PIEF - A year of success - MCB-Arif Habib Savings and Investments ...

PIEF - A year of success - MCB-Arif Habib Savings and Investments ...

PIEF - A year of success - MCB-Arif Habib Savings and Investments ...

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

<strong>Arif</strong> <strong>Habib</strong> <strong>Investments</strong> Limited<br />

(formerly: <strong>Arif</strong> <strong>Habib</strong> Investment Management Limited)<br />

Aug-08<br />

Sep-08<br />

Oct-08<br />

Nov-08<br />

Dec-08<br />

Dec-08<br />

Jan-09<br />

Feb-09<br />

Mar-09<br />

Apr-09<br />

Management Quality Rating “AM2”<br />

May-09<br />

May-09<br />

Jun-09<br />

Jul-09<br />

Aug-09<br />

Dear Investor,<br />

In recent times, invariably all asset managers begin their performance reports with a preamble <strong>of</strong> recent<br />

challenging times by using defensive tone, try to calm their investors. It’s a different story altogether writing<br />

about Pakistan Income Enhancement Fund (<strong>PIEF</strong>). Its’ astounding performance really justifies naming<br />

the fund as an Income Enhancement Fund.<br />

We would like to start with a note <strong>of</strong> thanks to our investors for showing faith & confidence in the fund<br />

management capabilities <strong>of</strong> <strong>Arif</strong> <strong>Habib</strong> <strong>Investments</strong> by continuously increasing their investments in <strong>PIEF</strong> (in<br />

challenging times) <strong>and</strong> they must also commend themselves for making the best investment decision for<br />

enhancement <strong>of</strong> their income. The growth in both the Fund’s Assets under Management <strong>and</strong> Return were<br />

made possible by many factors including continual inflows <strong>of</strong> investments when the market was <strong>of</strong>fering<br />

exceptional return enhancement opportunities <strong>and</strong> the right investment calls made by the Fund Manager,<br />

picking the right assets at the right price <strong>and</strong> converting crisis into opportunities.<br />

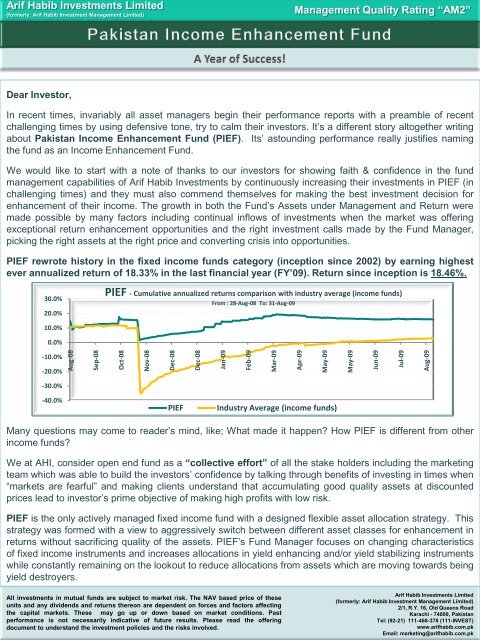

<strong>PIEF</strong> rewrote history in the fixed income funds category (inception since 2002) by earning highest<br />

ever annualized return <strong>of</strong> 18.33% in the last financial <strong>year</strong> (FY‟09). Return since inception is 18.46%.<br />

30.0%<br />

20.0%<br />

<strong>PIEF</strong> - Cumulative annualized returns comparison with industry average (income funds)<br />

From : 28-Aug-08 To: 31-Aug-09<br />

10.0%<br />

0.0%<br />

-10.0%<br />

-20.0%<br />

-30.0%<br />

-40.0%<br />

<strong>PIEF</strong><br />

Industry Average (income funds)<br />

Many questions may come to reader’s mind, like; What made it happen How <strong>PIEF</strong> is different from other<br />

income funds<br />

We at AHI, consider open end fund as a “collective effort” <strong>of</strong> all the stake holders including the marketing<br />

team which was able to build the investors’ confidence by talking through benefits <strong>of</strong> investing in times when<br />

“markets are fearful” <strong>and</strong> making clients underst<strong>and</strong> that accumulating good quality assets at discounted<br />

prices lead to investor’s prime objective <strong>of</strong> making high pr<strong>of</strong>its with low risk.<br />

