final output

final output

final output

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

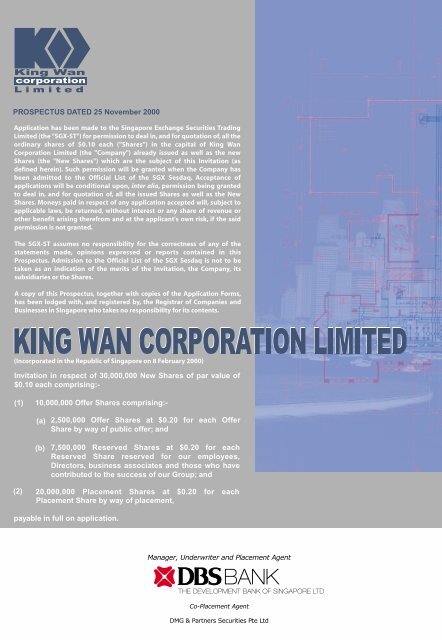

PROSPECTUS DATED 25 November 2000<br />

Application has been made to the Singapore Exchange Securities Trading<br />

Limited (the "SGX-ST") for permission to deal in, and for quotation of, all the<br />

ordinary shares of $0.10 each ("Shares") in the capital of King Wan<br />

Corporation Limited (the "Company") already issued as well as the new<br />

Shares (the "New Shares") which are the subject of this Invitation (as<br />

defined herein). Such permission will be granted when the Company has<br />

been admitted to the Official List of the SGX Sesdaq. Acceptance of<br />

applications will be conditional upon, inter alia, permission being granted<br />

to deal in, and for quotation of, all the issued Shares as well as the New<br />

Shares. Moneys paid in respect of any application accepted will, subject to<br />

applicable laws, be returned, without interest or any share of revenue or<br />

other benefit arising therefrom and at the applicant's own risk, if the said<br />

permission is not granted.<br />

The SGX-ST assumes no responsibility for the correctness of any of the<br />

statements made, opinions expressed or reports contained in this<br />

Prospectus. Admission to the Official List of the SGX Sesdaq is not to be<br />

taken as an indication of the merits of the Invitation, the Company, its<br />

subsidiaries or the Shares.<br />

A copy of this Prospectus, together with copies of the Application Forms,<br />

has been lodged with, and registered by, the Registrar of Companies and<br />

Businesses in Singapore who takes no responsibility for its contents.<br />

(Incorporated in the Republic of Singapore on 8 February 2000)<br />

Invitation in respect of 30,000,000 New Shares of par value of<br />

$0.10 each comprising:-<br />

(1) 10,000,000 Offer Shares comprising:-<br />

(2)<br />

(a)<br />

(b)<br />

2,500,000 Offer Shares at $0.20 for each Offer<br />

Share by way of public offer; and<br />

7,500,000 Reserved Shares at $0.20 for each<br />

Reserved Share reserved for our employees,<br />

Directors, business associates and those who have<br />

contributed to the success of our Group; and<br />

20,000,000 Placement Shares at $0.20 for each<br />

Placement Share by way of placement,<br />

payable in full on application.

Our Business<br />

Specialist in providing M&E engineering<br />

services to main contractors in Singapore. Our<br />

wide range of M&E engineering services<br />

include:<br />

•<br />

• ••<br />

• •<br />

Plumbing and sanitary systems<br />

Electrical engineering systems<br />

Fire protection and alarm systems<br />

Air-conditioning and mechanical<br />

ventilation systems<br />

Communications and security systems<br />

Underground pipeline communication<br />

systems<br />

Our ancillary business is to supply, deliver and<br />

service mobile lavatories to main contractors<br />

and event organisers.<br />

Key Investment Highlights<br />

•<br />

•<br />

•<br />

Extensive experience in M&E sector,<br />

completed 180 projects worth over S$320<br />

million between 1977 and September 2000<br />

Able to provide integrated services with<br />

Design-and-Build capabilities<br />

Order book of 38 current contracts in<br />

progress with an approximate aggregate<br />

contract value of S$141 million.<br />

Our Board of Directors

Competitive Strengths<br />

Extensive Experience and Established Track<br />

Record<br />

•<br />

•<br />

•<br />

completed more than 180 M&E projects worth over<br />

S$320 million between 1977 and September 2000<br />

one of few M&E specialists with ISO9002 certification<br />

23 years of M&E engineering experience<br />

Integrated Services Capabilities<br />

•<br />

•<br />

provides a wide range of M&E engineering services<br />

ability to undertake and coordinate the different M&E<br />

engineering services<br />

Strong Design-and-Build capabilities<br />

•<br />

•<br />

•<br />

experienced and dedicated Design-and-Build team of<br />

17 engineers and 13 tradesmen<br />

completed 3 HDB Design-and-Build projects and<br />

2 private Design-and-Build projects<br />

4 HDB and 3 private Design-and-Build projects in<br />

progress<br />

Experienced & Committed Management Team<br />

•<br />

key management team have average of more<br />

than 20 years experience in the industry<br />

Growth Prospects<br />

•<br />

•<br />

•<br />

•<br />

Increase in building construction in the commercial,<br />

industrial and institutional sectors<br />

Increasing trend towards Design-and-Build projects<br />

Increasing demand for more complex M&E services in<br />

the construction of "intelligent premises"<br />

Increasing demand for M&E companies that can<br />

provide integrated services

Growth Strategies<br />

•<br />

•<br />

•<br />

•<br />

Expand our business into non-residential construction sectors<br />

Increase our activity in Design-and-Build projects<br />

Expand services to include Network and Structured Cabling<br />

Focus on residential projects to increase our market share<br />

Our Financial Highlights<br />

Group's Profit Before Tax<br />

Group's Turnover<br />

Our Current Projects<br />

with contract value of more than S$3 million

CORPORATE INFORMATION<br />

BOARD OF DIRECTORS : Chua Kim Hua (Executive Chairman/Managing Director)<br />

Chua Hai Kuey (Executive Director)<br />

Ng Eng Kiong (Non-Executive Director)<br />

Chua Eng Eng (Executive Director)<br />

Goh Chee Wee (Independent Director)<br />

Foo Kok Swee @ Pu Kok Swi (Independent Director)<br />

COMPANY SECRETARY : Eliza Lim Bee Lian, ACIS<br />

REGISTERED OFFICE : 8 Sungei Kadut Loop<br />

Singapore 729455<br />

MANAGER, UNDERWRITER : The Development Bank of Singapore Ltd<br />

AND PLACEMENT AGENT 6 Shenton Way<br />

DBS Building Tower One<br />

Singapore 068809<br />

AUDITORS AND REPORTING : Deloitte & Touche<br />

ACCOUNTANTS Certified Public Accountants<br />

95 South Bridge Road #09-00<br />

Pidemco Centre<br />

Singapore 058717<br />

SOLICITORS TO THE : Shook Lin & Bok<br />

INVITATION 1 Robinson Road #18-00<br />

AIA Tower<br />

Singapore 048542<br />

REGISTRAR AND SHARE : M&C Services Private Limited<br />

TRANSFER OFFICE 138 Robinson Road #17-00<br />

Hong Leong Centre<br />

Singapore 068906<br />

PRINCIPAL BANKERS : Oversea-Chinese Banking Corporation Limited<br />

65 Chulia Street<br />

OCBC Centre<br />

Singapore 049513<br />

Keppel TatLee Bank Limited<br />

10 Hoe Chiang Road #04-00<br />

Keppel Towers<br />

Singapore 089315<br />

CONTACT PARTICULARS : Telephone: (65) 368-4300<br />

Facsimile: (65) 365-7675<br />

Website address: www.kingwan.com<br />

1

DEFINITIONS<br />

In this Prospectus, the accompanying Application Forms and, in relation to Electronic Applications,<br />

the instructions appearing on the screens of the ATMs of the Participating Banks or the Internet<br />

banking websites of the relevant Participating Banks, unless the context otherwise requires, the<br />

