Raw materials from SCA become IKEA furniture - SCA Forest ...

Raw materials from SCA become IKEA furniture - SCA Forest ...

Raw materials from SCA become IKEA furniture - SCA Forest ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

timbernews<br />

A magazine for <strong>SCA</strong>’s solid wood products customers | www.timber.sca.com<br />

42007<br />

<strong>Raw</strong> <strong>materials</strong> <strong>from</strong> <strong>SCA</strong><br />

<strong>become</strong> <strong>IKEA</strong> <strong>furniture</strong><br />

• Production adapted<br />

to market conditions<br />

• Focus on components<br />

cuts customer costs<br />

• Swedish spruce protects<br />

Danish Christmas trees

timber news<br />

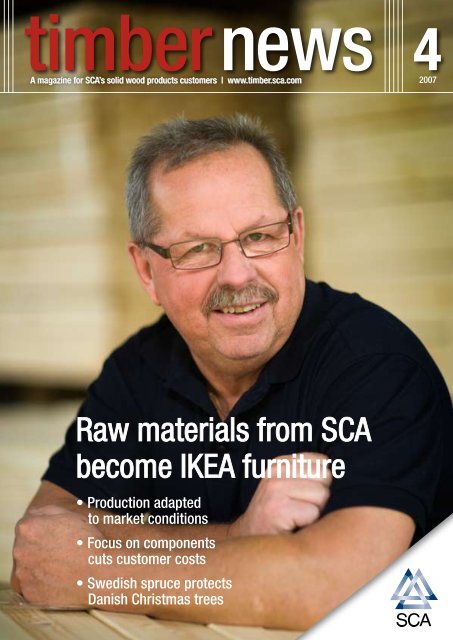

Dick Bergh, president of<br />

Hedlunda Industri AB, Lycksele, Sweden.<br />

Cover photo: Michael Engman<br />

<strong>SCA</strong> Timber to<br />

scale down production<br />

3<br />

<strong>Raw</strong> <strong>materials</strong> <strong>from</strong> <strong>SCA</strong><br />

