2005 Annual Review - National Futures Association

2005 Annual Review - National Futures Association

2005 Annual Review - National Futures Association

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

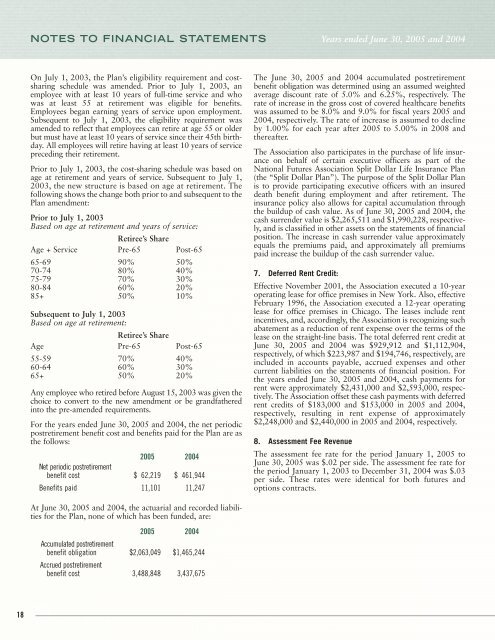

NOTES TO FINANCIAL STATEMENTS Years ended June 30, <strong>2005</strong> and 2004<br />

On July 1, 2003, the Plan’s eligibility requirement and costsharing<br />

schedule was amended. Prior to July 1, 2003, an<br />

employee with at least 10 years of full-time service and who<br />

was at least 55 at retirement was eligible for benefits.<br />

Employees began earning years of service upon employment.<br />

Subsequent to July 1, 2003, the eligibility requirement was<br />

amended to reflect that employees can retire at age 55 or older<br />

but must have at least 10 years of service since their 45th birthday.<br />

All employees will retire having at least 10 years of service<br />

preceding their retirement.<br />

Prior to July 1, 2003, the cost-sharing schedule was based on<br />

age at retirement and years of service. Subsequent to July 1,<br />

2003, the new structure is based on age at retirement. The<br />

following shows the change both prior to and subsequent to the<br />

Plan amendment:<br />

Prior to July 1, 2003<br />

Based on age at retirement and years of service:<br />

Retiree’s Share<br />

Age + Service Pre-65 Post-65<br />

65-69 90% 50%<br />

70-74 80% 40%<br />

75-79 70% 30%<br />

80-84 60% 20%<br />

85+ 50% 10%<br />

Subsequent to July 1, 2003<br />

Based on age at retirement:<br />

Retiree’s Share<br />

Age Pre-65 Post-65<br />

55-59 70% 40%<br />

60-64 60% 30%<br />

65+ 50% 20%<br />

Any employee who retired before August 15, 2003 was given the<br />

choice to convert to the new amendment or be grandfathered<br />

into the pre-amended requirements.<br />

For the years ended June 30, <strong>2005</strong> and 2004, the net periodic<br />

postretirement benefit cost and benefits paid for the Plan are as<br />

the follows:<br />

<strong>2005</strong> 2004<br />

Net periodic postretirement<br />

benefit cost $ 62,219 $ 461,944<br />

Benefits paid 11,101 11,247<br />

The June 30, <strong>2005</strong> and 2004 accumulated postretirement<br />

benefit obligation was determined using an assumed weighted<br />

average discount rate of 5.0% and 6.25%, respectively. The<br />

rate of increase in the gross cost of covered healthcare benefits<br />

was assumed to be 8.0% and 9.0% for fiscal years <strong>2005</strong> and<br />

2004, respectively. The rate of increase is assumed to decline<br />

by 1.00% for each year after <strong>2005</strong> to 5.00% in 2008 and<br />

thereafter.<br />

The <strong>Association</strong> also participates in the purchase of life insurance<br />

on behalf of certain executive officers as part of the<br />

<strong>National</strong> <strong>Futures</strong> <strong>Association</strong> Split Dollar Life Insurance Plan<br />

(the “Split Dollar Plan”). The purpose of the Split Dollar Plan<br />

is to provide participating executive officers with an insured<br />

death benefit during employment and after retirement. The<br />

insurance policy also allows for capital accumulation through<br />

the buildup of cash value. As of June 30, <strong>2005</strong> and 2004, the<br />

cash surrender value is $2,265,511 and $1,990,228, respectively,<br />

and is classified in other assets on the statements of financial<br />

position. The increase in cash surrender value approximately<br />

equals the premiums paid, and approximately all premiums<br />

paid increase the buildup of the cash surrender value.<br />

7. Deferred Rent Credit:<br />

Effective November 2001, the <strong>Association</strong> executed a 10-year<br />

operating lease for office premises in New York. Also, effective<br />

February 1996, the <strong>Association</strong> executed a 12-year operating<br />

lease for office premises in Chicago. The leases include rent<br />

incentives, and, accordingly, the <strong>Association</strong> is recognizing such<br />

abatement as a reduction of rent expense over the terms of the<br />

lease on the straight-line basis. The total deferred rent credit at<br />

June 30, <strong>2005</strong> and 2004 was $929,912 and $1,112,904,<br />

respectively, of which $223,987 and $194,746, respectively, are<br />

included in accounts payable, accrued expenses and other<br />

current liabilities on the statements of financial position. For<br />

the years ended June 30, <strong>2005</strong> and 2004, cash payments for<br />

rent were approximately $2,431,000 and $2,593,000, respectively.<br />

The <strong>Association</strong> offset these cash payments with deferred<br />

rent credits of $183,000 and $153,000 in <strong>2005</strong> and 2004,<br />

respectively, resulting in rent expense of approximately<br />

$2,248,000 and $2,440,000 in <strong>2005</strong> and 2004, respectively.<br />

8. Assessment Fee Revenue<br />

The assessment fee rate for the period January 1, <strong>2005</strong> to<br />

June 30, <strong>2005</strong> was $.02 per side. The assessment fee rate for<br />

the period January 1, 2003 to December 31, 2004 was $.03<br />

per side. These rates were identical for both futures and<br />

options contracts.<br />

At June 30, <strong>2005</strong> and 2004, the actuarial and recorded liabilities<br />

for the Plan, none of which has been funded, are:<br />

<strong>2005</strong> 2004<br />

Accumulated postretirement<br />

benefit obligation $2,063,049 $1,465,244<br />

Accrued postretirement<br />

benefit cost 3,488,848 3,437,675<br />

18<br />

NFA<br />

<strong>2005</strong> ANNUAL REVIEW