<strong>PIEF</strong> is the only actively managed fixed income fund with a designed flexible asset allocation strategy. This<br />

strategy was formed with a view to aggressively switch between different asset classes for enhancement in<br />

returns without sacrificing quality <strong>of</strong> the assets. <strong>PIEF</strong>’s Fund Manager focuses on changing characteristics<br />

<strong>of</strong> fixed income instruments <strong>and</strong> increases allocations in yield enhancing <strong>and</strong>/or yield stabilizing instruments<br />

while constantly remaining on the lookout to reduce allocations from assets which are moving towards being<br />

yield destroyers.<br />

As<br />

All investments in mutual funds are subject to market risk. The NAV based price <strong>of</strong> these<br />

All investments in mutual funds are subject to market risk. The NAV based price <strong>of</strong> these<br />

units <strong>and</strong> any dividends <strong>and</strong> returns thereon are dependent on forces <strong>and</strong> factors affecting<br />

units <strong>and</strong> any dividends <strong>and</strong> returns thereon are dependent on forces <strong>and</strong> factors affecting<br />

the capital markets. These may go up or down based on market conditions. Past<br />

the capital markets. These may go up or down based on market conditions. Past<br />

performance is not necessarily indicative <strong>of</strong> future results. Please read the <strong>of</strong>fering<br />

performance is not necessarily indicative <strong>of</strong> future results. Please read the <strong>of</strong>fering<br />

document to underst<strong>and</strong> the investment policies <strong>and</strong> the risks involved.<br />

document to underst<strong>and</strong> the investment policies <strong>and</strong> the risks involved.<br />

as<br />

<strong>Arif</strong> <strong>Habib</strong> <strong>Arif</strong> <strong>Habib</strong> <strong>Investments</strong> Limited<br />

(formerly: <strong>Arif</strong> <strong>Habib</strong> 2/1, Investment R.Y. 16, Management Old Queens Limited) Road<br />

2/1, R.Y. 16, Old Queens Road<br />

Karachi - 74000, Pakistan<br />

Karachi - 74000, Pakistan<br />

Tel: (92-21) Tel: (92-21) 111-468-378 111-468-378 (111-INVEST)<br />

(111-INVEST)<br />

www.arifhabib.com.pk<br />

Email: Email: marketing@arifhabib.com.pk

<strong>Arif</strong> <strong>Habib</strong> <strong>Investments</strong> Limited<br />

(formerly: <strong>Arif</strong> <strong>Habib</strong> Investment Management Limited)<br />

Management Quality Rating “AM2”<br />

During the initial period (Fund’s inception date 28 th August, 2008), <strong>PIEF</strong> enhanced its’ yield by entering into<br />

TDR placement transactions when highest rated banks were <strong>of</strong>fering exceptionally high returns. Then the<br />

Fund became the first investor <strong>of</strong> long-term Government Bonds in the mutual fund industry at the right<br />

moment before Bond yields started to slide translating into huge price gains on the Bonds’ portfolio. The<br />

Fund also realized substantial income by entering into quality TFCs pertaining to Banking & Fertilizer<br />

sectors, which were available at deep discounts to face value to secure high accrual income as well as price<br />

gains when market returned to some sanity. <strong>PIEF</strong> was again the first fund to move into very short-term<br />

Market Treasury Bills (MTBs) to optimize returns when Banks lowered their overnight deposit rates, while<br />

ensuring safety <strong>and</strong> liquidity for the investors.<br />

40.0%<br />

<strong>PIEF</strong> - Monthly annualized returns comparison with industry average (income funds)<br />

From: 28-Aug-08 To: 31-Aug-09<br />

20.0%<br />

0.0%<br />

-20.0%<br />

Aug-08 Sep-08 Oct-08 Nov-08 Dec-08 Jan-09 Feb-09 Mar-09 Apr-09 May-09 Jun-09 Jul-09 Aug-09<br />

-40.0%<br />

<strong>PIEF</strong><br />

Industry Average (income funds)<br />

Transparency:<br />

AHI at present is the only Asset Management Company in Pakistan (if not in the world) to publish Daily Fact<br />

