TECH NOTES FOCUS ON: BRENT CRUDE OIL ICE NEWS

TECH NOTES FOCUS ON: BRENT CRUDE OIL ICE NEWS

TECH NOTES FOCUS ON: BRENT CRUDE OIL ICE NEWS

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

FEBRUARY 2009<br />

<strong>FOCUS</strong> <strong>ON</strong>: <strong>BRENT</strong> <strong>CRUDE</strong> <strong>OIL</strong><br />

<strong>ICE</strong> Futures Europe has been home of the Brent Crude futures<br />

contract for more than two decades. The <strong>ICE</strong> Brent<br />

futures contract has always been financially settled, originally<br />

taking as its basis Brent crude, which is blended<br />

from a group of crude streams within the Brent and Ninian<br />

systems in the North Sea.<br />

In July 2002, the North Sea forward market, on which the<br />

Brent futures contract is based, was modified to include<br />

additional grades Forties and Oseberg, with Ekofisk added<br />

as an additional component in June 2007. This complex<br />

is now known as BFOE — Brent, Forties, Oseberg<br />

and Ekofisk. The physical market for setting the price of<br />

dated Brent or dated BFOE is based upon an assessment<br />

by the price reporting agencies to reflect the most competitive<br />

spot value of Brent, Forties, Oseberg and Ekofisk.<br />

The lowest price is chosen to avoid the potential for adverse<br />

upward price movements as three of the four crude<br />

oils would act as a floating cap. Total daily production<br />

of the crude oils within the BFOE complex are around<br />

1.2-mil barrels per day, compared to daily West Texas<br />

Intermediate (WTI) daily production of around 350,000<br />

barrels per day.<br />

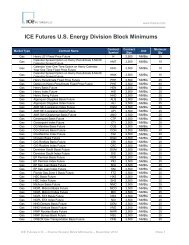

Crude Oil Country API Gravity (º) Sulfur (%)<br />

Brent UK 38.5 0.41<br />

Forties UK 40.3 0.56<br />

Oseberg Norway 37.8 0.27<br />

Ekofisk UK/Norway 37.5 0.24<br />

Source: Petroleum Intelligence Weekly Crude oil handbook 2008<br />

Unlike Forties, Oseberg or Ekofisk, Brent is rarely used by<br />

European refiners: most is transported to and refined in<br />

North America as a gasoline-rich blend.<br />

Dated Brent or BFOE is the benchmark for pricing twothirds<br />

of the world’s traded crude oil by volume. Crude<br />

oil blends as far apart as Russia, Africa, the Middle East<br />

— and occasionally Asia-Pacific — are priced as a differential<br />

to Brent (i.e., Brent plus or minus $1.00). Like WTI,<br />

Brent is classified as a light, sweet blend, which means it<br />

contains higher value hydrocarbons than a heavier crude<br />

oil and is lower in sulfur content (i.e., “sweet”).<br />

Continues on page 2.<br />

<strong>TECH</strong> <strong>NOTES</strong><br />

Cleared PJM options now available on<br />

Web<strong>ICE</strong> and via the broker market<br />

<strong>ICE</strong> Tip: Web<strong>ICE</strong> now offers GTC orders for<br />

<strong>ICE</strong> Futures Europe<br />

New OTC Clearing Guide now available<br />

Setup and Maintain YJ Message Consoles,<br />

Distribution Lists and Activity Consoles with<br />

Linked Folders<br />

New Version of <strong>ICE</strong> Platform Launched<br />

Version 12.200 of the <strong>ICE</strong> Platform was successfully<br />

launched on January 26. This latest upgrade allows<br />

<strong>ICE</strong> to move the Henry Hub OTC markets to Trading<br />

Engine and will dramatically reduce round trip times<br />

while increasing throughput in this important market.<br />

It also offers many other enhancements and key architectural<br />

changes that will set the stage for options<br />

upgrades and market data segregation, including enhancements<br />

to clearing administration, Web<strong>ICE</strong> and<br />

<strong>ICE</strong>Block, which will be rolled out later in the year.<br />

<strong>ICE</strong> <strong>NEWS</strong><br />

<strong>ICE</strong> Named 2008 Derivatives Exchange of<br />

the Year by Risk Magazine<br />

<strong>ICE</strong> Reports Strong Energy Futures Volume for<br />

January 2009<br />

<strong>ICE</strong> Annual Shareholder Meeting Set for May 14<br />

<strong>ICE</strong> Achieves Record Volume for 2008<br />

<strong>ICE</strong> Clear Europe Receives Settlement Designation<br />

from Financial Services Authority (FSA)

