Hinesburg, Vermont Annual Report - The Town of Hinesburg

Hinesburg, Vermont Annual Report - The Town of Hinesburg

Hinesburg, Vermont Annual Report - The Town of Hinesburg

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

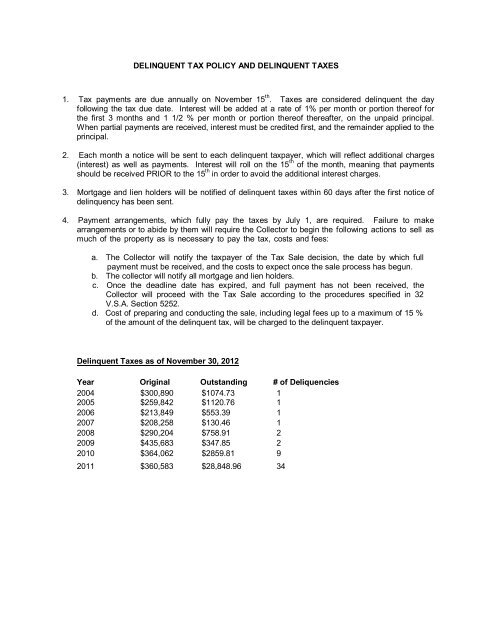

DELINQUENT TAX POLICY AND DELINQUENT TAXES<br />

1. Tax payments are due annually on November 15 th . Taxes are considered delinquent the day<br />

following the tax due date. Interest will be added at a rate <strong>of</strong> 1% per month or portion there<strong>of</strong> for<br />

the first 3 months and 1 1/2 % per month or portion there<strong>of</strong> thereafter, on the unpaid principal.<br />

When partial payments are received, interest must be credited first, and the remainder applied to the<br />

principal.<br />

2. Each month a notice will be sent to each delinquent taxpayer, which will reflect additional charges<br />

(interest) as well as payments. Interest will roll on the 15 th <strong>of</strong> the month, meaning that payments<br />

should be received PRIOR to the 15 th in order to avoid the additional interest charges.<br />

3. Mortgage and lien holders will be notified <strong>of</strong> delinquent taxes within 60 days after the first notice <strong>of</strong><br />

delinquency has been sent.<br />

4. Payment arrangements, which fully pay the taxes by July 1, are required. Failure to make<br />

arrangements or to abide by them will require the Collector to begin the following actions to sell as<br />

much <strong>of</strong> the property as is necessary to pay the tax, costs and fees:<br />

a. <strong>The</strong> Collector will notify the taxpayer <strong>of</strong> the Tax Sale decision, the date by which full<br />

payment must be received, and the costs to expect once the sale process has begun.<br />

b. <strong>The</strong> collector will notify all mortgage and lien holders.<br />

c. Once the deadline date has expired, and full payment has not been received, the<br />

Collector will proceed with the Tax Sale according to the procedures specified in 32<br />

V.S.A. Section 5252.<br />

d. Cost <strong>of</strong> preparing and conducting the sale, including legal fees up to a maximum <strong>of</strong> 15 %<br />

<strong>of</strong> the amount <strong>of</strong> the delinquent tax, will be charged to the delinquent taxpayer.<br />

Delinquent Taxes as <strong>of</strong> November 30, 2012<br />

Year<br />

2004<br />

Original<br />

$300,890<br />

Outstanding<br />

$1074.73<br />

# <strong>of</strong> Deliquencies<br />

1<br />

2005 $259,842 $1120.76 1<br />

2006 $213,849 $553.39 1<br />

2007 $208,258 $130.46 1<br />

2008 $290,204 $758.91 2<br />

2009 $435,683 $347.85 2<br />

2010 $364,062 $2859.81 9<br />

2011 $360,583 $28,848.96 34