SC 290 Leiren v AA09 (#2) - BC Assessment

SC 290 Leiren v AA09 (#2) - BC Assessment

SC 290 Leiren v AA09 (#2) - BC Assessment

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

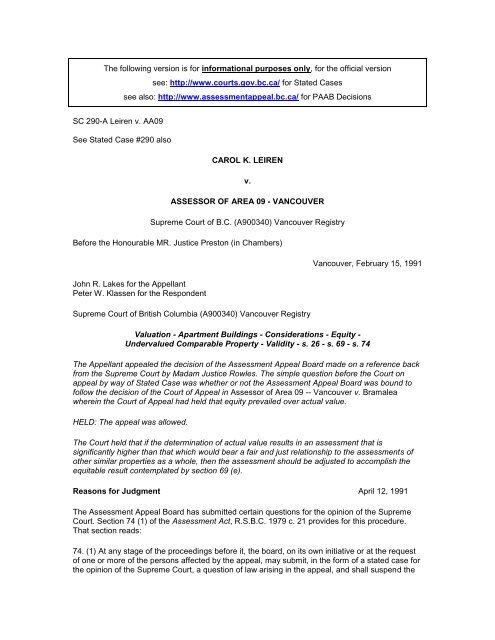

The following version is for informational purposes only, for the official version<br />

see: http://www.courts.gov.bc.ca/ for Stated Cases<br />

see also: http://www.assessmentappeal.bc.ca/ for PAAB Decisions<br />

<strong>SC</strong> <strong>290</strong>-A <strong>Leiren</strong> v. <strong>AA09</strong><br />

See Stated Case #<strong>290</strong> also<br />

CAROL K. LEIREN<br />

v.<br />

ASSESSOR OF AREA 09 - VANCOUVER<br />

Supreme Court of B.C. (A900340) Vancouver Registry<br />

Before the Honourable MR. Justice Preston (in Chambers)<br />

John R. Lakes for the Appellant<br />

Peter W. Klassen for the Respondent<br />

Supreme Court of British Columbia (A900340) Vancouver Registry<br />

Vancouver, February 15, 1991<br />

Valuation - Apartment Buildings - Considerations - Equity -<br />

Undervalued Comparable Property - Validity - s. 26 - s. 69 - s. 74<br />

The Appellant appealed the decision of the <strong>Assessment</strong> Appeal Board made on a reference back<br />

from the Supreme Court by Madam Justice Rowles. The simple question before the Court on<br />

appeal by way of Stated Case was whether or not the <strong>Assessment</strong> Appeal Board was bound to<br />

follow the decision of the Court of Appeal in Assessor of Area 09 -- Vancouver v. Bramalea<br />

wherein the Court of Appeal had held that equity prevailed over actual value.<br />

HELD: The appeal was allowed.<br />

The Court held that if the determination of actual value results in an assessment that is<br />

significantly higher than that which would bear a fair and just relationship to the assessments of<br />

other similar properties as a whole, then the assessment should be adjusted to accomplish the<br />

equitable result contemplated by section 69 (e).<br />

Reasons for Judgment April 12, 1991<br />

The <strong>Assessment</strong> Appeal Board has submitted certain questions for the opinion of the Supreme<br />

Court. Section 74 (1) of the <strong>Assessment</strong> Act, R.S.B.C. 1979 c. 21 provides for this procedure.<br />

That section reads:<br />

74. (1) At any stage of the proceedings before it, the board, on its own initiative or at the request<br />

of one or more of the persons affected by the appeal, may submit, in the form of a stated case for<br />

the opinion of the Supreme Court, a question of law arising in the appeal, and shall suspend the

proceedings and reserve its decision until the opinion of the final Court of Appeal has been given<br />

and then the Board shall decide the appeal in accordance with the opinion.<br />

This is the second time that questions concerning this particular appeal have been submitted to<br />

the Court under section 74 (1). The appeal relates to a 19-suite apartment building in the<br />

Oakridge/Cambie area of the City of Vancouver. This property was assessed for the 1989<br />

<strong>Assessment</strong> Roll at a value of $1,803,500. The Owner appealed the assessment and at the<br />

hearing of the appeal before the <strong>Assessment</strong> Appeal Board in October, 1989 questions arose<br />

which caused the Board to avail itself of the procedure provided by section 74 (1). Accordingly, on<br />

