Rate and Rule Review and Approval Process - Louisiana ...

Rate and Rule Review and Approval Process - Louisiana ...

Rate and Rule Review and Approval Process - Louisiana ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

Charles B. Hansberry, III, Esq., Director<br />

Linda T. Gonzales, Assistant Director<br />

Lawrence Steinert, Senior Actuary<br />

<strong>Louisiana</strong> Department of Insurance<br />

Office of Property <strong>and</strong> Casualty<br />

Insurance Rating Division

• La. R.S. 36:688 <strong>and</strong> 22:1451 et seq.<br />

• Commissioner has the exclusive authority to<br />

accept, review <strong>and</strong> approve any application<br />

for insurance rates, manual rules <strong>and</strong><br />

rate/rule changes<br />

• <strong>Rate</strong>s shall not be excessive, inadequate or<br />

unfairly discriminatory<br />

2

• <strong>Louisiana</strong> Revised Statutes (Primarily<br />

La. R.S. 22:1451 et seq.)<br />

• LDI <strong>Rate</strong> <strong>and</strong> <strong>Rule</strong> Filing H<strong>and</strong>book<br />

(LDI website)<br />

• LDI Product Filing Matrix (LDI website)<br />

• LDI Office of Property <strong>and</strong> Casualty<br />

(OPC)/Insurance Rating Staff<br />

3

Edward O’Brien – Deputy Commissioner<br />

Charles Hansberry – Director<br />

Linda Gonzales – Assistant Director<br />

Jaclyn Blackwell – All Vehicle <strong>and</strong> Other Liability<br />

(Umbrella/Excess)<br />

Constance Cannon – Commercial Package Programs, Medical<br />

Malpractice<br />

Darlene Chachere – Commercial Property (Fire <strong>and</strong> Allied),<br />

Fidelity, Surety, Burglary <strong>and</strong> Theft-Crime<br />

4

Herv Dorsey – Workers’ Compensation<br />

Ursula Hall – Commercial Lines<br />

Dayna Poche – Homeowners Personal Property, Title, Excess<br />

Flood, Earthquake, Crop, Personal Liability<br />

William Wolfe – Inl<strong>and</strong> Marine<br />

Technicians – NaKisha Butler, Edna “Missy” Shields<br />

5

• System for Electronic <strong>Rate</strong> <strong>and</strong> <strong>Rule</strong> Filing<br />

(SERFF) – NAIC<br />

• U.S. Mail (paper filings)<br />

6

• <strong>Louisiana</strong> is a modified prior approval state.<br />

• <strong>Rate</strong>s <strong>and</strong> rules must be on file with the LDI at<br />

least forty-five (45) days prior to<br />

implementation.<br />

• A proposed rate <strong>and</strong>/or rule can be made<br />

effective prior to the forty-five (45) day time<br />

period if the LDI has completed its review/<br />

approval process <strong>and</strong> the submitter makes a<br />

request in writing for earlier effective date.<br />

7

• Filing is submitted via SERFF or U.S. Mail<br />

• Contents of rate/rule filing are reviewed by technicians<br />

<strong>and</strong> the assigned examiner for compliance with<br />

Insurance Code, LDI <strong>Rule</strong>s, Regulations <strong>and</strong> Bulletins.<br />

• If contents are found to be compliant, rates <strong>and</strong> rules<br />

are forwarded to staff actuaries for actuarial<br />

justification, if required.<br />

• Informational filings are administratively reviewed by<br />

examiners <strong>and</strong> a disposition is drafted by the examiner<br />

for review by the Division Director.<br />

8

• Upon completion of the actuarial review, the rate filing<br />

is returned to the examiner with a recommendation for<br />

approval/disapproval.<br />

• The examiner drafts a disposition on behalf of the<br />

Commissioner. The disposition, along with the final<br />

contents of the rate filing, are reviewed by the Division<br />

Director.<br />

9

• Once the Division Director has reviewed the rate/rule<br />

filing for compliance <strong>and</strong> grammar, the filing is returned<br />

to the examiner for issuance of the disposition.<br />

10

• If an examiner or a technician has questions relative to<br />

the filing, the submitting entity has fifteen (15) days<br />

from receipt of the question to respond. If a response<br />

is not provided, the filing will be disapproved.<br />

• In regards to a rate filing, the company must provide<br />

the following:<br />

• Overall [statewide] rate percentage increase or decrease<br />

• Overall premium dollar impact<br />

• Overall number of policyholders affected by the rate<br />

change<br />

• Requested effective date<br />

11

• <strong>Louisiana</strong> does not accept “Me Too” rate<br />

filings. The rate filings must be based on the<br />

experience of the submitting company.<br />

However, a company can base its rates on<br />

rates that have been previously approved by<br />

the LDI for another company. With this filing,<br />

the company must supply all of the required<br />

exhibits <strong>and</strong> actuarial support relative to the<br />

affected program.<br />

12

• Consent to <strong>Rate</strong> (CTR) filings must clearly<br />

demonstrate that the rate offered to a<br />

prospective/contracting insured is in excess<br />

of the company’s filed <strong>and</strong> approved rate.<br />

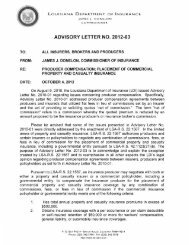

• Adoption of rates <strong>and</strong> rules of rating<br />

organizations must be filed with the LDI. All<br />

designation numbers must be provided in the<br />

adoption filing.<br />

13

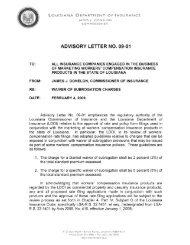

• Multiple rate filings within a policy term-<br />

Advisory Letter<br />

• Proprietary <strong>and</strong> confidential data should be<br />

clearly denoted. Please note that an entire rate<br />

filing cannot be deemed confidential.<br />

• Verify lines of coverage on company’s Certificate<br />

of Authority prior to filing the rates <strong>and</strong> rules for<br />

a new program. A company’s Certificate of<br />

Authority must be approved before the LDI can<br />

act upon any rate/rule filings.<br />

14

• Membership in Property Insurance<br />

Association of <strong>Louisiana</strong> (PIAL) for those<br />

companies writing fire insurance in the state<br />

of <strong>Louisiana</strong> (La. R.S. 22:1460).<br />

• Incomplete filings will be disapproved.<br />

• <strong>Rate</strong> <strong>and</strong> rule filings must be submitted<br />

independent of form filings.<br />

15

• Larry Steinert<br />

• Senior Actuary, <strong>Louisiana</strong> Department of<br />

Insurance, Office of Property <strong>and</strong> Casualty<br />

16

17

• (225) 342-5203 (OPC)<br />

• www.ldi.la.gov (Website)<br />

Mailing Address: P.O. Box 94214<br />

Baton Rouge, LA<br />

70804-9214<br />

*The <strong>Rate</strong> Division can be contacted online via<br />

SERFF if a filing has been submitted via SERFF.<br />

18