The Medicare Monthly Review, MMR-2010-09, September ... - CGS

The Medicare Monthly Review, MMR-2010-09, September ... - CGS

The Medicare Monthly Review, MMR-2010-09, September ... - CGS

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

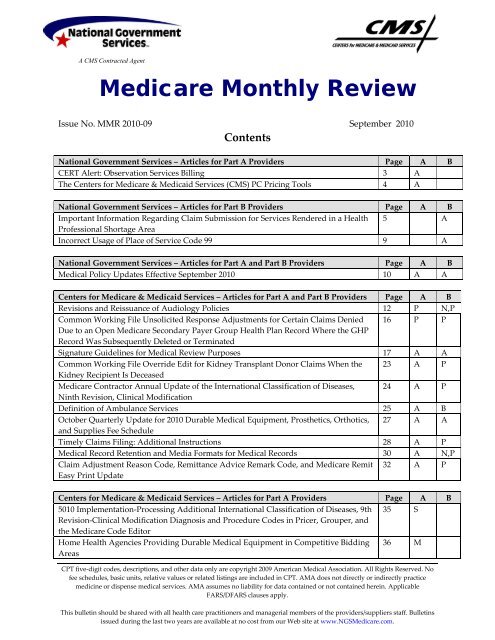

A CMS Contracted Agent<br />

<strong>Medicare</strong> <strong>Monthly</strong> <strong>Review</strong><br />

Issue No. <strong>MMR</strong> <strong>2010</strong>-<strong>09</strong> <strong>September</strong> <strong>2010</strong><br />

Contents<br />

National Government Services – Articles for Part A Providers Page A B<br />

CERT Alert: Observation Services Billing 3 A<br />

<strong>The</strong> Centers for <strong>Medicare</strong> & Medicaid Services (CMS) PC Pricing Tools 4 A<br />

National Government Services – Articles for Part B Providers Page A B<br />

Important Information Regarding Claim Submission for Services Rendered in a Health 5 A<br />

Professional Shortage Area<br />

Incorrect Usage of Place of Service Code 99 9 A<br />

National Government Services – Articles for Part A and Part B Providers Page A B<br />

Medical Policy Updates Effective <strong>September</strong> <strong>2010</strong> 10 A A<br />

Centers for <strong>Medicare</strong> & Medicaid Services – Articles for Part A and Part B Providers Page A B<br />

Revisions and Reissuance of Audiology Policies 12 P N,P<br />

Common Working File Unsolicited Response Adjustments for Certain Claims Denied 16 P P<br />

Due to an Open <strong>Medicare</strong> Secondary Payer Group Health Plan Record Where the GHP<br />

Record Was Subsequently Deleted or Terminated<br />

Signature Guidelines for Medical <strong>Review</strong> Purposes 17 A A<br />

Common Working File Override Edit for Kidney Transplant Donor Claims When the 23 A P<br />

Kidney Recipient Is Deceased<br />

<strong>Medicare</strong> Contractor Annual Update of the International Classification of Diseases, 24 A P<br />

Ninth Revision, Clinical Modification<br />

Definition of Ambulance Services 25 A B<br />

October Quarterly Update for <strong>2010</strong> Durable Medical Equipment, Prosthetics, Orthotics, 27 A A<br />

and Supplies Fee Schedule<br />

Timely Claims Filing: Additional Instructions 28 A P<br />

Medical Record Retention and Media Formats for Medical Records 30 A N,P<br />

Claim Adjustment Reason Code, Remittance Advice Remark Code, and <strong>Medicare</strong> Remit<br />

Easy Print Update<br />

32 A P<br />

Centers for <strong>Medicare</strong> & Medicaid Services – Articles for Part A Providers Page A B<br />

5010 Implementation-Processing Additional International Classification of Diseases, 9th 35 S<br />

Revision-Clinical Modification Diagnosis and Procedure Codes in Pricer, Grouper, and<br />

the <strong>Medicare</strong> Code Editor<br />

Home Health Agencies Providing Durable Medical Equipment in Competitive Bidding<br />

Areas<br />

36 M<br />

CPT five-digit codes, descriptions, and other data only are copyright 20<strong>09</strong> American Medical Association. All Rights Reserved. No<br />

fee schedules, basic units, relative values or related listings are included in CPT. AMA does not directly or indirectly practice<br />

medicine or dispense medical services. AMA assumes no liability for data contained or not contained herein. Applicable<br />

FARS/DFARS clauses apply.<br />

This bulletin should be shared with all health care practitioners and managerial members of the providers/suppliers staff. Bulletins<br />

issued during the last two years are available at no cost from our Web site at www.NGS<strong>Medicare</strong>.com.

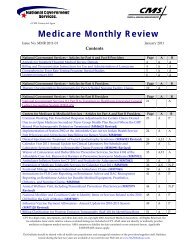

Centers for <strong>Medicare</strong> & Medicaid Services – Articles for Part A Providers Page A B<br />

Revised Instructions for Reporting Assessment Dates under the Inpatient Rehabilitation 37 S,A<br />

Facility, Skilled Nursing Facility, and Swing Bed Prospective Payment Systems<br />

Implementation of the Interrupted Stay Policy Under the Inpatient Psychiatric Facility 39 A<br />

Prospective Payment System<br />

Update to Hospice Payment Rates, Hospice Cap, Hospice Wage Index and the Hospice 40 P<br />

Pricer for Fiscal Year 2011<br />

<strong>Medicare</strong> Part A Skilled Nursing Facility Prospective Payment System Pricer Update FY 42 S<br />

2011<br />

Version 5010 Implementation—Changes to Present on Admission Indicator ‘1’ and the 43 H<br />

K3 Segment<br />

Inpatient Rehabilitation Facility Annual Update: Prospective Payment System Pricer<br />

Changes for Fiscal Year 2011<br />

45 A<br />

Centers for <strong>Medicare</strong> & Medicaid Services – Articles for Part B Providers Page A B<br />

Revisions to Claims Processing Instructions for Services Rendered in Place of Service 47 P,A<br />

Home<br />

Alternative Process for Individual Eligible Professionals to Access Physician Quality 49 A,P<br />

Reporting Initiative and Electronic Prescribing (E-Prescribing) Feedback Reports<br />

Clarification of Billing Requirement for Ancillary Services Performed in the Ambulatory 51 P<br />

Surgical Center by Entities Other Than ASCs<br />

Payment for Implantable Tissue Markers (HCPCS Code A4648) and Implantable<br />

Radiation Dosimeters (HCPCS Code A4650)<br />

53 P<br />

This key is provided as a convenience to alert providers/suppliers to articles with topics that may pertain to their particular field.<br />

This key is not a guarantee that information in other articles will not also apply. It is each provider’s/supplier’s responsibility to<br />

become familiar with the contents of each newsletter:<br />

Part A Key: A-All Providers, C-Community Mental Health Centers (CMHC), E-Renal Dialysis (ESRD) Providers, F-<br />

Federally Qualified Health Centers (FQHC), H-Hospitals, M-Home Health Providers, O-Comprehensive Outpatient<br />

Rehabilitation Facilities (CORF) and Outpatient Physical <strong>The</strong>rapy Providers, P-Hospice Providers, R-Rural Health Center<br />

(RHC), S-Skilled Nursing Facilities (SNF), NA-Not Applicable<br />

Part B Key: A-All Providers, B-Ambulance, C-Cardiovascular, D-DMEPOS, E-Drugs & Biologicals, F-ASC, G-Anesthesia,<br />

H-Physical & Occupational <strong>The</strong>rapy, I-Beneficiaries, J-Insurers, K-Home Health Care, L-Laboratory, M-Medicine, N-Non-<br />

Physician Practitioner, O-Nuclear Medicine, P-Physicians, Q-Mental Health R-Radiology, S-Surgery, T-Nephrology, U-<br />

Urology, V-Chiropractor, W-Ophthalmology & Optometry, X-Podiatry, Y-Radiation Z-Oncology, NA-Not Applicable<br />

Contact Information can be found on our Web site at: http://www.NGS<strong>Medicare</strong>.com.<br />

<strong>Medicare</strong> policies can be accessed from the Medical Policy Center section of our Web site. Providers without access to the<br />

Internet can request hard copies from National Government Services.<br />

CPT codes and descriptors are only copyright 20<strong>09</strong> American Medical Association (or such other date publication of CPT)<br />

<strong>The</strong> <strong>Medicare</strong> <strong>Monthly</strong> <strong>Review</strong> 2 <strong>MMR</strong> <strong>2010</strong>-<strong>09</strong> <strong>September</strong> <strong>2010</strong>

National Government Services Articles for Part A Providers<br />

CERT Alert: Observation Services Billing<br />

A trend of billing for outpatient observation services exceeding 48 hours has been identified as a result of<br />

