Fact Sheet for the month of May-07 - HDFC Mutual Fund

Fact Sheet for the month of May-07 - HDFC Mutual Fund

Fact Sheet for the month of May-07 - HDFC Mutual Fund

Create successful ePaper yourself

Turn your PDF publications into a flip-book with our unique Google optimized e-Paper software.

hdfc-fos.qxd 5/8/20<strong>07</strong> 20:36 Page 5<br />

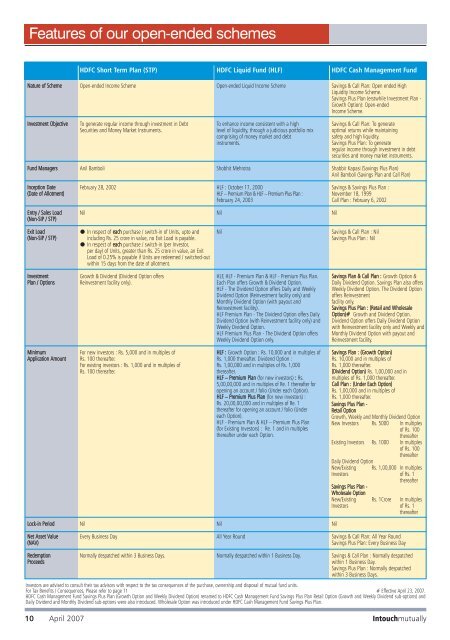

Features <strong>of</strong> our open-ended schemes<br />

<strong>HDFC</strong> Short Term Plan (STP)<br />

<strong>HDFC</strong> Liquid <strong>Fund</strong> (HLF)<br />

<strong>HDFC</strong> Cash Management <strong>Fund</strong><br />

Nature <strong>of</strong> Scheme<br />

Open-ended Income Scheme<br />

Open-ended Liquid Income Scheme<br />

Savings & Call Plan: Open ended High<br />

Liquidity Income Scheme.<br />

Savings Plus Plan (erstwhile Investment Plan -<br />

Growth Option): Open-ended<br />

Income Scheme.<br />

Investment Objective<br />

To generate regular income through investment in Debt<br />

Securities and Money Market Instruments.<br />

To enhance income consistent with a high<br />

level <strong>of</strong> liquidity, through a judicious portfolio mix<br />

comprising <strong>of</strong> money market and debt<br />

instruments.<br />

Savings & Call Plan: To generate<br />

optimal returns while maintaining<br />

safety and high liquidity.<br />

Savings Plus Plan: To generate<br />

regular income through investment in debt<br />

securities and money market instruments.<br />

<strong>Fund</strong> Managers<br />

Anil Bamboli<br />

Shobhit Mehrotra<br />

Shabbir Kapasi (Savings Plus Plan)<br />

Anil Bamboli (Savings Plan and Call Plan)<br />

Inception Date<br />

(Date <strong>of</strong> Allotment)<br />

February 28, 2002<br />

HLF : October 17, 2000<br />

HLF – Premium Plan & HLF – Premium Plus Plan :<br />

February 24, 2003<br />

Savings & Savings Plus Plan :<br />

November 18, 1999<br />

Call Plan : February 6, 2002<br />

Entry / Sales Load<br />

(Non-SIP / STP)<br />

Nil<br />

Nil<br />

Nil<br />

Exit Load<br />

(Non-SIP / STP)<br />

● In respect <strong>of</strong> each purchase / switch-in <strong>of</strong> Units, upto and<br />

including Rs. 25 crore in value, no Exit Load is payable.<br />

● In respect <strong>of</strong> each purchase / switch-in (per Investor,<br />

per day) <strong>of</strong> Units, greater than Rs. 25 crore in value, an Exit<br />

Load <strong>of</strong> 0.25% is payable if Units are redeemed / switched-out<br />

within 15 days from <strong>the</strong> date <strong>of</strong> allotment.<br />