following terms or expressions shall have the following meanings:-<br />

Companies<br />

“King Wan Group” or the “Group” : Our Company and its subsidiaries<br />

“KW” or the “Company” : King Wan Corporation Limited<br />

“KWC” : King Wan Construction Pte Ltd<br />

“K&W” : K&W Mobile Loo Services Pte Ltd<br />

“Proforma Group” : Our Company and its subsidiaries, following the<br />

completion of the Restructuring Exercise treated, for the<br />

purpose of this Prospectus, as if it had been in existence<br />

since 1 April 1995<br />

General<br />

“Act” or “Companies Act” : The Companies Act, Chapter 50, of Singapore<br />

“Application Forms” : Official printed application forms to be used for the<br />

purpose of the Invitation and which form part of this<br />

Prospectus<br />

“Application List” : List of applications to subscribe for the New Shares<br />

“ATM” : Automated teller machine<br />

“Audit Committee” : Audit committee of our Company<br />

“BCA” : Building and Construction Authority, the merged entity<br />

following the merger of the Construction Industry<br />

Development Board (“CIDB”) and the Building Control<br />

Division of the Public Works Department<br />

“CDP” or “Depository” : The Central Depository (Pte) Limited<br />

“DBS Bank” : The Development Bank of Singapore Ltd<br />

“Directors” : The directors of our Company as at the date of this<br />

Prospectus<br />

“Electronic Applications” : Applications for the Offer Shares made through an ATM<br />

of one of the Participating Banks or through the Internet<br />

banking websites of the relevant Participating Banks in<br />

accordance with the terms and conditions of this<br />

Prospectus<br />

“ENV” : Ministry of Environment<br />

“EPS” : Earnings per Share<br />

2

“Executive Officers” : The executive officers of our Company, as at the date of<br />

this Prospectus, unless otherwise stated<br />

“FY” : Financial year ended 31 March<br />

“HDB” : Housing and Development Board<br />

“Invitation” : The invitation by our Company to the public in Singapore<br />

in respect of the New Shares, subject to and on the terms<br />

and conditions of this Prospectus<br />

“Issue Price” : $0.20 for each New Share<br />

“JTC” : Jurong Town Corporation<br />

“M&E” : Mechanical and electrical engineering services<br />

“Manager” : DBS Bank<br />

“Market Day” : A day on which the SGX-ST is open for trading in<br />

securities<br />

“New Shares” : The 30,000,000 New Shares for which our Company<br />

invites applications to subscribe, subject to and on the<br />

terms and conditions of this Prospectus<br />

“NTA” : Net tangible assets<br />

“Offer” : The invitation by our Company to the public in Singapore<br />

including to our employees, Directors, business associates<br />

and those who have contributed to the success of our<br />

Group to subscribe for the Offer Shares at the Issue Price,<br />

subject to and on the terms and conditions of this<br />

Prospectus<br />

“Offer Shares” : The 10,000,000 New Shares which are the subject of<br />

the Offer, including the Reserved Shares<br />

“Participating Banks” : DBS Bank (including its POSBank Services division);<br />

Keppel TatLee Bank Limited (“KTB”); Overseas-Chinese<br />

Banking Corporation Limited (“OCBC”) Group (comprising<br />

OCBC and Bank of Singapore Limited); Overseas Union<br />

Bank Limited (“OUB”); and United Overseas Bank Limited<br />

(“UOB”) Group (comprising UOB, Far Eastern Bank<br />

Limited and Industrial & Commercial Bank Limited)<br />

“Placement” : The placement by our Company of the Placement Shares<br />

for subscription at the Issue Price, subject to and on the<br />

terms and conditions of this Prospectus<br />

“Placement Agent” : DBS Bank<br />

“Placement Shares” : The 20,000,000 New Shares which are the subject of<br />

the Placement<br />

“Reserved Shares” : The 7,500,000 New Shares reserved for our employees,<br />

Directors and business associates and those who have<br />

contributed to the success of our Group<br />

3

“Restructuring Exercise” : Restructuring exercise of our Group undertaken in<br />

connection with the Invitation, as described on page 13<br />

of this Prospectus<br />

“SCCS” : Securities Clearing & Computer Services (Pte) Ltd<br />

“Securities Account” : Securities account maintained by a depositor with CDP<br />

“SGX-ST” : Singapore Exchange Securities Trading Limited<br />

“Shares” : Ordinary shares of $0.10 each in the capital of our<br />

Company<br />

“Stock Split” : The sub-division of each ordinary share of $1.00 each in<br />

the authorised share capital of our Company into 10<br />

Shares, as described on page 70 of this Prospectus<br />

“Underwriter” : DBS Bank<br />

Currencies, Units and Others<br />

“$” and “cents” : Singapore dollars and cents, respectively<br />

“%” or “per cent.” : Per centum or percentage<br />

“sq ft” : Square feet<br />

“sq m” : Square metre<br />

References in this Prospectus to the “Group”, “we”, “our” and “us” refer to the Company and its<br />

subsidiaries.<br />

Words importing the singular shall, where applicable, include the plural and vice versa and words<br />

importing the masculine gender shall, where applicable, include the feminine and neuter genders<br />

and vice versa. References to persons, where applicable, shall include corporations.<br />

Unless otherwise indicated, any reference in this Prospectus and the Application Forms to any<br />

enactment is a reference to that enactment as for the time being amended or re-enacted. Any word<br />

defined under the Act or any statutory modification thereof and used in this Prospectus and the<br />

Application Forms shall, where applicable, have the meaning assigned to it under the said Act or<br />

statutory modification, as the case may be.<br />

Any reference in this Prospectus or the Application Forms to Shares being allotted to an applicant<br />

includes allotment to CDP for the account of that applicant.<br />

Any reference to a time and dates in this Prospectus and the Application Forms shall be a reference<br />

to Singapore time and dates unless otherwise stated.<br />

4

GLOSSARY OF TECHNICAL TERMS<br />

To facilitate a better understanding of our business, the following glossary provides an explanation<br />

(which should not be treated as being definitive of their meanings) on some of the technical terms<br />

and abbreviations used in this Prospectus:-<br />

“ACMV” : Air-conditioning & Mechanical Ventilation<br />

“AutoCAD” : An acronym for Computer Aided Design which is a computer<br />

software used to assist in designing and drawing for mechanical<br />

and electrical systems<br />

“Automatic sprinkler : A system for protecting a building against fire by means of<br />

system” overhead pipes which convey an extinguishing fluid through heatactivated<br />

outlets<br />

“Broadband communication : A communication technology that enables the user to have high<br />

technology” or speed access to the Internet and also make a phone call at the<br />

“Broadband reception same time.<br />

system”<br />

“Cable trays” : A cable support which consists of a continuous base with raised<br />

edges and has no covering<br />

“Coaxial cable” : Shielded copper cables for data and/or signal transmission,<br />

normally used for television and sound systems<br />

“Conduits” : Part of a closed wiring system for cables and electrical installations<br />

which allows the cables to be drawn in and/or replaced<br />

“Dry riser system: : A pipe riser that forms part of the fire protection system for<br />

buildings less than 25 metres in height<br />

“Earthing systems” : A system of cables that protects against faulty circuit current flows;<br />

prevents any dangerous overvoltages or excessive current on<br />

these equipment; provides a means for lightning protection and<br />

removal of static electricity, and for the reduction/elimination of<br />

electrical noise<br />

“Fibre optic cables” : Non-metallic cables for transmitting digital data or signals<br />

“Fire extinguishers” : Pressurized portable tanks for fire fighting purposes; usually filled<br />

with carbon dioxide<br />

“Fire hosereels” : A water hose for fire fighting purposes and forms a part of the<br />

fire protection system<br />

“Fire hydrant system” : A fire fighting system that consist of discharge pipes with a valve<br />

and spout at which water may be drawn from a water main, usually<br />

located in fire engine accessible areas<br />

“High voltage switchgears” : Made of high voltage switchgears, busbars and protection devices<br />

meant for the distribution of high voltage supply from the utility<br />

provider’s source (PUB substation) to the user’s transformers,<br />

where the electricity supply is transformed to the appropriate<br />

‘useful’ voltages for the different end users<br />

“Inspection chambers” : Surface access chambers located at regular intervals along the<br />

underground sewerage drain lines for inspection and maintenance<br />

5

“ISO” : International Organisation for Standardisation, a world-wide<br />

federation of national standards bodies<br />

“ISO 9000” : Series of international standards on quality management and<br />

quality assurance developed by the ISO Technical Committee in<br />

1987, which has been adopted by more than 30 countries,<br />

including the United Kingdom and the United States of America,<br />

as their national quality system standard<br />

“ISO 9002” : Constituent part of the ISO 9000 series which covers the following<br />

