OAM2681 OVCT 2 Prospectus aw12 - Clubfinance

OAM2681 OVCT 2 Prospectus aw12 - Clubfinance

OAM2681 OVCT 2 Prospectus aw12 - Clubfinance

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

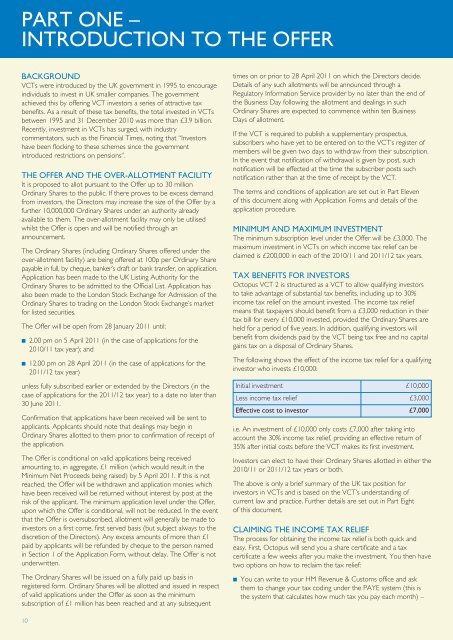

PART ONE –<br />

INTRODUCTION TO THE OFFER<br />

BACKGROUND<br />

VCTs were introduced by the UK government in 1995 to encourage<br />

individuals to invest in UK smaller companies. The government<br />

achieved this by offering VCT investors a series of attractive tax<br />

benefits. As a result of these tax benefits, the total invested in VCTs<br />

between 1995 and 31 December 2010 was more than £3.9 billion.<br />

Recently, investment in VCTs has surged, with industry<br />

commentators, such as the Financial Times, noting that “Investors<br />

have been flocking to these schemes since the government<br />

introduced restrictions on pensions”.<br />

THE OFFER AND THE OVER-ALLOTMENT FACILITY<br />

It is proposed to allot pursuant to the Offer up to 30 million<br />

Ordinary Shares to the public. If there proves to be excess demand<br />

from investors, the Directors may increase the size of the Offer by a<br />

further 10,000,000 Ordinary Shares under an authority already<br />

available to them. The over-allotment facility may only be utilised<br />

whilst the Offer is open and will be notified through an<br />

announcement.<br />

The Ordinary Shares (including Ordinary Shares offered under the<br />

over-allotment facility) are being offered at 100p per Ordinary Share<br />

payable in full, by cheque, banker’s draft or bank transfer, on application.<br />

Application has been made to the UK Listing Authority for the<br />

Ordinary Shares to be admitted to the Official List. Application has<br />

also been made to the London Stock Exchange for Admission of the<br />

Ordinary Shares to trading on the London Stock Exchange’s market<br />

for listed securities.<br />

The Offer will be open from 28 January 2011 until:<br />

■ 2.00 pm on 5 April 2011 (in the case of applications for the<br />

2010/11 tax year); and<br />

■ 12.00 pm on 28 April 2011 (in the case of applications for the<br />

2011/12 tax year)<br />

unless fully subscribed earlier or extended by the Directors (in the<br />

case of applications for the 2011/12 tax year) to a date no later than<br />

30 June 2011.<br />

Confirmation that applications have been received will be sent to<br />

applicants. Applicants should note that dealings may begin in<br />

Ordinary Shares allotted to them prior to confirmation of receipt of<br />

the application.<br />

The Offer is conditional on valid applications being received<br />

amounting to, in aggregate, £1 million (which would result in the<br />

Minimum Net Proceeds being raised) by 5 April 2011. If this is not<br />

reached, the Offer will be withdrawn and application monies which<br />

have been received will be returned without interest by post at the<br />

risk of the applicant. The minimum application level under the Offer,<br />

upon which the Offer is conditional, will not be reduced. In the event<br />

that the Offer is oversubscribed, allotment will generally be made to<br />

investors on a first come, first served basis (but subject always to the<br />

discretion of the Directors). Any excess amounts of more than £1<br />

paid by applicants will be refunded by cheque to the person named<br />

in Section 1 of the Application Form, without delay. The Offer is not<br />

underwritten.<br />

The Ordinary Shares will be issued on a fully paid up basis in<br />

registered form. Ordinary Shares will be allotted and issued in respect<br />

of valid applications under the Offer as soon as the minimum<br />

subscription of £1 million has been reached and at any subsequent<br />

times on or prior to 28 April 2011 on which the Directors decide.<br />

Details of any such allotments will be announced through a<br />

Regulatory Information Service provider by no later than the end of<br />

the Business Day following the allotment and dealings in such<br />

Ordinary Shares are expected to commence within ten Business<br />

Days of allotment.<br />

If the VCT is required to publish a supplementary prospectus,<br />

subscribers who have yet to be entered on to the VCT’s register of<br />

members will be given two days to withdraw from their subscription.<br />

In the event that notification of withdrawal is given by post, such<br />

notification will be effected at the time the subscriber posts such<br />

notification rather than at the time of receipt by the VCT.<br />

The terms and conditions of application are set out in Part Eleven<br />

of this document along with Application Forms and details of the<br />

application procedure.<br />

MINIMUM AND MAXIMUM INVESTMENT<br />

The minimum subscription level under the Offer will be £3,000. The<br />

maximum investment in VCTs on which income tax relief can be<br />

claimed is £200,000 in each of the 2010/11 and 2011/12 tax years.<br />

TAX BENEFITS FOR INVESTORS<br />

Octopus VCT 2 is structured as a VCT to allow qualifying investors<br />

to take advantage of substantial tax benefits, including up to 30%<br />

income tax relief on the amount invested. The income tax relief<br />

means that taxpayers should benefit from a £3,000 reduction in their<br />

tax bill for every £10,000 invested, provided the Ordinary Shares are<br />

held for a period of five years. In addition, qualifying investors will<br />

benefit from dividends paid by the VCT being tax free and no capital<br />

gains tax on a disposal of Ordinary Shares.<br />

The following shows the effect of the income tax relief for a qualifying<br />

investor who invests £10,000:<br />

Initial investment £10,000<br />

Less income tax relief £3,000<br />

Effective cost to investor £7,000<br />

i.e. An investment of £10,000 only costs £7,000 after taking into<br />

account the 30% income tax relief, providing an effective return of<br />

35% after initial costs before the VCT makes its first investment.<br />

Investors can elect to have their Ordinary Shares allotted in either the<br />

2010/11 or 2011/12 tax years or both.<br />

The above is only a brief summary of the UK tax position for<br />

investors in VCTs and is based on the VCT’s understanding of<br />

current law and practice. Further details are set out in Part Eight<br />

of this document.<br />

CLAIMING THE INCOME TAX RELIEF<br />

The process for obtaining the income tax relief is both quick and<br />

easy. First, Octopus will send you a share certificate and a tax<br />

certificate a few weeks after you make the investment. You then have<br />

two options on how to reclaim the tax relief:<br />

■ You can write to your HM Revenue & Customs office and ask<br />

them to change your tax coding under the PAYE system (this is<br />

the system that calculates how much tax you pay each month) –<br />

10