PROSPECTUS - Swissco Holdings Limited

PROSPECTUS - Swissco Holdings Limited

PROSPECTUS - Swissco Holdings Limited

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

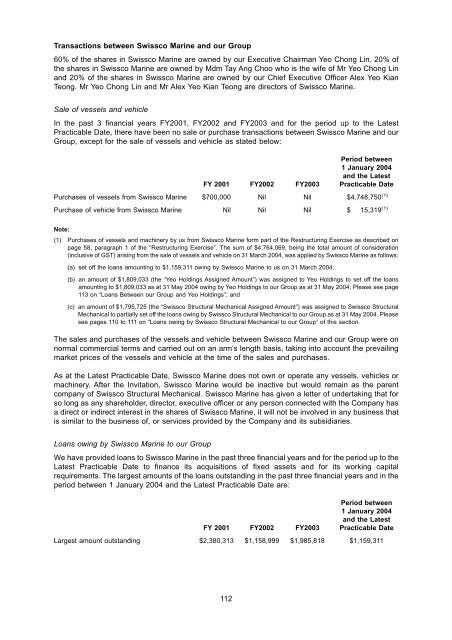

Transactions between <strong>Swissco</strong> Marine and our Group<br />

60% of the shares in <strong>Swissco</strong> Marine are owned by our Executive Chairman Yeo Chong Lin, 20% of<br />

the shares in <strong>Swissco</strong> Marine are owned by Mdm Tay Ang Choo who is the wife of Mr Yeo Chong Lin<br />

and 20% of the shares in <strong>Swissco</strong> Marine are owned by our Chief Executive Officer Alex Yeo Kian<br />

Teong. Mr Yeo Chong Lin and Mr Alex Yeo Kian Teong are directors of <strong>Swissco</strong> Marine.<br />

Sale of vessels and vehicle<br />

In the past 3 financial years FY2001, FY2002 and FY2003 and for the period up to the Latest<br />

Practicable Date, there have been no sale or purchase transactions between <strong>Swissco</strong> Marine and our<br />

Group, except for the sale of vessels and vehicle as stated below:<br />

FY 2001 FY2002 FY2003<br />

Period between<br />

1 January 2004<br />

and the Latest<br />

Practicable Date<br />

Purchases of vessels from <strong>Swissco</strong> Marine $700,000 Nil Nil $4,748,750 (1)<br />

Purchase of vehicle from <strong>Swissco</strong> Marine Nil Nil Nil $ 15,319 (1)<br />

Note:<br />

(1) Purchases of vessels and machinery by us from <strong>Swissco</strong> Marine form part of the Restructuring Exercise as described on<br />

page 58, paragraph 1 of the “Restructuring Exercise”. The sum of $4,764,069, being the total amount of consideration<br />

(inclusive of GST) arising from the sale of vessels and vehicle on 31 March 2004, was applied by <strong>Swissco</strong> Marine as follows:<br />

(a) set off the loans amounting to $1,159,311 owing by <strong>Swissco</strong> Marine to us on 31 March 2004;<br />

(b) an amount of $1,809,033 (the “Yeo <strong>Holdings</strong> Assigned Amount”) was assigned to Yeo <strong>Holdings</strong> to set off the loans<br />

amounting to $1,809,033 as at 31 May 2004 owing by Yeo <strong>Holdings</strong> to our Group as at 31 May 2004; Please see page<br />

113 on “Loans Between our Group and Yeo <strong>Holdings</strong>”; and<br />

(c) an amount of $1,795,725 (the “<strong>Swissco</strong> Structural Mechanical Assigned Amount”) was assigned to <strong>Swissco</strong> Structural<br />

Mechanical to partially set off the loans owing by <strong>Swissco</strong> Structural Mechanical to our Group as at 31 May 2004. Please<br />

see pages 110 to 111 on “Loans owing by <strong>Swissco</strong> Structural Mechanical to our Group” of this section.<br />

The sales and purchases of the vessels and vehicle between <strong>Swissco</strong> Marine and our Group were on<br />

normal commercial terms and carried out on an arm’s length basis, taking into account the prevailing<br />

market prices of the vessels and vehicle at the time of the sales and purchases.<br />

As at the Latest Practicable Date, <strong>Swissco</strong> Marine does not own or operate any vessels, vehicles or<br />

machinery. After the Invitation, <strong>Swissco</strong> Marine would be inactive but would remain as the parent<br />

company of <strong>Swissco</strong> Structural Mechanical. <strong>Swissco</strong> Marine has given a letter of undertaking that for<br />

so long as any shareholder, director, executive officer or any person connected with the Company has<br />

a direct or indirect interest in the shares of <strong>Swissco</strong> Marine, it will not be involved in any business that<br />

is similar to the business of, or services provided by the Company and its subsidiaries.<br />

Loans owing by <strong>Swissco</strong> Marine to our Group<br />

We have provided loans to <strong>Swissco</strong> Marine in the past three financial years and for the period up to the<br />

Latest Practicable Date to finance its acquisitions of fixed assets and for its working capital<br />

requirements. The largest amounts of the loans outstanding in the past three financial years and in the<br />

period between 1 January 2004 and the Latest Practicable Date are:<br />

FY 2001 FY2002 FY2003<br />

Period between<br />

1 January 2004<br />

and the Latest<br />

Practicable Date<br />

Largest amount outstanding $2,380,313 $1,158,999 $1,985,818 $1,159,311<br />

112