<strong>become</strong> <strong>IKEA</strong> <strong>furniture</strong><br />

6<br />

Strategeic move towards<br />

more component production<br />

8<br />

Flying start to 2008<br />

10<br />

Pressure on the solid wood<br />

products market<br />

11<br />

Spruce <strong>from</strong> <strong>SCA</strong> protects<br />

Danish Christmas trees<br />

12<br />

<strong>SCA</strong> Timber, <strong>SCA</strong>’s solid wood<br />

operation, covers eight sawmills and<br />

six planing mills. The total annual volume<br />

of solid wood products amounts<br />

to 1.8 million cubic metres.<br />

Solid wood operations are included in<br />

<strong>SCA</strong>’s <strong>Forest</strong> Products business area.<br />

TimberNews <strong>SCA</strong> <strong>Forest</strong> Products AB<br />

SE-851 88 Sundsvall<br />

tel +46 60 19 30 00<br />

www.timber.sca.com<br />

Timber News is published<br />

four times a year<br />

Editor-in-chief Björn Lyngfelt<br />

Production Fryklunds<br />

Repro & printing Tryckeribolaget<br />

Subscribe to Timber News, please<br />

contact ingrid.lofqvist@sca.com<br />

We all benefit <strong>from</strong><br />

a stable market<br />

In many ways, 2007 will be seen as a record<br />

year for both <strong>SCA</strong> Timber and the entire solid<br />

wood products industry. We have enjoyed<br />

record-breaking levels of production and deliveries,<br />

resulting in a record-breaking profit.<br />

The reason for this upturn is the boom currently<br />

being experienced by the majority of<br />

our most important markets. Construction<br />

activity is high. Huge demand for raw <strong>materials</strong>,<br />

especially <strong>from</strong> Asia, has forced up the prices of<br />

competing <strong>materials</strong> such as steel, plastic and aluminium,<br />

making solid wood products cheaper by<br />

comparison.<br />

Last year, and during the first six months of<br />

2007, the market was characterised by a lack of<br />

solid wood products of a Nordic origin. Customers<br />

have submitted their orders well in advance in<br />

order to be sure they get the products they need.<br />

They have also taken a long-term view due to the<br />

major risk of prices going even higher.<br />

The positive character of the solid wood products<br />

market has encouraged sawmill companies to<br />

increase production. Access to raw <strong>materials</strong> was<br />

proving to be a limiting factor, but storm felling<br />

and record-high sawlog prices have led to a glut of<br />

raw <strong>materials</strong> becoming available, and to production<br />

increasing substantially.<br />

We reached an equilibrium during August. Sawmill<br />

stocks began to increase and customers came<br />

to the realisation that products would be available<br />

when they needed them and that, in all probability,<br />

they would not get any more expensive. If customers<br />

go <strong>from</strong> ordering two months in advance to<br />

ordering one month in advance, the effects are<br />

quite dramatic.<br />

That’s why <strong>SCA</strong> Timber is now trying to adapt<br />

to market conditions. We’re scaling down production,<br />

mainly during the first quarter. Ideally, this<br />

move will focus on production based on imported<br />

raw <strong>materials</strong>, which are expensive and don’t<br />

always satisfy the quality requirements our customers<br />

impose on their products. In addition,<br />

notification we have received concerning export<br />

duty and other obstacles have cast doubt on the<br />

extent to which imported sawlogs will be available<br />

in the future.<br />

Ulf Larsson, president of <strong>SCA</strong> Timber.<br />

Photo: Per-Anders Sjöquist<br />

We will continue to develop our sawmills, but we<br />

will do so using raw <strong>materials</strong> we can obtain <strong>from</strong><br />

the region, an approach that fits in well with our<br />

product range and the quality requirements of our<br />

customers.<br />

Not only is it in our interests to have production<br />

in balance with demand, it is also in the interests<br />

of our customers. We will continue to develop the<br />

