State Bailouts in an Era of Financial Crisis ... - Global Trade Alert

State Bailouts in an Era of Financial Crisis ... - Global Trade Alert

State Bailouts in an Era of Financial Crisis ... - Global Trade Alert

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

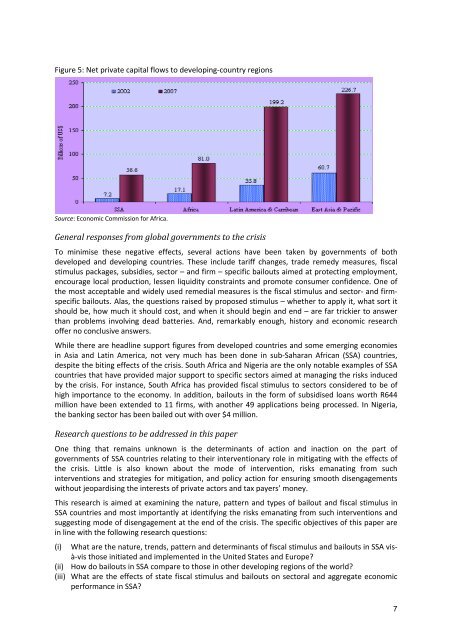

Figure 5: Net private capital flows to develop<strong>in</strong>g‐country regions<br />

Source: Economic Commission for Africa.<br />

General responses from global governments to the crisis<br />

To m<strong>in</strong>imise these negative effects, several actions have been taken by governments <strong>of</strong> both<br />

developed <strong>an</strong>d develop<strong>in</strong>g countries. These <strong>in</strong>clude tariff ch<strong>an</strong>ges, trade remedy measures, fiscal<br />

stimulus packages, subsidies, sector – <strong>an</strong>d firm – specific bailouts aimed at protect<strong>in</strong>g employment,<br />

encourage local production, lessen liquidity constra<strong>in</strong>ts <strong>an</strong>d promote consumer confidence. One <strong>of</strong><br />

the most acceptable <strong>an</strong>d widely used remedial measures is the fiscal stimulus <strong>an</strong>d sector‐ <strong>an</strong>d firmspecific<br />

bailouts. Alas, the questions raised by proposed stimulus – whether to apply it, what sort it<br />

should be, how much it should cost, <strong>an</strong>d when it should beg<strong>in</strong> <strong>an</strong>d end – are far trickier to <strong>an</strong>swer<br />

th<strong>an</strong> problems <strong>in</strong>volv<strong>in</strong>g dead batteries. And, remarkably enough, history <strong>an</strong>d economic research<br />

<strong>of</strong>fer no conclusive <strong>an</strong>swers.<br />

While there are headl<strong>in</strong>e support figures from developed countries <strong>an</strong>d some emerg<strong>in</strong>g economies<br />

<strong>in</strong> Asia <strong>an</strong>d Lat<strong>in</strong> America, not very much has been done <strong>in</strong> sub‐Sahar<strong>an</strong> Afric<strong>an</strong> (SSA) countries,<br />

despite the bit<strong>in</strong>g effects <strong>of</strong> the crisis. South Africa <strong>an</strong>d Nigeria are the only notable examples <strong>of</strong> SSA<br />

countries that have provided major support to specific sectors aimed at m<strong>an</strong>ag<strong>in</strong>g the risks <strong>in</strong>duced<br />

by the crisis. For <strong>in</strong>st<strong>an</strong>ce, South Africa has provided fiscal stimulus to sectors considered to be <strong>of</strong><br />

high import<strong>an</strong>ce to the economy. In addition, bailouts <strong>in</strong> the form <strong>of</strong> subsidised lo<strong>an</strong>s worth R644<br />

million have been extended to 11 firms, with <strong>an</strong>other 49 applications be<strong>in</strong>g processed. In Nigeria,<br />

the b<strong>an</strong>k<strong>in</strong>g sector has been bailed out with over $4 million.<br />

Research questions to be addressed <strong>in</strong> this paper<br />

One th<strong>in</strong>g that rema<strong>in</strong>s unknown is the determ<strong>in</strong><strong>an</strong>ts <strong>of</strong> action <strong>an</strong>d <strong>in</strong>action on the part <strong>of</strong><br />

governments <strong>of</strong> SSA countries relat<strong>in</strong>g to their <strong>in</strong>terventionary role <strong>in</strong> mitigat<strong>in</strong>g with the effects <strong>of</strong><br />

the crisis. Little is also known about the mode <strong>of</strong> <strong>in</strong>tervention, risks em<strong>an</strong>at<strong>in</strong>g from such<br />

<strong>in</strong>terventions <strong>an</strong>d strategies for mitigation, <strong>an</strong>d policy action for ensur<strong>in</strong>g smooth disengagements<br />

without jeopardis<strong>in</strong>g the <strong>in</strong>terests <strong>of</strong> private actors <strong>an</strong>d tax payers’ money.<br />

This research is aimed at exam<strong>in</strong><strong>in</strong>g the nature, pattern <strong>an</strong>d types <strong>of</strong> bailout <strong>an</strong>d fiscal stimulus <strong>in</strong><br />

SSA countries <strong>an</strong>d most import<strong>an</strong>tly at identify<strong>in</strong>g the risks em<strong>an</strong>at<strong>in</strong>g from such <strong>in</strong>terventions <strong>an</strong>d<br />

suggest<strong>in</strong>g mode <strong>of</strong> disengagement at the end <strong>of</strong> the crisis. The specific objectives <strong>of</strong> this paper are<br />

<strong>in</strong> l<strong>in</strong>e with the follow<strong>in</strong>g research questions:<br />

(i) What are the nature, trends, pattern <strong>an</strong>d determ<strong>in</strong><strong>an</strong>ts <strong>of</strong> fiscal stimulus <strong>an</strong>d bailouts <strong>in</strong> SSA visà‐vis<br />

those <strong>in</strong>itiated <strong>an</strong>d implemented <strong>in</strong> the United <strong>State</strong>s <strong>an</strong>d Europe<br />

(ii) How do bailouts <strong>in</strong> SSA compare to those <strong>in</strong> other develop<strong>in</strong>g regions <strong>of</strong> the world<br />

(iii) What are the effects <strong>of</strong> state fiscal stimulus <strong>an</strong>d bailouts on sectoral <strong>an</strong>d aggregate economic<br />

perform<strong>an</strong>ce <strong>in</strong> SSA<br />

7