Hindalco Industries Initiating Coverage - Emkay Global Financial ...

Hindalco Industries Initiating Coverage - Emkay Global Financial ...

Hindalco Industries Initiating Coverage - Emkay Global Financial ...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

<strong>Hindalco</strong> <strong>Industries</strong> <strong>Initiating</strong> <strong>Coverage</strong><br />

Strong value added product<br />

portfolio in aluminium segment<br />

and stable contribution from<br />

copper by- products to help<br />

mitigate LME volatility to a large<br />

extent<br />

We believe, in aluminium, fair exposure to value added products will continue to help the<br />

company offset LME volatility risk to a large extent, as these charge handsome premium<br />

over the LME and cater to customized demand category. On the other hand, in custom<br />

copper smelting business, LME prices are only a pass-through. TcRc and contribution from<br />

by-product sales drive segmental margins. Spot TcRc has significantly corrected during<br />

H1FY12. However, <strong>Hindalco</strong>’s low cost operations and contributions from by-product sales<br />

would enable the copper business to contribute even at low market TcRcs. Further,<br />

<strong>Hindalco</strong> usually has long term contracts, serving large part of its business needs.<br />

Novelis: the stepping stone to global leadership<br />

Novelis, earlier a part of Alcan Inc’s rolling division, was spun off and incorporated as a<br />

separate entity in January 2005. Through acquisition of Novelis in May 2007, <strong>Hindalco</strong><br />

became the world’s leading aluminium rolled product producer based on shipment of<br />

volume. It is now the largest producer in Europe and South America and second largest<br />

producer in North America and Asia. Novelis has a market share of ~20% in the global flatrolled<br />

aluminium product market, with global leadership in used beverage can recycling. It<br />

recycles ~40 bn beverage cans per annum. Novelis operates in 11 countries in the<br />

abovementioned 4 continents through 31 plants.<br />

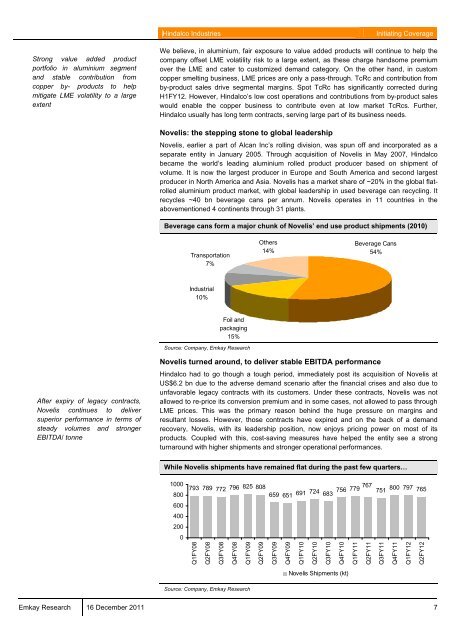

Beverage cans form a major chunk of Novelis’ end use product shipments (2010)<br />

Transportation<br />

7%<br />

Others<br />

14%<br />

Beverage Cans<br />

54%<br />

Industrial<br />

10%<br />

Foil and<br />

packaging<br />

15%<br />

Source: Company, <strong>Emkay</strong> Research<br />

After expiry of legacy contracts,<br />

Novelis continues to deliver<br />

superior performance in terms of<br />

steady volumes and stronger<br />

EBITDA/ tonne<br />

Novelis turned around, to deliver stable EBITDA performance<br />

<strong>Hindalco</strong> had to go though a tough period, immediately post its acquisition of Novelis at<br />

US$6.2 bn due to the adverse demand scenario after the financial crises and also due to<br />

unfavorable legacy contracts with its customers. Under these contracts, Novelis was not<br />

allowed to re-price its conversion premium and in some cases, not allowed to pass through<br />

LME prices. This was the primary reason behind the huge pressure on margins and<br />

resultant losses. However, those contracts have expired and on the back of a demand<br />

recovery, Novelis, with its leadership position, now enjoys pricing power on most of its<br />

products. Coupled with this, cost-saving measures have helped the entity see a strong<br />

turnaround with higher shipments and stronger operational performances.<br />

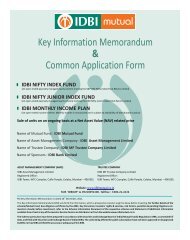

While Novelis shipments have remained flat during the past few quarters…<br />

1000<br />

800<br />

600<br />

400<br />

200<br />

0<br />

793 789 772 796 825 808<br />

Q1FY08<br />

Q2FY08<br />

Q3FY08<br />

Q4FY08<br />

Q1FY09<br />

Q2FY09<br />

659 651 691 724 683 756 767<br />

779 751 800 797 765<br />

Q3FY09<br />

Q4FY09<br />

Q1FY10<br />

Q2FY10<br />

Q3FY10<br />

Q4FY10<br />

Novelis Shipments (kt)<br />

Q1FY11<br />

Q2FY11<br />

Q3FY11<br />

Q4FY11<br />

Q1FY12<br />

Q2FY12<br />

Source: Company, <strong>Emkay</strong> Research<br />

<strong>Emkay</strong> Research 16 December 2011 7