OLI- 2 March 2012- INTERIMS 31 DECEMBER 2011 _3_.pdf - O-line

OLI- 2 March 2012- INTERIMS 31 DECEMBER 2011 _3_.pdf - O-line

OLI- 2 March 2012- INTERIMS 31 DECEMBER 2011 _3_.pdf - O-line

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

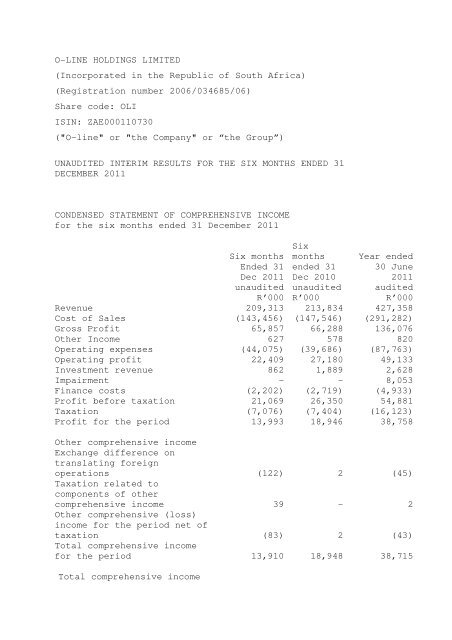

O-LINE HOLDINGS LIMITED<br />

(Incorporated in the Republic of South Africa)<br />

(Registration number 2006/034685/06)<br />

Share code: <strong>OLI</strong><br />

ISIN: ZAE000110730<br />

("O-<strong>line</strong>" or "the Company" or “the Group”)<br />

UNAUDITED INTERIM RESULTS FOR THE SIX MONTHS ENDED <strong>31</strong><br />

<strong>DECEMBER</strong> <strong>2011</strong><br />

CONDENSED STATEMENT OF COMPREHENSIVE INCOME<br />

for the six months ended <strong>31</strong> December <strong>2011</strong><br />

Six months<br />

Ended <strong>31</strong><br />

Dec <strong>2011</strong><br />

unaudited<br />

R’000<br />

Six<br />

months<br />

ended <strong>31</strong><br />

Dec 2010<br />

unaudited<br />

R’000<br />

Year ended<br />

30 June<br />

<strong>2011</strong><br />

audited<br />

R’000<br />

Revenue 209,<strong>31</strong>3 213,834 427,358<br />

Cost of Sales (143,456) (147,546) (291,282)<br />

Gross Profit 65,857 66,288 136,076<br />

Other Income 627 578 820<br />

Operating expenses (44,075) (39,686) (87,763)<br />

Operating profit 22,409 27,180 49,133<br />

Investment revenue 862 1,889 2,628<br />

Impairment - - 8,053<br />

Finance costs (2,202) (2,719) (4,933)<br />

Profit before taxation 21,069 26,350 54,881<br />

Taxation (7,076) (7,404) (16,123)<br />

Profit for the period 13,993 18,946 38,758<br />

Other comprehensive income<br />

Exchange difference on<br />

translating foreign<br />

operations (122) 2 (45)<br />

Taxation related to<br />

components of other<br />

comprehensive income 39 - 2<br />

Other comprehensive (loss)<br />

income for the period net of<br />

taxation (83) 2 (43)<br />

Total comprehensive income<br />

for the period 13,910 18,948 38,715<br />

Total comprehensive income

attributable to:<br />

Owners of the parent: 13,910 18,948 38,715<br />

Reconciliation of basic to<br />

head<strong>line</strong> earnings<br />

Head<strong>line</strong> earnings 13,976 18,902 38,942<br />

Basic earnings 13,993 18,946 38,758<br />

Loss / (Profit) on sale of<br />

fixed assets (17) (44) 184<br />

Total shares in issue 213,423,750 238,500,000 213,424,000<br />

Weighted average of shares<br />

in issue 213,423,750 238,500,000 235,339,705<br />

Basic earnings per share<br />

(cents) 6.56 7.94 16.47<br />

Basic head<strong>line</strong> earnings per<br />

share (cents) 6.55 7.93 16.55<br />

Fully diluted earnings per<br />

share (cents) 6.56 7.94 16.47<br />

Fully diluted head<strong>line</strong><br />

earnings per share (cents) 6.55 7.93 16.55<br />

CONDENSED STATEMENT OF CHANGES IN EQUITY<br />

for the six months ended <strong>31</strong> December <strong>2011</strong><br />

