JP Morgan Chase & Co. Investment Notes - Redfield, Blonsky & Co.

JP Morgan Chase & Co. Investment Notes - Redfield, Blonsky & Co.

JP Morgan Chase & Co. Investment Notes - Redfield, Blonsky & Co.

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>JP</strong> <strong>Morgan</strong> <strong>Chase</strong> & <strong>Co</strong>.<br />

<strong>Investment</strong> <strong>Notes</strong><br />

Please read Disclaimer at bottom of these notes!<br />

“<strong>JP</strong><strong>Morgan</strong> <strong>Chase</strong> & <strong>Co</strong>. (NYSE: <strong>JP</strong>M) is a leading global financial services firm with assets of $2.1<br />

trillion and operations in more than 60 countries. The firm is a leader in investment banking,<br />

financial services for consumers, small business and commercial banking, financial transaction<br />

processing, asset management and private equity. A component of the Dow Jones Industrial Average,<br />

<strong>JP</strong><strong>Morgan</strong> <strong>Chase</strong> & <strong>Co</strong>. serves millions of consumers in the United States and many of the world’s<br />

most prominent corporate, institutional and government clients under its J.P. <strong>Morgan</strong> and <strong>Chase</strong><br />

brands.” 2010 Annual Report<br />

"We are a buyer in size around tangible book value..." Jamie Dimon CEO <strong>JP</strong><strong>Morgan</strong> <strong>Chase</strong> 4/13/12<br />

(speaking about <strong>JP</strong>M buying back stock.)<br />

April 24, 2012 (43.11) Thesis<br />

One of the world’s largest and most respected Financial Services organizations. Jamie Dimon CEO,<br />

respected a great deal, and seems to “tell it like it is.” The Price to Book value and P/E are low relative<br />

to their historic averages. <strong>JP</strong>M traded at 2-3-times tangible book before the financial crisis. <strong>JP</strong>M<br />

should benefit when there is an economic, jobs and/or housing recovery. Most ratings agencies and<br />

investment houses rate their financial strength as ‘A’ or better. <strong>JP</strong>M is focused on growth and risk.<br />

Tier 1 ratio has been consistently over 12. ROE metric has been in excess of 10%. Price to Book is<br />

primary reason for owning.<br />

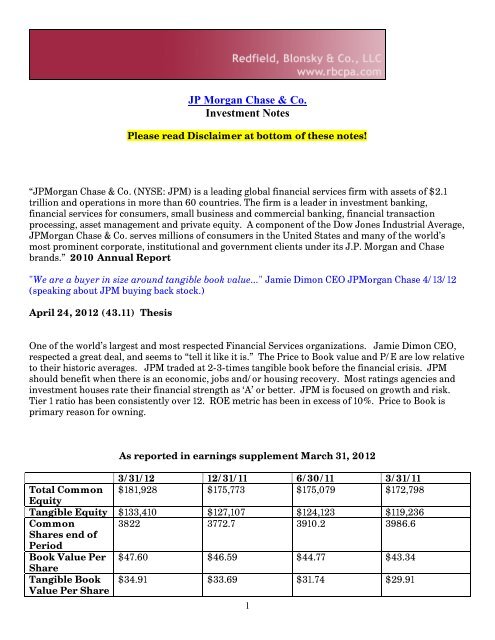

As reported in earnings supplement March 31, 2012<br />

3/31/12 12/31/11 6/30/11 3/31/11<br />

Total <strong>Co</strong>mmon $181,928 $175,773 $175,079 $172,798<br />

Equity<br />

Tangible Equity $133,410 $127,107 $124,123 $119,236<br />

<strong>Co</strong>mmon 3822 3772.7 3910.2 3986.6<br />

Shares end of<br />

Period<br />

Book Value Per $47.60 $46.59 $44.77 $43.34<br />

Share<br />

Tangible Book<br />

Value Per Share<br />

$34.91 $33.69 $31.74 $29.91<br />

1

Tier 1 Capital 12.6 12.3 12.4 12.3<br />

Ratio<br />

Price Per Share $45.98 $33.25 $40.94 $46.10<br />

Close<br />

P/BV 0.97X 0.7136 0.9145 1.064<br />

P/TBV 1.32X 0.987 1.29 1.54<br />

Net Income per $1.31 $0.90 $1.27 $1.28<br />

Share<br />

ROE 12% 8% 12% 13%<br />

I project earnings for 2012 of $4.50 - $5.00 per share. Based on current price, P/E would be in range<br />

of 9.6X – 8.6X. I would not think of selling this below 1.5X Book Value or ~$71.50, or P/E of 15,<br />

which would indicate a price of ~$71.25.<br />

April 27, 2011 (45.08) Thesis<br />

One of the worlds largest and most respected Financial Services organization. Jamie Dimon CEO,<br />

respected a great deal, and seems to “tell it like it is.” Great shareholder letters. Price to Book value<br />

and P/E low per average of past. Should benefit in economic, jobs and housing recovery. Most<br />

agencies and investment houses rate their financial strength as ‘A’ or better. Focused on growth and<br />

risk. Fortress balance sheet. ROE metric at 10%. Price to Book is primary reason for owning. Has<br />

often been priced in the past at 1.5X Book Value.<br />

November 14, 2011 (32.55) Review of VL 11/18/11<br />

1. Projecting F2011 and F2012 earnings of $4.50 to $4.70 respectively. Previous was $4.90<br />

and $5.20, respectively.<br />

2. Dividend of $1.00 is 3.07%.<br />

3. Book Value F2011 of $46.65 intangibles of $15.64, for TBV of $31.01.<br />

4. ROE projected at 10.5% for F2011 and 9.5% for F2012.<br />

5. “<strong>Co</strong>nservative investors may want to stay on sidelines.”<br />

August 24, 2011 (35.29) Review of VL 8/19/11<br />

1. Projecting F2011 and F2012 earnings of $4.90 to $5.20 respectively. Previous was $5.00 and<br />

$5.50, respectively.<br />

2. Dividend of $1.00 is a yield of 2.7%.<br />

3. Book Value F2011 of $46.70 intangibles of $16.57, for TBV of $30.13.<br />

4. ROE projected at 11% for F2011 and 10.5% for F2012.<br />

5. Net of hedging, VL expects worst case Europe scenario to be $3B. This is consistent with what<br />

Jamie Dimon has recently discussed.<br />

June 20, 2011 (40.76) <strong>Notes</strong> to Morningstar Report 6/8/11 – Nothing to add.<br />

