Consolidated Fire Lake North Project - GOLDINVEST.de

Consolidated Fire Lake North Project - GOLDINVEST.de

Consolidated Fire Lake North Project - GOLDINVEST.de

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

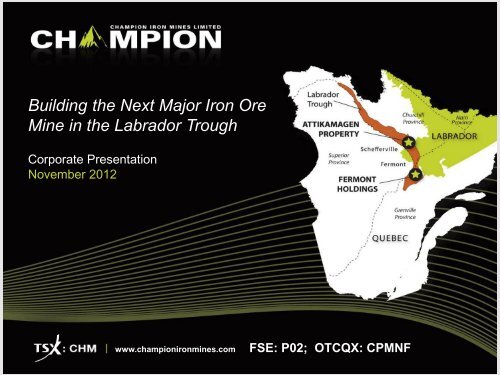

Building the Next Major Iron Ore<br />

Mine in the Labrador Trough<br />

Corporate Presentation<br />

November 2012<br />

www.championironmines.com<br />

FSE: P02; OTCQX: CPMNF

FORWARD-LOOKING STATEMENTS<br />

Certain information contained herein regarding Champion Iron Mines Ltd., including<br />

management’s assessment of future plans and operations, may constitute forward-looking<br />

statements un<strong>de</strong>r applicable securities law and necessarily involve risks, including but not<br />

limited to risks associated with mining exploration, operating costs, production costs, volatility<br />

of share prices, currency fluctuations, imprecision of resource and reserve estimates,<br />

environmental risks and ability to access sufficient capital from internal and external sources.<br />

As a consequence, actual results may differ materially from those anticipated in any forward<br />

looking statements. Plans, intentions or expectations disclosed in any forward-looking<br />

statements or information should not be read as guarantees of future results or events, and will<br />

not necessarily be accurate indications of whether or when or by which such results or events<br />

will be achieved.<br />

Except as required by law, Champion Iron Mines Ltd., expressly disclaims any intention and<br />

un<strong>de</strong>rtakes no obligation to update any forward looking statements or information as conditions<br />

change.<br />

The historical mineral resources mentioned are strictly historical in nature and are noncompliant<br />

to National Instrument 43-101 mineral resources and mineral reserves standards,<br />

and should therefore not be relied upon. A qualified person has not done sufficient work to<br />

upgra<strong>de</strong> or classify the historical mineral resources as current National Instrument NI-43-101<br />

compliant.<br />

2

About Champion Iron Mines<br />

Advanced iron ore exploration and <strong>de</strong>velopment projects located in<br />

Canada’s principal iron ore district, the Labrador Trough<br />

Fermont <strong>Project</strong>s (747 km 2 )<br />

• 14 projects in the Fermont Iron Ore District<br />

• Flagship <strong>Consolidated</strong> <strong>Fire</strong> <strong>Lake</strong> <strong>North</strong> <strong>Project</strong><br />

with the feasibility study due in early Q4 2012<br />

• 4.7 billion tonnes of NI 43-101 compliant estimates of<br />

iron mineral resources on 3 projects (564 MT of Measured<br />

+ Indicated and 4,136 MT of Inferred Mineral Resources)<br />

• 100% direct interest, 3% NSR (C$1.5 million buyback<br />

for an additional 0.5% NSR)<br />

Attikamagen <strong>Project</strong> (310 km 2 )<br />

• Champion Iron Mines holds a 44% interest<br />

• Century Iron Mines Corp. subsidiary has a 56% interest<br />

and can earn up to a 60% interest by spending further $3<br />

million on exploration expenditures by May 2014 1<br />

• Sept. 25 th 2012: 1.7 billion tonnes @ 31.3% FeT and a<br />

plan for a DSO project of 1 Mtpy 2<br />

1. Investment by WISCO of 25% ($60M) and Minmetals of 5% ($12M)<br />

2. As reported by Champion Iron’s JV Partner on Sept 25th, 2012<br />

3

Quebec’s Next<br />

Major Iron Ore Mine<br />

<strong>Consolidated</strong> <strong>Fire</strong> <strong>Lake</strong> <strong>North</strong> (CFLN) Development <strong>Project</strong><br />

