NOVEMBER/DECEMBER 2009 - NACVA.com

NOVEMBER/DECEMBER 2009 - NACVA.com

NOVEMBER/DECEMBER 2009 - NACVA.com

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>NOVEMBER</strong>/<strong>DECEMBER</strong> <strong>2009</strong>

Announcing the <strong>NACVA</strong>/IBA<br />

2010 Annual<br />

Consultants’ Conference<br />

June 2–5, 2010<br />

Fontainebleau Miami Beach<br />

Miami, FL<br />

<br />

Save the dates!

A PROFESSIONAL DEVELOPMENT JOURNAL for the CONSULTING DISCIPLINES<br />

On The Cover<br />

In This Issue…<br />

7 F R O M T H E E D I T O R<br />

Thanks to Our Guest Peer-Reviewers<br />

9<br />

LETTERS TO THE EDITOR<br />

Greed Blamed for Economic Crisis<br />

A reader responds to last issue’s editorial regarding the role<br />

greed played in causing the economic crisis of 2008–09.<br />

10<br />

The Capex Adjustment<br />

by John F. Coffey,<br />

MAS, CPA/ABV, CVA, CFF, PFS<br />

In applying the in<strong>com</strong>e method, a<br />

valuator will normalize cash flows by<br />

adjusting the financial statements of<br />

a business to more closely reflect its<br />

true operating results. An assumption of<br />

future capital expenditures (capex) is one<br />

of the typical normalization adjustments.<br />

At times, the valuator may accept prior<br />

depreciation as a proxy for future capex.<br />

Without a clear understanding of the fixed<br />

asset schedules and underlying assumptions,<br />

however, such an oversimplification can lead<br />

to an erroneous conclusion. This article<br />

explains the methodology for making the<br />

capex adjustment.<br />

15 V A L U A T I O N<br />

Size Matters: How to Apply Size Premium<br />

Metrics When Size-Based Category<br />

Breakpoints Overlap<br />

by Michael W. Barad<br />

When using cost-of-capital statistics in the buildup method and<br />

capital asset model, valuators must choose the appropriate size<br />

premium category. For the smallest <strong>com</strong>panies, the micro-cap,<br />

10th decile, 10a, and 10b size premia represent overlapping<br />

options from which to pick. This article helps valuators choose<br />

between overlapping size premium categories.<br />

27 P R A C T I C E M A N A G E M E N T<br />

Optimize Your Website Content<br />

by David M. Freedman<br />

How to attract clients, prospects, and referral sources to your<br />

website through social media.<br />

The Value Examiner November/December <strong>2009</strong> 3

A PROFESSIONAL DEVELOPMENT JOURNAL for the CONSULTING DISCIPLINES<br />

DEPARTMENTS<br />

20<br />

24<br />

30<br />

L I T I G A T I O N C O N S U L T I N G<br />

Court Corner<br />

by John Stockdale, Jr., Esq.<br />

Summaries and analyses of the most important<br />

cases that involve valuation issues, in both federal<br />

and state courts.<br />

FORENSIC ACCOUNTING<br />

The Fraud Files<br />

by James Martin, CMA, CIA, CFFA;<br />

Austin Marks, CPA, CFF, CFE, CFFA, CFD;<br />

and Todd Michael Jolicoeur, CFFA<br />

P R A C T I C E M A N A G E M E N T<br />

Use Active Voice to Earn Trust<br />

by David N. Wood, CPA/ABV, CVA<br />

In valuation reports, active voice is usually more<br />

persuasive than passive voice. Report Righter shows<br />

you how to change passive to active, and when to<br />

make an exception.<br />

EDITORIAL STAFF<br />

CEO & Publisher: Parnell Black<br />

Executive Editor: Doug Kirchner<br />

Senior Editor: David M. Freedman<br />

EDITORIAL BOARD<br />

Chairman: David N. Wood, CPA/ABV, CVA<br />

Elsie Enninful Adu, CVA (Ghana)<br />

D. Larry Crumbley, PhD, CPA, CrFA, CFFA<br />

Darrell D. Dorrell, CPA, MBA, CVA,<br />

ASA, CMA, DABFA, CMC<br />

Willis E. Eayrs, CVA, CM&AA (Germany)<br />

Mark G. Filler, CPA/ABV, CBA, AM, CVA<br />

Edward J. Giardina, MSA, CPA/ABV, CVA<br />

Michael Goldman, MBA, CPA, CVA, CFE<br />

Z. Christopher Mercer, ASA, CFA<br />

Odalys Lara, CPA, CVA, CFFA, CFF<br />

Neil Paschall, CPA/ABV, CVA, CFFA<br />

Keith Sellers, DBA, CPA/ABV, CVA<br />

Sandra M. Shell, CPA/ABV, CVA<br />

Edward Wandtke, CPA, CVA<br />

Susan Yi, CPA, CVA<br />

The Value Examiner ®<br />

is a publication of:<br />

National Association of Certified<br />

Valuation Analysts (<strong>NACVA</strong>)<br />

1111 Brickyard Road, Suite 200<br />

Salt Lake City, UT 84106-5401<br />

Tel: (801) 486-0600, Fax: (801) 486-7500<br />

E-mail: nacva1@nacva.<strong>com</strong><br />

ANNUAL SUBSCRIPTION<br />

United States—$195<br />

International—$235 U.S. Funds<br />

Articles are color-coded by topic for easy identification<br />

Cover photo: ©iStockphoto.<strong>com</strong>/LyaC<br />

Department photo credits:<br />

Court Corner: ©iStockphoto.<strong>com</strong>/DNY59<br />

The Fraud Files: ©iStockphoto.<strong>com</strong>/khz<br />

Use Active Voice to Earn Trust: ©iStockphoto.<strong>com</strong>/ResizeStudio<br />

Production: Mills Publishing, Inc.; President: Dan Miller; Art Director/Production Manager: Jackie Medina;<br />

Magazine Designer: Patrick Witmer; Graphic Designers: Matt Hall, Ken Magleby, Patrick Witmer; Advertising<br />

Representatives: Paula Bell, Dan Miller, Paul Nicholas, Don Nothdorft.<br />

Mills Publishing, Inc., 772 East 3300 South, Suite 200, Salt Lake City, Utah 84106, 801-467-9419. Inquiries<br />

concerning advertising should be directed to Mills Publishing, Inc. Copyright <strong>2009</strong>. For more information<br />

please visit www.millspub.<strong>com</strong>.<br />

SUBMISSION DATES<br />

Issue Submission Dates Publish Dates<br />

May/June 2010 March 1, 2010 May 1, 2010<br />

July/August 2010 May 1, 2010 July 1, 2010<br />

ALL SUBMISSIONS<br />

The Value Examiner is devoted to current, articulate,<br />

concise, and practical articles in business valuation,<br />

litigation consulting, fraud deterrence, matrimonial<br />

litigation support, mergers and acquisitions, exit<br />

planning, and building enterprise value. Articles<br />

submitted for publication should range from 500<br />

to 3,000 words. Case studies and best practices are<br />

always wel<strong>com</strong>e.<br />

SUBMISSION STANDARDS<br />

All articles should be thoroughly edited and proofread.<br />

Submit manuscript by e-mail (in standard<br />

word processing format) to David M. Freedman:<br />

davidf1@nacva.<strong>com</strong>. Include a brief biography to<br />

place at the end of the article, a color photo of the<br />

author (resolution 300 dpi). See authors’ guidelines<br />

and benefits at www.nacva.<strong>com</strong>/examiner/Publishing_Articles.pdf.<br />

The Value Examiner accepts some<br />

reprinted articles, if ac<strong>com</strong>panied by appropriate<br />

reprint permission.<br />

• Editorial . . . . . . . . . . . . . . . . . . . Gray<br />

• Valuation . . . . . . . . . . . . . . . . . . . Blue<br />

• Forensic Accounting . . . . . . . Green<br />

• Litigation Consulting . . . . . Orange<br />

• Practice Management . . . . . . . . . Red<br />

• Academic Research . . . . . . . . Purple<br />

REPRINTS<br />

Material in The Value Examiner may not be reproduced<br />

without express written permission. Article<br />

reprints are available; call <strong>NACVA</strong> at (800) 677-<br />

<strong>2009</strong> and/or visit the website: www.nacva.<strong>com</strong>.<br />

