1[FORM N-18A - Department Of Sales Tax

1[FORM N-18A - Department Of Sales Tax

1[FORM N-18A - Department Of Sales Tax

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

1<br />

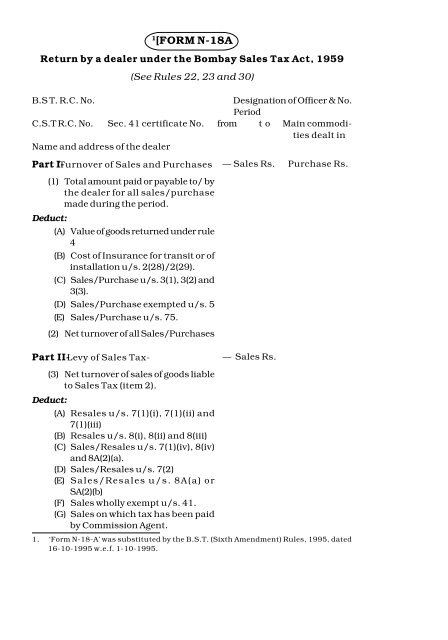

[<strong>FORM</strong> N-<strong>18A</strong><br />

Return by a dealer under the Bombay <strong>Sales</strong> <strong>Tax</strong> Act, 1959<br />

(See Rules 22, 23 and 30)<br />

B.S T. R.C. No.<br />

Designation of <strong>Of</strong>ficer & No.<br />

Period<br />

C.S.T R.C. No. Sec. 41 certificate No. from t o Main commodities<br />

dealt in<br />

Name and address of the dealer<br />

Part I-Turnover of <strong>Sales</strong> and Purchases<br />

(1) Total amount paid or payable to/ by<br />

the dealer for all sales/purchase<br />

made during the period.<br />

Deduct:<br />

(A) Value of goods returned under rule<br />

4<br />

(B) Cost of Insurance for transit or of<br />

installation u/s. 2(28)/2(29).<br />

(C) <strong>Sales</strong>/Purchase u/s. 3(1), 3(2) and<br />

3(3).<br />

(D) <strong>Sales</strong>/Purchase exempted u/s. 5<br />

(E) <strong>Sales</strong>/Purchase u/s. 75.<br />

(2) Net turnover of all <strong>Sales</strong>/Purchases<br />

— <strong>Sales</strong> Rs. Purchase Rs.<br />

Part II-Levy of <strong>Sales</strong> <strong>Tax</strong>-<br />

— <strong>Sales</strong> Rs.<br />

(3) Net turnover of sales of goods liable<br />

to <strong>Sales</strong> <strong>Tax</strong> (item 2).<br />

Deduct:<br />

(A) Resales u/s. 7(1)(i), 7(1)(ii) and<br />

7(1)(iii)<br />

(B) Resales u/s. 8(i), 8(ii) and 8(iii)<br />

(C) <strong>Sales</strong>/Resales u/s. 7(1)(iv), 8(iv)<br />

and 8A(2)(a).<br />

(D) <strong>Sales</strong>/Resales u/s. 7(2)<br />

(E) <strong>Sales</strong>/Resales u/s. 8A(a) or<br />

SA(2)(b)<br />

(F) <strong>Sales</strong> wholly exempt u/s. 41.<br />

(G) <strong>Sales</strong> on which tax has been paid<br />

by Commission Agent.<br />

1. ‘Form N-18-A’ was substituted by the B.S.T. (Sixth Amendment) Rules, 1995, dated<br />

16-10-1995 w.e.f. 1-10-1995.

(4) Balance,-<br />

(A) Liable to reduced rate of tax u/s. 41.<br />

(B) Liable to reduced rate of tax u/s. 11.<br />

(C) Liable to full rate of tax<br />

PART III-Levy of Purchase <strong>Tax</strong> u/s. 13,<br />

13AA, 13B, 14,15 and 41(2).<br />

Purchase Rs.<br />

(5 ) Net turnover of all purchases (item 2)<br />

Deduct:<br />

(A) Purchases of goods from registered<br />

dealers,-<br />

(i) under sections 8A, 11 and 12<br />

(ii) under section 7 or 8<br />

(B) Purchases of goods from unregistered<br />

dealers for resale.<br />

(C) Purchases u /s. 7(2) (not shown in B<br />

above).<br />

(D) Purchases under section 41<br />

(6) Balance liable to Purchase <strong>Tax</strong> u/s/.<br />

13<br />

(7) Purchases of goods purchased against declarations<br />

u/s. 8A, 11 and 12 liable to<br />

Purchase <strong>Tax</strong> u/s. 14.<br />

(8) Purchases liable to Purchase <strong>Tax</strong> u/s.<br />

41(2).<br />

(9) Purchases liable to Purchase <strong>Tax</strong> u/s.<br />

15.<br />

(10)Purchases liable to Purchase <strong>Tax</strong> u/s.<br />

13AA.<br />

(11)Purchases liable to Purchase <strong>Tax</strong> u/s.<br />

13B.<br />

(12)Total purchases liable to Purchase <strong>Tax</strong><br />

u/s. 13, 14, 15 and 41 (2) (items<br />

6+7+8+9+10+11).<br />

PART IV-Computation of taxes payable-<br />

(13)Calculation of <strong>Sales</strong> <strong>Tax</strong> and Turnover<br />

<strong>Tax</strong>.