• Nov. 21 2011 PEA indicated an ability to produce 8.7 million tonnes of<br />

concentrate per year for the first 25 years of a 40-year mine life the first<br />

5 years will average approximately 10 million tonnes of concentrate annually<br />

• Net Present Value of $4 billion at a discounted cash flow rate of 8% with<br />

an Internal Rate of Return of 41.5% and a payback period of 2.3 years<br />

Established Iron Ore District<br />

• Canada produces 44 Mtpy of iron ore concentrate in the southern end of the<br />

Labrador Trough and this is expected to grow to 200 Mtpy over the next 10<br />

years if all proposed <strong>de</strong>velopment projects are realized<br />

• Established rail, power and port infrastructure<br />

- Quebec’s Plan Nord: $80 billion investment over the next 25 years in<br />

northern Quebec for various projects including infrastructure projects<br />

- Competitive power rates<br />

- Port of Sept-Îles: world-class multi-user port project (50 Mtpy) un<strong>de</strong>rway<br />

Proven Team<br />

• Strengthened advisory board and board of directors inclu<strong>de</strong>s former<br />

<strong>Consolidated</strong> Thompson Iron Mines management and officers in addition<br />

with other mining companies.<br />

4

Capital Structure<br />

Share Data and Cash Position as of September 28, 2012.<br />

Shares Outstanding<br />

Warrants<br />

Options<br />

Fully Diluted Shares Outstanding<br />

Market Capitalization<br />

(based on $0.71 share price)<br />

Cash Position<br />

119.3 million<br />

10.0 million @ C$2.59 (avg. strike price)<br />

7.0 million @ C$3.00 not exerciseable until Nov. 2014<br />

0.8 million @ C$2.84 expiring Feb. 2013<br />

2.22 million @ C$1.50 expiring Oct. 2013, (insi<strong>de</strong>rs and advisors)<br />

11.6 million @ C$1.03 (avg. exercise price)<br />

141.1 million<br />

Management /Insi<strong>de</strong>rs Ownership ~ 17%<br />

C$84.7 million<br />

C$13.9 million<br />

Analyst Coverage<br />

5

Experienced Management Team<br />

Over 200 years of combined exploration and mine operations experience<br />

Tom Larsen,<br />

Chairman<br />

Board of Directors<br />

Alexan<strong>de</strong>r Horvath, P.Eng.<br />

Director<br />

Jean Depatie, P.Geo.<br />

Director<br />

Ashwath Mehra,<br />

Director<br />

Donald A. Sheldon, LLB., P.Eng.<br />

Director<br />

Jean Lafleur P.Geo.<br />

Director<br />

Francis Sauvé<br />

Director<br />

Joseph S. C. Chan<br />

Director<br />

Tom Larsen<br />

Presi<strong>de</strong>nt and CEO<br />

Management Team<br />

Alexan<strong>de</strong>r Horvath, P.Eng.<br />

Executive Vice Presi<strong>de</strong>nt, Exploration<br />

Martin Bourgoin, P.Geo.<br />

Executive Vice Presi<strong>de</strong>nt, Operations<br />

Jeff Hussey, P.Geo.<br />

Executive Vice Presi<strong>de</strong>nt, Business Development<br />

Bruce Mitton, P.Geo.<br />

Vice Presi<strong>de</strong>nt, Exploration<br />

Jean-Luc Chouinard, P Eng.<br />

Vice Presi<strong>de</strong>nt, <strong>Project</strong> Development<br />

Miles Nagamatsu, CA<br />

Chief Financial Officer<br />

Jorge Estepa<br />

Vice Presi<strong>de</strong>nt, Secretary-Treasurer<br />

Clau<strong>de</strong> Léveillée<br />

Director of Human Resources<br />

Beat Frei<br />

Director of <strong>Project</strong> Finance, Europe<br />

Richard Quesnel: Senior Technical Advisor and Head of the Advisory Board<br />

Advisory Board: Richard Quesnel, Paul Ankcorn, Doug Bache, and William Harding<br />