19 areas: management responsibility; quality system; contract<br />

review; document and data control; purchasing; control of<br />

customer-supplied product; product identification and traceability;<br />

process control; inspection and testing; control of inspection,<br />

measuring and test equipment; inspection and test status; control<br />

of non-conforming product; corrective and preventive action;<br />

handling, storage, packaging, preservation and delivery; control<br />

of quality records; internal quality audits; training; servicing and<br />

statistical techniques<br />

“Low voltage switchgears” : Made of switchgears, busbars and the necessary enclosures and<br />

support systems where the electricity at the appropriate useful<br />

voltage is distributed to the various electrical loads; it also provides<br />

the facilities for switching and circuit protection<br />

“M&E consultant” : A Qualified Person appointed to be responsible for the design of<br />

the Mechanical and Electrical systems of a building project<br />

“M&E systems” : Mechanical & Electrical Systems; usually refers to mechanical<br />

ventilation systems, plumbing systems, sanitary systems, electrical<br />

distribution systems, fire protection systems, etc<br />

“Network and structured : A network of telecommunication cables designed for broadband<br />

cabling” transmission<br />

“Private Automatic Branch : A private telephone exchange for a localized telephone system<br />

Exchange” or “PABX”<br />

“Pumper trucks” : Tank trucks that drains off and transport sludge from portable<br />

toilets and holding tanks to sewerage treatment plants<br />

“Riser ducts” : A compartment for housing distribution cables and switchboards<br />

in multi-storey buildings<br />

“Switchboard” : General term for switchgears, which are used for connecting the<br />

main incoming electrical cables within a premise from the utility<br />

supplier<br />

“Trunkings” : An enclosure for the protection of cables, normally of rectangular<br />

cross section where one side is removable or hinged<br />

“uPVC” : An acronym for unplasticised polyvinyl chloride which is a type of<br />

plastic material<br />

“UTP” : An acronym for unshielded twisted pair which is a type of cable<br />

for telecommunication or data transmission<br />

“Wet riser system” : A pressurized water pipe riser that forms part of the fire protection<br />

system for buildings exceeding 25 metres in height<br />

6

LISTING ON SGX SESDAQ<br />

DETAILS OF THE INVITATION<br />

Application has been made to the SGX-ST for permission to deal in, and for quotation of, all the<br />

Shares already issued as well as the New Shares on the SGX Sesdaq. Such permission will be<br />

granted when the Company has been admitted to the Official List of the SGX Sesdaq. Acceptance<br />

of applications will be conditional upon, inter alia, permission being granted to deal in, and for<br />

quotation of, all of the Shares already issued as well as the New Shares. Moneys paid in respect of<br />

any application accepted will, subject to applicable laws, be returned, without interest or any share<br />

of revenue or benefit arising therefrom and at the applicant’s own risk, if the said permission is not<br />

granted.<br />

The SGX-ST assumes no responsibility for the correctness of any of the statements made, opinions<br />

expressed or reports contained in this Prospectus. Admission to the Official List of the SGX Sesdaq<br />

is not to be taken as an indication of the merits of the Invitation, the Company, its subsidiaries or the<br />

Shares. A copy of this Prospectus, together with copies of the Application Forms, has been lodged<br />

with, and registered by, the Registrar of Companies and Business in Singapore who takes no<br />

responsibilities for its contents.<br />

The Directors individually and collectively accept full responsibility for the accuracy of the information<br />

given in this Prospectus and confirm, having made all reasonable enquiries, that to the best of their<br />

knowledge and belief, there are no other material facts the omission of which would make any<br />

statement in this Prospectus misleading and that this Prospectus constitutes full and true disclosure<br />

of all material facts about the Invitation and the Company and its subsidiaries.<br />

No person is authorised to give any information or to make any representation not contained in this<br />

Prospectus in connection with the Invitation and, if given or made, such information or representation<br />

must not be relied upon as having been authorised by the Company or DBS Bank. Neither the<br />

delivery of this Prospectus and the Application Forms nor the Invitation shall, under any circumstances,<br />

constitute a continuing representation or create any suggestion or implication that there has been no<br />

change in the affairs of the Company or the Group or any statements of fact or information contained<br />

in this Prospectus since the date of this Prospectus. Where such changes occur, the Company may<br />

make an announcement of the same to the SGX-ST. All applicants should take note of any such<br />

announcement and, upon release of such an announcement, shall be deemed to have notice of<br />

such changes. Save as expressly stated in this Prospectus, nothing herein is, or may be relied upon<br />

as, a promise or representation as to the future performance or policies of the Company or the<br />

Group.<br />

Neither the Company nor DBS Bank is making any representation to any person regarding the<br />

legality of an investment in the Shares by such person under any investment or any other laws or<br />

regulations. No information in this Prospectus should be considered to be business, legal or tax<br />

advice. Each prospective investor should consult his own professional or other advisors for business,<br />

legal or tax advice regarding an investment in the Shares.<br />

This Prospectus has been prepared solely for the purpose of the Invitation and may not be relied<br />

upon by any persons other than the applicants in connection with their application for the New<br />

Shares or for any other purpose. This Prospectus does not constitute an offer of, or invitation or<br />

solicitation to subscribe for, the New Shares in any jurisdiction in which such offer, invitation or<br />

solicitation is unauthorised or unlawful nor does it constitute an offer, invitation or solicitation to any<br />

person to whom it is unlawful to make such offer, invitation or solicitation.<br />

7

Copies of this Prospectus and the Application Forms and envelopes may be obtained on request,<br />

subject to availability, from:-<br />

The Development Bank of Singapore Ltd<br />

6 Shenton Way<br />

DBS Building Tower One<br />

Singapore 068809<br />

and from DBS Bank branches (including its POSBank Services division), members of the Association<br />

of Banks in Singapore, members of the SGX-ST and merchant banks in Singapore.<br />

The Application List will open at 10.00 a.m. on 4 December 2000 and will remain open until<br />

12.00 noon on the same day or for such further period or periods as the Directors may, in<br />

their absolute discretion decide, subject to any limitation under all applicable laws. In the<br />

event of any change in the close of the Application List, a paid press announcement will be<br />

made in an English language newspaper circulating in Singapore to keep members of the<br />

public informed of such change.<br />

Members of the public will be informed of the subscription and distribution results and balloting<br />

of Applications (if any) through MASNET and paid press announcements made in both English<br />

and Chinese language newspapers in circulation in Singapore.<br />

8

INDICATIVE TIMETABLE FOR LISTING<br />

In accordance with the SGX-ST’s News Release of 28 May 1993 on the trading of initial public<br />

offering shares on a “when issued” basis, an indicative timetable is set out below for the reference of<br />

applicants:-<br />

Indicative date/time Event<br />

4 December 2000, 12 noon Close of Application List<br />

5 December 2000 Balloting of applications, if necessary (in the event of an oversubscription<br />

for the Offer Shares (other than the Reserved Shares))<br />

6 December 2000, 9.00 a.m. Commence trading on a “when issued” basis<br />

15 December 2000 Last day of trading on a “when issued” basis<br />

18 December 2000, 9.00 a.m. Commence trading on a “ready” basis<br />

21 December 2000 Settlement date for all trades done on a “when issued” basis and<br />

for all trades done on a “ready” basis on 18 December 2000<br />

The above timetable is only indicative as it assumes that the closing of the Application List is<br />

4 December 2000, the date of admission of the Company to the Official List of SGX Sesdaq will be<br />

6 December 2000, the SGX-ST’s shareholding spread requirement will be complied with and the<br />

New Shares will be issued and fully paid up prior to 6 December 2000. The actual date on which the<br />

