Cooperative Microfinance in Agriculture Analyzing the Outreach and Financial Sustainability of Albanian Savings & Credit Union

Our research aimed in analyzing the outreach and financial sustainability of Albanian Savings & Credit Union. It was based on a descriptive study and on quantitative data that was collected through interviews, direct observations and different annual financial statements. Concerning the outreach, our study found out that the number of active clients increased from 7,621 active clients in 2003 to 15,499 active clients in 2012. The average loan size showed a growth for the period 2003-2008 by reaching the amount of $US 2,509, then it decreased at $US 2,207 in 2010 and raised at $US 2,314 in 2012. From the other hand, the Operating Expense Ratio has shown instability such as from 9.62% in 2002 it dropped to 8.62% in 2007 to fell off to 7.58% in 2009 and raised again in 2010 by 8.20%, while the cost per loan increased by making the ASC Union inefficient. Moreover, the dependency ratio reduced from 89% in 2005 to 26.8% in 2012 while retained earnings to total capital ratio went up to 9.2% in 2008, but then it reduced to 6% in 2012. Similarly to the dependency ratio, the donated capital has also shown reduction over the years from 45% in 2005 to 9.2% in 2012, allowing the ASC Union to be financially self-sufficient. Key words: Microfinance, Microcredit, Outreach, Financial Sustainability, Credit Union, Albania

Our research aimed in analyzing the outreach and financial sustainability of Albanian Savings & Credit Union. It was based on a descriptive study and on quantitative data that

was collected through interviews, direct observations and different annual financial statements. Concerning the outreach, our study found out that the number of active clients increased from 7,621 active clients in 2003 to 15,499 active clients in 2012. The average loan size showed a growth for the period 2003-2008 by reaching the amount of $US 2,509, then it decreased at $US 2,207 in 2010 and raised at $US 2,314 in 2012. From the other hand, the

Operating Expense Ratio has shown instability such as from 9.62% in 2002 it dropped to 8.62% in 2007 to fell off to 7.58% in 2009 and raised again in 2010 by 8.20%, while the

cost per loan increased by making the ASC Union inefficient.

Moreover, the dependency ratio reduced from 89% in 2005 to 26.8% in 2012 while retained earnings to total capital ratio went up to 9.2% in 2008, but then it reduced to 6%

in 2012. Similarly to the dependency ratio, the donated capital has also shown reduction over the years from 45% in 2005 to 9.2% in 2012, allowing the ASC Union to be

financially self-sufficient.

Key words: Microfinance, Microcredit, Outreach, Financial Sustainability, Credit Union,

Albania

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

32<br />

European Journal <strong>of</strong> Susta<strong>in</strong>able Development (2014), 3, 4, 29-36<br />

services. This <strong>in</strong>dicator is more useful than <strong>the</strong> cumulative number <strong>of</strong> loans made or<br />

clients served dur<strong>in</strong>g<br />

a period. 6<br />

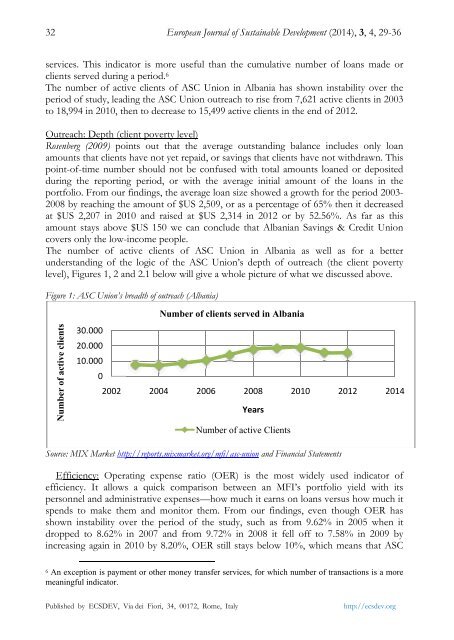

The number <strong>of</strong> active clients <strong>of</strong> ASC <strong>Union</strong> <strong>in</strong> Albania has shown <strong>in</strong>stability over <strong>the</strong><br />

period <strong>of</strong> study, lead<strong>in</strong>g <strong>the</strong> ASC <strong>Union</strong> outreach to<br />

rise from 7,621<br />

active clients <strong>in</strong> 2003<br />

to 18,994 <strong>in</strong> 2010, <strong>the</strong>n to decrease to 15,499 active clients <strong>in</strong> <strong>the</strong> end <strong>of</strong> 2012.<br />