Comprehensive Error Rate Testing (CERT) review and denial of inpatient hospital services.<br />

<strong>The</strong>re is a new medically unlikely edit (MUE) that denies outpatient observation services when<br />

units/hours exceed 48.<br />

• American National Standards Institute (ANSI) adjustment reason code 151 and ANSI remark code<br />

N362 will appear on the remittance notice if more than 48 hours of observation services are billed.<br />

• In the Fiscal Intermediary Standard System (FISS) claims processing system, denial reason code<br />

51MUE denies the entire line of service; the narrative for the denial reason code is: Beginning with<br />

dates of service on and after 01/01/07, it has been determined the units of service are in excess of the<br />

medically reasonable daily allowable frequency. <strong>The</strong> excess charges due to units of service greater<br />

than the maximum allowable may not be billed to the beneficiary and, this provision can neither be<br />

waived nor subject to an Advance Beneficiary Notice of Noncoverage (ABN).<br />

<strong>The</strong> following three scenarios outline the possibilities for billing observation services when hours exceed<br />

48.<br />

Scenario #1<br />

When observation services exceed 48 hours (and the length of observation is medically necessary), bill the<br />

actual number of hours on one line. <strong>The</strong> claim will deny as above with ANSI adjustment reason code 151<br />

and ANSI remark code N362.<br />

Submit an appeal request with medical records showing the care rendered including the medical<br />

necessity of observation services exceeding 48 hours. <strong>The</strong> Centers for <strong>Medicare</strong> & Medicaid Services<br />

(CMS) has required review by appeals of all medically necessary observation services that exceed 48<br />

hours.<br />

Scenario #2<br />

When observation services exceed 48 hours but not all hours are medically necessary, give the patient an<br />

ABN when they no longer require medically necessary observation services. Bill the first line of<br />

observation services with the number of hours medically necessary as covered. Bill the second line with<br />

the number of hours where the patient received medically unnecessary care as noncovered with modifier<br />

GA.<br />

Scenario #3<br />

When observation services exceed 48 hours but not all hours are medically necessary, but the provider<br />

fails to give an ABN for the hours that were not medically necessary, bill the first line as covered (with the<br />

number of hours where medically necessary services were rendered) and bill the second line with the<br />

number of hours as noncovered with modifier GZ.<br />

Providers also relayed concern with other services subject to MUEs, such as labs. <strong>The</strong> labs are billed with<br />

units that exceed the limit set by CMS, and the lines are being denied by the MUE edits. This also requires<br />

an appeal in order to request payment for number of units allowed.<br />

CPT codes and descriptors are only copyright 20<strong>09</strong> American Medical Association (or such other date publication of CPT)<br />

<strong>The</strong> <strong>Medicare</strong> <strong>Monthly</strong> <strong>Review</strong> 3 <strong>MMR</strong> <strong>2010</strong>-<strong>09</strong> <strong>September</strong> <strong>2010</strong>

<strong>The</strong> <strong>Medicare</strong> administrative contractors (MACs), fiscal intermediaries, and carriers do not establish the<br />

MUE edits.<br />

For questions and concerns regarding these edits please contact:<br />

National Correct Coding Initiative<br />

Correct Coding Solutions, LLC<br />

P.O. Box 907<br />

Carmel, IN 46082-<strong>09</strong>07<br />

Fax #: 317-571-1745<br />

Additional MUE information is available on the www.cms.gov Web site.<br />

If you have questions regarding this information please contact the Clinical Education Department at:<br />

E-mail: Clinical.Education@Wellpoint.com<br />

Phone: 800-338-6101<br />

<strong>The</strong> Centers for <strong>Medicare</strong> & Medicaid Services (CMS) PC Pricing Tools<br />

As Federal Fiscal Year (FY) 2011 approaches, National Government Services reminds providers that CMS<br />

maintains very useful claims pricing tools on their Web site. <strong>The</strong>se CMS pricing tools, often referred to as<br />

PC Pricer tools, can be used to evaluate payments made by the FISS claims processing system. Even<br />

though the FISS system is the official payment source for the <strong>Medicare</strong> Program, providers may find<br />

these CMS PC Pricer tools helpful in evaluating payments.<br />

<strong>The</strong> CMS PC Pricers are located at the following link:<br />

http://www.cms.gov/PCPricer/01_overview.asp#TopOfPage<br />

It should be pointed out that<br />

the Pricer programs for FY<br />

2011 will not be available<br />

until mid-October 2011<br />

(should this be <strong>2010</strong>).<br />

CMS includes Pricer tools for various prospective payment systems (PPS). Pricer tools are available for<br />

the following: inpatient prospective payment system (IPPS), inpatient psychiatric facility (IPF), inpatient<br />

rehabilitation facility (IRF), long-term care hospital (LTCH), skilled nursing facility (SNF), and home<br />

health agency (HHA). <strong>The</strong> various payment system links are on the left side of the PC Pricer home page.<br />

CMS includes download instructions on their Web site.<br />

Questions regarding the CMS PC Pricer tools can be addressed to the Audit & Reimbursement office<br />

servicing your facility.<br />

CPT codes and descriptors are only copyright 20<strong>09</strong> American Medical Association (or such other date publication of CPT)<br />

<strong>The</strong> <strong>Medicare</strong> <strong>Monthly</strong> <strong>Review</strong> 4 <strong>MMR</strong> <strong>2010</strong>-<strong>09</strong> <strong>September</strong> <strong>2010</strong>

National Government Services Articles for Part B Providers<br />

Important Information Regarding Claim Submission for Services<br />

Rendered in a Health Professional Shortage Area<br />

Recently, National Government Services reviewed claims for services reported with the AQ modifier<br />

indicating the service was performed in a health professional shortage area (HPSA).<br />

<strong>The</strong> review, conducted on claims in Connecticut and New York, revealed that a majority of the claims<br />

were billed for services that did not take place at a facility in one of the underserved HPSA areas. <strong>The</strong><br />

review was conducted on a post-payment basis whereas these services had already received the HPSA<br />

incentive bonus. As a result, National Government Services needed to request refunds of the incentive<br />

bonus from those providers who incorrectly billed as if the services were performed in a HPSA area.<br />

It is important to be fully aware that the service you are performing is within a recognized HPSA area.<br />

We recommend that prior to submitting a claim with the AQ modifier (indicating the service was<br />

performed in a HPSA area), you can check the following Web sites to determine if you are eligible for the<br />

HPSA bonus payment:<br />

• Verify Automated HPSA Bonus Designation Status on the CMS Web site. Within the Downloads<br />

section you can select the HPSA file for the appropriate year.<br />

• Verify HPSA Status on the Health Resources and Services Administration (HRSA) Web site. You can<br />

click on the HPSA Eligible for the <strong>Medicare</strong> Physician Bonus Payment link to enter an address to<br />

check its HPSA eligibility<br />

It is also important to realize that continued use of the AQ modifier for services that are not truly<br />

rendered in a recognized HPSA area can be considered an abusive practice, and providers who continue<br />

to do so may be referred to the program safeguard contractor (PSC) for further audit.<br />

<strong>The</strong> following is an overview of <strong>Medicare</strong>’s bonus program for physicians who provide services in a<br />

HPSA.<br />

What Is HPSA<br />

Health Professional Shortage Area<br />

Physicians who provide covered professional services in any rural or urban primary care HPSA are<br />

entitled to a ten-percent bonus payment. A health professional shortage area is an area, either urban or<br />

rural, designated as having a shortage of health care professionals. In addition, effective for claims with<br />

dates of service on or after July 1, 2004, psychiatrists (provider specialty 26) furnishing services in an area<br />

designated as a mental health HPSA are eligible to receive bonus payments quarterly. If an area is<br />

designated as both a primary care HPSA and a mental health HPSA, only one ten-percent bonus payment<br />

will be made for a covered service.<br />

HPSA Eligibility and Designation<br />

<strong>The</strong> location of the office or primary service location of a provider does not determine HPSA eligibility,<br />

nor is HPSA determined because a beneficiary resides in a HPSA. <strong>The</strong> key to HPSA eligibility is where<br />

the service is actually provided (place of service). For example:<br />

• A physician providing a service in his/her office, the patient’s home, or in a hospital qualifies for the<br />

bonus payment as long as the specific location of the service is within an area designated as a HPSA.<br />

• A physician may have an office in a HPSA, but go outside the designated HPSA area to provide the<br />

service. In this case, the physician would not be eligible for the bonus.<br />

CPT codes and descriptors are only copyright 20<strong>09</strong> American Medical Association (or such other date publication of CPT)<br />