Shares will commence trading on a “when issued” basis will be announced when it is confirmed by<br />

the SGX-ST.<br />

The above timetable and procedure may be subject to such modifications as the SGX-ST may in its<br />

discretion decide, including the decision to permit trading on a “when issued” basis and the<br />

commencement date of such trading. The commencement of trading on a “when issued” basis<br />

will be entirely at the discretion of the SGX-ST. All persons trading in the Shares on a “when<br />

issued” basis, if implemented, do so at their own risk. In particular, persons trading in the<br />

Shares before their Securities Accounts are credited with the relevant number of Shares do<br />

so at the risk of selling Shares which neither they nor their nominees, as the case may be,<br />

have been allotted or are otherwise beneficially entitled to. Such persons are also exposed to<br />

the risk of having to cover their net sell positions earlier if “when issued” trading ends sooner<br />

than the indicative date mentioned above. Persons who have a net sell position traded on a<br />

“when issued” basis should close their position on or before the first day of “ready” basis<br />

trading.<br />

Investors should consult the SGX-ST’s announcement on the “ready” listing date on the Internet (at<br />

the SGX-ST website http://www.singaporeexchange.com), INTV or the newspapers, or check with<br />

their brokers on the date on which trading on a “ready” basis will commence.<br />

9

PROSPECTUS SUMMARY<br />

This summary highlights selected information contained elsewhere in this Prospectus. Since this<br />

summary does not contain all the information that you should consider before investing in our Shares,<br />

it is advised that you read the entire Prospectus carefully before making an investment decision.<br />

Our Business<br />

We are principally engaged in the business of providing mechanical and electrical (“M&E”) engineering<br />

services. Our customers are main contractors in Singapore who are engaged in property development<br />

in public and private residential sectors. Our services are mainly to install the following M&E systems<br />

for main contractors in various property development sectors:-<br />

(a) plumbing and sanitary systems;<br />

(b) electrical engineering systems;<br />

(c) fire protection and alarm systems;<br />

(d) air-conditioning and mechanical ventilation systems;<br />

(e) communications and security systems; and<br />

(f) underground pipeline communication systems.<br />

We are an L6 grade contractor under BCA’s categorization for “Plumbing & Sanitary Works”. This<br />

allows us to tender or take on such projects of unlimited contract value. We are also registered as<br />

an L5 grade contractor under the category “Electrical Engineering” and therefore are able to tender<br />

or take on such projects of up to $10 million in contract value. In addition, we are able to carry out<br />

other areas of M&E engineering services, in which we possess BCA gradings from L1 to L3. Details<br />

of our BCA gradings for different areas of M&E engineering services are elaborated on page 32 of<br />

this Prospectus.<br />

Our major M&E projects secured in the last three years were mainly public housing projects and<br />

private residential property developments. Such projects include Aquarius by the Park, Seletar Springs,<br />

Rivervale Executive Condominium, Hillington Green, Jurong West Neighbourhood 6 Contract 14,<br />

Bukit Merah Redevelopment Contract 47, Choa Chu Kang Neighbourhood 4 Contract 11 and Jurong<br />

West Neighbourhood 6 Contracts 17 and 18.<br />

Our ancillary business is to supply, deliver and service portable lavatories to various sites, such as<br />

property development work sites and areas where public events are conducted. We currently own<br />

714 portable lavatories, commonly referred to as “mobile toilets” and we lease such mobile lavatories<br />

to our customers. Our customers are predominantly main contractors and event organisers such as<br />

the National Day Parade and the Millennium Party.<br />

We derive approximately 79%, 19% and 2% of our turnover from plumbing and sanitary services,<br />

electrical system installation services and our ancillary portable lavatories business, respectively,<br />

based on the average for the last three financial years. We provide integrated M&E services as we<br />

are able to service our clients in more than one area of M&E services, such as plumbing and<br />

sanitary systems, electrical engineering systems, fire protection and alarm systems, air-conditioning<br />

and mechanical ventilation systems, communications and security systems and underground pipeline<br />

communication systems, or any combination of these services as required by our customers. Currently,<br />

our niche market is in the public housing sector, from which we derive approximately 84% of our<br />

M&E turnover for the last three financial years. The balance of 16% of our M&E turnover is derived<br />

from private residential projects for the last three financial years.<br />

10

Our Competitive Strengths<br />

(a) We have an established track record<br />

From 1977 to the date of this Prospectus, we have completed more than 180 projects for M&E<br />

services with an aggregate contract value of over $320 million in Singapore. We completed<br />

approximately $173.1 million worth of such contracts between April 1997 and September 2000.<br />

We are ISO 9002 certified for our quality management systems. In January 1999, we obtained<br />

ISO 9002 certification for all four trades of plumbing & sanitary, electrical, air-conditioning and<br />

mechanical ventilation(“ACMV”) and fire protection. As at the date of this Prospectus, we have<br />

38 contracts in progress with an approximate aggregate contract value of $141 million.<br />

(b) We provide a wide range of M&E services and are able to customize our services to our<br />

customers’ requirements<br />

We have 23 years of experience in plumbing, sanitary and electrical engineering, particularly in<br />

the residential sector. We possess capabilities and know-how to carry out and coordinate the<br />

different M&E services such as plumbing, electrical and ACMV. As an integrated service provider,<br />

we are able to provide more than one area of M&E services such as plumbing and sanitary<br />

systems, electrical engineering systems, fire protection and alarm systems, air-conditioning and<br />

mechanical ventilation systems, communications and security systems and underground pipeline<br />

communication systems, or any combination of these services as required by our customers.<br />

We coordinate the workflow for different M&E system installation to maximize efficiency and<br />

reduce reworks or wastage. Our clients need only coordinate their own workflow with that of<br />

ours instead of a few different M&E contractors.<br />

(c) We provide design-and-build services for the installation of M&E systems<br />

At the date of this Prospectus, we have 17 qualified engineers and 13 licensed tradesmen in<br />

our design-and-build teams. Our team will carry out the detailed design and recommend<br />

modifications for the plumbing, sanitary and electrical distribution systems with the aim of reducing<br />

costs for our clients. After the building plans are approved, we would install our plumbing,<br />

sanitary and electrical distribution systems in accordance to the approved plans. Between April<br />

1993 and September 2000, we were awarded seven HDB design-and-build projects and five<br />

private residential design-and-build projects for the provision of M&E services.<br />

(d) Good cost management<br />

Owing to our involvement in numerous HDB projects, we are able to purchase raw materials in<br />

bulk for our M&E projects. For example, bulk purchase prices for certain bathroom fixtures are<br />

much lower than the regular retail prices. This can result in cost savings of approximately 2%<br />

of the contract value over the duration of the project. Therefore, we would be able to reduce<br />

our costs when we purchase in bulk. In addition, we fabricate certain sewerage works required<br />

for maintenance and cleaning of sanitary pipes in-house instead of fabricating them on site.<br />

This one item alone can result in cost savings of approximately 1% of the contract value over<br />

the duration of the project. Such cost savings would have a direct flow through impact on the<br />

profitability of each project. As a result, these cost savings can significantly affect our profit<br />

margins.<br />

11

Our Strategy and Future Plans<br />

(a) To improve our M&E integrated services<br />

We intend to build on our integrated services, particularly in the design and installation of<br />

plumbing & sanitary, electrical engineering, air-conditioning and mechanical ventilation systems<br />

and fire protection and alarm systems. We intend to continue to train and upgrade the skills of<br />

our employees through on-the-job training and external training programmes and increase our<br />

efforts in securing more M&E integrated services projects.<br />

(b) Diversify our income base<br />

While we will continue to remain focused on our M&E services to the residential sector, we<br />

intend to diversify our income base to include other sectors. Currently, approximately 98% of<br />

our turnover is derived from the residential property sector. Apart from the residential sector,<br />

we plan to expand our operations into commercial, industrial and institutional building sectors.<br />

For example, in March and June 2000, we secured two contracts for the provision of M&E<br />

services for two educational institutions. We also intend to provide M&E services to the lightflatted<br />

industries. As at the date of this Prospectus, we have been awarded one such project<br />

for the supply and installation of plumbing & sanitary and electrical systems to an industrial<br />

building at Jalan Kilang Barat with a contract value of approximately $1.3 million.<br />