2

May 25, 2011 (42.69) Review of VL 5/20/11<br />

1. Projecting F2011 and F2012 earnings of $5.00 and $5.50, respectively.<br />

2. Dividend of $1.00 is a yield of 2.2%.<br />

3. Book Value F2011 of $47.30, intangibles of $16.51, for TBV of $30.79.<br />

4. ROE projected at 11% for F2011 and F2012<br />

April 27, 2011 (45.08)<br />

Fundamental Analysis<br />

<strong>Co</strong>mpany Name<br />

Symbol<br />

Date Worked On<br />

Base Year<br />

<strong>JP</strong> <strong>Morgan</strong><br />

<strong>Chase</strong><br />

<strong>JP</strong>M<br />

27-Apr-11<br />

3-Jul-05<br />

Price $45.52<br />

Shares Outstanding 4,014<br />

Market Capitalization $182,722<br />

Cash and CE $104,311<br />

Long Term Debt $269,616<br />

Minority Interests $0<br />

Goodwill $48,856<br />

Intangibles $3,857<br />

Other Intangibles $13,093<br />

Enterprise Value $348,027<br />

Short Term Debt $0<br />

Stockholders Equity $180,598<br />

Depreciation and Amortization $5,000<br />

CapEx $0<br />

3

Revenues $100,000<br />

Total Assets $2,117,605<br />

Net Income $19,600<br />

Dividend $1.00<br />

Interest Expense $12,781<br />

Net Income Before Taxes $24,859<br />

Enterprise Value Per Share $86.70<br />

Price To Enterprise Value 52.50%<br />

Total Debt $269,616<br />

Total Debt / Net Income 1375.59%<br />

Total Debt Per Share $67.17<br />

Tangible Book Value $114,792<br />

Book Value Per Share $44.99<br />

Tangible Book Value Per Share $28.60<br />

Price / Book Value 101.18%<br />

Price / Tangible Book Value 159.18%<br />

Price / Earnings Ratio 9.32<br />

Enterprise Value / Earnings<br />

Ratio 17.76<br />

Earnings Yield 10.73%<br />

Price To Sales Ratio 182.72%<br />

Net Income / Total Assets 0.93%<br />

Total Assets / (Revenues/365) 7729.26<br />

Enterprise Value / Revenues 348.03%<br />

Goodwill / Total Assets 2.31%<br />

Goodwill / Stockholders Equity 27.05%<br />

4

Debt / Equity 149.29%<br />

Average P/E Last 10 Years 0.0<br />

Cash Flow $24,600<br />

Cash Flow Per Share 6.13<br />

Cash Flow Yield 13.46%<br />

Price / Cash Flow 7.43<br />

Revenues Per Share $24.91<br />

Net Income Per Share $4.88<br />

Return on Equity 10.85%<br />

Bond Rating (S&P)<br />

Growth Rate 5.00%<br />

Dividend Yield 2.20%<br />

Dividend / Net Income 20.48%<br />

Dividend / Cash Flow 16.32%<br />

Interest <strong>Co</strong>verage Ratio 2.94<br />

Insider Activity<br />

Buy-Backs<br />

Dilution<br />

Management <strong>Co</strong>mpensation<br />

Neutral to<br />

Positive.<br />

claims will happen<br />

No<br />

Fair for sure<br />

Price to buy more $45.00<br />

Price to sell or consider<br />

reducing $60.00<br />

Action (Buy, Hold or Sell)<br />

Buy<br />

Portfolio Allocation Suggestion 5%<br />

5

Valuation Analysis<br />

<strong>Co</strong>mpany<br />

<strong>JP</strong> <strong>Morgan</strong> <strong>Chase</strong><br />

As of Date March 31, 2011<br />

EV Analysis<br />

April 27, 2011<br />

Share Outstanding 4,014.10<br />

Share Price $60.00<br />

Market Capitalization $240,846.00<br />

Less: Cash and Short Term<br />

<strong>Investment</strong>s $0.00<br />

Add: Long Term Debt $0.00<br />

Minority Interest $0.00<br />

Enterprise Value $240,846.00<br />

EV per share $60.00<br />

Stockholders' Equity $180,598.00<br />

Adjustments:<br />

Goodwill ($48,854.00)<br />

Mortgage Servicing Rights ($13,649.00)<br />

Other Intangibles ($4,039.00)<br />

Net Stockholders' Equity $114,056.00<br />

Adjusted Book Value per Share $28.41<br />

Quick Projections 2011 April 27, 2011<br />

Revenue $100,000.00<br />

Net Margin % before tax 28.00%<br />

Net Margin before taxes $28,000.00<br />

Tax Rate 30.00%<br />

<strong>Co</strong>rporate Taxes $8,400.00<br />

6

Net Income after Taxes $19,600.00<br />

Net Margin % 19.60%<br />

Shares Outstanding 4,014.10<br />

eps $4.88<br />

FV of current equity and future earnings<br />

27-Apr-11<br />

Adjusted Stockholder's Equity $114,056.00<br />

Net Income after Taxes $19,600.00<br />

Growth Rate of Net Profit for 10N 5.00%<br />

Growth Rate of Net Profit after 10N through 15N 5.00%<br />

FV of Net Profit in 10N $31,926.33<br />

FV of Net Profit in 15N $40,746.99<br />

FV of tangible book value plus Net Profits for 10N $432,311.90<br />

FV of tangible book value plus Net Profits for years 11 - 15N $728,164.86<br />

Current Enterprise Value $240,846.00<br />

FV of tangible book value plus Net Profits for 10N ($432,311.90)<br />

Years 10<br />

ROI on tangible book value plus Net Profits for 10N 6.02%<br />

FV of tangible book value plus Net Profits for 10N $432,311.90<br />

FV of tangible book value multiplier 1.20<br />

FV of Tangible Book Value using BV multiplier in year 10 $518,774.28<br />

Current Enterprise Value $240,846.00<br />

FV of tangible book value plus Net Profits for years 11 - 15N ($728,164.86)<br />

Years 15<br />

ROI on tangible book value plus Net Profits for 15N 7.65%<br />

FV of tangible book value plus Net Profits for 15N $728,164.86<br />

FV of tangible book value multiplier 1.2<br />

FV of Tangible Book Value using BV multiplier in year 15 $873,797.83<br />

Potential Future EV using BV multiplier above<br />

Current Enterprise Value $240,846.00<br />

FV of Tangible Book Value using BV multiplier in year 10 ($518,774.28)<br />

Years 10<br />

ROI on FV of Tangible Book Value using BV multiplier in year 10 7.98%<br />

7

Current Enterprise Value $240,846.00<br />

FV of Tangible Book Value using BV multiplier in year 15 ($873,797.83)<br />

Years 15<br />

ROI on FV of Tangible Book Value using BV multiplier in year 15 8.97%<br />

Sanity Checks:<br />

P/E in future<br />

FV of Net Profit in 15N $40,747<br />

P/E estimate 13.00<br />

Market Cap on above -$529,711<br />

Years 15<br />

Current Enterprise Value $240,846<br />

ROI in 15N using above 5.39%<br />

Potential Revenue Growth<br />

Current Revenues $100,000<br />

Growth Rate of Revenues for 10N 5.00%<br />

Growth Rate of Revenues after 10N through 15N 5.00%<br />

FV of Revenues in 10N ($162,889)<br />

FV of Revenues in 15N $207,893<br />

FV of Revenues in 15N $207,893<br />

Revenue Multiplier based on Al Meyer Rule of Thumb net margins 4<br />

Possible Market Cap year 15 ($831,571)<br />

Years 15<br />

Current Enterprise Value $240,846<br />

ROI in 15N using above 9%<br />

Intrinsic Value Analysis<br />

<strong>Co</strong>mpany<br />

<strong>JP</strong> <strong>Morgan</strong><br />

Report Date<br />

27-Apr-11<br />

Price 45.57<br />

Growth Rate 5.00%<br />

Price/Sales 1.82<br />

Price/ Net Cash Flow 7.43<br />

8

Price/ Net Book Value 1.59<br />

P/E Ratio Current 9.40<br />

P/E Ratio Year 2 8.14<br />

Current Ratio<br />

#DIV/0!<br />

Quick Ratio<br />

#DIV/0!<br />

LT Debt / Shr. Equity 140.64%<br />

LT Debt / Current Assets #DIV/0!<br />

Return on Shr. Equity 10.85%<br />

PEG Ratio (Current) 1.88<br />

PEG Ratio Year 2 1.63<br />

PEGY Ratio (Current) 1.31<br />

PEGY Ratio Year 2 1.13<br />

Graham Ratio (current) 14.97<br />

Graham Ratio Year 2 12.97<br />

Growth Flow Ratio<br />

( 10 % ) 24.52%<br />

Flow Ratio (s/b < 1.25 ) #DIV/0!<br />

Intrinsic Value (current) 71.78<br />

Intrinsic Value Year 2 82.88<br />

Intrinsic Value Year 3 87.02<br />

Intrinsic Value Year 4 91.38<br />

Intrinsic Value Year 5 95.94<br />

Intrinsic Value / Price<br />

(current) 57.52%<br />

Intrinsic Value / Price Year 2 81.87%<br />

Intrinsic Value / Price Year 3 90.97%<br />

Intrinsic Value / Price Year 4 100.52%<br />

Intrinsic Value / Price Year 5 110.54%<br />

Review of Value Line 2/18/11<br />

1. “Investors reacted favorably after banking giant <strong>JP</strong><strong>Morgan</strong> <strong>Chase</strong> posted better-than-expected<br />

