Healthcare without boundaries - EMIS Group plc Annual report and ...

Healthcare without boundaries - EMIS Group plc Annual report and ...

Healthcare without boundaries - EMIS Group plc Annual report and ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

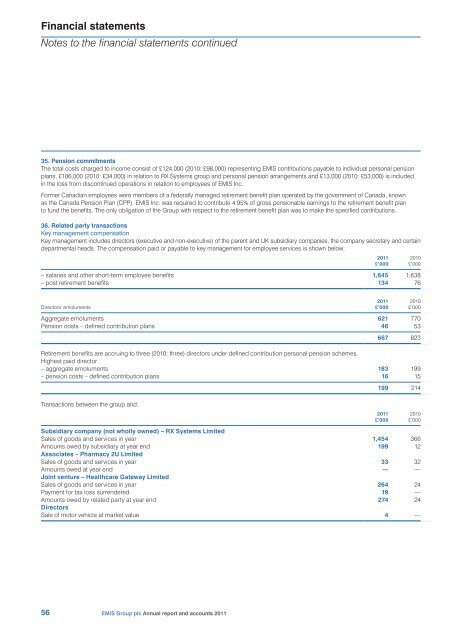

Financial statements<br />

Notes to the financial statements continued<br />

35. Pension commitments<br />

The total costs charged to income consist of £124,000 (2010: £98,000) representing <strong>EMIS</strong> contributions payable to individual personal pension<br />

plans, £106,000 (2010: £34,000) in relation to RX Systems group <strong>and</strong> personal pension arrangements <strong>and</strong> £13,000 (2010: £53,000) is included<br />

in the loss from discontinued operations in relation to employees of <strong>EMIS</strong> Inc.<br />

Former Canadian employees were members of a federally managed retirement benefit plan operated by the government of Canada, known<br />

as the Canada Pension Plan (CPP). <strong>EMIS</strong> Inc. was required to contribute 4.95% of gross pensionable earnings to the retirement benefit plan<br />

to fund the benefits. The only obligation of the <strong>Group</strong> with respect to the retirement benefit plan was to make the specified contributions.<br />

36. Related party transactions<br />

Key management compensation<br />

Key management includes directors (executive <strong>and</strong> non‐executive) of the parent <strong>and</strong> UK subsidiary companies, the company secretary <strong>and</strong> certain<br />

departmental heads. The compensation paid or payable to key management for employee services is shown below:<br />

– salaries <strong>and</strong> other short‐term employee benefits 1,645 1,638<br />

– post retirement benefits 134 76<br />

2011<br />

£’000<br />

2010<br />

£’000<br />

Directors’ emoluments<br />

Aggregate emoluments 621 770<br />

Pension costs – defined contribution plans 46 53<br />

2011<br />

£’000<br />

2010<br />

£’000<br />

667 823<br />

Retirement benefits are accruing to three (2010: three) directors under defined contribution personal pension schemes.<br />

Highest paid director<br />

– aggregate emoluments 183 199<br />

– pension costs – defined contribution plans 16 15<br />

Transactions between the group <strong>and</strong>:<br />

199 214<br />

Subsidiary company (not wholly owned) – RX Systems Limited<br />

Sales of goods <strong>and</strong> services in year 1,454 366<br />

Amounts owed by subsidiary at year end 199 12<br />

Associates – Pharmacy 2U Limited<br />

Sales of goods <strong>and</strong> services in year 33 32<br />

Amounts owed at year end — —<br />

Joint venture – <strong>Healthcare</strong> Gateway Limited<br />

Sales of goods <strong>and</strong> services in year 264 24<br />

Payment for tax loss surrendered 19 —<br />

Amounts owed by related party at year end 274 24<br />

Directors<br />

Sale of motor vehicle at market value 4 —<br />

2011<br />

£’000<br />

2010<br />

£’000<br />

56<br />

<strong>EMIS</strong> <strong>Group</strong> <strong>plc</strong> <strong>Annual</strong> <strong>report</strong> <strong>and</strong> accounts 2011