January 12, 1990 the Board stated a case containing a number of questions for the Court. A<br />

hearing was held on March 16 and 19, 1990 before Rowles J. and on March 30, 1990 she<br />

remitted the matter back to the Board with answers to the questions submitted.<br />

The Board convened again on June 22, 1990. After hearing submissions the Board submitted<br />

further questions for the opinion of the Court and has once again suspended proceedings<br />

pending receipt of the Court's opinion. These questions are set out in a Stated Case dated<br />

September 12, 1990.<br />

The difficulty experienced by the Board arose from differing interpretations given to the Reasons<br />

for Judgment of the Court of Appeal in British Columbia <strong>Assessment</strong> Authority and Surrey-White<br />

Rock <strong>Assessment</strong> District v. Simpson-Sears Ltd. (1981) 27 B.C.L.R. 77 ("Simpson-Sears"). After<br />

this case was stated in September 1990 but before this hearing, the issues raised by the<br />

Simpson-Sears case were considered by a five judge Court in the Court of Appeal in Assessor for<br />

Area 09 (Vancouver) v. Bramalea Limited et al., Unreported, December 14, 1990, Victoria<br />

Registry No. CAV00992 ("Bramalea").<br />

It is common ground on this appeal that the Board did not follow the directions given to them by<br />

Rowles J. The matter must again be remitted to the Board with answers to the second set of<br />

questions and with further directions. Mr. Klassen, on behalf of the Assessor, submits that the<br />

conclusion of the Court of Appeal in Bramalea cannot be reconciled with the directions to the<br />

Board given by Rowles J. and, because her decision was not appealed, the principles of issue<br />

estoppel prevent me from referring the matter back to the Board on a basis other than that upon<br />

which it was referred to them by Rowles J.<br />

I will go on at this point to deal in detail with the questions submitted for the Court's opinion in the<br />

hearing before Rowles J., her opinion and directions to the Board, the second set of questions,<br />

the effect of the Bramalea decision on these proceedings, and my opinion on the matters raised<br />

by the second set of questions.<br />

THE QUESTIONS SUBMITTED TO ROWLES J.<br />

In the Stated Case which accompanied the questions submitted by the Board to Rowles J. the<br />

Board set out the background to their questions as follows:<br />

1. The subject matter of this Stated Case is a two-storey wood-frame apartment building (and lot)<br />

containing nineteen suites, located in the Oakridge/Cambie neighbourhood of the City of<br />

Vancouver.<br />

2. This property was placed upon the 1989 <strong>Assessment</strong> Roll by the Assessor at a value of<br />

$1,803,500.<br />

3. Both parties to the appeal employed the "Income Approach to Value" in arriving at values for<br />

this property for the appeal before the Board.

4. The Appraiser for the Appellant arrived at a value of $1,265,000. For reasons given in its<br />

decision the Board rejected this value.<br />

5. The actual values the Assessor had determined for the comparable properties for the 1989<br />

<strong>Assessment</strong> Roll resulted in 1989 roll values of these properties being an average 73% of the<br />

value for which they were sold.<br />

6. The Board concluded, on the evidence before it, that the actual value (that is the amount which<br />

the subject property would have fetched if put up for sale on the open market) was $1,950,000 on<br />

the valuation date for the 1989 <strong>Assessment</strong> Roll.<br />

7. While section 26 (2) requires the Assessor to determine the actual value of the subject land<br />

and improvements and to enter them at their actual value on the 1989 <strong>Assessment</strong> Roll the Board<br />

was concerned that if it accepted the value of $1,950,000 an inequity would be created between<br />

the subject property and other similar properties within the same general neighbourhood.<br />

8. Section 69 (1) of the <strong>Assessment</strong> Act gives the Board the power to determine whether or not<br />

the value of the subject property would bear a just and fair relation to the value at which similar<br />

land and improvements are assessed in the municipality in which it is situated.<br />

9. It is the view of the Board that if the assessments appearing upon the three comparable<br />

apartment buildings, situated in the same general area of Vancouver, is correct, to arrive at a fair<br />

and just relation for the value of the subject property, it would have to be placed on the 1989<br />