March-quarter earnings of $1.28 a share. Reported results both exceeded our estimate of $1.00 and<br />

pulled well ahead of earnings of $0.74 in the year-earlier quarter.<br />

A $2 billion reduction in the loan loss reserve in the bank's credit card division contributed $0.29 a<br />

share to earnings in the period, but this was mostly offset by $0.16 negative adjustment for<br />

anticipated higher mortgage servicing costs and $0.10 of expenses related to mortgage foreclosure<br />

delays.<br />

9

For the company, as a whole, revenue declined 9% and expenses were flattish, but the provision for<br />

loan losses fell by $6 billion, reflecting reductions in the retail financial services and credit card<br />

businesses. In the investment banking division, debt underwriting fees were strong. The commercial<br />

banking, treasury, and asset management businesses also turned in decent performances, offsetting a<br />

$200 million loss in retail financial services caused by the aforementioned higher mortgage costs.<br />

For the balance of 2011, management looks for further improvement in the card division's credit costs<br />

and expects card outstanding, which have been declining, to stabilize. Although releases of credit card<br />

loan loss reserves in the next several periods may not be as large as in the March quarter and<br />

mortgage costs may stay high, we are raising our share-net estimate for 2011 by $0.50, to $5.00, and<br />

we are introducing a 2012 projection of $5.80.<br />

With earnings still on the recovery track, <strong>JP</strong><strong>Morgan</strong> shares look attractive for the long haul. And the<br />

recent increase in the annual per-share dividend rate, from $0.20 to $1.00, enhances the stock's total<br />

return potential.” Value Line released this after earnings were released by <strong>JP</strong>M<br />

2. <strong>Co</strong>mpany Financial Strength is ‘A.’<br />

3. EPS growth rates of 16.0%, Book Value growth at 8.5%.<br />

4. Book Value $43.04 F2010, and $47.65 estimate for F2011. Intangibles listed of $17.02.<br />

5. Projected 5 year Price range of ~$60 - $95.<br />

Credit Suisse 4/12/11<br />

1. “Reiterate Outperform rating. We continue to recommend <strong>JP</strong>M shares due to the strong<br />

balance sheet and competitive positioning.”<br />

2. “Valuation. Our $58 price target equates to 1.8x forward tangible book value and 11x 2012<br />

earnings.”<br />

3.<br />

10

Argus 4/15/11<br />

1. “Reiterating HOLD; expense growth concerns us.”<br />

2. “<strong>JP</strong>M recently increased it dividend by 400% to yield about 2% or still well below the 4% levels<br />

that prevailed pre-crisis. Still, CEO Jamie Dimon said on the 1Q11 conference call that investors<br />

should not expect further dividend increases over the next few quarters.” (Ron’s note - Recall in 2010<br />

Annual Report where Dimon spoke of dividend of $1.00, and if he had it his way, he would reinvest in<br />

the business, and would not pay a dividend. Yet, he states, since investors seem to desire a dividend,<br />

he will pay one.<br />

3. “We do not recommend the purchase of <strong>JP</strong>M shares at this time, though we believe that the<br />

stock should remain a core holding in diversified portfolios.”<br />

4. “<strong>JP</strong>M's above-average capital ratios also position the company well for share buybacks.”<br />

5. “J P <strong>Morgan</strong> <strong>Chase</strong> is arguably the best managed of the major banks so its lackluster first<br />

quarter results do not bode well for the group.”<br />

6.<br />

7. “Our financial strength rating for <strong>JP</strong><strong>Morgan</strong> <strong>Chase</strong> is High. In the past, management has<br />

referred to its desire to build a 'fortress balance sheet' to protect the firm from unforeseen shocks.<br />

<strong>JP</strong>M's Basel 1 Tier 1 common equity ratio was 10% at March 31, 2011 (<strong>JP</strong>M estimate), up from 6.8% in<br />

11

2008, and easily the highest among the major banks. The ratio is 7.3% under Basel III rules, already<br />

slightly exceeding with the minimum required ratio. “<br />

1. 12 Month price target of $52.<br />

2.<br />

Standard & Poors 3/28/11<br />

3.<br />

12

Zacks 4/14/11<br />

1. “The shares of <strong>JP</strong><strong>Morgan</strong> currently trade at 9.5x our earnings estimate for 2011, a 31% discount<br />

to the industry average of 13.8x. On a price-to-book basis, the shares trade at 1.1x, at par with the<br />

industry average. The valuation on a price-to-book basis looks attractive, given a trailing 12-month<br />

ROE that is 36% higher than the industry average.”<br />

2. “Our six-month target price of $49.00 per share equates to about 10.0x our earnings estimate<br />

for 2011. <strong>Co</strong>mbined with a quarterly dividend of $0.25 per share, this target price implies an<br />

expected total return of about 7.0% over that period, which is consistent with our Neutral<br />

recommendation on the shares.”<br />

3.<br />

13

4. “<strong>JP</strong><strong>Morgan</strong> maintained a strong capital position with an estimated Tier 1 common ratio of<br />

10.0% as of March 31, 2011, up from 9.8% as of December 31, 2010, and 9.1% as of March 31, 2010.<br />

Book value per common share was $43.34 as of March 31, 2011, compared with $43.04 as of<br />

December 31, 2010, and $39.38 as of March 31, 2010."<br />

Merrill Lynch 4/14/11<br />

14

Morningstar 4/14/11<br />

1. “J.P. <strong>Morgan</strong> <strong>Chase</strong> has received--and earned--high praise throughout the credit crisis. While<br />

the company deserves kudos for its accomplishments during the crisis, as well as for the mistakes it<br />

didn't make in the preceding years, we are more excited about its future opportunities. We believe<br />

much of its success is attributable to well-known CEO Jamie Dimon and his tight grip on the risks the<br />

company takes as a whole. Now, with a stronger-than-ever franchise, J.P. <strong>Morgan</strong> must show that it<br />

15

can execute and meet its return targets. We believe management has laid out a clear path for each of<br />

its divisions and must now prove that its glowing reputation is well deserved.”<br />

2. “We are maintaining our $61 fair value estimate. The Basel III standards confirm our<br />

expectations that banks will hold substantially more capital after the crisis, reducing long-term<br />

returns on equity for shareholders. We currently believe J.P. <strong>Morgan</strong> can achieve a decent 13% ROE<br />

in the long run. If the company could bump that up to a 14.6% long-run ROE, our fair value would be<br />

$70. We believe consumer credit is stabilizing, but lingering problems and high unemployment will<br />

force charge-offs to remain elevated in 2011, with total charge-offs running around 2.1%. We believe<br />

noninterest income will decline slightly in 2011 as the loss in overdraft fees, debit card interchange<br />

fees, and slightly lower trading income offset improvements in other business lines. However, over<br />

the long run, we expect fee income to grow at a nearly 7% clip--showing the strength of the credit<br />

card, asset management, and investment banking businesses.”<br />

3.<br />

Review of 1Q11 Earnings release<br />

16

<strong>Co</strong>nference Call <strong>Notes</strong> 4/13/11<br />

1. “A normalized charge-off ratio will eventually be 4.5%, that's through-the-cycle, to be obviously<br />

lower than that or higher than that.” Jamie Dimon CEO discussing Credit Card reserves.<br />

2. “We can only buy back $8 billion of stock according to the guidelines from the Fed. We are<br />

going to buy back, regardless of price, $3 billion which is what we issue -- or approximately what we<br />

issue every year for stock-related compensation. And the other part is discretionary, we're not going<br />

to automatically do it. It will be price-sensitive and if we build up excess capital so be it.” Jamie<br />

Dimon CEO discussing stock buy-backs.<br />

Review of 2010 Annual Report<br />

21

October 27, 2010 (37.52) J<br />

S&P (10/19/10; price $37.71) rates a 5 star strong buy with a $47 price target. Strong 3 rd quarter<br />

revenue and credit results have been overshoadowed by industry-wide issue of possibly erroneous<br />

foreclosures. The $47 price target is based on 1.65 times estimated year-end tangible book (a<br />

premium to peers) and 11.2 times their 2011 estimated eps of $4.21.<br />

October 15, 2010 (37.58) J<br />

Analyst notes on 3Q earnings:<br />

<strong>Morgan</strong> Stanley (10/14/10; price $39.84) rated as overweight with a price target of $59. They<br />

raised eps estimates by $0.17 for 2010 to $3.85. EPS estimates for 2011 and 2012 are $4.32 and<br />