<strong>ICE</strong> IN <strong>FOCUS</strong><br />

2<br />

<strong>FOCUS</strong> <strong>ON</strong>: <strong>BRENT</strong> <strong>CRUDE</strong> <strong>OIL</strong> (continued)<br />

On <strong>ICE</strong>’s electronic platform, <strong>ICE</strong> Brent trades alongside<br />

the <strong>ICE</strong> WTI contract, which is a benchmark contract for<br />

North American crude oil. This enables users to trade the<br />

two largest crude oil futures markets on a single platform.<br />

Because of WTI’s particular suitability for gasoline production<br />

in a region dominated by that refined product, and<br />

because of the cost of freight to pull Brent across the Atlantic<br />

Basin, WTI has historically traded at a $1 to $2 per<br />

barrel premium over Brent.<br />

4<br />

2<br />

0<br />

-2<br />

-4<br />

-6<br />

-8<br />

First nearby spread history for <strong>ICE</strong> Brent and <strong>ICE</strong> WTI<br />

history since January 2008<br />

Unlike WTI, which is a pipeline delivered crude stream, the<br />

North Sea grades are all sold on an FOB (Free on Board)<br />

cargo basis, which means the oil is easily sold anywhere in<br />

the world. WTI is a US-domiciled crude oil which cannot<br />

be re-sold into the international market. This means that<br />

Brent is not subject to the same limitations around storage<br />

as WTI, and is more exposed to developments in the<br />

international market.<br />

Recent developments<br />

In April and May 2007, the historical pricing relationship inverted<br />

when a premium began to emerge for Brent against<br />

WTI. This was largely due to storage capacity problems at<br />

Cushing, Oklahoma, which depressed the value of WTI relative<br />

to other crude oils in the US Gulf coast and beyond.<br />

The inversion re-emerged in December 2008 with a surge<br />

in stocks at Cushing and weakening U.S. demand for crude<br />

oil. Cushing oil stocks are 17.7-mil bbl higher than a year<br />

ago and are currently at a new all time high level of 33.5-<br />

mil barrels, according to the latest report from Societe<br />

Generale (US Petroleum Report dated January 28, 2009).<br />

-10<br />

02/01/08<br />

18/01/08<br />

03/02/08<br />

19/02/08<br />

06/03/08<br />

22/03/08<br />

Source: <strong>ICE</strong> Futures Europe historical data<br />

07/04/08<br />

The duration, depth and size of the premium for Brent<br />

has strengthened into 2009. Since the beginning of December<br />

2008, the front month WTI spread has averaged<br />

-$3.62 per barrel (contango), compared to -$2.43 per barrel<br />

(contango) for Brent.<br />

During the period of the previous price inversion in April<br />

and May 2007, on average, the front 24 contract months<br />

for Brent were trading at a premium to WTI. However,<br />

from the middle of December and into January, the depth<br />

of the inversion extended to an average of around 60 contract<br />

months. With the distortions at Cushing, the International<br />

Energy Agency observed in its January monthly<br />

report that Brent was “arguably more reflective of global<br />

oil market sentiment.”<br />

Continues on page 3<br />

23/04/08<br />

09/05/08<br />

25/05/08<br />

10/06/08<br />

26/06/08<br />

Prompt Brent Spread<br />

12/07/08<br />

28/07/08<br />

13/08/08<br />

29/08/08<br />

14/09/08<br />

30/09/08<br />

16/10/08<br />

Prompt WTI Spread<br />

01/11/08<br />

17/11/08<br />

03/12/08<br />

19/12/08<br />

04/01/09<br />

20/01/09<br />

PRODUCTS & SERV<strong>ICE</strong>S<br />

New <strong>ICE</strong> OTC Cleared Energy Contracts: Print full list<br />

February 13 Launch for Cleared Ag Swaps<br />

NGI Indices to be Exclusive to <strong>ICE</strong> in May<br />

<strong>ICE</strong> Announces Third Set of New OTC Cleared Contracts<br />

<strong>ICE</strong> Launches Dozens of New Cleared Contracts Including<br />

Gas, Heating Oil and PJM West Real Time<br />

<strong>ICE</strong>’s Product Guide: Specs for all <strong>ICE</strong> Contracts<br />

