You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

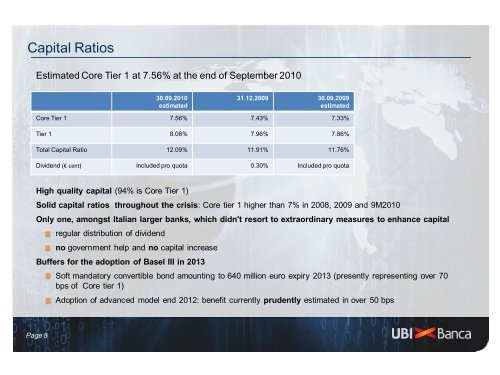

Capital Ratios<br />

Estimated Core Tier 1 at 7.56% at the end of September 2010<br />

High quality capital (94% is Core Tier 1)<br />

Solid capital ratios throughout the crisis: Core tier 1 higher than 7% in 2008, 2009 and 9M2010<br />

Only one, amongst Italian larger banks, which didn't resort to extraordinary measures to enhance capital<br />

regular distribution of dividend<br />

no government help and no capital increase<br />

Buffers for the adoption of Basel III in 2013<br />

Page 8<br />

30.09.2010<br />

estimated<br />

31.12.2009 30.09.2009<br />

estimated<br />

Core Tier 1 7.56% 7.43% 7.33%<br />

Tier 1 8.08% 7.96% 7.86%<br />

Total Capital Ratio 12.09% 11.91% 11.76%<br />

Dividend (€ cent) Included pro quota 0.30% Included pro quota<br />

Soft mandatory convertible bond amounting to 640 million euro expiry 2013 (presently representing over 70<br />

bps of Core tier 1)<br />

Adoption of advanced model end 2012: benefit currently prudently estimated in over 50 bps