6

Why invest in Champion Iron Mines<br />

Favourable Operating<br />

Environment<br />

• Established iron ore mining district:<br />

The Labrador Trough<br />

• Favourable tax environment<br />

(40% tax rebate on exploration<br />

expenditures)<br />

• Access to low-cost power and<br />

close to rail and port infrastructure<br />

• Quebec’s Plan Nord $80 billion<br />

over 25 years<br />

• Quebec is a world class area to<br />

<strong>de</strong>velop mines<br />

• Unprece<strong>de</strong>nted Iron Ore price<br />

range and forecast<br />

• Skilled labor work force<br />

• Environmental: Iron ore process is<br />

grinding to liberate iron and using<br />

gravity and magnetics for<br />

separation from gangue minerals<br />

Champion Iron Mines’<br />

Competitive Advantage<br />

• Fermont holdings: 14 iron ore<br />

Brownfield projects (747 km 2 )<br />

• <strong>Consolidated</strong> <strong>Fire</strong> <strong>Lake</strong> <strong>North</strong><br />

<strong>Project</strong>: Feasibility Study of surface<br />

<strong>de</strong>posits of coarse grained specular<br />

Hematite:<br />

• Easier to liberate<br />

• Deleterious elements in<br />

concentrate are well below<br />

industry specifications limits<br />

• Experienced team of project<br />

<strong>de</strong>velopers and mine buil<strong>de</strong>rs<br />

• Upsi<strong>de</strong> potential for growth is high<br />

with 4.7 Billion tonnes<br />

• Several <strong>de</strong>-risking initiatives<br />

un<strong>de</strong>rway including rail, port,<br />

agreements and environmental<br />

studies and permit applications<br />

7

Existing Rail Infrastructure<br />

Quebec <strong>North</strong> Shore & Labrador<br />

Railway (“QNS&L”)<br />

• <strong>Consolidated</strong> <strong>Fire</strong> <strong>Lake</strong> <strong>North</strong> PEA Base<br />

Case connection to Bloom <strong>Lake</strong> railway<br />

requires 94 km of rail – inclu<strong>de</strong>s<br />

turnaround loop and sidings<br />

• QNS&L links to Sept-Îles and Pointe Noire<br />

• Bloom <strong>Lake</strong> and QNS&L railways are<br />

consi<strong>de</strong>red common carriers<br />

• Common carriers allocate capacity on a<br />

first-come, first-serve basis<br />

Cartier Railway:<br />

• Linked to Port-Cartier<br />

• Privately owned by ArcelorMittal<br />

• Within <strong>Consolidated</strong> <strong>Fire</strong> <strong>Lake</strong> <strong>North</strong><br />

<strong>Project</strong> boundary<br />

8

World Class<br />

Port of Sept-Îles Infrastructure<br />

Expanding to Meet Demand<br />

Pointe Noire Multi User Wharf<br />

• Announced long term agreement between<br />

CHM & Port of Sept-Îles (20-40 years) on<br />

July 18 th , 2012<br />

• 10 Mt ship loading capacity reserved with<br />

the possibility to increase tonnage<br />

• Completion March 31 st , 2014; 18 months<br />

prior to “CFLN" startup<br />

• Phase 1: 50 Mtpy $220 million<br />

• Fe<strong>de</strong>ral Government announced $55<br />

million funding or 25% of project<br />

• Phase 2: Planning for 100 Mtpy<br />

Sept-Iles<br />

Pointe Noire<br />

Port of Sept-Îles<br />

• RTZ-IOC shipping facility<br />

Port-Cartier<br />

• ArcelorMittal shipping facility<br />

• $2.1B expansion is un<strong>de</strong>rway and will<br />

inclu<strong>de</strong> concentrator expansion with port<br />

and rail infrastructure upgra<strong>de</strong>s<br />

• Located 62 km west of Sept-Îles<br />

Courtesy of the Port <strong>de</strong> Sept Îles<br />

China Max ship capacity 300kt<br />

9

Champion Iron Mines participating in a<br />

feasibility study with CN Rail and Caisse<br />

<strong>de</strong> Dépot et Placement du Québec<br />

• See August 29 th 2012 press release<br />

• Reduction in OPEX compared to PEA<br />

study<br />

• Objective to reduce rail CAPEX<br />

component<br />

• CHM still focused on the feasibility study<br />

• CN focused on environmental permitting<br />

• CHM will continue to <strong>de</strong>velop<br />

in<strong>de</strong>pen<strong>de</strong>nt options for port handling for<br />

concentrate stockpiling and reclaiming

Development: <strong>Consolidated</strong> <strong>Fire</strong> <strong>Lake</strong> <strong>North</strong> <strong>Project</strong><br />

