EasyFile CFTC Form PQR Template

EasyFile CFTC Form PQR Template

EasyFile CFTC Form PQR Template

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

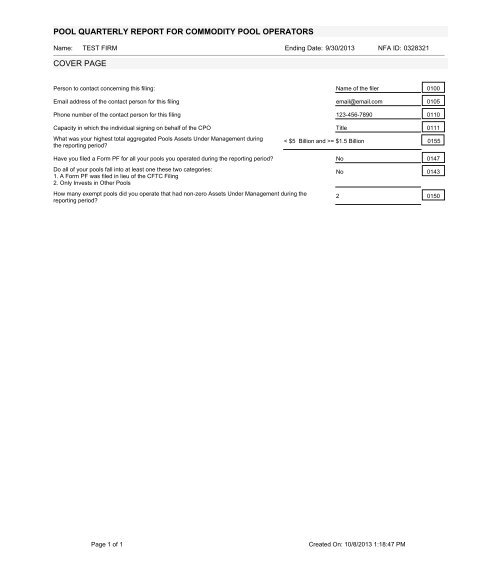

POOL QUARTERLY REPORT FOR COMMODITY POOL OPERATORS<br />

Name: TEST FIRM Ending Date: 9/30/2013 NFA ID: 0328321<br />

COVER PAGE<br />

Person to contact concerning this filing: Name of the filer 0100<br />

Email address of the contact person for this filing email@email.com 0105<br />

Phone number of the contact person for this filing 123-456-7890 0110<br />

Capacity in which the individual signing on behalf of the CPO Title 0111<br />

What was your highest total aggregated Pools Assets Under Management during<br />

the reporting period<br />

< $5 Billion and >= $1.5 Billion 0155<br />

Have you filed a <strong>Form</strong> PF for all your pools you operated during the reporting period No 0147<br />

Do all of your pools fall into at least one these two categories:<br />

1. A <strong>Form</strong> PF was filed in lieu of the <strong>CFTC</strong> Filing<br />

2. Only Invests in Other Pools<br />

How many exempt pools did you operate that had non-zero Assets Under Management during the<br />

reporting period<br />

No 0143<br />

2 0150<br />

Page 1 of 1<br />

Created On: 10/8/2013 1:18:47 PM

POOL QUARTERLY REPORT FOR COMMODITY POOL OPERATORS<br />

Name: TEST FIRM Ending Date: 9/30/2013 NFA ID: 0328321<br />

<strong>Form</strong> CPO-<strong>PQR</strong> - Schedule A<br />

PART 1 - INFORMATION ABOUT THE CPO<br />

1. CPO INFORMATION<br />

a. CPO's Name: TEST FIRM 0205<br />

b. CPO's NFA ID# 0328321 0210<br />

c. Person to contact concerning this <strong>Form</strong> CPO-<strong>PQR</strong> Name of the filer 0215<br />

d. CPO's chief compliance officer Name of the CCO 0220<br />

e. Total number of employees of the CPO 12 0225<br />

f. Total number of equity holders of the CPO 3 0230<br />

g. Total number of Pools operated by the CPO 2 0235<br />

h. Telephone number and email for person identified in c. above<br />

2. CPO ASSETS UNDER MANAGEMENT<br />

123-456-7890<br />

email@email.com<br />

a. CPO's Total Assets Under Management 1,700,000,000 0250<br />

b. CPO's Total Net Assets Under Management 1,600,000,000 0255<br />

0240<br />

SUPPLEMENTAL FIRM INFORMATION<br />

Are you registered as an Investment Adviser with the SEC No 0115<br />

Of the total Assets Under Management entered in Box 0255 above, please provide the amount<br />

allocated to futures and swaps as of the reporting date.<br />

700,000,000 0146

<strong>Form</strong> CPO-<strong>PQR</strong> - Schedule C<br />

1. GEOGRAPHICAL BREAKDOWN OF POOLS' INVESTMENTS<br />

a. Provide a geographical breakdown of the investments (by percentage of aggregated Assets Under Management) of all Pools that are<br />

not Private Funds that were operated by the Large CPO during the most recent Reporting Period.<br />

(i) Africa 0 0300<br />

(ii) Asia and Pacific (other than the Middle East) 0 0301<br />

(iii) Europe (EEA) 0 0302<br />

(iv) Europe (other than EEA) 0 0303<br />

(v) Middle East 0 0304<br />

(vi) North America 0 0305<br />

(vii) South America 0 0306<br />

(viii) Supranational 0 0307<br />

b. Provide the value of investments in the following countries held by the hedge funds that you advise (by percentage of the total net<br />

asset value of these hedge funds).<br />

(i) Brazil 0 0308<br />

(ii) China (including Hong Kong) 0 0309<br />

(iii) India 0 0310<br />

(iv) Japan 0 0311<br />

(v) Russia 0 0312<br />

(vi) United States 0 0313<br />

2. TURNOVER RATE OF AGGREGATE PORTFOLIO OF POOLS<br />

Provide the turnover rate by volume for the aggregate portfolio of all Pools that are not Private Funds and that were operated by the<br />

Large CPO during the most recent Reporting Period.<br />

First Month Second Month Third Month<br />

Open Positions: 0 0314 0 0315 0 0316<br />

Page 2 of 2<br />

Created On: 10/8/2013 1:18:45 PM

POOL QUARTERLY REPORT FOR COMMODITY POOL OPERATORS<br />

Name: MY POOL LISA Ending Date: 9/30/2013 NFA ID: P087320<br />

COVER PAGE<br />

Enter the highest NAV during the Reporting Period: 501,000,000 0160<br />

Enter the total funds allocated to futures and swaps as of the reporting date: 401,000,000 0161<br />

Have you filed an SEC <strong>Form</strong> PF for this pool in lieu of the <strong>CFTC</strong> Filing No 0162<br />

Does this pool only invest in other pools No 0163<br />

Page 1 of 31<br />

Created On: 10/8/2013 1:29:06 PM

POOL QUARTERLY REPORT FOR COMMODITY POOL OPERATORS<br />

Name: MY POOL LISA Ending Date: 9/30/2013 NFA ID: P087320<br />

<strong>Form</strong> CPO-<strong>PQR</strong> - Schedule A<br />

PART 2 - INFORMATION ABOUT THE POOLS OPERATED BY THE CPO<br />

3. POOL INFORMATION<br />

a. Pool's name MY POOL LISA 5005<br />

b. Pool's NFA ID#: P000000 5010<br />

c. If the Pool is operated by Co-CPOs the name of the other CPOs: 5015<br />

d. Under the laws of what state or country is the Pool organized 5020<br />

e. On what date does the Pool's fiscal year end: 5025<br />

f. Is this Pool a Private Fund 5030<br />

g. List the English name of each Foreign Financial Regulatory Authority and the country with which the Pool is registered:<br />

Foreign Financial Regulatory Authority<br />

Country<br />

Test Regulatory Authority 5080 UK 5081<br />

h. Is this a Master Fund in a Master - Feeder Arrangement Yes 5045<br />

If "Yes", provide the name and NFA ID# of each Feeder Fund investing in this Pool:<br />

Feeder Fund NFA ID #<br />

TEST 5082 P000000 5083<br />

i. Is this a Feeder Fund in a Master-Feeder Arrangement Yes 5060<br />

If "Yes", provide the name and NFA ID# of the Master Fund in which this Pool invests:<br />

Master Fund<br />

NFA ID<br />

TESTPOOL 5084 P000000 5085<br />

j. If this Pool invests in other Pools, a) what is the maximum number of investee pool tiers 0 5075<br />

i. What is the value of this Pool's investments in equity of other Pools or private funds 0 5087<br />

4. POOL THIRD PARTY ADMINISTRATORS<br />

a. Does the CPO use third party administrators for the Pool No 0810<br />

If “Yes,” provide the following information for each third party administrator:<br />

i. Name of the administrator: TESTER INVESTOR 7405<br />

ii. NFA ID# of administrator: 0000000 7406<br />

iii. Address of the administrator: 1285 TEST AVE LOS ANGELES CA 90015 US 7407<br />

iv. Telephone number of the administrator: (213)255-8564 7408<br />

v. Starting date of the relationship with the administrator: 01-MAR-2013 7409<br />

vi. Services performed by the administrator:<br />

Page 2 of 31<br />

Created On: 10/8/2013 1:29:06 PM

POOL QUARTERLY REPORT FOR COMMODITY POOL OPERATORS<br />

Name: MY POOL LISA Ending Date: 9/30/2013 NFA ID: P087320<br />

vi. Services performed by the administrator:<br />

Preparation of Pool Financial Statements No 7410<br />

Calculation of Pool's Performance No 7411<br />

Maintenance of the Pool's books and records No 7412<br />

Other 7413<br />

i. Name of the administrator: TEST FIRM 7405<br />

ii. NFA ID# of administrator: 0000000 7406<br />

iii. Address of the administrator: 7407<br />

iv. Telephone number of the administrator: 7408<br />

v. Starting date of the relationship with the administrator: 01-FEB-2013 7409<br />

vi. Services performed by the administrator:<br />

Preparation of Pool Financial Statements No 7410<br />

Calculation of Pool's Performance No 7411<br />

Maintenance of the Pool's books and records No 7412<br />

Other 7413<br />

i. Name of the administrator: TEST ADVISORS LLC 7405<br />

ii. NFA ID# of administrator: 0000000 7406<br />

iii. Address of the administrator: 123 TEST NEW YORK NV 10025 US 7407<br />

iv. Telephone number of the administrator: 212 999-9999 7408<br />

v. Starting date of the relationship with the administrator: 01-APR-2013 7409<br />

vi. Services performed by the administrator:<br />

Preparation of Pool Financial Statements No 7410<br />

Calculation of Pool's Performance No 7411<br />

Maintenance of the Pool's books and records No 7412<br />

Other 7413<br />

b. What percentage of the Pool’s Assets Under Management is valued by a third party administrator,<br />

or similar entity, that is independent of the CPO<br />

0 0825<br />

If the number entered is greater than “0,” provide the following information:<br />

