Economic Development Investment Strategy - City of Las Vegas

Economic Development Investment Strategy - City of Las Vegas

Economic Development Investment Strategy - City of Las Vegas

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

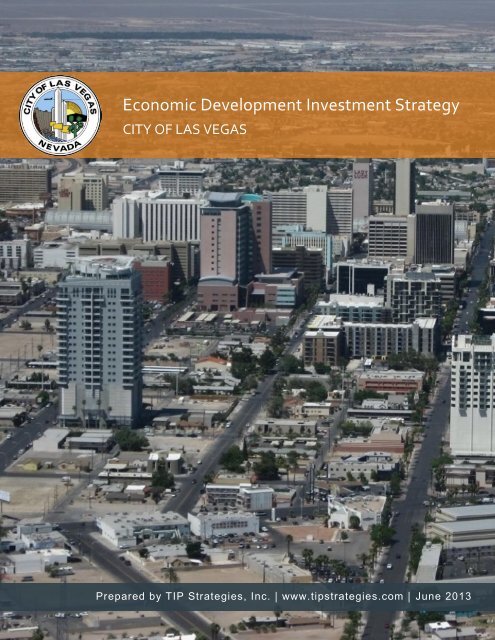

<strong>Economic</strong> <strong>Development</strong> <strong>Investment</strong> <strong>Strategy</strong><br />

CITY OF LAS VEGAS<br />

t h e o r y i n t o p r a c t i c e<br />

Prepared by TIP Strategies, Inc. | www.tipstrategies.com | June 2013<br />

5 1 2 . 3 4 3 . 9 1 1 3 | w w w . t i p s t r a t e g i e s . c o m | 1 0 6 E a s t 6 t h S t r e e t , S u i t e

C i t y o f L a s V e g a s | E c o n o m i c D e v e l o p m e n t I n v e s t m e n t S t r a t e g y<br />

Contents<br />

ACKNOWLEDGEMENTS ...................................................................................................................................................................................................... II<br />

EXECUTIVE SUMMARY ........................................................................................................................................................................................................ 1<br />

INTRODUCTION..................................................................................................................................................................................................................... 6<br />

SWOT ANALYSIS .................................................................................................................................................................................................................. 8<br />

GOAL: STRENGTHEN & EXPAND THE LAS VEGAS MEDICAL DISTRICT. ................................................................................................................ 11<br />

GOAL: SUPPORT THE LONG-TERM OBJECTIVES OF THE DOWNTOWN PROJECT. ............................................................................................. 13<br />

GOAL: PURSUE NEW DEVELOPMENT & REDEVELOPMENT OPPORTUNITIES. ..................................................................................................... 16<br />

GOAL: ENGAGE IN A COMPREHENSIVE BUSINESS RECRUITMENT AND PROSPECT MANAGEMENT PROGRAM. ....................................... 20<br />

GOAL: MARKET AND PROMOTE THE CITY OF LAS VEGAS AS A DESTINATION FOR NEW INVESTMENT AND EMPLOYMENT. .................. 25<br />

GOAL: TARGET COMPANIES RECEIVING FEDERAL SBIR/STTR AWARDS FOR BUSINESS RECRUITMENT TO LAS VEGAS. ...................... 28<br />

GOAL: UTILIZE NEW INCENTIVE TOOLS TO ENCOURAGE NEW DEVELOPMENT AND REDEVELOPMENT...................................................... 30<br />

GOAL: EXPAND THE CITY’S BUSINESS RETENTION AND EXPANSION PROGRAM. ............................................................................................. 33<br />

GOAL: ENHANCE THE QUALITY OF PLACE IN LAS VEGAS. ...................................................................................................................................... 36<br />

IMPLEMENTATION.............................................................................................................................................................................................................. 39<br />

PERFORMANCE MEASURES ............................................................................................................................................................................................ 43<br />

APPENDIX: MEDICAL DISTRICT CASE STUDIES .......................................................................................................................................................... 45<br />

CASE STUDY #1: TEXAS MEDICAL CENTER | HOUSTON, TEXAS ....................................................... 46<br />

CASE STUDY #2: ILLINOIS MEDICAL DISTRICT | CHICAGO, ILLINOIS ................................................ 49<br />

CASE STUDY #3: FORT WORTH NEAR SOUTHSIDE | FORT WORTH, TEXAS .................................... 51<br />

CASE STUDY #4: MEMPHIS MEDICAL CENTER | MEMPHIS, TENNESSEE ......................................... 53<br />

T I P S t r a t e g i e s | T h e o r y I n t o P r a c t i c e<br />

P a g e | i

C i t y o f L a s V e g a s | E c o n o m i c D e v e l o p m e n t I n v e s t m e n t S t r a t e g y<br />

Acknowledgements<br />

TIP Strategies would like to thank the many individuals who participated in the development <strong>of</strong> this plan. We are particularly<br />

grateful to the project steering committee who generously gave their time and input. Their knowledge and expertise contributed<br />

greatly to our understanding <strong>of</strong> <strong>Las</strong> <strong>Vegas</strong> and our recommendations.<br />

We would also like to thank the leadership and staff <strong>of</strong> the <strong>City</strong> <strong>of</strong> <strong>Las</strong> <strong>Vegas</strong> for their critical guidance, support, and feedback.<br />

<strong>Las</strong> <strong>Vegas</strong> <strong>City</strong> Council<br />

Carolyn G. Goodman, Mayor Mayor Pro Tem Stavros S. Anthony, Ward 4<br />

Lois Tarkanian, Ward 1 Ricki Y. Barlow, Ward 5<br />

Bob Beers, Ward 2 Steven D. Ross, Ward 6<br />

Bob C<strong>of</strong>fin, Ward 3<br />

Project Steering Committee<br />

.<br />

Marc Abelman<br />

Inside Style<br />

Danielle Bisterfeldt<br />

Howard Hughes Corporation<br />

Jeff Fine<br />

Fine Companies<br />

Sam Gladstein<br />

Newland Real Estate Group<br />

Dan Gouker<br />

College <strong>of</strong> Southern Nevada<br />

John Guedry<br />

Bank <strong>of</strong> Nevada<br />

Jon Leleu<br />

World Market Center<br />

Eric Louttit<br />

Forest <strong>City</strong> Real Estate Services<br />

Mike Nolan<br />

Fremont East District<br />

David Scherer<br />

Newmark Grubb Knight Frank<br />

Paul Schmitt<br />

Whiting-Turner<br />

Jody Sherman<br />

ecomom<br />

John Tippins<br />

ST Residential<br />

Marcia Turner<br />

Nevada System <strong>of</strong> Higher Education<br />

Jeff Victor<br />

Fremont Street Experience<br />

Josh Bowden<br />

Downtown Project<br />

Rich Worthington<br />

Downtown Alliance<br />

Betsy Fretwell<br />

<strong>Las</strong> <strong>Vegas</strong> <strong>City</strong> Manager<br />

Scott Adams<br />

Chief Urban Redevelopment Officer, CLV<br />

Bill Arent<br />

Direct <strong>of</strong> <strong>Economic</strong> and Urban <strong>Development</strong>, CLV<br />

Romeo Betea<br />

Business <strong>Development</strong> Manager, CLV<br />

Jeff McGeachy<br />

Senior <strong>Economic</strong> <strong>Development</strong> Specialist, CLV<br />

T I P S t r a t e g i e s | T h e o r y I n t o P r a c t i c e<br />

P a g e | ii

C i t y o f L a s V e g a s | E c o n o m i c D e v e l o p m e n t I n v e s t m e n t S t r a t e g y<br />

Executive Summary<br />

The effect <strong>of</strong> the Great Recession on <strong>Las</strong> <strong>Vegas</strong> was among the most severe in the country. A near-collapse <strong>of</strong> the construction<br />

industry, abandoned developments, and a hollowed-out downtown left many wondering whether there was a future for the city.<br />

Even the <strong>Las</strong> <strong>Vegas</strong> Strip, with which the city is so <strong>of</strong>ten identified, was left with shell buildings and an uncertain future. But<br />

instead <strong>of</strong> succumbing to this gloom, a series <strong>of</strong> high-pr<strong>of</strong>ile projects and a corporate headquarters relocation have propelled <strong>Las</strong><br />

<strong>Vegas</strong> into the national limelight. This plan seeks to capitalize on those opportunities. It is less a “master plan” than a set <strong>of</strong><br />

targeted recommendations designed to broaden and strengthen the economic health <strong>of</strong> the community.<br />

