From Old Economics to New Economics- Radical ... - Bruce Nixon

From Old Economics to New Economics- Radical ... - Bruce Nixon

From Old Economics to New Economics- Radical ... - Bruce Nixon

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

However, the role of the financial system in the economy goes beyond the direct transactions<br />

that occur between financial institutions, particularly with regard <strong>to</strong> its influence on the<br />

private sec<strong>to</strong>r. The short-termism of many businesses is, at least in part, a result of the need <strong>to</strong><br />

a) service debt raised in the financial system, and b) maintain upward pressure on the share<br />

price. The requirement <strong>to</strong> ‘maximise shareholder value’ is one of practical survival in many<br />

instances. Companies that see their share price fall are liable <strong>to</strong> be a takeover target by a<br />

competi<strong>to</strong>r or a private equity firm promising <strong>to</strong> increase the ‘efficiency’ of the enterprise and<br />

so generate yet higher profits.<br />

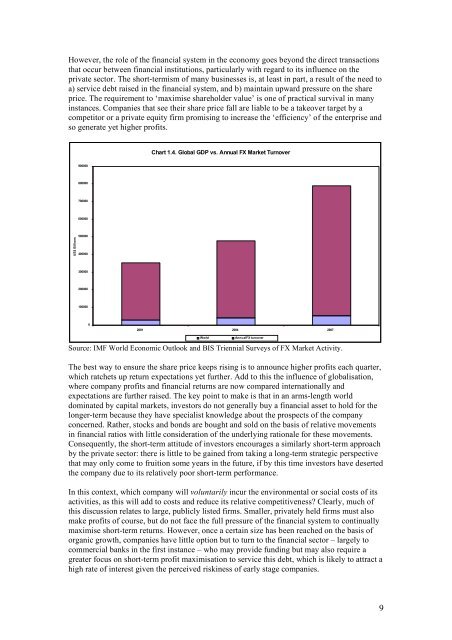

Chart 1.4. Global GDP vs. Annual FX Market Turnover<br />

900000<br />

800000<br />

700000<br />

600000<br />

US$ Billions<br />

500000<br />

400000<br />

300000<br />

200000<br />

100000<br />

0<br />

2001 2004 2007<br />

World<br />

Annual FX turnover<br />

Source: IMF World Economic Outlook and BIS Triennial Surveys of FX Market Activity.<br />

The best way <strong>to</strong> ensure the share price keeps rising is <strong>to</strong> announce higher profits each quarter,<br />

which ratchets up return expectations yet further. Add <strong>to</strong> this the influence of globalisation,<br />

where company profits and financial returns are now compared internationally and<br />

expectations are further raised. The key point <strong>to</strong> make is that in an arms-length world<br />

dominated by capital markets, inves<strong>to</strong>rs do not generally buy a financial asset <strong>to</strong> hold for the<br />

longer-term because they have specialist knowledge about the prospects of the company<br />

concerned. Rather, s<strong>to</strong>cks and bonds are bought and sold on the basis of relative movements<br />

in financial ratios with little consideration of the underlying rationale for these movements.<br />

Consequently, the short-term attitude of inves<strong>to</strong>rs encourages a similarly short-term approach<br />

by the private sec<strong>to</strong>r: there is little <strong>to</strong> be gained from taking a long-term strategic perspective<br />

that may only come <strong>to</strong> fruition some years in the future, if by this time inves<strong>to</strong>rs have deserted<br />

the company due <strong>to</strong> its relatively poor short-term performance.<br />

In this context, which company will voluntarily incur the environmental or social costs of its<br />

activities, as this will add <strong>to</strong> costs and reduce its relative competitiveness Clearly, much of<br />

this discussion relates <strong>to</strong> large, publicly listed firms. Smaller, privately held firms must also<br />

make profits of course, but do not face the full pressure of the financial system <strong>to</strong> continually<br />

maximise short-term returns. However, once a certain size has been reached on the basis of<br />

organic growth, companies have little option but <strong>to</strong> turn <strong>to</strong> the financial sec<strong>to</strong>r – largely <strong>to</strong><br />

commercial banks in the first instance – who may provide funding but may also require a<br />

greater focus on short-term profit maximisation <strong>to</strong> service this debt, which is likely <strong>to</strong> attract a<br />

high rate of interest given the perceived riskiness of early stage companies.<br />

9