Nil<br />

Savings & Call Plan : Nil<br />

Savings Plus Plan : Nil<br />

Investment<br />

Plan / Options<br />

Growth & Dividend (Dividend Option <strong>of</strong>fers<br />

Reinvestment facility only).<br />

HLF, HLF - Premium Plan & HLF - Premium Plus Plan.<br />

Each Plan <strong>of</strong>fers Growth & Dividend Option.<br />

HLF - The Dividend Option <strong>of</strong>fers Daily and Weekly<br />

Dividend Option (Reinvestment facility only) and<br />

Monthly Dividend Option (with payout and<br />

Reinvestment facility).<br />

HLF Premium Plan - The Dividend Option <strong>of</strong>fers Daily<br />

Dividend Option (with Reinvestment facility only) and<br />

Weekly Dividend Option.<br />

HLF Premium Plus Plan - The Dividend Option <strong>of</strong>fers<br />

Weekly Dividend Option only.<br />

Savings Plan & Call Plan : Growth Option &<br />

Daily Dividend Option. Savings Plan also <strong>of</strong>fers<br />

Weekly Dividend Option. The Dividend Option<br />

<strong>of</strong>fers Reinvestment<br />

facility only.<br />

Savings Plus Plan : (Retail and Wholesale<br />

Option)# Growth and Dividend Option.<br />

Dividend Option <strong>of</strong>fers Daily Dividend Option<br />

with Reinvestment facility only and Weekly and<br />

Monthly Dividend Option with payout and<br />

Reinvestment facility.<br />

Minimum<br />

Application Amount<br />

For new investors : Rs. 5,000 and in multiples <strong>of</strong><br />

Rs. 100 <strong>the</strong>reafter.<br />

For existing investors : Rs. 1,000 and in multiples <strong>of</strong><br />

Rs. 100 <strong>the</strong>reafter.<br />

HLF : Growth Option : Rs. 10,000 and in multiples <strong>of</strong><br />

Rs. 1,000 <strong>the</strong>reafter. Dividend Option :<br />

Rs. 1,00,000 and in multiples <strong>of</strong> Rs. 1,000<br />

<strong>the</strong>reafter.<br />

HLF – Premium Plan (<strong>for</strong> new investors) : Rs.<br />

5,00,00,000 and in multiples <strong>of</strong> Re. 1 <strong>the</strong>reafter <strong>for</strong><br />

opening an account / folio (Under each Option).<br />

HLF – Premium Plus Plan (<strong>for</strong> new investors) :<br />

Rs. 20,00,00,000 and in multiples <strong>of</strong> Re. 1<br />

<strong>the</strong>reafter <strong>for</strong> opening an account / folio (Under<br />

each Option).<br />

HLF - Premium Plan & HLF – Premium Plus Plan<br />

(<strong>for</strong> Existing Investors) : Re. 1 and in multiples<br />

<strong>the</strong>reafter under each Option.<br />

Savings Plan : (Growth Option)<br />

Rs. 10,000 and in multiples <strong>of</strong><br />

Rs. 1,000 <strong>the</strong>reafter.<br />

(Dividend Option) Rs. 1,00,000 and in<br />

multiples <strong>of</strong> Rs. 1,000 <strong>the</strong>reafter.<br />

Call Plan : (Under Each Option)<br />

Rs. 1,00,000 and in multiples <strong>of</strong><br />

Rs. 1,000 <strong>the</strong>reafter.<br />

Savings Plus Plan -<br />

Retail Option<br />

Growth, Weekly and Monthly Dividend Option<br />

New Investors Rs. 5000 In multiples<br />

<strong>of</strong> Rs. 100<br />

<strong>the</strong>reafter<br />

Existing Investors Rs. 1000 In multiples<br />

<strong>of</strong> Rs. 100<br />

<strong>the</strong>reafter<br />

Daily Dividend Option<br />

New/Existing Rs. 1,00,000 In multiples<br />

Investors <strong>of</strong> Rs. 1<br />

<strong>the</strong>reafter<br />

Savings Plus Plan -<br />

Wholesale Option<br />

New/Existing Rs. 1Crore In multiples<br />

Investors <strong>of</strong> Rs. 1<br />

<strong>the</strong>reafter<br />

Lock-in Period<br />

Nil<br />

Nil<br />

Nil<br />

Net Asset Value<br />

(NAV)<br />

Every Business Day<br />

All Year Round<br />

Savings & Call Plan: All Year Round<br />

Savings Plus Plan: Every Business Day<br />

Redemption<br />

Proceeds<br />

Normally despatched within 3 Business Days.<br />

Normally despatched within 1 Business Day.<br />

Savings & Call Plan : Normally despatched<br />

within 1 Business Day.<br />

Savings Plus Plan : Normally despatched<br />

within 3 Business Days.<br />

Investors are advised to consult <strong>the</strong>ir tax advisors with respect to <strong>the</strong> tax consequences <strong>of</strong> <strong>the</strong> purchase, ownership and disposal <strong>of</strong> mutual fund units.<br />

For Tax Benefits / Consequences, Please refer to page 11 # Effective April 23, 20<strong>07</strong>.<br />

<strong>HDFC</strong> Cash Management <strong>Fund</strong> Savings Plus Plan (Growth Option and Weekly Dividend Option) renamed to <strong>HDFC</strong> Cash Management <strong>Fund</strong> Savings Plus Plan Retail Option (Growth and Weekly Dividend sub-options) and<br />

Daily Dividend and Monthly Dividend sub-options were also introduced. Wholesale Option was introduced under <strong>HDFC</strong> Cash Management <strong>Fund</strong> Savings Plus Plan.<br />

10 April 20<strong>07</strong><br />

Intouchmutually