The Challenge<br />

Among the significant findings during<br />

the Discovery Phase <strong>of</strong> the project<br />

were those related to workforce and<br />

the availability <strong>of</strong> suitable <strong>of</strong>fice space<br />

in the city to accommodate new<br />

pr<strong>of</strong>essional employment.<br />

Workforce and Employment Base<br />

Higher education has become a<br />

critical component for regions seeking<br />

a competitive advantage in economic<br />

development. This is true both for<br />

supplying a sufficient base <strong>of</strong> talent as<br />

well as for providing opportunities in<br />

research and innovation. According to<br />

US Census 2010 estimates, 20<br />

percent <strong>of</strong> the <strong>Las</strong> <strong>Vegas</strong> population<br />

possesses a four-year degree,<br />

compared to 28 percent <strong>of</strong> the US<br />

population. Helping to create new<br />

higher education opportunities, as well<br />

as supporting institutions and<br />

organizations dedicated to better<br />

preparing the city’s youth for higher<br />

education, are two fundamental needs<br />

in <strong>Las</strong> <strong>Vegas</strong>. The <strong>City</strong>’s new<br />

agreement to lease vacant space in<br />

<strong>City</strong> Hall to the College <strong>of</strong> Southern<br />

Nevada is an innovative example <strong>of</strong><br />

the contribution it can make to this<br />

fundamental need.<br />

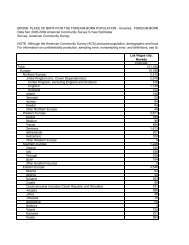

Educational attainment, 2010<br />

Highest level <strong>of</strong> education achieved by the population age 25 or older.<br />

no high school diploma<br />

high school diploma or GED<br />

some college but less than a 4-year degree<br />

bachelor's degree or higher<br />

28%<br />

29%<br />

22%<br />

32%<br />

USA<br />

14%<br />

Clark County<br />

16%<br />

29%<br />

30%<br />

<strong>City</strong> <strong>of</strong> <strong>Las</strong> <strong>Vegas</strong><br />

20%<br />

32%<br />

22%<br />

33%<br />

Nevada<br />

18%<br />

15%<br />

30%<br />

30%<br />

Source: U.S. Census Bureau (2010 American Community Survey, 1-Year Estimates)<br />

T I P S t r a t e g i e s | T h e o r y I n t o P r a c t i c e P a g e | 1

C i t y o f L a s V e g a s | E c o n o m i c D e v e l o p m e n t I n v e s t m e n t S t r a t e g y<br />

Another challenge for the <strong>City</strong><br />

<strong>of</strong> <strong>Las</strong> <strong>Vegas</strong> is to create more<br />

employment opportunities in the<br />

city for its residents. Since<br />

2002, the number <strong>of</strong> people<br />

who live and work in <strong>Las</strong> <strong>Vegas</strong><br />

has actually declined from<br />

80,000 to 65,000. The vast<br />

majority <strong>of</strong> the city's net outflow<br />

is actually to unincorporated<br />

Paradise, where many <strong>of</strong> the<br />

county's major employers are<br />

located, including the resorts<br />

located along the <strong>Las</strong> <strong>Vegas</strong><br />

Strip, McCarran International<br />

Airport, and UNLV. Creating<br />

new employment centers in <strong>Las</strong><br />

<strong>Vegas</strong> would reduce regional<br />

traffic congestion and expand<br />

the city’s tax base.<br />

However, the challenge goes<br />

beyond the volume <strong>of</strong><br />

employment opportunities. <strong>Las</strong><br />

<strong>Vegas</strong> needs higher quality and<br />

better paying jobs. The city’s<br />

service-oriented economy is<br />

reflected in its occupational<br />

structure. Together, the city's<br />

three largest occupational<br />

groups—sales, administrative<br />

support, and food services—<br />

account for more than 125,000<br />

jobs, or roughly two out <strong>of</strong> every<br />

five workers. Depending on the<br />

employer, some <strong>of</strong> city’s largest<br />

occupations, especially food<br />

preparation and personal<br />

services, historically pay low<br />

wages.<br />

At the other end <strong>of</strong> the<br />

spectrum, the three high-wage<br />

occupational groups that<br />

Net daily inbound and outbound commuter traffic for the city <strong>of</strong> <strong>Las</strong> <strong>Vegas</strong><br />

300,000<br />

250,000<br />

200,000<br />

150,000<br />

100,000<br />

50,000<br />

0<br />

2002 2003 2004 2005 2006 2007 2008 2009 2010<br />

Sources: U.S. Bureau <strong>of</strong> the Census, Local Employment Dynamics (LED) database, 2002-2010<br />

2011 job base by occupational group in the city <strong>of</strong> <strong>Las</strong> <strong>Vegas</strong><br />

Sales<br />

Office & administrative support<br />

Food preparation & serving<br />

Personal care & service<br />

Business & financial operations<br />

Management*<br />

Property maintenance<br />

Healthcare (technical)<br />

Transportation & material moving<br />

Protective service<br />

Arts, design, & media<br />

Installation, maintenance, & repair<br />

Healthcare (support)<br />

Construction & extraction<br />

Production<br />

Education, training, & library<br />

Military<br />

Legal<br />

Community & social services<br />

Computer & mathematical science<br />

Architecture & engineering<br />

Life, physical, & social science<br />

Farming, fishing, & forestry<br />

Inbound commuters<br />

Outbound commuters<br />

Live & work within <strong>Las</strong> <strong>Vegas</strong> city limits<br />

*NOTE: Management occupations include self-employed real estate agents and farmers<br />

& ranchers as well as construction managers and general managers.<br />

SOURCE: EMSI Complete Employment - 2012.2<br />

include computer technology, engineering, and the sciences each account for fewer than 9,000 jobs (less than 3 percent <strong>of</strong> total<br />

jobs).<br />

242<br />

3,997<br />

3,787<br />

2,735<br />

2,208<br />

6,339<br />

5,226<br />

4,974<br />

4,652<br />

10,808<br />

10,658<br />

10,122<br />

9,212<br />

9,148<br />

15,968<br />

15,533<br />

19,676<br />

19,501<br />

19,015<br />

18,871<br />

28,731<br />

49,392<br />

48,320<br />

0 10,000 20,000 30,000 40,000 50,000 60,000<br />

T I P S t r a t e g i e s | T h e o r y I n t o P r a c t i c e P a g e | 2

C i t y o f L a s V e g a s | E c o n o m i c D e v e l o p m e n t I n v e s t m e n t S t r a t e g y<br />

Sites and Buildings<br />

In addition to workforce and the existing job base, <strong>Las</strong><br />

<strong>Vegas</strong> also faces the challenge <strong>of</strong> developing buildings<br />

and sites to accommodate new business and<br />

employment. Years <strong>of</strong> explosive residential growth has<br />

left the city with a paucity <strong>of</strong> competitive commercial<br />

<strong>of</strong>fice and industrial space. In the downtown area, rising<br />

property values, new business growth, and rising<br />

demand for a mix <strong>of</strong> building types all suggest that the<br />

city needs to take a more aggressive approach to <strong>of</strong>fice<br />

and tech space. This should include both Class A <strong>of</strong>fice<br />

space as well as the highly adaptable communal space<br />

envisioned by the Downtown Project.<br />

<strong>Las</strong> <strong>Vegas</strong> also lacks available industrial sites and<br />

buildings that can accommodate large employers. With<br />

existing high vacancy rates for industrial properties in<br />

the Valley, it is not likely the market would currently<br />

support a new greenfield park. This is especially true for<br />

sites lacking surrounding development or services. Still,<br />

<strong>Las</strong> <strong>Vegas</strong> will continue to have a long-term need for<br />

shovel-ready industrial land within the city’s boundaries.<br />

<strong>Las</strong> <strong>Vegas</strong> Regional Office Market, Q1 2013<br />

#<br />

Properties<br />

Total<br />

Rentable<br />

SF<br />

Vacancy<br />

Rate<br />

Net<br />

Absorption<br />

QTD<br />

Downtown 110 3,748,832 12.2% 52,727<br />

Airport 306 5,228,255 22.7% 13,122<br />

East <strong>Las</strong> <strong>Vegas</strong> 183 6,021,321 27.8% 8,773<br />

Henderson 319 5,999,875 20.6% 239,098<br />

North <strong>Las</strong> <strong>Vegas</strong> 96 783,529 23.9% 1,040<br />

Northwest 403 8,895,564 25.7% 49,642<br />

Southwest 391 6,587,155 25.6% 197,141<br />

West Central 274 5,561,170 19.1% -31,275<br />

Total 2,082 42,825,701 22.8% 482,030<br />

Source: RCG <strong>Economic</strong>s<br />

Lou Ruvo Brain Center<br />

Without question, the <strong>City</strong> <strong>of</strong> <strong>Las</strong> <strong>Vegas</strong> has been<br />

instrumental in the development <strong>of</strong> unique and<br />

economically important buildings and districts. These<br />

facilities include the Lou Ruvo Brain Center, the Medical<br />

District, Smith Center, the International Trade Mart, the<br />

Arts District, the new <strong>City</strong> Hall, the Zappos<br />

headquarters, the Downtown Project properties, East<br />

Fremont District, and Symphony Park. However, from<br />

an outsider’s perspective, these facilities and sites lack<br />

photo credit: Kirk Gittings<br />

the physical, transportation, and programmatic links that<br />

give the sense <strong>of</strong> a connected and integrated downtown. In a sense, they form an archipelago. Within its Downtown <strong>Investment</strong><br />

