ESSEL PROPACK LIMITED

ESSEL PROPACK LIMITED

ESSEL PROPACK LIMITED

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>ESSEL</strong> <strong>PROPACK</strong> <strong>LIMITED</strong><br />

Regd. Office : P.O. Vasind, Taluka Shahapur, Dist. Thane, Maharashtra - 421 604.<br />

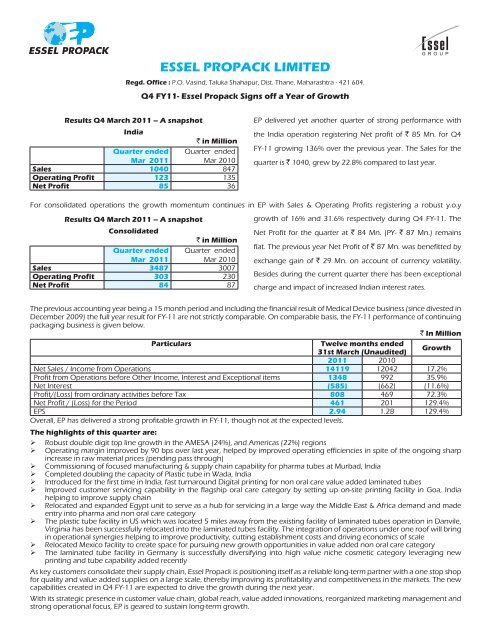

Q4 FY11- Essel Propack Signs off a Year of Growth<br />

Results Q4 March 2011 – A snapshot<br />

India<br />

` in Million<br />

Quarter ended<br />

Mar 2011<br />

Quarter ended<br />

Mar 2010<br />

Sales 1040 847<br />

Operating Profit 123 135<br />

Net Profit 85 36<br />

EP delivered yet another quarter of strong performance with<br />

the India operation registering Net profit of ` 85 Mn. for Q4<br />

FY-11 growing 136% over the previous year. The Sales for the<br />

quarter is ` 1040, grew by 22.8% compared to last year.<br />

For consolidated operations the growth momentum continues in EP with Sales & Operating Profits registering a robust y.o.y<br />

Results Q4 March 2011 – A snapshot<br />

Consolidated<br />

` in Million<br />

Quarter ended<br />

Mar 2011<br />

Quarter ended<br />

Mar 2010<br />

Sales 3487 3007<br />

Operating Profit 303 230<br />

Net Profit 84 87<br />

growth of 16% and 31.6% respectively during Q4 FY-11. The<br />

Net Profit for the quarter at ` 84 Mn. (PY- ` 87 Mn.) remains<br />

flat. The previous year Net Profit of ` 87 Mn. was benefitted by<br />

exchange gain of ` 29 Mn. on account of currency volatility.<br />

Besides during the current quarter there has been exceptional<br />

charge and impact of increased Indian interest rates.<br />

The previous accounting year being a 15 month period and including the financial result of Medical Device business (since divested in<br />

December 2009) the full year result for FY-11 are not strictly comparable. On comparable basis, the FY-11 performance of continuing<br />

packaging business is given below.<br />

` In Million<br />

Particulars<br />

Twelve months ended<br />

31st March (Unaudited)<br />

Growth<br />

2011 2010<br />

Net Sales / Income from Operations 14119 12042 17.2%<br />

Profit from Operations before Other Income, Interest and Exceptional items 1348 992 35.9%<br />

Net Interest (585) (662) (11.6%)<br />

Profit/(Loss) from ordinary activities before Tax 808 469 72.3%<br />

Net Profit / (Loss) for the Period 461 201 129.4%<br />

EPS 2.94 1.28 129.4%<br />

Overall, EP has delivered a strong profitable growth in FY-11, though not at the expected levels.<br />

The highlights of this quarter are:<br />

‣ Robust double digit top line growth in the AMESA (24%), and Americas (22%) regions<br />

‣ Operating margin improved by 90 bps over last year, helped by improved operating efficiencies in spite of the ongoing sharp<br />

increase in raw material prices (pending pass through)<br />

‣ Commissioning of focused manufacturing & supply chain capability for pharma tubes at Murbad, India<br />

‣ Completed doubling the capacity of Plastic tube in Wada, India<br />

‣ Introduced for the first time in India, fast turnaround Digital printing for non oral care value added laminated tubes<br />

‣ Improved customer servicing capability in the flagship oral care category by setting up on-site printing facility in Goa, India<br />

helping to improve supply chain<br />

‣ Relocated and expanded Egypt unit to serve as a hub for servicing in a large way the Middle East & Africa demand and made<br />

entry into pharma and non oral care category<br />

‣ The plastic tube facility in US which was located 5 miles away from the existing facility of laminated tubes operation in Danvile,<br />

