Uniting Church Superannuation Plan - SuperFacts.com

Uniting Church Superannuation Plan - SuperFacts.com

Uniting Church Superannuation Plan - SuperFacts.com

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

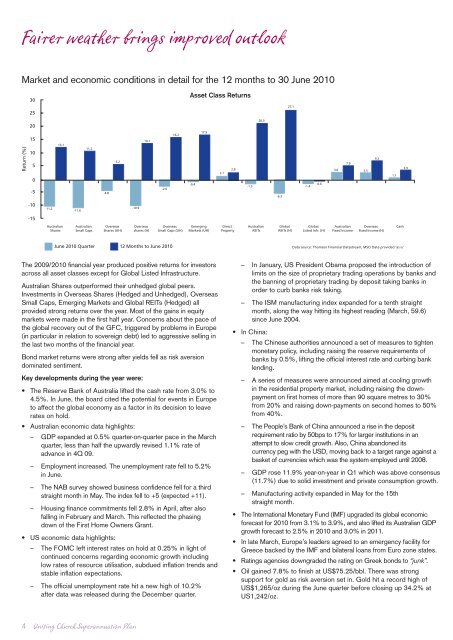

Fairer weather brings improved outlook<br />

Market and economic conditions in detail for the 12 months to 30 June 2010<br />

30<br />

Asset Class Returns<br />

25<br />

27.1<br />

Return (%)<br />

20<br />

15<br />

10<br />

5<br />

0<br />

-5<br />

13.1<br />

11.2<br />

-4.8<br />

5.2<br />

14.1<br />

-2.6<br />

16.2<br />

-0.4<br />

17.9<br />

2.1<br />

2.8<br />

-1.5<br />

20.3<br />

-6.3<br />

-1.4<br />

-0.6<br />

3.6<br />

7.9<br />

3.5<br />

9.2<br />

1.1<br />

3.9<br />

-10<br />

-11.2<br />

-11.6<br />

-10.9<br />

-15<br />

Australian<br />

Shares<br />

Australian<br />

Small Caps<br />

Overseas<br />

Shares (UH)<br />

Overseas<br />

shares (H)<br />

Overseas<br />

Small Caps (UH)<br />

Emerging<br />

Markets (UH)<br />

Direct<br />

Property<br />

Australian<br />

REITs<br />

Global<br />

REITs (H)<br />

Global<br />

Listed Infr. (H)<br />

Australian<br />

Fixed In<strong>com</strong>e<br />

Overseas<br />

Fixed In<strong>com</strong>e (H)<br />

Cash<br />

June 2010 Quarter 12 Months to June 2010<br />

Data source: Thomson Financial Datastream; MSCI Date provided ‘as is’<br />

The 2009/2010 financial year produced positive returns for investors<br />

across all asset classes except for Global Listed Infrastructure.<br />

Australian Shares outperformed their unhedged global peers.<br />

Investments in Overseas Shares (Hedged and Unhedged), Overseas<br />

Small Caps, Emerging Markets and Global REITs (Hedged) all<br />

provided strong returns over the year. Most of the gains in equity<br />

markets were made in the first half year. Concerns about the pace of<br />

the global recovery out of the GFC, triggered by problems in Europe<br />

(in particular in relation to sovereign debt) led to aggressive selling in<br />

the last two months of the financial year.<br />

Bond market returns were strong after yields fell as risk aversion<br />

dominated sentiment.<br />

Key developments during the year were:<br />

• The Reserve Bank of Australia lifted the cash rate from 3.0% to<br />

4.5%. In June, the board cited the potential for events in Europe<br />

to affect the global economy as a factor in its decision to leave<br />

rates on hold.<br />

• Australian economic data highlights:<br />

– GDP expanded at 0.5% quarter-on-quarter pace in the March<br />

quarter, less than half the upwardly revised 1.1% rate of<br />

advance in 4Q 09.<br />

– Employment increased. The unemployment rate fell to 5.2%<br />

in June.<br />

– The NAB survey showed business confidence fell for a third<br />

straight month in May. The index fell to +5 (expected +11).<br />

– Housing finance <strong>com</strong>mitments fell 2.8% in April, after also<br />

falling in February and March. This reflected the phasing<br />

down of the First Home Owners Grant.<br />

• US economic data highlights:<br />

– The FOMC left interest rates on hold at 0.25% in light of<br />

continued concerns regarding economic growth including<br />

low rates of resource utilisation, subdued inflation trends and<br />

stable inflation expectations.<br />

– The official unemployment rate hit a new high of 10.2%<br />

after data was released during the December quarter.<br />

– In January, US President Obama proposed the introduction of<br />

limits on the size of proprietary trading operations by banks and<br />

the banning of proprietary trading by deposit taking banks in<br />

order to curb banks risk taking.<br />

– The ISM manufacturing index expanded for a tenth straight<br />

month, along the way hitting its highest reading (March, 59.6)<br />

since June 2004.<br />

• In China:<br />

– The Chinese authorities announced a set of measures to tighten<br />

monetary policy, including raising the reserve requirements of<br />

banks by 0.5%, lifting the official interest rate and curbing bank<br />

lending.<br />

– A series of measures were announced aimed at cooling growth<br />

in the residential property market, including raising the downpayment<br />

on first homes of more than 90 square metres to 30%<br />

from 20% and raising down-payments on second homes to 50%<br />

from 40%.<br />

– The People’s Bank of China announced a rise in the deposit<br />

requirement ratio by 50bps to 17% for larger institutions in an<br />

attempt to slow credit growth. Also, China abandoned its<br />

currency peg with the USD, moving back to a target range against a<br />

basket of currencies which was the system employed until 2008.<br />

– GDP rose 11.9% year-on-year in Q1 which was above consensus<br />

(11.7%) due to solid investment and private consumption growth.<br />

– Manufacturing activity expanded in May for the 15th<br />

straight month.<br />

• The International Monetary Fund (IMF) upgraded its global economic<br />

forecast for 2010 from 3.1% to 3.9%, and also lifted its Australian GDP<br />

growth forecast to 2.5% in 2010 and 3.0% in 2011.<br />

• In late March, Europe’s leaders agreed to an emergency facility for<br />

Greece backed by the IMF and bilateral loans from Euro zone states.<br />

• Ratings agencies downgraded the rating on Greek bonds to “junk”.<br />

• Oil gained 7.8% to finish at US$75.25/bbl. There was strong<br />

support for gold as risk aversion set in. Gold hit a record high of<br />

US$1,265/oz during the June quarter before closing up 34.2% at<br />

US1,242/oz.<br />

4 <strong>Uniting</strong> <strong>Church</strong> <strong>Superannuation</strong> <strong>Plan</strong>