<strong>Strategy</strong> and other planning/development efforts, the <strong>City</strong> should strive to fill in the physical and figurative spaces that separate<br />

these individual assets.<br />

The Response<br />

What the plan’s assessment laid bare is that the diverse projects undertaken by the city over the last five years – each with<br />

significant benefits – do not aggregate into a coherent whole. Nor do they, individually, meet the goals set out by this broader<br />

strategy. This is the basis for the guiding principles that guide the plan.<br />

T I P S t r a t e g i e s | T h e o r y I n t o P r a c t i c e P a g e | 3

C i t y o f L a s V e g a s | E c o n o m i c D e v e l o p m e n t I n v e s t m e n t S t r a t e g y<br />

Innovative centers <strong>of</strong><br />

employment,<br />

commerce, and<br />

education<br />

Destination for talented<br />

entrepreneurs<br />

Richness and diversity<br />

<strong>of</strong> amenities<br />

Rising standard <strong>of</strong><br />

living for all residents<br />

What does<br />

economic vitality<br />

in <strong>Las</strong> <strong>Vegas</strong><br />

mean<br />

Sense <strong>of</strong> community<br />

Under this approach, new projects are evaluated by their impact as well as how they connect with each other. As it stands now,<br />

no one project “saves” the city. A coherent approach to economic vitality is the right starting point. As important as a medical<br />

district is to a forward-looking community, it is only one component.<br />

The same can be said <strong>of</strong> the Downtown Project. There is, arguably, no current urban development in the United States on a par<br />

with the $350 million investment in downtown <strong>Las</strong> <strong>Vegas</strong> by Tony Hsieh. The relocation <strong>of</strong> a corporate headquarters to<br />

downtown <strong>Las</strong> <strong>Vegas</strong> would have been cause enough for celebration. The investment into the Downtown Project changes the<br />

game entirely. The overall goals <strong>of</strong> the Downtown Project are to enable people to live, work, and play within walking distance;<br />

create the most community-focused large city in the world; and to establish <strong>Las</strong> <strong>Vegas</strong> as the co-working capital <strong>of</strong> the world.<br />

The realization <strong>of</strong> these goals would certainly be <strong>of</strong> enormous benefit to the <strong>City</strong> <strong>of</strong> <strong>Las</strong> <strong>Vegas</strong>. Because <strong>of</strong> its ambitious nature, it<br />

stretches the limits <strong>of</strong> economic development. Urban renewal, transportation, and talent attraction are all parts <strong>of</strong> the Project.<br />

While it may not be Tony Hsieh’s intent to “reinvent” <strong>Las</strong> <strong>Vegas</strong>, the opportunity to capitalize on that vision is significant.<br />

The $50M <strong>Vegas</strong>TechFund in particular is a potentially transformative element <strong>of</strong> the Project. And while it is clearly beneficial to<br />

be attracting entrepreneurs to downtown <strong>Las</strong> <strong>Vegas</strong>, the long term benefits that come with establishing growth companies in the<br />

city is not guaranteed. The recent loss <strong>of</strong> the Romotive (a robotics company) to California is a signal <strong>of</strong> how important it is to<br />

connect with start-up companies and seek to anchor them in <strong>Las</strong> <strong>Vegas</strong>. It is not the obligation <strong>of</strong> Tony Hsieh – or the Downtown<br />

Project – to ensure the growth <strong>of</strong> businesses in <strong>Las</strong> <strong>Vegas</strong>. That is the responsibility <strong>of</strong> the <strong>City</strong> and it’s economic development<br />

partners.<br />

Moreover, the <strong>City</strong> cannot rely exclusively on the efforts <strong>of</strong> the Downtown Project or the <strong>Las</strong> <strong>Vegas</strong> Global <strong>Economic</strong> Alliance<br />

(LVGEA) to bring new employers to the <strong>City</strong>. It must have a lead role in marketing <strong>Las</strong> <strong>Vegas</strong> to innovative companies, finding<br />

them adequate sites and space, and <strong>of</strong>fering tools to help them succeed. With the current relative scarcity <strong>of</strong> industry clusters<br />

(outside <strong>of</strong> gaming and entertainment), <strong>Las</strong> <strong>Vegas</strong> is in a position to identify targets based on their benefit to the city rather than<br />

on gaps in the existing supply chain. In other words, the <strong>City</strong> shouldn’t confine itself to recruiting companies based on location<br />

quotients and projected job growth. It should pursue those industries that it feels will be successful in <strong>Las</strong> <strong>Vegas</strong> and will diversify<br />

the economic base.<br />

T I P S t r a t e g i e s | T h e o r y I n t o P r a c t i c e P a g e | 4

C i t y o f L a s V e g a s | E c o n o m i c D e v e l o p m e n t I n v e s t m e n t S t r a t e g y<br />

The <strong>City</strong>’s economic development program should also not focus exclusively on business recruitment. The core <strong>of</strong> any<br />

successful economic development program is assisting the existing business base. This includes <strong>Las</strong> <strong>Vegas</strong>’ traditional tourism,<br />

gaming, and entertainment cluster.<br />

Goals<br />

The economic development strategy is built around nine goals. This is a higher number <strong>of</strong> goals than most strategic plans<br />

contain. However, strategic planning goals tend to be broad statements on issues such as talent development and business<br />

diversification. For this plan, each goal is focused on a specific initiative, project, or program recommended for action on the part<br />

<strong>of</strong> the <strong>City</strong> <strong>of</strong> <strong>Las</strong> <strong>Vegas</strong> and its economic development partners. Under each goal are a number <strong>of</strong> strategies and actions<br />

needed for implementation.<br />

Below are the nine goals TIP recommends the <strong>City</strong> pursue as part <strong>of</strong> its economic development program.<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

Goal 1: Strengthen and expand the <strong>Las</strong> <strong>Vegas</strong> Medical District.<br />

Goal 2: Support the long-term success <strong>of</strong> the Downtown Project.<br />

Goal 3: Pursue new development and redevelopment opportunities.<br />

Goal 4: Engage in a comprehensive business recruitment and prospect management program.<br />

Goal 5: Market and promote the city <strong>of</strong> <strong>Las</strong> <strong>Vegas</strong> as a destination for new investment and employment.<br />

Goal 6: Target companies receiving federal SBIR/STTR awards for business recruitment to <strong>Las</strong> <strong>Vegas</strong>.<br />

Goal 7: Utilize new incentive tools to encourage new development and redevelopment.<br />

Goal 8: Expand the <strong>City</strong>’s Business Retention and Expansion program.<br />

Goal 9: Enhance the quality <strong>of</strong> place in <strong>Las</strong> <strong>Vegas</strong>.<br />

T I P S t r a t e g i e s | T h e o r y I n t o P r a c t i c e P a g e | 5

C i t y o f L a s V e g a s | E c o n o m i c D e v e l o p m e n t I n v e s t m e n t S t r a t e g y<br />

Introduction<br />

TIP Strategies was engaged by the <strong>City</strong> <strong>of</strong> <strong>Las</strong> <strong>Vegas</strong> to prepare an economic development plan for the city. The following<br />

recommendations are the result <strong>of</strong> a six-month process incorporating input and ideas from key stakeholders and organizations<br />

throughout the city. The plan is designed with the overall goal <strong>of</strong> positioning <strong>Las</strong> <strong>Vegas</strong> for long-term growth and prosperity.<br />

Guiding Principles<br />

Guiding principles reflect the values <strong>of</strong> the community. In the context <strong>of</strong> an economic development plan, they are a set <strong>of</strong> brief<br />

statements expressing how a city defines economic vitality. The overarching principle for the city <strong>of</strong> <strong>Las</strong> <strong>Vegas</strong> is to promote<br />

long-lasting and diverse economic vitality throughout the community. This approach was arrived at with the support <strong>of</strong> the project<br />

steering committee and encompasses values broadly shared throughout the city. Based on the input we have received as well as<br />

our analysis, TIP proposes the city plan be organized around the following core principles:<br />