4<br />

November/December <strong>2009</strong><br />

The Value Examiner

The valuation data &<br />

research you need…<br />

In one affordable<br />

subscription package!<br />

Why choose KeyValueData<br />

Through its web-based annual subscription packages,<br />

KeyValueData offers Internet-based access to thousands of<br />

dollars in essential valuation data, research, and tools—all<br />

for a single, low annual subscription fee. KeyValueData<br />

subscribers enjoy on-demand access to:<br />

Three subscription levels<br />

to choose from!<br />

Industry-leading databases for private <strong>com</strong>pany<br />

transactions (IBA & BIZCOMPS®)<br />

Silver<br />

Gold<br />

Platinum<br />

Guideline public <strong>com</strong>pany financial data and ratios<br />

(using Morningstar data)<br />

Attorneys<br />

Database*<br />

Addressess, No<br />

Emails<br />

Addresses +<br />

Emails<br />

Addresses +<br />

Emails<br />

Private <strong>com</strong>pany financial statement benchmark data<br />

(IRS Corporate Ratios & RMA Annual Statement Studies)<br />

S-1 filings and other industry and market research<br />

Federal and state valuation case law<br />

A growing library of must-read valuation articles<br />

The industry’s leading monthly National Economic<br />

Report<br />

BIZCOMPS<br />

Guideline<br />

Company<br />

IBA Market Data<br />

7 Downloads<br />

per year<br />

7 Downloads<br />

per year<br />

3 Downloads<br />

per year<br />

Unlimited<br />

Downloads<br />

Unlimited<br />

Downloads<br />

10 Downloads<br />

Unlimited<br />

Downloads<br />

Unlimited<br />

Downloads<br />

Unlimited<br />

Downloads<br />

A weekly series of informative best-practices newsletters<br />

Access to best-in-class economic, industry, and metro<br />

area research<br />

And much, much more<br />

IRS Ratios<br />

RMA Valuation<br />

Edition<br />

Not Available<br />

Not Available<br />

Unlimited<br />

Downloads<br />

Not Available<br />

Unlimited<br />

Downloads<br />

Unlimited<br />

Downloads<br />

KeyValueData’s web-based subscription packages are<br />

available in three subscription levels, designed to deliver<br />

the right amount of data and research to support the<br />

unique needs of every practice and budget.<br />

Base<br />

Subscription † $295/year $595/year $1,195/year<br />

*<br />

All plans are limited to a cumulative download of 5,000 names per year.<br />

†<br />

Prices are subject to change. Subscription fees are nonrefundable.<br />

The Leader in Valuation Data and Research<br />

800.246.2488 | www.keyvaluedata.<strong>com</strong> | info@keyvaluedata.<strong>com</strong>

Up<strong>com</strong>ing Business<br />

Appraisal Review<br />

Accreditation Workshop<br />

Dates :<br />

November 9-12<br />

Jersey City, NJ<br />

December 7-10<br />

Atlanta, GA<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

<br />

For more information contact IBA at: 800-299-4130<br />

All images are credited to & from Flickr.<strong>com</strong> through Creative Commons and Attribution Licenses.

A PROFESSIONAL DEVELOPMENT JOURNAL for the CONSULTING DISCIPLINES<br />

F R O M T H E E D I T O R<br />

Thanks to Our Guest<br />

Peer-Reviewers<br />

Occasionally we invite valuation<br />

analysts and other<br />

professionals outside of our<br />

Editorial Board to peerreview<br />

articles that have been submitted<br />

to the Examiner for publication. In some<br />

cases, after an article has been approved<br />

pending requested revisions, a reviewer<br />

works directly with an author by phone<br />

and e-mail to improve an article. I’d like<br />

to thank the following professionals who<br />

have served as guest reviewers in the past<br />

six months or so:<br />

John E. Barrett, Jr.,<br />

MBA, CPA/ABV, CVA, CBA<br />

(Cranston, RI)<br />

Vincent Covrig, PhD, CFA<br />

(Northridge, CA)<br />

Jonathan P. Friedland, Attorney<br />

(Chicago)<br />

Gilbert E. Matthews, CFA<br />

(San Francisco)<br />

Dan McConaughy, PhD<br />

(Long Beach, CA)<br />

Susan Saidens,<br />

CPA/ABV, ASA, CVA, CFE, CFF<br />

(Exton, PA)<br />

ARE YOU LINKED IN<br />

Over 50 million people in 200 countries<br />

have profiles on LinkedIn (www.<br />

linkedin.<strong>com</strong>), the Internet’s top businessoriented<br />

networking site. Sooner or later,<br />

you will get an invitation to “connect” with<br />

a LinkedIn member, and you have to be<strong>com</strong>e<br />

a member to accept the invitation.<br />

Each member can set up a profile,<br />

invite others to connect, manage connections,<br />

conduct research, build a<br />

reputation, hunt for jobs, recruit talent,<br />

generate sales leads, find advisers<br />

and subject matter experts, participate<br />

in group discussions, and more.<br />

One of the most useful features of<br />

LinkedIn is groups. There are thousands<br />

of affinity groups within LinkedIn, organized<br />

by industry, profession, special<br />

interest, etc. Each LinkedIn member<br />

can join up to 50 affinity groups, to<br />

network, collaborate, and share information<br />

with colleagues, customers,<br />

<strong>com</strong>munity, and people who share the<br />

same interests. In fact, any member can<br />

start his or her own group, and set policies<br />

and membership criteria. To find a<br />

group you might want to join, you can<br />

search the group directory.<br />

One of the LinkedIn groups is<br />

Business Valuation Professionals, with<br />

231 members in November <strong>2009</strong>. It is<br />

managed by Lloyd Brown, MBA, AVA,<br />

of Memphis.<br />

The AICPA’s official LinkedIn group<br />

has 7,936 members. There is a group<br />

called United Against Fraud, with 1,044<br />

members who include forensic accountants,<br />

information security professionals,<br />

investigators, lawyers, law enforcement<br />

officials, and experts from related<br />

fields. The Expert Witness Network,<br />

with 487 members, hosts discussions,<br />

offers marketing advice, and lets members<br />

refer business to each other. Other<br />

groups include the Mergers & Acquisitions<br />

Network (6,567 members), American<br />

Divorce Lawyers (708 members<br />

including some valuation analysts), and<br />

so on.<br />

To benefit from LinkedIn membership,<br />

you need to spend time participating<br />

on the site. It’s an effective way<br />

to network for some professionals, a<br />

time waster for others.<br />

You don’t have to wait until you’re invited<br />

to join. You can sign up and lurk before<br />

you decide whether to get involved.<br />

I wouldn’t say that you need to join<br />

a business network like LinkedIn (there<br />

are others) to succeed. But online networking<br />

skills will serve you well in<br />

the future, even within your own <strong>com</strong>pany,<br />

as social networking technology<br />

be<strong>com</strong>es integrated into websites of all<br />

kinds. If you need help learning those<br />

skills, ask any teenager. VE<br />

David M. Freedman<br />

Senior Editor<br />

davidf1@nacva.<strong>com</strong><br />

The Value Examiner November/December <strong>2009</strong> 7

Forensic Accounting Demand Reaches New High<br />

Accounting Today’s recent survey of the top 100 accounting<br />

firms—and their plans for increasing their business—<br />

dramatically illustrates this niche opportunity: 77%<br />

of the 78 firms responding cite forensic accounting growth<br />

on their radar. Yet the accounting profession has yet to<br />

embrace—or even offer—a cogent, <strong>com</strong>prehensive<br />

forensic accounting methodology by which accountants<br />

can guide and refine their forensic accounting craft.<br />

Until now.<br />

The Consultants’ Training Institute and financialforensics ®<br />

have developed an intensive, five-day workshop that is the<br />

only program of its kind in the United States. Entitled, Forensic<br />

Accounting Academy — What Your Clients “Think” You Know about<br />

Forensic Accounting © , this timely program takes participants from<br />

concept to detail and delivers specific forensic accounting tools<br />

and techniques that are immediately applicable to virtually all<br />

aspects of the accounting profession: auditing, tax, valuation,<br />

litigation, and fraud.<br />

Here Are the Skill Sets You’ll Acquire<br />

• Training in the “Top 30” specific tools and techniques to use in forensic accounting and related assignments such as Full-and-False<br />

Inclusion, Genogram, Entity(ies) Charts, Timeline Analysis, Link Analysis, Item Listing, (Modified) Net Worth Method, Source and<br />

Use of Cash Method, Proof-of-Cash Method, Digital Analysis (e.g., Benford’s), CAGR, ANOVA, and others.<br />

• A working knowledge of proprietary forensic accounting methodology called FA/IM © . Its “process map” approach (depicted below)<br />

will be used to illustrate the application of forensic accounting tools and techniques to all aspects of professional services. The workshop<br />

applies a selectively available software-based methodology that provides specific investigative tools and techniques.<br />

