2011 Report.pdf - Fortress Fund Managers

2011 Report.pdf - Fortress Fund Managers

2011 Report.pdf - Fortress Fund Managers

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Directors’ <strong>Report</strong> Cont.<br />

PORTFOLIO POSITIONING<br />

The <strong>Fund</strong> has approximately 26% of its portfolio invested in Government of Barbados treasury bills and deposits with<br />

commercial banks. These are the lowest risk, most liquid investments available. Treasury bills are auctioned by the<br />

Government every few weeks and we often participate in these auctions, bidding to invest cash or, more often, to<br />

reinvest the proceeds of maturing treasury bills. From time to time our bids are not successful and we then invest<br />

the cash in bank deposits until the next auction at which our bids are accepted. At September 30, the bulk of this 26%<br />

balance happened to be on deposit with CIBC FirstCaribbean International Bank. However throughout the year this<br />

amount was typically invested in treasury bills with 90-day maturities.<br />

The rest of the portfolio is made up of a diversified mix of corporate and government bonds from the Caribbean<br />

and international market, as well as specialised income-producing strategies and funds. The result of this structure<br />

is a unique portfolio that can generate an attractive rate of return while controlling risk and enjoying much greater<br />

liquidity than investments in regional debt alone would typically offer. Approximately 27% of the portfolio is invested<br />

in US dollar and other international assets. The average term to maturity is very short, at 2.5 years. This significantly<br />

limits the portfolio’s potential losses if interest rates rise.<br />

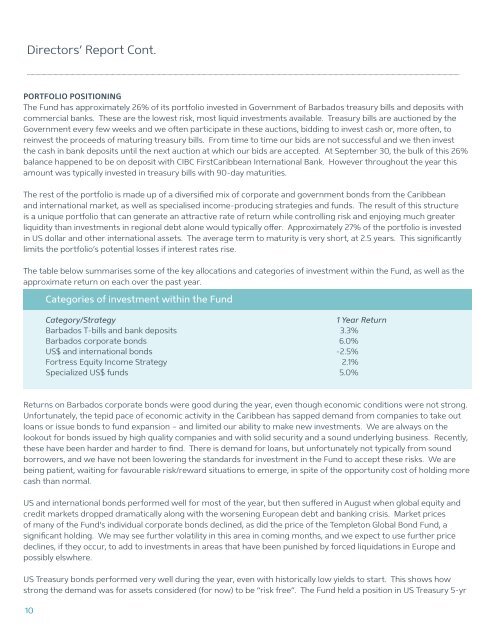

The table below summarises some of the key allocations and categories of investment within the <strong>Fund</strong>, as well as the<br />

approximate return on each over the past year.<br />

Categories of investment within the <strong>Fund</strong><br />

Category/Strategy<br />

1 Year Return<br />

Barbados T-bills and bank deposits 3.3%<br />

Barbados corporate bonds 6.0%<br />

US$ and international bonds -2.5%<br />

<strong>Fortress</strong> Equity Income Strategy 2.1%<br />

Specialized US$ funds 5.0%<br />

Returns on Barbados corporate bonds were good during the year, even though economic conditions were not strong.<br />

Unfortunately, the tepid pace of economic activity in the Caribbean has sapped demand from companies to take out<br />

loans or issue bonds to fund expansion – and limited our ability to make new investments. We are always on the<br />

lookout for bonds issued by high quality companies and with solid security and a sound underlying business. Recently,<br />

these have been harder and harder to find. There is demand for loans, but unfortunately not typically from sound<br />

borrowers, and we have not been lowering the standards for investment in the <strong>Fund</strong> to accept these risks. We are<br />

being patient, waiting for favourable risk/reward situations to emerge, in spite of the opportunity cost of holding more<br />

cash than normal.<br />

US and international bonds performed well for most of the year, but then suffered in August when global equity and<br />

credit markets dropped dramatically along with the worsening European debt and banking crisis. Market prices<br />

of many of the <strong>Fund</strong>’s individual corporate bonds declined, as did the price of the Templeton Global Bond <strong>Fund</strong>, a<br />

significant holding. We may see further volatility in this area in coming months, and we expect to use further price<br />

declines, if they occur, to add to investments in areas that have been punished by forced liquidations in Europe and<br />

possibly elswhere.<br />

US Treasury bonds performed very well during the year, even with historically low yields to start. This shows how<br />

strong the demand was for assets considered (for now) to be “risk free”. The <strong>Fund</strong> held a position in US Treasury 5-yr<br />

10