(A)B-Schedule goods<br />

<strong>Tax</strong> rate<br />

Turnover<br />

liable to<br />

<strong>Sales</strong> <strong>Tax</strong><br />

Deduction<br />

under Rule<br />

46A<br />

Balance turnover<br />

liable to<br />

<strong>Sales</strong> <strong>Tax</strong><br />

<strong>Sales</strong> <strong>Tax</strong> payable<br />

at the rate specified<br />

in Col. 1<br />

(1)<br />

(2)<br />

(3)<br />

(4)<br />

(5)<br />

Total<br />

(B)C-Schedule goods<br />

<strong>Tax</strong> rate<br />

Turnover<br />

liable to<br />

<strong>Sales</strong> <strong>Tax</strong><br />

Deduction<br />

under Rules<br />

46A, 46B, 46C<br />

Balance turnover<br />

liable to<br />

<strong>Sales</strong> <strong>Tax</strong><br />

<strong>Sales</strong> <strong>Tax</strong> payable<br />

at the rate specified<br />

in Col. 1<br />

(1)<br />

(2)<br />

(3)<br />

(4)<br />

(5)<br />

Total<br />

(C)Turnover of sales liable to Turnover <strong>Tax</strong><br />

(i) Turnover of sales in column 5 of (b) above.<br />

(ii) Turnover of sales u/s 8(iv) included in item 3(c).<br />

(iii) Turnover of sales of C-Schedule goods wholly exempted from sales<br />

tax [but not from whole of tax u/s 41 included in item 3(f)].<br />

(iv) Turnover of sales of C-Schedule goods of nature (i), (ii) and (iii)<br />

above, effected in the preceding periods of the year liable to<br />

Turnover <strong>Tax</strong>, if any.<br />

(v) Total turnover of sales liable to Turnover <strong>Tax</strong> [i.e.<br />

(i)+(ii)+(iii)+(iv)].<br />

(D) (i) Total of sales tax [i.e. total of column 6 of (a) and column 6 of (b)<br />

above].<br />

(ii) Turnover <strong>Tax</strong> payable at ____________________ person of turnover<br />

of sales calculated in (c) above.<br />

(iii) Total of sales tax and Turnover <strong>Tax</strong> [i.e.(i)+(ii) above].

(14)Calculation of Purchase <strong>Tax</strong> (item II)-<br />

<strong>Tax</strong> rate<br />

(1)<br />

Turnover liable to<br />

Purchase <strong>Tax</strong><br />

(item II)<br />

(2)<br />

Purchase <strong>Tax</strong> payable at the<br />

rate specified in Col. 1<br />

(3)<br />

1<br />

[PART IVA.Calculation of Resale <strong>Tax</strong> Payable-<br />

14A. Total turnover of resale liable to resale tax under section 10.<br />

14B. Total Resale tax payable under section ………………….;]<br />

PART V-Calculation of taxes payable-<br />

Rs.<br />

(15)Total taxes payable as per items 13<br />

and 14.<br />

2<br />

[(16)Add : (A) Amount of surcharge payable<br />

under section 15-1-A.<br />

(B) Amount of resale <strong>Tax</strong> payable<br />

under section 10 as<br />

per item 14B.]<br />

(17)Total taxes payable as per items 15<br />

and 16.<br />

Deduct:<br />

(A) Set-off under second proviso to section<br />

14(1) and proviso to section<br />

41(2).<br />

(B) Set-off/Remission admissible under<br />

Rule ______________________<br />

(C) Set-off/Remission admissible under<br />

Rule _______________________<br />

(D) Set-off/Remission admissible under<br />

Rule _______________________<br />

Add: Interest chargeable under clause(a) o f<br />

sub-section (3) of section 36.<br />

(18)Total amount payable/refundable<br />

Deduct:<br />

(A) Amount credited under Refund Adjustment<br />

Order No. _________ dated<br />

__________________________<br />

(B) Refund due as per previous return.<br />

(C) Amount paid as per Statement.<br />

1. The "Part IVA" was inserted by the B.S.T. (Third Amendment) Rules, 2001, dated<br />

8-8-2001 w.e.f. 1st April, 2001.<br />

2. The "Item 16" was substituted by the B.S.T. (Third Amendment) Rules, 2001, dated<br />

8-8-2001 w.e.f. 1st April, 2001.