collaborative relationship we have with our customers,<br />

to develop products that meet their requirements<br />

and, by working closely with them,<br />

increase the value of those products and slash the<br />

costs of the supply chain. A disjointed market<br />

with massive price fluctuations and periods when<br />

it is difficult to obtain products benefits neither us<br />

nor our customers. Ploughing time and resources<br />

into ensuring that products are available one<br />

month and being on the hunt for low prices the<br />

next, takes away the focus <strong>from</strong> our most<br />

important business – ensuring that the wood<br />

<strong>become</strong>s a product for an end customer.<br />

That is the business that we must work together<br />

to develop. The potential for wood to take market<br />

shares <strong>from</strong> other <strong>materials</strong>, and to find other areas<br />

of use, is good. Together, we must find ways of<br />

exploiting this potential to its fullest extent.<br />

Ulf Larsson<br />

President, <strong>SCA</strong> Timber<br />

timbernews | 2

<strong>SCA</strong> Timber to scale down production<br />

<strong>SCA</strong> Timber is set to implement a series of measures that will<br />

reduce its production of sawn solid wood products by almost 15<br />

percent during the first quarter of 2008 compared to this year’s<br />

production level. In addition to production cutbacks at the Munksund<br />

and Rundvik sawmills, all sawmills will stop for an extended<br />

break over Christmas and New Year. A ban on overtime will also be<br />

implemented.<br />

“<br />

For the past two years, demand<br />

for solid wood products in<br />

our product segments has<br />

outstripped supply,” says Ulf Larsson,<br />

president of <strong>SCA</strong> Timber.<br />

“Although the underlying consumption<br />

of wood products remains<br />

high, an exceptionally high<br />

level of production in the sawmills<br />

in Scandinavia and on the continent<br />

is acting as the catalyst for<br />

many customers to play a waiting<br />

game when placing their orders.”<br />

Once Munksund Sawmill adapts its production level to the availability of domestic raw material, one of the<br />

sawmill’s two trimming mills will be decommissioned.<br />

Photo: Per Pettersson<br />

In order to adapt production to<br />

the prevailing level of demand,<br />

<strong>SCA</strong> Timber has decided to scale<br />

back its production. At Munksund<br />

Sawmill outside Piteå in<br />

northern Sweden, the older of the<br />

two trimming mills is being shut<br />

down, reducing production by<br />

40,000 cubic metres of pine solid<br />

wood products. At Rundvik Sawmill,<br />

production is being reduced<br />

by some 70,000 cubic metres of<br />

spruce solid wood products. These<br />

cutbacks will see the number of<br />

people employed at Munksund<br />

fall by ten, whilst Rundvik will<br />

see a drop of just over 20.<br />

“Munksund and Rundvik have<br />

both been partially supplied with<br />

imported sawlogs,” says Larsson.<br />

“The price of this raw material<br />

has increased dramatically and<br />

we believe that in the future it will<br />

constitute an unreliable and<br />

unpredictable raw <strong>materials</strong> base,<br />

both in terms of availability and<br />

cost. That’s why we’ve come to<br />

the decision to phase out the use<br />

of imported raw <strong>materials</strong> and to<br />

base the future development of<br />

our sawmill operations on raw<br />

<strong>materials</strong> we can obtain within<br />

the region. We’re endeavouring to<br />

increase our procurement of sawlogs<br />

<strong>from</strong> sources in northern<br />

➔<br />

3 | timbernews

“We’re focusing on strengthening our in-house sawlog procurement<br />

organisation, ensuring that we’ll be well equipped<br />

once the order landscape <strong>become</strong>s stable again,” says Anders<br />

Nordmark, sawmill manager at Munksund.<br />

Photo: Per Nilsson<br />

Sten Olov Andersson, sawmill manager at Rundvik, believes<br />

that it is important to increase the procurement of raw <strong>materials</strong><br />