$5.09, respectively. They think the stock “looks cheap at 6.2x P/E multiple on 2013 normalized<br />

earnings.” Their target price “implies a 9.1x 2013 P/E.” They have a “bull” case price target of $68<br />

and a “bear” case price target of $33. In their bear case, the value is based on tangible book value.<br />

They cite the probability of dividend hikes, improving charge-offs, and consumer loan efficiencies as<br />

potential catalysts for the share price.<br />

Credit Suisse (10/13/10; price $40.42) rates as outperform with a price target of $56. Their price<br />

target is based on 10 times 2012 earnings of $5.50 and 1.6 times tangible book. Revenues in the<br />

quarter were better than they anticipated and view as indicative of stronger prospective earnings<br />

power. They think <strong>JP</strong>M will return to normalized earnings ahead of peers.<br />

Book value $42.29<br />

Tangible book value $29.54<br />

Shares o/s 3,979<br />

Foreclosure moratorium update: <strong>JP</strong>M is currently reviewing approx. 115,000 loan files that are in<br />

foreclosure process and will re-file where appropriate. New processes are being put in place to ensure<br />

that the company is in compliance with legal requirements.<br />

27

Morningstar (10/13/10) rates 4 stars with fair value of $61 and says to consider selling at $122.<br />

Noted good results in investment banking and a decline in credit card losses. Total loan losses remain<br />

very high and expenses are being pressured by cyclical items – “including the mortgage foreclosure<br />

scandal currently rocking the bank.” Both of those items are considered temporary. Repurchases of<br />

shares continued in the quarter and the long anticipated dividend increase may occur in the first<br />

quarter.<br />

John notes:<br />

This continues (in my opinion) to be an investment that is based on book value due to the difficulty in<br />

projecting earnings. Prior to the foreclosure moratorium, there was uncertainty with still to be written<br />

financial regulations. Although they beat eps estimates, the beat was due to a reversal of previous loss<br />

reserves. We will need to see if that continues. I think this is still the premier bank and as long as the<br />

system is sound, it will be a leader.<br />

August 18, 2010 (38.12) J<br />

Review of Value Line 8/20/10:<br />

- Release of loan loss reserves added $0.36/share to 2Q eps; the U.K. bonus tax reduced eps by<br />

$0.14.<br />

- Revenues fell in investment banking, cards, and principal transactions<br />

- Retail and card units were profitable after several quarters of losses<br />

- 2010 and 2011 will be challenging<br />

- Fin reg will reduce annual income by $700M - $750M<br />

- Raising 2010 eps to $3.70 and think there is decent recovery potential in shares<br />

John notes – I think this investment is based entirely on its book value. It is virtually impossible to<br />

estimate earnings and the potential impact of financial regulation will not be known in the near<br />

future. We are left hoping that reported book value is correct.<br />

In ‘The Big Short”, one of the real-life characters is Vincent Daniel, and he offers up his experience as<br />

a CPA auditing Salomon Brothers: “there was no way for an accountant assigned to audit a giant Wall<br />

Street firm to figure out whether it was making or losing money. They were giant black boxes, whose<br />

hidden gears were constantly in motion.”<br />

July 21, 2010 (39.08) J<br />

Book value per share is $40.99 at 6/30/09.<br />

July 15, 2010 (40.25) R Some 2Q10 CC Quotes<br />

"We buy back stock when we think it's a great deal for the ongoing shareholders." Jamie Dimon<br />

<strong>JP</strong>M <strong>Co</strong>nf Call 7/15/10<br />

"If the stock goes down, we could buy back a lot more. If stock goes up, we may not buy back any."<br />

Jamie Dimon <strong>JP</strong>M <strong>Co</strong>nf Call 7/15/10<br />

"When we start the dividend we want it to be permanent." Jamie Dimon <strong>JP</strong>M <strong>Co</strong>nf Call 7/15/10 (He<br />

mentioned maybe late this year or early 2011<br />

28

"I'm not sitting here terrified over deflation, to tell you the truth." Jamie Dimon <strong>JP</strong>M <strong>Co</strong>nf Call<br />

7/15/10<br />

"I think it's significant that we started to buy back some stock, which means we are a value<br />

investor." Jamie Dimon <strong>JP</strong>M <strong>Co</strong>nf Call 7/15/10<br />

May 24, 2010 (39.17) R Review of 5/21/10 Value Line<br />

1. Retail banking and credit card business remain unprofitable.<br />

2. “<strong>Co</strong>mpany faces a number of near-term headwinds.” “Nonetheless, due to the positive<br />

March-quarter comparison, and in anticipation of further declines in credit costs, we have<br />

raised our share-net estimates for 2010, from $2.75 to $3.50.<br />

3. VL thinks that actual losses on various products may turn out to be less than originally<br />

anticipated.<br />

4. “Another sizable earnings advance is possible in 2011, supported by a more meaningful<br />

decline in credit costs, etc.”<br />

5. Book Value is $39.88. Yet intangibles are $17.38 per share. Hence, TBV is $22.50 per<br />

share.<br />

6. ROE’s have been in mid single digits. As high as 14.6% in 2003, and between 2.2% (2008)<br />

and 12.5% (2007). Projects 8.5% in 2010, and 10.0% in 2011.<br />

7. Book Value for 2010 projected at $43.50, and $26.12 w/out intangibles. This has been<br />

increased slightly since 2/19/10 mention below.<br />

5/19/10 <strong>JP</strong> <strong>Morgan</strong> (<strong>JP</strong>M) (39.33) J<br />

Current year eps estimate of 3.46, PE 11.4; next year eps estimate of 4.93, PE of 7.9. Dividend is<br />

currently .20 per year but could be raised. This is probably the best run and cheapest financial<br />

institution. Risks include financial regulation legislation and they have the WAMU portfolio with its<br />

crap and 2 nd mortgages.<br />

February 22, 2010 (41.00) (R) Review of 2/19/10 Value Line<br />

1. Strong investment banking offset weakness in consumer business in 4Q09.<br />

2. Housing loans could slash $1B from Net Interest Income.<br />

3. Credit costs expected to stay high. Loan loss reserves expected to stay high. Possible<br />

deterioration in CRE portfolio. Loan loss reserves are strong, but more reserves may be<br />

needed if economic recovery slows down.<br />

4. VL remains cautious on <strong>JP</strong>M. Lowered eps expectations from $3.00 to $2.75in F2010.<br />

5. Dividend projected at $0.25. It is now $0.20 (.05 per ¼). Either way, less than 1%.<br />

6. Book Value for 2010 projected at $42.65, and $25.30 w/out intangibles.<br />

August 12, 2009 (42.14) (J)<br />

This is probably the best big bank in the country at this point. (I do not consider Government Sachs to<br />

be a bank.) They repaid the $25B TARP funds. The warrants that were issued have not been<br />

repurchased, as <strong>Chase</strong> has been unwilling to pay the government’s price.<br />

They have also led the pack in mortgage modifications-ranking at the top of government statistics.<br />

Wells Fargo has been the laggard.<br />

29

Tier 1 capital of 9.7% at the end of 2Q09. Book value of $37.36/share and tangible book per share of<br />

$23.76.<br />

We have been looking at a multiple of book value when valuing bank stocks. <strong>JP</strong>M may be close to<br />

reporting normal earnings that can be evaluated. I would not be shocked to see them raise the<br />

dividend later this year. At this price, I’d continue to hold and perhaps trim if someone was<br />

overweight the position. Yet long-term this stock will most likely be the leader of this industry.<br />

