Group Financial Statements/Auditors' Report - Pumpkin Patch ...

Group Financial Statements/Auditors' Report - Pumpkin Patch ...

Group Financial Statements/Auditors' Report - Pumpkin Patch ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

PUMPKIN PATCH LIMITED & SUBSIDIARIES NOTES TO THE FINANCIAL STATEMENTS 31 JULY 2010<br />

PUMPKIN PATCH LIMITED & SUBSIDIARIES NOTES TO THE FINANCIAL STATEMENTS 31 JULY 2010<br />

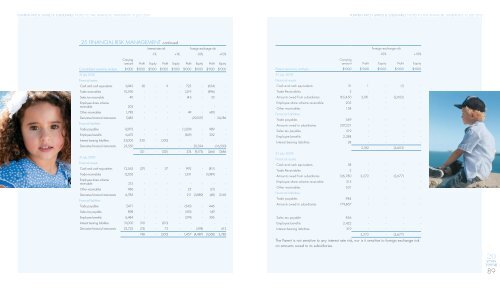

25 FINANCIAL RISK MANAGEMENT continued<br />

Interest rate risk<br />

Foreign exchange risk<br />

‐1% +1% ‐10% +10%<br />

Carrying<br />

amount Profit Equity Profit Equity Profit Equity Profit Equity<br />

Consolidated sensitivity analysis $’000 $’000 $’000 $’000 $’000 $’000 $’000 $’000 $’000<br />

31 July 2010<br />

<strong>Financial</strong> assets<br />

Cash and cash equivalents 6,945 (9) - 9 - 725 - (654) -<br />

Trade receivables 10,590 - - - - 1,219 - (896) -<br />

Sales tax receivable 40 - - - - (41) - 33 -<br />

Employee share scheme<br />

receivable 203 - - - - - - - -<br />

Other receivables 1,783 - - - - 49 - (40) -<br />

Derivative financial instruments 7,485 - - - - - (29,507) - 24,186<br />

<strong>Financial</strong> liabilities<br />

Trade payables 12,972 - - - - (1,209) - 989 -<br />

Employee benefits 6,475 - - - - (369) - 302 -<br />

Interest bearing liabilities 33,000 330 - (330) - - - - -<br />

Derivative financial instruments 25,550 - - - - - 20,334 - (16,500)<br />

321 - (321) - 374 (9,173) (266) 7,686<br />

31 July 2009<br />

<strong>Financial</strong> assets<br />

Cash and cash equivalents 12,563 (37) - 37 - 992 - (811) -<br />

Trade receivables 12,052 - - - - 1,331 - (1,089) -<br />

Employee share scheme<br />

receivable 215 - - - - - - - -<br />

Other receivables 986 - - - - 25 - (21) -<br />

Derivative financial instruments 6,785 - - - - 211 (3,889) (48) 3,169<br />

<strong>Financial</strong> liabilities<br />

Trade payables 7,471 - - - - (545) - 446 -<br />

Sales tax payable 898 - - - - (183) - 149 -<br />

Employee benefits 6,484 - - - - (374) - 306 -<br />

Interest bearing liabilities 31,000 310 - (310) - - - - -<br />

Derivative financial instruments 23,722 (75) - 73 - - (598) - 613<br />

198 - (200) - 1,457 (4,487) (1,068) 3,782<br />

Foreign exchange risk<br />

‐10% +10%<br />

Carrying<br />

amount Profit Equity Profit Equity<br />

Parent sensitivity analysis $’000 $’000 $’000 $’000 $’000<br />

31 July 2010<br />

<strong>Financial</strong> assets<br />

Cash and cash equivalents 31 1 - (1) -<br />

Trade Receivables 2 - - - -<br />

Amounts owed from subsidiaries 165,450 3,181 - (2,602) -<br />

Employee share scheme receivable 203 - - - -<br />

Other receivables 158 - - - -<br />

<strong>Financial</strong> liabilities<br />

Trade payables 549 - - - -<br />

Amounts owed to subsidiaries 207,221 - - - -<br />

Sales tax payable 519 - - - -<br />

Employee benefits 2,388 - - - -<br />

Interest bearing liabilities 28 - - - -<br />

3,182 - (2,603) -<br />

31 July 2009<br />

<strong>Financial</strong> assets<br />

Cash and cash equivalents 38 - - - -<br />

Trade Receivables 2 - - - -<br />

Amounts owed from subsidiaries 126,780 3,272 - (2,677) -<br />

Employee share scheme receivable 215 - - - -<br />

Other receivables 631 - - - -<br />

<strong>Financial</strong> liabilities<br />

Trade payables 984 - - - -<br />

Amounts owed to subsidiaries 179,867 - - - -<br />

Sales tax payable 856 - - - -<br />

Employee benefits 2,422 - - - -<br />

Interest bearing liabilities 319 - - - -<br />

3,272 - (2,677) -<br />

The Parent is not sensitive to any interest rate risk, nor is it sensitive to foreign exchange risk<br />

on amounts owed to its subsidiaries.<br />

20<br />

years<br />

young<br />

89