<strong>from</strong> northern Sweden.<br />

Sweden as it is a raw material that<br />

fits both our range of products<br />

and the stringent quality demands<br />

of our customers.”<br />

In addition to these cutbacks,<br />

<strong>SCA</strong> Timber will be stopping production<br />

in all sawmills over the<br />

Christmas and New Year holidays.<br />

Furthermore, a ban on overtime<br />

or other non-standard operating<br />

times will also be introduced.<br />

Taken together, these measures<br />

will reduce production levels by<br />

almost 15 percent, equivalent to<br />

55,000 cubic metres, during the<br />

first quarter.<br />

“We’re implementing these measures<br />

quickly to adapt to what we<br />

believe to be a temporary period<br />

of uncertainty in the market,” says<br />

Larsson. “Consumption of solid<br />

wood products is high and competing<br />

<strong>materials</strong> have increased<br />

significantly more in price in<br />

recent years. In my opinion, we<br />

will soon have a stable order<br />

book and market prices will have<br />

settled down, benefiting both<br />

customers and producers in the<br />

long term.”<br />

Rundvik is one of the two sawmills<br />

to be most affected by the<br />

changes. In the past two years,<br />

demand for the sawmill’s products<br />

has sky-rocketed. Large volumes<br />

of solid wood products have<br />

been supplied to customers in<br />

Scandinavia, France, the Netherlands<br />

and the UK. The sawmill’s<br />

planing facility has sold almost<br />

70,000 cubic metres of processed<br />

solid wood products to Home<br />

Depot and other customers in the<br />

US.<br />

“The facility in Rundvik has<br />

therefore been pushed to the limit,”<br />

claims Sten Olov Andersson, sawmill<br />

manager at Rundvik. “We’ve<br />

been running an extra shift and<br />

have operated at full production<br />

for the entire summer to keep up<br />

with the demand for our products.<br />

We’ve even introduced a nightshift<br />

to cope with demand.”<br />

At present, production at Rundvik<br />

stands at around 240,000<br />

cubic metres of spruce sawn solid<br />

wood products, of which 80,000<br />

cubic metres are planed. The sawmill<br />

employs around 140 people,<br />

including contractors.<br />

However, in the last 12 months<br />

the sawmill has been periodically<br />

affected by production disruption<br />

caused by difficulties in acquiring<br />

sufficient volumes of raw material.<br />

It has been possible to maintain<br />

a substantial proportion of<br />

the production increase of recent<br />

years by increasing the amount of<br />

sawlogs imported <strong>from</strong> Russia.<br />

However, the recent explosion in<br />

Russian export tariffs means that it<br />

is no longer economically viable to<br />

continue to rely on sawlogs <strong>from</strong><br />

that part of the world.<br />

“At the moment, duty on sawlogs<br />

<strong>from</strong> Russia stands at € 10<br />

per cubic metre. In April next year,<br />

that figure will rise to € 15, and<br />

on 1 January 2009 it will be € 50<br />

per cubic metre,” says Andersson.<br />

“That will close the woodshed<br />

door permanently.”<br />

Once the import of Russian sawlogs<br />

has been phased out, production<br />

of sawn solid wood products<br />

will be reduced by 70,000 cubic<br />

metres to 170,000 cubic metres.<br />

This will also see production move<br />

<strong>from</strong> a three-shift rotation to a<br />

two-shift rotation during 2008.<br />

“Unfortunately, we will also<br />

be forced to let 20 or so people<br />

go, something that will naturally<br />

be a blow to those affected,” says<br />

Andersson, emphasising that the<br />

cutbacks are being undertaken<br />

<strong>from</strong> a production level that has<br />

not been exceeded at any time<br />

during the past 30 years.<br />

Munksund sawmill has also announced<br />

that it will be implementing<br />

production cutbacks, starting<br />

at the beginning of the new year.<br />

“Throughout this year, we’ve<br />

experienced major problems in<br />

getting our hands on sufficient a-<br />

mounts of raw material,” says saw-<br />

timbernews | 4

mill manager Anders Nordmark.<br />

This year, Munksund has produced<br />

approximately 400,000<br />

cubic metres of pine solid wood<br />

product and employs 130 people.<br />

The amount of custom and processed<br />

products leaving the mill<br />

stands at 200,000 cubic metres. Its<br />

most important markets are Scandinavia,<br />

the UK, Japan and Italy.<br />

“We get almost 30,000 cubic<br />

metres of pine raw material by<br />

boat <strong>from</strong> Russia, which we are<br />

now in the process of phasing<br />

out,” says Nordmark. ”Replacing<br />

this much wood with raw material<br />

sourced in the local region in the<br />

short term is difficult.”<br />

the availability of domestic raw<br />

<strong>materials</strong>, reducing output by approximately<br />

40,000 cubic metres,<br />

the older of the sawmill’s two<br />

trimming mills is being decommissioned.<br />

This means that ten<br />

people will be made redundant.<br />

“We’re now focusing on<br />

strengthening our in-house sawlog<br />

procurement organisation, ensuring<br />

that we’ll be well equipped<br />

once the order landscape <strong>become</strong>s<br />

stable again,” says Nordmark in<br />

summary.<br />

Mats Wigardt<br />

Once the import of sawlogs <strong>from</strong> Russia is phased out, the<br />

production of sawn solid wood products at Rundvik will be<br />

reduced. This will see the current three-shift rotation being<br />

replaced by a two-shift rotation during 2008.<br />

Photo: Bo Fernström<br />

In conjunction with adapting the<br />

production level at Munksund to<br />

5 | timbernews

Transforming <strong>SCA</strong> raw <strong>materials</strong> into<br />

<strong>IKEA</strong> <strong>furniture</strong><br />

For more than 20 years, Hedlunda Industri of Lycksele,<br />

northern Sweden, has supplied pine <strong>furniture</strong><br />

to <strong>IKEA</strong>. In order to meet increased demand, a<br />

further £3.8 million has been ploughed into new<br />

production equipment. One of the company’s important<br />