Others:<br />

Keefe, Bruyette & Woods (7/17/09; price of $36.13) noted the solid 2Q results. Raised their<br />

estimates and put a target price of $47/share.<br />

Credit Suisse (7/28/09; price 38.13) rated at outperform with a price target of $42 based on a<br />

multiple of 1.6-1.7 times projected year end tangible book. Management still somewhat cautious. 2H<br />

investment will not be as strong as first half. Management is committed to reducing the risk profile<br />

and maintaining returns rather than maximizing the upside.<br />

April 1, 2009 (Ron) (27.50)<br />

<strong>Notes</strong> to 2008 Shareholder Letter<br />

"With great hesitation, I would like to point out that mistakes also were made by the regulatory<br />

system. That said, I do not blame the regulators for what happened. In each and every<br />

circumstance, the responsibility for a company’s actions rests with us, the CEO and the company’s<br />

management. Just because regulators let you do something, it does not mean you should do it. But<br />

regulators have a responsibility, too. And if we are ever to get this right, it is important to examine<br />

what the regulators could have done better. In many instances, good regulation could have<br />

prevented some of the problems. And had some of these problems not happened, perhaps things<br />

would not have gotten this bad."<br />

1. They were determined to be prepared for downturn. Yet, they claim what transpired was<br />

unprecedented and inconceivable.<br />

2. Financial results marred by increasing credit costs for consumer and mortgage loans, as<br />

well as <strong>Investment</strong> Bank Write-Downs of > $10B, mostly from leveraged lending and<br />

mortgage exposure.<br />

3. “Fortress balance sheet.”<br />

4. Tier 1 ratio even without $25B TARP would have been 8.9%.<br />

5. “Although we did not anticipate all of the extraordinary events of the year, our strong<br />

balance sheet, general conservatism and constant focus on risk management served us<br />

well and enabled us to weather this terrible environment.”<br />

6. "We also know that the investment banking business, in many ways, will never be the<br />

same. Leverage will be lower, and certain structured financial products will likely cease to<br />

exist. But the fundamental business will remain the same: advising corporations and<br />

investors, raising capital, executing trades, providing research, making markets, and<br />

giving our clients the best ideas and the financing to make those plans a reality."<br />

30

7. Current charge-off expectations could range from $1.8B to $2.4B. This is an annualized<br />

loss rate of 3.5% to 5%. Dimon calls that rate “extremely high.” If I recall properly, long<br />

time historic rates are in the 1% range.<br />

8. Believes <strong>JP</strong>M has corrected underwriting lending mistakes of the past, and are now lending<br />

in a more “old-fashioned” manner. Claims a max of 80% LTV with full documentation.<br />

9. 30% of legacy mortgage loans were originated through the broken and now terminated<br />

broker channel.<br />

10. Expects branch based Retail Banking to generate 30% ROE’s over time. <strong>Co</strong>nsumer Lending<br />

expectations at 15% to 20%.<br />

11. Largest credit card issuer in nation, since the WAMU acquisition.<br />

12. Expects CC losses to track unemployment rate. Looking closely at risk management.<br />

Reducing the riskier lines of credit. Increasing reserves to $8B and intensifying credit<br />

collection efforts. Expects to lose money in this division in 2009. The reason the losses are<br />

expected to track the unemployment rate is because of accompanied housing price decline.<br />

Previously losses would be in area of ~78% of unemployment rate.<br />

13. <strong>Co</strong>mmercial Banking will have a tough year in 2009. Expects industry problems in<br />

<strong>Co</strong>mmercial <strong>Co</strong>nstruction. Yet claims to have “limited exposure and strong reserves.”<br />

14. Expects Treasury and Securities Services (TSS), to continue to grow and be an important<br />

part of their future. ROE in 2008 was 47%.<br />

15. Asset Management Business has been weak, expects weakness in 2009, but remains patient<br />

and expects 20% ROE over time.<br />

16. “One important and critical point to highlight is that each of our businesses now ranks as one of th<br />

top three players in its respective industry. As ever, our goal is to be the best, not necessarily the<br />

biggest. That said, we know that size matters in businesses where economies of scale – in areas su<br />

as systems, operations, innovation, branding and risk diversification – can be critical to success.<br />

The only reason to get bigger and gain economies of scale is when doing so enables you to do a<br />

better job for your clients; i.e., by giving them more, better and faster at a lower cost. Ultimately,<br />

this is also the only real reason to do a merger – the client gets something better.”<br />

17. Managed Net Revenue By Line of Business<br />

Retail Financial Services $23,520 32%<br />

Card Services $16,474 23%<br />

<strong>Investment</strong> Bank $12,214 17%<br />

TSS $ 8,134 11%<br />

Asset Management $ 7,584 10%<br />

<strong>Co</strong>mmercial Banking $ 4,777 7%<br />

31

Bear Stearns Purchase<br />

18. Integration and cost integration of Bear Stearns has been completed. By normal terms,<br />

Dimon considered the price low. Because conditions were not normal, they had to build in<br />

a risk price and a “huge margin of error.” “We were not buying a house, we were buying a<br />

house on fire.” All of Bears equity was used up in the integration. This ran through the<br />

income statement in the 2 nd half of 2008. <strong>JP</strong>M had hoped for retained equity, but that did<br />

not occur. Yet, Dimon wrote, “"Despite these additional costs, we still believe that Bear<br />

Stearns has added significantly to our franchise. In particular, it completed our franchise<br />

in two areas where we were weak, Prime Brokerage and <strong>Co</strong>mmodities, and it enhanced<br />

our broader equity and fixed income businesses. Ultimately, we expect the businesses we<br />

acquired to add approximately $1 billion of annual earnings to the company."<br />

WAMU Purchase<br />

19. <strong>JP</strong>M was only bank prepared to act on the FDIC takeover. Acquired 2200 branches, 5500<br />

ATM’s and 12.6M checking accounts. Also savings accounts, credit cards and mortgages.<br />

They did not buy any other assets, nor assume any unsecured or subordinated debt. This<br />

will add $2B (or $0.50 per share) of earnings in 2009, and more thereafter.<br />

20. Expected cost savings of $1.5B, but now expects $2.B<br />

21. Unlike Bear deal, they came out with around $4B in “good common equity.” The WAMU<br />

deal occurred on 9/25/08. <strong>JP</strong>M projected 10% forward decline in home prices. If home<br />

prices go down 20%, all other things being equal, could cost another $5B to $10B. Even if<br />

that occurred, <strong>JP</strong>M expects WAMU to have been a great deal.<br />

22. I will forever remember this quote:<br />

"In 2008, Bear Stearns collapsed; Lehman Brothers declared bankruptcy; Fannie<br />

Mae and Freddie Mac were placed into government conservatorship; the<br />

government assumed majority ownership of AIG; Merrill Lynch sold itself to Bank<br />

of America; Wells Fargo took over a struggling Wachovia; IndyMac and WaMu<br />

went into receivership by the Federal Deposit Insurance <strong>Co</strong>rporation; <strong>Co</strong>untrywide<br />

and the U.S. mortgage business virtually collapsed; the two remaining major<br />

investment banks, Goldman Sachs and <strong>Morgan</strong> Stanley, became bank holding<br />

companies; around the globe, French, British, Swiss and German banks were<br />

rescued by their governments; and the world entered the sharpest, most globalized<br />

downturn since the Great Depression.<br />

As for <strong>JP</strong><strong>Morgan</strong> <strong>Chase</strong>, we had large credit and operational exposures in virtually<br />

every situation mentioned above, affecting nearly every line of business. Our firm’s<br />

management teams, credit officers, risk officers, and legal, finance, audit and<br />

compliance teams worked tirelessly to protect the company. We believe it is a<br />

considerable sign of strength that we could manage through such extraordinary<br />

problems with minimal losses to the company."<br />

23. <strong>JP</strong>M emphasized they stayed away from sponsoring SIV’s, didn’t write Option Arms,<br />

cut back on sub prime mortgages early in the crisis, avoided structured finance (i.e.<br />

CDO’s), did not unduly leverage capital, maintained high level of liquidity, avoided<br />

32

short term funding of illiquid assets and does not rely on wholesale funding. “Simply<br />

put, we still follow the financial commandment: Do not borrow short to invest long.”<br />

