request for a payment from your investment solutions ... - TIAA-CREF

request for a payment from your investment solutions ... - TIAA-CREF

request for a payment from your investment solutions ... - TIAA-CREF

- No tags were found...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

REQUEST FOR A PAYMENT<br />

FROM YOUR INVESTMENT SOLUTIONS<br />

TRADITIONAL, ROTH OR SEP IRA<br />

For faster service, <strong>your</strong><br />

distribution and/or rollover<br />

<strong>request</strong> can be completed over<br />

the phone by calling us at:<br />

800 842-2252<br />

Monday to Friday<br />

8 a.m. – 10 p.m. (ET)<br />

Saturday<br />

9 a.m. – 6 p.m. (ET)<br />

You can also call us <strong>for</strong>:<br />

- account in<strong>for</strong>mation<br />

- the status of <strong>your</strong> <strong>request</strong><br />

- answers to <strong>your</strong> questions<br />

Or visit us online at<br />

tiaa-cref.org 24 hours a<br />

day. Have <strong>your</strong> user ID and<br />

password ready.<br />

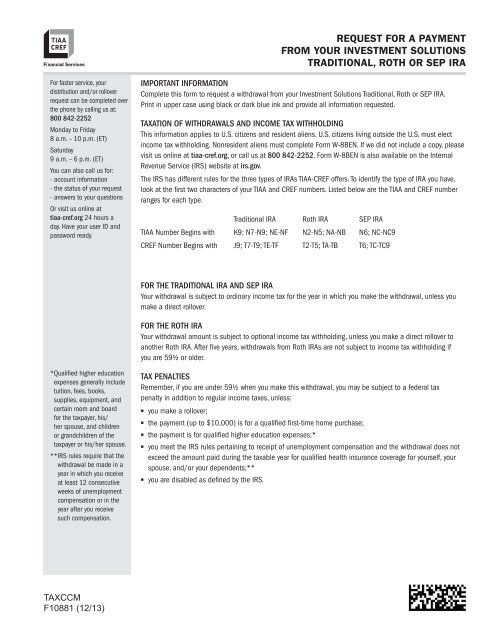

IMPORTANT INFORMATION<br />

Complete this <strong>for</strong>m to <strong>request</strong> a withdrawal <strong>from</strong> <strong>your</strong> Investment Solutions Traditional, Roth or SEP IRA.<br />

Print in upper case using black or dark blue ink and provide all in<strong>for</strong>mation <strong>request</strong>ed.<br />

TAXATION OF WITHDRAWALS AND INCOME TAX WITHHOLDING<br />

This in<strong>for</strong>mation applies to U.S. citizens and resident aliens. U.S. citizens living outside the U.S. must elect<br />

income tax withholding. Nonresident aliens must complete Form W-8BEN. If we did not include a copy, please<br />

visit us online at tiaa-cref.org, or call us at 800 842-2252. Form W-8BEN is also available on the Internal<br />

Revenue Service (IRS) website at irs.gov.<br />

The IRS has different rules <strong>for</strong> the three types of IRAs <strong>TIAA</strong>-<strong>CREF</strong> offers. To identify the type of IRA you have,<br />

look at the first two characters of <strong>your</strong> <strong>TIAA</strong> and <strong>CREF</strong> numbers. Listed below are the <strong>TIAA</strong> and <strong>CREF</strong> number<br />

ranges <strong>for</strong> each type.<br />

Traditional IRA Roth IRA SEP IRA<br />

<strong>TIAA</strong> Number Begins with K9; N7-N9; NE-NF N2-N5; NA-NB N6; NC-NC9<br />

<strong>CREF</strong> Number Begins with J9; T7-T9; TE-TF T2-T5; TA-TB T6; TC-TC9<br />