<br />

<br />

<br />

<br />

<br />

Destination for talented entrepreneurs: <strong>Las</strong> <strong>Vegas</strong> will create an envirornment that attracts the brightest and most<br />

ambitious entrepreneurs. It will build the networks, expertise, infrastructure, space, and capital access needed to become a<br />

global hub for technology innovation and business creation.<br />

Innovative centers <strong>of</strong> employment, commerce, and education: Companies, agencies, and institutions will strategically<br />

invest in new and revitalized buildings, sites, and districts in <strong>Las</strong> <strong>Vegas</strong>. These locations will attract economic, community,<br />

and social actitivies that will propel the city forward.<br />

Rising standard <strong>of</strong> living for all residents: The rising quality <strong>of</strong> the businesses and jobs in <strong>Las</strong> <strong>Vegas</strong> will generate better<br />

earnings, educational opportunities, and healthcare for its citzens. The rising standard <strong>of</strong> living will positively impact all<br />

classes <strong>of</strong> workers and demographic groups in the city.<br />

Richness and diversity <strong>of</strong> amenities: <strong>Las</strong> <strong>Vegas</strong> will <strong>of</strong>fer the amenities that skilled and educated pr<strong>of</strong>essionals would find<br />

attractive. The <strong>City</strong> will continue building on successes such as the Smith Center for the Performing Arts to strengthen arts,<br />

culture, education, recreation, and mobility assets and districts in the community.<br />

Sense <strong>of</strong> community: The <strong>City</strong> <strong>of</strong> <strong>Las</strong> <strong>Vegas</strong> will build on the strong sense <strong>of</strong> community, cohesion, and pride that is<br />

growing in the city and is being exhibited by the recent and planned investments in the companies, infrastructure, facilities,<br />

and people <strong>of</strong> <strong>Las</strong> <strong>Vegas</strong>.<br />

T I P S t r a t e g i e s | T h e o r y I n t o P r a c t i c e P a g e | 6

C i t y o f L a s V e g a s | E c o n o m i c D e v e l o p m e n t I n v e s t m e n t S t r a t e g y<br />

Plan Approach<br />

The economic development strategy is built around nine goals. This is a higher number <strong>of</strong> goals than most strategic plans<br />

contain. However, strategic planning goals tend to be broad statements on issues such as talent development and business<br />

diversification. For this plan, each goal is focused on a specific initiative, project, or program recommended for action on the part<br />

<strong>of</strong> the <strong>City</strong> <strong>of</strong> <strong>Las</strong> <strong>Vegas</strong> and its economic development partners. Under each goal are a number <strong>of</strong> strategies and actions<br />

needed for implementation.<br />

Below are the nine goals TIP recommends the <strong>City</strong> pursue as part <strong>of</strong> its economic development program.<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

Goal 1: Strengthen and expand the <strong>Las</strong> <strong>Vegas</strong> Medical District.<br />

Goal 2: Support the long-term goals <strong>of</strong> the Downtown Project.<br />

Goal 3: Pursue new development and redevelopment opportunities.<br />

Goal 4: Engage in a comprehensive business recruitment and prospect management program.<br />

Goal 5: Market and promote the city <strong>of</strong> <strong>Las</strong> <strong>Vegas</strong> as a destination for new investment and employment.<br />

Goal 6: Target companies receiving federal SBIR/STTR awards for business recruitment to <strong>Las</strong> <strong>Vegas</strong>.<br />

Goal 7: Utilize new incentive tools to encourage new development and redevelopment.<br />

Goal 8: Expand the <strong>City</strong>’s Business Retention and Expansion program.<br />

Goal 9: Enhance the quality <strong>of</strong> place in <strong>Las</strong> <strong>Vegas</strong>.<br />

Flowwing the goals, an Implementation Matrix assigns responsibility and sets out a time frame for implementing the strategies.<br />

We also list Performance Measures that should be tracked to record <strong>Las</strong> <strong>Vegas</strong>’s progress towards its economic goals.<br />

Appendix A presents case studies <strong>of</strong> four successful medical districts in the US.<br />

The <strong>Economic</strong> Assessment is provided under a separate cover as companion document.<br />

T I P S t r a t e g i e s | T h e o r y I n t o P r a c t i c e P a g e | 7

STRENGTHS<br />

C i t y o f L a s V e g a s | E c o n o m i c D e v e l o p m e n t I n v e s t m e n t S t r a t e g y<br />

SWOT Analysis<br />

This section highlights the city <strong>of</strong> <strong>Las</strong> <strong>Vegas</strong>’ strengths, weaknesses, opportunities, and threats, commonly referred to as a<br />

SWOT analysis. The SWOT was developed using data and quantitative analysis completed as part <strong>of</strong> the economic assessment<br />

(published separately) as well as direct input provided by the project steering committee. Additionally, information and input<br />

gathered from a number <strong>of</strong> task force meetings, focus groups, and interviews conducted as part <strong>of</strong> the regional Comprehensive<br />

<strong>Economic</strong> <strong>Development</strong> <strong>Strategy</strong> (CEDS) were incorporated into the SWOT. It was developed originally as a regional analysis<br />

and refined with elements specific to the city <strong>of</strong> <strong>Las</strong> <strong>Vegas</strong>.<br />

<br />

Image as an internationally recognized destination<br />

<br />

<br />

<br />

<br />

<br />

Cluster strength in the tourism, gaming, and entertainment industry<br />

Retail, dining, and entertainment amenities available at resorts<br />

Exceptional customer service culture<br />

Industry trade shows and conferences (and convention activity generally)<br />

Transportation infrastructure and connections:<br />

→ McCarran International Airport as a tourism and logistics asset<br />

→ Highway infrastructure (east/west access to California and north/south access to other mountain states)<br />

→ Rail connection to southern California<br />

→ Travel access (non-stop air service to major markets)<br />

→ Regional mass transit system<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

Telecommunications and broadband infrastructure<br />

Climate and geological safety related to weather and natural disasters<br />

Pro-business climate, especially vis-à-vis West Coast neighbors<br />

Favorable state tax structure (no corporate or personal income taxes)<br />

Long-term and reliable electricity supply<br />

Diverse ethnic population and business community with ties to Pacific Rim and Latin American markets<br />

Affordability <strong>of</strong> residential, commercial, and industrial real estate relative to competitor regions<br />

Significant workforce strengths hidden within gaming and resort industry, especially those with IT skills and training<br />

CCSD Magnet & Career and Technical Academies<br />

Outdoor amenities (world-class rock climbing)<br />

Attractiveness as a retirement destination<br />

T I P S t r a t e g i e s | T h e o r y I n t o P r a c t i c e P a g e | 8

OPPORTUNITIES<br />

C i t y o f L a s V e g a s | E c o n o m i c D e v e l o p m e n t I n v e s t m e n t S t r a t e g y<br />

<br />

Publicity, visibility, and enthusiasm generated by the Downtown Project<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

Business and entrepreneurial growth in downtown <strong>Las</strong> <strong>Vegas</strong><br />

Develop a new hybrid incubator/accelerator<br />

JumpStart <strong>Las</strong> <strong>Vegas</strong><br />

Potential redevelopment <strong>of</strong> Cashman Center as a downtown business and technology park<br />

<strong>Development</strong> <strong>of</strong> the digital media cluster<br />

Leveraging the region’s strong technology sales workforce<br />

New incentives for business attraction at the local and regional level<br />

Long-term and dedicated funding mechanism and source for economic development<br />

Strengthening and expansion <strong>of</strong> the <strong>Las</strong> <strong>Vegas</strong> Medical District<br />

<strong>Development</strong> <strong>of</strong> new medical education programs and facilities<br />

Expansion <strong>of</strong> post-secondary education facilities and programs in downtown<br />

Leveraging advantages in the financial services sector (e.g., industrial banks and the intangibles industry)<br />

Business recruitment and attraction strategy leveraging trade show and convention base<br />

FAA's Unmanned Aircraft System (UAS) Test Site designation<br />

Greater involvement and financial support <strong>of</strong> public education by the business community and the general public<br />

Leveraging Switch-NAP and broadband infrastructure<br />

Aging industry and healthcare<br />

Local sustainability initiatives<br />

T I P S t r a t e g i e s | T h e o r y I n t o P r a c t i c e P a g e | 9

WEAKNESSES<br />

THREATS<br />

C i t y o f L a s V e g a s | E c o n o m i c D e v e l o p m e n t I n v e s t m e n t S t r a t e g y<br />

<br />

Talent development, retention, and attraction<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

Low educational attainment and high school graduation rates<br />

Small base <strong>of</strong> businesses outside <strong>of</strong> gaming, entertainment, and tourism cluster<br />

Lack <strong>of</strong> fully-established clusters aside from tourism, entertainment, and gaming (historical over-reliance on the<br />

construction trade and on service industries)<br />

“Adult Freedom” image campaign hinders perception as a destination for business investment and/or expansion<br />

and location<br />

S<strong>of</strong>t demand in commercial and industrial real estate market<br />