24. Did not ask for TARP infusion of $25B, but felt it was the right thing to do. Calls our<br />

leaders “bold and brave.” Had a wonderful quote from Teddy Roosevelt. “It is not the<br />

critic who counts; not the man who points out how the strong man stumbles, or<br />

where the doer of deeds could have done them better. The credit belongs to the man<br />

who is actually in the arena, whose face is marred by dust and sweat and blood; who<br />

strives valiantly; who errs, who comes short again and again, because there is no<br />

effort without error and shortcoming; but who does actually strive to do the deeds;<br />

who knows great enthusiasms, the great devotions; who spends himself in a worthy<br />

cause; who at the best knows in the end the triumph of high achievement, and who at<br />

the worst, if he fails, at least fails while daring greatly, so that his place shall never<br />

be with those cold and timid souls who neither know victory nor defeat.”<br />

25. Thinks regulatory system is poorly organized and archaic.<br />

26. Thinks Basel II allows for too much leverage.<br />

On Derivatives<br />

27. "Derivatives have become an essential and widely used risk management tool."<br />

28. "As such, derivatives are a large business for <strong>JP</strong><strong>Morgan</strong> <strong>Chase</strong> and for firms around<br />

the world. It is important to note that derivatives in and of themselves did not cause<br />

this crisis. In fact, derivatives have performed fairly well in this crisis environment.<br />

However, it is clear that derivatives, at least in financial reporting, are hard to<br />

understand, lack transparency and did contribute somewhat to the crisis. At<br />

<strong>JP</strong><strong>Morgan</strong> <strong>Chase</strong>, we believe derivatives, when used properly, play an important<br />

role in managing risk, and we are trying to address the concerns about derivatives."<br />

29. "Some of the concerns about derivatives have to do with the large notional amounts.<br />

But those figures are reference measurements and do not reflect actual counterparty<br />

credit risk. Actual risk is the mark to- market value of the contract after taking into<br />

account netting of risk across all transactions with a counterparty, collateral and<br />

hedging. Actual risk projections also take into account the potential future exposure<br />

coming from market moves."<br />

30. "Our counterparty exposures net of collateral and hedges are $133 billion, and the<br />

company manages those exposures name by name – like a hawk. The figure is<br />

large, but we get paid to take the risks, we reserve and account for them<br />

conservatively, and we manage them in conjunction with all of our other credit<br />

exposures."<br />

31. <strong>JP</strong>M supports the development of clearing houses for derivatives. They think this will<br />

reduce counterparty and systematic risk.<br />

32. Claims AIG’s fall was due to poor risk management and not use of derivatives. AIG did<br />

not give proper collateral and took concentrated risks through CDS.<br />

33

33. "With proper management, systemic risks created by derivatives can be<br />

dramatically reduced without compromising the ability of companies to use them in<br />

managing their exposures."<br />

Fortress Balance Sheet<br />

34. Focused on keeping fortress balance sheet intact. Recognizes obligation to pay<br />

dividends as well. "extraordinary times require extraordinary measures." Discusses<br />

need for abundance of caution in this uncertain environment. Fortress balance sheet<br />

will give ability to seize opportunities.<br />

35. Expects to pay out via dividends 30% – 40% of normalized earnings.<br />

36. Expects to be able to withstand worse than expected economic scenarios, including<br />

Government stress test of 10.4% unemployment and 48% peak to trough house price<br />

declines.<br />

<strong>Co</strong>rporate Responsibility<br />

37. "We believe we have a deep responsibility to you, our shareholders, and to our<br />

creditors, our clients and all our employees. We work incredibly hard to uphold all<br />

our obligations every day."<br />

38. "We employ 225,000 people worldwide in 48 U.S. states and more than 60 countries.<br />

Our 5,000 branches serve customers in 23 states. We provide health care coverage<br />

for 400,000 people. On average, we pay more than $10 billion a year in taxes to the<br />

U.S. government, as well as to state and local jurisdictions."<br />

March 30, 2009 (25.34)<br />

10K review notes.<br />

1. Owns or leases 13.0M SF of commercial and retail office space.<br />

2. Interesting tidbit - In 2008 <strong>JP</strong>M acquired a 999 year lease term in Canary Wharf.<br />

3. Total Assets / <strong>Co</strong>mmon Equity increased to 16.1X in F2008, from 10.99X in F2004. This<br />

indicates greater leverage.<br />

4. Total Level 3 assets are $113.4B, which is 6% of total assets.<br />

5. Quick Look at Tangible Book Value. I only reduced by Goodwill and not MSR’s , purchased<br />

credit card assets or Other Intangibles. If you were to include all of the above, TBV would<br />

be $19.95.<br />

Total Stockholders’ equity $166,884<br />

Less:<br />

34

Preferred Stock (31,939)<br />

Goodwill (48,087)<br />

Tangible Book Value (TBV) $86,858<br />

Average Diluted Shares 3605<br />

TBV per share 24.09<br />

<strong>JP</strong>M<br />

3/30/2009<br />

Shares outstanding<br />

3605<br />

(000,000)<br />

Share price 3/30/09 25.78<br />

Market cap 92936.9<br />

Stockholders' equity<br />

(000,000)<br />

166,884<br />

Less: Preferred stock 31,939<br />

<strong>Co</strong>mmon SE 134,945<br />

Book value per share 37.43<br />

Intangibles (000,000) 63,011<br />

Tangible book<br />

19.95<br />

value/share<br />

From the 2008 10-k<br />

Goodwill 48,027<br />

Other intangible assets:<br />

Mortgage servicing rights 9,403<br />

Purchased credit card relationships 1,649<br />

All other intangibles 3,932<br />

John’s work up with all intangibles listed<br />

6. Tier 1 Capital ratio is 10.9% in F2008, compared to 8.4% in F2007.<br />

Derivatives discussed at analyst day in February:<br />

7. 8% of Total Revenues relate to derivatives. This equates to 33% of <strong>Investment</strong> Banking<br />

(IB). According to MS, <strong>JP</strong>M does not have outsized exposure to derivatives and falls in<br />

middle of peer group, and below both DB and GS. Total derivative receivable exposure is<br />

$119B.<br />

35

Thesis:<br />

1. Respected management. This includes apparent respect by US and world Governments.<br />

2. Price to Book and Price to Tangible Book at historic lows. Earning power exists<br />

3. Don't know when business will turn around, but future earning power is within reach.<br />

4. A leader in most business sections they are in<br />

Managed Net Revenue By Line of Business<br />

Retail Financial Services $23,520 32%<br />

Card Services $16,474 23%<br />

<strong>Investment</strong> Bank $12,214 17%<br />

TSS $ 8,134 11%<br />

Asset Management $ 7,584 10%<br />

<strong>Co</strong>mmercial Banking $ 4,777 7%<br />

5. Forthcoming management - shareholder letters are must reads<br />

6. Fortress balance sheet<br />

7. shareholder and government friendly<br />

8. Insider buying and ownership. Dimon owns 5M shares.<br />

9. One day business will change.<br />

10. WAMU and BSC could integrate well.<br />

11. Access to capital at a low rate. For example, they floated $5.85b on 4/1/09 at rate that is<br />

currently less than 1.50%.<br />

Review of Morningstar Report 3/24/09<br />

1. Fair Value $41, ***, Stewardship Grade A.<br />

2. Buying assets cheap in turbulent times, and thinks will give shareholders excellent returns<br />

in future. Not immune to economy though. Especially in Real Esate and Credit Cards.<br />

3. In its “Bears Say” section mentions derivative book as an opaque area. Bears claim<br />

unexpected losses could occur at any time. $88T of notional exposure. Impossible to get a<br />

grasp even as much of the exposure is offsetting.<br />

4. Calls it a “Universal Bank.”<br />

5. On 1/30/09 they reduced moat from Wide to Narrow.<br />

36

Miscellaneous other Stuff<br />

1. On February 19, 2009 Argus mentioned, “On the conference call announcing the Wamu<br />

transaction last fall, CEO Jamie Dimon acknowledged that Wamu's mortgage portfolio<br />

presents the biggest risk from this acquisition, despite the 18% markdown taken right off<br />

the top. That $31 billion haircut assumed a 25% peak-to-trough decline in home prices<br />

nationwide and that unemployment rises to 7%. <strong>JP</strong>M presented a 'severe recession'<br />

scenario, which contemplates a 37% total home price decline and 8% unemployment.<br />