NOTE FROM THE <strong>ICE</strong> HELP DESK<br />

Resolve trade disputes fast. If there is a trade issue, it is<br />

very important for <strong>ICE</strong> to be able to reach you immediately.<br />

To ensure your information is up to date, simply<br />

left click on “Admin/Edit my contact information” at<br />

the top of your Web<strong>ICE</strong> screen. Then click again on<br />

“information/update” to revise.<br />

When contacting the <strong>ICE</strong> Help Desk, please have your<br />

<strong>ICE</strong> User ID ready to provide to the <strong>ICE</strong> representative.<br />

This will help us resolve your issue as quickly as<br />

possible.<br />

<strong>ICE</strong> MILLI<strong>ON</strong>S<br />

FX FUTURES<br />

Free real-time<br />

prices<br />

** Note: As of May 1, 2009 <strong>ICE</strong> will require all Web<strong>ICE</strong><br />

users to operate with a minimum Java version of<br />

1.6.0_03. Please check with your IT staff to be ready<br />

for this change. The new version will allow <strong>ICE</strong> to ensure<br />

that customers receive the new functionality and<br />

performance enhancements we strive to deliver.

<strong>ICE</strong> IN <strong>FOCUS</strong><br />

3<br />

A WORD FROM JEFF SPRECHER<br />

Recognizing that the financial services sector has faced many<br />

challenges over the past 18 months, I wanted to take a moment<br />

to thank you for your continued business.<br />

While we share our industry’s concern about the broader<br />

business cycle, I am optimistic about the opportunities that<br />

tend to arise amid such challenges. Through your input and<br />

partnership, we have established a marketplace that offers<br />

the transparency, products and stability required to manage<br />

risk in uncertain times. In 2008, <strong>ICE</strong> reported record contract<br />

volume, Importantly, responding to needs in the marketplace,<br />

we launched a new clearinghouse, introduced a range of new<br />

products and made significant progress in our credit default<br />

swaps strategy. In the first few weeks of this year, we have announced<br />

over 50 new cleared OTC contracts. And this month,<br />

<strong>ICE</strong> Clear U.S. will be the first U.S. clearing house to clear ag<br />

swap contracts, including sugar, coffee and cocoa.<br />

We’ll continue to strive to lead the industry in growth and innovation<br />

in 2009 and beyond. Thank you for your business,<br />

and please let us know if you have any feedback that might<br />

help us better serve you.<br />

<strong>FOCUS</strong> <strong>ON</strong>: <strong>BRENT</strong> <strong>CRUDE</strong> <strong>OIL</strong> (continued)<br />