<strong>Outreach</strong>: Depth (client poverty level)<br />

Rosenberg (2009) po<strong>in</strong>ts out that <strong>the</strong> average outst<strong>and</strong><strong>in</strong>g balance <strong>in</strong>cludes only loan<br />

amounts that clients<br />

have not yet repaid, or sav<strong>in</strong>gs that clients have not withdrawn. This<br />

po<strong>in</strong>t-<strong>of</strong>-time number should not be confused with total amounts loaned or deposited<br />

dur<strong>in</strong>g <strong>the</strong> report<strong>in</strong>g period, or with <strong>the</strong> averagee <strong>in</strong>itial amount<br />

<strong>of</strong> <strong>the</strong> loans <strong>in</strong> <strong>the</strong><br />

portfolio. From our f<strong>in</strong>d<strong>in</strong>gs, <strong>the</strong> average loan size showed a growth for <strong>the</strong> period<br />

2003-<br />

2008<br />

by reach<strong>in</strong>g <strong>the</strong> amount <strong>of</strong> $US 2,509, or as a percentage <strong>of</strong> 65% <strong>the</strong>n it decreased<br />

at $US 2,207 <strong>in</strong> 2010 <strong>and</strong> raised at $US 2,314 <strong>in</strong><br />

2012 or by 52.56%. As far as this<br />

amount stays above<br />

$US 150 we can conclude that <strong>Albanian</strong> Sav<strong>in</strong>gs & <strong>Credit</strong> <strong>Union</strong><br />

covers only <strong>the</strong> low-<strong>in</strong>comnumber <strong>of</strong> active clients <strong>of</strong><br />

ASC <strong>Union</strong> <strong>in</strong> Albania as well as for a better<br />

people.<br />

The<br />

underst<strong>and</strong><strong>in</strong>g <strong>of</strong> <strong>the</strong> logic <strong>of</strong> <strong>the</strong> ASC <strong>Union</strong>’s depth <strong>of</strong> outreach (<strong>the</strong> client poverty<br />

level), Figures 1, 2 <strong>and</strong> 2.1 below will give a whole picture <strong>of</strong> what we discussed above.<br />

Figure 1: ASC <strong>Union</strong>’s breadth <strong>of</strong> outreach (Albania)<br />

Number <strong>of</strong> clients served <strong>in</strong> Albania<br />

Number <strong>of</strong> active clients<br />

30.000<br />

20.000<br />

10.000<br />

0<br />

2002<br />

2004<br />

2006 2008 2010<br />

Years<br />

2012<br />

2014<br />

Number <strong>of</strong> active Clients<br />

Source: MIX Market http://reports.mixmarket.org/mfi/asc-union <strong>and</strong> F<strong>in</strong>ancial Statements<br />

Efficiency: Operat<strong>in</strong>g expense ratio (OER) is <strong>the</strong> most widely used <strong>in</strong>dicator <strong>of</strong><br />

efficiency. It allows<br />

a quick comparison between an MFI’s portfolio yield with its<br />

personnel <strong>and</strong> adm<strong>in</strong>istrative expenses—how much<br />

it earns on loans versus how much it<br />

spends to make <strong>the</strong>m <strong>and</strong> monitor <strong>the</strong>m. From our f<strong>in</strong>d<strong>in</strong>gs, even though OER has<br />

shown <strong>in</strong>stability over <strong>the</strong> period <strong>of</strong> <strong>the</strong> study, such as from 9. 62% <strong>in</strong> 2005 when it<br />

dropped to 8.62% <strong>in</strong> 2007 <strong>and</strong> from 9.72% <strong>in</strong> 2008 it fell <strong>of</strong>f to 7.58% <strong>in</strong> 2009 by<br />

<strong>in</strong>creas<strong>in</strong>g aga<strong>in</strong> <strong>in</strong> 2010 by 8.20%, OER still stayss below 10%, which means that ASC<br />

6 An exception is payment or o<strong>the</strong>r money<br />

transfer services,<br />

for which number<br />

<strong>of</strong> transactions is<br />

a more<br />

mean<strong>in</strong>gful <strong>in</strong>dicator.<br />

Published by ECSDEV, Via dei Fiori, 34, 00172, Rome, Italy<br />

http://ecsdev.org