Name of the third party(-ies)<br />

5. POOL BROKERS<br />

No Answer.<br />

a. Does the CPO use Brokers for the Pool No 0855<br />

If “Yes,” provide the following information for each Broker:<br />

i. Name of the Broker TEST BANK 7414<br />

ii. NFA ID# of Broker: 0000000 7415<br />

iii. Address of Broker: 123 FIRST STREET CHICAGO IL 60606 US 7416<br />

Page 3 of 31<br />

Created On: 10/8/2013 1:29:06 PM

POOL QUARTERLY REPORT FOR COMMODITY POOL OPERATORS<br />

Name: MY POOL LISA Ending Date: 9/30/2013 NFA ID: P087320<br />

iii. Address of Broker: 123 FIRST STREET CHICAGO IL 60606 US 7416<br />

iv. Telephone number of the Broker: 123-123-1234 7417<br />

v. Starting date of the relationship with the Broker: 01-JAN-2013 7418<br />

vi. Services performed by the Broker:<br />

Clearing services for the Pool No 7419<br />

Prime brokerage services for the Pool No 7420<br />

Custodian services for some or all Pool assets No 7421<br />

Other 7422<br />

i. Name of the Broker TEST ADVISORS LLC 7414<br />

ii. NFA ID# of Broker: 0000000 7415<br />

iii. Address of Broker: 123 TEST NEW YORK NV 10025 US 7416<br />

iv. Telephone number of the Broker: 212 999-9999 7417<br />

v. Starting date of the relationship with the Broker: 01-JAN-2013 7418<br />

vi. Services performed by the Broker:<br />

Clearing services for the Pool No 7419<br />

Prime brokerage services for the Pool No 7420<br />

Custodian services for some or all Pool assets No 7421<br />

Other 7422<br />

6. POOL TRADING MANAGERS<br />

a. Has the CPO authorized Trading Managers to invest or allocate some or all of the Pool’s Assets<br />

Under Management<br />

No 0875<br />

If “Yes,” provide the following information for each Trading Manager:<br />

No Answer.<br />

7. POOL CUSTODIANS<br />

a. Does the CPO use custodians to hold some or all of the Pool’s Assets Under Management No 0900<br />

If “Yes,” provide the following information for each custodian:<br />

i. Name of the custodian: TEST BANK 7429<br />

ii. NFA ID# of custodian: 0000000 7430<br />

iii. Address of the custodian: 123 FIRST STREET CHICAGO IL 60606 US 7431<br />

iv. Telephone number of the custodian: 123-123-1234 7432<br />

v. Starting date of the relationship with the custodian: 01-JAN-2013 7433<br />

What percentage of the Pool's Assets Under Management is held by the<br />

custodian<br />

i. Name of the custodian: TEST COMPANY 7429<br />

ii. NFA ID# of custodian: 0000000 7430<br />

iii. Address of the custodian: 123 MAIN ST. BOSTON MA 02109 US 7431<br />

7434<br />

Page 4 of 31<br />

Created On: 10/8/2013 1:29:06 PM

POOL QUARTERLY REPORT FOR COMMODITY POOL OPERATORS<br />

Name: MY POOL LISA Ending Date: 9/30/2013 NFA ID: P087320<br />

iii. Address of the custodian: 123 MAIN ST. BOSTON MA 02109 US 7431<br />

iv. Telephone number of the custodian: (123)459-6789 7432<br />

v. Starting date of the relationship with the custodian: 01-JAN-2013 7433<br />

What percentage of the Pool's Assets Under Management is held by the<br />

custodian<br />

7434<br />

8. POOL AUDITOR<br />

a. Does the CPO have the Pool’s financial statements audited If "Yes", provide the following<br />

information:<br />

0925<br />

No Answer.<br />

b. Are the Pool’s audited financial statements distributed to the Pool’s participants 0935<br />

9. POOL MARKETERS<br />

a. Does the CPO use the services of third parties to market participations in the Pool 0945<br />

If “Yes,” provide the following information for each marketing firm:<br />

No Answer.<br />

10. POOL’S STATEMENT OF CHANGES CONCERNING ASSETS UNDER MANAGEMENT<br />

Provide the following information concerning the Pool’s activity during the Reporting Period. For the purposes of this question:<br />

a. The Assets Under Management and Net Asset Value at the beginning of the Reporting Period are considered to be the same as the<br />

assets under management and Net Asset Value at the end of the previous Reporting Period, in accordance with Commission Rule 4.<br />

25(a)(7)(A).<br />

b. The additions to the Pool include all additions whether voluntary or involuntary in accordance with Commission Rule 4.25(a)(7)(B).<br />

c. The withdrawals and redemptions from the Pool include all withdrawals or redemptions whether voluntary or not, in accordance with<br />

Commission Rule 4.25(a)(7)(C).<br />

d. The Pool’s Assets Under Management and Net Asset Value on the Reporting Date must be calculated by adding or subtracting from the<br />

Assets Under Management and Net Asset Value at the beginning of the Reporting Period, respectively, any additions, withdrawals,<br />

redemptions and net performance, as provided in Commission Rule 4.25(a)(7)(E).<br />

i. Pool’s Assets Under Management at the beginning of the Reporting Period 0 0360<br />

ii. Pool’s Net Asset Value at the beginning of the Reporting Period: 0 0370<br />

iii. Pool’s net income during the Reporting Period: 0 0380<br />

iv. Additions to the Pool during the Reporting Period: 0 0390<br />

v. Withdrawals and Redemptions from the Pool during the Reporting Period: 0 0400<br />

vi. Pool’s Assets Under Management on the Reporting Date: 0 0410<br />

vii. Pool’s Net Asset Value on the Reporting Date: 0 0420<br />

viii. Pool’s base currency: USD 0430<br />

11. POOL'S MONTHLY RATES OF RETURN<br />

P000000 - MY POOL LISA<br />

Month 2013 2012 2011 2010 2009 2008 2007<br />

Jan<br />

Feb<br />

1.00<br />

2.00<br />

9.00<br />

8.00<br />

Page 5 of 31<br />

Created On: 10/8/2013 1:29:06 PM

POOL QUARTERLY REPORT FOR COMMODITY POOL OPERATORS<br />

Name: MY POOL LISA Ending Date: 9/30/2013 NFA ID: P087320<br />

Feb<br />

Mar<br />

Apr<br />

May<br />

Jun<br />

Jul<br />

Aug<br />

Sep<br />

Oct<br />

Nov<br />

Dec<br />

ANNUAL<br />

2.00<br />

3.00<br />

4.00<br />

5.00<br />

6.00<br />

7.00<br />

8.00<br />

9.00<br />

8.00<br />

7.00<br />

6.00<br />

5.00<br />

4.00<br />

3.00<br />

2.00<br />

1.00<br />

2.00<br />

3.00<br />

4.00<br />

-.10 2.45<br />

87321 - TEST LAYER 1<br />

Month 2013 2012 2011 2010 2009 2008 2007<br />

Jan<br />

Feb<br />

Mar<br />

Apr<br />

May<br />

Jun<br />

Jul<br />

Aug<br />

Sep<br />

Oct<br />

Nov<br />

Dec<br />

ANNUAL -.10 2.45<br />

12. POOL SUBSCRIPTIONS AND REDEMPTIONS<br />

Provide the following information concerning subscriptions to and redemptions from the Pool during the Reporting Period<br />

a. Total Pool subscriptions by participants during the Reporting Period: 0 3720<br />

b. Total Pool redemptions by participants during the Reporting Period: 0 3725<br />

c. Are any Pool participants or share classes currently below the Pool’s high water mark 3735<br />

If “Yes,” provide the following information:<br />

Page 6 of 31<br />

Created On: 10/8/2013 1:29:06 PM

POOL QUARTERLY REPORT FOR COMMODITY POOL OPERATORS<br />

Name: MY POOL LISA Ending Date: 9/30/2013 NFA ID: P087320<br />

If “Yes,” provide the following information:<br />

i. What is the percentage of participants below the Pool’s high water mark as of the Reporting Date 0 3745<br />

ii. What is the weighted average percentage of participants below the Pool’s high water mark as of the<br />

Reporting Date<br />

0 3750<br />

d. Provide the following information regarding the Pool’s restrictions on participant withdrawals and redemptions.(For Questions iv. and v.,<br />

please note that the standards for imposing suspensions and restrictions on withdrawals/redemptions may vary among funds. Make a good<br />

faith determination of the provisions that would likely be triggered during conditions that you view as significant market stress.)<br />

i. Does the reporting fund provide participants with withdrawal/redemption rights in the ordinary course<br />

(If you responded “yes” to Question 12(d)(i), then you must respond to Questions 12(d)(ii)-(v).)As of the data reporting date, what percentage<br />

of the Pool’s net asset value, if any:<br />

ii. May be subjected to a suspension of participant withdrawals/redemptions CPO (this question<br />

relates to a CPO’s right to suspend and not just whether a suspension is currently effective)<br />

iii. May be subjected to material restrictions on participant withdrawals/ redemptions (e.g., “gates”)<br />

CPO (this question relates to a CPO’s right to impose a restriction and not just whether a restriction<br />

has been imposed)<br />

iv. Is subject to a suspension of participant withdrawals/redemptions (this question relates to whether<br />

a suspension is currently effective and not just a CPO’sright to suspend)<br />

v. Is subject to a material restriction on participant withdrawals/redemptions (e.g., a “gate”) (this<br />

question relates to whether a restriction has been imposed and not just a CPO’s right to impose a<br />

restriction)<br />

e. Has the Pool imposed a halt or any other material limitation on redemptions during the Reporting Period<br />

If “Yes,” provide the following information:<br />

3765<br />

0 3775<br />

0 3780<br />

0 3790<br />

0 3795<br />

No 3805<br />

i. On what date was the halt or material limitation imposed 3815<br />

ii. If the halt or material limitation has been lifted, on what date was it lifted 3820<br />

iii. What disclosure was provided to participants to notify them that the halt or material limitation was being imposed What disclosure was<br />

provided to participants to notify them that the halt or material limitation was being lifted<br />

iv. On what date(s) was this disclosure provided 3835<br />

v. Briefly explain the halt or material limitation(s) on redemptions and the reason for such halt or material limitation(s):<br />

3830<br />

3845<br />

Page 7 of 31<br />

Created On: 10/8/2013 1:29:06 PM

POOL QUARTERLY REPORT FOR COMMODITY POOL OPERATORS<br />

Name: MY POOL LISA Ending Date: 9/30/2013 NFA ID: P087320<br />

<strong>Form</strong> CPO-<strong>PQR</strong> - Schedule B<br />

DETAILED INFORMATION ABOUT THE POOLS OPERATED BY CPOs<br />

1. POOL INFORMATION<br />

Provide the following general information concerning the Pool:<br />

a. Pool's name: MY POOL LISA 6001<br />

b. Pool's NFA ID#: P000000 6002<br />

c. Does the Pool have a single primary investment strategy or multiple strategies<br />