(c) Expand our scope of M&E services<br />

In June 2000, we were awarded and had commenced work on a $2.8 million contract for the<br />

installation of plumbing & sanitary, electrical, air-conditioning and mechanical ventilation (“ACMV”)<br />

and fire protection systems, including computer cabling and wiring, for a primary school located<br />

along Thomson Road. We intend to expand our range of services to include network and<br />

structured cabling. We anticipate that home automation, safety, security and Internet readiness<br />

would likely become an increasingly common feature for new premises. Structured cabling forms<br />

the backbone to these intelligent features. Currently, we are able to provide installation of fibre<br />

optic cable networks and unshielded twisted pair (“UTP”), which constitute the structured cabling<br />

system.<br />

(d) Increase our activity in design-and-build projects<br />

We believe that there will be an increasing trend towards “design-and-build” construction projects<br />

compared to the conventional “design-bid-build” construction projects. In a conventional “designbid-build”<br />

project, we provide only the M&E systems installation services. In contrast, for “designand-build”<br />

projects, we provide higher value added services such as detailed design and<br />

recommend cost saving modifications in addition to the M&E systems installation services.<br />

Design-and-build construction projects require co-operation and collaboration among consultants,<br />

contractors and developers that would result in a more efficient construction activity where<br />

labour and cost saving modifications have been integrated into the design of the project.<br />

Between April 1993 and November 2000, we provided M&E services to three HDB design-andbuild<br />

projects which have been completed and have four on-going HDB design-and-build projects.<br />

In the private residential sector, we provided M&E services to two design-and-build projects<br />

which have been completed and have three on-going design-and-build private sector projects.<br />

We intend to build on our design-and-build experience to increase our business in this area.<br />

12

Our Restructuring Exercise Prior to IPO<br />

On 6 November 2000, we undertook a restructuring exercise which involved the formation of a<br />

holding company with two wholly-owned subsidiaries, KWC and K&W. The rationale of the restructuring<br />

exercise was to reorganize our two subsidiaries under a holding company.<br />

The Restructuring exercise involved the following steps:-<br />

1. Acquisition of KWC<br />

Our Company acquired the entire issued and paid-up capital of KWC, consisting of 1,500,000<br />

existing ordinary shares of $1.00 each, from Messrs Chua Kim Hua, Chua Hai Kuey, Chua Kon<br />

Seng, Chua Yan Peng and Chua Eng Eng (“KWC Shareholders”) for a purchase consideration<br />

equivalent to the audited net tangible assets of KWC as at 31 March 2000 of $14,425,408. The<br />

purchase consideration was satisfied by the issue of 14,425,408 ordinary shares of $1.00 each<br />

in our Company at par, credited as issued and fully paid, to the KWC Shareholders. The<br />

acquisition was completed on 6 November 2000.<br />

2. Acquisition of K&W<br />

Our Company acquired the entire issued and paid-up capital of K&W, consisting of 20,000<br />

existing ordinary shares of $1.00 each, from Messrs Chua Kim Hua, Chua Hai Kuey, Chua Kon<br />

Seng, Chua Yan Peng and Chua Eng Eng (“K&W Shareholders”) for a purchase consideration<br />

equivalent to the audited net tangible assets of K&W as at 31 March 2000 of $304,777. The<br />

purchase consideration was satisfied by the issue of 304,777 ordinary shares of $1.00 each in<br />

our Company at par, credited as issued and fully paid, to the K&W Shareholders. The acquisition<br />

was completed on 6 November 2000.<br />

The resultant shareholding structure upon the completion of the Restructuring Exercise described<br />

above, both before and after the Invitation is set out under “Shareholders” on pages 72 and 73,<br />

respectively, in this Prospectus.<br />

Our Corporate Structure after the above Restructuring Exercise<br />

King Wan Corporation Limited<br />

(Singapore)<br />

100% 100%<br />

King Wan Construction Pte Ltd K&W Mobile Loo Services Pte Ltd<br />

(Singapore)<br />

(Singapore)<br />

13

Summary of Selected Proforma Group Financial Information<br />

The following table presents summary consolidated financial and operating data for our Proforma<br />

Group and should be read in conjunction with the section entitled “Review of Past Operating Results<br />

and Financial Positions” for a further explanation of the financial data summarised here and the<br />

Accountants’ Report herein.<br />

Selected Items of Consolidated Operating Results of the Proforma Group<br />

< Financial year ended 31 March > Six months Six months<br />

ended ended<br />

30 September 30 September<br />

($’000) 1998 1999 2000 1999 (1) 2000 (2)<br />

Turnover<br />

Operating profit before<br />

depreciation, interest<br />

51,315 40,279 59,141 29,776 44,918<br />

and taxation 1,574 5,143 6,762 4,498 3,676<br />

Profit before taxation<br />

Profit attributable to<br />

900 4,119 5,801 4,264 3,275<br />

Shareholders 507 2,739 4,288 3,266 2,282<br />

Selected Items of Consolidated Balance Sheet of the Proforma Group<br />

< As at 31 March > As at<br />

30 September<br />

($’000) 1998 1999 2000 2000 (2)<br />

Fixed assets 12,203 23,052 20,061 19,713<br />

Long term Investments 6,955 1,697 499 499<br />

Net current liabilities (8,508) (12,043) (5,333) (2,658)<br />

Non-current liabilities (904) (507) (500) (545)<br />

Shareholders’ funds 9,746 12,199 14,727 17,009<br />

Notes:<br />

(1) Based on management accounts<br />

(2) Based on limited review by Deloitte & Touche. Please refer to pages 104 to 106 of this Prospectus.<br />

14

THE INVITATION<br />

Issue Size : 30,000,000 New Shares comprising 10,000,000 Offer Shares,<br />

(including 7,500,000 Reserved Shares) and 20,000,000 Placement<br />

Shares. The New Shares will, upon issue and allotment and<br />

registration in the name of CDP or its nominee, rank pari passu in<br />

all respects with the then existing issued Shares.<br />

Issue Price : $0.20 for each New Share.<br />

The Placement : 20,000,000 Placement Shares by way of private placement.<br />

The Offer : The Offer comprises an invitation to members of the public in<br />

Singapore, including our employees, Directors, business associates<br />

and those who have contributed to the success of our Group, to<br />

subscribe for 10,000,000 New Shares (including Reserved Shares).<br />

Reserved Shares : 7,500,000 Reserved Shares will be reserved for our employees,<br />

Directors, business associates and those who have contributed to<br />

the success of our Group. In the event that any of the Reserved<br />

Shares are not taken up, they will be made available to satisfy<br />

applications made for Offer Shares (other than the Reserved<br />

Shares) or, in the event of an under-subscription for the Offer<br />

Shares, to satisfy excess applications made for the Placement<br />

Shares.<br />

Purpose of the Invitation : Our Directors consider that listing and quotation of our Shares on<br />

the SGX Sesdaq will enhance our public image and enable us to<br />

tap the capital markets. The Invitation will also provide members<br />

of the public, including our management, staff and business<br />

associates an opportunity to participate in our equity. In addition,<br />

the Invitation will facilitate the implementation of our strategy<br />

described under “Use of Proceeds” on page 26 of this Prospectus.<br />

Listing Status : The Shares will be quoted on SGX Sesdaq, subject to admission<br />

of our Company to the Official List of the SGX Sesdaq and<br />

permission for dealing in and quotation of the Shares being granted<br />

by the SGX-ST.<br />

15

RISK FACTORS<br />

You should carefully consider the following risks before deciding whether to invest in our Shares. All<br />

the risks that would have a material adverse impact on our business, operations or financials have<br />

been disclosed, to the best of our knowledge and belief as at the date of this Prospectus. The<br />

trading price of our Shares could decline because of general market conditions or if any or all of<br />

these risks came to pass, and you could lose all or part of your investment. In evaluating the risks<br />

of investing in our Company, you should also evaluate the other information set forth in this Prospectus,<br />

including our financial statements and the notes accompanying them.<br />

RISKS RELATING TO OUR COMPANY AND THE INDUSTRY<br />

Our business is subject to the cyclical nature of the construction industry in Singapore<br />

