Cooperative Microfinance in Agriculture Analyzing the Outreach and Financial Sustainability of Albanian Savings & Credit Union

Our research aimed in analyzing the outreach and financial sustainability of Albanian Savings & Credit Union. It was based on a descriptive study and on quantitative data that was collected through interviews, direct observations and different annual financial statements. Concerning the outreach, our study found out that the number of active clients increased from 7,621 active clients in 2003 to 15,499 active clients in 2012. The average loan size showed a growth for the period 2003-2008 by reaching the amount of $US 2,509, then it decreased at $US 2,207 in 2010 and raised at $US 2,314 in 2012. From the other hand, the Operating Expense Ratio has shown instability such as from 9.62% in 2002 it dropped to 8.62% in 2007 to fell off to 7.58% in 2009 and raised again in 2010 by 8.20%, while the cost per loan increased by making the ASC Union inefficient. Moreover, the dependency ratio reduced from 89% in 2005 to 26.8% in 2012 while retained earnings to total capital ratio went up to 9.2% in 2008, but then it reduced to 6% in 2012. Similarly to the dependency ratio, the donated capital has also shown reduction over the years from 45% in 2005 to 9.2% in 2012, allowing the ASC Union to be financially self-sufficient. Key words: Microfinance, Microcredit, Outreach, Financial Sustainability, Credit Union, Albania

Our research aimed in analyzing the outreach and financial sustainability of Albanian Savings & Credit Union. It was based on a descriptive study and on quantitative data that

was collected through interviews, direct observations and different annual financial statements. Concerning the outreach, our study found out that the number of active clients increased from 7,621 active clients in 2003 to 15,499 active clients in 2012. The average loan size showed a growth for the period 2003-2008 by reaching the amount of $US 2,509, then it decreased at $US 2,207 in 2010 and raised at $US 2,314 in 2012. From the other hand, the

Operating Expense Ratio has shown instability such as from 9.62% in 2002 it dropped to 8.62% in 2007 to fell off to 7.58% in 2009 and raised again in 2010 by 8.20%, while the

cost per loan increased by making the ASC Union inefficient.

Moreover, the dependency ratio reduced from 89% in 2005 to 26.8% in 2012 while retained earnings to total capital ratio went up to 9.2% in 2008, but then it reduced to 6%

in 2012. Similarly to the dependency ratio, the donated capital has also shown reduction over the years from 45% in 2005 to 9.2% in 2012, allowing the ASC Union to be

financially self-sufficient.

Key words: Microfinance, Microcredit, Outreach, Financial Sustainability, Credit Union,

Albania

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

J. Bou Dib (Lekocaj), J. Lekocaj, G. van Dijk 35<br />

Figure 5: The ASC <strong>Union</strong>’ f<strong>in</strong>ancial susta<strong>in</strong>ability (Albania)<br />

ROE<br />

0,1<br />

0,08<br />

0,06<br />

0,04<br />

0,02<br />

Trend <strong>of</strong> Dependency ratio <strong>and</strong> Reta<strong>in</strong>ed earn<strong>in</strong>gs to capital ratio<br />

1,00<br />

0,80<br />

0,60<br />

0,40<br />

0,20<br />

Dependency ratio<br />

0<br />

0,00<br />

2005 2006 2007 2008 2009 2010 2011 2012<br />

Dependency ratio<br />

Source: MIX Market <strong>and</strong> ASC <strong>Union</strong> Annual Reports<br />

ROE<br />

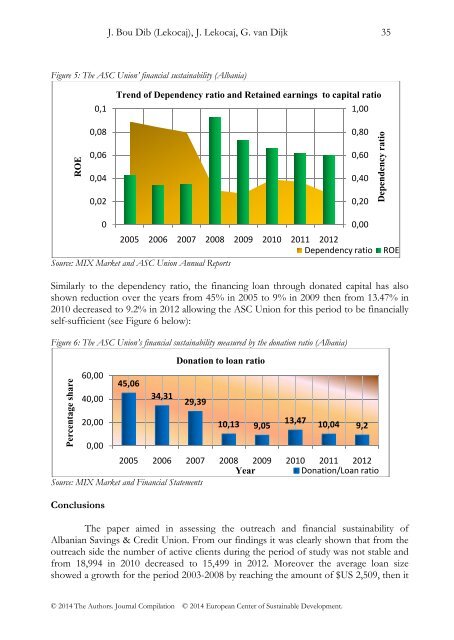

Similarly to <strong>the</strong> dependency ratio, <strong>the</strong> f<strong>in</strong>anc<strong>in</strong>g loan through donated capital has also<br />

shown reduction over <strong>the</strong> years from 45% <strong>in</strong> 2005 to 9% <strong>in</strong> 2009 <strong>the</strong>n from 13.47% <strong>in</strong><br />

2010 decreased to 9.2% <strong>in</strong> 2012 allow<strong>in</strong>g <strong>the</strong> ASC <strong>Union</strong> for this period to be f<strong>in</strong>ancially<br />

self-sufficient (see Figure 6 below):<br />

Figure 6: The ASC <strong>Union</strong>’s f<strong>in</strong>ancial susta<strong>in</strong>ability measured by <strong>the</strong> donation ratio (Albania)<br />

Percentage share<br />

60,00<br />

40,00<br />

20,00<br />

0,00<br />

Conclusions<br />

45,06<br />

34,31<br />

Donation to loan ratio<br />

29,39<br />

10,13 9,05<br />

13,47<br />

10,04 9,2<br />

2005 2006 2007 2008 2009 2010 2011 2012<br />

Year<br />

Donation/Loan ratio<br />

Source: MIX Market <strong>and</strong> F<strong>in</strong>ancial Statements<br />

The paper aimed <strong>in</strong> assess<strong>in</strong>g <strong>the</strong> outreach <strong>and</strong> f<strong>in</strong>ancial susta<strong>in</strong>ability <strong>of</strong><br />

<strong>Albanian</strong> Sav<strong>in</strong>gs & <strong>Credit</strong> <strong>Union</strong>. From our f<strong>in</strong>d<strong>in</strong>gs it was clearly shown that from <strong>the</strong><br />

outreach side <strong>the</strong> number <strong>of</strong> active clients dur<strong>in</strong>g <strong>the</strong> period <strong>of</strong> study was not stable <strong>and</strong><br />

from 18,994 <strong>in</strong> 2010 decreased to 15,499 <strong>in</strong> 2012. Moreover <strong>the</strong> average loan size<br />

showed a growth for <strong>the</strong> period 2003-2008 by reach<strong>in</strong>g <strong>the</strong> amount <strong>of</strong> $US 2,509, <strong>the</strong>n it<br />

© 2014 The Authors. Journal Compilation © 2014 European Center <strong>of</strong> Susta<strong>in</strong>able Development.