Single Primary Strategy 6003 Multiple Strategy 6004<br />

d. Indicate which of the investment strategies below best describe the reporting fund's strategies. For each strategy that you have selected,<br />

provide a good faith estimate of the percentage of the reporting fund's net asset value represented by that strategy. If, in your view, the<br />

reporting fund's allocation among strategies is appropriately represented by the percentage of deployed capital, you may also provide that<br />

information.<br />

Strategy % of NAV (required) % of capital (optional)<br />

Equity, Market Neutral 6005 0 6006 0 6007<br />

Equity, Long/Short 6008 0 6009 0 6010<br />

Equity, Short Bias 6011 0 6012 0 6013<br />

Equity, Fundamental 6014 0 6015 0 6016<br />

Macro, Active Trading (high frequency trading) 6017 0 6018 0 6019<br />

Macro, Commodity 6020 0 6021 0 6022<br />

Macro, Currency 6023 0 6024 0 6025<br />

Macro, Global Macro 6026 0 6027 0 6028<br />

Relative Value, Fixed Income Asset Backed 6029 0 6030 0 6031<br />

Relative Value, Fixed Income Convertible Arbitrage 6032 0 6033 0 6034<br />

Relative Value, Fixed Income Corporate 6035 0 6036 0 6037<br />

Relative Value, Fixed Income Sovereign 6038 0 6039 0 6040<br />

Relative Value, Volatility 6041 0 6042 0 6043<br />

Event Driven, Activist 6044 0 6045 0 6046<br />

Event Driven, Distressed/Restructuring 6047 0 6048 0 6049<br />

Event Driven, Risk Arbitrage/Merger Arbitrage 6050 0 6051 0 6052<br />

Event Driven, Equity Special Situations 6053 0 6054 0 6055<br />

Event Driven, Private Issue/Reg D 6056 0 6057 0 6058<br />

Credit, Fundamental 6059 0 6060 0 6061<br />

Managed Futures/CTA 6062 0 6063 0 6064<br />

Quantitative 6065 0 6066 0 6067<br />

Investment in other funds 6068 0 6069 0 6070<br />

Other 6071 6072 0 6073 0 6074<br />

e. Provide the approximate percentage of the Pool's portfolio that is managed using quantitative trading algorithms or quantitative techniques<br />

to select Page investments. 8 of 31 Do not include the use of algorithms used solely for trade execution: Created On: 10/8/2013 1:29:06 PM

POOL QUARTERLY REPORT FOR COMMODITY POOL OPERATORS<br />

Name: MY POOL LISA Ending Date: 9/30/2013 NFA ID: P087320<br />

e. Provide the approximate percentage of the Pool's portfolio that is managed using quantitative trading algorithms or quantitative techniques<br />

to select investments. Do not include the use of algorithms used solely for trade execution:<br />

0% 6075 51-75% 6079<br />

1-10% 6076 76-99% 6080<br />

11-25% 6077 100% 6081<br />

26-50% 6078<br />

f. Provide the following information concerning the Pool's participant concentration. Beneficial owners of Pool participations that are Affiliated<br />

Entities should be treated as a single participant:<br />

i. Total number of participants in the Pool: 0 6082<br />

ii. Percentage of the Pool that is beneficially owned by the five largest participants: 0 6083<br />

g. During the reporting period, approximately what percentage of the Pool's net asset value was managed using high-frequency trading<br />

strategies<br />

0% 6084 less than 10% 6088<br />

10-25% 6085 26-50% 6089<br />

51-75% 6086 76-99% 6090<br />

100% 6087<br />

2. POOL BORROWING AND TYPES OF CREDITORS<br />

a. Total Borrowings (dollar amount): 0 6091<br />

b. Percentage borrowed from U.S. Financial Institutions: 0 6092<br />

c. Percentage borrowed from non-U.S. Financial Institutions: 0 6093<br />

d. Percentage borrowed from U.S. creditors that are not Financial Institutions: 0 6094<br />

e. Percentage borrowed from non-U.S. creditors that are not Financial Institutions: 0 6095<br />

3. POOL COUNTERPARTY CREDIT EXPOSURE<br />

a. Provide the Pool's aggregate net counterparty credit exposure, measured in dollars: 0 6096<br />

b. Identify the five counterparties to which the reporting fund has the greatest mark-to-market net counterparty credit exposure, measured as<br />

a percentage of the reporting fund's net asset value.<br />

Legal name of the counterparty (or, if multiple<br />

affiliated entities, counterparties)<br />

Indicate below if the counterparty is affiliated<br />

with a major financial institution<br />

Exposure (% of reporting fund's<br />

net asset value)<br />

6097 6098 0 6099<br />

6100 6101 0 6102<br />

6103 6104 0 6105<br />

6106 6107 0 6108<br />

6109 6110 0 6111<br />

c. Identify the five counterparties that have the greatest mark-to-market net counterparty credit exposure to the reporting fund, measured in<br />

U.S. dollars.<br />

Legal name of the counterparty (or, if multiple<br />

affiliated entities, counterparties)<br />

Indicate below if the counterparty is affiliated<br />

with a major financial institution<br />

Exposure (in U.S. dollars)<br />

6112 6113 0 6114<br />

6115 6116 0 6117<br />

Page 9 of 31<br />

6118 6119 0 6120<br />

Created On: 10/8/2013 1:29:06 PM

POOL QUARTERLY REPORT FOR COMMODITY POOL OPERATORS<br />

Name: MY POOL LISA Ending Date: 9/30/2013 NFA ID: P087320<br />

6118 6119 0 6120<br />

6121 6122 0 6123<br />

6124 6125 0 6126<br />

d. Identify the three types of unregulated entities to which the Pool has the greatest net counterparty exposure, measured as a percentage of<br />

the Pool's Net Asset Value:<br />

Hedge Fund 6127 0 6128 Securitized Asset Fund 6129 0 6130<br />

Private Equity Fund 6131 0 6132 Other Private Fund 6133 0 6134<br />

Liquidity Fund 6135 0 6136 Sovereign Wealth Fund 6137 0 6138<br />

Venture Capital Fund 6139 0 6140 Other: 6141 6142 0 6143<br />

Real Estate Fund 6144 0 6145<br />

4. POOL TRADING AND CLEARING MECHANISMS<br />

Trading and Clearing of Derivatives<br />

a. For each of the following types derivatives that are traded by the Pool, estimate the percentage (in terms of notional value) of the Pool's<br />

activity that is traded on a regulated exchange as opposed to over-the-counter.<br />

Traded on a Regulated Exchange<br />

Traded Over-the-Counter<br />

Credit derivatives: 0 6146 0 6147<br />

Interest rate derivatives: 0 6148 0 6149<br />

Commodity derivatives: 0 6150 0 6151<br />

Equity derivatives: 0 6152 0 6153<br />

Foreign exchange derivatives: 0 6154 0 6155<br />

Asset backed securities derivatives: 0 6156 0 6157<br />

Other derivatives: 0 6158 0 6159<br />

b. For each of the following types derivatives that are traded by the Pool, estimate the percentage (in terms of notional value) of the Pool's<br />

activity that is cleared by a CCP as opposed to being transacted bilaterally (not cleared by a CCP).<br />

Cleared by a CCP<br />

Transacted Bilaterally<br />

Credit derivatives: 0 6160 0 6161<br />

Interest rate derivatives: 0 6162 0 6163<br />

Commodity derivatives: 0 6164 0 6165<br />

Equity derivatives: 0 6166 0 6167<br />

Foreign exchange derivatives: 0 6168 0 6169<br />

Asset backed securities derivatives: 0 6170 0 6171<br />

Other derivatives: 0 6172 0 6173<br />

c. For each of the following types securities that are traded by the Pool, estimate the percentage (in terms of market value) of the Pool's<br />

activity that is traded on a regulated exchange as opposed to over-the-counter.<br />

Traded on a Regulated Exchange<br />

Traded Over-the-Counter<br />

Equity securities: 0 6174 0 6175<br />

Debt securities: 0 6176 0 6177<br />

d. For each of the following types securities that are traded by the Pool, estimate the percentage (in terms of market value) of the Pool's<br />

activity that is cleared by a CCP as opposed to being transacted bilaterally (not cleared by a CCP).<br />

Page 10 of 31<br />

Created On: 10/8/2013 1:29:06 PM

POOL QUARTERLY REPORT FOR COMMODITY POOL OPERATORS<br />

Name: MY POOL LISA Ending Date: 9/30/2013 NFA ID: P087320<br />

Cleared by a CCP<br />

Transacted Bilaterally<br />

Equity securities: 0 6178 0 6179<br />

Debt securities: 0 6180 0 6181<br />

Clearing of Repos<br />

e. For the repo trades into which the Pool has entered, estimate the percentages (in terms of market value) of the Pool's repo trades that are<br />

cleared by a CCP, that are transacted bilaterally (not cleared by a CCP) and that constitute a tri-party repo.<br />

Cleared by a CCP Transacted Bilaterally Tri-Party Repo<br />

Repo 0 6182 0 6183 0 6184<br />

5. VALUE OF THE POOL'S AGGREGATED DERIVATIVE POSITIONS<br />

Provide the aggregate value of all derivative positions of the Pool. The value of any derivative should be its total gross notional value, except<br />

that the value of an option should be its delta adjusted notional value. Do not net long and short positions.<br />

Aggregate value of derivative positions: 0 6185<br />

6. POOL SCHEDULE OF INVESTMENTS<br />

Provide the Pool's investments in each of the subcategories listed under the following seven headings: (1) Cash; (2) Equities; (3) Alternative<br />

Investments; (4) Fixed Income; (5) Derivatives; (6) Options; and (7) Funds.<br />