<strong>The</strong> <strong>Medicare</strong> <strong>Monthly</strong> <strong>Review</strong> 5 <strong>MMR</strong> <strong>2010</strong>-<strong>09</strong> <strong>September</strong> <strong>2010</strong>

• <strong>The</strong> office address is not located within a HPSA. <strong>The</strong>refore, the physician is not entitled to a bonus<br />

payment for services provided at this address. However, if this same physician travels to a nursing<br />

facility, the patient’s home, or a hospital within a HPSA designated area, the physician would be<br />

eligible for the bonus.<br />

HPSA Automatic Payments<br />

• HPSA Automatic Payments:<br />

1. Fall within a county designated as a HPSA or<br />

2. Fall partially within a county designated as a HPSA and are considered to be dominant in that<br />

county, based on a determination of the U.S. Postal Service; or<br />

3. Fall within a rural area of a metropolitan statistical area identified through the latest modification<br />

of the Goldsmith modification that is determined to be a HPSA.<br />

<strong>Medicare</strong> will automatically pay the bonus without the need for a modifier on the claim for services<br />

provided in ZIP code areas that:<br />

• In some cases, a service may be provided in a county that is considered a HPSA, but the ZIP code is<br />

not considered to be dominant for that area. In these cases the bonus payment cannot be made<br />

automatically. To receive the bonus for such services, physicians will need to include a modifier to<br />

reflect a physician service provided in a HPSA. Use AQ modifier for HPSA services.<br />

• Services submitted with the AQ modifier will be subject to validation by <strong>Medicare</strong>.<br />

• ZIP codes that are eligible for automatic payment of the physician scarcity bonus are posted on the<br />

CMS Web site at http://www.cms.gov/HPSAPSAPhysicianBonuses/.<br />

How to Determine HPSA Eligibility<br />

<strong>The</strong> first step in billing for HPSA bonus payments should be verification of the eligibility of the location<br />

where the services were performed. <strong>The</strong> bonus is based on the actual places of service and not where the<br />

physician’s office is located or where the patient resides.<br />

You can check the following Web sites to determine if you are eligible for the HPSA bonus payment:<br />

• Verify Automated HPSA Bonus Designation Status on the CMS Web site Within the Downloads<br />

section you can select the HPSA file for the appropriate year.<br />

• Verify HPSA Status on the Health Resources and Services Administration (HRSA) Web site You can<br />

click on the HPSA Eligible for the <strong>Medicare</strong> Physician Bonus Payment link to enter an address to<br />

check its HPSA eligibility<br />

HPSA Designations<br />

<strong>The</strong> Division of Shortage Designation (DSD) of the Public Health Service (PHS) determines HPSA<br />

designations. Requests for additional information on HPSA designations, withdrawals, or reinstatement<br />

of a withdrawn designation should be directed to:<br />

Public Health Services<br />

Division of Shortage Designation<br />

4350 East-West Highway; Room 91-D1<br />

Bethesda, MD 20814<br />

For shortage designation inquiries, please call 888-275-4772. Press option 1, then option 2 or visit the<br />

HRSA Web site at http://bhpr.hrsa.gov/shortage.<br />

You can also contact the Shortage Designation Branch:<br />

E-mail: sdb@hrsa.gov<br />

Phone: 301-594-0816<br />

CPT codes and descriptors are only copyright 20<strong>09</strong> American Medical Association (or such other date publication of CPT)<br />

<strong>The</strong> <strong>Medicare</strong> <strong>Monthly</strong> <strong>Review</strong> 6 <strong>MMR</strong> <strong>2010</strong>-<strong>09</strong> <strong>September</strong> <strong>2010</strong>

Fax: 301-443-4370 fax<br />

Mail: Shortage Designation Branch<br />

5600 Fishers Lane; Room 8C-26<br />

Rockville, MD 20857<br />

HPSA Locations<br />

Although some HPSAs span entire counties (or other territorial subdivisions within a state), typically,<br />

they represent only sections of counties. Urban HPSAs, particularly in large metropolitan areas, are<br />

usually identified by census tract. To help you identify specific street addresses within a census tract,<br />

contact your county planning office.<br />

To determine your Census Tract Location please refer to the following Web site<br />

http://www.census.gov/main/www/cen2000.html.<br />

Claim Coding Requirements and Payment<br />

<strong>The</strong> ten-percent HPSA bonus payment is based on the amount actually paid by <strong>Medicare</strong>, not the<br />

approved amount. Payment is made for services identified on either assigned or unassigned claims.<br />

Some HPSA areas are designated as auto-pay areas based on the ZIP code. For these auto-pay areas, no<br />

modifier is required to receive the HPSA payment. To determine if your area is designated as an auto-pay<br />

HPSA area, please visit the Centers for <strong>Medicare</strong> & Medicaid Services (CMS) Web site at<br />

http://www.cms.gov/bonuspayment/.<br />

Effective January 1, 2005, a modifier no longer has to be included on claims to receive the HPSA bonus<br />

payment, which will be paid automatically, if services are provided in ZIP code areas that either:<br />

• Fall entirely in a county designated as a full-county HPSA; or<br />

• Fall entirely within the county, through a USPS determination of dominance; or<br />

• Fall entirely within a partial county HPSA.<br />

If services are provided in ZIP code areas that do not fall entirely within a full county HPSA or partial<br />

county HPSA, the AQ modifier must be entered on the claim to receive the bonus.<br />

<strong>The</strong> following are the specific instances in which a modifier must be entered:<br />

• When services are provided in ZIP code areas that do not fall entirely within a designated full<br />

county HPSA bonus area;<br />

• When services are provided in a ZIP code area that falls partially within a full county HPSA but<br />

is not considered to be in that county based on the USPS dominance decision;<br />

• When services are provided in a ZIP code area that falls partially within a non-full county HPSA;<br />

• When services are provided in a ZIP code area that was not included in the automated file of<br />

HPSA areas based on the date of the data run used to create the file.<br />

A physician whose ZIP code is not on the auto-pay list must indicate that their services were provided in<br />

a bonus-eligible rural or urban HPSA by using the following modifier:<br />

AQ - Service was provided in a HPSA for dates of service on or after January 1, 2006.<br />

<strong>The</strong> AQ modifier must be reported next to the procedure code. <strong>The</strong> provider must report the address<br />

where the service was actually performed.<br />

CPT codes and descriptors are only copyright 20<strong>09</strong> American Medical Association (or such other date publication of CPT)<br />

<strong>The</strong> <strong>Medicare</strong> <strong>Monthly</strong> <strong>Review</strong> 7 <strong>MMR</strong> <strong>2010</strong>-<strong>09</strong> <strong>September</strong> <strong>2010</strong>

<strong>The</strong> bonus payments are not included with each claim payment. Rather, a quarterly schedule is<br />

established for issuing bonus payments. A remittance will accompany each quarterly payment.<br />

<strong>The</strong>se payments are taxable and must be reported to the Internal Revenue Services (IRS).<br />

When you receive your HPSA remittance, if you discover that one or more of the claims should not have<br />

been paid a bonus, please contact us with the claim information.<br />

Bonus Payments Limited to Professional Services<br />

HPSA bonus payments are limited to professional services only.<br />

Eligible Providers<br />

Only the physician specialties listed below are eligible to receive the HPSA bonus payment for services<br />

that are rendered in a HPSA:<br />

• Doctors of medicine<br />

• Doctors of osteopathic medicine<br />

• Doctors of dental surgery<br />

• Doctors of chiropractic medicine<br />

• Doctors of podiatric medicine<br />

• Doctors of optometry<br />

Postpayment <strong>Review</strong><br />

Each quarter, an analysis is performed on a sample of physicians who received HPSA bonus payments<br />

for the prior quarter.<br />

If we discover, in our review process, that any claims submitted should not have been paid bonus<br />

payments, the claims will be adjusted.<br />

It is not necessary to send a check for the HPSA overpayment amount, as it will be deducted from your<br />

future HPSA bonus payment check. If there is a remaining balance, or there is no HPSA check to be sent,<br />

our accounting department will contact you for the amount due.<br />

What Else You Should Know<br />

<strong>The</strong>re is no administrative or judicial review regarding the identification of a county or area; the<br />

assignment of a physician to a county; the assignment of a specialty of any physician; and/or a postal ZIP<br />

code to a county or other area. HPSA bonuses are not subject to the formal appeals process.<br />

You can visit the CMS Web site to keep up to date on changes to the process at http://www.cms.gov.<br />

CPT codes and descriptors are only copyright 20<strong>09</strong> American Medical Association (or such other date publication of CPT)<br />

<strong>The</strong> <strong>Medicare</strong> <strong>Monthly</strong> <strong>Review</strong> 8 <strong>MMR</strong> <strong>2010</strong>-<strong>09</strong> <strong>September</strong> <strong>2010</strong>