We provide M&E services to main contractors in the construction and property industries in Singapore.<br />

With Singapore as our only market, a downturn in the Singapore construction industry would adversely<br />

affect our business and results.<br />

We are exposed to the cyclical fluctuations of the construction industry in Singapore as illustrated in<br />

the following. The construction industry in general tracks the overall performance of the Singapore<br />

economy. The Singapore economy grew by 0.4% in 1998 due to the economic downturn consequent<br />

to the Asian economic crisis, much lower than the 8% growth registered in 1997 1 . The total construction<br />

demand, measured in terms of contracts awarded, was $15.3 billion in 1998, representing a 34.9%<br />

decline from $23.5 billion in 1997. In 1999, the construction demand decreased even further to $11.7<br />

billion 2 . Although the estimated construction demand for 2000 is $17.3 billion 3 , there is no assurance<br />

that this forecast will be achieved. Furthermore, the actual figures could be lower than projected.<br />

Any decrease in construction demand can adversely affect our business volume and result in<br />

significantly lower turnover. The construction industry in Singapore is also discussed on pages 46<br />

and 55 of this Prospectus.<br />

HDB projects contribute to approximately 95% of our gross profit. Our business is therefore<br />

dependent on HDB<br />

For the last three financial years, HDB projects contributed to approximately 82% of our turnover and<br />

approximately 95% to our gross profit. Any significant reduction in housing projects by HDB or any<br />

major delay or cancellation of HDB housing projects will result in lower business volume and<br />

consequently lower earnings. Details of our customers are set out on page 58 of this Prospectus.<br />

Our revenue and gross profit derived from HDB projects and as a percentage of our Group’s turnover<br />

and gross profit for the last three financial years are shown below:-<br />

1998<br />

Financial year ended 31 March<br />

1999 2000<br />

($’000) % ($’000) % ($’000) %<br />

Turnover derived from HDB projects 45,970 89.6 36,349 90.2 40,905 69.2<br />

Gross profit derived from HDB projects 3,678 96.5 7,899 104.5 (1) 7,749 84.5<br />

Note:-<br />

(1) In FY 1999, we had $0.4 million gross losses relating to private projects. This reduced the total profits earned for the<br />

year. As a result, the profits derived from HDB projects contributed to 104% of the total gross profits.<br />

1 1999 Economic Survey of Singapore<br />

2 Construction Economics Report, Second Quarter 2000<br />

3 Construction Economics Report, Second Quarter 2000<br />

16

We depend on four customers who contributed approximately 80% to our revenue in FY 2000.<br />

Therefore, any termination or loss of projects from any of these customers would materially<br />

adversely affect our business<br />

In FY 2000, four of our top customers accounted for approximately 80% of our turnover as elaborated<br />

on pages 58 and 59 of this Prospectus. These four customers accounted for approximately 67% of<br />

our gross profits in FY 2000. In the event that our business volume with any of these customers<br />

should decline or they terminate their relationship with us, our performance would decline significantly<br />

and our business, financial condition and operating results would be materially adversely affected.<br />

Cost overruns can adversely affect our Group’s profitability<br />

When providing quotation for a project, we may underestimate our project cost, particularly labour<br />

and time costs at the time of preparing our quotation. As such, we could incur cost overruns. Due to<br />

the long duration of certain projects, costs of materials, supplies and labour may increase beyond<br />

our estimate. Cost overruns may also occur due to poor site management, wastage or damage of<br />

materials. Unforeseen circumstances beyond our control, such as delays due to unanticipated<br />

difficulties, such as excavation difficulties due to unforeseen soil conditions or poor co-ordination in<br />

work schedules among sub-contractors, may also result in cost overruns. There is no assurance that<br />

we may not have any material cost overruns on our current and future projects. Such cost overruns<br />

would reduce our earnings on these projects or may even result in us incurring losses for a project.<br />

Disputes, claims and variation orders can erode our Group’s profitability<br />

In our business, it is common for claims to be made by customers against contractors or subcontractors<br />

for defective works and/or non-compliance with contract specifications. It is also common for our<br />

customers to retain a certain percentage of the contract sum as retention moneys for the costs of<br />

rectifying any defective works not rectified by us.<br />

Variation orders are usually additional works or changes requested by the customer for specifications<br />

not included in the original contract. Additional time would be extended to us to allow for completion<br />

of the project. On certain occasions, the parties may agree that variation orders be performed before<br />

the costs for such additional works are <strong>final</strong>ised. Thus, the <strong>final</strong> values of such variation orders may<br />

be subject to dispute by our customers. In such an event, additional works resulting from variation<br />

orders that may not be chargeable to our customers arising from disputes as elaborated in the<br />

preceding sentences would be absorbed by us. As a result of absorbing such costs, we may have to<br />

suffer lower profits or even losses for that project. To date, we have not experienced any material<br />

variation orders, claims or disputes. However, there is no assurance that such variation orders, claims<br />

or disputes may not arise materially in the future. In the event that we are required to bear any part<br />

of the variation costs or, claims or disputes, our earnings would be adversely affected.<br />

We are subject to credit risk of our customers<br />

Our credit terms to our customers are typically between 45 days to 90 days from date of progress<br />

claim. However, actual collection may range up to 120 days, as payment may only be made after<br />

certification of the works completed. The longer collection period is due to the time required for the<br />

main contractor to receive the moneys from the developers who may only pay after works completed<br />

have been certified by qualified surveyors or architects. Therefore, our collection period depends, to<br />

a large extent, on payments by the developers to the main contractor.<br />

We may not be able to collect payment from our customers due to bad debts by our customers. Any<br />

bad debts written off due to our inability to collect payment would increase our operating expenses<br />

and thereby reduce our profitability.<br />

Details of our bad debts written off are set out on page 59 of this Prospectus.<br />

17

We are dependent on foreign labour for manpower as we currently have approximately 430<br />

foreign labourers at our work sites<br />

The construction industry in Singapore is highly labour intensive. As local manpower is scarce, we<br />

rely substantially on foreign workers. The supply and recruitment of foreign labour is subject to<br />

policies imposed by the Ministry of Manpower. In the event of any changes in such policies, our<br />

ability to recruit foreign labour may be affected. Currently, the Ministry of Manpower imposes levies<br />

of $30 per month on skilled foreign workers and $470 per month on unskilled foreign workers. Any<br />

increase in the aforesaid levies will increase our cost of sales and thus reduce our profitability.<br />

The construction industry in Singapore is also discussed on pages 46 and 55 of this Prospectus.<br />

We may lose our business licence, we may also lose our BCA gradings or we may be<br />

downgraded<br />

We are registered with BCA as an L6 grade contractor under the category “Plumbing & Sanitary<br />

Works” and an L5 grade contractor under the category “Electrical Engineering”. The L6 and L5<br />

grades allow us to tender for projects of unlimited value and up to $10 million respectively. In addition,<br />

we possess at least an L1 BCA grade under several other categories.<br />

We have to meet the various requirements of BCA in order to maintain our BCA gradings. The<br />

requirements include (i) a minimum issued and paid-up capital; (ii) qualified personnel with the<br />

necessary professional or technical qualifications and experience; (iii) the necessary performance<br />

track records; (iv) contracts’ profile; and (v) the necessary licences and certificates from the various<br />

authorities such as the Public Utilities Board, Telecommunications Authority of Singapore and ENV.<br />

The gradings awarded by BCA are usually valid for a period of up to three years, and are subject to<br />

review at anytime within that period. This BCA grading only limits the contract value that a company<br />

may directly tender from governmental bodies.<br />

There is no assurance that we can maintain the necessary licences and certificates from the various<br />

authorities. In addition, the respective authorities may revoke our licences, certificates and BCA<br />

gradings. There is no assurance that we will not lose our licences or BCA gradings. To date, we have<br />

been awarded two M&E contracts each exceeding $10 million, and these two projects were completed<br />

in 1996. As at the date of this Prospectus, we do not have any contracts exceeding $10 million.<br />