<strong>Assessment</strong> Roll at a value of $1,423,500 (being 73% of its market value of $1,950,000).<br />

10. A copy of the decision of the Board dated the 12th day of January, 1990 is attached hereto<br />

and marked Schedule "A" and a copy of order dated the 19th day of January, 1990 is attached<br />

hereto marked Schedule "B".<br />

Note: Schedules A and B not attached, see 1989 A.A.B. Decisions Blue Book.<br />

The Board submitted the following questions:<br />

1. In considering the value at which a property should be assessed, is the Board required by<br />

section 26 of the <strong>Assessment</strong> Act to maintain actual (market) value, when faced with evidence<br />

that, by doing so, the value arrived at will not bear a fair and just relation to the value at which<br />

similar lands and improvements are assessed, by the same Assessor, in the same municipality<br />

2. If the Board accepts the evidence of the Assessor as being a better measure of actual value, is<br />

the Board empowered by section 69 (1) (e) of the <strong>Assessment</strong> Act to determine an assessed<br />

value for the individual parcel under consideration which will bear a fair and just relation to the<br />

value at which similar lands and improvements are assessed in the municipality in which it is<br />

situated<br />

3. If the Board considers itself obliged to value the subject lands and improvements at an actual<br />

value which would not be equitable in comparison to similar lands and improvements, would the<br />

Board err as a result by requiring the Assessor to increase the assessments on the three<br />

comparables presented as evidence to the Board to bring those properties to a comparable value<br />

with the value applied by the Board to the subject property, albeit the comparables were not<br />

appealed <br />

4. If the Board decided that the comparables referred to in evidence had been assessed at less<br />

than what the Board considered to be actual value, would the Board be in error in requiring the

Commissioner to reassess all the residential apartment buildings situate in the affected<br />

neighbourhood for the 1989 <strong>Assessment</strong> Roll<br />

Two additional questions were placed before the Court, one by the Assessor and one by the<br />

Owner. The question which the Assessor requested be placed before the Court was:<br />

5. Is the Board required to find the actual value of the subject property, when other similar<br />

properties in the municipality are assessed at less than their actual value<br />

The question which the Owner requested be placed before the Court was:<br />

6. Would the Board be in error if it accepted the evidence of the Assessor resulting in a valuation<br />

of $1,950,000 when there is no evidence that the assessments on similar properties in Vancouver<br />

were assessed at which the Assessor is alleging to be actual value and the evidence establishes<br />

that in order to have a fair and just relation the assessment on the subject property would have to<br />

be reduced to a value of $1,423,500<br />

ROWLES J.'S OPINION AND DIRECTIONS TO THE BOARD<br />

Rowles J. answered the questions submitted to the Court as follows:<br />

First, she dealt with questions 3 and 4.<br />

Question 3<br />

In respect to question 3, counsel were in agreement that the Board has no jurisdiction to order an<br />

increase in the assessed value of the three comparable properties. I agree. The Board is limited<br />

to making a decision with reference to the property that has been appealed.<br />

Question 4<br />

In respect to question 4, counsel were also in agreement that the Board has no jurisdiction to<br />

require the Commissioner to make the reassessment contemplated by the question. Again, I<br />

agree. Under s. 69 (1) the Board's jurisdiction is confined to the property which is the subject<br />

matter of the appeal and under s. 69 (2) the Board can only order the Commissioner to reassess<br />

properties in the municipality if it determines "that the assessed value of land and improvements<br />

in a municipality or rural area is in excess of assessed value as determined under s. 26". In this<br />

instance the Board has made no such determination.<br />

She then went on to deal with questions 1, 2, 5 and 6.<br />

Questions 1, 2, 5 and 6<br />

I do not propose to speculate further on what question or questions the Board intended in this<br />

case, based on a series of assumed facts which the Board may or may not find. The questions<br />

are ambiguous, and it is difficult to discern the particular point or points of law on which the Board<br />

seeks an opinion.<br />

The matter is remitted to the Board under s. 74 (6). The Board must determine, if it has not<br />

already been determined, whether or not the assessments on the three comparables are in error.