collaboration partners is <strong>SCA</strong>, which provides<br />

close to 40 percent of the raw <strong>materials</strong> used.<br />

Coming onto the workshop<br />

floor at Hedlunda Industri is<br />

like paying a visit to Santa’s<br />

grotto.<br />

At one end of the massive factory<br />

space, sawn pine timber <strong>from</strong><br />

sources such as <strong>SCA</strong>’s sawmills in<br />

Munksund and Bollstabruk is<br />

unloaded <strong>from</strong> the loading bay.<br />

More than 130,000 linear metres<br />

– around 500 cubic metres – pass<br />

through the cutting line every<br />

week, all cut to precise specifications.<br />

Short pieces are finger<br />

joined to suitable lengths – almost<br />

nothing is wasted.<br />

The raw material is then processed<br />

further by skilled craftsmen<br />

who plane, drill, surface treat and<br />

pack, resulting in a range of pine<br />

shelving and beds. The products<br />

are shipped to <strong>IKEA</strong> stores in<br />

Sweden, the US, Europe and the<br />

rest of the world.<br />

“Obviously, we’re regarded as<br />

being fairly competitive,” says factory<br />

manager Anders Persson, who<br />

acts as our guide around the workshop.<br />

The factory is a fast-paced environment.<br />

Many of the machines<br />

used have been specially built onsite<br />

to replace heavy and labour<br />

intensive processes. One machine<br />

screws and glues bed sides, a<br />

second machine fits the rails to<br />

a shelf and attaches a packet of<br />

screws, whilst a third screws 62<br />

screws into a bed end.<br />

“That was something that used<br />

to be done by hand,” says Persson.<br />

“The guys who had that job didn’t<br />

need to go to the gym after<br />

work!”<br />

Given the large volumes and<br />

small margins associated with this<br />

type of work, it is important to<br />

employ a carefully considered flow<br />

in the manufacturing process.<br />

According to Persson, he really<br />

had to rack his brains before he<br />

could finally implement a process<br />

that satisfied the stringent precision<br />

and quality requirements<br />

imposed by customers.<br />

“And we’re going to get better<br />

and faster,” he assures us.<br />

On a slow-moving conveyor belt,<br />

flat packs are filled with finished<br />

components. Not one single pack<br />

of screws may be forgotten. The<br />

<strong>furniture</strong> is test assembled at regular<br />

intervals to ensure that there<br />

are no defects.<br />

“One of the packs contains<br />

timbernews | 6

around 40 different components,”<br />

says Persson. “The entire system is<br />

based on ensuring that no component<br />

ends up in the wrong place.”<br />

Finished packs are then driven<br />

out by forklift to the warehouse<br />

before being shipped out to destinations<br />

across the world. Every<br />

day, five railway wagons are filled<br />

with <strong>furniture</strong> <strong>from</strong> Hedlunda<br />

Industri, as well as a number of<br />

trucks. The railway line runs all<br />

the way to the integrated loading<br />

bay and was built solely for this<br />

purpose.<br />

“Logistics is one of our strong<br />

suits,” says Persson, moving out<br />

of the way of fully loaded truck<br />

heading for the open door of the<br />

railway wagon.<br />

Compared to the hive of activity<br />

out on the factory floor, the office<br />

is a much more tranquil environment.<br />

Dick Bergh, together with a<br />

partner, set up the factory in Lycksele<br />

back in 1984. From the outset,<br />

<strong>IKEA</strong> was an important collaborative<br />

partner. Since then, the<br />

business has gradually grown and<br />

developed and now employs 95<br />

people with a turnover of £11.5<br />

million. Hedlunda Industri is now<br />

a family-run company, with Dick<br />

Bergh as its president and his two<br />

sons, Jonas and Mathias, as partners.<br />

“We recently signed a long-term<br />

agreement with <strong>IKEA</strong> that will see<br />

us invest another £3.8 million in<br />

the business up until 2012,” says<br />

Bergh. “We’ll also be increasing<br />

our staff to approximately 160<br />

employees.”<br />

More efficient planing lines,<br />

increased finishing capacity, automation<br />

of production and mechanising<br />

the packing process are just<br />

a few of the measures that will be<br />

implemented. In addition, the company<br />

will also extend its organisation<br />

and acquire leading-edge<br />

expertise in production technology<br />

and logistics.<br />

“<strong>IKEA</strong> is an incredibly straighttalking<br />

customer,” continues Bergh.<br />

“They know what they want, when<br />

they want it and how they want it.<br />

It’s then just up to us to deliver on<br />

our promises.”<br />

The expansion of Hedlunda<br />

Industri will also have consequences<br />

for the volume of raw<br />

<strong>materials</strong> required. Bergh has<br />

held discussions with a number of<br />

sawmills, including <strong>SCA</strong>’s mills in<br />

Munksund and Bollstabruk, with<br />

the aim of doubling their current<br />

“The majority of our raw <strong>materials</strong><br />

requirement will be satisfied by <strong>SCA</strong>,”<br />

says Dick Bergh, president of<br />

Hedlunda Industri AB in Lycksele.<br />

supply. The longer-term aim is also<br />

to be able to buy more processed<br />

products <strong>from</strong> the sawmills.<br />

“We see our collaborative relationship<br />

with <strong>SCA</strong> as one that is<br />

fundamentally sound and can be<br />

built on for the long term,” summarises<br />

Bergh. “This means that<br />

the majority of our raw <strong>materials</strong><br />

requirement, around 40 percent,<br />

will be satisfied by <strong>SCA</strong>.”<br />

Mats Wigardt<br />

Photo: Michael Engman<br />

Company facts:<br />

Founded on<br />

2 January 1986<br />

Family-owned since 2003<br />

Biggest customer is <strong>IKEA</strong><br />

President: Dick Bergh<br />

Turnover: £11.5 million<br />

95 Employees<br />

News: About to embark on<br />

a £3.8 million investment<br />

programme<br />

www.hedlunda-industri.se<br />

The company manufactures shelving and beds that are then sold by <strong>IKEA</strong> throughout the world.<br />