CASH<br />

Total Cash 500 6186<br />

At Carrying Broker 500 6187<br />

At Bank 0 6188<br />

EQUITIES Long Short<br />

Total Listed Equities 0 6189 0 6190<br />

Stocks 0 6191 0 6192<br />

a. Energy and Utilities 0 6193 0 6194<br />

b. Technology 0 6195 0 6196<br />

c. Media 0 6197 0 6198<br />

d. Telecommunication 0 6199 0 6200<br />

e. Healthcare 0 6201 0 6202<br />

f. Consumer Services 0 6203 0 6204<br />

g. Business Services 0 6205 0 6206<br />

h. Issued by Financial Institutions 0 6207 0 6208<br />

i. Consumer Goods 0 6209 0 6210<br />

j. Industrial Materials 0 6211 0 6212<br />

Exchange Traded Funds 0 6213 0 6214<br />

American Deposit Receipts 0 6215 0 6216<br />

Other 0 6217 0 6218<br />

Total Unlisted Equities 0 6219 0 6220<br />

Page 11 of 31<br />

Created On: 10/8/2013 1:29:06 PM

POOL QUARTERLY REPORT FOR COMMODITY POOL OPERATORS<br />

Name: MY POOL LISA Ending Date: 9/30/2013 NFA ID: P087320<br />

Total Unlisted Equities 0 6219 0 6220<br />

Unlisted Equities Issued by Financial Institutions 0 6221 0 6222<br />

ALTERNATIVE INVESTMENTS Long Short<br />

Total Alternative Investments 0 6223 0 6224<br />

Real Estate 0 6225 0 6226<br />

a. Commercial 0 6227 0 6228<br />

b. Residential 0 6229 0 6230<br />

Private Equity 0 6231 0 6232<br />

Venture Capital 0 6233 0 6234<br />

Forex 0 6235 0 6236<br />

Spot 0 6237 0 6238<br />

a. Total Metals 0 6239 0 6240<br />

i. Gold 0 6241 0 6242<br />

b. Total Energy 0 6243 0 6244<br />

i. Crude oil 0 6245 0 6246<br />

ii. Natural gas 0 6247 0 6248<br />

iii. Power 0 6249 0 6250<br />

c. Other 0 6251 0 6252<br />

Loans to Affiliates 0 6253 0 6254<br />

Promissory Notes 0 6255 0 6256<br />

Physicals 0 6257 0 6258<br />

a. Total Metals 0 6259 0 6260<br />

i. Gold 0 6261 0 6262<br />

b. Agriculture 0 6263 0 6264<br />

c. Total Energy 0 6265 0 6266<br />

i. Crude oil 0 6267 0 6268<br />

ii. Natural gas 0 6269 0 6270<br />

iii. Power 0 6271 0 6272<br />

Other 0 6273 0 6274<br />

FIXED INCOME Long Short<br />

Total Fixed Income 0 6275 0 6276<br />

Notes, Bonds and Bills 0 6277 0 6278<br />

a. Corporate 0 6279 0 6280<br />

i. Investment grade 0 6281 0 6282<br />

ii. Non-investment grade 0 6283 0 6284<br />

Page 12 of 31<br />

Created On: 10/8/2013 1:29:06 PM

POOL QUARTERLY REPORT FOR COMMODITY POOL OPERATORS<br />

Name: MY POOL LISA Ending Date: 9/30/2013 NFA ID: P087320<br />

ii. Non-investment grade 0 6283 0 6284<br />

b. Municipal 0 6285 0 6286<br />

c. Government 0 6287 0 6288<br />

i. U.S. Treasury securities 0 6289 0 6290<br />

ii. Agency securities 0 6291 0 6292<br />

iii. Foreign (G10 countries) 0 6293 0 6294<br />

IV. Foreign (all other) 0 6295 0 6296<br />

d. Govn't Sponsored 0 6297 0 6298<br />

e. Convertible 0 6299 0 6300<br />

i. Investment grade 0 6301 0 6302<br />

ii. Non-investment grade 0 6303 0 6304<br />

Certificates of Deposit 0 6305 0 6306<br />

a. U.S. 0 6307 0 6308<br />

b. Foreign 0 6309 0 6310<br />

Asset Backed Securities<br />

a. Mortgage Backed Securities 0 6311 0 6312<br />

i. Commercial Securitizations 0 6313 0 6314<br />

A. Senior or higher 0 6315 0 6316<br />

B. Mezzanine 0 6317 0 6318<br />

C. Junior/Equity 0 6319 0 6320<br />

ii. Commercial Resecuritizations 0 6321 0 6322<br />

A. Senior or higher 0 6323 0 6324<br />

B. Mezzanine 0 6325 0 6326<br />

C. Junior/Equity 0 6327 0 6328<br />

iii. Residential Securitizations 0 6329 0 6330<br />

A. Senior or higher 0 6331 0 6332<br />

B. Mezzanine 0 6333 0 6334<br />

C. Junior/Equity 0 6335 0 6336<br />

iv. Residential Resecuritizations 0 6337 0 6338<br />

A. Senior or higher 0 6339 0 6340<br />

B. Mezzanine 0 6341 0 6342<br />

C. Junior/Equity 0 6343 0 6344<br />

v. Agency Securitizations 0 6345 0 6346<br />

A. Senior or higher 0 6347 0 6348<br />

B. Mezzanine 0 6349 0 6350<br />

C. Junior/Equity 0 6351 0 6352<br />

vi. Agency Resecuritizations 0 6353 0 6354<br />

Page 13 of 31<br />

Created On: 10/8/2013 1:29:06 PM

POOL QUARTERLY REPORT FOR COMMODITY POOL OPERATORS<br />

Name: MY POOL LISA Ending Date: 9/30/2013 NFA ID: P087320<br />

vi. Agency Resecuritizations 0 6353 0 6354<br />

A. Senior or higher 0 6355 0 6356<br />

B. Mezzanine 0 6357 0 6358<br />

C. Junior/Equity 0 6359 0 6360<br />

b. CDO Securitizations 0 6361 0 6362<br />

i. Senior or higher 0 6363 0 6364<br />

ii. Mezzanine 0 6365 0 6366<br />

iii. Junior/Equity 0 6367 0 6368<br />

c. CDO Resecuritizations 0 6369 0 6370<br />

i. Senior or higher 0 6371 0 6372<br />

ii. Mezzanine 0 6373 0 6374<br />

iii. Junior/Equity 0 6375 0 6376<br />

d. CLOs Securitizations 0 6377 0 6378<br />

i. Senior or higher 0 6379 0 6380<br />

ii. Mezzanine 0 6381 0 6382<br />

iii. Junior/Equity 0 6383 0 6384<br />

e. CLO Resecuritizations 0 6385 0 6386<br />

i. Senior or higher 0 6387 0 6388<br />

ii. Mezzanine 0 6389 0 6390<br />

iii. Junior/Equity 0 6391 0 6392<br />

f. Credit Card Securitizations 0 6393 0 6394<br />

i. Senior or higher 0 6395 0 6396<br />

ii. Mezzanine 0 6397 0 6398<br />

iii. Junior/Equity 0 6399 0 6400<br />

g. Credit Card Resecuritizations 0 6401 0 6402<br />

i. Senior or higher 0 6403 0 6404<br />

ii. Mezzanine 0 6405 0 6406<br />

iii. Junior/Equity 0 6407 0 6408<br />

h. Auto-Loan Securitizations 0 6409 0 6410<br />

i. Senior or higher 0 6411 0 6412<br />

ii. Mezzanine 0 6413 0 6414<br />

iii. Junior/Equity 0 6415 0 6416<br />

i. Auto-Loan Resecuritizations 0 6417 0 6418<br />

i. Senior or higher 0 6419 0 6420<br />

ii. Mezzanine 0 6421 0 6422<br />

iii. Junior/Equity 0 6423 0 6424<br />

j. Other 0 6425 0 6426<br />

Page 14 of 31<br />

Created On: 10/8/2013 1:29:06 PM

POOL QUARTERLY REPORT FOR COMMODITY POOL OPERATORS<br />

Name: MY POOL LISA Ending Date: 9/30/2013 NFA ID: P087320<br />

j. Other 0 6425 0 6426<br />

i. Senior or higher 0 6427 0 6428<br />

ii. Mezzanine 0 6429 0 6430<br />

iii. Junior/Equity 0 6431 0 6432<br />

Repos 0 6433 0 6434<br />

Reverse Repos 0 6435 0 6436<br />

DERIVATIVES Positive OTE Negative OTE<br />

Total Derivatives 0 6437 0 6438<br />

Futures 0 6439 0 6440<br />

a. Indices 0 6441 0 6442<br />

i. Equity 0 6443 0 6444<br />

ii. Commodity 0 6445 0 6446<br />

b. Metals 0 6447 0 6448<br />

i. Gold 0 6449 0 6450<br />

c. Agriculture 0 6451 0 6452<br />

d. Energy 0 6453 0 6454<br />

i. Crude oil 0 6455 0 6456<br />

ii. Natural gas 0 6457 0 6458<br />

iii. Power 0 6459 0 6460<br />

e. Interest Rate 0 6461 0 6462<br />

f. Currency 0 6463 0 6464<br />

g. Related to Financial Institutions 0 6465 0 6466<br />

h. Other 0 6467 0 6468<br />

Forwards 0 6469 0 6470<br />

Swaps 0 6471 0 6472<br />

a. Interest Rate Swap 0 6473 0 6474<br />

b. Equity/Index Swap 0 6475 0 6476<br />

c. Dividend Swap 0 6477 0 6478<br />

d. Currency Swap 0 6479 0 6480<br />

e. Variance Swap 0 6481 0 6482<br />

f. Credit Default Swap 0 6483 0 6484<br />

i. Single name CDS 0 6485 0 6486<br />

A. Related to Financial Institutions 0 6487 0 6488<br />

ii. Index CDS 0 6489 0 6490<br />

iii. Exotic CDS 0 6491 0 6492<br />

g. OTC Swap 0 6493 0 6494<br />

Page 15 of 31<br />

Created On: 10/8/2013 1:29:06 PM

POOL QUARTERLY REPORT FOR COMMODITY POOL OPERATORS<br />

Name: MY POOL LISA Ending Date: 9/30/2013 NFA ID: P087320<br />

g. OTC Swap 0 6493 0 6494<br />

i. Related to Financial Institutions 0 6495 0 6496<br />

h. Total Return Swap 0 6497 0 6498<br />

i. Other 0 6499 0 6500<br />

OPTIONS Long Option Value Short Option Value<br />

Total Options 0 6501 0 6502<br />

Futures 0 6503 0 6504<br />

a. Indices 0 6505 0 6506<br />

i. Equity 0 6507 0 6508<br />

ii. Commodity 0 6509 0 6510<br />

b. Metals 0 6511 0 6512<br />

i. Gold 0 6513 0 6514<br />

c. Agriculture 0 6515 0 6516<br />

d. Energy 0 6517 0 6518<br />

i. Crude oil 0 6519 0 6520<br />

ii. Natural Gas 0 6521 0 6522<br />

iii. Power 0 6523 0 6524<br />

e. Interest Rate 0 6525 0 6526<br />

f. Currency 0 6527 0 6528<br />

g. Related to Financial Institutions 0 6529 0 6530<br />

h. Other 0 6531 0 6532<br />

Stocks 0 6533 0 6534<br />

a. Related to Financial Institutions 0 6535 0 6536<br />

Customized/OTC 0 6537 0 6538<br />

Physicals 0 6539 0 6540<br />

a. Metals 0 6541 0 6542<br />

i. Gold 0 6543 0 6544<br />

b. Agriculture 0 6545 0 6546<br />

c. Currency 0 6547 0 6548<br />

d. Energy 0 6549 0 6550<br />

i. Crude oil 0 6551 0 6552<br />

ii. Natural gas 0 6553 0 6554<br />

iii. Power 0 6555 0 6556<br />

e. Other 0 6557 0 6558<br />

FUNDS<br />

Page 16 of 31<br />

Long<br />

Created On: 10/8/2013 1:29:06 PM

POOL QUARTERLY REPORT FOR COMMODITY POOL OPERATORS<br />

Name: MY POOL LISA Ending Date: 9/30/2013 NFA ID: P087320<br />

FUNDS<br />

Long<br />

Total Funds 0 6559<br />

Mutual Fund 0 6560<br />

a. U.S. 0 6561<br />

b. Foreign 0 6562<br />

NFA Listed Fund 0 6563<br />

Hedge Fund 0 6564<br />

Equity Fund 0 6565<br />