FOR THE TRADITIONAL IRA AND SEP IRA<br />

Your withdrawal is subject to ordinary income tax <strong>for</strong> the year in which you make the withdrawal, unless you<br />

make a direct rollover.<br />

FOR THE ROTH IRA<br />

Your withdrawal amount is subject to optional income tax withholding, unless you make a direct rollover to<br />

another Roth IRA. After five years, withdrawals <strong>from</strong> Roth IRAs are not subject to income tax withholding if<br />

you are 59½ or older.<br />

*Qualified higher education<br />

expenses generally include<br />

tuition, fees, books,<br />

supplies, equipment, and<br />

certain room and board<br />

<strong>for</strong> the taxpayer, his/<br />

her spouse, and children<br />

or grandchildren of the<br />

taxpayer or his/her spouse.<br />

**IRS rules require that the<br />

withdrawal be made in a<br />

year in which you receive<br />

at least 12 consecutive<br />

weeks of unemployment<br />

compensation or in the<br />

year after you receive<br />

such compensation.<br />

TAX PENALTIES<br />

Remember, if you are under 59½ when you make this withdrawal, you may be subject to a federal tax<br />

penalty in addition to regular income taxes, unless:<br />

• you make a rollover;<br />

• the <strong>payment</strong> (up to $10,000) is <strong>for</strong> a qualified first-time home purchase;<br />

• the <strong>payment</strong> is <strong>for</strong> qualified higher education expenses;*<br />

• you meet the IRS rules pertaining to receipt of unemployment compensation and the withdrawal does not<br />

exceed the amount paid during the taxable year <strong>for</strong> qualified health insurance coverage <strong>for</strong> <strong>your</strong>self, <strong>your</strong><br />

spouse, and/or <strong>your</strong> dependents;**<br />

• you are disabled as defined by the IRS.<br />

TAXCCM<br />

F10881 (12/13)

REQUEST FOR A PAYMENT<br />

FROM YOUR INVESTMENT SOLUTIONS<br />

TRADITIONAL, ROTH OR SEP IRA<br />

Page 1 of 5<br />

If you claim residence AND<br />

citizenship outside the U.S.,<br />

you must complete Form<br />

W-8BEN in addition to this<br />

<strong>for</strong>m to certify <strong>your</strong> <strong>for</strong>eign<br />

tax status. To print the<br />

W-8BEN <strong>for</strong>m, go to<br />

www.tiaa-cref.org/<strong>for</strong>ms,<br />

and see General Tax <strong>for</strong>ms.<br />

1. PROVIDE YOUR INFORMATION<br />

First Name<br />

Last Name<br />

Social Security Number/<br />

Taxpayer Identification Number Contact Telephone Number Extension<br />

X X X X X<br />

Middle Initial<br />

Suffix<br />

State of Residence (if outside the U.S., write in Country of Residence)<br />

Citizenship (if not U.S.)<br />

Your account will be valued<br />

as of market close on the<br />

date we receive this <strong>for</strong>m in<br />

good order. If <strong>your</strong> <strong>request</strong> is<br />

received after market close<br />

on a business day, <strong>your</strong><br />

account will be valued at the<br />

close of the next business<br />

day.<br />

2. TELL US WHICH IRA CONTRACT YOU WANT TO RECEIVE YOUR DISTRIBUTION FROM<br />

The following contract:<br />

<strong>TIAA</strong> Number<br />

<strong>CREF</strong> Number<br />

<strong>TIAA</strong> Number*<br />

*This field only applies to those with both an “open” and “closed” <strong>TIAA</strong> contract in their IRA plan.<br />

IMPORTANT<br />

If you have an IRA with a “closed” <strong>TIAA</strong> contract please keep in mind that once you withdraw funds <strong>from</strong><br />

<strong>TIAA</strong> Traditional and/or <strong>TIAA</strong> Real Estate in <strong>your</strong> “closed” contract, you can’t move funds back into those same<br />

accounts later, and funds distributed <strong>from</strong> <strong>TIAA</strong> Traditional will no longer receive the 3% guaranteed minimum<br />

rate and any applicable additional amounts. New funds added to <strong>TIAA</strong> Traditional will go to the account in<br />

<strong>your</strong> “open” <strong>TIAA</strong> contract, which has a guaranteed minimum rate between 1% and 3% (plus any applicable<br />

amounts). If <strong>your</strong> withdrawal <strong>request</strong> is unclear as to which IRA contract (open/closed) funds are to be withdrawn<br />

<strong>from</strong> they will be distributed proportionately across all <strong>investment</strong>s within that IRA plan (Traditional, Roth, or SEP).<br />

TAXCCM<br />

F10881 (12/13)