Sheets for all <strong>of</strong> its’ Fixed Income funds which enables savvy <strong>and</strong> educated investors <strong>and</strong> the investment<br />

advisors to actually track Fund Manager’s investment/disinvestment decisions <strong>and</strong> compare them in the<br />

hindsight. <strong>PIEF</strong>’s credit quality & asset allocation as on 31 st August, 2009 Fact Sheet is shown as below:<br />

Asset Allocation (%)<br />

T Bills<br />

54.94<br />

TFCs<br />

35.97<br />

MMP<br />

NE Assets<br />

2.89<br />

2.11<br />

Other<br />

0.66<br />

Cash<br />

3.43<br />

Credit Quality Distribution (%)<br />

AA+<br />

10.36<br />

AA<br />

11.32 AA-<br />

15.22<br />

AAA<br />

54.94<br />

A<br />

7.50<br />

N.R.<br />

0.66<br />

Collective Wisdom:<br />

Identifying opportunities <strong>and</strong> entering into assets is not the only yield enhancing measure. There were times<br />

when conserving cash (retaining short term liquidity, at the cost <strong>of</strong> low returns in the short-term) can create<br />

space for making the right moves. The investment committee approach at <strong>Arif</strong> <strong>Habib</strong> <strong>Investments</strong> ensures<br />

that there are no compulsive investments <strong>and</strong> every move is justified.<br />

As<br />

All investments in mutual funds are subject to market risk. The NAV based price <strong>of</strong> these<br />

All investments in mutual funds are subject to market risk. The NAV based price <strong>of</strong> these<br />

units <strong>and</strong> any dividends <strong>and</strong> returns thereon are dependent on forces <strong>and</strong> factors affecting<br />

units <strong>and</strong> any dividends <strong>and</strong> returns thereon are dependent on forces <strong>and</strong> factors affecting<br />

the capital markets. These may go up or down based on market conditions. Past<br />

the capital markets. These may go up or down based on market conditions. Past<br />

performance is not necessarily indicative <strong>of</strong> future results. Please read the <strong>of</strong>fering<br />

performance is not necessarily indicative <strong>of</strong> future results. Please read the <strong>of</strong>fering<br />

document to underst<strong>and</strong> the investment policies <strong>and</strong> the risks involved.<br />

document to underst<strong>and</strong> the investment policies <strong>and</strong> the risks involved.<br />

as<br />

<strong>Arif</strong> <strong>Habib</strong> <strong>Arif</strong> <strong>Habib</strong> <strong>Investments</strong> Limited<br />

(formerly: <strong>Arif</strong> <strong>Habib</strong> 2/1, Investment R.Y. 16, Management Old Queens Limited) Road<br />

2/1, R.Y. 16, Old Queens Road<br />

Karachi - 74000, Pakistan<br />

Karachi - 74000, Pakistan<br />

Tel: (92-21) Tel: (92-21) 111-468-378 111-468-378 (111-INVEST)<br />

(111-INVEST)<br />

www.arifhabib.com.pk<br />

Email: Email: marketing@arifhabib.com.pk

<strong>Arif</strong> <strong>Habib</strong> <strong>Investments</strong> Limited<br />

(formerly: <strong>Arif</strong> <strong>Habib</strong> Investment Management Limited)<br />

Management Quality Rating “AM2”<br />

Unique Selling Points (USPs):<br />

a) Instant redemption: <strong>PIEF</strong>’s retail investors enjoy ATM card service for instant redemptions, presently<br />

we are the only AMC to <strong>of</strong>fer this service.<br />

b) Monthly Dividends <strong>PIEF</strong> has the unique feature <strong>of</strong> monthly distribution with choice between bonus OR<br />

cash dividend. Currently, <strong>PIEF</strong> & PCF are the only two funds distributing monthly dividends.<br />

c) No lock-in period: Unlike Term Deposits with banks, <strong>PIEF</strong> allows daily entry & exit from the fund.<br />

d) Liquidity: <strong>PIEF</strong> invests in both liquid <strong>and</strong> value fixed income securities (including Government, Reverse<br />

