Investment Options Leaflet - AXA Life Insurance Singapore

Investment Options Leaflet - AXA Life Insurance Singapore

Investment Options Leaflet - AXA Life Insurance Singapore

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

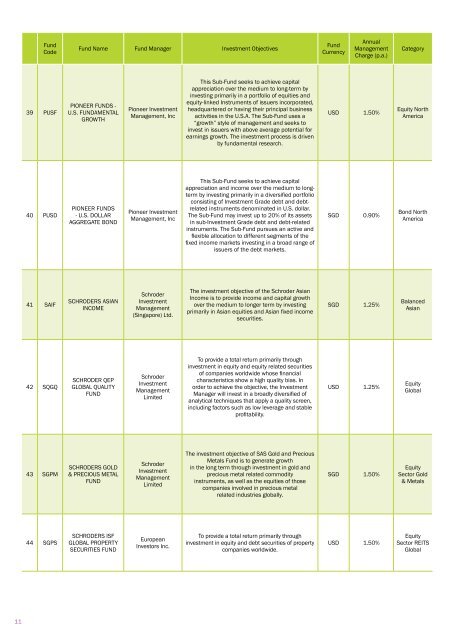

Fund<br />

Code<br />

Fund Name Fund Manager <strong>Investment</strong> Objectives<br />

Fund<br />

Currency<br />

Annual<br />

Management<br />

Charge (p.a.)<br />

Category<br />

39 PUSF<br />

Pioneer Funds -<br />

U.S. Fundamental<br />

Growth<br />

Pioneer <strong>Investment</strong><br />

Management, Inc<br />

This Sub-Fund seeks to achieve capital<br />

appreciation over the medium to long-term by<br />

investing primarily in a portfolio of equities and<br />

equity-linked Instruments of issuers incorporated,<br />

headquartered or having their principal business<br />

activities in the U.S.A. The Sub-Fund uses a<br />

“growth” style of management and seeks to<br />

invest in issuers with above average potential for<br />

earnings growth. The investment process is driven<br />

by fundamental research.<br />

USD 1.50%<br />

Equity North<br />

America<br />

40 PUSD<br />

Pioneer Funds<br />

- U.S. Dollar<br />

Aggregate Bond<br />

Pioneer <strong>Investment</strong><br />

Management, Inc<br />

This Sub-Fund seeks to achieve capital<br />

appreciation and income over the medium to longterm<br />

by investing primarily in a diversified portfolio<br />

consisting of <strong>Investment</strong> Grade debt and debtrelated<br />

instruments denominated in U.S. dollar.<br />

The Sub-Fund may invest up to 20% of its assets<br />

in sub-<strong>Investment</strong> Grade debt and debt-related<br />

instruments. The Sub-Fund pursues an active and<br />

flexible allocation to different segments of the<br />

fixed income markets investing in a broad range of<br />

issuers of the debt markets.<br />

SGD 0.90%<br />

Bond North<br />

America<br />

41 SAIF<br />

SCHRODERS ASIAN<br />

INCOME<br />

Schroder<br />

<strong>Investment</strong><br />

Management<br />

(<strong>Singapore</strong>) Ltd.<br />

The investment objective of the Schroder Asian<br />

Income is to provide income and capital growth<br />

over the medium to longer term by investing<br />

primarily in Asian equities and Asian fixed income<br />

securities.<br />

SGD 1.25%<br />

Balanced<br />

Asian<br />

42 SQGQ<br />

SCHRODER QEP<br />

GLOBAL QUALITY<br />

FUND<br />

Schroder<br />

<strong>Investment</strong><br />

Management<br />

Limited<br />

To provide a total return primarily through<br />

investment in equity and equity related securities<br />

of companies worldwide whose financial<br />

characteristics show a high quality bias. In<br />

order to achieve the objective, the <strong>Investment</strong><br />

Manager will invest in a broadly diversified of<br />

analytical techniques that apply a quality screen,<br />

including factors such as low leverage and stable<br />

profitability.<br />

USD 1.25%<br />

Equity<br />

Global<br />

43 SGPM<br />

SCHRODERS GOLD<br />

& PRECIOUS METAL<br />

FUND<br />

Schroder<br />

<strong>Investment</strong><br />

Management<br />

Limited<br />

The investment objective of SAS Gold and Precious<br />

Metals Fund is to generate growth<br />

in the long term through investment in gold and<br />

precious metal related commodity<br />

instruments, as well as the equities of those<br />

companies involved in precious metal<br />

related industries globally.<br />

SGD 1.50%<br />

Equity<br />

Sector Gold<br />

& Metals<br />

44 SGPS<br />

SCHRODERS ISF<br />

GLOBAL PROPERTY<br />

SECURITIES FUND<br />

European<br />

Investors Inc.<br />

To provide a total return primarily through<br />

investment in equity and debt securities of property<br />

companies worldwide.<br />

USD 1.50%<br />

Equity<br />

Sector REITS<br />

Global<br />

11