(19)Net amount payable _ _ _ _<br />

(20)Net amount refundable _ _ _ _<br />

(21) Calculations of deferment benefits<br />

u/r 31B or u/r 31C.<br />

(To be filled in by a dealer to whom<br />

deferment benefits u/r 31B or u/r<br />

31C have been granted)<br />

(i) Name of the implementing agency,<br />

which issued in the Eligibility Certificate<br />

(ii) Eligibility Certificate No. and date<br />

of its issue.<br />

(iii)Certificate of Entitlement No. and<br />

date of its issue.<br />

(iv) Scheme __ __<br />

(v) Period of validity of the Certificate<br />

of Entitlement from ____________<br />

to ____________________<br />

(vi) Ceiling, if any, subject to which<br />

the tax benefits are granted.<br />

*(1) Deferment u/r. 31B-<br />

(i) Total gross taxes payable under<br />

1979, 1983, 1988 or 1993 Package<br />

Scheme of Incentives.<br />

(ii) Less:Set-off admissible.<br />

(iii)Net taxes payable under l979,<br />

1983, 1988 or 1993 Package<br />

Scheme of Incentives.<br />

(iv) C.S.T. payable on inter-State<br />

sales.<br />

(v) Total of taxes payable at (iii) and<br />

(iv) above, which is eligible for<br />

deferment.<br />

*(2) Deferment u/r. 31C-<br />

(i) Total gross taxes payable under<br />

1979, 1983, 1988 or 1993 Package<br />

Scheme of Incentives.<br />

(ii) Less: Set-off admissible.<br />

(iii)Net taxes payable under<br />

1979,1983, 1988 or 1993 Package<br />

Scheme of Incentives.<br />

(iv) C.S.T. payable on inter-State<br />

sales.<br />

(v) Total of taxes payable at (iii) and<br />

(iv) above, which is eligible for<br />

deferment.<br />

*SICOM/DCKL/WMDC/<br />

VDCL/MDCL/DIC concerned<br />

*1979/1983/1988/1993.<br />

Rs.

(vi) Amount of tax out of (iii) and (iv)<br />

above in respect of which the implementing<br />

agency has issued<br />

voucher No. _________ dated<br />

___________ permitting the deferment<br />

of Rs. ______________<br />

(22) Status of tax deferment u/r 31B or<br />

31C.<br />

(a) opening balance of ceiling at the<br />

beginning of the period for which<br />

the return is filed.<br />

(b) Less: Total tax deferred for the period<br />

covered by this return i.e.<br />

sub-item 1(v) or 2(v) of item 21.<br />

(c) Closing balance of ceiling at the<br />

end of the period for which return<br />

is filed i.e. (a)-(b).<br />

The above statement is true to the best of my knowledge and belief.<br />

Date: __________________<br />

Place: __________________<br />

Submitted on: _________________<br />

Signature & Designation: _____________<br />

No. ______________<br />

Acknowledgement<br />

(To be detached and given to a dealer or his representative)<br />

Received are return in Form N-<strong>18A</strong> for the period from _____________<br />

to _______________ on ____________ in respect of M/s. ___________________<br />

(Date of receipt)<br />

(Name of the dealer)<br />

holding Certificate of Registration bearing number _________ and serial<br />

No. _______________ of the acknowledgement is _________________ as per<br />

Return Receipt Register.<br />

Date:<br />

Signature & Stamp of Assessing Authority.<br />

Place:

STATEMENT<br />

Amount paid with Return-cum-Chalan in Form N-18 or in Chalan in Form N-25<br />

Period<br />

Serial Amount paid Amount paid Date of<br />

No. From T o (in figures) (in words) Payment<br />

1.<br />

________________________________________________________________________<br />

2.<br />

________________________________________________________________________<br />

3.<br />

________________________________________________________________________<br />

4.<br />

________________________________________________________________________<br />

5.<br />

________________________________________________________________________<br />

6.<br />

________________________________________________________________________<br />

7.<br />

________________________________________________________________________<br />

8.<br />

________________________________________________________________________<br />

9.<br />

________________________________________________________________________<br />

10.<br />

________________________________________________________________________<br />

11.<br />

________________________________________________________________________<br />

12.<br />

________________________________________________________________________<br />

13.<br />

________________________________________________________________________<br />

14.<br />

________________________________________________________________________<br />

15.<br />

________________________________________________________________________<br />

Total<br />

________________________________________________________________________<br />

* Annex a separate page, if necessary.

![1[FORM XXXVII] - Department Of Sales Tax](https://img.yumpu.com/48683237/1/190x245/1form-xxxvii-department-of-sales-tax.jpg?quality=85)