7 | timbernews

Strategeic move towards<br />

more component production<br />

For <strong>SCA</strong> Timber, product development is a strategic<br />

objective. Traditional sawn timber in standard<br />

Nordic grades and multiple lengths will gradually<br />

be phased out and replaced by specialised timber<br />

for industry – or have value added by being turned<br />

into finished products for builder’s merchants.<br />

The component line investment<br />

project recently rolled out at<br />

Tunadal sawmill echoes company<br />

strategy. The new line will<br />

have a capacity of approximately<br />

30,000 cubic metres of door and<br />

window shutter components. The<br />

line will come online in May 2008,<br />

the plan being to reach full capacity<br />

sometime in the autumn of that<br />

year.<br />

Components are nothing new<br />

to <strong>SCA</strong> Timber. In recent years,<br />

we have gradually built up both<br />

our knowledge and supply. <strong>SCA</strong><br />

Timber is already the largest Scandinavian<br />

supplier of developed<br />

timber (including components) to<br />

French industry. Ongoing investment<br />

will enable us to further<br />

increase the volume of these components<br />

and at the same time<br />

lower the production cost.<br />

In 2006, the volume of components<br />

sold into France doubled,<br />

reaching approximately 11,000<br />

cubic metres. This growth has continued<br />

during 2007 into approximately<br />

18,000 cubic metres. Our<br />

goal for autumn 2009 is to get at<br />

least 30,000 cubic metres <strong>from</strong> the<br />

new line.<br />

A move <strong>from</strong> sawn timber into<br />

components can only be successful<br />

if it can be shown to benefit<br />

the customer. The aim is to make<br />

investments and other changes<br />

in order to reduce the total costs<br />

involved in the supply chain.<br />

Customers can use their resources,<br />

capital and expertise in order<br />

to focus on growing their businesses<br />

in the marketplace. Suppliers<br />

will solve the problems and<br />

challenges associated with timber<br />

production.<br />

<strong>SCA</strong> Timber will guarantee the<br />

supply of custom made components,<br />

supported by backup<br />

stocks and service at our French<br />

terminals. On-line administrative<br />

solutions are available to track<br />

product availability and production<br />

status in the supply pipeline.<br />

Continuous development, of<br />

products and services, is offered<br />

to customers.<br />

The benefits to customers are<br />

many:<br />

• Customers can stop, or substantially<br />

scale down, their timber<br />

processing. This frees capital<br />

and resources, providing either<br />

direct savings or an opportunity<br />

the channel resources into product<br />

finishing and/or marketing<br />

activities;<br />

• Shorter lead times <strong>from</strong> production<br />

to installation by industrial<br />

customers, resulting in a further<br />

reduction in the cost of stockholding.<br />

• Component production at<br />

source enables the supplier to<br />

optimise raw material usage and<br />

yield. The resulting cost savings<br />

will be passed on to customers.<br />

By producing components at<br />

its mills in Sweden, <strong>SCA</strong> Timber<br />

is able to reduce its production<br />

processes, achieving a reduction<br />

in supply chain costs as a result.<br />

Utilising integrated production<br />

techniques additionally brings<br />

environmental advantages:<br />

• In-line component production in<br />

the sawmill replaces traditional<br />

sorting and packaging, eliminating<br />

two production stages.<br />

Door frames of Nordic spruce,<br />

<strong>SCA</strong> Timber, Sweden.<br />

Photo: Per-Anders Sjöquist<br />

timbernews | 8

• By producing more components<br />

<strong>from</strong> each log, raw material<br />

usage is improved and the mill<br />

can focus on cutting, kilning<br />

and sorting to customers’ specific<br />

component requirements.<br />

• Production of customer-specific<br />

components means less transport.<br />

Production waste remains<br />

at the sawmill and can be reused<br />

for energy generation.<br />

However, centring component<br />

production at a Scandinavian mill<br />

is not the answer for all customer<br />

requirements. Suppliers must be<br />

able reliably to offer a full mix of<br />

products to their customers. The<br />

challenge for the producer is to<br />

establish a series of local production<br />

and warehousing facilities<br />

near to customers that will guarantee<br />

delivery service and reliability,<br />

whilst also offering low-cost<br />

production of larger volume runs<br />

at sawmill sites. This strategy<br />

offers customers a double benefit.<br />

Local engineering expertise,<br />

both in France and Sweden, is<br />

required in order to meet customer<br />

expectations. Administrative<br />

solutions that allow customers<br />

to track component availability<br />

on line, both at <strong>SCA</strong> Timber in<br />

France and at the sawmills in<br />

Scandinavia, are currently in the<br />

process of being implemented.<br />

In 2005, <strong>SCA</strong> was able to turn<br />

theory into practice and lower<br />

supply chain costs for its door<br />

component sales in the UK. Prior<br />

to that date, <strong>SCA</strong>’s former facility<br />

at Warrington was producing<br />

500,000 shrink-wrapped softwood<br />

door frame sets (casing &<br />

lining sets) per year. To expand<br />

capacity, a decision was taken to<br />

move the production line to its<br />

Stoke-on-Trent headquarters and<br />

Door and window shutter made in France. <strong>SCA</strong> Timber is the largest Scandinavian supplier of developed<br />

timber (including components) to French industrial customers.<br />

Photo: Lapeyre<br />

improve manufacturing capabilities.<br />

One option was to set up a full<br />

line with a planing machine onsite<br />

at Stoke. This would have<br />

meant high capital cost in addition<br />

to possible production bottlenecks,<br />

resulting <strong>from</strong> the feed<br />

speed of the planing machine<br />

being 3-4 times higher than that<br />

of the existing wrapping and<br />

packaging line.<br />

The solution has been to use<br />

<strong>SCA</strong>’s integrated production<br />

capabilities and machine casing<br />

and lining (C&L) components<br />

at two Swedish mills (Tunadal<br />

and Bollsta). The components are<br />

loaded on large cassettes, which<br />

are then shipped by RoRo vessels<br />

to <strong>SCA</strong>’s dock facilities at Tilbury,<br />

for onward haulage to the wrapping<br />

and packaging line at Stoke.<br />

The component blanks are then<br />

trenched, assembled, labelled and<br />

packed ready for transport to UK<br />

distributors and <strong>SCA</strong> customers.<br />

Some two years after making<br />

that investment, <strong>SCA</strong> Timber<br />

Supply now sells more than<br />

1,000,000 shrink-wrapped C&L<br />

sets in the UK, representing a<br />

35% share of the British market<br />

for these products. Quality, cost<br />

and service drive the UK’s C&L<br />

supply chain and the lowered cost<br />

<strong>from</strong> the Stoke plant makes it a<br />

robust supply option for everyone<br />

concerned. With further capacity<br />

still available, <strong>SCA</strong> is now<br />

looking forward to extending its<br />

product range and supplying even<br />

greater volumes of C&L goods to<br />

its builder’s merchant customer<br />

base.<br />

9 | timbernews

Flying<br />

start to 2008<br />

<strong>SCA</strong> Timber Supply’s managing director Rob Simpson says business<br />