Virginia has been successfully relocated into the laminated tubes facility. The integration of operations under one roof will bring<br />

in operational synergies helping to improve productivity, cutting establishment costs and driving economics of scale<br />

‣ Relocated Mexico facility to create space for pursuing new growth opportunities in value added non oral care category<br />

‣ The laminated tube facility in Germany is successfully diversifying into high value niche cosmetic category leveraging new<br />

printing and tube capability added recently<br />

As key customers consolidate their supply chain, Essel Propack is positioning itself as a reliable long-term partner with a one stop shop<br />

for quality and value added supplies on a large scale, thereby improving its profitability and competitiveness in the markets. The new<br />

capabilities created in Q4 FY-11 are expected to drive the growth during the next year.<br />

With its strategic presence in customer value chain, global reach, value added innovations, reorganized marketing management and<br />

strong operational focus, EP is geared to sustain long-term growth.

Packaging<br />

Business<br />

Twelve<br />

Months<br />

ended<br />

31st March<br />

GLOBAL OPERATIONS<br />

UNAUDITED CONSOLIDATED FINANCIAL RESULTS FOR QUARTER AND YEAR ENDED 31st MARCH, 2011<br />

(` in Lakhs)<br />

Particulars<br />

Quarter ended 31st March<br />

Year ended<br />

31st March<br />

15 Months<br />

ended<br />

31st March<br />

(See Note 3)<br />

2010 2011 2010 2011 2010<br />

{See Note<br />

No. 3 }<br />

Unaudited Unaudited Unaudited Audited<br />

Unaudited<br />

120420 1 a. Net Sales / Income from Operations 34871 30067 141192 167879<br />

206 b. Other Operating Income 95 58 359 342<br />

120626 Total 34966 30125 141551 168221<br />

2 Expenditure :<br />

1114 a. (Increase)/ Decrease in Stock in Trade 409 365 1114 434<br />

54290 b. Consumption of Raw Materials 16472 13713 66605 73338<br />

19492 c. Employees cost 5262 4916 21605 31567<br />

10507 d. Depreciation 2601 2556 10622 13287<br />

25306 e Other Expenditure 7195 6275 28128 34977<br />

110709 Total 31939 27825 128074 153603<br />

9917 3 Profit from Operations before Other Income, Interest and<br />

3027 2300 13477 14618<br />

Exceptional items (1-2)<br />

912 4 Other Income 132 223 373 1193<br />

10829 5 Profit before Interest and Exceptional items (3+4) 3159 2523 13850 15811<br />

486 6 Gain/(Loss) on Foreign Exchange Fluctuations(Net) (50) 290 204 (75)<br />

(6624) 7 Interest (1452) (1318) (5847) (8413)<br />

4691 8 Profit / (Loss) after Interest but before Exceptional items (5+6+7) 1657 1495 8207 7323<br />

- 9 Exceptional items (130) (67) (130) 3016<br />

4691 10 Profit / (Loss) from ordinary activities before Tax (8+9) 1527 1428 8077 10339<br />

(2465) 11 Tax expenses (618) (493) (3322) (3857)<br />

2226 12 Net Profit / (Loss) from ordinary activities after tax (10+11) 909 935 4755 6482<br />

41 13 Share of Profit from Associate company 39 19 167 136<br />

(260) 14 Minority Interest (111) (84) (316) (626)<br />

2007 15 Net Profit / (Loss) for the Period (12+13+14) 837 870 4606 5992<br />

3131 16 Paid-up Equity Share Capital (Face Value Rs. 2/-each ) 3131 3131 3131 3131<br />

17 Reserves excluding Revaluation Reserves as per Balance Sheet of<br />

72955<br />

previous accounting year<br />

18 Earnings per Share (EPS)<br />

1.28 Basic & Diluted EPS before Extraordinary items (not annualised) 0.53 0.56 2.94 3.83<br />

1.28 Basic & Diluted EPS after Extraordinary items (not annualised) 0.53 0.56 2.94 3.83<br />

19 Public Share Holding<br />

- Number of Shares (Lakhs) 640.12 643.32 640.12 643.32<br />

- Percentage of Shareholding 40.88% 41.08% 40.88% 41.08%<br />

NOTES:<br />

1 The above Consolidated results were reviewed by the Audit Committee and approved by the Board of Directors of the Company in its meeting held on 4th<br />

