SEED Continuation Agreement 2007 - Venture Philanthropy Partners

SEED Continuation Agreement 2007 - Venture Philanthropy Partners

SEED Continuation Agreement 2007 - Venture Philanthropy Partners

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

toward achievement of their Aspiration and Goals. The Milestones for Year Two, which have been<br />

mutually agreed upon by VPP and <strong>SEED</strong>, are presented in Attachment A and are an integral part of the<br />

<strong>Continuation</strong> <strong>Agreement</strong>.<br />

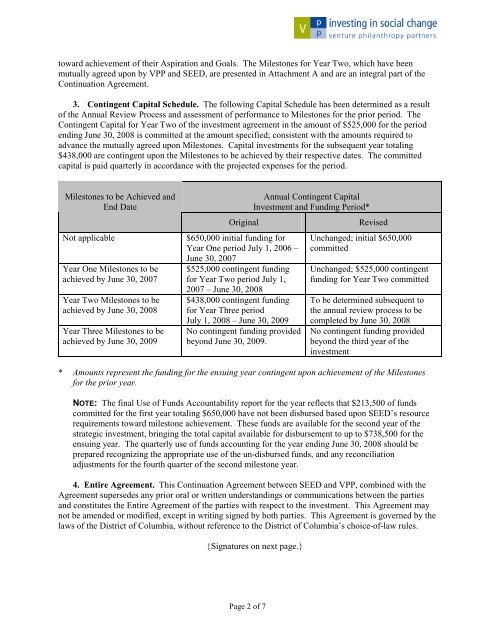

3. Contingent Capital Schedule. The following Capital Schedule has been determined as a result<br />

of the Annual Review Process and assessment of performance to Milestones for the prior period. The<br />

Contingent Capital for Year Two of the investment agreement in the amount of $525,000 for the period<br />

ending June 30, 2008 is committed at the amount specified; consistent with the amounts required to<br />

advance the mutually agreed upon Milestones. Capital investments for the subsequent year totaling<br />

$438,000 are contingent upon the Milestones to be achieved by their respective dates. The committed<br />

capital is paid quarterly in accordance with the projected expenses for the period.<br />

Milestones to be Achieved and<br />

End Date<br />

Not applicable<br />

Year One Milestones to be<br />

achieved by June 30, <strong>2007</strong><br />

Year Two Milestones to be<br />

achieved by June 30, 2008<br />

Year Three Milestones to be<br />

achieved by June 30, 2009<br />

Original<br />

$650,000 initial funding for<br />

Year One period July 1, 2006 –<br />

June 30, <strong>2007</strong><br />

$525,000 contingent funding<br />

for Year Two period July 1,<br />

<strong>2007</strong> – June 30, 2008<br />

$438,000 contingent funding<br />

for Year Three period<br />

July 1, 2008 – June 30, 2009<br />

No contingent funding provided<br />

beyond June 30, 2009.<br />

Annual Contingent Capital<br />

Investment and Funding Period*<br />

Revised<br />

Unchanged; initial $650,000<br />

committed<br />

Unchanged; $525,000 contingent<br />

funding for Year Two committed<br />

To be determined subsequent to<br />

the annual review process to be<br />

completed by June 30, 2008<br />

No contingent funding provided<br />

beyond the third year of the<br />

investment<br />

* Amounts represent the funding for the ensuing year contingent upon achievement of the Milestones<br />

for the prior year.<br />

NOTE: The final Use of Funds Accountability report for the year reflects that $213,500 of funds<br />

committed for the first year totaling $650,000 have not been disbursed based upon <strong>SEED</strong>’s resource<br />

requirements toward milestone achievement. These funds are available for the second year of the<br />

strategic investment, bringing the total capital available for disbursement to up to $738,500 for the<br />

ensuing year. The quarterly use of funds accounting for the year ending June 30, 2008 should be<br />

prepared recognizing the appropriate use of the un-disbursed funds, and any reconciliation<br />

adjustments for the fourth quarter of the second milestone year.<br />

4. Entire <strong>Agreement</strong>. This <strong>Continuation</strong> <strong>Agreement</strong> between <strong>SEED</strong> and VPP, combined with the<br />

<strong>Agreement</strong> supersedes any prior oral or written understandings or communications between the parties<br />

and constitutes the Entire <strong>Agreement</strong> of the parties with respect to the investment. This <strong>Agreement</strong> may<br />

not be amended or modified, except in writing signed by both parties. This <strong>Agreement</strong> is governed by the<br />

laws of the District of Columbia, without reference to the District of Columbia’s choice-of-law rules.<br />

{Signatures on next page.}<br />

Page 2 of 7