PROSPECTUS - Swissco Holdings Limited

PROSPECTUS - Swissco Holdings Limited

PROSPECTUS - Swissco Holdings Limited

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

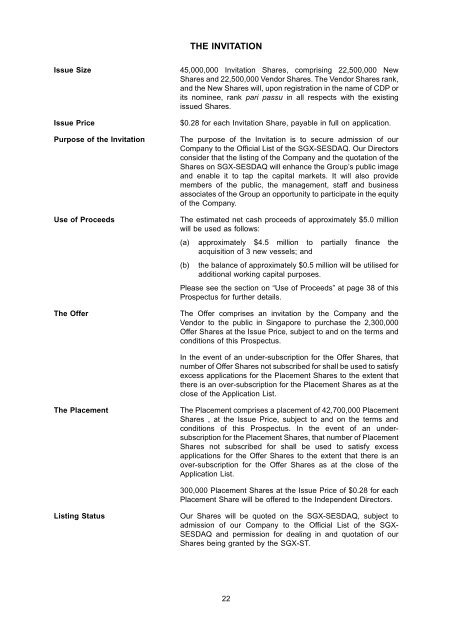

THE INVITATION<br />

Issue Size 45,000,000 Invitation Shares, comprising 22,500,000 New<br />

Shares and 22,500,000 Vendor Shares. The Vendor Shares rank,<br />

and the New Shares will, upon registration in the name of CDP or<br />

its nominee, rank pari passu in all respects with the existing<br />

issued Shares.<br />

Issue Price<br />

Purpose of the Invitation<br />

Use of Proceeds<br />

The Offer<br />

$0.28 for each Invitation Share, payable in full on application.<br />

The purpose of the Invitation is to secure admission of our<br />

Company to the Official List of the SGX-SESDAQ. Our Directors<br />

consider that the listing of the Company and the quotation of the<br />

Shares on SGX-SESDAQ will enhance the Group’s public image<br />

and enable it to tap the capital markets. It will also provide<br />

members of the public, the management, staff and business<br />

associates of the Group an opportunity to participate in the equity<br />

of the Company.<br />

The estimated net cash proceeds of approximately $5.0 million<br />

will be used as follows:<br />

(a) approximately $4.5 million to partially finance the<br />

acquisition of 3 new vessels; and<br />

(b) the balance of approximately $0.5 million will be utilised for<br />

additional working capital purposes.<br />

Please see the section on “Use of Proceeds” at page 38 of this<br />

Prospectus for further details.<br />

The Offer comprises an invitation by the Company and the<br />

Vendor to the public in Singapore to purchase the 2,300,000<br />

Offer Shares at the Issue Price, subject to and on the terms and<br />

conditions of this Prospectus.<br />

In the event of an under-subscription for the Offer Shares, that<br />

number of Offer Shares not subscribed for shall be used to satisfy<br />

excess applications for the Placement Shares to the extent that<br />

there is an over-subscription for the Placement Shares as at the<br />

close of the Application List.<br />

The Placement<br />

The Placement comprises a placement of 42,700,000 Placement<br />

Shares , at the Issue Price, subject to and on the terms and<br />

conditions of this Prospectus. In the event of an undersubscription<br />

for the Placement Shares, that number of Placement<br />

Shares not subscribed for shall be used to satisfy excess<br />

applications for the Offer Shares to the extent that there is an<br />

over-subscription for the Offer Shares as at the close of the<br />

Application List.<br />

300,000 Placement Shares at the Issue Price of $0.28 for each<br />

Placement Share will be offered to the Independent Directors.<br />

Listing Status<br />

Our Shares will be quoted on the SGX-SESDAQ, subject to<br />

admission of our Company to the Official List of the SGX-<br />

SESDAQ and permission for dealing in and quotation of our<br />

Shares being granted by the SGX-ST.<br />

22