Money Market Fund 0 6566<br />

Private Equity Fund 0 6567<br />

REIT 0 6568<br />

Other Private Funds 0 6569<br />

Funds and accounts other than private funds (i.e., the remainder of your assets under management) 0 6570<br />

Itemized data has not been entered.<br />

7. MISCELLANEOUS<br />

No Answer.<br />

Page 17 of 31<br />

Created On: 10/8/2013 1:29:06 PM

POOL QUARTERLY REPORT FOR COMMODITY POOL OPERATORS<br />

Name: MY POOL LISA Ending Date: 9/30/2013 NFA ID: P087320<br />

<strong>Form</strong> CPO-<strong>PQR</strong> - Schedule C<br />

PART 2 - INFORMATION ABOUT THE LARGE POOLS OF LARGE CPOs<br />

1. LARGE POOL INFORMATION<br />

Provide the following general information concerning the Large Pool:<br />

a. Large Pool’s name: MY POOL LISA 6574<br />

b. Large Pool’s NFA ID#: P000000 6575<br />

c. If the Pool has a co-CPO, or co-CPOs provide the name of CPO reporting the Pool’s information: 6576<br />

d. Total unencumbered cash held by the Large Pool at the close of each month during the Reporting Period:<br />

First Month Second Month Third Month<br />

Unencumbered Cash: 0 6577 0 6578 0 6579<br />

e. Total number of open positions (approximate) held by the Large Pool at the close of each month during the Reporting Period:<br />

First Month Second Month Third Month<br />

Open Positions: 0 6580 0 6581 0 6582<br />

2. LIQUIDITY OF LARGE POOL’S PORTFOLIO<br />

Percentage of Portfolio<br />

Capable of Liquidation in:<br />

1 day or less: 0 6583<br />

2 days - 7 days: 0 6584<br />

8 days - 30 days: 0 6585<br />

31 days - 90 days: 0 6586<br />

91 days - 180 days: 0 6587<br />

181 days - 365 days: 0 6588<br />

longer than 365 days: 0 6589<br />

3. LARGE POOL COUNTERPARTY CREDIT EXPOSURE<br />

a. For each of the five counterparties identified in question 3.b. of Schedule B, provide the following information regarding the collateral and<br />

other credit support that the counterparty has posted to the Large Pool.<br />

i. For the counterparty listed in Box6097: Provide the following values of the collateral posted to the Large Pool:<br />

Initial Margin/ Independent<br />

Amounts<br />

Variation Margin<br />

Value of collateral posed in the form of cash and cash equivalents: 0 7500 0 7501<br />

Value of collateral posed in the form of securities (other than<br />

cash /cash equivalents):<br />

0 7502 0 7503<br />

Value of all other collateral posted: 0 7504 0 7505<br />

ii. For the counterparty listed in Box6097: Provide the following percentages of margin amounts that have been rehypothecated or may<br />

be rehypothecated by the Large Pool:<br />

May be Rehypothecated<br />

The Large Pool has<br />

Rehypothecated<br />

Page 18 of 31<br />

Created On: 10/8/2013 1:29:06 PM

POOL QUARTERLY REPORT FOR COMMODITY POOL OPERATORS<br />

Name: MY POOL LISA Ending Date: 9/30/2013 NFA ID: P087320<br />

Percentage of initial margin/independent amounts that: 0 7506 0 7507<br />

Percentage of variation margin that: 0 7508 0 7509<br />

iii. For the counterparty listed in Box6097: Provide the face amount of letters of credit or other<br />

similar third party credit support posted to the Large Pool:<br />

0 7510<br />

i. For the counterparty listed in Box6100: Provide the following values of the collateral posted to the Large Pool:<br />

Initial Margin/ Independent<br />

Amounts<br />

Variation Margin<br />

Value of collateral posed in the form of cash and cash equivalents: 0 7520 0 7521<br />

Value of collateral posed in the form of securities (other than<br />

cash /cash equivalents):<br />

0 7522 0 7523<br />

Value of all other collateral posted: 0 7524 0 7525<br />

ii. For the counterparty listed in Box6100: Provide the following percentages of margin amounts that have been rehypothecated or may<br />

be rehypothecated by the Large Pool:<br />

May be Rehypothecated<br />

The Large Pool has<br />

Rehypothecated<br />

Percentage of initial margin/independent amounts that: 0 7526 0 7527<br />

Percentage of variation margin that: 0 7528 0 7529<br />

iii. For the counterparty listed in Box6100:Provide the face amount of letters of credit or other<br />

similar third party credit support posted to the Large Pool:<br />

0 7530<br />

i. For the counterparty listed in Box6103: Provide the following values of the collateral posted to the Large Pool:<br />

Initial Margin/ Independent<br />

Amounts<br />

Variation Margin<br />

Value of collateral posed in the form of cash and cash equivalents: 0 7540 0 7541<br />

Value of collateral posed in the form of securities (other than<br />

cash /cash equivalents):<br />

0 7542 0 7543<br />

Value of all other collateral posted: 0 7544 0 7545<br />

ii. For the counterparty listed in Box6103: Provide the following percentages of margin amounts that have been rehypothecated or may<br />

be rehypothecated by the Large Pool:<br />

May be Rehypothecated<br />

The Large Pool has<br />

Rehypothecated<br />

Percentage of initial margin/independent amounts that: 0 7546 0 7547<br />

Percentage of variation margin that: 0 7548 0 7549<br />

iii. For the counterparty listed in Box6103: Provide the face amount of letters of credit or other<br />

similar third party credit support posted to the Large Pool:<br />

0 7550<br />

i. For the counterparty listed in Box6106: Provide the following values of the collateral posted to the Large Pool:<br />

Initial Margin/ Independent<br />

Amounts<br />

Variation Margin<br />

Value of collateral posed in the form of cash and cash equivalents: 0 7560 0 7561<br />

Value of collateral posed in the form of securities (other than<br />

cash /cash equivalents):<br />

0 7562 0 7563<br />

Value of all other collateral posted: 0 7564 0 7565<br />

ii. For the counterparty listed in Box6106: Provide the following percentages of margin amounts that have been rehypothecated or may<br />

be rehypothecated by the Large Pool:<br />

May be Rehypothecated<br />

The Large Pool has<br />

Rehypothecated<br />

Percentage of initial margin/independent amounts that: 0 7566 0 7567<br />

Percentage of variation margin that: 0 7568 0 7569<br />

Page 19 of 31<br />

Created On: 10/8/2013 1:29:06 PM

POOL QUARTERLY REPORT FOR COMMODITY POOL OPERATORS<br />

Name: MY POOL LISA Ending Date: 9/30/2013 NFA ID: P087320<br />

Percentage of variation margin that: 0 7568 0 7569<br />

iii. For the counterparty listed in Box6106:Provide the face amount of letters of credit or other<br />

similar third party credit support posted to the Large Pool:<br />

0 7570<br />

i.For the counterparty listed in Box6109: Provide the following values of the collateral posted to the Large Pool:<br />

Initial Margin/ Independent<br />

Amounts<br />

Variation Margin<br />

Value of collateral posed in the form of cash and cash equivalents: 0 7580 0 7581<br />

Value of collateral posed in the form of securities (other than<br />

cash /cash equivalents):<br />

0 7582 0 7583<br />

Value of all other collateral posted: 0 7584 0 7585<br />

ii. For the counterparty listed in Box6109: Provide the following percentages of margin amounts that have been rehypothecated or may<br />

be rehypothecated by the Large Pool:<br />

May be Rehypothecated<br />

The Large Pool has<br />

Rehypothecated<br />

Percentage of initial margin/independent amounts that: 0 7586 0 7587<br />

Percentage of variation margin that: 0 7588 0 7589<br />

iii.For the counterparty listed in Box6109: Provide the face amount of letters of credit or other<br />

similar third party credit support posted to the Large Pool:<br />

0 7590<br />

b. For each of the five counterparties identified in question 3.c. of Schedule B, provide the following information regarding the collateral and<br />

other credit support that the Large Pool has posted to the counterparty.<br />

i. For the counterparty listed in Box6112: Provide the following values of the collateral posted by the Large Pool to the counterparty:<br />

Initial Margin/ Independent<br />

Amounts<br />

Variation Margin<br />

Value of collateral posed in the form of cash and cash equivalents: 0 7511 0 7512<br />

Value of collateral posed in the form of securities (other than<br />

cash /cash equivalents):<br />

0 7513 0 7514<br />

Value of all other collateral posted: 0 7515 0 7516<br />

ii. For the counterparty listed in Box6112: Provide the following percentages of margin amounts posted by the Large Pool that have been<br />

rehypothecated or may be rehypothecated by the counterparty:<br />

May be Rehypothecated<br />

Percentage of initial margin/independent amounts that: 0 7517<br />

Percentage of variation margin that: 0 7518<br />

iii. For the counterparty listed in Box6112:Provide the face amount of letters of credit or other<br />

similar third party credit support posted by the Large Pool to the counterparty:<br />