Access to finance for small businesses and entrepreneurs<br />

Current difficulty in obtaining real estate development capital<br />

Lack <strong>of</strong> existing real estate product for expanding or relocating companies (available downtown <strong>of</strong>fice and BLM<br />

land ownership)<br />

Lack <strong>of</strong> sustained, reliable funding for economic development<br />

Limited competitive economic development financial tools and incentives compared to other states and major<br />

metros<br />

Several years behind the competition in economic development planning<br />

Paucity <strong>of</strong> skilled technology workers<br />

Lack <strong>of</strong> adequate public funding (state and federal) to make UNLV a nationally-recognized research university<br />

Lack <strong>of</strong> medical education relative to demand<br />

<br />

Declining educational attainment and post-secondary enrollment<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

Out-migration <strong>of</strong> talented and experienced workers<br />

Base Realignment and Closure (BRAC)<br />

Over-reliance on traditional gaming and home construction sectors<br />

Water supply and cost (long-term)<br />

Competitive pressure from other regions, especially for capital, industry, and talent from western states<br />

Slow national economic recovery, as <strong>Las</strong> <strong>Vegas</strong> is currently dependent on tourism and gaming<br />

Cost <strong>of</strong> power, relative to regional and national markets<br />

1 GOAL: STRENGTHEN & EXPAND THE LAS VEGAS MEDICAL DISTRICT.<br />

T I P S t r a t e g i e s | T h e o r y I n t o P r a c t i c e P a g e | 10

C i t y o f L a s V e g a s | E c o n o m i c D e v e l o p m e n t I n v e s t m e n t S t r a t e g y<br />

1. GOAL: Strengthen & expand the <strong>Las</strong> <strong>Vegas</strong> Medical District.<br />

The <strong>Las</strong> <strong>Vegas</strong> Medical District has the potential to play a greater role in driving city and regional economic<br />

growth. It can also serve as a catalyst <strong>of</strong> urban renewal. This will require investing in infrastructure<br />

development; expanding the district boundaries; creating a new leadership structure and updated master<br />

plan; strengthening its major institutions and small business ; and linking it to the other institutions,<br />

developments, and districts in the downtown .<br />

OVERVIEW<br />

The <strong>Las</strong> <strong>Vegas</strong> Medical District encompasses 160 acres<br />

bordered by Charleston Blvd. to the south, Martin Luther King<br />

Blvd. to the east, Alta Drive to the north, and Rancho Drive to<br />

the west. Large public health institutions located in the district<br />

include the Nevada System <strong>of</strong> Higher Education (NSHE)<br />

Shadow Lane Campus, University Medical Center <strong>of</strong><br />

Southern Nevada (UMC), the Southern Nevada Health Distrct<br />

(SNHD), and Valley Hospital. The southern edge <strong>of</strong> the UMC<br />

campus along Charleston Blvd. has become a medical<br />

corridor interspersed with some retail uses.<br />

UMC, the NSHE Shadow Lane Campus, and SNHD have<br />

been renovating and expanding their facilities, technologies,<br />

practices, and programs within their current footprints. The<br />

NSHE Shadow Lane Campus commissioned its own master<br />

plan update to guide its efforts at becoming a shared health<br />

sciences campus occupied by multiple educational institutions<br />

and health disciplines.<br />

\\<br />

Adopted in 2008, the Medical District is intended as an<br />

area for the development <strong>of</strong> health care services and<br />

related functions as well as related residential facilities,<br />

such as nursing homes, assisted living facilities and central<br />

housing for health care employees.<br />

The major physical challenge facing the Medical District is the limited ability for institutions to grow and expand within the current<br />

160-acre footprint. In comparison, the Memphis Medical Center (see text box, next page) encompasses 14,000 acres. One<br />

potential opportunity to expand its footprint is to extend the borders <strong>of</strong> the Medical District to include the Cleveland Clinic Lou<br />

Ruvo Brain Institute and planned medical <strong>of</strong>fice space in Symphony Park. Another potential opportunity is to facilitate joint<br />

facilities planning among local entities to better maximize the utilization <strong>of</strong> the existing footprint within the Medical District. Efforts<br />

are already underway to initiate such collaborative facilities and programming planning among stakeholders within the Medical<br />

District. Until these recent joint planning discussions, the <strong>Las</strong> <strong>Vegas</strong> Medical District was a collection <strong>of</strong> medical and healthcare<br />

institutions joined together by proximity and zoning. It still requires a common vision and plan for strengthening healthcare<br />

services, research, and education in the community and establishing <strong>Las</strong> <strong>Vegas</strong> as a premier center <strong>of</strong> medicine in the Western<br />

US. The following proposed action steps are designed to build on the current collaborative efforts to further enhance economic<br />

development within the District and improve the health <strong>of</strong> the people in Southern Nevada.<br />

TIMELINE<br />

< 12 mos 1-2 years 3-5 years 5-10 years<br />

POTENTIAL PARTNERS<br />

<strong>City</strong> <strong>of</strong> <strong>Las</strong> <strong>Vegas</strong> • UMC • SNHD • NSHE • Valley Hospital •<br />

Cleveland Clinic Lou Ruvo Brain Institute<br />

T I P S t r a t e g i e s | T h e o r y I n t o P r a c t i c e P a g e | 11

C i t y o f L a s V e g a s | E c o n o m i c D e v e l o p m e n t I n v e s t m e n t S t r a t e g y<br />

1. GOAL: Strengthen & expand the <strong>Las</strong> <strong>Vegas</strong> Medical District.<br />

Continued<br />

APPROACH<br />

STRATEGY. Establish an oversight<br />

commission or board to guide the growth<br />

and development <strong>of</strong> the medical district.<br />

STRATEGY. Commission a district-wide<br />

master plan that assesses the zoning,<br />

physical, transportation, financial, business,<br />

R&D, and educational needs and<br />

opportunities <strong>of</strong> the district. The plan should<br />

establish a common vision among the<br />

existing institutions and lay out a long-range<br />

plan for growth and development, while<br />

identifying short- and mid-range options.<br />

STRATEGY. Continue to support Clark<br />

County/UMC and NSHE’s efforts to partner<br />

in the development <strong>of</strong> a robust Academic<br />

Medical Center at UMC.<br />

STRATEGY. Continue to support the planned<br />

expansion <strong>of</strong> the University <strong>of</strong> Nevada School<br />

<strong>of</strong> Medicine within the district.<br />

STRATEGY. Support the development <strong>of</strong><br />

UNLV Nursing and Physical Therapy<br />

Building on NSHE Shadow Lane Campus.<br />

STRATEGY. Link the district physically,<br />

programmatically, and institutionally to other<br />

assets and developments in downtown <strong>Las</strong><br />

<strong>Vegas</strong> and the region.<br />

STRATEGY. Support the continuing<br />

operations and expansion <strong>of</strong> the Cleveland<br />

Clinic Lou Ruvo Center for Brain Health as a<br />

medical "center <strong>of</strong> excellence" for <strong>Las</strong> <strong>Vegas</strong><br />

and the region. Champion additional<br />

Cleveland Clinic centers <strong>of</strong> excellence which<br />

are additive or complimentary to local medical<br />

care, with an emphasis on surgical specialties<br />

currently underserved by the local market.<br />

BEST PRACTICES THEMES<br />

TIP studied four successful urban medical districts to identify best<br />

practices and lessons that could be applied to the <strong>Las</strong> <strong>Vegas</strong><br />

Medical District: Memphis Medical Center (Memphis, TN); Fort<br />

Worth Seaside Medical District (Fort Worth, TX); Texas Medical<br />

Center (Houston, TX); and Illinois Medical District (Chicago, IL).<br />

The former two represent younger districts that don’t feature a<br />

major medical school, while the latter two are older and more<br />

comprehensive. Selected themes from this research are<br />

presented below. Full case studies are presented in the appendix.<br />

Set up an organizational framework. In each <strong>of</strong> the four<br />

districts, a planning board or oversight commission manages<br />

the medical district and is critical to their success. Such<br />

entities helped each grow from a collection <strong>of</strong> hospitals to an<br />

actual district. These entities recruit new companies and<br />

medical facilities, manage growth and infrastructure<br />

planning, and collaborate with local business and<br />

government. The type <strong>of</strong> organization ranged from<br />

completely private to mixed public-private partnerships to<br />

completely public.<br />

University involvement is key. A medical school is not<br />

required for success – the Memphis district is a good<br />

example. However, some university involvement in healthrelated<br />

areas (Dental, Optometry, Nursing, or Public Health<br />

for example) is important.<br />

Start-ups provide another avenue. Although not essential,<br />

establishing a local biotech incubator is an accepted way to<br />

attract companies and spur job growth.<br />

Have a plan. In addition, each district developed a master<br />

plan to guide long-range growth. Before beginning certain<br />

aspects <strong>of</strong> its plan, Memphis evaluated its existing health and<br />

medicine programs to identify areas where they may already<br />

have local strengths. In doing so, Memphis discovered a local<br />

strength in orthopedics, for example, and then built out<br />

aspects <strong>of</strong> their plan to capitalize on that specialty.<br />

Source: TIP Strategies research<br />

2 GOAL: SUPPORT THE LONG-TERM OBJECTIVES OF THE DOWNTOWN PROJECT.<br />

T I P S t r a t e g i e s | T h e o r y I n t o P r a c t i c e P a g e | 12

C i t y o f L a s V e g a s | E c o n o m i c D e v e l o p m e n t I n v e s t m e n t S t r a t e g y<br />

