A Tale of Two Millionaires: - Managers of Wealth

A Tale of Two Millionaires: - Managers of Wealth

A Tale of Two Millionaires: - Managers of Wealth

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

12 A <strong>Tale</strong> <strong>of</strong> <strong>Two</strong> <strong>Millionaires</strong>: The Best <strong>of</strong> Times for Private Banks to Look Beyond the Ultra-High-Net-Worth Market<br />

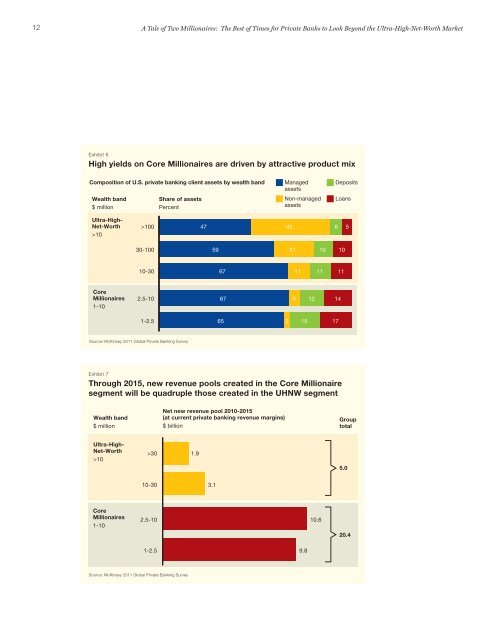

Exhibit 6<br />

High yields on Core <strong>Millionaires</strong> are driven by attractive product mix<br />

Composition <strong>of</strong> U.S. private banking client assets by wealth band<br />

<strong>Wealth</strong> band<br />

$ million<br />

Share <strong>of</strong> assets<br />

Percent<br />

Managed<br />

assets<br />

Non-managed<br />

assets<br />

Deposits<br />

Loans<br />

Ultra-High-<br />

Net-Worth<br />

>10<br />

>100<br />

47<br />

42<br />

6 5<br />

30-100<br />

59<br />

21<br />

10<br />

10<br />

10-30<br />

67<br />

11<br />

11 11<br />

Core<br />

<strong>Millionaires</strong><br />

1-10<br />

2.5-10<br />

67<br />

6<br />

12<br />

14<br />

1-2.5<br />

65<br />

3<br />

15<br />

17<br />

Source: McKinsey 2011 Global Private Banking Survey<br />

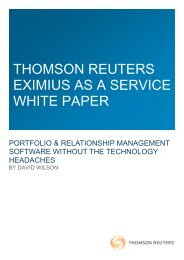

Exhibit 7<br />

Through 2015, new revenue pools created in the Core Millionaire<br />

segment will be quadruple those created in the UHNW segment<br />

<strong>Wealth</strong> band<br />

$ million<br />

Net new revenue pool 2010-2015<br />

(at current private banking revenue margins)<br />

$ billion<br />

Group<br />

total<br />

Ultra-High-<br />

Net-Worth<br />

>10<br />

>30<br />

1.9<br />

5.0<br />

10-30<br />

3.1<br />

Core<br />

<strong>Millionaires</strong><br />

1-10<br />

2.5-10<br />

10.6<br />

20.4<br />

1-2.5<br />

9.8<br />

Source: McKinsey 2011 Global Private Banking Survey