Forensic Accounting/Investigation Methodology (FA/IM ) ©<br />

FOUNDATIONAL INTERPERSONAL DATA COLLECTION AND ANALYSIS TRIAL<br />

Interviews &<br />

Interrogation<br />

Surveillance<br />

(Electronic,<br />

Physical)<br />

Trial<br />

Preparation<br />

Assignment<br />

Development<br />

Scoping<br />

Data<br />

Collection<br />

Confidential<br />

Informants<br />

Laboratory<br />

Analysis<br />

Analysis of<br />

Transactions<br />

Post-<br />

Assignment<br />

Background<br />

Research<br />

Undercover<br />

Testimony &<br />

Exhibits<br />

Purpose of Stage Tasks to be Performed Potential Issues<br />

• Obtain validating data<br />

• Obtain refuting data<br />

References<br />

• Internet research, e.g. Best websites<br />

for Financial Professionals, Business<br />

Appraisers, and Accountants, 2nd<br />

• Combine first-hand knowledge (e.g. Interviews and<br />

Depositions) with second-hand knowledge (e.g.,<br />

Background Research data)<br />

• Identify disparities for additional investigation<br />

• TASKS<br />

• Establish search protocol<br />

• Collect data for validation/corroboration<br />

• Veracity of parties<br />

• Currency of information<br />

• Admissability of data<br />

Deliverables<br />

• Search log<br />

• Updated Genogram<br />

• “Events Analysis”<br />

• Output notebook<br />

<strong>2009</strong> Remaining Date/Location<br />

December 7–12—Atlanta, GA<br />

Take Away Timely Techniques You Can Use Right Now<br />

Enhance your core practice (audit, tax, et al.) as well as your part-time niche disciplines. Identify new practice areas as logical extensions of<br />

your expertise and train your staff to leverage your knowledge. Leave with actual report excerpts and trial exhibits for future applications.<br />

You’ll find descriptions of the topics covered in each day of the program online at: www.nacva.<strong>com</strong> in the Training area. Or call Member<br />

Services with questions about the program and what Accounting Today calls “this fast-growing niche”: (800) 677-<strong>2009</strong>.<br />

Consultants’ Training Institute<br />

1111 Brickyard Road, Suite 200, Salt Lake City, Utah 84106-5401<br />

Tel: (801) 486-0600 • Fax: (801) 486-7500 • Internet: www.nacva.<strong>com</strong>

A PROFESSIONAL DEVELOPMENT JOURNAL for the CONSULTING DISCIPLINES<br />

L E T T E R S T O T H E E D I T O R<br />

Greed Blamed<br />

for Economic Crisis<br />

We encourage readers to express<br />

opinions, share insights, ask questions,<br />

raise objections, and challenge the<br />

information that we publish in The<br />

Value Examiner. The advancement of<br />

the valuation profession depends on<br />

your ideas and innovations.<br />

I<br />

just read your editorial on greed<br />

(“Greed Takes the Blame,” The<br />

Value Examiner, September/<br />

October <strong>2009</strong>, page 5), and here<br />

is my take on it. Adam Smith’s invisible<br />

hand works when <strong>com</strong>petition is high,<br />

and providers of goods and services<br />

must provide quality and fair pricing<br />

in order to <strong>com</strong>pete and thrive. This,<br />

of course, reflects the economically<br />

and financially simpler time in which<br />

Smith lived.<br />

The greed-related part of our recent<br />

economic problems is due in large part<br />

to a lack of transparency, in that the<br />

investing marketplace was not properly<br />

aware of the risks being taken—it was<br />

the morphing of behemoth organizations<br />

(“too big to fail”) and snake-oil salesmen.<br />

This, coupled with inadequate<br />

regulation that would have helped<br />

protect and inform the public, allowed<br />

greed to run unchecked. Greed is OK,<br />

but unchecked greed is not. Such<br />

examples are all over our economic<br />

history, such as with railroads in the<br />

mid-1800s, for example.<br />

Russell T. Glazer,<br />

MBA, CPA/ABV, CVA<br />

Woodbury, New York<br />

The greed-related part of our recent economic<br />

problems is due in large part to a lack of<br />

transparency, in that the investing marketplace<br />

was not properly aware of the risks being taken…<br />

Editor’s note: We also received the<br />

following letter from a reader who wishes<br />

to remain anonymous because the subject<br />

is “too politically charged.”<br />

I read your editorial about greed and<br />

couldn’t agree with you more. If you<br />

have not already checked it out, I<br />

would re<strong>com</strong>mend Meltdown, by<br />

Thomas E. Woods Jr., a long-standing<br />

follower of the Austrian School of<br />

economics. The book gives a solid<br />

account of the financial collapse of<br />

the past couple of years.<br />

In Meltdown (Regnery Press, <strong>2009</strong>),<br />

Woods offers a free-market, smallgovernment<br />

view, blaming the U.S. Federal<br />

Reserve System for the worldwide financial<br />

crisis of 2008–09. He argues that the only<br />

way to rebuild our economy is by returning<br />

to the “fundamentals of capitalism” and<br />

letting the free market work.<br />

For balance, try The Keynes Solution:<br />

The Path to Global Economic Prosperity,<br />

by Paul Davidson (Palgrave Macmillan,<br />

<strong>2009</strong>). Keynes advocated for an<br />

interventionist government role in the<br />

market economy, in cooperation with<br />

private initiative, to mitigate the adverse<br />

effects of recessions, depressions, and<br />

booms—a view that influenced FDR’s<br />

new deal policies. VE<br />

The Value Examiner November/December <strong>2009</strong> 9

A PROFESSIONAL DEVELOPMENT JOURNAL for the CONSULTING DISCIPLINES<br />

V A L U A T I O N<br />

The Capex Adjustment<br />

by John F. Coffey, MAS, CPA/ABV, CVA, CFF, PFS<br />

I<br />

was recently hired by one of the<br />

spouses to prepare a valuation for<br />

purposes of divorce. The other<br />

spouse also hired an experienced<br />

CVA. Both valuators selected the<br />

capitalization of after-tax cash flows<br />

method. I assumed we would <strong>com</strong>e to<br />

similar conclusions, given the same set<br />

of facts. When the reports were issued,<br />

however, my valuation was nearly<br />

double that of the other.<br />

When I drilled down in the two<br />

reports, I found that one of the largest<br />

differences was the assumption of<br />

necessary future capital expenditures<br />

(capex). The case went to trial, and the<br />

capex adjustment was hotly debated.<br />

In preparing for trial, I searched at great<br />

length for literature on normalizing capex.<br />

I found that little had been published on<br />

the topic, and I spent considerable time<br />

generating trial exhibits to explain the<br />

concept for the court. This article is the<br />

fruit of those efforts.<br />

In applying the capitalization of<br />

earnings method, valuators are typically<br />

taught to normalize the last five years<br />

of historical financial statements. The<br />

intent is to determine the <strong>com</strong>pany’s<br />

expected future cash flows into<br />

perpetuity. As part of the normalization<br />

process, it is necessary to estimate cash<br />

flows required to continue funding<br />

capex. After all, this cash is not available<br />

to shareholders.<br />

A proper normalization of capex will<br />

happen in two steps. 1 First, depreciation<br />

is added back to net in<strong>com</strong>e, because<br />

depreciation is an expense that does not<br />

use cash. Second, capex is subtracted<br />

from net in<strong>com</strong>e, because capex is a<br />

use of cash that does not affect in<strong>com</strong>e<br />

until the assets are depreciated.<br />

As an illustration, let’s start with a<br />

simple example based on the facts in<br />

Table 1, below.<br />

The two-step process to normalize<br />

capex is illustrated in Exhibit A.<br />

In this example, capex (Step 2) was<br />

determined by reference to historical<br />

book depreciation (Step 1). But will<br />

historical book depreciation always<br />

equal estimated future capex Stated<br />

differently, is historical depreciation<br />

always an appropriate proxy for capex<br />

This was the issue to be debated at my<br />

recent trial.<br />

Which came first, the chicken or<br />

the egg I cannot answer that age-old<br />

question, but I can tell you that capital<br />

expenditures always <strong>com</strong>e before<br />

depreciation. A <strong>com</strong>pany cannot<br />

expense depreciation on an asset it has<br />

not acquired. Thus, future depreciation<br />

into perpetuity can only <strong>com</strong>e from<br />

future capex. It is an error to capitalize<br />

cash flows into perpetuity where<br />

depreciation exceeds capex, because<br />

that is impossible. 2<br />

With that in mind, it is important<br />

to understand that depreciation should<br />

be adjusted to capex. To do the reverse<br />

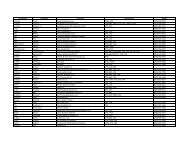

TABLE 1<br />

Five-year average pretax net in<strong>com</strong>e $1,500,000<br />

Five-year average book depr/amort $1,000,000<br />

Federal in<strong>com</strong>e tax rate 30%<br />

State in<strong>com</strong>e tax rate 5%<br />

EXHIBIT A<br />

Pretax Net In<strong>com</strong>e $1,500,000<br />

State In<strong>com</strong>e Tax $(75,000)<br />

In<strong>com</strong>e Before Federal Tax $1,425,000<br />

Federal In<strong>com</strong>e Tax $(427,500)<br />

Subtotal $997,500<br />

Step 1: Add Depr/Amort $1,000,000<br />

Step 2: Subtract Capex ($1,000,000)<br />

Cash Flow to be Capitalized $997,500<br />

10<br />

1 James R. Hitchner, Financial Valuation Applications and Models, 2 nd Edition, Wiley & Sons, New Jersey, 2006, pg. 1288.<br />