Share Share Foreign Retained Total<br />

capital premium Currency income equity<br />

Translation<br />

Reserve<br />

R'000 R'000 R'000 R'000 R'000<br />

Balance at <strong>31</strong><br />

December 2010 * 132,217 40 108,147 240,404<br />

Total<br />

comprehensive<br />

income for the<br />

period (45) 19,812 19,767<br />

Share buy back (26,136) (26,136)<br />

Dividends paid (4,770) (4,770)<br />

Balance at 1<br />

July <strong>2011</strong> * 106,081 (5) 123,189 229,265<br />

Total<br />

comprehensive<br />

income for the<br />

period (83) 13,993 13,910

Dividends paid (10,671) (10,671)<br />

Balance at <strong>31</strong><br />

December <strong>2011</strong> * 106,081 (88) 126,511 232,504<br />

* less than<br />

R1 000<br />

CONDENSED STATEMENT OF FINANCIAL POSITION<br />

at <strong>31</strong> December <strong>2011</strong><br />

<strong>31</strong> December<br />

<strong>2011</strong><br />

Unaudited<br />

R'000<br />

<strong>31</strong> December<br />

2010<br />

Unaudited<br />

R'000<br />

30 June<br />

<strong>2011</strong> Audited<br />

R'000<br />

Assets<br />

Non-Current Assets<br />

Property, plant and equipment 96,046 75,8<strong>31</strong> 88,591<br />

Goodwill 64,632 64,632 64,632<br />

Other financial assets - 19,645 -<br />

Deferred tax 3,601 4,478 4,720<br />

164,279 164,586 157,943<br />

Current Assets<br />

Inventories 87,359 72,595 79,332<br />

Other financial assets - 1,009 -<br />

Current tax receivable 1,432 3,766 279<br />

Trade and other receivables 44,759 53,341 60,809<br />

Cash and cash equivalents 44,630 35,210 34,420<br />

178,180 165,921 174,840<br />

Total Assets 342,459 330,507 332,783<br />

Equity and Liabilities<br />

Equity and reserves 232,504 240,404 229,265<br />

Non-Current Liabilities<br />

Borrowings 27,875 36,378 29,500<br />

Finance lease obligation 3,681 2,160 4,296<br />

Deferred tax 9,485 8,570 9,226<br />

41,041 47,108 43,022<br />

Current Liabilities<br />

Borrowings 16,3<strong>31</strong> 14,384 13,957<br />

Current tax payable 521 148 801<br />

Finance lease obligations 2,520 1,786 2,675<br />

Trade and other payables 49,542 26,677 43,063<br />

68,914 42,995 60,496<br />

Total Liabilities 109,955 90,103 103,518<br />

Total Equity and Liabilities 342,459 330,507 332,783<br />

CONDENSED STATEMENT OF CASH FLOWS

for the six months ended <strong>31</strong> December <strong>2011</strong><br />

<strong>31</strong> December<br />

<strong>2011</strong><br />

Unaudited<br />

R'000<br />

<strong>31</strong> December<br />

2010<br />

Unaudited<br />

R'000<br />

30 June<br />

<strong>2011</strong><br />

Audited<br />

R'000<br />

Cash flows from operating<br />

activities<br />

Cash generated from<br />

operations 40,463 1,610 28,878<br />

Interest income 862 1,889 2,628<br />

Finance costs (1,919) (2,505) (4,472)<br />

Tax paid (7,033) (8,510) (12,642)<br />

Net cash flows from operating<br />

activities 32,373 (7,516) 14,392<br />

Cash flows from investing<br />

activities<br />

Purchases of property, plant<br />

and equipment (10,498) (1,760) (13,955)<br />

Sale of property, plant and<br />

equipment 28 211 466<br />

Sale of financial assets - 341 -<br />

Repayment of loan - - 2,911<br />

Net cash flows from investing<br />

activities (10,470) (1,208) (10,578)<br />

Cash flows from financing<br />

activities<br />

Repayment of borrowings (7,307) (11,539) (18,844)<br />

Proceeds from borrowings 8,056 - -<br />

Finance lease payments (1,580) (1,292) (2,459)<br />

Dividends paid (10,671) - (4,770)<br />

Net cash flows from financing<br />

activities (11,502) (12,8<strong>31</strong>) (26,073)<br />

Total cash movement for<br />

period 10,401 (21,555) (22,259)<br />

Cash and cash equivalents at<br />

beginning of period 34,420 56,748 56,748<br />

Effect of exchange rate<br />

movement on cash balances (191) 17 (69)<br />

Cash and cash equivalents at<br />

end of period 44,630 35,210 34,420<br />

SEGMENT REPORT<br />

for the six months ended <strong>31</strong> December <strong>2011</strong><br />