Appeal Rights<br />

State/Jurisdiction<br />

Connecticut and New York<br />

Indiana<br />

Redetermination Mailing Address<br />

National Government Services, Inc.<br />

P.O. Box 7111<br />

Indianapolis, Indiana 46207-7111<br />

National Government Services, Inc.<br />

P.O. Box 7073<br />

Indianapolis, Indiana 46207-7073<br />

Kentucky<br />

National Government Services, Inc.<br />

P.O. Box 7155<br />

Indianapolis, Indiana 46207-7155<br />

If you did not receive a HPSA bonus payment, but believe that you are entitled, you may request that we<br />

reopen the claim.<br />

<strong>The</strong> Health Professional Shortage Area (HPSA) Fact Sheet (March <strong>2010</strong>) is now available in downloadable<br />

format from the CMS <strong>Medicare</strong> Learning Network at<br />

http://www.cms.gov/MLNProducts/downloads/HPSAfctsht.pdf (502 KB) on the CMS Web site. This fact<br />

sheet provides general requirements and an overview of the HPSA payment system.<br />

Incorrect Usage of Place of Service Code 99<br />

<strong>The</strong> place of service (POS) codes are two-digit codes placed on health care professional claims in Item 24B<br />

or its electronic equivalent, to designate the actual place where the service was provided. <strong>The</strong>refore, it is<br />

important providers bill the correct POS codes.<br />

<strong>The</strong> Centers for <strong>Medicare</strong> & Medicaid Services (CMS) maintains the POS code sets used throughout the<br />

health care industry.<br />

<strong>The</strong>se code sets are available in the CMS POS Database located on the CMS Web site at<br />

www.cms.gov/PlaceofServiceCodes/03_POSDatabase.asp<br />

Place of Service Code 99 is described as Other Place of Service/Other place of service not identified within<br />

the place of service code set listing. Meaning, there is no other place of service code within the code<br />

listing that describes the place where the service was rendered.<br />

National Government Services has received a high volume of claims billed with POS code 99 when<br />

another more appropriate POS code within the code set listing should have been utilized.<br />

POS 99 may be appropriate for performing the interpretation of diagnostic tests in various locations such<br />

as a physician’s home, a hotel room, an office suite that is neither the test location nor the physician’s<br />

office, and an interpretation provided under arrangement to a hospital.<br />

To avoid claim denials, be sure to check the Place of Service Codes for Professional Claims on the CMS<br />

Web site before utilizing POS code 99.<br />

CPT codes and descriptors are only copyright 20<strong>09</strong> American Medical Association (or such other date publication of CPT)<br />

<strong>The</strong> <strong>Medicare</strong> <strong>Monthly</strong> <strong>Review</strong> 9 <strong>MMR</strong> <strong>2010</strong>-<strong>09</strong> <strong>September</strong> <strong>2010</strong>

Reference: <strong>The</strong> CMS Internet Only Manual (IOM) Publication 100-04, <strong>Medicare</strong> Claims Processing Manual,<br />

Chapter 26, Section 10.5 and 10.6.<br />

National Government Services Articles for Part A and Part B Providers<br />

Medical Policy Updates Effective <strong>September</strong> <strong>2010</strong><br />

Local Coverage Determinations (LCDs) and Article Revisions<br />

LCD for Cardiac Catheterization and Coronary Angiography - L26880<br />

R9 (effective <strong>09</strong>/01/<strong>2010</strong>): Based on a reconsideration request, the following International Classification of<br />

Diseases, Clinical Modification, 9th Revision (ICD-9) codes have been added as payable for current<br />

procedural terminology (CPT) code 93503 effective for services on or after June 16, <strong>2010</strong>: 394.0-394.2,<br />

394.9, 395.0-395.2, 395.9, 396.0-396.3, 396.8-396.9, 397.0-397.1, 397.9, 402.01, 402.11, 402.91, 404.01, 404.03,<br />

404.11, 404.13, 404.91, 404.93, 410.00-410.02, 410.10-410.12, 410.20-410.22, 410.30-410.32, 410.40-410.42,<br />

410.50-410.52, 410.60-410.62, 410.70-410.72, 410.80-410.82, 410.90-410.92, 411.1, 411.81, 411.89, 412, 413.0,<br />

413.1, 413.9, 414.00-414.07, 414.10-414.12, 414.19, 414.2-414.3, 414.8-414.9, 415.12, 423.0-423.3, 423.8, 424.0-<br />

424.3, 424.90-424.91, 424.99, 425.0-425.5, 425.7-425.9, 429.4, 429.5, 429.71, 429.83, 441.01-441.03, 441.1-441.7,<br />

441.9, V12.50, and V15.9. No comment or notice periods required and none given.<br />

Cardiac Catheterization and Coronary Angiography – Supplemental Instructions Article - A48368<br />

Article published <strong>September</strong> <strong>2010</strong>: Changes were made in response to a reconsideration request<br />

submitted June 16, <strong>2010</strong>. <strong>The</strong> diagnosis coding guidelines for Part A and Part B claims for CPT code 93503<br />

were revised to provide instructions when a Swan-Ganz catheterization is performed for intraoperative<br />

monitoring of patients undergoing open heart surgery, abdominal aortic aneurysm repair, or non-cardiac<br />

surgery in high-risk patients with known severe cardiac conditions.<br />

LCD for Esophagogastroduodenoscopy (EGD) - L26394<br />

R7 (effective <strong>09</strong>/01/<strong>2010</strong>) ICD-9-CM code 537.89 was added to the “ICD-9-CM Codes that Support<br />

Medical Necessity” section of the LCD for CPT codes 43231, 43232, 43237, 43238, 43242 and 43259. <strong>The</strong><br />

ICD-9-CM code will be considered covered retroactive to the original effective date of the LCD.<br />

No comment and notice periods required and none given.<br />

Article for Ibandronate Sodium (e.g., Boniva®) – Related to LCD L25820- A46087<br />

Article published <strong>September</strong> <strong>2010</strong>: <strong>The</strong> first four coding guidelines have been revised to add ICD-9-CM<br />

codes 530.10, 530.19 and V15.89. ICD-9-CM codes 530.10, 530.19 and V15.89 have also been added to the<br />

list of secondary diagnosis codes in the “ICD-9 Codes that Are Covered” section of the article for<br />

Healthcare Common Procedure Coding System (HCPCS) code J1740 effective for dates of service on or<br />

after <strong>09</strong>/01/<strong>2010</strong>.<br />

Article for Iron Sucrose, Iron Dextran and Ferumoxytol, (Intravenous Iron <strong>The</strong>rapy) – Related to LCD<br />

L25820 - A48420<br />

Article published <strong>September</strong> <strong>2010</strong>: <strong>The</strong> primary and secondary diagnosis lists for anemia related to<br />

chronic kidney disease have been revised to indicate that the primary diagnosis is chronic kidney disease<br />

and anemia is listed as secondary.<br />

Article for Paclitaxel (e.g., Taxol®/Abraxane ) - Related to LCD L25820 - A46758<br />

Article published <strong>September</strong> <strong>2010</strong>: <strong>The</strong> indications for paclitaxel have been revised to remove metastatic<br />

esophageal cancer and metastatic small cell lung cancer which were inadvertently added in error. ICD-9-<br />

CPT codes and descriptors are only copyright 20<strong>09</strong> American Medical Association (or such other date publication of CPT)<br />

<strong>The</strong> <strong>Medicare</strong> <strong>Monthly</strong> <strong>Review</strong> 10 <strong>MMR</strong> <strong>2010</strong>-<strong>09</strong> <strong>September</strong> <strong>2010</strong>

CM code V10.03 has been removed from the ICD-9 listing for paclitaxel (J9265) effective for dates of<br />

service on or after 06/01/<strong>2010</strong>. ICD-9-CM code 195.0 has been added to the ICD-9 listing for albuminbound<br />

paclitaxel (J9264) effective for dates of service on or after 06/01/<strong>2010</strong>. <strong>The</strong> following paragraph for<br />

albumin-bound paclitaxel has been revised to include the language “non-small cell lung cancer<br />

(NSCLC):”<br />

Albumin-bound paclitaxel may be substituted for either paclitaxel or docetaxel for treating non-small<br />

cell lung cancer (NSCLC) in patients who have experienced hypersensitivity reactions after receiving<br />

paclitaxel or docetaxel despite premedication or for patients in whom standard hypersensitivity<br />

premedication are contraindicated.<br />

Article for Sodium Ferric Gluconate, (Intravenous Iron <strong>The</strong>rapy) – Related to LCD L25820 - A46105<br />

