TIC Guideline.pdf - Tanzania Investment Centre

TIC Guideline.pdf - Tanzania Investment Centre

TIC Guideline.pdf - Tanzania Investment Centre

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

• VAT Deferment: Capital goods and deemed capital goods for investment do not attract<br />

VAT up front as the VAT is deferred to allow investor relief of tax up front. VAT deferment<br />

on any capital goods is open to all VAT registered and non-registered traders.<br />

• VAT Refunds: VAT refunds are made either within 30 days or 6 months from the due<br />

date depending on the type of taxpayer. Regular repayment traders like exporters can<br />

claim their refunds within 30 days while other traders can get their refunds after six (6)<br />

months.<br />

There are various goods and services that are either zero rated, such as exports or VAT<br />

exempt, such as health supplies and tourists services. The TRA desk at <strong>TIC</strong> will provide the<br />

list of goods and services falling under these categories as well as those with special relief.<br />

Taxes on international trade<br />

The Customs and Excise Department administers all taxes and duties on international trade<br />

including import duty, excise duty on imports, and VAT on imports.<br />

Import duty: The EAC members have adopted Common External Tariff from 1 st Jan. 2005<br />

with a structure of 0%, 10%, and 25%. It is levied at an advalorem rate on the CIF value of<br />

goods imported into the country.<br />

Agreement on Customs Value (ACV): <strong>Tanzania</strong> is implementing the WTO article VII’s<br />

ACV. It prohibits the use of arbitrary or fictitious customs values.<br />

Excise duty: Is charged on specific or advalorem tax rate on certain imported and locally<br />

manufactured consumer goods. Currently there are three advalorem rates 10%, 15% and<br />

30%. Most of the locally manufactured goods are charged excise duty.<br />

Stamp duty: Stamp duty is charged on certain legal instruments, affidavits, conveyances<br />

& lease agreements. The rate applicable is 1% and 500 TZS for conveyance and agricultural<br />

land respectively. The maximum stamp duty rate for registration of property for security or<br />

mortgage is 10,000 TZS.<br />

Motor vehicle: Transfer of motor vehicle costs 50,000 TZS. The motor vehicle registration<br />

and annual license fees vary depending on the engine cubic capacity of the cars.<br />

Import procedures:<br />

All transactions on imports, exports and transits are handled through the Customs Service<br />

<strong>Centre</strong> (CSC)<br />

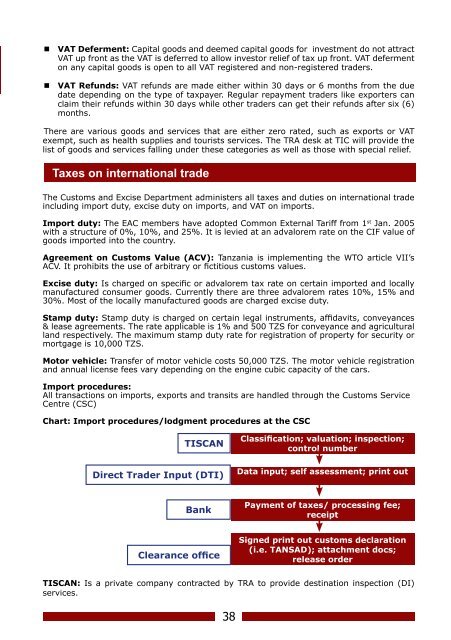

Chart: Import procedures/lodgment procedures at the CSC<br />

TISCAN<br />

Direct Trader Input (DTI)<br />

Classification; valuation; inspection;<br />

control number<br />

Data input; self assessment; print out<br />

Bank<br />

Payment of taxes/ processing fee;<br />

receipt<br />

Clearance office<br />

Signed print out customs declaration<br />

(i.e. TANSAD); attachment docs;<br />

release order<br />

TISCAN: Is a private company contracted by TRA to provide destination inspection (DI)<br />

services.<br />

38