0 7519<br />

i. For the counterparty listed in Box6115: Provide the following values of the collateral posted by the Large Pool to the counterparty:<br />

Initial Margin/ Independent<br />

Amounts<br />

Variation Margin<br />

Value of collateral posed in the form of cash and cash equivalents: 0 7531 0 7532<br />

Value of collateral posed in the form of securities (other than<br />

cash /cash equivalents):<br />

0 7533 0 7534<br />

Value of all other collateral posted: 0 7535 0 7536<br />

ii. For the counterparty listed in Box6115: Provide the following percentages of margin amounts posted by the Large Pool that have been<br />

rehypothecated or may be rehypothecated by the counterparty:<br />

May be Rehypothecated<br />

Percentage of initial margin/independent amounts that: 0 7537<br />

Percentage of variation margin that: 0 7538<br />

Page 20 of 31<br />

Created On: 10/8/2013 1:29:06 PM

POOL QUARTERLY REPORT FOR COMMODITY POOL OPERATORS<br />

Name: MY POOL LISA Ending Date: 9/30/2013 NFA ID: P087320<br />

Percentage of variation margin that: 0 7538<br />

iii. For the counterparty listed in Box6115: Provide the face amount of letters of credit or other<br />

similar third party credit support posted by the Large Pool to the counterparty:<br />

0 7539<br />

i. For the counterparty listed in Box6118: Provide the following values of the collateral posted by the Large Pool to the counterparty:<br />

Initial Margin/ Independent<br />

Amounts<br />

Variation Margin<br />

Value of collateral posed in the form of cash and cash equivalents: 0 7551 0 7552<br />

Value of collateral posed in the form of securities (other than<br />

cash /cash equivalents):<br />

0 7553 0 7554<br />

Value of all other collateral posted: 0 7555 0 7556<br />

ii. For the counterparty listed in Box6118: Provide the following percentages of margin amounts posted by the Large Pool that have been<br />

rehypothecated or may be rehypothecated by the counterparty:<br />

May be Rehypothecated<br />

Percentage of initial margin/independent amounts that: 0 7557<br />

Percentage of variation margin that: 0 7558<br />

iii. For the counterparty listed in Box6118: Provide the face amount of letters of credit or other<br />

similar third party credit support posted by the Large Pool to the counterparty:<br />

0 7559<br />

i. For the counterparty listed in Box6121: Provide the following values of the collateral posted by the Large Pool to the counterparty:<br />

Initial Margin/ Independent<br />

Amounts<br />

Variation Margin<br />

Value of collateral posed in the form of cash and cash equivalents: 0 7571 0 7572<br />

Value of collateral posed in the form of securities (other than<br />

cash /cash equivalents):<br />

0 7573 0 7574<br />

Value of all other collateral posted: 0 7575 0 7576<br />

ii. For the counterparty listed in Box6121: Provide the following percentages of margin amounts posted by the Large Pool that have been<br />

rehypothecated or may be rehypothecated by the counterparty:<br />

May be Rehypothecated<br />

Percentage of initial margin/independent amounts that: 0 7577<br />

Percentage of variation margin that: 0 7578<br />

iii. For the counterparty listed in Box6121:Provide the face amount of letters of credit or other<br />

similar third party credit support posted by the Large Pool to the counterparty:<br />

0 7579<br />

i. For the counterparty listed in Box6124: Provide the following values of the collateral posted by the Large Pool to the counterparty:<br />

Initial Margin/ Independent<br />

Amounts<br />

Variation Margin<br />

Value of collateral posed in the form of cash and cash equivalents: 0 7591 0 7592<br />

Value of collateral posed in the form of securities (other than<br />

cash /cash equivalents):<br />

0 7593 0 7594<br />

Value of all other collateral posted: 0 7595 0 7596<br />

ii. For the counterparty listed in Box6124: Provide the following percentages of margin amounts posted by the Large Pool that have been<br />

rehypothecated or may be rehypothecated by the counterparty:<br />

May be Rehypothecated<br />

Percentage of initial margin/independent amounts that: 0 7597<br />

Percentage of variation margin that: 0 7598<br />

iii. For the counterparty listed in Box6124: Provide the face amount of letters of credit or other<br />

similar third party credit support posted by the Large Pool to the counterparty:<br />

0 7599<br />

c. During the reporting period did the pool clear any transactions through a CCP 6610<br />

Page 21 of 31<br />

Created On: 10/8/2013 1:29:06 PM

POOL QUARTERLY REPORT FOR COMMODITY POOL OPERATORS<br />

Name: MY POOL LISA Ending Date: 9/30/2013 NFA ID: P087320<br />

c. During the reporting period did the pool clear any transactions through a CCP 6610<br />

4. LARGE POOL RISK METRICS<br />

Provide the following information concerning the Large Pool’s risk metrics during the Reporting Period:<br />

a. Did the Large CPO regularly calculate the VaR of the Large Pool during the Reporting Period: 6611<br />

b. If "Yes," provide the following information concerning the VaR calculation(s). If you regularly calculate the VaR of the Large Pool using<br />

multiple combinations of confidence interval, horizon and historical observation period, complete a separate question 4.b. of Part 2 of<br />

Schedule C for each such combination.<br />

i. What confidence interval was used (e.g. 1 - alpha) (as a percentage): 0 6612<br />

ii. What time horizon was used (in number of days): 0 6613<br />

iii. What weighting method was used:<br />

None 6614 Other: 6615 0 6616<br />

Exponential 6617<br />

If "exponential" provide the weighting factor used: 0 6618<br />

iv. What method was used to calculate VaR:<br />

Historical simulation 6619<br />

Parametric 6620<br />

Monte Carlo simulation 6621<br />

Other: 6622 0 6623<br />

v. Historical look-back period used, if applicable: 0 6624<br />

vi. Under the above parameters, what was VaR for the Large Pool for each of the three months of the Reporting Period,<br />

percent of Net Asset Value:<br />

First Month Second Month Third Month<br />

stated as a<br />

VaR 0 6625 0 6626 0 6627<br />

c. Are there any risk metrics other than (or in addition to) VaR that you consider to be important to the reporting fund’s risk management<br />

(If none, “None.”) 0 6628<br />

d. For each of the market factors specified below, determine the effect that each specified change would have on the Large Pool’s portfolio<br />