Repo, Money Market instruments, Bank Placements both in the form <strong>of</strong> TDRs <strong>and</strong> Daily Product<br />

Accounts, <strong>and</strong> Corporate TFCs etc.<br />

e) Tax Efficient: Capital Gains tax exempt for individuals & Companies, DFIs <strong>and</strong> NBFCs. Commercial<br />

Banks can avail monthly cash dividends for lesser tax implication as compared to 35% short-term CGT<br />

f) Low Credit Risk: <strong>PIEF</strong>’s current portfolio credit quality is „AA+‟ (weighted average).<br />

g) No Exchange Rate Risk: Currently all investments have been made in PKR denominated securities.<br />

h) Highly Transparent: All key variables <strong>of</strong> portfolio are highlighted in the Daily Fact Sheets. Investment<br />

decisions can be tracked on daily basis.<br />

i) Proven Track Record: <strong>PIEF</strong> has a proven track record <strong>of</strong> delivering above average enhanced returns<br />

(without compromising on the quality <strong>of</strong> assets) since inception.<br />

Concluding Remarks<br />

While managing funds or advising investors it is also important that the Fund Managers <strong>and</strong> Investment<br />

Advisors do not fall in love with any investment instruments/fund but they need to constantly watch changing<br />

dynamics <strong>of</strong> the instruments <strong>and</strong> the markets. There shall be justification for positioning <strong>of</strong> every instrument<br />

in each portfolio. <strong>PIEF</strong>’s Fund Managers had the ability to stay away or sell down all <strong>of</strong> the TFCs <strong>and</strong> enter<br />

into TDRs with banks but they chose to built portfolio <strong>of</strong> good credit quality TFCs when some <strong>of</strong> the<br />

investment advisors were recommending staying away from this asset class without analyzing the merits<br />

<strong>and</strong> demerits <strong>of</strong> individual instruments. <strong>PIEF</strong>’s Fund Manager opted for the highest quality instrument i.e. “T-<br />

Bills” when investment advisors were recommending TDRs based funds <strong>of</strong>fering low returns without deeply<br />

analyzing quality <strong>and</strong> returns <strong>of</strong> this asset classes.<br />

We will continue to introspect <strong>and</strong> analyze environment to provide value for money products to our<br />

investors having faith in us. We will strive to continuously improve our services <strong>and</strong> products <strong>and</strong> would<br />

welcome your valued suggestions.<br />

Happy Investing<br />

Adnan Siddiqui<br />

Deputy Chief Executive<br />

Strategy & Business Development<br />

As<br />

All investments in mutual funds are subject to market risk. The NAV based price <strong>of</strong> these<br />

All investments in mutual funds are subject to market risk. The NAV based price <strong>of</strong> these<br />

units <strong>and</strong> any dividends <strong>and</strong> returns thereon are dependent on forces <strong>and</strong> factors affecting<br />

units <strong>and</strong> any dividends <strong>and</strong> returns thereon are dependent on forces <strong>and</strong> factors affecting<br />

the capital markets. These may go up or down based on market conditions. Past<br />

the capital markets. These may go up or down based on market conditions. Past<br />

performance is not necessarily indicative <strong>of</strong> future results. Please read the <strong>of</strong>fering<br />

performance is not necessarily indicative <strong>of</strong> future results. Please read the <strong>of</strong>fering<br />

document to underst<strong>and</strong> the investment policies <strong>and</strong> the risks involved.<br />

document to underst<strong>and</strong> the investment policies <strong>and</strong> the risks involved.<br />

as<br />

<strong>Arif</strong> <strong>Habib</strong> <strong>Arif</strong> <strong>Habib</strong> <strong>Investments</strong> Limited<br />

(formerly: <strong>Arif</strong> <strong>Habib</strong> 2/1, Investment R.Y. 16, Management Old Queens Limited) Road<br />

2/1, R.Y. 16, Old Queens Road<br />

Karachi - 74000, Pakistan<br />

Karachi - 74000, Pakistan<br />

Tel: (92-21) Tel: (92-21) 111-468-378 111-468-378 (111-INVEST)<br />

(111-INVEST)<br />

www.arifhabib.com.pk<br />

Email: Email: marketing@arifhabib.com.pk