Basic Principles of Life Insurance - The American College

Basic Principles of Life Insurance - The American College

Basic Principles of Life Insurance - The American College

You also want an ePaper? Increase the reach of your titles

YUMPU automatically turns print PDFs into web optimized ePapers that Google loves.

1.22 Essentials <strong>of</strong> <strong>Life</strong> <strong>Insurance</strong> Products<br />

Earnings commence at C. <strong>The</strong> area <strong>of</strong> arc CD that extends above arc AB<br />

represents earnings in excess <strong>of</strong> taxes and the cost <strong>of</strong> self-maintenance. Point<br />

D marks the age <strong>of</strong> retirement, and the area DFB represents the second major<br />

period in the individual’s life when the cost <strong>of</strong> self-maintenance exceeds his<br />

or her income.<br />

In Figure 1-4, the monetary value <strong>of</strong> the individual is at its peak at point<br />

E when earnings are just beginning. At the point where xx 1 intersects the<br />

arcs, the earnings rate has increased, but potential future earnings have<br />

declined. <strong>The</strong> earnings potential shows further decreases at yy 1 and zz 1 ; at<br />

point F, it has shrunk to zero.<br />

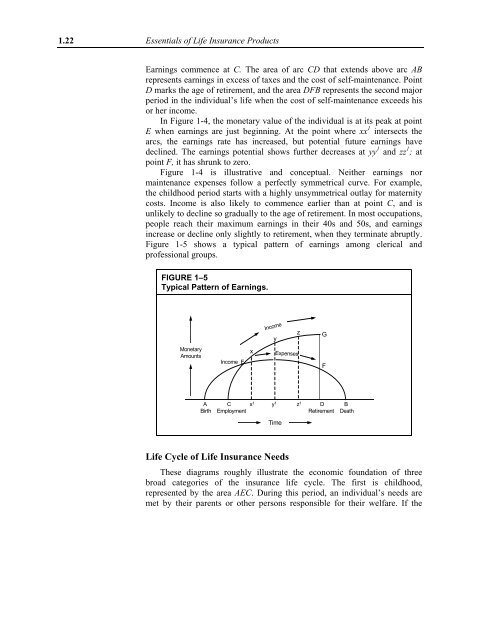

Figure 1-4 is illustrative and conceptual. Neither earnings nor<br />

maintenance expenses follow a perfectly symmetrical curve. For example,<br />

the childhood period starts with a highly unsymmetrical outlay for maternity<br />

costs. Income is also likely to commence earlier than at point C, and is<br />

unlikely to decline so gradually to the age <strong>of</strong> retirement. In most occupations,<br />

people reach their maximum earnings in their 40s and 50s, and earnings<br />

increase or decline only slightly to retirement, when they terminate abruptly.<br />

Figure 1-5 shows a typical pattern <strong>of</strong> earnings among clerical and<br />

pr<strong>of</strong>essional groups.<br />

FIGURE 1–5<br />

Typical Pattern <strong>of</strong> Earnings.<br />

Income<br />

y<br />

z<br />

G<br />

Monetary<br />

Amounts<br />

Income E<br />

x<br />

Expenses<br />

F<br />

A C x 1 y 1 z 1 D B<br />

Birth Employment Retirement Death<br />

Time<br />

<strong>Life</strong> Cycle <strong>of</strong> <strong>Life</strong> <strong>Insurance</strong> Needs<br />

<strong>The</strong>se diagrams roughly illustrate the economic foundation <strong>of</strong> three<br />

broad categories <strong>of</strong> the insurance life cycle. <strong>The</strong> first is childhood,<br />

represented by the area AEC. During this period, an individual’s needs are<br />

met by their parents or other persons responsible for their welfare. If the