2 Ibid., pg. 118.<br />

November/December <strong>2009</strong><br />

The Value Examiner

A PROFESSIONAL DEVELOPMENT JOURNAL for the CONSULTING DISCIPLINES<br />

will distort the capitalized cash flow and<br />

ultimately distort the value conclusion.<br />

Into perpetuity, depreciation expense will<br />

equal the cash needed to purchase capital<br />

assets, absent growth and inflation. The<br />

goal is to first determine the level of<br />

ongoing capex required to sustain the<br />

existing level of cash flows, and then<br />

adjust depreciation accordingly.<br />

Furthermore, is it proper to presume<br />

that the historical assemblage of assets<br />

is required to produce the same level of<br />

cash flows into perpetuity Five years is<br />

clearly not perpetuity, and most valuators<br />

have encountered circumstances where<br />

book depreciation exceeds capital<br />

expenditures over a five-year period.<br />

The following are a few examples of how<br />

this can happen:<br />

• Accelerated depreciation methods<br />

(e.g., the IRC Section 179 election)<br />

• Failure to consider salvage values<br />

• Depreciation on a building<br />

(or other long-lived asset)<br />

• Purchased goodwill<br />

(or other in-tangibles)<br />

• Discontinued operations<br />

• Non-operating assets<br />

Therefore, before accepting historical<br />

depreciation as a proxy for estimated future<br />

capital expenditures, it is imperative<br />

for the valuator to understand the <strong>com</strong>pany’s<br />

future capex needs. Some factors<br />

that can influence future<br />

capex include the EXHIBIT B<br />

<strong>com</strong>pany’s business<br />

plan and depreciation<br />

policy, the nature<br />

of the industry, and<br />

technology advances.<br />

can impact future capex. For example,<br />

adding or discontinuing a product line<br />

will likely precede fixed asset additions<br />

and/or disposals. Certain assets may not<br />

be replaced, and new assets not yet existing<br />

at the <strong>com</strong>pany may be required. Accordingly,<br />

the valuator should understand<br />

the <strong>com</strong>pany’s business plan because the<br />

historical assemblage of assets is not always<br />

indicative of future capex needs.<br />

DEPRECIATION POLICY<br />

The depreciation policy must be<br />

reviewed when assessing future capex<br />

needs. Circumstances that may require<br />

adjustment include:<br />

• Assets are not depreciated over<br />

estimated useful lives.<br />

• Salvage values have not been<br />

considered.<br />

• Obsolete and/or nonoperating assets<br />

have been depreciated.<br />

NATURE OF INDUSTRY<br />

Some industries are capitalintensive<br />

(i.e., more capital resources<br />

are consumed as opposed to labor in<br />

the production of goods). Automobile<br />

manufacturing, chemical, and oil<br />

refinery are some examples. When the<br />

subject <strong>com</strong>pany operates in a capitalintensive<br />

industry, greater emphasis<br />

should be placed on forecasted capex. In<br />

addition, it is important to understand<br />

the nature of the industry, as replacement<br />

needs can vary. For example, utility<br />

<strong>com</strong>panies are generally characterized<br />

as having high initial capex and low<br />

asset turnover. In contrast, software<br />

research and development <strong>com</strong>panies<br />

tend to have lower initial capex and<br />

higher asset turnover.<br />

TECHNOLOGY ADVANCES<br />

Innovations in technology often<br />

impact the future capital requirements<br />

of a particular industry. New technology<br />

can create the need to retool immediately<br />

and can even render an entire industry<br />

obsolete. For example, the digital age<br />

has dramatically changed both the<br />

film processing and analog television<br />

industries. Equipment prices are also<br />

influenced by new technology. Hightech<br />

medical equipment prices generally<br />

increase with improved technology, for<br />

example, while the cost of better cell<br />

phones and <strong>com</strong>puters has dropped.<br />

Continuing with our example, a<br />

detailed review of the fixed assets<br />

revealed the following information:<br />

• Over the last five years, the <strong>com</strong>pany<br />

purchased and immediately expensed<br />

$50,000 of equipment in year<br />

1 and $20,000 of equipment in year<br />

4. Both pieces of equipment have an<br />

estimated useful life of 10 years with no<br />

salvage value. As shown in Exhibit B,<br />

Year 1 2 3 4 5 Totals<br />

Purchase 1 $50,000 $50,000<br />

Purchase 2 $20,000 $20,000<br />

Total Cash Flow $50,000 $20,000 $70,000<br />

BUSINESS<br />

PLAN<br />

Changes in the<br />

<strong>com</strong>pany’s underlying<br />

business model<br />

Historical Depreciation $50,000 $20,000 $70,000<br />

Estimated Life Depreciation $5,000 $5,000 $5,000 $7,000 $7,000 $29,000<br />

Excess Depreciation $45,000 $(5,000) $(5,000) $13,000 $(7,000) $41,000<br />

The Value Examiner November/December <strong>2009</strong> 11

A PROFESSIONAL DEVELOPMENT JOURNAL for the CONSULTING DISCIPLINES<br />

depreciation per books was $70,000<br />

over the five-year historical period,<br />

but the useful life depreciation was<br />

only $29,000. The average excess<br />

depreciation on this equipment over<br />

the last five years was $8,200 per year<br />

($41,000 ÷ 5 years).<br />

• The <strong>com</strong>pany purchased a building<br />

eight years ago for $2,500,000. The<br />

building is expected to last for 40 years<br />

with a salvage value of $1,000,000. It is<br />

being depreciated on the books over 25<br />

years on a straight-line basis without<br />

regard to salvage value. For each of<br />

the last five years, the annual book<br />

depreciation was $100,000 per year<br />

($2,500 ÷ 25 years), and the useful life<br />

depreciation was $37,500 ([$2,500,000<br />

– 1,000,000] ÷ 40 years). The excess<br />

depreciation expense in each of the<br />

last five years was therefore $62,500.<br />

• The <strong>com</strong>pany <strong>com</strong>menced operations<br />

10 years ago under an asset purchase<br />

where goodwill of $750,000 was<br />

acquired. Amortization has been<br />

taken over 15 years on a straight-line<br />

basis. Amortization for each of the<br />

last five years was $50,000 per year<br />

($750,000 ÷ 15 years). The <strong>com</strong>pany is<br />

not expected to make such a purchase<br />

in future years.<br />

• In year 3, the <strong>com</strong>pany discontinued a<br />

product line. A portion of the related<br />

equipment was sold in the same year.<br />

The average impact on historical<br />

depreciation for the last five years<br />

from this equipment was $16,000<br />

per year.<br />

• Some of the assets in the discontinued<br />

product line were obsolete and could<br />

not be sold. However, the <strong>com</strong>pany<br />

continued to record depreciation<br />

expense of $4,800 in each of the last<br />

five years.<br />

• All other fixed assets are used in<br />

production of cash flow, will be replaced<br />

when exhausted, and have been<br />

depreciated over estimated useful lives.<br />

Salvage values have been considered.<br />

Thus, historical depreciation is<br />

representative of future depreciation<br />

for these remaining assets.<br />

The valuator can now estimate future<br />

capex needs as outlined in Exhibit C.<br />

Based on this new information, the<br />

two-step process for normalizing capex<br />

is illustrated in Exhibit D.<br />

Cash flow in Exhibit D exceeds cash<br />

flow in Exhibit A by the after-tax capex<br />

adjustment. In this example, a failure to<br />

understand the fixed asset detail would<br />

result in understating the worth of this<br />