If the Board's conclusion is that the assessments on the three comparables are in error, I have<br />

already answered the following question in the affirmative:<br />

Is the Board required to maintain actual value, in the face of evidence that three comparable<br />

properties have been erroneously under-assessed<br />

If the Board's conclusion is that the assessed value of the three comparables is correct, that<br />

conclusion must be stated, and the Board must specify the point or points of law on which it<br />

seeks the opinion of the Court.<br />

From questions 1, 2, 5 and 6, and paragraph 9 of the Stated Case, a conclusion is implicit, that is,<br />

that the assessments on three comparables are an accurate reflection of assessments for all or<br />

substantially all similar land and improvements in the municipality. That conclusion or assumption<br />

has not been found as a fact by the Board, and there is no indication in the Stated Case to<br />

suggest that there was evidence before the Board on which such a determination could have<br />

been reached in any event. Mr. Klassen submitted that the Court should remit the Stated Case to<br />

the Board with a direction that it hear further evidence as to the assessed value of all or<br />

substantially all similar properties in the City of Vancouver, before the Board seeks the opinion of<br />

the Court. I agree that whether or not the value at which an individual parcel under consideration<br />

is assessed bears a fair and just relation to the value at which similar land and improvements are<br />

assessed in the municipality in which the property under appeal is situated must be determined<br />

on the basis of evidence before the Board. Therefore the parties must be permitted to address<br />

the Board, and present evidence directed to that issue.<br />

Finally, I wish to make this observation. The Board, from some comments which it made in its<br />

decision, appears to have placed the requirement to assess the property under appeal on the<br />

basis of actual value on the same footing as reaching a fair and equitable result. The decision of<br />

the Court of Appeal in Simpson-Sears made clear that the Board, as its prime requirement, is<br />

required to assess the land under appeal on the basis of actual value.<br />

THE QUESTIONS ON THIS APPLICATION<br />

The Stated Case which is the subject of this application repeats the questions submitted to<br />

Rowles J. and her answers. It then goes on as follows:<br />

4. . . . The Board reconvened on June 22, 1990 to reconsider this matter.<br />

5. The Board found that the value of $1,950,000 presented by the Assessor was the market value<br />

of the subject property. This value was determined without the Board knowing the assessed<br />

values of the three comparable properties (from which the market value of the subject was<br />

concluded).<br />

6. The Appellant requested an opportunity to present evidence of an assessment sales ratio<br />

comparing similar properties to the subject. The Board declined to hear such evidence as in its<br />

opinion, based on the decision of Madam Justice Rowles that because the Board had arrived at<br />

the market value for the subject property, that is, its actual value for assessment purposes, and<br />

since the actual value of the subject property was arrived at from evidence from the market place,<br />

the Board cannot move away from actual value to arrive at equity.<br />

7. The Board further found that it would be a fruitless undertaking to attempt to ascertain the<br />

correctness of the assessments on the three comparable properties for the following reasons:

(a) This would not conclusively establish whether the assessments on other similar land and<br />

improvements in the neighbourhood or in all of Vancouver are incorrect.<br />

7. (b) Even if the assessments on the three comparables are incorrect there is nothing that the<br />

Board can do about it because:<br />

i(i) It is obliged to find the actual value of the subject property (which it has done) and it will not<br />

help anything in the valuation of the subject property if the assessed value of other properties is<br />

incorrect.<br />

7. (b) (ii) The Board is not empowered to order the Assessor to alter the assessed values of other<br />

properties, unless they are in excess of assessed value as determined under section 26 (see<br />

section 69 (2) ).<br />

7. ( c) Even if the assessments on the comparable properties are correct (which the Board<br />

doubts), there is nothing the Board can do about it, so long as it is satisfied that it has arrived at<br />

the correct actual value of the subject.<br />

The Board then frames the following questions for the Court on this application:<br />

THE QUESTIONS on which the Board is required to ask for the opinion of the Supreme Court<br />

are:<br />

1. Did the <strong>Assessment</strong> Appeal Board err in law by finding that it had to apply its own opinion of<br />

"market value" as the actual value despite the fact that the result would be an inequitable and<br />

discriminatory assessment<br />

2. Did the <strong>Assessment</strong> Appeal Board err in law by misinterpreting the decision of the Court of<br />

Appeal in Simpson-Sears v. Assessor of Area #14 - Surrey-White Rock as that decision would<br />

apply to this appeal<br />

3. Did the <strong>Assessment</strong> Appeal Board err in law by refusing to hear the evidence which would be<br />

submitted to establish a value which would be a fair and equitable value as the actual value of<br />

this property<br />

4. Did the <strong>Assessment</strong> Appeal Board err in law because it refused to hear evidence to establish<br />

the required assessment values as was directed by Madam Justice Rowles in the application<br />

made by the Appeal Board for an opinion under section 74 (1) of the <strong>Assessment</strong> Act <br />