11

<strong>Consolidated</strong> <strong>Fire</strong> <strong>Lake</strong> <strong>North</strong><br />

Development <strong>Project</strong><br />

November 2011 Preliminary Economic Assessment Update – Highlights<br />

Key Results<br />

Pre-Tax Basis<br />

Internal Rate of Return (IRR) (8% Discount Rate) 41.5%<br />

Undiscounted Cash Flow<br />

Net Present Value @ 5% Discounted Cash Flow<br />

Net Present Value @ 8% Discounted Cash Flow<br />

Based upon the following assumptions:<br />

Net Present Value @ 10% Discounted Cash Flow<br />

Payback Period (8% Discount Rate)<br />

$10.9B<br />

$5.6B<br />

$4.0B<br />

$3.2B<br />

2.3 Years<br />

• Capital Costs:<br />

• Operating Costs:<br />

• Price assumptions:<br />

• Mine-Life:<br />

• Exchange rate:<br />

• Total Resources (1) :<br />

• In Pit Resources<br />

US$1,368 million (inclu<strong>de</strong>s rail and port infrastructure)<br />

US$52.68 per tonne (average 25 years);<br />

US$44.63 per tonne (average years 1 to 5)<br />

US$115 per tonne of concentrate at 65% Fe<br />

40 years (average of 8.7 million tonnes/year for the first 25 years)<br />

$1.00 USD to $1.00 CDN<br />

400 million tonnes grading 30.6% Fe (NI43-101 Measured and Indicated Resources)<br />

661 million tonnes grading 27.7% Fe (NI43-101 Inferred Resources)<br />

921.8 million tonnes grading 28.8% Fe at an 8% cut-off gra<strong>de</strong><br />

13

<strong>Consolidated</strong> <strong>Fire</strong> <strong>Lake</strong> <strong>North</strong> <strong>Project</strong><br />

Preliminary Economic Assessment Study<br />

OPERATING EXPENDITURES (US$/TONNE OF CONCENTRATE)<br />

COST PARAMETERS AVERAGE 25 YEARS AVERAGE YEARS 1 TO 5<br />

Mining 22.56 12.13<br />

Concentrating, crushing and processing 4.52 3.97<br />

Site infrastructure, sales and general administration 4.40 3.39<br />

Environmental tailings and management 0.29 0.26<br />

Rail transport 15.52 16.14<br />

Port facilities 3.72 3.57<br />

Equipment Lease Cost 1.67 5.17<br />

Total 52.68 44.63<br />

CAPITAL EXPENDITURES (US$ MILLIONS)<br />

COST CENTRES<br />

$ MILLIONS<br />

Pre-stripping of open pit areas 97.5<br />

Concentrator and site infrastructure including loadout facilities 682.3<br />

Railway (62km distance and 94km total including turnaround loop and sidings) 228.8<br />

Port Facilities: Railcar unloading, stacker/reclaimer, conveyors 96.8<br />

Environmental and Tailings Management 27.9<br />

Other Pre Production Costs 34.0<br />

Sub-total 1,167<br />

Contingency 201<br />

Total 1,368<br />

14

<strong>Consolidated</strong> <strong>Fire</strong> <strong>Lake</strong> <strong>North</strong><br />

<strong>Project</strong> Schedule<br />

Development, Construction, and Production<br />

15

<strong>Consolidated</strong><br />

<strong>Fire</strong> <strong>Lake</strong> <strong>North</strong> <strong>Project</strong><br />