<strong>31</strong> December<br />

<strong>2011</strong><br />

Unaudited<br />

<strong>31</strong> December<br />

2010<br />

Unaudited<br />

30 June<br />

<strong>2011</strong><br />

Audited

R'000 R'000 R'000<br />

Revenue<br />

O-Line 86,186 96,906 203,849<br />

Armco 1<strong>31</strong>,934 125,495 240,589<br />

Corporate - - -<br />

South African operations 218,120 222,401 444,438<br />

O-Line Mozambique 2,032 436 1,529<br />

Eliminations (10,839) (9,003) (18,609)<br />

209,<strong>31</strong>3 213,834 427,358<br />

Operating Profit<br />

O-Line 4,194 11,906 20,684<br />

Armco 18,555 16,743 30,258<br />

Corporate (8) (200) (928)<br />

South African operations 22,741 28,449 50,014<br />

O-Line Mozambique 260 (588) (275)<br />

Eliminations (592) (681) (606)<br />

22,409 27,180 49,133<br />

Assets<br />

O-Line 109,816 108,377 115,497<br />

Armco 204,233 168,121 188,629<br />

Corporate 114,946 141,128 123,388<br />

South African operations 428,995 417,626 427,514<br />

O-Line Mozambique 4,418 2,143 3,114<br />

Eliminations (90,954) (89,262) (97,845)<br />

342,459 330,507 332,783<br />

Liabilities<br />

O-Line 34,941 39,826 42,874<br />

Armco 163,571 139,565 157,438<br />

Corporate 389 <strong>31</strong>6 439<br />

South African operations 198,901 179,707 200,751<br />

O-Line Mozambique 4,860 2,799 3,611<br />

Eliminations (93,807) (92,403) (100,844)<br />

109,954 90,103 103,518<br />

Capital expenditure<br />

O-Line 1,417 692 4,302<br />

Armco 9,608 1,390 13,920<br />

Corporate - - -<br />

South African operations 11,025 2,082 18,222<br />

O-Line Mozambique - 9 9<br />

Eliminations - - -<br />

11,025 2,091 18,2<strong>31</strong><br />

For management purposes the Group is organised into four<br />

major operating divisions namely, O-<strong>line</strong> Support Systems,<br />

Armco Superlite, Corporate and O-<strong>line</strong> Mozambique. It

epresents the basis on which the Group reports its primary<br />

segment information.<br />

BASIS OF PREPARATION<br />

These interim financial statements have been prepared in<br />

accordance with IAS 34 - Interim Financial Reporting,<br />

International Financial Reporting Standards (IFRS), AS 500<br />

Standards, the Companies Act of South Africa and the JSE<br />

Limited Listings Requirements.<br />

The accounting policies and methods of measurement,<br />

recognition and computation applied in the preparation of<br />

these interim financial statements are consistent with<br />

those applies in the Group's most recent audited annual<br />

financial statements for the year ended 30 June <strong>2011</strong>.<br />

The results for the period are not necessarily indicative<br />

of the results for the entire year, and interim financial<br />

statements should be read in conjunction with the audited<br />

annual financial statements for the year ended 30 June<br />

<strong>2011</strong>.<br />

The interim financial statements have been prepared under<br />

the supervision of the group financial director, Mr. Gary<br />

Driver.<br />

COMMENTARY<br />

Financial performance<br />

Revenue decreased from R213.8 million, for the six months<br />

ended <strong>31</strong> December 2010(“the comparative period”), to R209.3<br />

million, for the six months ended <strong>31</strong> December <strong>2011</strong> (“the<br />

current period”), mainly as a result of trading volume<br />

dec<strong>line</strong> in O-<strong>line</strong> Support Systems (Pty) Limited (“O-<strong>line</strong><br />