It is clear that the Board did not follow the procedure recommended by Rowles J. She said in her<br />

reasons (at p. 18):<br />

The Board must determine, if it has not already been determined, whether or not the<br />

assessments on the three comparables are in error.<br />

She made it clear that such determination is necessary to provide a factual basis for the<br />

questions that the Board submitted to her. But that determination is not the end of the process.<br />

She said (at p. 17):<br />

The Board has apparently assumed that the assessed value of the three comparables is<br />

representative of assessed values of substantially all other similar properties in the municipality.<br />

Unless there is some evidentiary basis for such a conclusion, which has not been stated by the<br />

Board, the assumption is unwarranted.

She went on to direct that the Board consider evidence concerning the assessed value of similar<br />

lands and improvements in the municipality.<br />

I agree that whether or not the value at which an individual parcel under consideration is<br />

assessed bears a fair and just relation to the value at which similar land and improvements are<br />

assessed in the municipality in which the property under appeal is situated must be determined<br />

on the basis of evidence before the Board. Therefore, the parties must be permitted to address<br />

the Board, and present evidence directed to that issue.<br />

Since Rowles J. provided her directions to the Board, the Court of Appeal has provided further<br />

guidance in this area of the law in Bramalea. The Court dealt extensively with the conflict which<br />

may sometimes exist between a finding of actual value in relation to a particular property and a<br />

value which reflects a fair and just relationship to the assessed values of other similar properties.<br />

Taylor J.A. gave the Reasons for Judgment of the Court. He said (at p. 13):<br />

It is my view that the principles mentioned give the taxpayer two distinct rights: (i) a right to an<br />

assessment which is not in excess of that which can be regarded as equitable; and (ii) a right not<br />

to be assessed in excess of actual value.<br />

He went on to say (at p. 19):<br />

It does not, in my view, follow that a taxpayer's land can be assessed, or reassessed, on a view<br />

of actual value which results in an assessment significantly higher than would bear a fair and just<br />

relationship to assessments on other similar properties as a whole. Such a broad interpretation of<br />

the effect of the Simpson-Sears decision would deny the taxpayer the right to equitable treatment,<br />

a right which the law recognizes and which the Board is in my view required to uphold.<br />

Section 69 of the <strong>Assessment</strong> Act reads, in part, as follows:<br />

(1) In an appeal under this Act . . . the Board may determine . .<br />

(a) whether or not the land or improvements, or both, have been valued at too high or too low an<br />

amount;<br />

(1) (e) Whether or not the value at which an individual parcel under consideration is assessed<br />

bears a fair and just relation to the value at which similar land and improvements are assessed in<br />

the municipality or rural area in which it is situated;<br />

The principles relevant to this Stated Case that emerge from Bramalea can be summarized as<br />

follows:<br />

1. The <strong>Assessment</strong> Appeal Board may grant relief on either of the grounds set out in subsections<br />

(a) or (e). The Board, however, has no power to change assessments of other properties which<br />

are not the subject of the appeal to resolve any anomalies that result.<br />

2. As a result of subsections (a) and (e) the taxpayer has two distinct rights. He or she has a right<br />

to an assessment that:<br />

(1) is not in excess of that which can be regarded as equitable.<br />

(2) is not in excess of actual value.