May 2011.<br />

2 Interest of Rs.1452 Lakhs is net of receipt of Rs.508 Lakhs for the quarter ended 31st March 2011.<br />

3 The previous accounting year was a 15 month period ending 31st March, 2010 which also included financial results of Medical Device operations divested<br />

in December 2009. Hence the results for the current year ended 31st March 2011 are not strictly comparable. The performance of continuing packaging<br />

business, on comparable basis is as under :<br />

(` In Lakhs)<br />

Particulars<br />

Twelve months ended 31st March<br />

(Unaudited)<br />

2011 2010<br />

Growth<br />

Net Sales / Income from Operations 141192 120420 17.2%<br />

Profit from Operations before Other Income, Interest and Exceptional items 13477 9917 35.9%<br />

Profit / (Loss) from ordinary activities before Tax 8077 4691 72.2%<br />

Net Profit / (Loss) for the Period 4606 2007 129.5%<br />

4 Exceptional item relates to manufacturing facility relocation expenses in AMERICAS Region net of certain retentions relating to the Medical Devices<br />

business being realised.

5 The Management has identified geographical segment as the primary segment pursuant to Accounting Standard 17 for purposes of segment reporting<br />

of the Company and its Subsidiaries, Joint Ventures and Associates.These geographical segments have been identified considering the differential risk<br />

and returns, the Corporate organization structure and the internal financial reporting system. The relevant segment results for the Quarter and Year ended<br />

31st March, 2011 are set out below :<br />

a. AMESA : Africa, Middle East and South Asia include operations in India, Nepal and Egypt.<br />

b. EAP : East Asia Pacific includes operations in China and Philippines.<br />

c. AMERICAS : includes operations in United States of America, Mexico and Colombia<br />

d. EUROPE : includes operations in Germany, United Kingdom, Poland and Russia.<br />

1 Segment Revenue<br />

Particulars Quarter ended 31st March Year ended 31st<br />

March<br />

15 Months ended<br />

31st March<br />

(See Note 3)<br />

2011 2010 2011 2010<br />

Unaudited Unaudited Unaudited Audited<br />

A. AMESA 17265 13920 67308 68613<br />

B. EAP 6006 6174 27921 30604<br />

C. Americas 8240 6755 33128 53176<br />

D. Europe 3455 3276 13194 15765<br />

E. Unallocated - - - 63<br />

Net Sales / Income From Operations 34966 30125 141551 168221<br />

2 Segment Results<br />

Profit / (Loss) before interest and tax from Each Segment<br />

A. AMESA 2381 1758 9468 8958<br />

B. EAP 1033 1798 6761 10035<br />

C. Americas 221 (635) 214 1061<br />

D. Europe (341) (545) (2203) (4521)<br />

E. Unallocated 5090 301 8227 7775<br />

Total 8384 2677 22467 23308<br />

Gain/ (Loss) on Foreign Exchange Fluctuations (Net) (50) 290 204 (75)<br />

Less : Inter Segmental elimination (5225) (154) (8617) (7497)<br />

Segment Result 3109 2813 14054 15736<br />

Add: Interest Income 508 553 2096 3334<br />

Less: Interest Expenses (1960) (1871) (7943) (11747)<br />

Add/(Less): Exceptional Item (130) (67) (130) 3016<br />

Total Profit from Ordinary Activities Before Tax 1527 1428 8077 10339<br />

3 Capital Employed<br />

(Segment Assets - Segment Liabilities)<br />

A. AMESA 59599 55854 59599 46317<br />

B. EAP 21383 24281 21383 25305<br />

C. Americas 18157 19172 18157 18697<br />

D. Europe 16852 15183 16852 16496<br />

E. Unallocated 24038 10127 24038 25504<br />

Less : Inter Segmental elimination (59338) (48712) (59338) (57034)<br />

Total 80691 75905 80691 75285<br />

Figures of the previous period have been regrouped wherever considered necessary.<br />