Article published <strong>September</strong> <strong>2010</strong>: <strong>The</strong> primary and secondary diagnosis lists for anemia related to<br />

chronic kidney disease have been revised to indicate that the primary diagnosis is chronic kidney disease<br />

and anemia is listed as secondary. Bill type, 72x, has been added to the “Bill Type Codes” for<br />

independent dialysis facilities. <strong>The</strong> following paragraph has been moved from the “Indications Expanded<br />

by this Article” section to the “Indications” section of the article:<br />

Iron deficiency anemia, in patients with renal impairment, chronic nondialysis dependent, with or<br />

without erythropoietin.<br />

LCD for Stem Cell Transplantation - L30183<br />

R1 (effective <strong>09</strong>/01/<strong>2010</strong>): <strong>The</strong> LCD was revised to update for changes published by the Centers for<br />

<strong>Medicare</strong> & Medicaid Services (CMS) on August 4, <strong>2010</strong> in the National Decision Memorandum for<br />

Allogeneic Hematopoietic Stem Cell Transplantation for Myelodysplastic Syndrome. <strong>The</strong> Decision<br />

Memorandum was added to the CMS National Policy references.<br />

<strong>The</strong> Indications and Limitations for Allogeneic Stem Cell Transplantation were updated to include the<br />

following statements: “<strong>The</strong> Decision Memorandum for Allogeneic Hematopoietic Stem Cell<br />

Transplantation for Myelodysplastic Syndrome published August 4, <strong>2010</strong> states the following: CMS has<br />

determined that the evidence does not demonstrate that the use of allogeneic hematopoietic stem cell<br />

transplantation (HSCT) improves health outcomes in <strong>Medicare</strong> beneficiaries with myelodysplastic<br />

syndrome (MDS). <strong>The</strong>refore, we determine that allogeneic HSCT for MDS is not reasonable and<br />

necessary under Section 1862(a)(1)(A) of the Social Security Act (the Act). However, we believe the<br />

available evidence shows that allogeneic HSCT for MDS is reasonable and necessary under Section<br />

1862(a)(1)(E) of the Act through Coverage with Evidence Development (CED). <strong>The</strong>refore, we are<br />

making the following decision. Allogeneic HSCT for MDS is covered by <strong>Medicare</strong> only for<br />

beneficiaries with MDS participating in an approved clinical study that meets the criteria documented<br />

in the Decision Memorandum.”<br />

Myelodysplastic syndrome was removed from the list of indications that will be covered locally.<br />

<strong>The</strong> coding list for CPT code 38240 was updated to remove ICD-9 codes 238.72, 238.73, 238.76 and add<br />

ICD-9 code 238.75* with the following asterisk explanation: *Only covered when meeting national<br />

coverage determination requirements for Coverage with Evidence Development (CED).<br />

<strong>The</strong> policy was updated for current CMS and National Government Services template language and<br />

other minor changes. <strong>The</strong> Decision Memorandum for Allogeneic Hematopoietic Stem Cell<br />

Transplantation for Myelodysplastic Syndrome was added to the policy as an attachment. Although the<br />

revision effective date is <strong>September</strong> 1, <strong>2010</strong> the revisions to this policy are effective for claims submitted<br />

for dates of service on or after August 4, <strong>2010</strong>. No notice given and none required.<br />

CPT codes and descriptors are only copyright 20<strong>09</strong> American Medical Association (or such other date publication of CPT)<br />

<strong>The</strong> <strong>Medicare</strong> <strong>Monthly</strong> <strong>Review</strong> 11 <strong>MMR</strong> <strong>2010</strong>-<strong>09</strong> <strong>September</strong> <strong>2010</strong>

Transthoracic Echocardiography (TTE) – Supplemental Instructions Article -A48397<br />

Article published <strong>September</strong> <strong>2010</strong>: Payable places of service under Part B for stress echocardiography<br />

services (CPT codes 93350, 93351, and 93352) have been updated to remove places of service 12, 13, 14, 15,<br />

16, 20, 32, 33, and 51. In addition place of service 34 (hospice) has been removed as payable under Part B<br />

for the professional component of tests.<br />

Article for Zoledronic Acid (e.g., Zometa ®, Reclast®) – Related to LCD L25820 - A46<strong>09</strong>6<br />

Article published <strong>September</strong> <strong>2010</strong>: Clarification has been added to the “Indications” section of the article<br />

to indicate that National Government Services does not cover Reclast® for the prevention of osteoporosis<br />

in postmenopausal women with the exception of those women with documented osteopenia. <strong>The</strong> “ICD-9<br />

Codes that Are Covered” section has been revised to include primary and secondary diagnoses for the<br />

management of female patients with postmenopausal osteopenia. ICD-9-CM code 733.90 has been<br />

removed from the stand-alone list of ICD-9-CM codes listed for Reclast® and is now listed as a primary<br />

diagnosis and ICD-9-CM codes V49.81, 256.2, 256.31 and 627.2 have been added as the secondary<br />

diagnoses effective for dates of service on or after 08/01/<strong>2010</strong> for HCPCS code J3488.<br />

Centers for <strong>Medicare</strong> & Medicaid Services Articles for Part A and Part B<br />

Providers<br />

Revisions and Reissuance of Audiology Policies<br />

MLN Matters® Number: MM6447 Revised<br />

Related Change Request (CR) #: 6447<br />

Related CR Release Date: July 23, <strong>2010</strong><br />

Effective Date: July 28, <strong>2010</strong><br />

Related CR Transmittal #: R129BP and R2007CP<br />

Implementation Date: July 28, <strong>2010</strong><br />

Note: This article was revised on July 26, <strong>2010</strong>, to include revised effective and implementation dates, a<br />

revised CR release date, transmittal numbers, and Web addresses for accessing the transmittals. In<br />

addition, Claim Adjustment Reason Codes and Remittance Advice Remark Codes have been added,<br />

where appropriate. <strong>The</strong> Web address for accessing the Audiology code list was also revised. All other<br />

information is the same.<br />

Provider Types Affected<br />

This article is for physicians, nonphysician practitioners, audiologists, and speech-language pathologists<br />

submitting claims to <strong>Medicare</strong> administrative contractors (A/B MACs), carriers and fiscal intermediaries<br />

(FIs) for services provided to hearing impaired <strong>Medicare</strong> beneficiaries.<br />

Provider Action Needed<br />

This article is based on Change Request (CR) 6447. <strong>The</strong> Centers for <strong>Medicare</strong> & Medicaid Services (CMS)<br />

issued CR 6447 to respond to provider requests for clarification of some of the language in CR5717 and<br />

CR6061. Special attention is given to clarifying policy concerning services incident to physician services<br />

that are paid under the <strong>Medicare</strong> Physician Fee Schedule (MPFS). See the Key Points section below for the<br />

clarifications provided by CR6447.<br />

Background<br />

Key parts of the clarified policy are in the revised Chapter 12, Section 30.3 of the <strong>Medicare</strong> Claims<br />

Processing Manual and in Chapter 15, Section 80.3 of the <strong>Medicare</strong> Benefit Policy Manual. <strong>The</strong>se revised<br />

manual sections are attached to CR 6447. As mentioned in these revised sections of the manuals and per<br />

CPT codes and descriptors are only copyright 20<strong>09</strong> American Medical Association (or such other date publication of CPT)<br />

<strong>The</strong> <strong>Medicare</strong> <strong>Monthly</strong> <strong>Review</strong> 12 <strong>MMR</strong> <strong>2010</strong>-<strong>09</strong> <strong>September</strong> <strong>2010</strong>

Section 1861 (ll) (3) of the Social Security Act, “audiology services” are defined as such hearing and<br />

balance assessment services furnished by a qualified audiologist as the audiologist is legally authorized<br />

to perform under state law (or the state regulatory mechanism provided by State law), as would<br />

otherwise by covered if furnished by a physician. <strong>The</strong>se hearing and balance assessment services are<br />

termed “audiology services,” regardless of whether they are furnished by an audiologist, physician,<br />

nonphysician practitioner (NPP), or hospital.<br />

Because audiology services are diagnostic tests, when furnished in an office or hospital outpatient<br />

department, they must be furnished by or under the appropriate level of supervision of a physician as<br />

established in 42 Code of Federal Regulations (CFR) 410.32(b)(1) and 410.28(e). If not personally<br />

furnished by a physician, audiologist, or NPP, audiology services must be performed under direct<br />

physician supervision. As specified in 42 CFR 410.32(b)(2)(ii) or (v), respectively, these services are<br />

excepted from physician supervision when they are personally furnished by a qualified audiologist or<br />

performed by a nurse practitioner or clinical nurse specialist authorized to perform the tests under<br />

applicable state laws.<br />

Note: References to technicians in CR 6447 and this article apply also to other qualified clinical staff. <strong>The</strong><br />

qualifications for technicians vary locally and may also depend on the type of test, the patient, and the<br />

level of participation of the physician who is directly supervising the test.<br />