<strong>com</strong>pany by overstating capex.<br />

GROWTH AND INFLATION<br />

Until now, we have not considered<br />

the impact of growth and inflation.<br />

Absent growth and inflation, it is<br />

reasonable to assume that depreciation<br />

will equal capex into perpetuity, because<br />

current depreciation is based on past<br />

capex. However, when the <strong>com</strong>pany<br />

is growing and subject to inflation, it<br />

is natural to assume that future capex<br />

will outpace past capex (i.e., current<br />

depreciation). There are varying<br />

opinions as to whether this difference<br />

is material to the conclusion of value.<br />

According to James R. Hitchner,<br />

“Many valuation analysts will normalize<br />

depreciation and capital expenditures by<br />

making them equal. This equalization<br />

process is a simplifying assumption,<br />

EXHIBIT C<br />

Historical Depr/Amort $1,000,000<br />

Expensed Equipment $(8,200)<br />

Excess Building Depreciation $(62,500)<br />

Goodwill Amortization $(50,000)<br />

Discontinued Operations $(16,000)<br />

Non-operating Assets ($4,800)<br />

Capex Adjustment $(141,500)<br />

Estimated Future Capex $858,500<br />

EXHIBIT D<br />

Pretax Net In<strong>com</strong>e $1,500,000<br />

Capex Adjustment $141,500<br />

Adjusted Pretax Net In<strong>com</strong>e $1,641,500)<br />

State In<strong>com</strong>e Tax $(82,075)<br />

In<strong>com</strong>e Before Federal Tax $1,559,425<br />

Federal In<strong>com</strong>e Tax $(467,828)<br />

Subtotal $1,091,597<br />

Step 1: Add Depr/Amort (Adjusted) $858,500<br />

Step 2: Subtract Capex $858,500<br />

Cash Flow to be Capitalized $1,091,597<br />

12<br />

November/December <strong>2009</strong><br />

The Value Examiner

A PROFESSIONAL DEVELOPMENT JOURNAL for the CONSULTING DISCIPLINES<br />

since capital expenditures will slightly<br />

exceed depreciation due to inflationary<br />

pressure in a stable business. However,<br />

this simplification usually, but not always,<br />

has a nominal effect on the value.” 3<br />

In contrast, Gilbert E. Matthews<br />

advocates <strong>com</strong>puting capex in excess<br />

of depreciation based on asset life,<br />

depreciation method, and assumed rate<br />

of growth. In a 2002 article appearing<br />

in Shannon Pratt’s Business Valuation<br />

Update, Matthews illustrates how capex<br />

exceeds depreciation by 15.5 percent<br />

based on a 10-year, straight-line, 3 percent<br />

growth rate assumption. Matthews<br />

states, “Many valuation reports overstate<br />

depreciation in growth models, and<br />

thus, overestimate free cash flow.” 4 He<br />

[<br />

PRESENTATION<br />

attributes this material error to nonrecognition<br />

of the impact of growth and<br />

inflation on capex.<br />

FUTURE CAPEX REQUIREMENTS<br />

To properly normalize capex, it is<br />

critical for the valuator to first make<br />

an appropriate determination of future<br />

capex requirements. This includes an<br />

understanding of the business plan,<br />

depreciation policy, nature of the<br />

industry, and impact of technology.<br />

Depreciation is then adjusted based on<br />

projected capex. Finally, the valuator<br />

should determine whether to increase<br />

capex to account for the impact of<br />

growth and inflation.<br />

Next time you are faced with this<br />

issue, your client will be grateful when<br />

you clearly explain the appropriate way<br />

to <strong>com</strong>pute the capex adjustment. VE<br />

John F. Coffey, MAS,<br />

CPA/ABV, PFS, CVA,<br />

CFF, is the principal at<br />

Coffey & Associates, PC<br />

(www.coffeypc.<strong>com</strong>).<br />

Specializing in litigation<br />

support for divorce<br />

proceedings, he has been<br />

retained as an expert and has testified<br />

at trial or depositions in valuation cases<br />

in Illinois.<br />

3 Ibid., pg. 1288.<br />

4 Gilbert E. Matthews, “Capex = Depreciation is Unrealistic Assumption for Most Terminal Values,” Shannon Pratt’s Business Valuation Update, March 200, pg. 3.<br />

In Business Valuation,<br />

It Pays To Speak Well.<br />

Build your practice with training from the country’s leading<br />

business <strong>com</strong>munication specialists.<br />

& COMMUNICATION TRAINING<br />

At Eloqui, we believe nothing is more important to your business growth than<br />

<strong>com</strong>municating your message with clarity, impact, confidence, and authenticity.<br />

That’s why our training is customized for each individual or team. We identify your<br />

strengths and give you the specific tools to persuade your audience or client—<br />

whether you’re speaking to one person or thousands!<br />

CUSTOMIZED TRAINING FOR:<br />

■ Business Development<br />

■ Testimony & Litigation Support<br />

■ Presenting to Boards of Directors ■ Leadership Development<br />

■ Keynote Speaking, including PowerPoint<br />

“I have been a professional speaker and educator for more than 30 years. Deborah Shames and David Booth of Eloqui have<br />

enabled my presentations to evolve from merely well received to outstanding.”Michael G. Kaplan, CPA, CVA, CFFA<br />

4723 Barcelona Court, Calabasas, CA 91302<br />

PH 818.225.7991 • www.eloqui.biz

Available at reduced price<br />

Additional Support Publication for <strong>NACVA</strong> Members<br />

To further support its Certified Forensic Financial Analysts (CFFAs), as well as its financial forensics practitioners<br />

and litigation consultants, <strong>NACVA</strong> now offers the National Litigation Consultants’ Review (NLCR). The oldest<br />

and most highly regarded publication for financial forensics and expert witness professionals, the NLCR brings<br />

practitioners the most informed opinion, current news analysis, and insightful <strong>com</strong>mentary on financial forensic<br />

issues each month—now electronically at a reduced price (free to CFFAs).<br />

Indispensible for Consulting and Testifying Financial Experts<br />

Now published by the Litigation Forensics Board of <strong>NACVA</strong>, the NLCR contains information each month that could well<br />

be crucial in the courtroom.<br />

• The NLCR articles apply concepts to the litigation arena, as opposed to just explaining and discussing the concepts<br />

• NLCR is the singular publication that deals primarily with the knowledge needs of consulting and testifying<br />

financial experts, not as an afterthought<br />

• The NLCR covers practice management as well as the “technical” aspects of litigation<br />

• The NLCR is expanding to include articles by the users of financial forensic services (judges and lawyers receive the<br />

publication free of charge)<br />

Depth of Practical Experience<br />

The NLCR Editorial Board/authors represent the pinnacle of the profession in terms of relevant training and experience. Under the<br />

leadership of Managing Editor, P. Dermot O’Neil, CPA/ABV, CVA, CFFA, the Board includes Darrell Dorrell, CPA/ABV, MBA,<br />

ASA, CVA, CMA, DABFA, CMC; Paul French, CPA/ABV, CVA, CFE, BVAL, CFFA, CDFA, CPIM, CFD, FCPA, CM&AA,<br />

CMEA, CrFA; Michael Kaplan, CPA/ABV, CVA, CFFA; John Markel, CPA/ABV, ASA; Gregory Marsh, CPA/ABV, ASA; Lari<br />

Masten, MSA, CPA/ABV, CVA; Steve Scherf, CPA/ABV, CVA, CFE, CrFA; Rebekah Smith, CPA, CVA, CFFA; Paul Zikmund,<br />

MAcc, MBA, CFE, CFD, CFFA; Howard Zandman, CPA/CFF, CFFA; and Ricardo (Ric) Zayas, CPA, CVA. Indicative of their<br />

<strong>com</strong>mitment to the discipline, the NLCR authors are available to subscribers for clarification or discussion.<br />

Special Offer<br />

Register for any CFFA credential training program (Litigation Bootcamp for Financial Experts, Forensic Accounting<br />

Academy, Business and Intellectual Property Damages Workshop, Business Fraud—Deterrence, Detection, and<br />