Under that scenario, <strong>JP</strong>M projected an additional $18 billion in losses. <strong>JP</strong>M's current<br />

market forecast calls for a decline of 31% in home prices, but the 8% unemployment peak of<br />

the severe recession scenario is already looking too optimistic."<br />

2. Each major franchise is in top 3 in its business.<br />

3. <strong>Investment</strong> Banking should have growth with addition of Bear Stearns. This might be an<br />

under appreciated asset, as losses occurred in 2008.<br />

4. On analyst day in February 2009, <strong>JP</strong>M expected industry wide CRE losses of 20%. <strong>JP</strong>M<br />

expects this to occur via 1.5-2% annually, because of portfolio and small size of the<br />

construction and development portfolio ($13B of $110B book). Non Performing loans are<br />

3.6% for C&D vs. 1% or less for rest of portfolio. C&D loans are 10% of loans.<br />

5. All reports I have read indicate light exposure to CRE and construction lending (i.e. Merrill<br />

and MS).<br />

6. Merrill identifies a worst case scenario stress test, that encompasses unemployment at<br />

10.4% and Home Price Declines of 41%. Using these alleged worst case scenarios, Merrill<br />

could see a loss after preferred dividends to US Government. Yet , only a small likelihood of<br />

dilution to raise equity. Claims the worst case scenario is in line with Government case. All<br />

ratios stay within “safe zone.”<br />

7. After Analyst Day in February, <strong>Morgan</strong> Stanley wrote, “<strong>JP</strong>M's analyst day is another<br />

example of why you want to own this stock: they answer the tough investor questions,<br />

discuss their mistakes, give analysis that matters even if competitors don't, have a strong<br />

management team and have a good story in a tough environment. That coupled with an<br />

industry facing accelerating nonperforming loan trends over the next several quarters keeps<br />

<strong>JP</strong>M on the buy list.”<br />

8. Credit Card assumptions are based on 9% unemployment by year end.<br />

9. On 4/1/09 <strong>JP</strong>M floating $5.85B of paper at 3 year yield + 25bps. on other side of that,<br />

DELL is floating paper at 425BPS. <strong>JP</strong>M cost of capital is extremely low. Low cost of<br />

capital, will create higher Net Interest Margins (NIM), which banking is based on, yet lost<br />

over last few years. times are changing. Heck, even AAA's are paying 175bps+ if they are<br />

lucky. <strong>JP</strong>M gets great deal because their bonds are backed by FDIC in this case. <strong>JP</strong><strong>Morgan</strong><br />

<strong>Chase</strong> sizes and launch a slight change - $5.850 bln launched at 2.25 bln 3 yr FXD ms+25<br />

and 3.6 bln 3 yr FRN 3ML+25<br />

37

February 26, 2009 (21.73) Investor Day <strong>Notes</strong>.<br />

“Best in class and stay in class.”<br />

January 15, 2009 (25.91) Quick earnings release notes<br />

1. Earnings per release for year was $1.37, Value Line on 11/21/08 (36.35) was expecting<br />

$1.50. These earnings were after extraordinary benefits. Net Loss from Operations was<br />

$2.4B for quarter. NIBT and before Extraordinary for 2008 was $2,773. This compares to<br />

2007 of $22,805.<br />

2. Tier 1 Capital ratio estimated at 10.8. That is healthier than previous 8.9.<br />

3. Stockholders Equity 166,884. <strong>Co</strong>mmon Shareholders Equity 134,945. Difference is<br />

preferred stock of 31,939. I suspect much of the preferred stock is TARP. Book value<br />

$36.16 . Intangibles include Goodwill $48,027, MSR’s $9,403, Purchased Credit Card<br />

relationships $1,649 and Other Intangibles $$3,932. Tangible Book Value is 71,934.<br />

Market cap at 26 per share is 97,175. Price to book is .72X. Price to Tangible Book value is<br />

1.35X.<br />

4. Interest rate spread has increased to 3.11%.<br />

Egan Jones Update 1/15/09<br />

1. Estimated Share Value $31.49. Debt $713.3B, Cash $54.4B.<br />

2. “Best of the worst.” Domestic banking firms 9excluding processing firms) need US<br />

Government help.<br />

3. <strong>Co</strong>ncerns of future hits if economy weakens.<br />

4. <strong>JP</strong>M might be forced to support weaker institutions.<br />

5. Assigns an ‘A+’ rating, lowered from ‘AA-’ rating. S&P has A+ rating. (Yet, they could in<br />

theory downgrade at same time.) A+ is upper end of medium grade, AA- is bottom tier of<br />

high grade.<br />

December 22, 2008 (29.92)<br />

Reviewing <strong>Morgan</strong> Stanley report from September 26 , 2008:<br />

They mention that they don’t expect a return to more normalized ROA/ROE until 2011 and they<br />

expect accelerating nonperforming loan growth. Just something to keep in mind.<br />

Last week, S&P cut the ratings on 11 national and international banks. They cited challenging<br />

conditions ahead. Wow, talk about being late to the party.<br />

At this point, I don’t think it is a question of survival as the gov’t has taken a stake in large banks.<br />

Need to focus on economic conditions and how banks are involved. As I think about it, WAMU is a<br />

great fit for its west coast footprint---if the loans aren’t totally worthless.<br />

38

12/15/08 report from Merrill Lynch cutting <strong>JP</strong>M to underperform:”<strong>JP</strong>M has emerged…as arguably<br />

the best positioned US financial institution with broad deposit base, strong capital and an<br />

increasingly dominant global investment bank. However, the credit loss picture continues to worsen<br />

and there is an increasing possibility of sub 5% ROE…”<br />

October 2008 <strong>Co</strong>nference Call Quotes<br />

1. “Bear Stearns, we still expect the Bear Stearns units -- they've almost been combined at this<br />

point, by not all the systems, but the way we run the businesses. So it's really hard for us to<br />

completely break it out. But we still expect Bear Stearns' businesses to add about $1 billion of<br />

earnings to the <strong>Co</strong>mpany. That's exactly the same.” “And BSC cost us more money than we<br />

thought. If you asked me the question how much more, probably about $10 billion more. When we<br />

announced the deal, we said that we expected to get $5 billion of equity with it; we basically got<br />

nothing. So -- but it's mostly done.”<br />

2. WAMU a good fit, integration going well. Deposits growing, key staff kept, immediately<br />

accretive.<br />

3. “Credit card losses, we told you. would be about 5% in the third and fourth quarter. We still<br />

expect that 5% plus. We think it's a reasonable expectation that it will start next year at 6% and<br />

end next year at 7% plus. So we don't know that for a fact, but if you build unemployment in<br />

like we're looking in housing, that's a reasonable expectation. If unemployment goes much<br />

higher than 7%, 7.5%, we would expect this number to go up too. Since we don't know what<br />

unemployment is oing, you have to make your own estimates for what that is.”<br />

4. “My own personal opinion is that in an environment that is stressed like this, you have to see<br />

non-performers and charge-offs go up. There will be a lot of surprises coming out of the<br />

woodwork, so we're prepared for that. And I should point out that while our charge-offs are<br />

really low compared to the competition and the non-performers are low compared to the<br />

competition, our loan loss reserves are not low compared to the competition. So we think we<br />

are kind of prepared, but we are expecting this to deteriorate a little bit too.”<br />

5. “Obviously, strong loan-loss reserves are an important part of what we call our fortress balance<br />

sheet. So is strong capital. After the TARP program, we will have Basel I Tier 1 capital of about<br />

10.8%. Before that, it was about 8.9%; so it was strong before that.”<br />

6. “We feel our liquidity position is exceptional. I'm not going to take you through it. But if you<br />

look at loans to deposits in any business, like in the <strong>Co</strong>mmercial Bank, it's $70 billion of loan,<br />

$100 billion of deposits. And all of our businesses are very liquid and very well-funded, as is<br />

the rest of the <strong>Co</strong>mpany.”<br />

7. “And remember, we also have to stand ready to serve clients who pull down revolvers. We have<br />