Support Systems”) of 11.06%. Armco Superlite (Pty) Limited

(“Armco”) experienced a trading volume increase of 5.13%<br />

and O-Line Holdings (Mocambique) Limitada (“O-<strong>line</strong><br />

Mocambique”) also experienced a trading volume increase.<br />

This represents a net 2.11% decrease in revenue for the<br />

current period compared to the comparative period. Gross<br />

profit decreased from R66.3 million in the comparative<br />

period to R65.9m over the current period.<br />

O-<strong>line</strong> Support Systems and Armco Superlite achieved gross<br />

profit margins for the current period of 32.5% and 28.6%<br />

respectively, while O-<strong>line</strong> Mocambique achieved a gross<br />

profit margin of 14% for the current period, excessive<br />

transportation costs impacting negatively on their gross<br />

margin. The Group’s operating profit for the current period<br />

decreased by 17.6%, from R27.2 million in the comparative<br />

period to R22.4 million in the current period, whilst<br />

operating expenses increased by 11.1% from R39.7 million to<br />

R44.1 million. Finance costs decreased from R2.7 million in<br />

the comparative period to R2.2 million in the current<br />

period, this is mainly attributable to the decrease in<br />

borrowings as Group debt has been settled.<br />

Cash and cash equivalents have increased from R35.2 million<br />

in the<br />

comparative period to R44.6 million in the current period.<br />

The Group will continue to utilise its available cash to<br />

finance operations, for expansion and to settle debt. The<br />

Group also experienced the following decreases / increases,<br />

compared to the comparative period:<br />

• Borrowings reflect a net decrease of R6.6 million from<br />

R50.8 million to R44.2 million, this is in <strong>line</strong> with<br />

repayments in terms of loan agreements entered into by<br />

the Group. A new medium term loan of R8 million was

drawn down to purchase the property for the<br />

Randfontein galvanising facility;<br />

• Trade and other payables increased by R22.8 million to<br />

R49.5 million, a substantial portion of the increase<br />

being attributable to advance payments received by<br />

Armco;<br />

• Trade and other receivables decreased by R8.6 million<br />

to R44.8 million following the overall downward trend<br />

in sales volumes for the period and better debtors<br />

collections;<br />

• Cash generated from operations increased from R1.6<br />

million to R40.5 million mainly as a result of a<br />

decreased cash investment in working capital as<br />

reflected in the decrease in trade receivables and an<br />

increase in trade payables and inventory at the<br />

current period end compared to the corresponding<br />

period. While the timing of the period end resulted in<br />

a negative impact on trade payables and receivables,<br />

working capital management remains a key area of focus<br />

for the Group;<br />

• Inventory also increased from R72.6 million to R87.4<br />

million to support the increase in trading activities<br />

at Armco and O-<strong>line</strong> Mocambique; and<br />

• Capital expenditure increased from R2.1 million in the<br />

comparative period to R11 million mainly as a result<br />

of the acquisition of the Randfontein property for the<br />

new galvanising facility.<br />

Operational Performance and Prospects<br />

Operational performance of the Group pertaining to the<br />

period were heavily subdued as a result of diminishing<br />

margins relating to continuous increases in Power, Gas and<br />

labour. Further aggravation came in the form of the Metal

Workers Union strikes forcing the Group to evacuate<br />

manufacturing premises for a period due to the violence and<br />

intimidation. O-<strong>line</strong> Support Systems was severely affected<br />

due to the extended time <strong>line</strong>s of materials flow from order<br />

to expediting resulting in increased inventory levels.<br />

Armco’s ability of quick recovery helped lessen the affect<br />

and fared well in providing a fair set of results. The<br />

first quarter resulted in some divisional losses relating<br />

to the above, this left the Group with a mere three months<br />

of proper operations considering taking into play December<br />

is construction close down. In order to manage the deficit<br />

the Group will focus around savings and efficiencies<br />

through the reduction of overtime and downsizing of the<br />

work force, although this will not allow for total recovery<br />

it will assist in reducing operating costs of which in turn<br />

will provide for some relief. Looking ahead to the third<br />

and fourth quarters both Armco and O-<strong>line</strong> will continue the<br />

strategic approach of cost saving through mechanisations<br />

and will focus on the start of supply of goods and services<br />

to the Kusile Power Stations accompanied by the future<br />

Renewable Energy Projects and Roads Infrastructure<br />

Development in Africa.<br />

Directors<br />

Mr David Adomakoh resigned as a director of the Company on<br />

18 August <strong>2011</strong>.<br />

Mr William ("Bill") Cosby was appointed as a non-executive<br />

director of the Company on 23 August <strong>2011</strong>.<br />

02 <strong>March</strong> <strong>2012</strong><br />

Designated Advisor<br />

Sasfin Capital

(a division of Sasfin Bank Limited)