Investigation Training Center, or Matrimonial Litigation Support Workshop), or financial forensics/litigation consulting<br />

live course or webinar offered by the Consultants’ Training Institute and receive a <strong>com</strong>plimentary one-year<br />

subscription to NLCR (retail value: $195).<br />

To subscribe or register for a course, contact<br />

<strong>NACVA</strong>’s director of Member Services:<br />

nacva1@nacva.<strong>com</strong> or call (800) 677-<strong>2009</strong>.<br />

With editorial submission questions, contact<br />

P. Dermot O’Neill, CPA/ABV, CVA, CFFA,<br />

managing editor: doneill@amper.<strong>com</strong>.<br />

c/o National Association of Certified<br />

Valuation Analysts<br />

1111 Brickyard Road, Suite 200<br />

Salt Lake City, Utah 84106-5401<br />

Tel: (801) 486-0600 ▪ Fax: (801) 486-7500<br />

Internet: www.nacva.<strong>com</strong>

A PROFESSIONAL DEVELOPMENT JOURNAL for the CONSULTING DISCIPLINES<br />

V A L U A T I O N<br />

Size Matters:<br />

How to Apply Size Premium Metrics When<br />

Size-Based Category Breakpoints Overlap<br />

by Michael W. Barad<br />

have been involved with the Ibbotson<br />

yearbooks in a variety of capacities<br />

since 2000, and one constant is that<br />

I continue to get asked for guidance<br />

on how to use the size premium published<br />

in the Ibbotson SBBI Valuation Yearbook.<br />

Morningstar publishes a <strong>com</strong>prehensive<br />

range of cost of capital statistics for use in<br />

the buildup method and capital asset pricing<br />

model (CAPM), so that valuators can<br />

use their own expertise in choosing the<br />

right measures of risk premia, date ranges,<br />

and other adjustments to their model. That<br />

said, a little guidance never hurt, right<br />

For all of you who have been spending<br />

long nights toiling over the decision<br />

to choose micro-cap, 10th decile, 10a,<br />

or 10b size premia, this article is for you<br />

(that, and some sleep). I would also like<br />

to address the folks who have shut down<br />

their capacity to choose between a menu<br />

of overlapping data options, preferring<br />

to be told by publishers like Morningstar<br />

exactly how they should be constructing<br />

their valuation models. The profession of<br />

business valuation is both art and science.<br />

Accumulated expertise is what balances<br />

the art and science. Ayn Rand said man’s<br />

most important attribute is “his reasoning<br />

mind.” This article is about applying<br />

our reasoning minds in constructing our<br />

valuation models.<br />

The application of different size premia<br />

is widely debated and often contested in<br />

litigation. I will outline a process for helping<br />

valuation professionals choose between<br />

overlapping size premium categories.<br />

SIZE PREMIA<br />

I think Morningstar (and previously<br />

Ibbotson Associates) has been clear that<br />

our beta-adjusted size premia are intended<br />

for use in either the buildup or CAPM<br />

models. The beta-adjusted size premium<br />

calculation is our purest methodology<br />

for isolating firm return that is solely due<br />

to size. In other words, we are measuring<br />

the return that is attributable to firm<br />

size which cannot be explained by other<br />

systematic factors. This is far superior to<br />

the simple “small stock premium,” which<br />

simply measures the excess return of small<br />

stocks over large stocks. 1<br />

Morningstar believes that our size<br />

premium methodology is an elegant extension<br />

of the CAPM because it allows<br />

us to treat other risk factors that would<br />

influence a firm’s cost of equity in other<br />

parts of the model without concern for<br />

double-counting them. Another such<br />

risk factor is industry risk, which can be<br />

addressed for a buildup method in the<br />

form of a published industry premium<br />

from Morningstar or in an artful application<br />

by the practitioner. For a CAPM,<br />

the industry risk can be addressed in one<br />

of the following ways:<br />

1. Use a peer group/industry Beta from<br />

Morningstar Cost of Capital Yearbook,<br />

ValuSource, and Value Line.<br />

2. Combine individual <strong>com</strong>pany Betas<br />

from any number of sources (including<br />

Bloomberg, S&P Compustat, Value<br />

Line, Morningstar.<strong>com</strong>, and Yahoo!<br />

Finance).<br />

3. Manually <strong>com</strong>bine peer firm returns<br />

into a blended index that is regressed<br />

against a market benchmark.<br />

While we are only addressing size adjustments<br />

in this article, a proper cost of<br />

capital estimate requires as much attention<br />

on the equity risk premium, riskless<br />

rate, industry adjustment, and <strong>com</strong>panyspecific<br />

factors. Whether we are talking<br />

about size premium or other <strong>com</strong>ponent<br />

parts to the cost of capital, the metrics<br />

that are the cleanest to apply are ones<br />

that measure only what they are intended<br />

to, and pose as little risk of double-counting<br />

other factors as possible.<br />

OVERLAPPING CATEGORIES<br />

The meat and potatoes of this article<br />

is a discussion of how to use the various<br />

1 See the Ibbotson SBBI Valuation Yearbook for a <strong>com</strong>plete analysis and <strong>com</strong>parison (http://corporate.morningstar.<strong>com</strong>/ib/asp/subject.aspxxmlfile=1415.xml).<br />

The Value Examiner November/December <strong>2009</strong> 15

A PROFESSIONAL DEVELOPMENT JOURNAL for the CONSULTING DISCIPLINES<br />

TABLE 1: SIZE PREMIUM CHOICES FOR SMALL FIRM VALUATION<br />

Decile Market Cap of Smallest Market Cap of Largest Size Premium<br />

(size category) Company (in millions) Company (in millions) (return in excess of CAPM)<br />

Micro-Cap, 9–10 $1.575 $453.254 3.74%<br />

10 $1.575 $218.533 5.81%<br />

10a $136.599 $218.533 4.11%<br />

10b $1.575 $136.500 9.53%<br />

size premium metrics that Morningstar<br />

provides when size-based category<br />

breakpoints overlap. For example, we<br />

have the choices for a small firm valuation<br />

shown in Table 1.<br />

What to do with all those choices If<br />

I have a small firm with an estimated equity<br />

value of $120 million, I could choose<br />

among the micro-cap, 10th decile, or<br />

10b category for my size premium. The<br />

range of size premium for this one firm<br />

would be between 3.74 and 9.53 percent.<br />

This range would have a tremendous effect<br />

on the firm’s enterprise value.<br />

There are two decision paths I see<br />

folks take when making this choice. The<br />

dark and scary path is where practitioners<br />

choose the size premium that achieves<br />

the self-serving goal of influencing the<br />

enterprise value in the direction most<br />

desired. In many cases this leads them to<br />

choose the highest size premium number<br />

(9.53 percent in the data above),<br />

because this will lead to the lowest enterprise<br />

value for tax purposes, marital<br />

dissolution, acquisition valuation, etc.<br />

The path of enlightenment, on the other<br />

hand, is when practitioners choose the<br />

size premium that is most statistically<br />

relevant for their application.<br />

PATH OF ENLIGHTENMENT<br />

There are two primary factors in determining<br />

which size premium to use.<br />

First, identify how close to a size category<br />

boundary your subject <strong>com</strong>pany<br />

falls. Second, determine how confident<br />

you are in your estimate of equity value.<br />

With this information, you can make the<br />

right choice. That’s all there is to it.<br />

Not following yet Let’s take it a step<br />

further. In the example above, where we<br />

have a firm estimated at $120 million of<br />

equity, this is close to the top breakpoint<br />

of the 10b category, toward the middle<br />

of the 10th decile, and toward the bottom<br />

of the micro-cap. There are always<br />

going to be more <strong>com</strong>panies included in<br />

the micro-cap than in the 10th decile,<br />

and more <strong>com</strong>panies in the 10th decile<br />

than in the 10b category. More <strong>com</strong>panies<br />

are usually better, since that means<br />

more statistical significance in the data.<br />

However, once we get to a large enough<br />

number of <strong>com</strong>panies, more data doesn’t<br />

necessarily add much significance. The<br />

10th decile was as small as 49 <strong>com</strong>panies,<br />

back in March of 1926. This is still<br />

# of Companies<br />

2,500<br />

2,000<br />

1,500<br />

1,000<br />

500<br />

significant. While Morningstar doesn’t<br />

publish the split between historical<br />

number of <strong>com</strong>panies in 10a and 10b,<br />

it is fair to say that it is approximately<br />

half of what it was back in the 1920s<br />

(since our breakpoint definition <strong>com</strong>es<br />

from the Center for Research in Security<br />

Prices at the University of Chicago’s<br />

Graduate School of Business, which<br />

would have used only NYSE stocks to<br />

split back in the 1920s).<br />

Are 25 <strong>com</strong>panies too few I might<br />

be concerned if we were only using data<br />

from the 1920s, but after that it really<br />

picks up and we add a tremendous<br />

amount of firm data to even the smallest<br />

breakpoint we publish. 2<br />

Since the number of <strong>com</strong>panies in the<br />

data set is not a determining factor, we<br />

should pick the most “conservative” category<br />

that has the most “relevance” for<br />

GRAPH 1: SIZE PREMIA CATEGORIZATION<br />

10b<br />

10<br />

10a<br />

Micro-Cap<br />

$0 $50 $100 $150 $200 $250 $300 $350 $400 $450 $500<br />

Market Value of Equity ($mil)<br />

9<br />

16<br />

2 See Table 7–8 of the <strong>2009</strong> Ibbotson SBBI Valuation Yearbook.<br />

November/December <strong>2009</strong><br />

The Value Examiner

Announcing the <strong>NACVA</strong>/IBA<br />

2010 Annual<br />

Consultants’ Conference<br />

June 2–5, 2010<br />

Fontainebleau Miami Beach<br />

Miami, FL<br />

*<br />

Save the dates!<br />

Attention Sole Practitioners &<br />

Small Valuation Shops<br />

Ever wanted “a second set of eyes” to review your<br />

valuation/damage report before it’s issued<br />

Within a reasonable time frame<br />

At a reasonable cost<br />

Burkert Valuation Advisors now offers this service.<br />

Cost is $300-$500 based on report length/<strong>com</strong>plexity.<br />

Turnaround guaranteed in 1-3 business days.<br />

Email rod.burkert@burkertvaluation.<strong>com</strong> for details.<br />

Rod Burkert, CPA/ABV, CVA was a member of and a lead<br />

instructor for <strong>NACVA</strong>’s Training Development Team for 10<br />

years. Rod is a past chairman of <strong>NACVA</strong>’s Executive Advisory<br />