Growth through Development<br />

• Feasibility Study: January 2013<br />

• Press Release June 21, 2012: Over<br />

20,000 m feasibility <strong>de</strong>finition drilling is<br />

completed for feasibility study<br />

• Strike length of both the West Pit<br />

(3500m) and the East Pit (2400m)<br />

synformal fold closures are open at<br />

<strong>de</strong>pth<br />

• Resources are increasing outsi<strong>de</strong> the<br />

Nov. 2011 PEA ultimate pit limits<br />

• Several <strong>de</strong>-risking initiatives are<br />

un<strong>de</strong>rway<br />

See www.championironmines.com for reports maps and assays<br />

16

<strong>Consolidated</strong> <strong>Fire</strong> <strong>Lake</strong> <strong>North</strong><br />

Metallurgy<br />

Press Release, August 1 st , 2012<br />

• High quality sinter concentrate with very low <strong>de</strong>leterious elemental content<br />

• Liberates at 850 micron (-20 mesh) and produces a 65-66% iron concentrate<br />

• Assuming a concentrate with 66% Fe ; No magnetic separation circuit required<br />

• Alumina is 0.52% International Standard < 2%<br />

• Silica content is 5%<br />

• Al 2 O 3 : SiO 2 ratio of 0.14 versus the upper industry specification limit of 1<br />

• This very low alumina to silica ratio is an i<strong>de</strong>al blending product for steel mills<br />

High Gra<strong>de</strong> – Coarse Specular Hematite<br />

Quartz Specular Hematite Mineralization<br />

17

<strong>Fire</strong> <strong>Lake</strong> <strong>North</strong> Development <strong>Project</strong><br />

18

<strong>Fire</strong> <strong>Lake</strong> <strong>North</strong> Development <strong>Project</strong><br />

19

Moiré <strong>Lake</strong> <strong>Project</strong><br />

Initial Mineral Resource Estimate: March 29, 2012<br />

• Mineral Resource Estimate:<br />

Arcelor Mittal Property Boundary<br />

A’<br />

• Indicated Resources: 164 million<br />

tonnes grading 30.5% Total Iron<br />

• Inferred Resources: 417 million<br />

tonnes grading 29.4% Total Iron<br />

• DDH LM11-12: 503 m @ 31% total iron<br />

• Kilometric synform with hematite and<br />

magnetite outcrops at surface<br />

• Adjacent to ArcelorMittal Mont-Wright mine<br />

A<br />

500<br />

meters<br />

20

Moiré <strong>Lake</strong> <strong>Project</strong><br />

Infrastructure: Adjacent to Bloom <strong>Lake</strong> Railway (8km), road, &<br />

power<br />

442 Mt @ 30.1% FeT;<br />

Zone B: 285 Mt @ 30.1% FeT<br />

500<br />

meters<br />

21

Oil Can <strong>Project</strong><br />

Initial Mineral Resource Estimate<br />

• Potential for low strip ratio < 1 : 1<br />

• Potential Bench width 150- 350m<br />

• 972 Mt of iron oxi<strong>de</strong> grading 33.2% at a<br />

15% iron cut-off<br />

• 924 Mt of mixed iron oxi<strong>de</strong><br />

mineralization with a silicate component<br />

• This <strong>de</strong>posit is open at <strong>de</strong>pth<br />

• Orientation metallurgical tests indicate a<br />

relatively coarse liberation grind size<br />

• Commercial gra<strong>de</strong> magnetite sinter feed<br />

concentrate can be produced<br />

• The 2011 drill program returned long<br />

magnetite-hematite iron formation<br />

intersections up to 545 metres in length<br />

• The 400 metre spaced drill program is<br />

completed<br />

To view a larger more <strong>de</strong>tailed version of this map please visit:<br />