REQUEST FOR A PAYMENT<br />

FROM YOUR INVESTMENT SOLUTIONS<br />

TRADITIONAL, ROTH OR SEP IRA<br />

Page 2 of 5<br />

3. TYPE OF WITHDRAWAL<br />

ONE-TIME WITHDRAWAL<br />

If you do not want these funds sent to you immediately, please specify the date you would like us to<br />

process <strong>your</strong> withdrawal.<br />

(mm/dd/yyyy)<br />

/ /<br />

RECURRING WITHDRAWAL<br />

(mm/dd/yyyy)<br />

Start initial <strong>payment</strong> on: / /<br />

(mm/dd/yyyy)<br />

Which day of subsequent month to start <strong>payment</strong>s: / /<br />

You can stop recurring<br />

withdrawals at any time by<br />

calling 800 842-2252.<br />

When do you want to stop receiving recurring withdrawals<br />

OR<br />

When I have received the following number of <strong>payment</strong>s<br />

When there is no money remaining in designated funds. (Default if no selection is made.)<br />

OR<br />

(mm/dd/yyyy)<br />

On the following date:<br />

/ /<br />

How often do you want to receive recurring withdrawals (Check one)<br />

Monthly Quarterly Semiannually Annually<br />

Complete this part to<br />

<strong>request</strong> <strong>payment</strong> in specific<br />

amounts <strong>from</strong> selected<br />

accounts.<br />

If <strong>your</strong> withdrawal<br />

<strong>request</strong> is unclear as to<br />

which IRA contract<br />

(open/closed) funds are to<br />

be withdrawn <strong>from</strong> they will<br />

be distributed<br />

proportionately across all<br />

<strong>investment</strong>s within that<br />

IRA plan (Traditional, Roth,<br />

or SEP).<br />

4. TELL US HOW MUCH YOU WOULD LIKE TO WITHDRAW (CHECK ONE)<br />

Tell us how much of the available amount you want to withdraw <strong>from</strong> each of <strong>your</strong> eligible accounts.<br />

I want to withdraw the entire amount <strong>from</strong> all my accounts.<br />

OR<br />

I am <strong>request</strong>ing a partial amount <strong>from</strong> the following:<br />

Fund/Account Name<br />

Amount or percentage to be withdrawn<br />

1<br />

2<br />

3<br />

4<br />

5<br />

TAXCCM<br />

F10881 (12/13)

5. DO YOU HAVE A REQUIRED MINIMUM DISTRIBUTION<br />

OR<br />

This is in addition to my required minimum distribution <strong>payment</strong>.<br />

REQUEST FOR A PAYMENT<br />

FROM YOUR INVESTMENT SOLUTIONS<br />

TRADITIONAL, ROTH OR SEP IRA<br />

Page 3 of 5<br />

I want to include all applicable cash withdrawals I’ve already taken this year and have <strong>TIAA</strong>-<strong>CREF</strong><br />

calculate my required minimum distribution.<br />

If you are married, is <strong>your</strong> spouse more than ten years younger than you and listed as sole beneficiary <strong>for</strong> the<br />

plans listed in Section 2 (If you are not married, go to Section 6)<br />

Yes<br />

Spouse’s Name (please print)<br />

(mm/dd/yyyy)<br />

Date of Birth / /<br />

No<br />

If you answered YES, the Joint Life Expectancy method will be used to calculate <strong>your</strong> annual minimum<br />

distribution amount.<br />

To opt-out of this method, please check this box:<br />

NOTE: If <strong>your</strong> spouse is not listed as <strong>your</strong> sole beneficiary or this section is not completed, <strong>TIAA</strong>-<strong>CREF</strong> will use<br />

the Uni<strong>for</strong>m Lifetime Table to calculate the minimum distribution <strong>for</strong> those contracts.<br />

TAXCCM<br />

F10881 (12/13)

REQUEST FOR A PAYMENT<br />

FROM YOUR INVESTMENT SOLUTIONS<br />

TRADITIONAL, ROTH OR SEP IRA<br />

Page 4 of 5<br />

6. PROVIDE PAYMENT INSTRUCTIONS<br />

NOTE: If <strong>TIAA</strong>-<strong>CREF</strong> is unable to validate <strong>your</strong> bank account in<strong>for</strong>mation <strong>for</strong> any reason, or you do not make a<br />

selection below, we will automatically mail a check to <strong>your</strong> current address on file.<br />