and Education Boards. He received many <strong>NACVA</strong> instructor<br />

awards, including the Circle of Light and Instructor of the Year,<br />

and is one of <strong>NACVA</strong>’s Outstanding Members.

A PROFESSIONAL DEVELOPMENT JOURNAL for the CONSULTING DISCIPLINES<br />

our subject firm. In this case, it is clearly<br />

the 10th decile. We need to balance the<br />

confidence that our subject firm actually<br />

falls within a particular size category<br />

with the need to tailor that size grouping<br />

as tightly as possible to make the peers<br />

relevant to our analysis. The micro-cap<br />

category is too broad for this case, since<br />

our $120 million subject firm would fall<br />

in the lower range of the category; and<br />

the 10b is too narrow, since our subject<br />

<strong>com</strong>pany would barely squeeze in<br />

under the top breakpoint before sliding<br />

into 10a. We can say with confidence<br />

that the 10th decile puts our $120 million<br />

<strong>com</strong>pany among the most peers of<br />

similar size.<br />

Graph 1 (page 16) shows each size premium<br />

category. The peak of each premium<br />

is the number of <strong>com</strong>panies in the category,<br />

and the range spreads down from the<br />

peak to the x-axis where the outer limits<br />

are the market value breakpoints for the<br />

category. For example, 10b (the smallest<br />

category) has 1,182 <strong>com</strong>panies ranging<br />

from approximately $2 to $136 million<br />

in market value. This is a conceptual illustration<br />

that shows how practitioners<br />

can think about assigning a size category<br />

to their subject <strong>com</strong>pany. In our $120<br />

million example, it is clear that we can<br />

squeeze into the upper end of 10b (along<br />

the x-axis), but decile 10 is much more relevant<br />

because its midpoint between upper<br />

and lower bounds hovers around the low<br />

$100 million range. Focusing as close to<br />

the center of the size grouping as possible<br />

suggests that your subject <strong>com</strong>pany falls<br />

nicely within the range of peers that make<br />

up its size premium estimate.<br />

Now let’s examine the issue of confidence<br />

in our estimate of equity value.<br />

Where did that $120 million estimate<br />

<strong>com</strong>e from, anyway Some practitioners<br />

make their initial estimate of equity value<br />

based on fundamentals, past transactions,<br />

or market <strong>com</strong>parables. The truth is that<br />

equity value is what we are trying to solve<br />

for, not what we start with. In the example<br />

above, let’s say we started with a price/earnings<br />

ratio of 20 from the subject <strong>com</strong>pany’s<br />

peer group (from the Morningstar Cost of<br />

Capital Yearbook) and <strong>com</strong>bined that with<br />

the subject <strong>com</strong>pany’s $6 million in earnings,<br />

to arrive at a $120 million estimate of<br />

“price,” or equity value:<br />

Price subject <strong>com</strong>pany/$6 million = 20<br />

Price = 20 x $6 million<br />

Price = $120 million<br />

That’s great, but it is only one measure,<br />

and it is based on public <strong>com</strong>panies,<br />

which my hypothetical subject <strong>com</strong>pany<br />

is not. Therefore, I am not that confident<br />

in my $120 million estimate, and<br />

I shouldn’t contend that my estimate is<br />

precise when I apply it to the size premium<br />

breakpoints. In other words, my firm<br />

could just as easily be worth $140 million<br />

as it is $120 million, which would bump<br />

it out of the 10b size category into 10a.<br />

This is a big reason why the 10th decile is<br />

the best category, and how “confidence”<br />

in bucketing plays a role in choosing the<br />

appropriate size premium.<br />

Of course we shouldn’t just use one<br />

approximation of equity value to bucket<br />

into a size category. The more <strong>com</strong>parables<br />

and fundamentals you can use, the<br />

better. Then you should have a scattering<br />

of equity estimates. Let’s say we followed<br />

this exercise and found that our estimates<br />

for a firm’s equity value were $60 million,<br />

$120 million, and $180 million. The average<br />

is $120 million, but as you can see<br />

once again, the 10th decile, which ranges<br />

from around $2 million to $218 million,<br />

is still the best choice to provide relevant<br />

peer <strong>com</strong>panies of similar size.<br />

DEFINITIONS OF SIZE<br />

All of this suggests the question: Is<br />

“price” (or market capitalization) the<br />

best measure of size for determining size<br />

premium Ask yourself this: How big is<br />

a <strong>com</strong>pany If I told you that a firm had<br />

net in<strong>com</strong>e of $15 million, would that inform<br />

you as to its size What if I told you<br />

that a firm had 25 employees, is that clear<br />

enough Net in<strong>com</strong>e doesn’t help because<br />

<strong>com</strong>panies of all sizes produce a wide range<br />

of in<strong>com</strong>e. A firm like Yahoo has a market<br />

cap of more than $23 billion, yet it had net<br />

in<strong>com</strong>e of only $15 million. When Citigroup<br />

or Time Warner have negative net<br />

in<strong>com</strong>e, they shouldn’t then be classified as<br />

small <strong>com</strong>panies. The advertising agency<br />

Bark Group has only 25 employees, but its<br />

market capitalization of equity is over $21<br />

billion. There may be statistical relationships<br />

between a wide range of factors and<br />

firm size, but market capitalization is still<br />

the most relevant.<br />

Even with market capitalization representing<br />

the most relevant measure of<br />

size, we still must acknowledge the bias<br />

introduced in first having to estimate<br />

size in order to establish a size premium<br />

category, ultimately resulting in a<br />

firm value that defines “size.” The logic<br />

is circular. For those of you interested<br />

in factors other than market capitalization,<br />

the Duff & Phelps Risk Premium<br />

Report (D&P Report) provides<br />

seven alternative measures of size. The<br />

D&P Report also provides regression<br />

statistics for people who choose to<br />

extrapolate the findings to <strong>com</strong>panies<br />

significantly smaller than the smallest<br />

size grouping presented.<br />

THE IMPACT OF DISTRESS<br />

To date, the D&P Report has been the<br />

primary source for size-based risk premium<br />

data that segregates financially distressed<br />

<strong>com</strong>panies into a separate bucket, leaving<br />

only healthy <strong>com</strong>panies in the standard<br />

results. It may not surprise you that high<br />

financial risk <strong>com</strong>panies represented over<br />

25 percent of the data set in recent years of<br />

18<br />

November/December <strong>2009</strong><br />

The Value Examiner

A PROFESSIONAL DEVELOPMENT JOURNAL for the CONSULTING DISCIPLINES<br />

the D&P Report (though this number was<br />

historically much lower).<br />

Morningstar has spent a good part<br />

of <strong>2009</strong> evaluating predictive ability<br />

to measure financial distress, and we<br />

found that standard measures can be<br />

improved. In the October <strong>2009</strong> issue<br />

of Business Valuation Update, Warren<br />

Miller and James Harrington’s article<br />

“A Timely New Study on Bankruptcy<br />

Prediction Models from Morningstar”<br />

<strong>com</strong>pares the Altman Z-Score to a newer<br />

model called Distance-to-Default.<br />

The results showed that the Distanceto-Default<br />

model outperformed the Z-<br />

Score, providing us a better predictive<br />

measure of default.<br />

While the D&P Report is based on the<br />

Z-Score for segregating high financial risk<br />

<strong>com</strong>panies from the data, the Morningstar<br />

yearbooks have never separated the distressed<br />

firms from the healthy ones. The<br />

main reason why Morningstar has not separated<br />

the financially distressed <strong>com</strong>panies<br />

from the rest is that we were looking for a<br />

better predictor of financial distress than<br />

Z-Score provided. We found this in the<br />

Distance-to-Default model. We then asked<br />

the Center for Research in Security Prices<br />

to apply the Distance-to-Default methodology<br />

to historical data going back to the<br />

1960s so we could evaluate whether there<br />

was merit in segmenting the distressed<br />

firms from the healthy ones. Healthy and<br />