and provide the results, stated as a percent of Net Asset Value.<br />

Not Relevant<br />

Relevant<br />

Market Factor:<br />

Equity Prices<br />

Effect on long component<br />

of portfolio (as % of NAV)<br />

Effect on short<br />

component of portfolio<br />

(as % of NAV)<br />

6629 6630<br />

Equity prices increase 5% 0 6631 0 6632<br />

Equity prices decrease 5% 0 6633 0 6634<br />

Equity prices increase 20% 0 6635 0 6636<br />

Equity prices decrease 20% 0 6637 0 6638<br />

Not Relevant<br />

Relevant<br />

Market Factor:<br />

Risk Free Interest<br />

Rates<br />

Effect on long component<br />

of portfolio (as % of NAV)<br />

Effect on short<br />

component of portfolio<br />

(as % of NAV)<br />

6639 6640<br />

Page 22 of 31<br />

Created On: 10/8/2013 1:29:06 PM

POOL QUARTERLY REPORT FOR COMMODITY POOL OPERATORS<br />

Name: MY POOL LISA Ending Date: 9/30/2013 NFA ID: P087320<br />

6639 6640<br />

Risk free interest rates increase<br />

25 bp<br />

Risk free interest rates<br />

decrease 25 bp<br />

Risk free interest rates increase<br />

75 bp<br />

Risk free interest rates<br />

decrease 75 bp<br />

0 6641 0 6642<br />

0 6643 0 6644<br />

0 6645 0 6646<br />

0 6647 0 6648<br />

Not Relevant<br />

Relevant<br />

Market Factor:<br />

Credit Spreads<br />

Effect on long component<br />

of portfolio (as % of NAV)<br />

Effect on short<br />

component of portfolio<br />

(as % of NAV)<br />

6649 6650<br />

Credit spreads increase 50bp 0 6651 0 6652<br />

Credit spreads decrease 50 bp 0 6653 0 6654<br />

Credit spreads increase 250 bp 0 6655 0 6656<br />

Credit spreads decrease 250<br />

bp<br />

0 6657 0 6658<br />

Not Relevant<br />

Relevant<br />

Market Factor:<br />

Currency Rates<br />

Effect on long component<br />

of portfolio (as % of NAV)<br />

Effect on short<br />

component of portfolio<br />

(as % of NAV)<br />

6659 6660<br />

Currency rates increase 5% 0 6661 0 6662<br />

Currency rates decrease 5% 0 6663 0 6664<br />

Currency rates increase 20% 0 6665 0 6666<br />

Currency rates decrease 20% 0 6667 0 6668<br />

Not Relevant<br />

Relevant<br />

Market Factor:<br />

Commodity<br />

Prices<br />

Effect on long component<br />

of portfolio (as % of NAV)<br />

Effect on short<br />

component of portfolio<br />

(as % of NAV)<br />

6669 6670<br />

Commodity prices increase<br />

10%<br />

Commodity prices decrease<br />

10%<br />

Commodity prices increase<br />

40%<br />

Commodity prices decrease<br />

40%<br />

0 6671 0 6672<br />

0 6673 0 6674<br />

0 6675 0 6676<br />

0 6677 0 6678<br />

Not Relevant<br />

Relevant<br />

Market Factor: Options<br />

Implied Volatility<br />

Effect on long component<br />

of portfolio (as % of NAV)<br />

Effect on short<br />

component of portfolio<br />

(as % of NAV)<br />

6679 6680<br />

Page 23 of 31<br />

Implied volatilities increase 4<br />

percentage points<br />

0 6681 0 6682<br />

Created On: 10/8/2013 1:29:06 PM

POOL QUARTERLY REPORT FOR COMMODITY POOL OPERATORS<br />

Name: MY POOL LISA Ending Date: 9/30/2013 NFA ID: P087320<br />

Implied volatilities decrease 4<br />

percentage points<br />

Implied volatilities increase 10<br />

percentage points<br />

Implied volatilities decrease 10<br />

percentage points<br />

0 6683 0 6684<br />

0 6685 0 6686<br />

0 6687 0 6688<br />

Not Relevant<br />

Relevant<br />

Market Factor: Default Rates<br />

for ABS<br />

Effect on long component<br />

of portfolio (as % of NAV)<br />

Effect on short<br />

component of portfolio<br />

(as % of NAV)<br />

6689 6690<br />

Default rates increase 1<br />

percentage point<br />

Default rates decrease 1<br />

percentage point<br />

Default rates increase 5<br />

percentage points<br />

Default rates decrease 5<br />

percentage points<br />

0 6691 0 6692<br />

0 6693 0 6694<br />

0 6695 0 6696<br />

0 6697 0 6698<br />

Not Relevant<br />

Relevant<br />

Market Factor: Default Rates<br />

for Corporate Bonds<br />

Effect on long component<br />

of portfolio (as % of NAV)<br />

Effect on short<br />

component of portfolio<br />

(as % of NAV)<br />

6699 6700<br />

Default rates increase 1<br />

percentage point<br />

Default rates decrease 1<br />

percentage point<br />

Default rates increase 5<br />

percentage points<br />

Default rates decrease 5<br />

percentage points<br />

0 6701 0 6702<br />

0 6703 0 6704<br />

0 6705 0 6706<br />

0 6707 0 6708<br />

5. LARGE POOL BORROWING INFORMATION<br />

a. Unsecured Borrowing:<br />

First Month Second Month Third Month<br />

Total Dollar amount: 0 6709 0 6710 0 6711<br />

Percentage borrowed from U.S.<br />

Financial Institutions<br />

Percentage borrowed from<br />

Non-U.S. Financial Institutions<br />

Percentage borrowed from non-<br />

U.S, creditors that are not<br />

Financial Institutions<br />

Percentage borrowed from U.S<br />

creditors that are not Financial<br />

Institutions<br />

0 6712 0 6713 0 6714<br />

0 6715 0 6716 0 6717<br />

0 6718 0 6719 0 6720<br />

0 6721 0 6722 0 6723<br />

b. Secured Borrowing:<br />

i. Via prime brokerage:<br />

Page 24 of 31<br />

First Month Second Month Third Month<br />

Created On: 10/8/2013 1:29:06 PM

POOL QUARTERLY REPORT FOR COMMODITY POOL OPERATORS<br />

Name: MY POOL LISA Ending Date: 9/30/2013 NFA ID: P087320<br />

First Month Second Month Third Month<br />

Total Dollar amount: 0 6724 0 6725 0 6726<br />

Value of collateral posted in the<br />

form of cash and cash<br />

equivalents<br />

Value of collateral posted in the<br />

form of securities (not cash/cash<br />

equivalents)<br />

0 6727 0 6728 0 6729<br />

0 6730 0 6731 0 6732<br />

Value of other collateral posted 0 6733 0 6734 0 6735<br />

Face amount of letters of credit<br />

(or similar third party credit<br />

support) posted<br />

Percentage of posted collateral<br />

that may be rehypothecated<br />

Percentage borrowed from U.S.<br />

Financial Institutions<br />

Percentage borrowed from<br />

Non-U.S. Financial Institutions<br />

Percentage borrowed from<br />

creditors that are not Financial<br />

Institutions<br />

0 6736 0 6737 0 6738<br />

0 6739 0 6740 0 6741<br />

0 6750 0 6742 0 6743<br />

0 6744 0 6745 0 6746<br />

0 6747 0 6748 0 6749<br />

ii. Via repo. For the questions concerning collateral via repo, include as collateral any assets sold in connection<br />

as any variation margin.<br />

with the repo as well<br />

First Month Second Month Third Month<br />

Total Dollar amount: 0 6751 0 6752 0 6753<br />

Value of collateral posted in the<br />

form of cash and cash<br />

equivalents<br />

Value of collateral posted in the<br />

form of securities (not cash/cash<br />

equivalents)<br />

0 6754 0 6755 0 6756<br />

0 6757 0 6758 0 6759<br />

Value of other collateral posted 0 6760 0 6761 0 6762<br />

Face amount of letters of credit<br />

(or similar third party credit<br />

support) posted<br />

Percentage of posted collateral<br />

that may be rehypothecated<br />

Percentage borrowed from U.S.<br />

Financial Institutions<br />

Percentage borrowed from<br />

Non-U.S. Financial Institutions<br />

Percentage borrowed from<br />

creditors that are not Financial<br />

Institutions<br />

iii. Other Secured Borrowings:<br />

0 6763 0 6764 0 6765<br />

0 6766 0 6767 0 6768<br />

0 6769 0 6770 0 6771<br />

0 6772 0 6773 0 6774<br />

0 6775 0 6776 0 6777<br />

First Month Second Month Third Month<br />

Total Dollar amount: 0 6778 0 6779 0 6780<br />

Value of collateral posted in the<br />

form of cash and cash<br />

equivalents<br />

Value of collateral posted in the<br />

form of securities (not cash/cash<br />

equivalents)<br />

Page 25 of 31<br />

0 6781 0 6782 0 6783<br />

0 6784 0 6785 0 6786<br />

Created On: 10/8/2013 1:29:06 PM

POOL QUARTERLY REPORT FOR COMMODITY POOL OPERATORS<br />

Name: MY POOL LISA Ending Date: 9/30/2013 NFA ID: P087320<br />

equivalents)<br />

Value of other collateral posted 0 6787 0 6788 0 6789<br />

Face amount of letters of credit<br />

(or similar third party credit<br />

support) posted<br />

Percentage of posted collateral<br />

that may be rehypothecated<br />

Percentage borrowed from U.S.<br />

Financial Institutions<br />

Percentage borrowed from<br />

Non-U.S. Financial Institutions<br />

Percentage borrowed from<br />

creditors that are not Financial<br />

Institutions<br />

0 6790 0 6791 0 6792<br />

0 6793 0 6794 0 6795<br />

0 6796 0 6797 0 6798<br />

0 6799 0 6800 0 6801<br />

0 6802 0 6803 0 6804<br />

6 LARGE POOL DERIVATIVE POSITIONS AND POSTED COLLATERAL<br />

Aggregate value of all derivative<br />

positions:<br />

First Month Second Month Third Month<br />

0 6805 0 6806 0 6807<br />

Value of collateral posted in the form of cash and cash equivalents<br />

As initial margin/independent<br />

amounts:<br />

0 6808 0 6809 0 6810<br />

As variation margin: 0 6811 0 6812 0 6813<br />

Value of collateral posted in the form of securities (not cash/cash equivalents)<br />

As initial margin/independent<br />

amounts:<br />

0 6814 0 6815 0 6816<br />

As variation margin: 0 6817 0 6818 0 6819<br />

Value of other collateral posted<br />

As initial margin/independent<br />

amounts:<br />

0 6820 0 6821 0 6822<br />

As variation margin: 0 6823 0 6824 0 6825<br />

Face amount of letters of credit<br />

(or similar third party credit<br />

support) posted<br />

Percentage of initial<br />

margin/independent amounts that<br />

may be rehypothecated:<br />

Percentage of variation margin<br />

that may be rehypothecated:<br />

0 6826 0 6827 0 6828<br />

0 6829 0 6830 0 6831<br />

0 6832 0 6833 0 6834<br />

7. LARGE POOL FINANCING LIQUIDITY<br />

Provide the following information concerning the Large Pool’s financing liquidity:<br />

a. Provide the aggregate dollar amount of cash financing drawn by or available to the Large Pool,<br />

including all drawn and undrawn, committed and uncommitted lines of credit as well as any term<br />

financing:<br />

0 6835<br />

b. Below, enter the percentage of cash financing (as stated in response to question 7.a.) that is contractually committed to the Large Pool by<br />

its creditor(s) for the specified periods of time.<br />

Percentage of Total Financing:<br />

1 day or less: 0 6836<br />

Page 26 of 31<br />

Created On: 10/8/2013 1:29:06 PM

POOL QUARTERLY REPORT FOR COMMODITY POOL OPERATORS<br />

Name: MY POOL LISA Ending Date: 9/30/2013 NFA ID: P087320<br />

1 day or less: 0 6836<br />

2 days - 7 days: 0 6837<br />

8 days - 30 days: 0 6838<br />

31 days - 90 days: 0 6839<br />

91 days - 180 days: 0 6840<br />

181 days - 364 days: 0 6841<br />

365 days or longer: 0 6842<br />

8. LARGE POOL PARTICIPANT INFORMATION<br />

Provide the following information concerning the Large Pool’s participants:<br />

a. As of the Reporting Date, what percentage of the Large Pool’s Net Asset Value:<br />

Percentage of<br />

Large Pool’s NAV<br />

Is subject to a "side pocket" arrangement: 0 6843<br />

May be subject to a suspension of participant withdrawal or redemption by the Large CPO or other<br />

governing body:<br />

May be subject to material restrictions of participant withdrawal or redemption by the Large CPO or<br />

other governing body:<br />

0 6844<br />

0 6845<br />

Is subject to a daily margin requirement: 0 6846<br />

b. For within the specified periods of time below, enter the percentage of the Large Pool's Net Asset Value that could have been withdrawn or<br />

redeemed by the Large Pool's participants as of the Reporting Date.<br />

Percentage of<br />

Total Financing:<br />

1 day or less: 0 6847<br />

2 days - 7 days: 0 6848<br />

8 days - 30 days: 0 6849<br />

31 days - 90 days: 0 6850<br />

91 days - 180 days: 0 6851<br />

181 days - 364 days: 0 6852<br />

365 days or longer: 0 6853<br />

9. DURATION OF LARGE POOL'S FIXED INCOME ASSETS<br />

1st Month 2nd Month 3rd Month<br />

LV SV LV SV LV<br />

a. Listed equity<br />

i. Issued by financial institutions 0 6854 0 6855 0 6856 0 6857 0 6858 0 6859<br />

ii. Other listed equity 0 6860 0 6861 0 6862 0 6863 0 6864 0 6865<br />

b. Unlisted equity<br />

i. Issued by financial institutions 0 6866 0 6867 0 6868 0 6869 0 6870 0 6871<br />