<strong>The</strong>refore, an individual must meet qualifications appropriate to the service furnished as determined by<br />

the <strong>Medicare</strong> contractor to whom the claim is billed. If it is necessary to determine whether the individual<br />

who furnished the labor for appropriate audiology services is qualified, contractors may request<br />

verification of any relevant education and training that has been completed by the technician, which shall<br />

be available in the records of the clinic or facility.<br />

Audiology services, like all other services, should be reported under the most specific Healthcare<br />

Common Procedure Coding System (HCPCS) code that describes the service that was furnished and in<br />

accordance with all CPT guidance and <strong>Medicare</strong> national and local contractor instructions.<br />

See the CMS Web site at http://www.cms.gov/therapyservices for a listing of all current procedural<br />

terminology (CPT) codes for audiology services. For information concerning codes that are not on the list,<br />

and which codes may be billed when furnished by technicians, contractors shall provide guidance. <strong>The</strong><br />

MPFS at http://www.cms.gov/PFSlookup/ allows you to search pricing amounts, various payment policy<br />

indicators, and other MPFS data.<br />

Qualifications Discussion<br />

<strong>The</strong> individuals who furnish audiology services in all settings must be qualified to furnish those services.<br />

<strong>The</strong> qualifications of the individual performing the services must be consistent with the number, type and<br />

complexity of the tests, the abilities of the individual, and the patient’s ability to interact to produce valid<br />

and reliable results. <strong>The</strong> physician who supervises and bills for the service is responsible for assuring the<br />

qualifications of the technician, if applicable, are appropriate to the test.<br />

When a professional personally furnishes an audiology service, that individual must interact with the<br />

patient to provide professional skills and be directly involved in decision-making and clinical judgment<br />

during the test.<br />

<strong>The</strong> skills required when professionals furnish audiology services for payment under the MPFS are<br />

masters or doctoral level skills that involve clinical judgment or assessment and specialized knowledge<br />

and ability including, but not limited to, knowledge of anatomy and physiology, neurology, psychology,<br />

CPT codes and descriptors are only copyright 20<strong>09</strong> American Medical Association (or such other date publication of CPT)<br />

<strong>The</strong> <strong>Medicare</strong> <strong>Monthly</strong> <strong>Review</strong> 13 <strong>MMR</strong> <strong>2010</strong>-<strong>09</strong> <strong>September</strong> <strong>2010</strong>

physics, psychometrics, and interpersonal communication. <strong>The</strong> interactions of these knowledge bases are<br />

required to attain the clinical expertise for audiology tests. Also required are skills to administer valid<br />

and reliable tests safely, especially when they involve stimulating the auditory nerve and testing complex<br />

brain functions.<br />

Diagnostic audiology services also require skills and judgment to administer and modify tests, to make<br />

informed interpretations about the causes and implications of the test results in the context of the history<br />

and presenting complaints, and to provide both objective results and professional knowledge to the<br />

patient and to the ordering physician.<br />

Examples include, but are not limited to:<br />

• Comparison or consideration of the anatomical or physiological implications of test results or patient<br />

responsiveness to stimuli during the test;<br />

• Development and modification of the test battery and test protocols;<br />

• Clinical judgment, assessment, evaluation, and decision-making;<br />

• Interpretation and reporting observations, in addition to the objective data, that may influence<br />

interpretation of the test outcomes;<br />

• Tests related to implantation of auditory prosthetic devices, central auditory processing, contralateral<br />

masking; and/or<br />

• Tests to identify central auditory processing disorders, tinnitus, or nonorganic hearing loss<br />

Key Points of CR 6447<br />

• For claims with dates of service on or after October 1, 2008 audiologists are required to be enrolled in<br />

the <strong>Medicare</strong> program and use their National Provider Identifier (NPI) on all claims for services they<br />

render in office settings.<br />

• For audiologists who are enrolled and bill independently for services they render, the audiologist’s<br />

NPI is required on all claims they submit. For example, in offices and private practice settings, an<br />

enrolled audiologist shall use his or her own NPI in the rendering loop to bill under the MPFS for the<br />

services the audiologist furnished. If an enrolled audiologist furnishing services to hospital<br />

outpatients reassigns his/her benefits to the hospital, the hospital may bill the <strong>Medicare</strong> contractor for<br />

the professional services of the audiologist under the MPFS using the NPI of the audiologist. If an<br />

audiologist is employed by a hospital but is not enrolled in <strong>Medicare</strong>, the only payment for a hospital<br />

outpatient audiology service that can be made is the payment to the hospital for its facility services<br />

under the hospital Outpatient Prospective Payment System (OPPS) or other applicable hospital<br />

payment system. No payment can be made under the MPFS for professional services of an<br />

audiologist who is not enrolled.<br />

• Audiology services may be furnished and billed by audiologists and, when these services are<br />

furnished by an audiologist, no physician supervision is required.<br />

• When a physician or supplier furnishes a service that is covered by <strong>Medicare</strong>, then it is subject to the<br />

mandatory claim submission provisions of section 1848(g)(4) of the Social Security Act. <strong>The</strong>refore, if<br />

an audiologist charges or attempts to charge a beneficiary any remuneration for a service that is<br />

covered by <strong>Medicare</strong>, then the audiologist must submit a claim to <strong>Medicare</strong>.<br />

• <strong>Medicare</strong> pays for diagnostic audiological tests under the MPFS when they meet the requirements of<br />

audiology services as shown in Chapter 15, Section 80.3 of the <strong>Medicare</strong> Benefit Policy Manual as<br />

attached to CR 6447.<br />

• For claims with dates of service on or after October 1, 2008, the NPI of the enrolled audiologist is<br />

required on claims in the appropriate rendering and billing fields.<br />

• <strong>Medicare</strong> will not pay for services performed by audiologists and billed under the NPI of a physician.<br />

In denying such claims, <strong>Medicare</strong> will use:<br />

CPT codes and descriptors are only copyright 20<strong>09</strong> American Medical Association (or such other date publication of CPT)<br />

<strong>The</strong> <strong>Medicare</strong> <strong>Monthly</strong> <strong>Review</strong> 14 <strong>MMR</strong> <strong>2010</strong>-<strong>09</strong> <strong>September</strong> <strong>2010</strong>

o CARC 170 (Payment is denied when performed/billed by this type of provider. Note:<br />

Refer to the 835 Healthcare Policy Identification Segment (loop 2110 Service Payment<br />

Information REF), if present.); and<br />

o Remittance Advice Remark Code (RARC) MA102 (Missing/incomplete/invalid name or<br />

provider identifier for the rendering/referring/ordering/supervising provider.)<br />

• <strong>Medicare</strong> will not pay for an audiological test under the MPFS if the test was performed by a<br />

technician under the direct supervision of a physician if the test requires professional skills. Such<br />

claims will be denied using Claim Adjustment Reason Code (CARC) 170 (Payment is denied when<br />

performed/billed by this type of provider. Note: Refer to the 835 Healthcare Policy Identification<br />

Segment (loop 2110 Service Payment Information REF), if present.).<br />

• <strong>Medicare</strong> will not pay for audiological tests furnished by technicians unless the service is furnished<br />

under the direct supervision of a physician. In denying claims under this provision, <strong>Medicare</strong> will<br />

use:<br />

o CARC 185 (<strong>The</strong> rendering provider is not eligible to perform the service billed. Note:<br />

Refer to the 835 Healthcare Policy Identification Segment (loop 2110 Service Payment<br />

Information REF), if present.); and<br />

o RARC M136 (Missing/incomplete/invalid indication that the service was supervised or<br />

evaluated by a physician.)<br />

• <strong>Medicare</strong> will pay for the technical component (TC) of diagnostic tests that are not on the list of<br />

audiology services when those tests are furnished by audiologists under the designated level of<br />

physician supervision for the service and the audiologist is qualified to perform the service. (Once<br />

again, the list of audiology services is posted at http://www.cms.gov/therapyservices on the CMS<br />

Web site.)<br />

• <strong>Medicare</strong> will pay physicians and NPPs for treatment services furnished by audiologists incident to<br />

physicians’ services when the services are not on the list of audiology services at<br />

http://www.cms.gov/therapyservices and are not “always” therapy services and the audiologist is<br />

qualified to perform the service.<br />

• All audiological diagnostic tests must be documented with sufficient information so that <strong>Medicare</strong><br />

contractors may determine that the services do qualify as an audiological diagnostic test.<br />

• <strong>The</strong> interpretation and report shall be written in the medical record by the audiologist, physician, or<br />

