2011 Report.pdf - Fortress Fund Managers

2011 Report.pdf - Fortress Fund Managers

2011 Report.pdf - Fortress Fund Managers

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Fortress</strong> Caribbean High Interest <strong>Fund</strong> Limited<br />

Notes to Financial Statements<br />

September 30, <strong>2011</strong><br />

(expressed in Barbados dollars)<br />

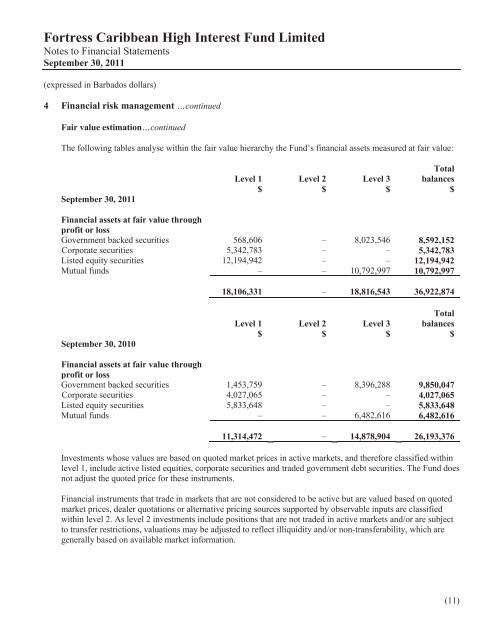

4 Financial risk management …continued<br />

Fair value estimation…continued<br />

The following tables analyse within the fair value hierarchy the <strong>Fund</strong>’s financial assets measured at fair value:<br />

September 30, <strong>2011</strong><br />

Level 1<br />

$<br />

Level 2<br />

$<br />

Level 3<br />

$<br />

Total<br />

balances<br />

$<br />

Financial assets at fair value through<br />

profit or loss<br />

Government backed securities 568,606 – 8,023,546 8,592,152<br />

Corporate securities 5,342,783 – – 5,342,783<br />

Listed equity securities 12,194,942 – – 12,194,942<br />

Mutual funds – – 10,792,997 10,792,997<br />

18,106,331 – 18,816,543 36,922,874<br />

September 30, 2010<br />

Level 1<br />

$<br />

Level 2<br />

$<br />

Level 3<br />

$<br />

Total<br />

balances<br />

$<br />

Financial assets at fair value through<br />

profit or loss<br />

Government backed securities 1,453,759 – 8,396,288 9,850,047<br />

Corporate securities 4,027,065 – – 4,027,065<br />

Listed equity securities 5,833,648 – – 5,833,648<br />

Mutual funds – – 6,482,616 6,482,616<br />

11,314,472 – 14,878,904 26,193,376<br />

Investments whose values are based on quoted market prices in active markets, and therefore classified within<br />

level 1, include active listed equities, corporate securities and traded government debt securities. The <strong>Fund</strong> does<br />

not adjust the quoted price for these instruments.<br />

Financial instruments that trade in markets that are not considered to be active but are valued based on quoted<br />

market prices, dealer quotations or alternative pricing sources supported by observable inputs are classified<br />

within level 2. As level 2 investments include positions that are not traded in active markets and/or are subject<br />

to transfer restrictions, valuations may be adjusted to reflect illiquidity and/or non-transferability, which are<br />

generally based on available market information.<br />

(11)