2. GOAL: Support the long-term objectives <strong>of</strong> the Downtown Project.<br />

The Downtown Project represents a unique opportunity to revitalize and transform the economy <strong>of</strong> the East<br />

Fremont Street area <strong>of</strong> downtown <strong>Las</strong> <strong>Vegas</strong>. The successful implementation <strong>of</strong> the Project’s principles <strong>of</strong><br />

collisions, co-learning, and connectivity could spawn a new city within a city, one that draws on the themes<br />

<strong>of</strong> this plan: entrepreneurship, technology, and innovation. The challenge for the <strong>City</strong> <strong>of</strong> <strong>Las</strong> <strong>Vegas</strong> is to<br />

integrate the vision <strong>of</strong> the Downtown Project and to ensure its sustainability.<br />

OVERVIEW<br />

The Downtown Project was spawned by Zappos<br />

relocating to downtown <strong>Las</strong> <strong>Vegas</strong> and occupying the<br />

former <strong>City</strong> Hall building. To make the downtown a more<br />

desirable location for the company’s 1,200 employees to<br />

work and live in, Zappos’ CEO, Tony Hsieh, launched the<br />

initiative to transform the area. While his goal was to<br />

make the area around city hall more hospitable for<br />

Zappos’ employees, it has rapidly expanded into the most<br />

innovative and cohesive urban development effort in the<br />

US. Of the $350 million dedicated to revitalizing the old<br />

downtown <strong>of</strong> <strong>Las</strong> <strong>Vegas</strong>, $200 million is in real estate, $50<br />

million in small businesses, $50 million in education, and<br />

$50 million in tech startups through the <strong>Vegas</strong>Tech Fund.<br />

The Project intends to use these funds to catalyze a<br />

“vibrant, connected urban core” within five years.<br />

Source: Powerpoint presentation, “Zappos.com: Delivering<br />

Happiness | Downtown Project”<br />

To help ensure the Project’s goals, the <strong>City</strong> must define a supportive role for itself that includes the traditional responsibilities <strong>of</strong><br />

efficiently processing permits and licenses, conducting site inspections, ensuring public safety and sanitation. Downtown Project<br />

leaders indicated this is a primary need from their perspective. Additionally, the <strong>City</strong> should work to ensure the economic benefits<br />

generated by the Project (e.g., business creation, job growth, new construction, rising property values, population increase) are<br />

leveraged fully to impact areas outside <strong>of</strong> its investment footprint. In other words, the <strong>City</strong> must work to extend the vitality created<br />

by the Downtown Project to other areas <strong>of</strong> <strong>Las</strong> <strong>Vegas</strong>.<br />

The relocation <strong>of</strong> Zappos to downtown <strong>Las</strong> <strong>Vegas</strong>, major property acquisition (especially on East Fremont), and the bold vision <strong>of</strong><br />

Tony Hsieh to create a livable and walkable downtown core, are unique components <strong>of</strong> an economic revitalization that has<br />

transformative power. Nevertheless, the Downtown Project itself does not automatically address city-wide goals and objectives.<br />

How local businesses are supported, how they can find additional space for growth, and how new businesses can be brought<br />

into the wider community are challenges that must be met by the city.<br />

TIMELINE<br />

< 12 mos 1-2 years 3-5 years 5-10 years<br />

POTENTIAL PARTNERS<br />

<strong>City</strong> <strong>of</strong> <strong>Las</strong> <strong>Vegas</strong> • DowntownProject.com • Downtown<br />

Alliance • downtown neighborhood and social service<br />

organizations • commercial development community • local<br />

higher education institutions • Fremont East Entertainment<br />

District<br />

T I P S t r a t e g i e s | T h e o r y I n t o P r a c t i c e P a g e | 13

C i t y o f L a s V e g a s | E c o n o m i c D e v e l o p m e n t I n v e s t m e n t S t r a t e g y<br />

2. GOAL: Support the long-term objectives <strong>of</strong> the Downtown Project.<br />

Continued<br />

APPROACH<br />

STRATEGY. Work with downtown businesses, land-owners, and organizations, including the Downtown Project, to support<br />

the ongoing efforts <strong>of</strong> the Downtown <strong>Las</strong> <strong>Vegas</strong> Alliance to establish Business Improvement District (BID) in order to<br />

promote community and economic development in downtown <strong>Las</strong> <strong>Vegas</strong>. (See text box for three example organizations.)<br />

STRATEGY. Form an internal rapid response team focused on working with the Downtown Project and its partner<br />

organizations to efficiently and rapidly address permitting, zoning, licensing, entitlement, public safety, and sanitation issues.<br />

STRATEGY. Incorporate the principles <strong>of</strong> the Downtown Project into the Downtown <strong>Investment</strong> Plan the <strong>City</strong> is preparing.<br />

→ More flexible zoning, including greater use <strong>of</strong> mixed-use<br />

→ More diverse options in transportation, housing, and building design<br />

→ Continued emphasis on creating density<br />

BEST PRACTICES<br />

Many urban areas have benefited from the presence <strong>of</strong> an organization dedicated to facilitating, marketing, maintaining,<br />

and investing in downtown community and economic development projects, programs, and services. These organizations<br />

can take different forms. Three more common models include nonpr<strong>of</strong>its, Business Improvement Districts, and Public<br />

Improvement Districts. Below are brief descriptions <strong>of</strong> three examples <strong>of</strong> these models.<br />

Midtown Detroit, Inc. (MDI). MDI is a nonpr<strong>of</strong>it 501(c)(3) organization created in 1976 to support and enhance<br />

community and economic development in Detroit’s Midtown area. MDI spearheads a number <strong>of</strong> different types <strong>of</strong><br />

community improvement initiatives, including maintaining the aesthetic value <strong>of</strong> local public spaces; providing<br />

walkable passage to area attractions and businesses; championing new construction; encouraging reinvestment;<br />

historic preservation; and marketing and special events. http://midtowndetroitinc.org/<br />

New York <strong>City</strong> BID Program. New York <strong>City</strong> is home to the nation's largest, most comprehensive network <strong>of</strong><br />

business improvement districts (BIDs) in the country. BIDs are a key public/ private partnership in New York <strong>City</strong> and<br />

have helped revitalize neighborhoods and catalyze economic development throughout the <strong>City</strong>. The <strong>City</strong>'s 67 BIDs<br />

annually invest over $100 million worth <strong>of</strong> programs and services in neighborhoods across the five boroughs.<br />

http://www.nyc.gov/html/sbs/html/neighborhood/bid.shtml<br />

The <strong>City</strong> <strong>of</strong> Austin Public Improvement District (PID). Austin’s Downtown PID was established in 1993 by the<br />

Austin <strong>City</strong> Council to provide constant and permanent funding to implement downtown initiatives. The PID is a<br />

means for the Downtown Austin community to provide adequate and constant funds for quality <strong>of</strong> life improvements<br />

and planning and marketing <strong>of</strong> Downtown Austin. Properties in the District are assessed an additional 10¢ per $100<br />

in assessed value. The <strong>City</strong> contracts with the Downtown Austin Alliance to manage the downtown initiative program<br />

and promote growth and revitalization in Downtown Austin. The DAA consists <strong>of</strong> owners <strong>of</strong> downtown property,<br />

downtown tenants, and other interested Austinites. http://austintexas.gov/department/downtown-public-improvementdistricts#overlay-context=<br />

T I P S t r a t e g i e s | T h e o r y I n t o P r a c t i c e P a g e | 14

C i t y o f L a s V e g a s | E c o n o m i c D e v e l o p m e n t I n v e s t m e n t S t r a t e g y<br />

2. GOAL: Support the long-term objectives <strong>of</strong> the Downtown Project.<br />

Continued<br />

STRATEGY. Develop the space and physical infrastructure needed to support successful tech companies in <strong>Las</strong> <strong>Vegas</strong>.<br />