http://www.championironmines.com/vns-site/page-oil_can.html<br />

22

Oil Can <strong>Project</strong><br />

Exploration Upsi<strong>de</strong><br />

South & East Zones<br />

Section 9800N (Facing <strong>North</strong>)<br />

South Zone<br />

OC11-05<br />

303.4m @ 34.7%<br />

incl. 130.8m @<br />

36.5%<br />

OC11-07<br />

Ovb<br />

OC11-08<br />

OC11-02<br />

East Zone<br />

OC11-19<br />

Assay Pending<br />

OC11-01<br />

IF<br />

545.7m @ 33.7%<br />

incl. 442.3 @<br />

36.4%<br />

IF<br />

190.0m @<br />

30.6%<br />

197.2m @ 26.8%<br />

incl. 145.5 @<br />

28.1%<br />

401.5m @ 30.7%<br />

incl. 213.5 @<br />

33.1%<br />

200 metres<br />

23

Oil Can <strong>Project</strong><br />

Exploration Upsi<strong>de</strong><br />

Central Zone<br />

(Facing <strong>North</strong>west)<br />

191.7m @<br />

28.2%<br />

OC11-14 OC11-16<br />

OC11-03<br />

OC11-10<br />

Ovb<br />

311.4m @ 27.6%<br />

incl. 269.0m @<br />

29.2%<br />

224.0m @ 28.1%<br />

incl. 140.0m @<br />

30.0%<br />

IF<br />

472.2m @ 28.0%<br />

incl. 119.6m @<br />

35.2%<br />

200 metres<br />

24

Oil Can <strong>Project</strong><br />

Exploration Upsi<strong>de</strong><br />

<strong>North</strong> Zone<br />

Section 5800E (Facing East)<br />

221.2m @ 25.0%<br />

incl. 128.9m @<br />

28.7%<br />

OC11-12 OC11-13 OC11-15<br />

OC11-09<br />

Assays Pending<br />

IF<br />

414.1m @ 25.1%<br />

incl. 139.0m @<br />

29.5%<br />

141.5m @ 29.2%<br />

Ovb<br />

OC11-04<br />

179.5m @ 32.8%<br />

472.2m @ 28.0%<br />

incl. 119.6m @<br />

35.2%<br />

200 metres<br />

25

Milestones<br />

<strong>Consolidated</strong> <strong>Fire</strong> <strong>Lake</strong> <strong>North</strong> Definition Drilling<br />

Updated PEA on <strong>Consolidated</strong> <strong>Fire</strong> <strong>Lake</strong> <strong>North</strong><br />

Initial NI 43-101 Mineral Resource Estimate for Oil Can <strong>Project</strong><br />

(adjacent to <strong>Fire</strong> <strong>Lake</strong> <strong>North</strong> <strong>Project</strong>)<br />

Metallurgical results – <strong>Consolidated</strong> <strong>Fire</strong> <strong>Lake</strong> <strong>North</strong>, Moire <strong>Lake</strong>, Oil Can<br />

<strong>Project</strong>s<br />

Completed<br />

Completed<br />

Completed<br />

Completed<br />

<strong>Consolidated</strong> <strong>Fire</strong> <strong>Lake</strong> <strong>North</strong> Feasibility Study Q1 2013<br />

<strong>Consolidated</strong> <strong>Fire</strong> <strong>Lake</strong> <strong>North</strong> Construction Start Q4 2013<br />

<strong>Consolidated</strong> <strong>Fire</strong> <strong>Lake</strong> <strong>North</strong> Production Q1 2016<br />

26

Why Invest in<br />

Champion Iron Mines<br />

<strong>Fire</strong> <strong>Lake</strong> <strong>North</strong> NPV: $4 Billion @ 8% DCF.<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

Oil Can Deposit: Initial Resource Estimate 1,896Mt @<br />

28.7%.<br />

14 Brownfield projects (747 km 2 ) near 5 operating mines.<br />

Experienced team: Exploration; <strong>de</strong>velopment;<br />

construction; commissioning & operations management.<br />

Financed through to feasibility; Favourable tax<br />

environment.<br />

Quebec`s Plan Nord: Object to attract $80B in investment.<br />

Access to power and close to rail and port.<br />

Multi-user port in construction; Trans-shipping is an option.<br />

Iron price range and forecasts is unprece<strong>de</strong>nted.<br />

Several <strong>de</strong>-risking initiatives associated to mine start-up<br />

un<strong>de</strong>rway.<br />

27

Thank You<br />

www.championironmines.com<br />

FSE: P02; OTCQX: CPMNF<br />

28<br />

28

<strong>Fire</strong> <strong>Lake</strong> <strong>North</strong> Exploration Camp<br />

