St. James's Place Investment Bond

St. James's Place Investment Bond

St. James's Place Investment Bond

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

The limitations of bank<br />

deposits<br />

We always encourage clients to retain sufficient money on deposit<br />

to cater for emergencies and other short-term needs. However, if<br />

you leave the majority of your capital on deposit over the medium to long<br />

term, there are three factors you need to consider:<br />

• The low rate of interest currently available on deposits<br />

• The impact of inflation on the future value of your capital<br />

• Whether you are prepared to take a risk with part of your capital.<br />

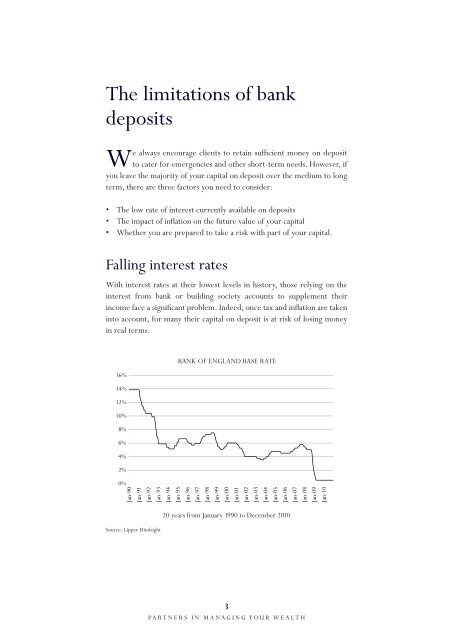

Falling interest rates<br />

With interest rates at their lowest levels in history, those relying on the<br />

interest from bank or building society accounts to supplement their<br />

income face a significant problem. Indeed, once tax and inflation are taken<br />

into account, for many their capital on deposit is at risk of losing money<br />

in real terms.<br />

BANK OF ENGLAND BASE RATE<br />

16%<br />

14%<br />

12%<br />

10%<br />

8%<br />

6%<br />

4%<br />

2%<br />

0%<br />

Jan-90<br />

Jan-91<br />

Jan-92<br />

Jan-93<br />

Jan-94<br />

Jan-95<br />

Jan-96<br />

Jan-97<br />

Jan-98<br />

Jan-99<br />

Jan-00<br />

Jan-01<br />

Jan-02<br />

Jan-03<br />

Jan-04<br />

Jan-05<br />

Jan-06<br />

Jan-07<br />

Jan-08<br />

Jan-09<br />

Jan-10<br />

20 years from January 1990 to December 2010<br />

Source: Lipper Hindsight<br />

3<br />

PARTNERS IN MANAGING YOUR WEALTH