If you select direct deposit,<br />

you will usually receive funds<br />

within two (2) business<br />

days once we have all the<br />

required approvals and<br />

documentation.<br />

Please indicate where you would like us to send the money:<br />

Direct Deposit to my bank account already on file:<br />

Bank Name:<br />

Account Number ending in:<br />

The address listed on the<br />

check or bank letter must<br />

match <strong>your</strong> current address<br />

on file at <strong>TIAA</strong>-<strong>CREF</strong>.<br />

Direct Deposit to my new Checking Account:<br />

Provide an original voided check. Starter checks, deposit slips and third-party checks are not acceptable.<br />

Direct Deposit to my new Savings Account:<br />

Provide documentation described in item A or B below.<br />

A. An original voided check. Starter checks, deposit slips and third-party checks are not acceptable.<br />

B. Letter <strong>from</strong> <strong>your</strong> bank with the following in<strong>for</strong>mation:<br />

• On bank letterhead<br />

• Name on <strong>your</strong> account<br />

• Address on <strong>your</strong> account<br />

• Bank/ABA routing number<br />

• Account number<br />

• Bank stamp or seal <strong>from</strong> authorized bank personnel<br />

If you choose to receive<br />

a check, we send it by<br />

standard U.S. Mail and<br />

it may take up to 8 – 10<br />

business days <strong>for</strong> you to<br />

receive it.<br />

Mail a check to my current address on file.<br />

Note: To ensure <strong>your</strong> account is secure, we can’t send a check to a mailing address that has changed in<br />

the last 14 days. So, if you’re <strong>request</strong>ing that we send the <strong>payment</strong> to <strong>your</strong> mailing address and you’ve<br />

recently changed it, we may not be able to process <strong>your</strong> current <strong>request</strong>. Call us at 800 842-2252 so we<br />

can discuss some of <strong>your</strong> options <strong>for</strong> completing <strong>your</strong> <strong>request</strong>.<br />

TAXCCM<br />

F10881 (12/13)

REQUEST FOR A PAYMENT<br />

FROM YOUR INVESTMENT SOLUTIONS<br />

TRADITIONAL, ROTH OR SEP IRA<br />

Page 5 of 5<br />

NOTE: This section is <strong>for</strong> use<br />

by U.S. citizens and resident<br />

aliens only.<br />

Nonresident aliens must<br />

complete Form W-8BEN. If<br />

we did not include a copy,<br />

visit us online at<br />

tiaa-cref.org or call us at<br />

800 842-2252. Form<br />

W-8BEN is also available on<br />

the IRS website at irs.gov.<br />

7. TAX WITHHOLDING<br />

FEDERAL TAX WITHHOLDING<br />

For U.S. citizens residing in the U.S., the mandatory rate is 10% of the taxable amount. If you are a U.S. citizen<br />

residing outside the U.S., you must elect income tax withholding.<br />

YES, withhold the following amount <strong>for</strong> federal income taxes:<br />

$ OR %<br />

I choose NOT to have taxes withheld <strong>from</strong> my <strong>payment</strong>.<br />

VOLUNTARY STATE TAX WITHHOLDING<br />

If you are subject to mandatory state withholding, visit us online at tiaa-cref.org <strong>for</strong> the <strong>for</strong>m or call us at<br />

800 842-2252. If you are not subject to mandatory state withholding but would like to have state taxes<br />

withheld <strong>from</strong> <strong>your</strong> <strong>payment</strong>s, please tell us the amount below.<br />

Withhold<br />

% <strong>from</strong> my <strong>payment</strong>s <strong>for</strong> voluntary income tax withholding <strong>for</strong> the state of<br />

Please read, sign and date<br />

where indicated.<br />

8. YOUR SIGNATURE<br />

By signing below:<br />

You authorize <strong>TIAA</strong>-<strong>CREF</strong> to make withdrawals <strong>from</strong> <strong>your</strong> account balances with <strong>TIAA</strong>-<strong>CREF</strong>, as stated in this<br />

<strong>for</strong>m. If you receive distributions, such as dividends, return of capital, or a capital gains distribution, to an<br />

account after you have <strong>request</strong>ed a full transfer <strong>from</strong> it, that distribution will be paid to you.<br />

