice_clear/technical_specifications<br />

<strong>Clear</strong>ing Reports<br />

<strong>ICE</strong> <strong>Clear</strong> U.S. provides numerous reports and data files that relate to trades, positions, banking and billing, all of which are available on MFT.<br />

RETURN TO CONTENTS

<strong>ICE</strong> <strong>Clear</strong> U.S. <strong>Clear</strong>ing <strong>Membership</strong> <strong>Information</strong> Pack 21<br />

<strong>Clear</strong>ing members should refer to <strong>ICE</strong> <strong>Clear</strong> – Member Report Specification which is available in <strong>ICE</strong> Community:<br />

https://community.theice.com/docs/DOC-11146<br />

FROM CLEARING MEMBERS TO <strong>ICE</strong> CLEAR U.S. (CLEARING MEMBER UPLOADS)<br />

• PCS File (See Position Change Submission, above)<br />

• Large Trader Report<br />

• Gross Customer Margins (GCM) (see GCM Reporting, above)<br />

• Submission of Bulk Cotton Notices<br />

FOR PHYSICAL DELIVERY OF COMMODITIES<br />

eCOPS (Commodity Operations and Processing System)<br />