for 2008 has got off to a flying start, with high demand<br />

amongst new and existing customers.<br />

Produced through <strong>SCA</strong>’s<br />

Munksund sawmill, a 2.4 m<br />

decking board has <strong>become</strong> the<br />

summer-time 5th best-selling SKU<br />

(stock-keeping unit) in the Wickes<br />

DIY store range of 17,000 items.<br />

<strong>SCA</strong> Timber Supply has closed<br />

a supply partnership on decking<br />

for all of Wickes 220 stores for<br />

2008. Contracts for supply chain<br />

management of timber and wood<br />

products to 325 Homebase stores<br />

Rob Simpson, managing director, <strong>SCA</strong> Timber Supply.<br />

and 170 Focus DIY stores have<br />

also been agreed.<br />

“Our flexibility in moving across<br />

the supply platform can be seen in<br />

new business gained <strong>from</strong> Magnet.<br />

Success in developing customerspecific<br />

window components for<br />

Magnet has led us to widen our<br />

relationship with them in other<br />

areas,” says managing director Rob<br />

Simpson. “Magnet’s own distribu-<br />

tion centre services its 165 stores<br />

across the UK and we are now<br />

supplying them with core range<br />

builders’ merchant mini-packs<br />

covering PAR, skirtings, architraves,<br />

flooring and dado rails.<br />

We are also supplying 1,600m 3 in<br />

door casings and linings, produced<br />

at our facilities at Tunadal, Bollsta<br />

and Stoke. Magnet are looking to<br />

expand their business in Britain<br />

and <strong>SCA</strong> is well-placed to supply<br />

their multiplicity of needs.”<br />

Before the end of 2007, <strong>SCA</strong><br />

Timber Supply surpassed a production<br />

milestone at its Stokeon-Trent<br />

headquarters. Its aim of<br />

reaching one million sets of door<br />

casings and linings, produced on<br />

the premises and sold to customers<br />

before the end of 2007, has<br />

been achieved with some weeks<br />

to spare. These products are being<br />

marketed through major customers<br />

including Howden Joinery,<br />

Jewsons, Travis Perkins, Magnet<br />

and the Grafton Group.<br />

Working closely with the distinctive<br />

elements of the Grafton<br />

Group, which is now Britain’s 4th<br />

largest building <strong>materials</strong> supplier,<br />

<strong>SCA</strong> Timber Supply has also just<br />

renewed the contract to supply<br />

<strong>from</strong> its Welshpool facility the<br />

timber product needs of Grafton’s<br />

Selco trade outlets in the London<br />

and south east region. “Our ability<br />

to offer a mix and match service<br />

timbernews | 10

through our production facilities<br />

at Stoke and Welshpool, backed<br />

by our UK distribution centre and<br />

our flexible sawmill and planing<br />

partners in Sweden means we<br />

are able to capture an increasing<br />

market share in the UK,” asserts<br />

Rob Simpson.<br />

Camilla Hair<br />

A production milestone has been<br />

surpassed this year. One million sets<br />

of door casings and linings have been<br />

produced and sold to customers.<br />

Increased pressure on the solid wood products market<br />

A growth in stock levels held by producers<br />

in Germany and Austria put<br />

increasing pressure on the market<br />

during the first six months of this<br />

year. Initially, Scandinavian producers<br />

fared better, but they are now subject<br />

to similar pressures.<br />

Consumption of sawn solid wood products<br />

in Europe is good, although house<br />

construction, which is the biggest sector<br />

for wood consumption, is now weakening<br />

due to high interest rates and increasing<br />

economic uncertainty.<br />

The Swedish domestic market is strong,<br />

which is vitally important for Swedish producers.<br />

However, growth in construction<br />

in Europe, especially in Germany, is not as<br />

positive as previously forecast.<br />

The US continues to be a problem<br />

market, with new construction down<br />

approximately 30% compared to the situation<br />

a year ago. This limits the potential<br />

for exporting European surplus production<br />

to the US. In addition, the Japanese<br />

market has experienced a short-term collapse<br />

as the result of a newly introduced<br />

set of regulations not working as planned,<br />

leading to a fall in excess of 40% in the<br />

number of building permits issued during<br />

the third quarter.<br />

Stocks in Germany and Austria increased<br />

during the spring, with Scandinavian<br />

stocks gradually increasing during the<br />

autumn. The reason for this increase is a<br />

combination of high sawmill production<br />

rates and a reduction in customer order<br />

volumes. Consumption in the market<br />

has fallen slightly as customers are applying<br />

a much shorter-term approach to<br />

their purchasing, which means that the<br />

planning situation for the sawmills is<br />

becoming increasingly uncertain.<br />

Production at the sawmills continues to<br />

maintain a high tempo. In Scandinavia,<br />

production was up 4.5% during the first<br />

ten months of this year compared to the<br />

same period last year. The bulk of this<br />