However, in the event that our L6 status cannot be maintained, we will not be able to directly tender<br />

for any public sector plumbing & sanitary projects with contract value exceeding $10 million. This will<br />

have an adverse impact on our performance.<br />

We may be liable to pay liquidated damages due to delays in the completion of projects<br />

In the event of any delays in the completion of a project, we may be liable to pay liquidated damages<br />

to main contractors or developers. The quantum of liquidated damages payable is normally specified<br />

in the contracts. However, if the delay is due to factors beyond our control, such as unanticipated<br />

site conditions, we may not be liable for liquidated damages and may be granted an extension of<br />

completion time. To date, we have not had to pay any liquidated damages. However, there is no<br />

assurance that there will be no delays in the completion of our current or future projects which may<br />

result in claims for liquidated damages that will adversely affect the profit margins of the project.<br />

Our revenue recognition may be delayed due to delays in the completion of projects<br />

Our revenue is recognised based on the percentage completion basis, which is in line with the<br />

Singapore Accounting Standards and industry practice. We recognise revenue upon incurring 50% of<br />

the estimated cost to completion for the project (“Completion”). If the costs incurred on a project do<br />

not exceed the 50% of Completion when we <strong>final</strong>ize our annual accounts, the project revenues and<br />

costs would be deferred as work-in-progress in the balance sheet. No profit or loss is recognised in<br />

our results of operations for projects which do not exceed 50% of the estimated cost to completion<br />

for the project.<br />

18

If ongoing projects extend their dates of completion and their estimated cost to completion is less<br />

than 50%, we would have to delay recognising our project revenue and profits. There is no assurance<br />

that there will be no delays in the completion of our current or future projects that would delay the<br />

recognition of our revenue and profits and adversely affect our performance.<br />

Details on the costs of delays in the completion of projects are discussed on page 48 of this<br />

Prospectus.<br />

Changes in the relevant laws and regulations may affect our operations<br />

The Singapore construction industry is highly regulated and there can be no assurance that the<br />

regulatory environment in which we operate will not change significantly in the future. We are subject<br />

to laws and regulations, including the Building Control Act (Cap 29) and Building Control Regulations,<br />

which require us to engage licensed tradesmen, adhere to applicable codes of practice and meet<br />

certain financial requirements.<br />

To the best of our knowledge, we are in compliance with the applicable laws and regulations.<br />

Nevertheless, there can be no assurance that a review by the BCA or other regulatory authorities<br />

will not result in adverse determinations against us. In addition, there is no assurance that the<br />

construction regulatory environment will not be more stringent. For example, the regulatory authorities<br />

may increase the financial requirements required of other industry participants and us. Any change<br />

to the relevant laws and regulations may affect our business operations and performance.<br />

Fluctuations in raw material prices may erode our earnings<br />

The installation of M&E systems requires raw materials such as uPVC pipes and fittings, ductile iron<br />

pipes and fittings, electrical cables, and light fittings. Such raw materials account for approximately<br />

37.4% of our M&E cost of sales for the last three financial years. Any interruptions to the supply of<br />

these materials or increase in the prices for such materials would increase our project costs. To<br />

date, we have not experienced any material fluctuation in raw material prices. However, there is no<br />

assurance that we would not suffer any material increase in raw material prices in our current or<br />

future projects. An increase in the prices for these materials would have a negative impact on our<br />

profitability.<br />

Details on our costs of sales are discussed on pages 46 and 47 of this Prospectus.<br />

Our negative working capital position may adversely affect our operations<br />

As at 30 September 2000, our net current liabilities (negative working capital) amounted to $2.7<br />

million. Likewise in FY 2000 and FY 1999, we had negative working capital of $5.3 million and $12.0<br />

million, respectively. The negative working capital was due to the short-term financing of the<br />

construction of our Jurong Port Road factory cum office. This led to an increase in our bank overdrafts<br />

and trade creditors.<br />

In the event that we are unable to meet our liabilities when they are due or if our creditors take legal<br />

action against us for payment, we would have to liquidate our long-term assets to pay off our creditors.<br />

We may have difficulty realising our long-term assets into current assets in such a situation and may<br />

suffer losses upon the sale of our long-term assets. As a result, our liquidity and cashflow will be<br />

affected. This will adversely affect our operations and we may not be able to carry out our existing<br />

projects or take on new projects.<br />

Our business is subject to keen competition and low barriers of entry<br />

Although we are registered with BCA as a L6 plumbing & sanitary contractor, the BCA financial<br />

grading does not limit our competitors with similar or lower BCA financial gradings from competing<br />

against us for the same project as M&E subcontractors. The BCA financial grading only limits the<br />

size of a public project a contractor may directly tender for. In addition, contractors can obtain similar<br />

gradings as ourselves if they meet the requirements of BCA. Thus, they may compete with us in the<br />

same category of business when we directly tender for public projects.<br />

19

In view of the recent decline in the construction industry in Singapore and the large number of<br />

contractors registered with the BCA, we expect competition to intensify for tenders of public and<br />

private projects. Such intense competition among approximately 200 M&E plumbing and sanitary<br />

BCA registered contractors (according to the BCA Directory 2000) for the same project is likely to<br />

result in lower profit margins of our business and reduce our profitability.<br />

Our competition is also discussed on page 60 of this Prospectus.<br />

We are dependent on main contractors as all our projects are obtained through invited tenders<br />

from them<br />

Our projects are secured on an invited tender basis. We are invited by main contractors to provide<br />

M&E quotes for the new projects that they are tendering. Our ability to secure M&E contracts depends<br />

on such main contractors inviting us on a frequent and regular basis to provide M&E quotes to them.<br />

These main contractors may not invite us to tender and quote for a project if they find that we do not<br />

have relevant BCA gradings or adequate track record to carry on the scope and responsibilities<br />

required for a particular project or sufficient manpower or financial resources to perform a project.<br />

There is no assurance that these main contractors will continue to invite us to provide quotes for all<br />

projects that they participate in. Our revenue and financial performance would be materially and<br />

adversely affected in the event we are no longer invited by main contractors to quote on new projects.<br />

We are subject to a pending litigation which may reduce our profitability<br />

We had engaged a private company incorporated in Singapore (“the Contractor”) to construct a 4storey<br />

factory at 22 Jurong Port Road. On 20 March 2000, the project architect issued a <strong>final</strong> certificate<br />

certifying that a sum of $199,406.70 was payable by us to the Contractor. This amount was derived<br />

after setting off the sum of $342,350 which we paid to a third party contractor engaged by us for<br />

rectification of the defective works of the Contractor. We withheld payment to the Contractor after<br />

having being advised by one of our solicitors that we have a valid set-off and counterclaim against<br />

the Contractor for PUB charges and loss of rental income.<br />

On 3 July 2000, the Contractor commenced legal proceedings against us to claim the sums of<br />

$199,406.70 and $342,350, together with interest at 6% per annum and legal costs.<br />

On 15 July 2000, we applied for a stay of the action in court and for the matter to be referred to<br />

arbitration. On 25 July 2000, we made payment of the sum claimed of $199,406.70. However, we<br />

made a counterclaim for an amount in excess of $500,000 against the Contractor for PUB charges<br />

and damages caused by the defective works.<br />

On 11 September 2000, a judgement was awarded by the Assistant Registrar of the High Court<br />

against us for the sum $342,350. We successfully appealed to the High Court against such decision.<br />

The High Court allowed our application for the entire proceedings to be referred to arbitration. The<br />

High Court also ordered the Contractor to pay our legal costs. On 30 October 2000, the Contractor<br />

filed an appeal to the Court of Appeal. We are waiting for the Court of Appeal to fix a date for the<br />

hearing of the appeal. We have thus far acted on the advice of our legal counsel.<br />

In the event we are unsuccessful in our counterclaim against the Contractor, we may have to pay the<br />

Contractor the amount of $342,350 together with interests at 6% per annum and its legal costs.<br />

Should we be unsuccessful, this may reduce our profitability in the future.<br />