$300 billion of un-drawn revolvers across all the lines of businesses on the wholesale side. And<br />

we have to be prepared for that too. Obviously, the more stressed the environment gets, the<br />

more we're going to be called on to do that. Then things like buying back the $4 billion of<br />

auction rate obviously uses up some of that too.”<br />

8. “But deposits, more deposits, more accounts, more checking, more credit cards, more loans,<br />

more net assets -- well, assets under management down; we actually had net flows in. This is<br />

the stuff which is going to drive our results for five or 10 years.”<br />

39

9. “There is a reason we have a steep yield curve and very high risk premiums, that people are<br />

going to eventually move out that curve. Like I'll give you an example right now. I'm probably<br />

not supposed to say this, but I just took a lot of my cash, which I was getting like 1% on, and<br />

bought <strong>JP</strong><strong>Morgan</strong> Preferreds at 11.5%. I think they're pretty good investments and I'd rather<br />

get 11.5% than 1%.”<br />

Yes, the question is when the government stop Fannie and Freddie from paying dividends on<br />

preferred Yes, we know because lost -- we wrote those to [$0.05 on the dollar] and lost $1<br />

billion too.<br />

The regulators -- and I think what I'm about to say is accurate -- have always had the right to<br />

force companies -- banks to stop paying on their Preferreds if they think that paying dividends<br />

on Preferreds will create an unsound bank. And that's always been true. So I think our ability is<br />

to pay dividends on our Preferred or <strong>Co</strong>mmon will relate to us maintaining a safe and sound<br />

bank. So I don't think we are going to stop paying dividends on our Preferred. But they've<br />

always kind of had that right.”“<br />

10. “So when Warren Buffett says when the tide goes out, you see who's swimming naked, there<br />

were people swimming naked everywhere -- and they weren't just banks. There were banks.<br />

There were investment banks. There were hedge funds. There were investors. There were<br />

individuals. There were margin loans. And I think that it will get cleaned up.”<br />

11. “Which is one of the reasons the dollar's strong, is it's still a haven. And you know, we're not<br />

running this <strong>Co</strong>mpany like we have a Great Depression. We don't think so. We just think we'll<br />

have a tough year.”<br />

September 26, 2008 (44.40)<br />

Announcement last night that <strong>JP</strong>M was taking over the deposits, assets and certain liabilities of<br />

Washington Mutual. WM had been taken over by the FDIC yesterday and a the purchase of the assets<br />

was completed between the FDIC and <strong>JP</strong>M. WM had put itself up for sale in the last few weeks and<br />

<strong>JP</strong>M had been looking at the assets and was familiar with WM’s assets prior to the takeover by the<br />

FDIC. <strong>JP</strong>M will make a payment of $1.9B to the FDIC. <strong>JP</strong>M plans on issuing $8B of common equity.<br />

September 24, 2008 (40.72)<br />

7/31/08 common shares outstanding – 3,437 M<br />

6/30/08 common stockholders’ equity – 127,176 M (BV 37.00/share and tangible BV of 18.59/share)<br />

Price/Book of 1.10 and Price/Tangible book of 2.19<br />

Quick comparisons to Buffett investments:<br />

Wells Fargo has BV of 14.50/share and tangible BV of 4.53/share. Using 9/24/08 price of 34.29,<br />

Price/Book is 2.36 and Price/Tangible Book is 7.57.<br />

US Bancorp has BV of 12.54/share and tangible book of 6.12/share. Using 9/24/08 price of 34.42,<br />

Price/Book is 2.74 and Price/Tangible book of 5.62.<br />

Debt<br />

Debt is rated AA- by S&P.<br />

40

<strong>JP</strong>M.LZ due 2/1/2011 with a coupon of 6.75% trading 9/24/08 at 101.66 for a yield of 5.975%. On<br />

7/1/08 it traded 103.67 and yielded 5.2%<br />

<strong>JP</strong>M.<strong>JP</strong>F due 1/15/2018 with a coupon of 6% trading 9/24/08 at 95.50 for a yield of 6.65%. 7/1/08<br />

yield was about 6.5%.<br />

Given the decline and uncertainty in the financial markets, especially with financial companies, the<br />

fact that the debt is not significantly lower than July 1 is a positive.<br />

June 23, 2008 (37.22)<br />

Began purchasing in beginning of June 2008 with stock price in the $40 area. At that time, stock was<br />

trading at about 1.15 times the 3/3/08 book value. Since then, the financial sector has come under<br />

some pressure due to Lehman results, and concerns about consumer credit as we head into the<br />

second half of the year with a still slowing economy. This morning Goldman Sachs downgraded the<br />

entire financial sector, saying they made a mistake only last month when they said to overweight the<br />

sector. This downgrade led to some serious selling pressure across the board.<br />

<strong>JP</strong>M is a financial holding company consisting of six bsuiness segments as well as <strong>Co</strong>rporate/Private<br />

equity.<br />

<strong>Investment</strong> Bank-clients are corporations, financial institutions, governments and institutional<br />

investors.<br />

Retail Financial services-includes regional banking, mortgage banking, auto finance. 3,100 bank<br />

branches (4 th largest nationally), 9,200 atms (3 rd largest nationally). Branches are located in 17 states.<br />

<strong>Co</strong>nsumers can also obtain loans through 14,300 auto dealerships and 5,200 schools and universities.<br />

Card services-156 million cards in circulation and more than $150 billion in managed loans. $85<br />

billion worth of spending in 1 st qtr 2008. <strong>Chase</strong> Paymentech Solutions is processor of MasterCard and<br />

Visa payments. Handles in excess of 5 billion transactions during 1 st qtr.<br />

<strong>Co</strong>mmercial banking- serves more than 30,000 clients with annual revenue from $10M to $2B.<br />

Provides comprehensive solutions including lending, treasury, invest banking and asset management.<br />

Treasury & Security Services-global leader in transaction investment and info services. One of<br />

the world’s largest cash management providers and a leading global custodian. It provides cash<br />

management services, trade, wholesale card and liquidity products and services. Some of TS revenue<br />

is include in other segment revenue as it partners with commercial banking, retail and asset<br />

management. Worldwide Security Services holds, values, clears and services securities, cash and<br />

alternative investments for investors and broker-dealers.<br />

Asset Management-global leader in investment and wealth management with assets under<br />

supervision of $1.6 trillion. Clients include institutions, retail investors and high net worth individuals<br />

around the world.<br />

41

Disclaimer<br />

If you are a client of ours, and if you have questions regarding J P <strong>Morgan</strong> <strong>Chase</strong> & <strong>Co</strong>.<br />

please call our office. If you are not a client of <strong>Redfield</strong>, <strong>Blonsky</strong> & <strong>Co</strong>. LLC <strong>Investment</strong><br />

Management Division and are reading these notes, we urge you to do your own research. We<br />

will not be responsible for any person making an investment decision based on these notes.<br />

These notes are a "by-product" of our research. We are not responsible for the accuracy of<br />

these notes. We are not responsible for errors that may occur in these notes. Please do not<br />

rely on us to monitor or update this or any other report we may issue. In theory, we could<br />

come across some type of data or idea, which causes us to eliminate our long or short<br />

position of J P <strong>Morgan</strong> <strong>Chase</strong> & <strong>Co</strong>. from our portfolios. We will not notify reader’s revisions<br />

to these notes. We are not responsible to keep readers of these notes updated for changes or<br />

material errors or for any reason whatsoever. We manage portfolios for clients, and those<br />

clients are our greatest concern as it relates to investing. Certain clients of <strong>Redfield</strong>, <strong>Blonsky</strong><br />

& <strong>Co</strong> LLC may not have J P <strong>Morgan</strong> <strong>Chase</strong> & <strong>Co</strong>. in their portfolios. There could be various<br />

reasons for this. Again, if you would like to discuss J P <strong>Morgan</strong> <strong>Chase</strong> & <strong>Co</strong>., please contact<br />

Ronald R. <strong>Redfield</strong>, CPA, PFS (partner in charge of investment management division).<br />

Information herein is believed to be reliable, but its accuracy and completeness cannot be<br />

guaranteed. Opinions, estimates, and projections constitute our judgment and are subject to<br />

change without notice. This publication is provided to you for information purposes only and<br />

is not intended as an offer or solicitation. <strong>Redfield</strong>, <strong>Blonsky</strong> & <strong>Co</strong>. LLC and Ronald R <strong>Redfield</strong>,<br />

CPA, PFS, may hold a position or act as an advisor on any investments mentioned in a report<br />

or discussion.<br />

42