Coarse Specular Hematite in Drill Core<br />

Coarse Grained<br />

Specular Hematite<br />

29

O’Keefe Purdy <strong>Project</strong><br />

Exploration Upsi<strong>de</strong><br />

30

Advanced Exploration<br />

Bellechasse Deposit<br />

• Deposit located within <strong>Consolidated</strong> <strong>Fire</strong> <strong>Lake</strong><br />

<strong>North</strong><br />

• NI 43-101 Resource Estimate: Inferred Resources<br />

estimate; 215Mt @ 29% Iron; potential for more<br />

• Magnetite rich iron formation<br />

• Adjacent to Hwy 389<br />

• Synform geometry is favorable for open pit mining<br />

Harvey Tuttle <strong>Project</strong><br />

• NI 43-101 Inferred Resource Estimate:<br />

717Mt @ 25% iron; magnetite rich iron formation<br />

• Intersected multiple significant iron formation<br />

intervals in 2010 drill program<br />

• Total of 13,165m of drilling completed<br />

• Less than 50% of the kilometric scale magnetic<br />

anomalies have been tested<br />

• 25 km W-NW of <strong>Consolidated</strong> <strong>Fire</strong> <strong>Lake</strong> <strong>North</strong><br />

• Within conveying distance from <strong>Consolidated</strong><br />

<strong>Fire</strong> <strong>Lake</strong> <strong>North</strong> planned concentrator (20-30km)<br />

31

Labrador Trough Annual Production<br />

Iron Ore Production Upsi<strong>de</strong><br />

Company<br />

Current Annual<br />

Production<br />

Future<br />

Annual Forecast<br />

IOC/RTZ 17 mtpy 26 mtpy 1<br />

ArcelorMittal 13 mtpy 24 mtpy 2<br />

Cliffs Natural Resources (Wuhan) 12 mtpy 28 mtpy<br />

Labrador Iron Mines 2 mtpy 5 mtpy<br />

Adriana Resources (Wuhan) 0 50 mtpy<br />

New Millennium (Tata) 0 27 mtpy<br />

Century Iron Mines (Wuhan) 0 ~22 mtpy<br />

Champion Iron Mines 0 ~18 mtpy<br />

Al<strong>de</strong>ron Iron Ore Corp. 0 ~16 mtpy<br />

Total Current and Forecasted Production 44 ~ 200 mtpy<br />

1. Possibility of expanding production up to 50 mtpy<br />

2. Possibility of expanding production to 50 mtpy<br />

32

Kilotons<br />

Global Steel Production Shows<br />

Continued Demand for Iron Ore<br />

1,600,000<br />

1,400,000<br />

1,200,000<br />

China’s CAGR* is 9.88% over<br />

the last 30 years vs. 2.30% for<br />

total global steel production<br />

over the same period.<br />

1,000,000<br />

China<br />

800,000<br />

Japan<br />

600,000<br />

Rest of the<br />

World<br />

400,000<br />

200,000<br />

-<br />

1980 1985 1990 1995 2000 2005 2010<br />

Source: World Steel Association website<br />

* CAGR: Compound annual growth rate<br />

33

Iron Ore Types<br />

Direct Shipping Ore<br />

Coarse Grained Specular Hematite<br />

Magnetite Rich Taconite & DSO<br />

Coarse Grained Specular Hematite<br />

34

Fermont Iron Ore District<br />

(“FIOD”)<br />

Historically the Fermont and Labrador mining<br />

camps have produced 33 Mtpa.<br />

RTZ/IOC = 17 Mtpa<br />

ArcelorMittal = 13 Mtpa<br />

Wabush = 3 Mtpa<br />

“ Marginal Era”:<br />

For 30-40 years pre-2003<br />

the price per tonne of concentrate<br />

was $25- $30/tonne,<br />

costs per tonne were similar.<br />

Current 3 years moving average is<br />

$115-120/tonne<br />

2011 spot price averaged ~$150-170/tonne<br />

35