For Essel Propack Limited<br />

Place : Mumbai<br />

Date : 4th May 2011<br />

Ashok Kumar Goel<br />

Vice-Chairman & Managing Director

INDIA STANDALONE<br />

UNAUDITED STANDALONE FINANCIAL RESULTS FOR QUARTER AND YEAR ENDED 31st MARCH, 2011<br />

Quarter ended<br />

31 March<br />

Year ended<br />

31 March<br />

(` in Lakhs)<br />

Fifteen months<br />

ended 31 March<br />

(See Note 3)<br />

Particulars<br />

2011 2010 2011 2010<br />

Unaudited Unaudited Unaudited Audited<br />

1 a. Net Sales / Income from Operations 10401 8470 40523 41322<br />

b. Other operating income 336 259 1311 1587<br />

2 Expenditure:<br />

a. (Increase) / Decrease in Stock in trade 223 (61) (207) 54<br />

b. Consumption of Raw Materials 4810 3846 18779 18640<br />

c. Employees Cost 1021 980 4320 4610<br />

d. Depreciation 636 565 2431 2889<br />

e. Other Expenditure 2822 2048 9973 10407<br />

Total 9512 7378 35296 36600<br />

3 Profit from Operations before Other Income, Interest and 1225 1351 6538 6309<br />

Exceptional Items (1-2)<br />

4 Other Income 537 - 1969 2504<br />

5 Profit before Interest and Exceptional Items (3+4) 1762 1351 8507 8813<br />

6 Gain/(Loss) on Foreign Exchange Fluctuations (Net) (81) (357) (274) (1253)<br />

7 Interest (net) (580) (523) (1962) (3135)<br />

8 Profit after Interest but before Exceptional Items (5+6+7) 1101 471 6271 4425<br />

9 Exceptional Items - - - (10)<br />

10 Profit / (Loss) before Tax for the period (8+9) 1101 471 6271 4415<br />

11 Tax Expenses (249) (113) (1796) (960)<br />

12 Net Profit / (Loss) after tax for the period (10+11) 852 358 4475 3455<br />

Paid-up equity share capital (Face Value ` 2/- each) 3131 3131 3131 3131<br />

Reserves excluding Revaluation reserves as per Balance Sheet<br />

of previous accounting year<br />

13 Earnings Per Share (EPS)<br />

Basic and Diluted EPS before Extraordinary items (not<br />

annualised)<br />

57972<br />

0.54 0.23 2.86 2.21<br />

Basic and Diluted EPS after Extraordinary items (not<br />

0.54 0.23 2.86 2.21<br />

annualised)<br />

14 Public shareholding<br />

- Number of Shares (Lakhs) 640.12 643.32 640.12 643.32<br />

- Percentage of Shareholding 40.88% 41.08% 40.88% 41.08%<br />

15 Promoters and Promoters Group Shareholding<br />

a) Pledged / Encumbered (Lakhs) 77.16 443.42 77.16 443.42<br />

Number of Shares<br />

- Percentage of shares (as a % of the total shareholding<br />

of Promoter and Promoter Group) 8.33% 48.06% 8.33% 48.06%<br />

- Percentage of shares (as a % of the total Share Capital<br />

of the Company) 4.93% 28.32% 4.93% 28.32%<br />

b) Non-encumbered<br />

Number of Shares (Lakhs) 848.73 479.27 848.73 479.27<br />

- Percentage of shares (as a % of the total shareholding<br />

of Promoter and Promoter Group) 91.67% 51.94% 91.67% 51.94%<br />

- Percentage of shares (as a % of the total Share Capital<br />

of the Company) 54.19% 30.60% 54.19% 30.60%<br />

NOTES:<br />

1 The above results were reviewed by the Audit Committee and approved by the Board of Directors of the Company in its meeting held on 4 May, 2011.<br />

The Statutory Auditors have carried out a Limited Review of the results for the quarter and year ended 31 March, 2011.<br />

2 None of the Subsidiaries / Associates / JVs have been consolidated in the above results.<br />

3 Since the previous accounting year was a 15 month period ending 31 March, 2010, the results for the current year ended 31 March, 2011 are not strictly<br />

comparable. The performance of the Company on comparable basis for 12 months ending is as under :<br />

(` In Lakhs)<br />

Particulars Twelve months ended Growth<br />

31 March, 2011 31 March, 2010<br />

Unaudited<br />

Unaudited<br />

Net Sales / Income from Operations 40523 33842 19.7%<br />

Profit from Operations before Other Income, Interest and Exceptional items 6538 5213 25.4%<br />

Profit / (Loss) from ordinary activities before Tax 6271 4020 56.0%<br />

Net Profit / (Loss) for the Period 4475 3229 38.6%<br />

4 Interest of ` 580 lakhs is net of income of ` 807 lakhs for the quarter ended 31 March, 2011.<br />

5 Under AS-17, the Company has only one major identifiable business segment viz. Plastic Packaging Material.<br />

6 The number of Investor Complaints at the beginning and pending at the end of the quarter is Nil. No Complaints were received during the quarter.<br />

7 Figures of the previous period have been regrouped wherever considered necessary.<br />

For Essel Propack Limited<br />

Place : Mumbai<br />

Date : 4th May 2011<br />

Ashok Kumar Goel<br />

Vice-Chairman & Managing Director