Through January 28, 2009, <strong>ICE</strong> Brent futures closed higher<br />

than WTI futures on 31 consecutive trading days. And<br />

on January 15, 2009, the Brent premium reached a record<br />

of $10.58 on an intra-day basis. As the Financial Times observed<br />

on January 18, “This is not the first time WTI has<br />

diverged from other benchmarks, but the discrepancy is<br />

far more severe this time.” In a January 2009 report, Barclays<br />

commented, “…if you want to take a position based<br />

on balances and fundamentals, it is perhaps better for the<br />

moment to stick to Brent or other non-WTI exposure.”<br />

Storage capacity at Cushing is often cited as a limitation<br />

of WTI. Increasing supplies of Canadian crudes have<br />

exacerbated the Cushing issue, as pipelines required to<br />

take crude oil from Canada to the U.S. Gulf Coast have<br />

not been constructed, adding to storage build-ups around<br />

Cushing. Between October 2008 and January 2009, oil<br />

stocks at Cushing more than doubled to 33 million barrels.<br />

With this increase, the pressure on the front WTI intermonth<br />

spread has intensified. The contango for the front<br />

WTI spread fell to -$8.14/bbl on January 15 2009. At the<br />

start of 2009, the front WTI spread settled at -$3.87/bbl.<br />

Differential spreads between WTI and other U.S. Gulf<br />

coast crude oils have also begun to break down. The WTI<br />

spread has reversed against Light Louisiana Sweet (LLS)<br />

and other non-Cushing delivered (and non-exchange<br />

traded) grades against which it usually sells at a premium.<br />

The IEA noted its January report that there is evidence of<br />

traders doing deals on a non-WTI related basis.<br />

Why trade <strong>ICE</strong> Brent Crude futures<br />

Hedgers, commercials and traders who require exposure<br />

to global economic trends should consider the <strong>ICE</strong> Brent<br />

Crude futures contract. Brent prices are heavily influenced<br />

by global supply and demand fundamentals. Its liquidity<br />

is ensured by substantial commercial paper. Because it<br />

serves as a pricing mechanism for producers and refiners,<br />

it offers exposure not available in other markets.<br />

Benefits of Brent Crude on the <strong>ICE</strong> Platform<br />

1<br />

2<br />

3<br />

4<br />

5<br />

6<br />

<strong>ICE</strong> Clear Europe offers competitive initial margins and inter-month<br />

spread charges, including a 90% margin offset between Brent and<br />

WTI, the most liquidly traded arbitrage market on any exchange.<br />

Swaps traders in the crude markets can mark to market their positions<br />

against a liquid Brent tradable marker at 16:30 London time.<br />

Because European product prices are set at this time, traders and<br />

refiners who need to lock in a crack spread can do so.<br />

Several Middle East producers use the exchange derived Brent<br />

Weighted Average Price (BWAVE) to price crude oils for European<br />

customers. Customers exposed to the BWAVE price are able to<br />

hedge exposure on a liquid exchange using the liquid <strong>ICE</strong> Brent<br />

Crude futures contract.<br />

Gasoil Crack: Trading the Gasoil crack will result in two separate<br />

positions in the underlying futures markets for Brent and Gasoil.<br />

The settlement of each leg will be respective expiry of the Brent<br />

and Gasoil futures contracts as made public by <strong>ICE</strong> Futures Europe.<br />

Upon expiry of the Brent leg, holders of a Gasoil crack trade will<br />

then be left with a long or short position in the Gasoil market which<br />

will then be settled on expiry of the relevant underlying <strong>ICE</strong> Gasoil<br />

futures contract.<br />

<strong>ICE</strong> is increasing its OTC Cleared offerings in the Brent market. A<br />

large family of related OTC instruments have emerged that price in<br />

relation to the <strong>ICE</strong> Brent futures contract. Current products include<br />

Dated to Front-Line swaps, Brent CFD swaps, Dated Brent swaps<br />

and WTI/Brent 1st line swaps as a differential.<br />

For more information, visit <strong>ICE</strong>’s Product Guide.<br />

Futures style Options on <strong>ICE</strong> Brent Crude futures are also available<br />

with plans for additional contracts in 2009.<br />

For more information, visit <strong>ICE</strong>’s Product Guide.<br />

<strong>ICE</strong> EDUCATI<strong>ON</strong> <strong>ICE</strong> EVENTS QUICK LINKS<br />

Feb 11: Fundamental Analysis - Energy Markets<br />

Feb 11: Electricity Market & Trading Program<br />

Feb 12: Charting & Technical Analysis<br />

View the 2009 <strong>ICE</strong> Education<br />

Course Calendar<br />

Email education@theice.com<br />

for more information<br />

Feb 8-10: MFA Network 2009 - Key Biscayne, FL<br />

Feb 8-10: 5 Kingsman Sugar Conference, Dubai<br />

Feb 11-13: Western Barley Growers Assoc., Alberta<br />

Feb 16 - 19: IP Week – London<br />

Feb 18-19: OPIS NGL Fundamental Executive<br />

Education Series - Houston, TX<br />

Feb 21-24: Traders Expo - New York, NY<br />

Feb 22-24: Grain World - Winnipeg<br />

C<strong>ON</strong>TACT US<br />

<strong>ICE</strong> WEBSITE<br />

HOLIDAY CALENDAR<br />

NOTE: On February 16, both <strong>ICE</strong> Futures<br />

U.S. and <strong>ICE</strong> Futures Canada will be closed<br />

in observance of U.S. Presidents Day and<br />

Louis Riel Day. Read More.