CIFPs: Tax & Budget 2012 Update

CIFPs: Tax & Budget 2012 Update

CIFPs: Tax & Budget 2012 Update

- No tags were found...

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

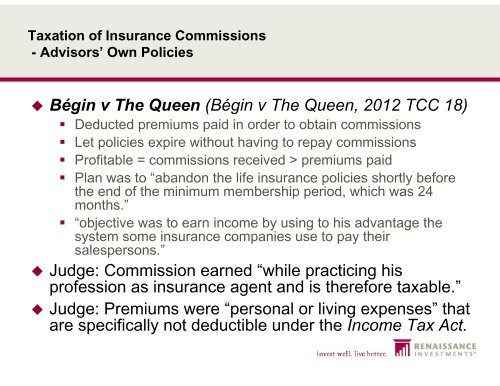

<strong>Tax</strong>ation of Insurance Commissions<br />

- Advisors’ Own Policies<br />

Bégin v The Queen (Bégin v The Queen, <strong>2012</strong> TCC 18)<br />

• Deducted premiums paid in order to obtain commissions<br />

• Let policies expire without having to repay commissions<br />

• Profitable = commissions received > premiums paid<br />

• Plan was to “abandon the life insurance policies shortly before<br />

the end of the minimum membership period, which was 24<br />

months.”<br />

• “objective was to earn income by using to his advantage the<br />

system some insurance companies use to pay their<br />

salespersons.”<br />

Judge: Commission earned “while practicing his<br />

profession as insurance agent and is therefore taxable.”<br />

Judge: Premiums were “personal or living expenses” that<br />

are specifically not deductible under the Income <strong>Tax</strong> Act.