increase was in Finland, where rocketing<br />

raw <strong>materials</strong> prices caused the felling<br />

level to increase substantially as profitability<br />

in the sawmill industry came<br />

under pressure.<br />

The sawmills in Germany and Austria<br />

are reporting similarly increased production<br />

rates, which will see 2007 being<br />

regarded as an all-time high for German<br />

sawmill production. Extensive investment<br />

in recent years has seen Germany increase<br />

its production capacity and benefit <strong>from</strong><br />

a greater number of state-of-the-art facilities.<br />

As a result of this high production<br />

level, raw <strong>materials</strong> prices are now also<br />

rising in central Europe.<br />

At the same time as production levels<br />

have increased, customers have adopted<br />

a more short-term approach to their<br />

purchasing, and the outlook for the immediate<br />

future looks somewhat uncertain.<br />

The prices of spruce and lower quality<br />

pine have fallen.<br />

In order to strike a better balance between<br />

supply and demand, <strong>SCA</strong> Timber<br />

has announced a scaling-down of production<br />

of around 15% to take place during<br />

the first quarter of 2008. This will be<br />

achieved through a combination of an<br />

across-the-board reduction in production<br />

time, e.g. over Christmas and New<br />

Year, and a cut in the number of operating<br />

hours and staffing levels at the sawmills<br />

in Munksund and Rundvik.<br />

Other producers have followed <strong>SCA</strong><br />

Timber’s lead and have recently announced<br />

a similar scaling-back of their own<br />

production volumes. Press releases <strong>from</strong><br />

Sweden and Finland outlining such proposals<br />

blanketed the month of November.<br />

No such announcements are to be made<br />

on the continent, although our paper mill<br />

in Laakirchen, Austria will suffer <strong>from</strong><br />

a significant downturn in the supply of<br />

sawmill chips. This flow is directly linked<br />

to the production volumes of the regional<br />

sawmills in northern Austria and southern<br />

Germany.<br />

Anders Ek, marketing director<br />

11 | timbernews

Spruce <strong>from</strong> <strong>SCA</strong> protects Danish<br />

Christmas trees<br />

Christmas is drawing near and soon millions of<br />

spruce trees will be decked out in their seasonal<br />

finery the length and breadth of Sweden. Many of<br />

these trees come <strong>from</strong> Denmark, which is the biggest<br />

exporter of Christmas trees in the world, and it is<br />

timber <strong>from</strong> <strong>SCA</strong> that protects a significant number<br />

of them <strong>from</strong> damage during transit.<br />

The custom of decorating the<br />

home with living trees and<br />

branches is an ancient one,<br />

originally serving to provide protection<br />

against evil forces and<br />

spirits.<br />

The Christmas tree first appeared<br />

in Germany during the 15th<br />

Century. The first reported use of a<br />

Christmas tree in Sweden came in<br />

1741 in Stora Sundby, Södermanland,<br />

in the home of the Wrede-<br />

Sparre family.<br />

Today, the Christmas tree industry<br />

is a global phenomenon, enjoying<br />

a multi-billion kronor turnover.<br />

In Denmark, growing Christmas<br />

trees is a major industry.<br />

Every year, ten million spruce trees<br />

are grown to supply customers<br />

throughout Europe.<br />

The majority of Danish Christmas<br />

trees are of the Nordmann<br />

fir (Abies nordmanniana) variety,<br />

which is grown on former farmland<br />

and regarded as an agricultural<br />

crop. Once they have been<br />

harvested, the trees are put into<br />

nets and packed on pallets.<br />

Last summer, when a Danish<br />

Christmas tree grower got in<br />

touch with Peter Henriksson<br />

at <strong>SCA</strong>’s sawmill in Rundvik<br />

asking for a batch of high-quality<br />

northern Swedish spruce timber<br />

to protect his own spruces, a few<br />

eyebrows were raised.<br />

“Normally, the lowest quality<br />

timber is used for packing, but in<br />

this case he only wanted the very<br />

best,” says Henriksson.<br />

As it turned out, the Christmas<br />

tree grower knew exactly what<br />

he wanted. During the busy days<br />

when the trees are harvested and<br />

packed, the packaging used must<br />

be of a high quality in order to<br />

ensure that there is no snapping<br />

or breaking.<br />

Each pallet is fitted with six side<br />

pieces, which have been planed,<br />

pre-drilled and precision-cut at<br />

Rundvik. So far, two trucks, each<br />

containing 50 cubic metres of<br />

material, have been shipped out<br />

to Denmark.<br />

“If everything goes to plan,<br />

there is an enormous market for<br />

fibre <strong>from</strong> northern Sweden in the<br />

Danish Christmas tree industry,”<br />

notes Henriksson.<br />

Mats Wigardt<br />

Footnote:<br />

Taking spruce indoors brings along<br />

tens of thousands of tiny creatures<br />

such as mites, spiders and several<br />

species of ladybird, most of which<br />

are invisible to the naked and totally<br />

harmless.