Vietnam Securities Market Summit 2008 - Asian Bankers Association

Vietnam Securities Market Summit 2008 - Asian Bankers Association

Vietnam Securities Market Summit 2008 - Asian Bankers Association

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

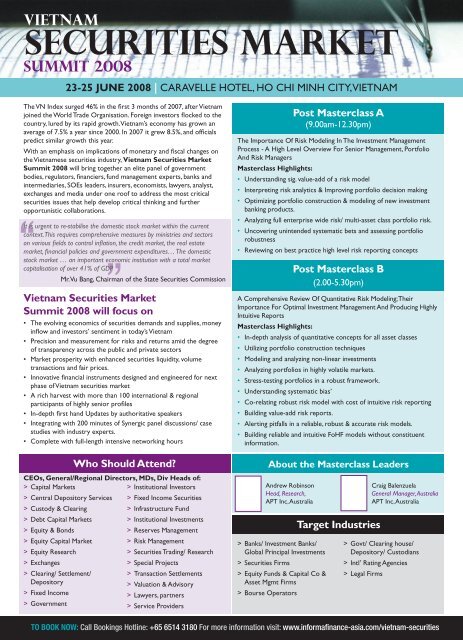

VIETNAM<br />

SECURITIES MARKET<br />

SUMMIT <strong>2008</strong><br />

23-25 JUNE <strong>2008</strong> | CARAVELLE HOTEL, HO CHI MINH CITY, VIETNAM<br />

The VN Index surged 46% in the first 3 months of 2007, after <strong>Vietnam</strong><br />

joined the World Trade Organisation. Foreign investors flocked to the<br />

country, lured by its rapid growth. <strong>Vietnam</strong>’s economy has grown an<br />

average of 7.5% a year since 2000. In 2007 it grew 8.5%, and officials<br />

predict similar growth this year.<br />

With an emphasis on implications of monetary and fiscal changes on<br />

the <strong>Vietnam</strong>ese securities industry, <strong>Vietnam</strong> <strong>Securities</strong> <strong>Market</strong><br />

<strong>Summit</strong> <strong>2008</strong> will bring together an elite panel of government<br />

bodies, regulators, financiers, fund management experts, banks and<br />

intermediaries, SOEs leaders, insurers, economists, lawyers, analyst,<br />

exchanges and media under one roof to address the most critical<br />

securities issues that help develop critical thinking and further<br />

opportunistic collaborations.<br />

It is urgent to re-stabilise the domestic stock market within the current<br />

context. This requires comprehensive measures by ministries and sectors<br />

on various fields to control inflation, the credit market, the real estate<br />

market, financial policies and government expenditures… The domestic<br />

stock market … an important economic institution with a total market<br />

capitalisation of over 41% of GDP<br />

Mr. Vu Bang, Chairman of the State <strong>Securities</strong> Commission<br />

<strong>Vietnam</strong> <strong>Securities</strong> <strong>Market</strong><br />

<strong>Summit</strong> <strong>2008</strong> will focus on<br />

• The evolving economics of securities demands and supplies, money<br />

inflow and investors’ sentiment in today’s <strong>Vietnam</strong><br />

• Precision and measurement for risks and returns amid the degree<br />

of transparency across the public and private sectors<br />

• <strong>Market</strong> prosperity with enhanced securities liquidity, volume<br />

transactions and fair prices.<br />

• Innovative financial instruments designed and engineered for next<br />

phase of <strong>Vietnam</strong> securities market<br />

• A rich harvest with more than 100 international & regional<br />

participants of highly senior profiles<br />

• In-depth first hand Updates by authoritative speakers<br />

• Integrating with 200 minutes of Synergic panel discussions/ case<br />

studies with industry experts.<br />

• Complete with full-length intensive networking hours<br />

Who Should Attend<br />

CEOs, General/Regional Directors, MDs, Div Heads of:<br />

> Capital <strong>Market</strong>s<br />

> Institutional Investors<br />

> Central Depository Services > Fixed Income <strong>Securities</strong><br />

> Custody & Clearing<br />

> Infrastructure Fund<br />

> Debt Capital <strong>Market</strong>s > Institutional Investments<br />

> Equity & Bonds<br />

> Reserves Management<br />

> Equity Capital <strong>Market</strong> > Risk Management<br />

> Equity Research<br />

> <strong>Securities</strong> Trading/ Research<br />

> Exchanges<br />

> Special Projects<br />

> Clearing/ Settlement/<br />

> Transaction Settlements<br />

Depository<br />

> Valuation & Advisory<br />

> Fixed Income<br />

> Lawyers, partners<br />

> Government<br />

> Service Providers<br />

Post Masterclass A<br />

(9.00am-12.30pm)<br />

The Importance Of Risk Modeling In The Investment Management<br />

Process - A High Level Overview For Senior Management, Portfolio<br />

And Risk Managers<br />

Masterclass Highlights:<br />

• Understanding sig. value-add of a risk model<br />

• Interpreting risk analytics & Improving portfolio decision making<br />

• Optimizing portfolio construction & modeling of new investment<br />

banking products.<br />

• Analyzing full enterprise wide risk/ multi-asset class portfolio risk.<br />

• Uncovering unintended systematic bets and assessing portfolio<br />

robustness<br />

• Reviewing on best practice high level risk reporting concepts<br />

Post Masterclass B<br />

(2.00-5.30pm)<br />

A Comprehensive Review Of Quantitative Risk Modeling; Their<br />

Importance For Optimal Investment Management And Producing Highly<br />

Intuitive Reports<br />

Masterclass Highlights:<br />

• In-depth analysis of quantitative concepts for all asset classes<br />

• Utilizing portfolio construction techniques<br />

• Modeling and analyzing non-linear investments<br />

• Analyzing portfolios in highly volatile markets.<br />

• Stress-testing portfolios in a robust framework.<br />

• Understanding systematic bias’<br />

• Co-relating robust risk model with cost of intuitive risk reporting<br />

• Building value-add risk reports.<br />

• Alerting pitfalls in a reliable, robust & accurate risk models.<br />

• Building reliable and intuitive FoHF models without constituent<br />

information.<br />

About the Masterclass Leaders<br />

Andrew Robinson<br />

Head, Research,<br />

APT Inc, Australia<br />

> Banks/ Investment Banks/<br />

Global Principal Investments<br />

> <strong>Securities</strong> Firms<br />

> Equity Funds & Capital Co &<br />

Asset Mgmt Firms<br />

> Bourse Operators<br />

Target Industries<br />

Craig Balenzuela<br />

General Manager, Australia<br />

APT Inc, Australia<br />

> Govt/ Clearing house/<br />

Depository/ Custodians<br />

> Intl’ Rating Agencies<br />

> Legal Firms<br />

TO BOOK NOW: Call Bookings Hotline: +65 6514 3180 For more information visit: www.informafinance-asia.com/vietnam-securities