→ Work with local entrepreneurs and investors to develop a new incubator/accelerator facility for young high-growth<br />

tech companies in need <strong>of</strong> <strong>of</strong>fice space and mentoring. (See Goal 3, <strong>Strategy</strong> 2.)<br />

→ Explore a longer term goal <strong>of</strong> establishing a downtown technology park or mixed-used commercial park in or near<br />

downtown <strong>Las</strong> <strong>Vegas</strong>. (See Goal 3, <strong>Strategy</strong> 3.)<br />

→ Establish a technology infrastructure grant program. (See Goal 7, <strong>Strategy</strong> 2.)<br />

STRATEGY. Work with local and regional organizations to expand the local talent pool <strong>of</strong> technology and knowledge<br />

industry workers.<br />

→ Encourage UNLV, CSN, and other educational institutions to expand academic programs and curricula in<br />

information technology, s<strong>of</strong>tware, computer science, and digital media.<br />

▪<br />

▪<br />

UNLV operates two teaching programs at the 5th Street School, including the School <strong>of</strong> Architecture’s<br />

Downtown Design Studios.<br />

CSN’s Division <strong>of</strong> Workforce and <strong>Economic</strong> <strong>Development</strong> has recently signed an agreement with the <strong>City</strong> <strong>of</strong><br />

<strong>Las</strong> <strong>Vegas</strong> to lease unoccupied space at <strong>City</strong> Hall to develop job training and academic programs for city<br />

employees and residents and begin <strong>of</strong>fering noncredit classes. CSN will also <strong>of</strong>fer business consulting<br />

services and workforce certificate programs for specific industries located in the downtown.<br />

→ Work with the <strong>Las</strong> <strong>Vegas</strong> Metro Chamber, JumpStart <strong>Las</strong> <strong>Vegas</strong>, and the Downtown Project to retain existing and<br />

recruit new technology workers to <strong>Las</strong> <strong>Vegas</strong>.<br />

▪<br />

One recent example <strong>of</strong> a region actively recruiting IT workers is workIT Nashville, a multi-faceted marketing<br />

campaign spearheaded by the Nashville Area Chamber <strong>of</strong> Commerce. workIT Nashville features a jobmatching<br />

website where applicants can post resumes and companies can post openings; a guidebook for<br />

recruiting talent; and a digital media marketing strategy. (See http://talent.workitnashville.com/.)<br />

STRATEGY. Target sectors and companies compatible with (and sought by) the Downtown Project’s <strong>Vegas</strong> Tech Fund, the<br />

Nevada Capital <strong>Investment</strong> Corporation's Venture Fund, and other angel and venture capital (VC) funds in <strong>Las</strong> <strong>Vegas</strong>.<br />

→ For example, digital media and 3-D printing companies<br />

STRATEGY. Encourage the Downtown <strong>Las</strong> <strong>Vegas</strong> Alliance and the Downtown Project to collaborate on joint marketing,<br />

visitation, and development promotion activities.<br />

3 GOAL: PURSUE NEW DEVELOPMENT & REDEVELOPMENT OPPORTUNITIES.<br />

T I P S t r a t e g i e s | T h e o r y I n t o P r a c t i c e P a g e | 15

C i t y o f L a s V e g a s | E c o n o m i c D e v e l o p m e n t I n v e s t m e n t S t r a t e g y<br />

3. GOAL: Pursue new development & redevelopment opportunities.<br />

The <strong>City</strong> <strong>of</strong> <strong>Las</strong> <strong>Vegas</strong> should continue working with developers, private employers, and public sector<br />

partners to support the development and redevelopment <strong>of</strong> sites and facilities that will expand the city’s<br />

employment and business base.<br />

OVERVIEW<br />

One <strong>of</strong> <strong>Las</strong> <strong>Vegas</strong>’ most pressing economic<br />

development needs is the development <strong>of</strong><br />

buildings and sites to accommodate new business<br />

and employment. Years <strong>of</strong> explosive residential<br />

growth has left the city with a paucity <strong>of</strong><br />

competitive commercial <strong>of</strong>fice and industrial space.<br />

In the downtown area, rising property values,<br />

new business growth, and rising demand for a<br />

mix <strong>of</strong> building types all suggest that the city<br />

needs to take a more aggressive approach to<br />

<strong>of</strong>fice and tech space. This should include both<br />

Class A <strong>of</strong>fice space as well as the highly<br />

adaptable communal space envisioned by the<br />

Downtown Project.<br />

<strong>Las</strong> <strong>Vegas</strong> Regional Office Market, Q1 2013<br />

# Properties<br />

Total<br />

Rentable<br />

SF<br />

Vacancy<br />

Rate<br />

Net<br />

Absorption<br />

QTD<br />

Downtown 110 3,748,832 12.2% 52,727<br />

Airport 306 5,228,255 22.7% 13,122<br />

East <strong>Las</strong> <strong>Vegas</strong> 183 6,021,321 27.8% 8,773<br />

Henderson 319 5,999,875 20.6% 239,098<br />

North <strong>Las</strong> <strong>Vegas</strong> 96 783,529 23.9% 1,040<br />

Northwest 403 8,895,564 25.7% 49,642<br />

Southwest 391 6,587,155 25.6% 197,141<br />

West Central 274 5,561,170 19.1% -31,275<br />

Total 2,082 42,825,701 22.8% 482,030<br />

Source: RCG <strong>Economic</strong>s<br />

Without question, the <strong>City</strong> has been instrumental in the development <strong>of</strong> unique and economically important buildings and<br />

districts. These facilities include the Lou Ruvo Brain Center, the Medical District, Smith Center, the International Trade Mart, the<br />

Arts District, <strong>Las</strong> <strong>Vegas</strong> Premium Outlets, and new government buildings, including <strong>City</strong> Hall. Other assets are either in the<br />

planning stages or currently under development, including the Zappos headquarters, the Downtown Project properties, East<br />

Fremont District, Symphony Park, and a convention center. However, from an outsider’s perspective, these facilities lack the<br />

physical, transportation, and programmatic links that give the sense <strong>of</strong> a connected and integrated downtown. In a sense, they<br />

form an archipelago. Within its Downtown <strong>Investment</strong> <strong>Strategy</strong> and other planning/development efforts, the <strong>City</strong> should strive to<br />

fill in the physical and figurative spaces that separate these individual assets.<br />

<strong>Las</strong> <strong>Vegas</strong> also lacks available industrial sites and buildings that can accommodate large employers. With existing high vacancy<br />

rates for industrial properties in the Valley, it is not likely the market would currently support a new greenfield park. This is<br />

especially true for sites lacking surrounding development or services. However, <strong>Las</strong> <strong>Vegas</strong> has a long-term need for shovelready<br />

industrial land. This need could be accelerated if Southern Nevada were to secure an FAA UAS Certified Test Site,<br />

Cybersecurity (Regional) Center <strong>of</strong> Excellence, or other large R&D/industrial facility. Therefore, the <strong>City</strong> <strong>of</strong> <strong>Las</strong> <strong>Vegas</strong> should<br />

begin the process <strong>of</strong> planning for a park and exploring development options.<br />

TIMELINE<br />

< 12 mos 1-2 years 3-5 years 5-10 years<br />

POTENTIAL PARTNERS<br />

<strong>City</strong> <strong>of</strong> <strong>Las</strong> <strong>Vegas</strong> • <strong>Las</strong> <strong>Vegas</strong> Metro Chamber <strong>of</strong> Commerce<br />

• DowntownProject.com • downtown developers and land<br />

owners • entrepreneurs and venture capitalists • LVCVA •<br />

UNLV • GOED<br />

T I P S t r a t e g i e s | T h e o r y I n t o P r a c t i c e P a g e | 16

C i t y o f L a s V e g a s | E c o n o m i c D e v e l o p m e n t I n v e s t m e n t S t r a t e g y<br />

3. GOAL: Pursue new development & redevelopment opportunities.<br />

continued<br />

APPROACH<br />

STRATEGY. Continue efforts to construct a new downtown convention center.<br />

→ A new convention center has the potential to further revitalize the downtown area. With the right dimensions,<br />

amenities, and location, such a facility would bolster <strong>Las</strong> <strong>Vegas</strong>’ entertainment sector and support conferences<br />

and events focused on digital media, film, music, education, and e-commerce.<br />

→ Ideally, the facility would be located in between Symphony Park and the Downtown Project. Such a location would<br />

provide it close proximity to the existing hotel base and allow it to physically connect the two areas.<br />

STRATEGY. Connect and integrate the downtown’s key buildings and districts.<br />

