Putnam Asia Pacific Equity Fund - Putnam Investments

Putnam Asia Pacific Equity Fund - Putnam Investments

Putnam Asia Pacific Equity Fund - Putnam Investments

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

and stocks — would generally be expected to<br />

lose some of their appeal. In our multi-year,<br />

low-interest-rate environment, emergingmarket<br />

countries have generally benefited<br />

from global capital flows into their higheryielding<br />

assets. With the prospect of the<br />

emerging-market yield advantage drying<br />

up, some foreign investors turned to other<br />

markets — such as Europe and the United<br />

States — in an attempt to capture opportunities<br />

that may have been perceived to have<br />

more attractive risk/reward potential.<br />

What are some examples of stocks or<br />

strategies that were significant contributors<br />

to the fund’s performance relative to<br />

the benchmark<br />

The top contributor to the fund’s performance<br />

was HCL Technologies. This is an<br />

Indian software company that we feel<br />

executed well on its business objective,<br />

which is to provide software support to help<br />

manage infrastructure projects and other<br />

business processes. Despite a run-up in<br />

the stock price, we foresee further growth<br />

potential for HCL and believe it continues to<br />

trade at a discount to its inherent value.<br />

Another top contributor for the period was<br />

the stock of Sands China, a gaming company<br />

with operations in Macau. <strong>Asia</strong>n consumers<br />

are increasingly spending their savings on<br />

travel and leisure activities, and the gaming<br />

industry is a beneficiary of this significant<br />

development of <strong>Asia</strong>n consumer preferences.<br />

By the end of the period, we eliminated<br />

this position after it had experienced a<br />

substantial gain.<br />

A third top contributor was Biostime<br />

International, a China-based company that<br />

focuses on pediatric nutrition and baby<br />

products for Chinese consumers. With today’s<br />

heightened concerns over food-safety issues<br />

in China, the company has commanded<br />

healthy pricing power for its products, the<br />

ingredients of which are largely imported<br />

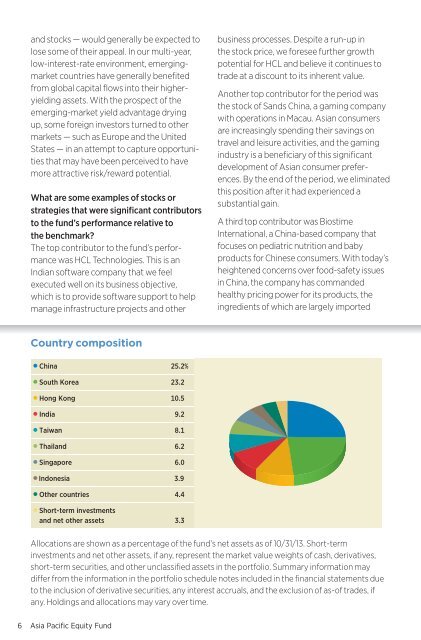

Country composition<br />

China 25.2%<br />

South Korea 23.2<br />

Hong Kong 10.5<br />

India 9.2<br />

Taiwan 8.1<br />

Thailand 6.2<br />

Singapore 6.0<br />

Indonesia 3.9<br />

Other countries 4.4<br />

Short-term investments<br />

and net other assets 3.3<br />

Allocations are shown as a percentage of the fund’s net assets as of 10/31/13. Short-term<br />

investments and net other assets, if any, represent the market value weights of cash, derivatives,<br />

short-term securities, and other unclassified assets in the portfolio. Summary information may<br />

differ from the information in the portfolio schedule notes included in the financial statements due<br />

to the inclusion of derivative securities, any interest accruals, and the exclusion of as-of trades, if<br />

any. Holdings and allocations may vary over time.<br />

6 <strong>Asia</strong> <strong>Pacific</strong> <strong>Equity</strong> <strong>Fund</strong>