3. Valuation of property is not always an exact process. It may be that there are a range of actual<br />

values that are equally appropriate in any individual case. There also may be a range of values<br />

that are equitable between taxpayers. When these two ranges overlap a Board will be able to<br />

determine actual value and achieve equity within the range of overlap. When the ranges do not<br />

overlap the conflict between the Board's duty to determine actual value and achieve equity must<br />

be resolved by giving preference to one principle over the other.<br />

4. If the assessment of actual value results in an assessment that is significantly higher than that<br />

which would bear a fair and just relationship to assessments of other similar properties as a<br />

whole, then the assessment should be adjusted to accomplish the equitable result contemplated<br />

by s. 69 (e).<br />

Question 2<br />

This question reads:<br />

Did the <strong>Assessment</strong> Appeal Board err in law by misinterpreting the decision of the Court of<br />

Appeal in Simpson-Sears v. Assessor of Area #14 - Surrey-White Rock, as that decision would<br />

apply to this appeal <br />

Some guidance can be obtained from the Reasons for Judgment of the Court of Appeal in<br />

Bramalea. Taylor J.A. said (at p. 18):<br />

In the Simpson-Sears case this Court was not, in my view, concerned with the resolution of a<br />

conflict between the Assessor's duty to assess at "actual value" and the requirement that he do<br />

so in such a way as to ensure equity between similar properties. It was concerned with resolution<br />

of a conflict which arose when the taxpayer claimed it was entitled to have its lands assessed on<br />

the same basis as immediately adjacent similar land which the Board found had been assessed<br />

below actual value, rather than on the same basis as similar land elsewhere in the municipality,<br />

land assessed at a value found by the Board to represent its actual value and that also of the land<br />

under appeal.<br />

It was in those circumstances that this Court said that the requirement that assessments be at<br />

"actual value" should be the "dominant consideration" in resolving the conflict. In the Stated Case<br />

before me the Board indicates that it has found actual value of the subject property and that it did<br />

not need to determine whether the assessed values of the three comparable properties were<br />

correct in satisfactorily arriving at its conclusion. It must therefore go on to apply the principles set<br />

out in Bramalea. It has not done so, therefore the answer to question two must be "Yes".<br />

Questions 1 and 3<br />

The Board erred in finding that it had to apply its own opinion of market value as the actual value<br />

without hearing evidence submitted to establish a value that would bear a fair and just<br />

relationship to other properties as a whole in accordance with s. 69 (1) (e). The Reasons for<br />

Judgment of the Court of Appeal in Bramalea make it clear that this is a necessary part of the<br />

process contemplated by s. 69. The answer to questions 1 and 3 is "Yes".<br />

Question 4<br />

Question 4 reads as follows:

Did the <strong>Assessment</strong> Appeal Board err in law because it refused to hear evidence to establish the<br />

required assessment values as was directed by Madam Justice Rowles in the application made<br />

by the Appeal Board for an opinion under section 74 (1) of the <strong>Assessment</strong> Act<br />

I assume from this question that the Board is referring to the assessment values of the three<br />

comparable properties.<br />

The Board was directed to determine whether or not the assessments on the three comparable<br />

properties were in error because of the ambiguity of the questions submitted to Rowles J. by the<br />

Board. Rowles J. alluded to this (at p. 18):<br />

I do not propose to speculate further on what question or questions the Board intended in this<br />

case, based on a series of assumed facts which the Board may or may not find. The questions<br />

are ambiguous, and it is difficult to discern the particular point or points of law on which the Board<br />

seeks an opinion.<br />

The matter is remitted to the Board under s. 74 (6). The Board must determine, if it has not<br />

already been determined, whether or not the assessments on the three comparables are in error.<br />

It appears from the wording of the Stated Case submitted to me that the Board has come to the<br />

conclusion that it can properly assess the actual value of the subject property without reference to<br />

the three comparables. If that is a considered decision after hearing submissions on the point, I<br />

see no necessity for the Board to now determine whether the assessments on the three<br />

comparables are in error. In that event, I would answer the fourth question "No". If the Board has<br />

not considered submissions on the point it should do so and go on to decide whether it can<br />

properly assess the actual value of the subject property without reference to the three<br />

comparables.<br />

I cannot accept Mr. Klassen's submission that the directions given by Rowles J. are inconsistent<br />

with the interpretation placed on Simpson-Sears by the Court of Appeal in Bramalea. I have,<br />

earlier in these reasons, indicated that her Reasons for Judgment require that the Board hear<br />

further evidence to determine whether the assessment of the subject property bears a fair and<br />

just relation to the value at which similar lands and improvements are assessed in the<br />

municipality in which the subject property is situated. Her concluding comments regarding the<br />

Simpson-Sears case now have to be applied in light of the judgment of the Court of Appeal in<br />

Bramalea.<br />

The case is remitted to the Board.