Page 27 of 31<br />

Created On: 10/8/2013 1:29:06 PM

POOL QUARTERLY REPORT FOR COMMODITY POOL OPERATORS<br />

Name: MY POOL LISA Ending Date: 9/30/2013 NFA ID: P087320<br />

i. Issued by financial institutions 0 6866 0 6867 0 6868 0 6869 0 6870 0 6871<br />

ii. Other listed equity 0 6872 0 6873 0 6874 0 6875 0 6876 0 6877<br />

c. Listed equity derivatives<br />

i. Related to financial institutions 0 6878 0 6879 0 6880 0 6881 0 6882 0 6883<br />

ii. Other listed equity derivatives 0 6884 0 6885 0 6886 0 6887 0 6888 0 6889<br />

d. Derivative exposures to unlisted equities<br />

i. Related to financial institutions 0 6890 0 6891 0 6892 0 6893 0 6894 0 6895<br />

ii. Other derivative exposures to<br />

unlisted equities<br />

e. Corporate bonds issued by financial institutions (other than convertible bonds)<br />

0 6896 0 6897 0 6898 0 6899 0 6900 0 6901<br />

i. Investment grade 0 6902 0 6903 0 6904 0 6905 0 6906 0 6907<br />

Duration 6908 WAT 6909<br />

10-year eq 6910 0 6911 0 6912 0 6913 0 6914 0 6915 0 6916<br />

ii. Non-investment grade 0 6917 0 6918 0 6919 0 6920 0 6921 0 6922<br />

Duration 6923 WAT 6924<br />

10-year eq 6925 0 6926 0 6927 0 6928 0 6929 0 6930 0 6931<br />

f. Corporate bonds not issued by financial institutions (other than convertible bonds)<br />

i. Investment grade 0 6932 0 6933 0 6934 0 6935 0 6936 0 6937<br />

Duration 6938 WAT 6939<br />

10-year eq 6940 0 6941 0 6942 0 6943 0 6944 0 6945 0 6946<br />

ii. Non-investment grade 0 6947 0 6948 0 6949 0 6950 0 6951 0 6952<br />

Duration 6953 WAT 6954<br />

10-year eq 6955 0 6956 0 6957 0 6958 0 6959 0 6960 0 6961<br />

g. Convertible bonds issued by financial institutions<br />

i. Investment grade 0 6962 0 6963 0 6964 0 6965 0 6966 0 6967<br />

Duration 6968 WAT 6969<br />

10-year eq 6970 0 6971 0 6972 0 6973 0 6974 0 6975 0 6976<br />

ii. Non-investment grade 0 6977 0 6978 0 6979 0 6980 0 6981 0 6982<br />

Duration 6983 WAT 6984<br />

10-year eq 6985 0 6986 0 6987 0 6988 0 6989 0 6990 0 6991<br />

h. Convertible bonds not issued by financial institutions<br />

i. Investment grade 0 6992 0 6993 0 6994 0 6995 0 6996 0 6997<br />

Duration 6998 WAT 6999<br />

10-year eq 7000 0 7001 0 7002 0 7003 0 7004 0 7005 0 7006<br />

ii. Non-investment grade 0 7007 0 7008 0 7009 0 7010 0 7011 0 7012<br />

Duration 7013 WAT 7014<br />

10-year eq 7015 0 7016 0 7017 0 7018 0 7019 0 7020 0 7021<br />

i. Sovereign bonds and municipal bonds<br />

Page 28 of 31<br />

Created On: 10/8/2013 1:29:06 PM

POOL QUARTERLY REPORT FOR COMMODITY POOL OPERATORS<br />

Name: MY POOL LISA Ending Date: 9/30/2013 NFA ID: P087320<br />

i. Sovereign bonds and municipal bonds<br />

i. U.S. treasury securities 0 7022 0 7023 0 7024 0 7025 0 7026 0 7027<br />

Duration 7028 WAT 7029<br />

10-year eq 7030 0 7031 0 7032 0 7033 0 7034 0 7035 0 7036<br />

ii. Agency securities 0 7037 0 7038 0 7039 0 7040 0 7041 0 7042<br />

Duration 7043 WAT 7044<br />

10-year eq 7045 0 7046 0 7047 0 7048 0 7049 0 7050 0 7051<br />

iii. GSE bonds 0 7052 0 7053 0 7054 0 7055 0 7056 0 7057<br />

Duration 7058 WAT 7059<br />

10-year eq 7060 0 7061 0 7062 0 7063 0 7064 0 7065 0 7066<br />

iv. Sovereign bonds issued by G10<br />

countries other than the U.S.<br />

0 7067 0 7068 0 7069 0 7070 0 7071 0 7072<br />

Duration 7073 WAT 7074<br />

10-year eq 7075 0 7076 0 7077 0 7078 0 7079 0 7080 0 7081<br />

v. Other sovereign bonds (including<br />

supranational bonds)<br />

0 7082 0 7083 0 7084 0 7085 0 7086 0 7087<br />

Duration 7088 WAT 7089<br />

10-year eq 7090 0 7091 0 7092 0 7093 0 7094 0 7095 0 7096<br />

vi. U.S. state and local bonds 0 7097 0 7098 0 7099 0 7100 0 7101 0 7102<br />

Duration 7103 WAT 7104<br />

10-year eq 7105 0 7106 0 7107 0 7108 0 7109 0 7110 0 7111<br />

j. Loans<br />

i. Leveraged loans 0 7112 0 7113 0 7114 0 7115 0 7116 0 7117<br />

Duration 7118 WAT 7119<br />

10-year eq 7120 0 7121 0 7122 0 7123 0 7124 0 7125 0 7126<br />

ii. Other loans (not including repos) 0 7127 0 7128 0 7129 0 7130 0 7131 0 7132<br />

Duration 7133 WAT 7134<br />

10-year eq 7135 0 7136 0 7137 0 7138 0 7139 0 7140 0 7141<br />

k. Repos 0 7142 0 7143 0 7144 0 7145 0 7146 0 7147<br />

Duration 7148 WAT 7149<br />

10-year eq 7150 0 7151 0 7152 0 7153 0 7154 0 7155 0 7156<br />

l. ABS/structured products<br />

i. MBS 0 7157 0 7158 0 7159 0 7160 0 7161 0 7162<br />

Duration 7163 WAT 7164<br />

10-year eq 7165 0 7166 0 7167 0 7168 0 7169 0 7170 0 7171<br />

ii. ABCP 0 7172 0 7173 0 7174 0 7175 0 7176 0 7177<br />

Duration 7178 WAT 7179<br />

10-year eq 7180 0 7181 0 7182 0 7183 0 7184 0 7185 0 7186<br />

iii. CDO/CLO 0 7187 0 7188 0 7189 0 7190 0 7191 0 7192<br />

Page 29 of 31<br />

Created On: 10/8/2013 1:29:06 PM

POOL QUARTERLY REPORT FOR COMMODITY POOL OPERATORS<br />

Name: MY POOL LISA Ending Date: 9/30/2013 NFA ID: P087320<br />

iii. CDO/CLO 0 7187 0 7188 0 7189 0 7190 0 7191 0 7192<br />

Duration 7193 WAT 7194<br />

10-year eq 7195 0 7196 0 7197 0 7198 0 7199 0 7200 0 7201<br />

iv. Other ABS 0 7202 0 7203 0 7204 0 7205 0 7206 0 7207<br />

Duration 7208 WAT 7209<br />

10-year eq 7210 0 7211 0 7212 0 7213 0 7214 0 7215 0 7216<br />

v. Other structured products 0 7217 0 7218 0 7219 0 7220 0 7221 0 7222<br />

m. Credit derivatives<br />

i. Single name CDS 0 7223 0 7224 0 7225 0 7226 0 7227 0 7228<br />

ii. Index CDS 0 7229 0 7230 0 7231 0 7232 0 7233 0 7234<br />

iii. Exotic CDS 0 7235 0 7236 0 7237 0 7238 0 7239 0 7240<br />

n. Foreign exchange derivatives<br />

(investment)<br />

o. Foreign exchange derivatives<br />

(hedging)<br />

0 7241 0 7242 0 7243 0 7244 0 7245 0 7246<br />

0 7247 0 7248 0 7249 0 7250 0 7251 0 7252<br />

p. Non-U.S. currency holdings 0 7253 0 7254 0 7255 0 7256 0 7257 0 7258<br />

q. Interest rate derivatives 0 7259 0 7260 0 7261 0 7262 0 7263 0 7264<br />

r. Commodities (derivatives)<br />

i. Crude oil 0 7265 0 7266 0 7267 0 7268 0 7269 0 7270<br />

ii. Natural gas 0 7271 0 7272 0 7273 0 7274 0 7275 0 7276<br />

iii. Gold 0 7277 0 7278 0 7279 0 7280 0 7281 0 7282<br />

iv. Power 0 7283 0 7284 0 7285 0 7286 0 7287 0 7288<br />

v. Other commodities 0 7289 0 7290 0 7291 0 7292 0 7293 0 7294<br />

s. Commodities (physical)<br />

i. Crude oil 0 7295 0 7296 0 7297 0 7298 0 7299 0 7300<br />

ii. Natural gas 0 7301 0 7302 0 7303 0 7304 0 7305 0 7306<br />

iii. Gold 0 7307 0 7308 0 7309 0 7310 0 7311 0 7312<br />

iv. Power 0 7313 0 7314 0 7315 0 7316 0 7317 0 7318<br />

v. Other commodities 0 7319 0 7320 0 7321 0 7322 0 7323 0 7324<br />

t. Other derivatives 0 7325 0 7326 0 7327 0 7328 0 7329 0 7330<br />

u. Physical real estate 0 7331 0 7332 0 7333 0 7334 0 7335 0 7336<br />

v. Investments in internal private funds 0 7337 0 7338 0 7339 0 7340 0 7341 0 7342<br />

w. Investments in external private funds 0 7343 0 7344 0 7345 0 7346 0 7347 0 7348<br />

x. Investments in registered<br />

investmentcompanies<br />

0 7349 0 7350 0 7351 0 7352 0 7353 0 7354<br />

y. Cash and cash equivalents<br />

i. Certificates of deposit 0 7355 0 7356 0 7357 0 7358 0 7359 0 7360<br />

Duration 7361 WAT 7362<br />

10-year eq 7363 0 7364 0 7365 0 7366 0 7367 0 7368 0 7369<br />

Page 30 of 31<br />

Created On: 10/8/2013 1:29:06 PM

POOL QUARTERLY REPORT FOR COMMODITY POOL OPERATORS<br />