NPP who personally furnished any audiology service, or by the physician who supervised the<br />

service. Technicians shall not interpret audiology services, but may record objective test results of<br />

those services they may furnish under direct physician supervision. Payment for the interpretation<br />

and report of the services is included in payment for all audiology services, and specifically in the<br />

professional component (PC), if the audiology service has a professional component/technical<br />

component split.<br />

• When <strong>Medicare</strong> contractors review medical records of audiological diagnostic tests for payment<br />

under the MPFS, they will review the technician’s qualifications to determine whether, under the<br />

unique circumstances of that test, a technician is qualified to furnish the test under the direct<br />

supervision of a physician.<br />

• <strong>The</strong> PC of a PC/TC split code may be billed by the audiologist, physician, or NPP who personally<br />

furnishes the service. (Note this is also true in the facility setting.) A physician or NPP may bill for the<br />

PC when the physician or NPP furnish the PC and an (unsupervised) audiologist furnishes and bills<br />

for the TC. <strong>The</strong> PC may not be billed if a technician furnishes the service. A physician or NPP may<br />

not bill for a PC service furnished by an audiologist.<br />

• <strong>The</strong> TC of a PC/TC split code may be billed by the audiologist, physician, or NPP who personally<br />

furnishes the service. Physicians may bill the TC for services furnished by technicians when the<br />

technician furnishes the service under the direct supervision of that physician. Audiologists and<br />

NPPs may not bill for the TC of the service when a technician furnishes the service, even if the<br />

technician is supervised by the NPP or audiologist.<br />

CPT codes and descriptors are only copyright 20<strong>09</strong> American Medical Association (or such other date publication of CPT)<br />

<strong>The</strong> <strong>Medicare</strong> <strong>Monthly</strong> <strong>Review</strong> 15 <strong>MMR</strong> <strong>2010</strong>-<strong>09</strong> <strong>September</strong> <strong>2010</strong>

• <strong>The</strong> “global” service is billed when both the PC and TC of a service are personally furnished by the<br />

same audiologist, physician, or NPP. <strong>The</strong> global service may also be billed by a physician, but not an<br />

audiologist or NPP, when a technician furnishes the TC of the service under direct physician<br />

supervision and that physician furnishes the PC, including the interpretation and report.<br />

• Tests that have no appropriate CPT code may be reported under CPT code 92700 (Unlisted<br />

otorhinolaryngological service or procedure).<br />

• Audiology services may not be billed when the place of service is a comprehensive outpatient<br />

rehabilitation facility (CORF) or a rehabilitation agency.<br />

• <strong>The</strong> opt out law does not define “physician” or “practitioner” to include audiologists; therefore, they<br />

may not opt out of <strong>Medicare</strong> and provide services under private contracts.<br />

Additional Information<br />

<strong>The</strong>re are two transmittals related to CR6447, the official instruction issued to your <strong>Medicare</strong> A/B MAC,<br />

FI and/or carrier. <strong>The</strong> first modifies the <strong>Medicare</strong> Benefit Policy Manual and that transmittal is at<br />

http://www.cms.gov/Transmittals/downloads/R129BP.pdf on the CMS Web site.<br />

<strong>The</strong> other transmittal modifies the <strong>Medicare</strong> Claims Processing Manual and it is at<br />

http://www.cms.gov/Transmittals/downloads/R2007CP.pdf on the CMS Web site.<br />

If you have questions, please contact your <strong>Medicare</strong> A/B MAC, FI or carrier at their toll-free number<br />

which may be found at http://www.cms.gov/MLNProducts/downloads/CallCenterTollNumDirectory.zip<br />

on the CMS Web site.<br />

Disclaimer<br />

This article was prepared as a service to the public and is not intended to grant rights or impose obligations. This article may contain references or links to<br />

statutes, regulations, or other policy materials. <strong>The</strong> information provided is only intended to be a general summary. It is not intended to take the place of either<br />

the written law or regulations. We encourage readers to review the specific statutes, regulations and other interpretive materials for a full and accurate statement<br />

of their contents. CPT only copyright 2008 American Medical Association.<br />

Common Working File Unsolicited Response Adjustments for Certain<br />

Claims Denied Due to an Open <strong>Medicare</strong> Secondary Payer Group<br />

Health Plan Record Where the GHP Record Was Subsequently Deleted<br />

or Terminated<br />

MLN Matters® Number: MM6625<br />

Related Change Request (CR) #: 6625<br />

Related CR Release Date: July 30, <strong>2010</strong><br />

Effective Date: April 1, 2011<br />

Related CR Transmittal #: R2014CP<br />

Implementation Date: April 4, 2011<br />

Provider Types Affected<br />

Physicians, providers, and suppliers who bill <strong>Medicare</strong> contractors (fiscal intermediaries [FI], regional<br />

home health intermediaries [RHHI], carriers, <strong>Medicare</strong> administrative contractors [A/B MAC], or durable<br />

medical equipment contractors [DME MAC]) for services provided, or supplied, to <strong>Medicare</strong><br />

beneficiaries.<br />

What You Need to Know<br />

CR 6625, from which this article is taken, instructs <strong>Medicare</strong> contractors (FIs, RHHIs, carriers, A/B MACs,<br />

and DME MACs) and shared system maintainers (SSM) to implement (effective April 1, 2011) an<br />

CPT codes and descriptors are only copyright 20<strong>09</strong> American Medical Association (or such other date publication of CPT)<br />

<strong>The</strong> <strong>Medicare</strong> <strong>Monthly</strong> <strong>Review</strong> 16 <strong>MMR</strong> <strong>2010</strong>-<strong>09</strong> <strong>September</strong> <strong>2010</strong>

automated process to reopen Group Health Plan (GHP) <strong>Medicare</strong> Secondary Payer (MSP) claims when<br />

related MSP data is deleted or terminated after claims were processed subject to the beneficiary record on<br />

<strong>Medicare</strong>’s database. Make sure that your billing staffs are aware of these new <strong>Medicare</strong> contractor<br />

instructions. Please see the Background section, below, for more details.<br />

Background<br />

MSP GHP claims were not automatically reprocessed in situations where <strong>Medicare</strong> became the primary<br />

payer after an MSP GHP record had been deleted or when an MSP GHP record was terminated after<br />

claims were processed subject to MSP data in <strong>Medicare</strong> files. It was the responsibility of the beneficiary,<br />

provider, physician or other suppliers to contact the <strong>Medicare</strong> contractor and request that the denied<br />

claims be reprocessed when reprocessing was warranted. However, this process places a burden on the<br />

beneficiary, physician, or other supplier and CR 6625 eliminates this burden. As a result of CR 6625,<br />

<strong>Medicare</strong> will implement an automated process to:<br />

1. Reopen certain MSP claims when certain MSP records are deleted, or<br />

2. Under some circumstances when certain MSP records are terminated and claims are denied due to<br />

MSP or <strong>Medicare</strong> made a secondary payment before the termination date is accreted.<br />

Basically, where <strong>Medicare</strong> learns, retroactively, that MSP data for a beneficiary is no longer applicable,<br />

<strong>Medicare</strong> will require its systems to search claims history for claims with dates of service within 180 days<br />

of a MSP GHP deletion date or the date the MSP GHP termination was applied, which were processed for<br />

secondary payment or were denied (rejected for Part A only claims). If claims were processed, the<br />

<strong>Medicare</strong> contractors will reprocess them in view of the more current MSP GHP information and make<br />

any claims adjustments that are appropriate. If providers, physicians or other suppliers believe some<br />

claim adjustments were missed please contact your <strong>Medicare</strong> contractor regarding those missing<br />

adjustments.<br />

Additional Information<br />

You can find the official instruction, CR 6625, issued to your FI, RHHI, carrier, A/B MAC, or DME MAC<br />

by visiting http://www.cms.gov/Transmittals/downloads/R2014CP.pdf on the Centers for <strong>Medicare</strong> &<br />

Medicaid Services (CMS) Web site.<br />

If you have any questions, please contact your FI, RHHI, carrier, A/B MAC, or DME MAC at their tollfree<br />

number, which may be found at<br />

http://www.cms.gov/MLNProducts/downloads/CallCenterTollNumDirectory.zip on the CMS Web site.<br />

Disclaimer<br />

This article was prepared as a service to the public and is not intended to grant rights or impose obligations. This article may contain references or links to<br />

statutes, regulations, or other policy materials. <strong>The</strong> information provided is only intended to be a general summary. It is not intended to take the place of either<br />

the written law or regulations. We encourage readers to review the specific statutes, regulations and other interpretive materials for a full and accurate statement<br />

of their contents.<br />

Signature Guidelines for Medical <strong>Review</strong> Purposes<br />

MLN Matters® Number: MM6698 Revised<br />

Related Change Request (CR) #: 6698<br />

Related CR Release Date: March 16, <strong>2010</strong><br />

Effective Date: March 1, <strong>2010</strong><br />

Related CR Transmittal #: R327PI<br />

Implementation Date: April 16, <strong>2010</strong><br />

CPT codes and descriptors are only copyright 20<strong>09</strong> American Medical Association (or such other date publication of CPT)<br />