We may lose our credit facilities if certain of our Directors and substantial shareholders were<br />

to withdraw their joint and several personal guarantees<br />

As at 30 September 2000, our borrowings comprising bank overdrafts and hire purchase commitments<br />

amounted to $0.7 million. In addition, we had credit facilities of $20.0 million as at 30 September<br />

2000. These credit facilities are secured on fixed deposits of $265,000, our two properties at Sungei<br />

Kadut Loop and Jurong Port Road and a joint and several personal guarantees of $24.25 million by<br />

certain of our Directors and substantial shareholders, Messrs Chua Kim Hua, Chua Hai Kuey, Chua<br />

Kon Seng and Chua Yan Peng.<br />

20

In the event that our Directors and substantial shareholders should withdraw their personal guarantees<br />

after the Invitation, our borrowing rates and/or interest expense would be affected if we have to<br />

negotiate the terms and conditions that may be less favourable. We may even lose our credit facilities.<br />

This would have a material and adverse impact on our operations, as we would not be able to carry<br />

out our existing projects or take on new projects.<br />

Failure to retain key personnel will seriously harm our business<br />

Our Group’s success depends on the continued effort and abilities of our management team and<br />

technical personnel. Our Executive Directors and Executive Officers Messrs Chua Kim Hua, Chua<br />

Hai Kuey and Chua Kon Seng have at least 20 years of experience each in the M&E services<br />

industry. We have entered into separate service agreements with Messrs Chua Kim Hua and Chua<br />

Hai Kuey discussed on pages 69 and 70 of this Prospectus. In addition, we do not have any “key<br />

man” life insurance policy. Should any of our key management terminate their employment and we<br />

are unable to attract suitably qualified personnel as replacement, this could have a material adverse<br />

effect on our business and results.<br />

RISKS RELATED TO INVESTMENT IN OUR SHARES<br />

Our Directors and certain Executive Officers own a large percentage of our Company and<br />

could significantly influence the outcome of actions<br />

Our Directors and certain Executive Officers will, in aggregate, beneficially own approximately 79.44%<br />

of our issued share capital immediately after the Invitation (excluding the Reserved Shares, which<br />

may be allotted pursuant to the Invitation). These shareholders, if acting together, would be able to<br />

significantly influence other matters requiring shareholders’ approval, including the election of directors<br />

and the approval of certain mergers or other business transactions.<br />

Future sale of Shares could adversely affect our Share price<br />

Our current shareholders hold a substantial number of our shares, which they will be able to sell to<br />

the public in the near future. Except as otherwise described in the section titled “Moratorium” on<br />

page 74 of this Prospectus, there is no restriction on the ability of the substantial shareholders to<br />

sell their Shares either on the SGX Sesdaq or otherwise. Any sale of a substantial number of our<br />

Shares after the Invitation by our current shareholders could cause our Share price to fall. In addition,<br />

the sale of these Shares could impair our ability to raise capital through the issue of additional<br />

Shares.<br />

There has been no prior market for our Shares and this offering may not result in an active<br />

or liquid market for these Shares<br />

There has been no public market for our Shares prior to this Invitation. The Issue Price may not be<br />

indicative of the market price of our Shares after the completion of this Invitation. The market price<br />

of our Shares could be subject to significant fluctuations in response to various external factors and<br />

events including the liquidity of Shares in the market, differences between our Group’s actual financial<br />

and operating results compared to those expected by investors and analysts and the general market<br />

conditions and broad market fluctuations. Although application has been made to list our Shares on<br />

the Official List of SGX Sesdaq, there can be no assurance that an active trading market for our<br />

Shares will develop or, be sustained if it develops.<br />

21

ISSUE STATISTICS<br />

Issue Price for each New Share $0.20<br />

NET TANGIBLE ASSETS<br />

NTA per Share based on our Proforma Group’s audited consolidated NTA as at<br />

31 March 2000, adjusted for the Restructuring Exercise referred to on page 13 of<br />

this Prospectus and the Stock Split:-<br />

(a) before adjusting for the estimated net proceeds from the issue of the New<br />

Shares based on the pre-Invitation share capital of 147,301,870 Shares 10.00 cents<br />

(b) after adjusting for the estimated net proceeds from the issue of the New<br />

Shares based on the post-Invitation share capital of 177,301,870 Shares 11.18 cents<br />

Premium of Issue Price per Share over our Proforma Group’s audited consolidated<br />

NTA per Share as at 31 March 2000, adjusted for the Restructuring Exercise referred<br />

to on page 13 of this Prospectus and the Stock Split:-<br />

(a) before adjusting for the estimated net proceeds from the issue of the New<br />

Shares based on the pre-Invitation share capital of 147,301,870 Shares 100.00%<br />

(b) after adjusting for the estimated net proceeds from the issue of the New<br />

Shares based on the post-Invitation share capital of 177,301,870 Shares 78.89%<br />

EARNINGS PER SHARE<br />

Historical net earnings per Share of our Proforma Group for the financial year<br />

ended 31 March 2000 based on the pre-Invitation share capital of 147,301,870<br />

Shares 2.91 cents<br />

Historical net earnings per Share of our Proforma Group for the financial year<br />

ended 31 March 2000, based on the pre-Invitation share capital of 147,301,870<br />

Shares, had the Service Agreements described on pages 69 and 70 of this<br />

Prospectus been in place 2.84 cents<br />

PRICE EARNINGS RATIO<br />

Historical price earnings ratio based on the historical net earnings per Share of<br />

our Proforma Group for the financial year ended 31 March 2000 based on the<br />

pre-Invitation share capital of 147,301,870 Shares 6.9 times<br />

Historical price earnings ratio based on the historical net earnings per Share of<br />

our Proforma Group for the financial year ended 31 March 2000, based on the<br />

pre-Invitation share capital of 147,301,870 Shares, had the Service Agreements<br />

described on pages 69 and 70 of this Prospectus been in place 7.0 times<br />

22

NET OPERATING CASH FLOW (1)<br />

Historical net operating cash flow per Share of our Proforma Group for the<br />

financial year ended 31 March 2000 based on the pre-Invitation share capital<br />

of 147,301,870 Shares 3.98 cents<br />

PRICE TO NET OPERATING CASH FLOW (1)<br />

Historical price to net operating cash flow based on the historical proforma net<br />

operating cashflow per Share for the financial year ended 31 March 2000 based<br />

on the pre-Invitation share capital of 147,301,870 Shares 5.0 times<br />

MARKET CAPITALISATION<br />

Based on the Issue Price of $0.20 per Share and the enlarged share capital of<br />

our Company after the Invitation of 177,301,870 Shares $35,460,374<br />

Note:-<br />

(1) Net operating cash flow is defined as net profit after tax and minority interests but before extraordinary items with<br />

provision for depreciation added back.<br />

23

CAPITALISATION<br />

The following table illustrates our capitalisation (i) at 31 March 2000, (ii) as adjusted for the<br />

Restructuring Exercise and sub-division and (iii) the proceeds of the Invitation. This table should be<br />

read in conjunction with the section entitled “Review of Past Operating Results and Financial Positions”<br />

set out on pages 42 to 55 of this Prospectus.<br />

After<br />

Restructuring<br />

As at Exercise and After<br />

$’000 31 March 2000 sub-division Invitation<br />

Short-term Borrowings<br />

Bank overdrafts — secured<br />

Current portion of obligations under<br />

877 877 877<br />

hire purchase creditors — secured 336 336 336<br />

1,213 1,213 1,213<br />

Long-term Borrowings<br />

Long-term portion of hire purchase<br />

creditors — secured 268 268 268<br />

268 268 268<br />

Shareholders’ Funds<br />

Issued and fully paid-up share<br />

capital – (1) 14,730 17,730<br />

Share premium – – 2,100<br />

Revenue reserves (3) (3) (3)<br />

(3) 14,727 19,827<br />

Capitalisation 265 14,995 20,095 (2)<br />

Note:<br />

(1) The issued and fully paid-up share capital as at 31 March 2000 was $2.00 comprising 2 ordinary shares of $1.00 each.<br />

(2) As at 30 September 2000, our bank overdraft was $228,000 and our current portion of obligations under hire purchase<br />