If you <strong>request</strong>ed that <strong>your</strong> withdrawal be directly deposited, you authorize that the bank charge <strong>your</strong> account<br />

and refund any over<strong>payment</strong>s to <strong>TIAA</strong>-<strong>CREF</strong>. You release <strong>your</strong> bank <strong>from</strong> any liability to <strong>TIAA</strong>-<strong>CREF</strong> <strong>for</strong><br />

over<strong>payment</strong> above the amount of the funds available at the time <strong>TIAA</strong>-<strong>CREF</strong> <strong>request</strong>s a refund.<br />

Under penalties of perjury, you certify that:<br />

1. The number shown on this <strong>for</strong>m is my correct taxpayer identification number (or I am waiting <strong>for</strong> a number<br />

to be issued to me); and<br />

2. I am not subject to backup withholding because (a) I am exempt <strong>from</strong> backup withholding, or (b) I have<br />

not been notified by the Internal Revenue Service (IRS) that I am subject to backup withholding as a result<br />

of a failure to report all interest or dividends, or (c) the IRS has notified me that I am no longer subject to<br />

backup withholding; and<br />

3. I am a U.S. citizen or other U.S. person.<br />

Your Signature<br />

Today’s Date (mm/dd/yyyy)<br />

/ / 2 0<br />

TAXCCM<br />

F10881 (12/13)

RETURN COMPLETED FORMS PACKAGE TO:<br />

REQUEST FOR A PAYMENT<br />

FROM YOUR INVESTMENT SOLUTIONS<br />

TRADITIONAL, ROTH OR SEP IRA<br />

STANDARD MAIL: OVERNIGHT: FAX:<br />

<strong>TIAA</strong>-<strong>CREF</strong> <strong>TIAA</strong>-<strong>CREF</strong> 800 914-8922<br />

P.O. Box 1268<br />

8500 Andrew Carnegie Blvd.<br />

Charlotte, NC 28201-1268 Charlotte, NC 28262<br />

If you are providing new bank in<strong>for</strong>mation <strong>for</strong> direct deposit via EFT, please mail <strong>your</strong> original documents and<br />

the completed <strong>for</strong>m.<br />

CHECKLIST<br />

Did you remember to:<br />

Complete all necessary personal in<strong>for</strong>mation and indicate how much you want to withdraw.<br />

Include an original voided check or bank letter with the completed <strong>for</strong>ms package if you chose direct<br />

deposit. (We cannot accept faxed copies.)<br />

Sign and date this <strong>for</strong>m.<br />

Complete all necessary tax <strong>for</strong>ms, if applicable.<br />

FRAUD WARNING<br />

FOR YOUR PROTECTION, WE PROVIDE THIS NOTICE/WARNING REQUIRED BY MANY STATES<br />

This notice/warning does not apply in New York.<br />

Any person who, knowingly and with intent to defraud any insurance company or other person, files<br />

an application <strong>for</strong> insurance or a statement of claim <strong>for</strong> insurance benefits containing materially false<br />

in<strong>for</strong>mation or conceals, <strong>for</strong> the purpose of misleading, in<strong>for</strong>mation concerning any fact material thereto,<br />

commits a fraudulent insurance act, which is a crime and may be subject to criminal penalties, including<br />

confinement in prison, and civil penalties. Such action may entitle the insurance company to deny or void<br />

coverage or benefits.<br />

Colorado residents, please note: Any insurance company or agent of an insurance company who knowingly<br />

provides false, incomplete, or misleading facts or in<strong>for</strong>mation to a policyholder or claimant <strong>for</strong> the purpose of<br />

defrauding or attempting to defraud the policyholder or claimant with regard to a settlement or award payable<br />

<strong>from</strong> insurance proceeds shall be reported to the Colorado Division of Insurance within the Department of<br />

Regulatory Agencies.<br />

Virginia and Washington, DC residents, please note: Any person who knowingly presents a false or<br />

fraudulent claim <strong>for</strong> <strong>payment</strong> of a loss or benefit or knowingly presents false in<strong>for</strong>mation in an application<br />

<strong>for</strong> insurance is guilty of a crime and may be subject to fines and confinement in prison.<br />

TAXCCM<br />

F10881 (12/13)