distressed portfolios were created across all<br />

standard Morningstar size categories. The<br />

results showed that the distressed portfolios<br />

underperformed the healthy portfolios<br />

across all size categories. We then applied<br />

this data to create beta-adjusted size premia,<br />

resulting in lower size premia for the<br />

distressed firms. This would lead to higher<br />

firm values for distressed <strong>com</strong>panies when<br />

this data is applied to a discounted cash<br />

flow model.<br />

Since we found that distressed firms<br />

have historically performed poorly, and<br />

investors were not <strong>com</strong>pensated with extra<br />

return for the extra risk they took on,<br />

we are un<strong>com</strong>fortable applying this data<br />

to a forward-looking cost of capital model<br />

at this time.<br />

Why doesn’t Morningstar pull out the<br />

financially distressed firms from our cost<br />

of capital data Traditional default prediction<br />

models like Z-Score don’t work<br />

as well as newer models like Distanceto-Default,<br />

and when we do apply newer<br />

models to the historical data, we find the<br />

results contradict the risk-return tradeoff.<br />

D&P segregates high financial risk <strong>com</strong>panies<br />

from their data because they believe,<br />

as many would expect, that highly<br />

leveraged, financially distressed firms<br />

have higher returns than their counterparts.<br />

In the analysis we performed with<br />

the invaluable assistance from the Center<br />

for Research in Security Prices, we<br />

have found the opposite to be the case.<br />

As Miller and Harrington concluded in<br />

their <strong>2009</strong> article:<br />

When valuing a business as a going<br />

concern, a firm is assumed to continue<br />

operations into the indefinite<br />

future. Does this mean that you need<br />

to remove distressed <strong>com</strong>panies from<br />

public <strong>com</strong>pany risk premiums when<br />

applying the latter to the valuation of<br />

healthy, going concern private entities<br />

It does not. Although the firm<br />

is presumed to be a going concern,<br />

predictive ability is never 100 percent.<br />

Applying risk premium data based on<br />

a portfolio of primarily healthy <strong>com</strong>panies<br />

with a small slice of potentially<br />

distressed <strong>com</strong>panies acknowledges<br />

the less-than-100 percent chance that<br />

a subject firm will be perfectly healthy<br />

for the indefinite future.<br />

FINER CATEGORIES<br />

The relationship between firm size<br />

and return continues to be an area that<br />

receives a good deal of attention. For practitioners<br />

who value very small <strong>com</strong>panies<br />

and might feel that size premia categorization<br />

is easy, Morningstar is about to stir<br />

the pot again. New analysis of the smallest<br />

<strong>com</strong>panies now allows us to dissect the<br />

size premium into further categories (cutting<br />

10a and 10b each in half), providing<br />

even more choices for the seasoned valuation<br />

professional.<br />

Firms like Morningstar, Duff & Phelps,<br />

and others publish a wealth of data on cost<br />

of capital so that practitioners have the resources<br />

to find their own solutions based<br />

on their knowledge and experience. We<br />

could simplify what is presented and give<br />

only one option for each scenario you might<br />

encounter, but that assumes that business<br />

valuation is a pure science. There is still a<br />

place for interpretation of information in<br />

this field. Data providers hope to provide<br />

business valuation practitioners with the<br />

data and tools needed to form intelligent<br />

cost of capital estimates. In this article I<br />

offered guidance in regard to the use of<br />

overlapping size premium categories. Having<br />

choices is something to value, not fear.<br />

Enjoy your freedom. VE<br />

Michael W. Barad is<br />

the vice president and<br />

business manager for<br />

Morningstar’s Financial<br />

Communications<br />

Business, which is part<br />

of Morningstar’s Investment<br />

Research Division<br />

(www.morningstar.<strong>com</strong>). He has written<br />

and spoken on such topics as asset<br />

allocation, returns-based style analysis,<br />

mean-variance optimization, MVO inputs<br />

generation, growth and value investing,<br />

<strong>com</strong>mercial real estate investing, the<br />

cost of capital, equity risk premium, size<br />

premium, and other topics in the fields of<br />

finance and economics.<br />

The Value Examiner November/December <strong>2009</strong> 19

A PROFESSIONAL DEVELOPMENT JOURNAL for the CONSULTING DISCIPLINES<br />

L I T I G A T I O N C O N S U L T I N G<br />

Court Corner<br />

John Stockdale, Jr., Esq., Schafer and Weiner, PLLC<br />

BANKRUPTCY ACTIONS<br />

In In re Advanced Modular Power<br />

Systems, <strong>2009</strong> WL 2960615 (Bankr.<br />

S.D. Tex. Sept. 16, <strong>2009</strong>), the U.S. Bankruptcy<br />

Court for the Southern District<br />

of Texas awarded a Chapter 7 trustee<br />

damages for fraudulent transfer and<br />

conversion of estate assets, where the<br />

controlling shareholder opened an<br />

identical business using a similar name<br />

and the debtor’s intangible property<br />

prior to the petition date. The controlling<br />

shareholder further destroyed the<br />

debtor’s financial records. The court rejected<br />

the trustee’s, a CPA, assessment<br />

of damages at gross profits of the identical<br />

business less its cost of goods sold.<br />

Rather, the court assessed damages as<br />

gross profit of the identical business<br />

less certain expenses including salary,<br />

repairs, rents, taxes and licenses, interest,<br />

depreciation, and 50 percent of<br />

miscellaneous expenses as reported on<br />

its tax returns.<br />

In In re American Home Mortgage<br />

Holdings, Inc., <strong>2009</strong> WL 2855888<br />

(Bankr. D. Del. Sept. 8, <strong>2009</strong>), the U.S.<br />

Bankruptcy Court for the District of<br />

Delaware determined that the phrase<br />

“<strong>com</strong>mercially reasonable determinants<br />

of value” as used in 11 U.S.C. Sec.<br />

562 was ambiguous. It defined the term<br />

to mean “any <strong>com</strong>mercially reasonable<br />

valuation methodology may be used as<br />

evidence of the damages under a repurchase<br />

agreement after its rejection,<br />

termination, or acceleration.” The court<br />

then adopted the debtor’s expert’s discounted<br />

cash flow valuation of the loan<br />

portfolio that was the subject of the<br />

repurchase agreement at issue, even<br />

though the actual market for the loan<br />

portfolio was dysfunctional.<br />

In In re SMTC Manufacturing of<br />

Texas, <strong>2009</strong> WL 2940161 (Bankr. W.D.<br />

Tex. Sept. 11, <strong>2009</strong>), the U.S. Bankruptcy<br />

Court for the Western District<br />

of Texas determined that, for state law<br />

fraudulent transfer purposes, where<br />

the assets of a business are secured by<br />

a blanket lien and the loan supporting<br />

the lien is guaranteed by affiliated business,<br />

the value of that lien should be<br />

discounted to account for the chance<br />

that the debtor may not be required to<br />

fulfill that loan. In addition, the court<br />

concluded that the right of contribution<br />

from co-guarantors of that debt<br />

should be considered in valuing the<br />

amount of the debt.<br />

SHAREHOLDER APPRAISAL ACTIONS<br />

In McDaniel v. 162 Columbia Heights<br />

Housing Corporation, <strong>2009</strong> WL 3131173<br />

(N.Y. Sup. Sept. 29, <strong>2009</strong>), the Supreme<br />

Court of Kings County, NY, determined<br />

the appropriate calculation of fair value<br />

of a cooperative housing corporation<br />

to avoid dissolution under the Business<br />

Corporation Act was the value of the<br />

business as a going concern, considering<br />

the current use (rather than its highest<br />

and best use) of the real property,<br />

subject to the long-term obligations to<br />

the remaining shareholder-tenants. The<br />

court relied on a <strong>com</strong>parable recent sale<br />

of an apartment in the corporation’s<br />

building to determine the value of the<br />

corporation and then offset a valuation<br />

decrement occasioned by this litigation<br />

against the rise real property values in<br />

the area.<br />

In Schimke v Liquid Dustlayer, Inc.,<br />

<strong>2009</strong> WL 3049723 (Mich. App. Sept.<br />