→ Work with land owners, developers, institutions, and other stakeholders to develop greater physical,<br />

transportation, and programmatic links.<br />

→ Strategically target the location <strong>of</strong> new developments to help bridge gaps in downtown development.<br />

→ Emphasize connectedness in an updated Downtown <strong>Investment</strong> <strong>Strategy</strong> and other planning efforts.<br />

STRATEGY. Encourage and support the private development <strong>of</strong> new high-tech commercial <strong>of</strong>fice space and flex-tech space.<br />

→ Market planned commercial <strong>of</strong>fice properties (e.g., Symphony Park and Forest Cities) to investment prospects.<br />

STRATEGY. Work with local entrepreneurs and investors, UNLV, and business technical service providers to develop a<br />

new incubator/accelerator hybrid facility for young high-growth tech companies in need <strong>of</strong> <strong>of</strong>fice space and mentoring.<br />

→ Such a facility would be designed to provide small open (co-working) spaces for young, growing companies,<br />

especially those that may have graduated from an accelerator without significant VC funding and in need <strong>of</strong> a<br />

“s<strong>of</strong>t landing” location. To be successful, it should be more than just a commercial real estate development that<br />

provides low-cost <strong>of</strong>fice space. It should have a strong value proposition for its potential users, including expertise<br />

and assistance, access to capital, and networking and mentoring. It could be formed as a non-pr<strong>of</strong>it organization,<br />

programmatically tied to a higher education institution, or funded and managed by private investors/mentors.<br />

FOCUS ON VALUE-ADDED SERVICES<br />

Access to expertise and capital are two <strong>of</strong> the most valuable services incubators and accelerators can provide. Assembling a<br />

network <strong>of</strong> experts—as part <strong>of</strong> the management team, board <strong>of</strong> directors, or by establishing a team <strong>of</strong> mentors—can improve<br />

the value <strong>of</strong> services and increase the chances <strong>of</strong> successful outcomes. The Austin Technology Incubator has built a team <strong>of</strong><br />

experts composed <strong>of</strong> at least one staff person and a group <strong>of</strong> advisors in four target industry sectors. Some incubators, such<br />

as the Ann Arbor SPARK Business Accelerator, actually provide financing. Others, like the North Texas Enterprise Center, in<br />

Frisco, Texas, spend time building relationships with venture capitalists and angel investors to facilitate their clients access to<br />

these sources <strong>of</strong> capital. The Power Plant (an Ocala, Florida, incubator) uses monies raised locally from banks, retirees, and<br />

businesses to provide seed funding and angel investing to member companies.<br />

Source: TIP Strategies research<br />

T I P S t r a t e g i e s | T h e o r y I n t o P r a c t i c e P a g e | 17

C i t y o f L a s V e g a s | E c o n o m i c D e v e l o p m e n t I n v e s t m e n t S t r a t e g y<br />

3. GOAL: Pursue new development & redevelopment opportunities.<br />

STRATEGY. Explore a longer term goal <strong>of</strong> establishing a<br />

downtown technology park in or near downtown <strong>Las</strong> <strong>Vegas</strong>.<br />

→ Follow the steps outlined in <strong>Strategy</strong> 6 below to<br />

determine the market feasibility <strong>of</strong> such a park.<br />

SELECTED INFRASTRUCTURE<br />

REQUIREMENTS OF<br />

TECHNOLOGY COMPANIES<br />

▪<br />

A possible site for such a development is<br />

Cashman Center. The 50-acre site currently<br />

features 98,100 sq. ft. <strong>of</strong> exhibit space, a<br />

theater, a 10,000-seat baseball stadium, and is<br />

home to the <strong>Las</strong> <strong>Vegas</strong> 51s, the AAA affiliate <strong>of</strong><br />

the New York Mets. It is owned and operated<br />

by the LVCVA. Should the Cashman Center<br />

cease to be operated and maintained by the<br />

LVCVA, ownership <strong>of</strong> the facility would revert to<br />

the <strong>City</strong> <strong>of</strong> <strong>Las</strong> <strong>Vegas</strong>. The site is large enough<br />

to accommodate a technology business park<br />

<br />

<br />

<br />

Reliable power supply, such as dual feed<br />

electric service with underground<br />

distribution system for reduced interruption.<br />

High-grade electrical capacity (can be as<br />

much as 25 to 30 watts per square foot<br />

versus 5 to 6 watts per square foot for<br />

average commercial tenant).<br />

Multiple options for telecommunications<br />

access, including fiber optics.<br />

STRATEGY. Engage the real estate development community<br />

to determine the market feasibility <strong>of</strong> new industrial and/or<br />

commercial <strong>of</strong>fice park developments in the city and also to<br />

determine if public sector involvement is needed.<br />

<br />

High floor loading capacity (metal floor<br />

plates), and 14 foot or greater ceiling<br />

heights to accommodate computer and<br />

telecommunications equipment racks.<br />

→ Develop a system for evaluating and scoring the<br />

various options, including such parameters as:<br />

▪<br />

▪<br />

Availability and cost <strong>of</strong> land;<br />

Environmental and other constraints;<br />

<br />

Ample parking, with some covered parking<br />

desirable for higher-end tenants.<br />

Attractive landscaping, greenbelts, and<br />

recreational amenities.<br />

▪<br />

▪<br />

▪<br />

Access to highways and rail;<br />

Flat land, good drainage;<br />

Access to utilities (water/waste water, electricity, gas); and<br />

Source: TIP Strategies research<br />

▪<br />

Access to telecommunications infrastructure, including broadband internet.<br />

→ Work with an experienced developer and/or engineering firm to evaluate the site and develop a master plan.<br />

→ Determine the ownership structure for a park, exploring options to include:<br />

▪<br />

▪<br />

▪<br />

Public-sector development, ownership, and management;<br />

Public/private partnership (public ownership, private development and management); and<br />

Private ownership supported by public sector development incentives.<br />

T I P S t r a t e g i e s | T h e o r y I n t o P r a c t i c e P a g e | 18

C i t y o f L a s V e g a s | E c o n o m i c D e v e l o p m e n t I n v e s t m e n t S t r a t e g y<br />

3. GOAL: Pursue new development & redevelopment opportunities.<br />

continued<br />

→ Develop a business plan for the park including operations, maintenance, targeted industries/tenants, and pricing<br />

structure for lots.<br />

→ If the <strong>City</strong> determines the development <strong>of</strong> a publicly-owned industrial park is not feasible, alternative strategies<br />

should be considered to encourage new employment sites.<br />

▪<br />

▪<br />

▪<br />

Purchase a single site or building. Such a purchase could be part <strong>of</strong> an incentive deal the <strong>City</strong> negotiates<br />

with an investment prospect. For example, the <strong>City</strong> would agree to buy an existing site and sell or lease it<br />

back to a company at below-market terms.<br />

Another option is to acquire private land or buildings and set them aside for future targeted development<br />

when market conditions warrant. This practice, commonly referred to as land banking, is a viable option for<br />

communities seeking to preserve undeveloped land for a specific future purpose.<br />

Evaluate undeveloped land owned by the Bureau <strong>of</strong> Land Management for potential development.<br />

STRATEGY. Continue development <strong>of</strong> entertainment, retail, and sports facilities and districts.<br />

→ Maintain efforts to develop a new arena and sports entertainment district within Symphony Park.<br />

→ Continue seeking to attract a major pr<strong>of</strong>essional sports franchise (i.e., NBA or NHL) to downtown <strong>Las</strong> <strong>Vegas</strong>.<br />

STRATEGY. Work with GOED and their Certified Sites program to certify buildings that are occupancy ready and<br />

development sites that are shovel ready.<br />

4 GOAL: ENGAGE IN A COMPREHENSIVE BUSINESS RECRUITMENT AND PROSPECT MANAGEMENT PROGRAM.<br />

T I P S t r a t e g i e s | T h e o r y I n t o P r a c t i c e P a g e | 19

2012 Jobs<br />

2022 Jobs<br />

Percent<br />

change<br />

2012 LQ<br />

C i t y o f L a s V e g a s | E c o n o m i c D e v e l o p m e n t I n v e s t m e n t S t r a t e g y<br />

4.<br />

GOAL: Engage in a comprehensive business recruitment and prospect<br />

management program.<br />

Prospect recruitment and management is a core economic development activity. With a nascent medical<br />

district and a nationally recognized revitalization effort, the city <strong>of</strong> <strong>Las</strong> <strong>Vegas</strong> can become a true magnet for<br />

digital media and E-commerce, IT services, healthcare, and financial services.<br />

OVERVIEW<br />

Formerly known as the Nevada <strong>Development</strong> Authority (NDA), the <strong>Las</strong> <strong>Vegas</strong> Global <strong>Economic</strong> Alliance (LVGEA) is the regional<br />