<strong>The</strong> <strong>Medicare</strong> <strong>Monthly</strong> <strong>Review</strong> 17 <strong>MMR</strong> <strong>2010</strong>-<strong>09</strong> <strong>September</strong> <strong>2010</strong>

Note: This article was revised on June 16, <strong>2010</strong> to include a table excerpted from CR 6698 under<br />

Additional Information that summarizes signature requirements. All other information is the same.<br />

Provider Types Affected<br />

This article is for physicians, nonphysician practitioners, and suppliers submitting claims to <strong>Medicare</strong><br />

fiscal intermediaries (FIs), Part A/B <strong>Medicare</strong> administrative contractors (A/B MACs), carriers, regional<br />

home health intermediaries (RHHIs) and/or durable medical equipment MACs (DME MACs) for services<br />

provided to <strong>Medicare</strong> beneficiaries.<br />

Provider Action Needed<br />

<strong>The</strong> Centers for <strong>Medicare</strong> & Medicaid Services (CMS) issued CR 6698 to clarify for providers how<br />

<strong>Medicare</strong> claims review contractors review claims and medical documentation submitted by providers.<br />

CR 6698 outlines the new rules for signatures and adds language for E-Prescribing. See the rest of this<br />

article for complete details. <strong>The</strong>se revised/new signature requirements are applicable for reviews<br />

conducted on or after the implementation date of April 16, <strong>2010</strong>. Please note that all signature<br />

requirements in CR 6698 are effective retroactively for Comprehensive Error Rate Testing (CERT) for<br />

the November <strong>2010</strong> report period.<br />

Background<br />

Those contractors who review <strong>Medicare</strong> claims include MACs, affiliated contractors (ACs), the CERT<br />

contractors, Recovery Audit Contractors (RACs), Program Safeguard Contractors (PSCs), and Zone<br />

Program Integrity Contractors (ZPICs). <strong>The</strong>se contractors are tasked with measuring, detecting, and<br />

correcting improper payments as well as identifying potential fraud in the Fee for Service (FFS) <strong>Medicare</strong><br />

Program.<br />

<strong>The</strong> previous language in the Program Integrity Manual (PIM) required a “legible identifier” in the form of<br />

a handwritten or electronic signature for every service provided or ordered. CR 6698 updates these<br />

requirements and adds E-Prescribing language.<br />

For medical review purposes, <strong>Medicare</strong> requires that services provided/ordered be authenticated by the<br />

author. <strong>The</strong> method used must be a hand written or an electronic signature. Stamp signatures are not<br />

acceptable. <strong>The</strong>re are some exceptions, i.e.:<br />

EXCEPTION 1: Facsimiles of original written or electronic signatures are acceptable for the certifications<br />

of terminal illness for hospice.<br />

EXCEPTION 2: <strong>The</strong>re are some circumstances for which an order does not need to be signed. For<br />

example, orders for clinical diagnostic tests are not required to be signed. <strong>The</strong> rules in 42 CFR 410 and the<br />

<strong>Medicare</strong> Benefit Policy Manual, Chapter 15, Section 80.6.1, state that if the order for the clinical diagnostic<br />

test is unsigned, there must be medical documentation by the treating physician (e.g., a progress note)<br />

that he/she intended the clinical diagnostic test be performed. This documentation showing the intent<br />

that the test be performed must be authenticated by the author via a handwritten or electronic signature.<br />

EXCEPTION 3: Other regulations and CMS instructions regarding signatures (such as timeliness<br />

standards for particular benefits) take precedence. For medical review purposes, if the relevant<br />

regulation, NCD, LCD and CMS manuals are silent on whether the signature be legible or present and the<br />

signature is illegible/missing, the reviewer shall follow the guidelines listed below to discern the identity<br />

and credentials (e.g., MD, RN) of the signator. In cases where the relevant regulation, NCD, LCD and<br />

CMS manuals have specific signature requirements, those signature requirements take precedence.<br />

CPT codes and descriptors are only copyright 20<strong>09</strong> American Medical Association (or such other date publication of CPT)<br />

<strong>The</strong> <strong>Medicare</strong> <strong>Monthly</strong> <strong>Review</strong> 18 <strong>MMR</strong> <strong>2010</strong>-<strong>09</strong> <strong>September</strong> <strong>2010</strong>

<strong>The</strong> AC, MAC and CERT reviewers shall apply the following signature requirements:<br />

If there are reasons for denial unrelated to signature requirements, the reviewer need not proceed to<br />

signature authentication. If the criteria in the relevant <strong>Medicare</strong> policy cannot be met but for a key piece<br />

of medical documentation which contains a missing or illegible signature, the reviewer shall proceed to<br />

the signature assessment.<br />

Providers should not add late signatures to the medical record, (beyond the short delay that occurs<br />

during the transcription process) but instead may make use of the signature authentication process.<br />

Keep in mind that a handwritten signature is a mark or sign by an individual on a document to signify<br />

knowledge, approval, acceptance or obligation and note the following:<br />

• If the signature is illegible, ACs, MACs, PSCs, ZPICs and CERT shall consider evidence in a signature<br />

log or attestation statement to determine the identity of the author of a medical record entry.<br />

• If the signature is missing from an order, ACs, MACs, PSCs, ZPICs and CERT shall disregard the<br />

order during the review of the claim.<br />

• If the signature is missing from any other medical documentation, ACs, MACs, PSCs, ZPICs and<br />

CERT shall accept a signature attestation from the author of the medical record entry.<br />

<strong>The</strong> following are the signature requirements that the ACs, MACs, RACs, PSCs, ZPICs, and CERT<br />

contractors will apply:<br />

• Other regulations and CMS instructions regarding signatures (such as timeliness standards for<br />

particular benefits) take precedence.<br />

• Definition of a handwritten signature is a mark or sign by an individual on a document to signify<br />

knowledge, approval, acceptance or obligation.<br />

• For medical review purposes, if the relevant regulation, NCD, LCD, and other CMS manuals are<br />

silent on whether the signature must be dated, the reviewer shall review to ensure that the<br />

documentation contains enough information for the reviewer to determine the date on which the<br />

service was performed/ ordered. EXAMPLE: <strong>The</strong> claim selected for review is for a hospital visit on<br />

October 4. <strong>The</strong> Additional Documentation Request (ADR) response is one page from the hospital<br />

medical record containing three entries. <strong>The</strong> first entry is dated October 4 and is a physical therapy<br />

note. <strong>The</strong> second entry is a physician visit note that is undated. <strong>The</strong> third entry is a nursing note<br />

dated October 4. <strong>The</strong> reviewer may conclude that the physician visit was conducted on October 4.<br />

• Definition of a Signature Log: Providers will sometimes include, in the documentation they submit,<br />

a signature log that identifies the author associated with initials or an illegible signature. <strong>The</strong><br />

signature log might be included on the actual page where the initials or illegible signature are used or<br />

might be a separate document. <strong>Review</strong>ers will consider all submitted signature logs regardless of the<br />

date they were created.<br />

• Definition of an Attestation Statement: In order for an attestation statement to be considered valid<br />

for <strong>Medicare</strong> medical review purposes, the statement must be signed and dated by the author of the<br />

medical record entry and contain the appropriate beneficiary information.<br />

• Providers will sometimes include in the documentation they submit an attestation statement. In order<br />

to be considered valid for <strong>Medicare</strong> medical review purposes, an attestation statement must be<br />

signed and dated by the author of the medical record entry and must contain sufficient information<br />

to identify the beneficiary. Should a provider choose to submit an attestation statement, they may<br />

choose to use the following statement:<br />

• “I, _____[print full name of the physician/practitioner]___, hereby attest that the medical record entry<br />

for _____[date of service]___ accurately reflects signatures/notations that I made in my capacity as<br />

_____[insert provider credentials, e.g., M.D.]___ when I treated/diagnosed the above listed <strong>Medicare</strong><br />

beneficiary. I do hereby attest that this information is true, accurate and complete to the best of my<br />

CPT codes and descriptors are only copyright 20<strong>09</strong> American Medical Association (or such other date publication of CPT)<br />

<strong>The</strong> <strong>Medicare</strong> <strong>Monthly</strong> <strong>Review</strong> 19 <strong>MMR</strong> <strong>2010</strong>-<strong>09</strong> <strong>September</strong> <strong>2010</strong>

knowledge and I understand that any falsification, omission, or concealment of material fact may<br />