Group Financial Statements/Auditors' Report - Pumpkin Patch ...

Group Financial Statements/Auditors' Report - Pumpkin Patch ...

Group Financial Statements/Auditors' Report - Pumpkin Patch ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

PUMPKIN PATCH LIMITED & SUBSIDIARIES NOTES TO THE FINANCIAL STATEMENTS 31 JULY 2010<br />

PUMPKIN PATCH LIMITED & SUBSIDIARIES NOTES TO THE FINANCIAL STATEMENTS 31 JULY 2010<br />

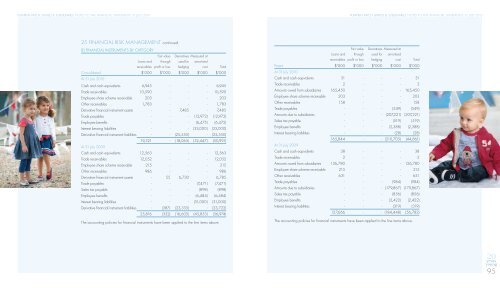

25 FINANCIAL RISK MANAGEMENT continued<br />

(E) FINANCIAL INSTRUMENTS BY CATEGORY<br />

Fair value Derivatives Measured at<br />

Loans and<br />

receivables<br />

through<br />

profit or loss<br />

used for<br />

hedging<br />

amortised<br />

cost Total<br />

Consolidated $’000 $’000 $’000 $’000 $’000<br />

At 31 July 2010<br />

Cash and cash equivalents 6,945 - - - 6,945<br />

Trade receivables 10,590 - - - 10,590<br />

Employee share scheme receivable 203 - - - 203<br />

Other receivables 1,783 - - - 1,783<br />

Derivative financial instrument assets - - 7,485 - 7,485<br />

Trade payables - - - (12,972) (12,972)<br />

Employee benefits - - - (6,475) (6,475)<br />

Interest bearing liabilities - - - (33,000) (33,000)<br />

Derivative financial instrument liabilities - - (25,550) - (25,550)<br />

19,521 - (18,065) (52,447) (50,991)<br />

At 31 July 2009<br />

Cash and cash equivalents 12,563 - - - 12,563<br />

Trade receivables 12,052 - - - 12,052<br />

Employee share scheme receivable 215 - - - 215<br />

Other receivables 986 - - - 986<br />

Derivative financial instrument assets - 55 6,730 - 6,785<br />

Trade payables - - - (7,471) (7,471)<br />

Sales tax payable - - - (898) (898)<br />

Employee benefits - - - (6,484) (6,484)<br />

Interest bearing liabilities - - - (31,000) (31,000)<br />

Derivative financial instrument liabilities - (387) (23,335) - (23,722)<br />

25,816 (332) (16,605) (45,853) (36,974)<br />

The accounting policies for financial instruments have been applied to the line items above.<br />

Loans and<br />

receivables<br />

Fair value<br />

through<br />

profit or loss<br />

Derivatives Measured at<br />

used for<br />

hedging<br />

amortised<br />

cost Total<br />

Parent $’000 $’000 $’000 $’000 $’000<br />

At 31 July 2010<br />

Cash and cash equivalents 31 - - - 31<br />

Trade receivables 2 - - - 2<br />

Amounts owed from subsidiaries 165,450 - - - 165,450<br />

Employee share scheme receivable 203 - - - 203<br />

Other receivables 158 - - - 158<br />

Trade payables - - - (549) (549)<br />

Amounts due to subsidiaries - - - (207,221) (207,221)<br />

Sales tax payable - - - (519) (519)<br />

Employee benefits - - - (2,388) (2,388)<br />

Interest bearing liabilities - - - (28) (28)<br />

165,844 - - (210,705) (44,861)<br />

At 31 July 2009<br />

Cash and cash equivalents 38 - - - 38<br />

Trade receivables 2 - - - 2<br />

Amounts owed from subsidiaries 126,780 - - - 126,780<br />

Employee share scheme receivable 215 - - - 215<br />

Other receivables 631 - - - 631<br />

Trade payables - - - (984) (984)<br />

Amounts due to subsidiaries - - - (179,867) (179,867)<br />

Sales tax payable - - - (856) (856)<br />

Employee benefits - - - (2,422) (2,422)<br />

Interest bearing liabilities - - - (319) (319)<br />

127,666 - - (184,448) (56,782)<br />

The accounting policies for financial instruments have been applied to the line items above.<br />

20<br />

years<br />

young<br />

95